Market Overview

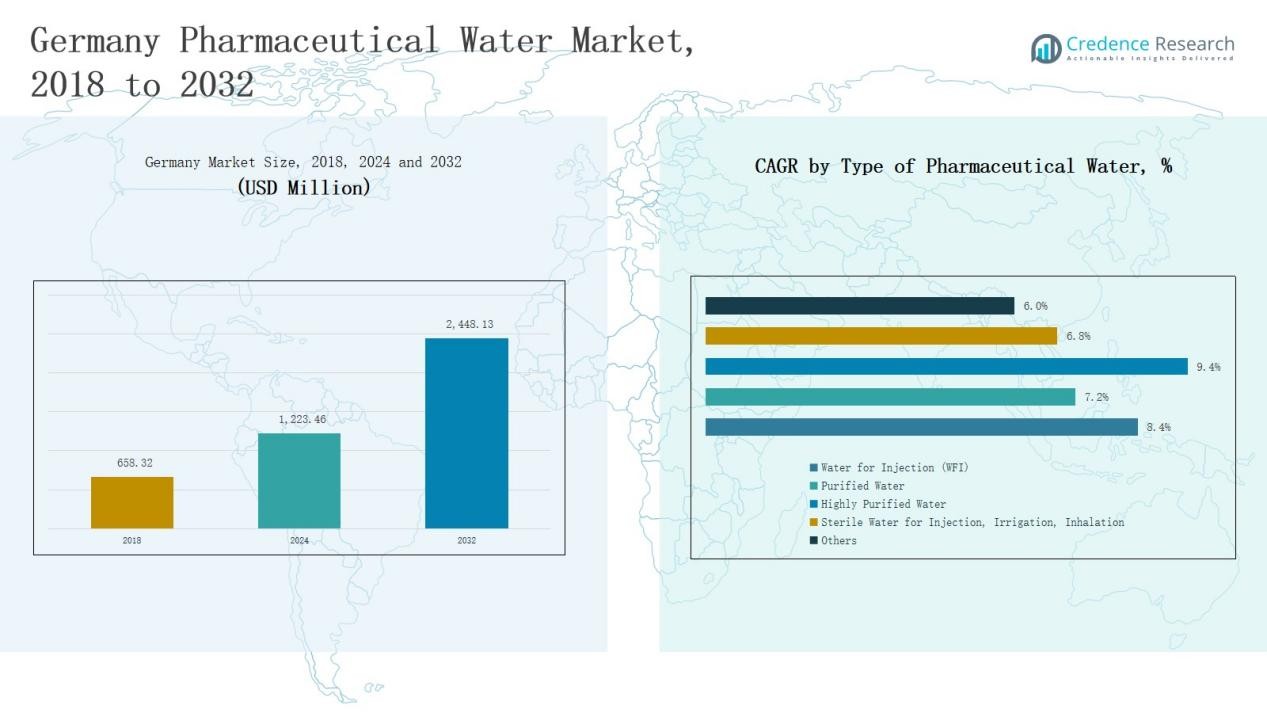

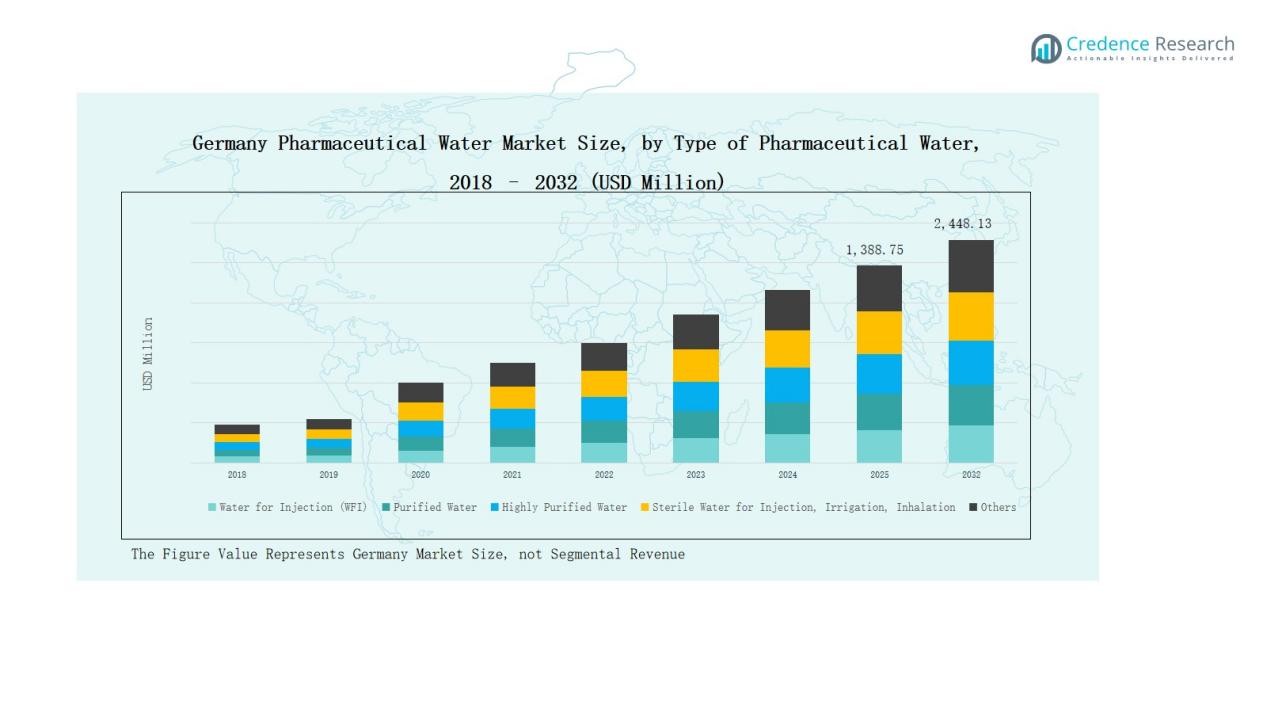

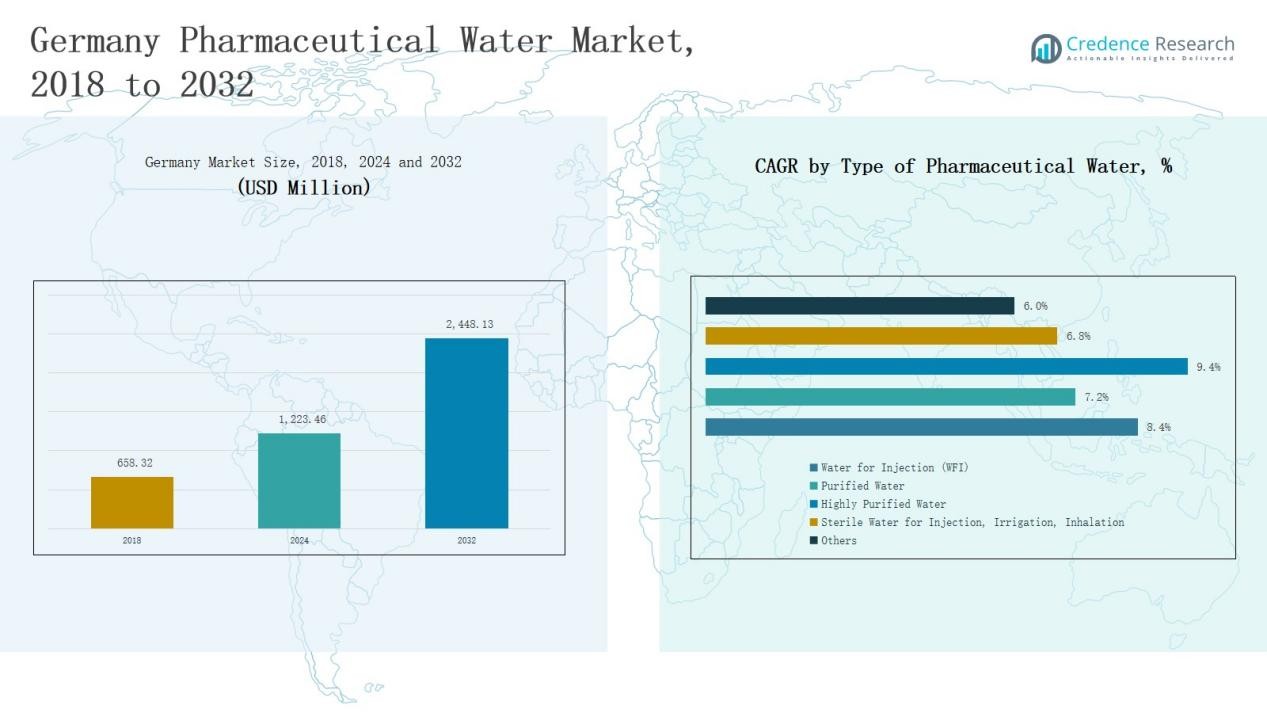

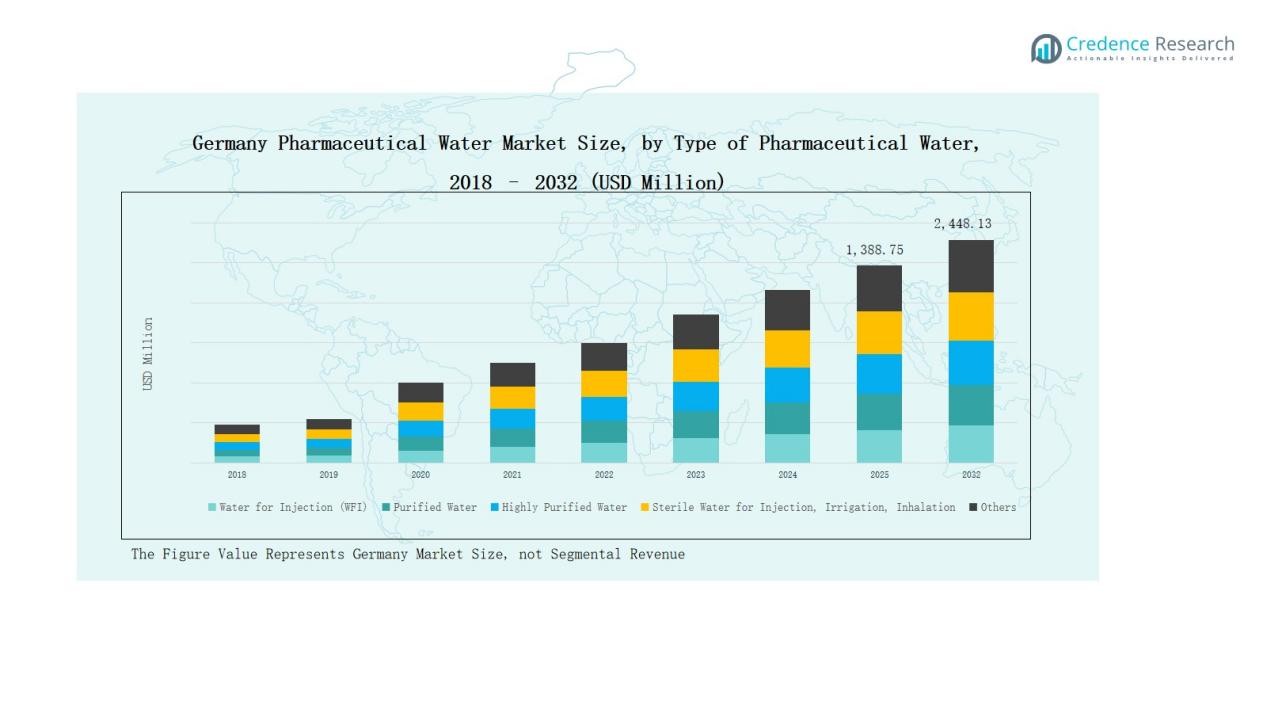

Germany Pharmaceutical Water Market size was valued at USD 658.32 million in 2018 to USD 1,223.46 million in 2024 and is anticipated to reach USD 2,448.13 million by 2032, at a CAGR of 8.44 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Pharmaceutical Water Market Size 2024 |

USD 1,223.46 Million |

| Germany Pharmaceutical Water Market, CAGR |

8.44 % |

| Germany Pharmaceutical Water Market Size 2032 |

USD 2,448.13 Million |

The Germany Pharmaceutical Water Market is led by major companies including Merck KGaA, B. Braun Melsungen AG, Sartorius AG, EnviroChemie GmbH, Evoqua Water Technologies GmbH, EnviroFALK PharmaWaterSystems GmbH, Weise Water GmbH, Christ Pharma & Life Science GmbH, Eisenmann SE, and Analytical Systems G. Obst GmbH. These players focus on developing validated, energy-efficient purification systems such as reverse osmosis, distillation, and deionization units to meet EMA and GMP standards. Strong investments in automation, digital monitoring, and sustainability practices reinforce their competitive positioning across pharmaceutical and biotechnology sectors. South Germany emerged as the leading region in 2024, capturing 31% of the national market share, driven by its concentration of biopharmaceutical manufacturing, technological expertise, and expanding production facilities in Bavaria and Baden-Württemberg. The region’s strong industrial base and supportive policies continue to make it the primary hub for high-purity pharmaceutical water production and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Pharmaceutical Water Market grew from USD 658.32 million in 2018 to USD 1,223.46 million in 2024 and is projected to reach USD 2,448.13 million by 2032, expanding at a CAGR of 8.44%.

- The Water for Injection (WFI) segment dominated with a 41.2% share in 2024, supported by high regulatory standards and growing demand for sterile-grade water in injectable drug production.

- The Reverse Osmosis (RO) segment led treatment technologies with 46.7% share, favored for its impurity removal efficiency and integration with UV and EDI systems for continuous purification.

- The Pharmaceutical & Biotechnology Manufacturing segment captured 58.3% share, driven by expanding biologics and vaccine production and adoption of automated purification systems for consistent output.

- South Germany held the largest regional share at 31%, supported by strong pharmaceutical manufacturing in Bavaria and Baden-Württemberg, robust innovation hubs, and favorable state-level industrial policies.

Market Segment Insights

By Type of Pharmaceutical Water:

The Water for Injection (WFI) segment dominated the Germany Pharmaceutical Water Market in 2024, accounting for 41.2% of the total share. Its leadership stems from strict regulatory standards and the high demand for sterile-grade water in parenteral and injectable drug manufacturing. Pharmaceutical producers increasingly use WFI systems to ensure product purity and compliance with GMP and EMA guidelines. Investments in automation and continuous distillation technology further strengthen WFI’s role in sterile pharmaceutical operations.

- For instance, pharmaceutical companies such as FUJIFILM Irvine utilize advanced WFI systems incorporating continuous distillation technology to maintain compliance with GMP and EMA guidelines.

By Treatment Technology:

The Reverse Osmosis (RO) segment held the largest share of 46.7% in the Germany Pharmaceutical Water Market in 2024. RO systems are preferred for their efficiency in removing impurities and dissolved solids while maintaining cost-effectiveness. Widespread use in pre-treatment stages across pharmaceutical facilities enhances water purification reliability. Growing adoption of advanced multi-stage RO systems and integration with UV and EDI units supports continuous, high-quality water production aligned with regulatory standards.

- For instance, Sartorius Stedim Biotech enhanced their water purification systems by integrating multi-stage RO with UV and EDI technologies, achieving regulatory compliance for pharmaceutical-grade water quality.

By Application:

The Pharmaceutical & Biotechnology Manufacturing segment led the Germany Pharmaceutical Water Market in 2024, capturing 58.3% of total revenue. This dominance arises from expanding biologics and sterile drug production that demands high-purity water. Manufacturers rely on automated purification systems to ensure consistency in product formulation and aseptic processing. Rising investments in vaccine and biosimilar production facilities further boost the demand for pharmaceutical-grade water across Germany’s robust life sciences sector.

Key Growth Driver

Growing Demand for High-Purity Water in Biopharmaceutical Production

The Germany Pharmaceutical Water Market is driven by increasing demand for high-purity water in biopharmaceutical and injectable drug manufacturing. Biologics, vaccines, and sterile formulations require Water for Injection (WFI) and Highly Purified Water that meet strict EMA and GMP standards. Continuous expansion of bioprocessing plants across Germany supports investments in automated water purification systems. Companies prioritize quality assurance and contamination control, boosting adoption of advanced distillation, reverse osmosis, and deionization systems in large-scale production facilities.

- For instance, BioNTech’s expansion of their mRNA vaccine production lines in Germany has included large-scale investments in advanced water purification infrastructure, supporting their stringent quality assurance protocols.

Stringent Regulatory Framework Promoting Compliance and Modernization

Germany’s strict pharmaceutical water quality standards under the European Pharmacopoeia and EMA guidelines drive modernization across production units. Pharmaceutical manufacturers invest in validated purification technologies to meet microbial and endotoxin limits. Frequent audits and compliance checks encourage the shift toward continuous monitoring systems. Automation, real-time data analytics, and smart control technologies are being widely integrated to maintain traceability and consistency. These measures ensure higher operational reliability and sustainable long-term compliance with regulatory norms.

- For instance, Merck KGaA introduced its Milli-Q EQ 7000 ultrapure water purification system, featuring digital traceability and real-time monitoring to support compliance with Good Manufacturing Practice (GMP) requirements.

Expansion of Contract Manufacturing and Outsourced Production

Rising outsourcing trends among pharmaceutical and biotechnology companies significantly boost the need for advanced pharmaceutical water systems in Germany. Contract Manufacturing Organizations (CMOs) depend on modular and scalable purification technologies to serve multiple clients. The growing preference for cost-efficient production drives investments in validated water treatment infrastructure. CMOs also integrate energy-efficient systems to optimize operations while meeting diverse purity requirements. This expansion strengthens the domestic demand for standardized and flexible water treatment technologies.

Key Trend & Opportunity

Integration of Smart Monitoring and Digital Validation Technologies

A key trend shaping the Germany Pharmaceutical Water Market is the integration of smart sensors and digital validation platforms. Pharmaceutical facilities adopt IoT-enabled systems for real-time quality monitoring, predictive maintenance, and automated data logging. These technologies enhance process transparency and minimize downtime. Continuous electronic documentation also ensures compliance with GMP and data integrity standards. This shift toward intelligent water management supports operational efficiency and strengthens regulatory readiness across the industry.

- For instance, Evoqua Water Technologies GmbH uses IoT-enabled dosing controllers with smart sensors to optimize chemical dosing in pharmaceutical water treatment, reducing operational disruptions and enhancing water quality consistency with continuous data logging.

Sustainability Initiatives and Green Water Management Practices

Growing environmental awareness encourages pharmaceutical companies in Germany to adopt sustainable water purification methods. Manufacturers invest in energy-efficient RO systems, water recovery solutions, and low-emission distillation units. Recycling and reusing purified water for non-critical applications reduce wastage and operational costs. Collaboration with technology providers to develop carbon-neutral purification infrastructure reflects a strategic move toward greener production. This sustainability-driven transformation positions pharmaceutical firms to meet both environmental and compliance goals effectively.

- For instance, Orion has implemented an integrated recovery reverse osmosis (RO) system that reprocesses concentrate from existing units, significantly enhancing water recovery and reducing waste.

Key Challenge

High Installation and Maintenance Costs of Water Systems

The Germany Pharmaceutical Water Market faces cost-related challenges due to the high capital and operational expenses of advanced purification systems. Equipment such as multi-effect distillers and double-pass RO units require significant upfront investment. Regular validation, maintenance, and calibration add to recurring costs. Smaller pharmaceutical manufacturers often struggle to justify these expenditures, limiting market penetration. Cost optimization through modular system design and shared utilities is gradually emerging as a feasible approach.

Complexity in Regulatory Compliance and Validation Procedures

Compliance with EMA and GMP regulations demands rigorous validation and documentation for pharmaceutical water systems. Continuous updates to regulatory guidelines increase operational complexity for manufacturers. Each process, from purification to distribution, must meet defined microbial and chemical purity standards. Maintaining consistency across production cycles requires advanced analytical systems and skilled personnel. The need for continuous audits and qualification processes can delay implementation and raise compliance management costs.

Rising Energy Consumption and Sustainability Pressure

Pharmaceutical water generation, especially through distillation and heating processes, involves significant energy use. High operational costs and carbon emissions challenge sustainability goals. With growing emphasis on energy efficiency, manufacturers face pressure to adopt eco-friendly technologies without compromising purity standards. Transitioning to hybrid systems combining RO, EDI, and UV processes offers partial relief but demands upfront investment. Balancing environmental responsibility with production efficiency remains a key challenge for German pharmaceutical producers.

Regional Analysis

North Germany

North Germany accounted for 27% of the Germany Pharmaceutical Water Market in 2024. The region hosts several biopharmaceutical clusters and advanced drug manufacturing facilities. Strong presence of firms specializing in sterile injectables and biologics drives the need for high-purity water systems. Investments in large-scale water treatment plants and strict environmental compliance reinforce its dominance. The port cities of Hamburg and Bremen support efficient distribution and logistics for pharmaceutical water infrastructure. Continuous expansion of bioprocessing operations further strengthens regional market demand.

South Germany

South Germany captured 31% of the Germany Pharmaceutical Water Market in 2024, emerging as the leading region. It benefits from strong pharmaceutical and biotechnology presence in states such as Bavaria and Baden-Württemberg. High production of biosimilars and vaccines drives adoption of Water for Injection (WFI) and purified water systems. The concentration of multinational pharma manufacturers and CMOs enhances demand for automated purification technologies. Regional innovation hubs focus on integrating digital control systems and energy-efficient solutions. Supportive state-level policies also encourage modernization of pharmaceutical water infrastructure.

West Germany

West Germany held 24% share of the Germany Pharmaceutical Water Market in 2024. The region’s robust industrial base and proximity to pharmaceutical exporters sustain steady growth in water purification demand. Companies based in North Rhine-Westphalia emphasize GMP-compliant purification units to support bulk drug and formulation plants. Expansion of contract manufacturing networks and integration of sustainable RO-based systems drive investments. Urban centers like Cologne and Düsseldorf serve as key technology hubs supporting advanced water system development.

East Germany

East Germany represented 18% of the Germany Pharmaceutical Water Market in 2024. Growth in this region is driven by expanding life sciences and biotech research clusters across Saxony and Thuringia. Public and private investments in laboratory infrastructure increase the use of high-purity water in analytical and pilot-scale operations. Emerging CMOs and research institutions adopt modular purification systems to meet varied application needs. Local efforts to attract pharmaceutical investment continue to improve production capabilities. Growing focus on R&D-based drug development reinforces the importance of advanced water treatment technologies.

Market Segmentations:

By Type of Pharmaceutical Water:

- Water for Injection (WFI)

- Purified Water

- Highly Purified Water

- Sterile Water for Injection, Irrigation, Inhalation

- Other

By Treatment Technology:

- Reverse Osmosis (RO)

- Ultraviolet (UV) Disinfection

- Distillation

- Deionization

- Others

By Application:

- Pharmaceutical & Biotechnology Manufacturing

- Research Laboratories & Academic Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

By Region

- North Germany

- South Germany

- West Germany

- East Germany

Competitive Landscape

The competitive landscape of the Germany Pharmaceutical Water Market is characterized by strong participation from established domestic and international players focusing on advanced purification solutions and compliance-driven innovation. Leading companies such as Merck KGaA, B. Braun Melsungen AG, Sartorius AG, EnviroChemie GmbH, and Evoqua Water Technologies GmbH dominate through extensive portfolios covering Water for Injection (WFI), purified water, and modular treatment systems. Firms emphasize automation, validation technologies, and sustainability to maintain regulatory alignment with EMA and GMP standards. Strategic collaborations with pharmaceutical manufacturers and Contract Manufacturing Organizations (CMOs) enhance their market presence and customer reach. Continuous investment in energy-efficient distillation and reverse osmosis systems, combined with digital monitoring and predictive maintenance, strengthens operational efficiency. Mid-tier players including EnviroFALK PharmaWaterSystems GmbH and Weise Water GmbH compete through cost-effective, customizable purification systems. Intense competition encourages technological advancement, capacity expansion, and long-term partnerships within Germany’s rapidly evolving life sciences and pharmaceutical infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In September 2025, WATCH WATER® launched its new FILTERSORB® TEST DROPS, a scale-prevention testing solution designed to support high-purity and pharmaceutical water systems in Germany.

- In November 2023, BW Water, a subsidiary of BW Group, completed the acquisition of H+E Pharma GmbH and S-Tec GmbH, strengthening its pharmaceutical process-water treatment operations in Germany.

- In May 2025, Veolia acquired CDPQ’s 30% stake in its subsidiary Water Technologies & Solutions (WTS), gaining full control to drive water-technology growth.

- In January 2024, Gradiant’s subsidiary H+E Group won a contract to build an ultrapure water (UPW) plant for a major semiconductor fab in Germany.

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmaceutical Water, Treatment Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity and sterile-grade water will increase with expanding biologics production.

- Pharmaceutical manufacturers will invest more in automated purification and monitoring systems.

- Regulatory compliance will continue to drive modernization of water treatment infrastructure.

- Integration of IoT and AI technologies will enhance real-time quality control and efficiency.

- Contract manufacturing organizations will expand purification capacity to meet outsourcing growth.

- Energy-efficient and sustainable purification systems will gain preference among manufacturers.

- Modular and scalable water systems will support flexibility in small and large production facilities.

- Digital validation and remote monitoring solutions will streamline quality documentation processes.

- Research institutions will adopt compact purification systems for laboratory and pilot applications.

- Collaboration between equipment suppliers and pharmaceutical companies will accelerate innovation in water treatment solutions.