Market Overview

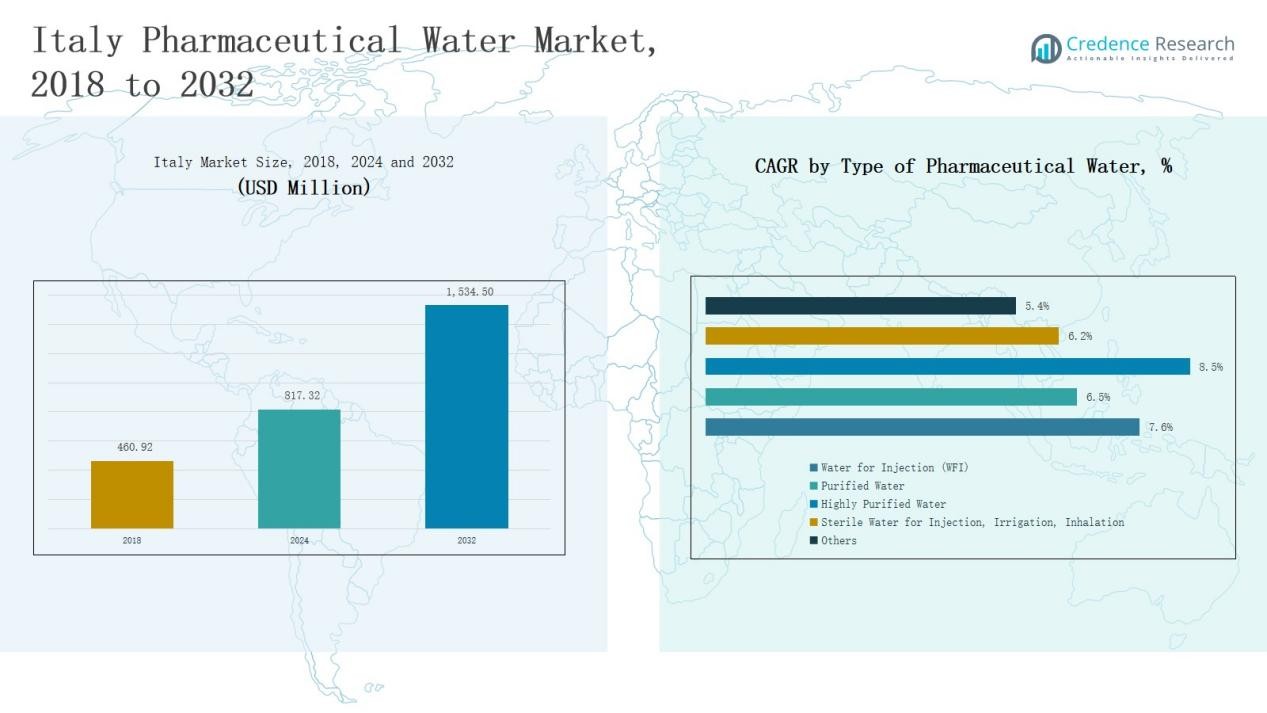

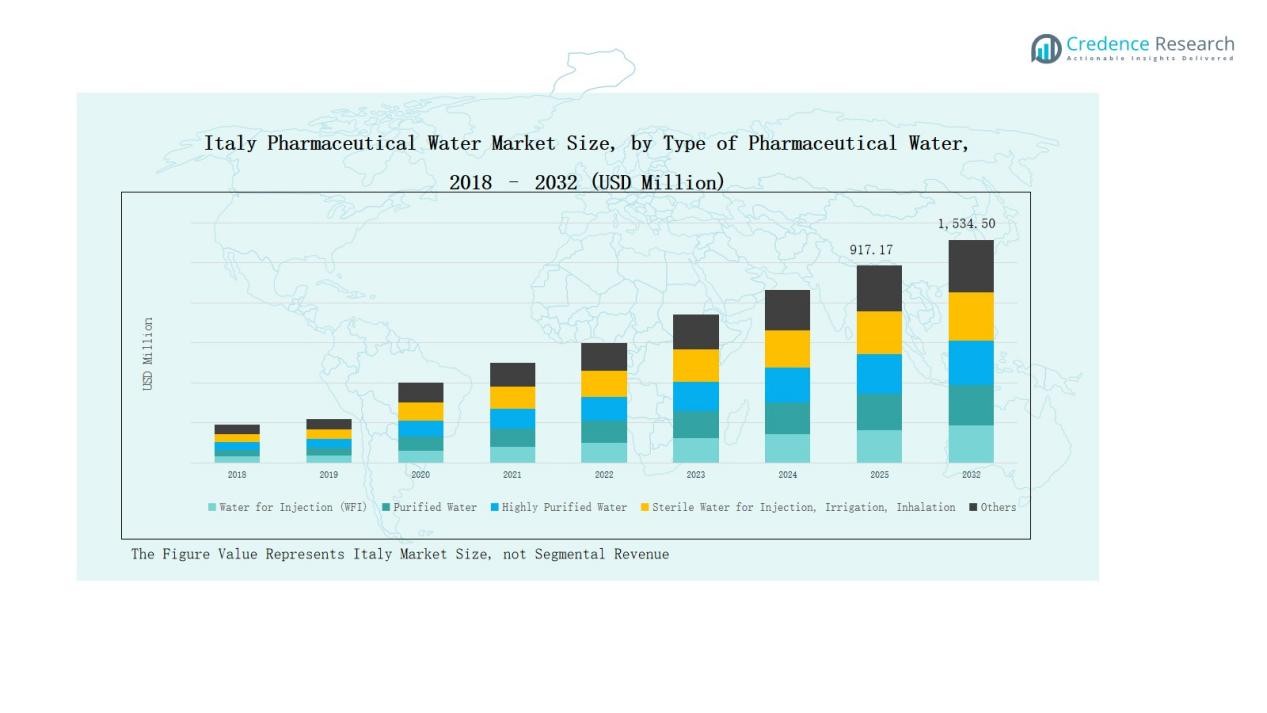

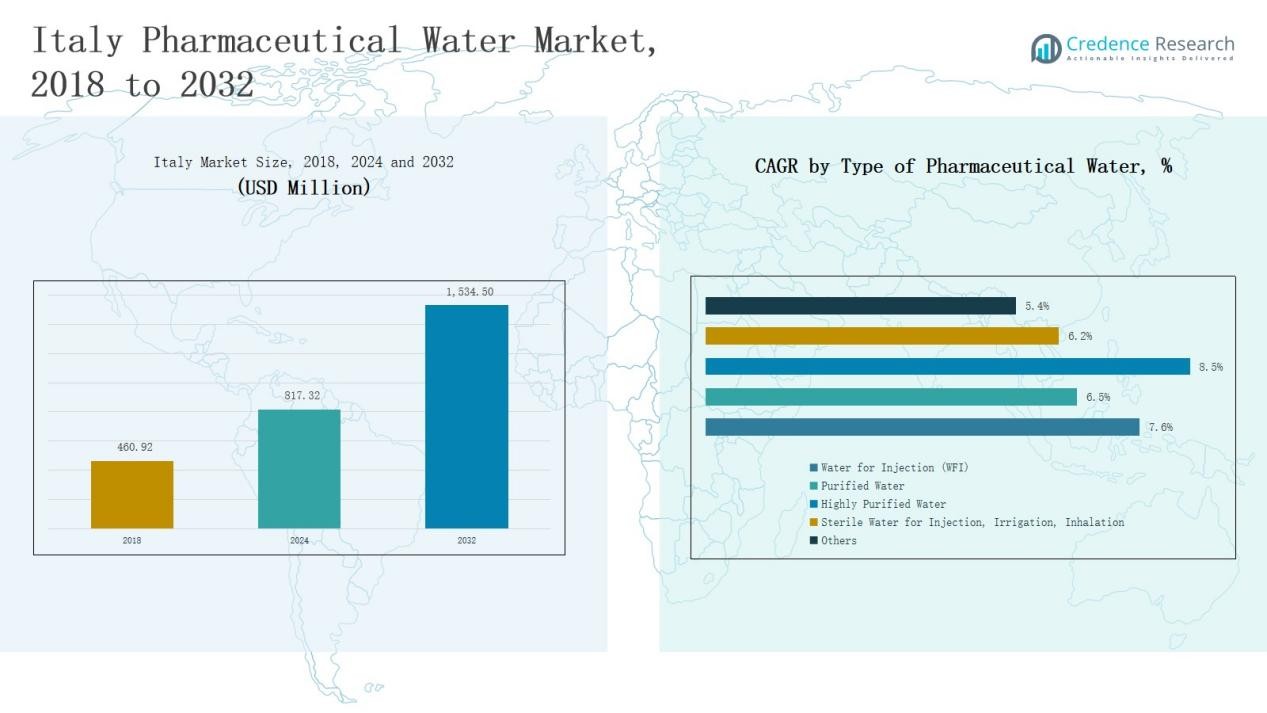

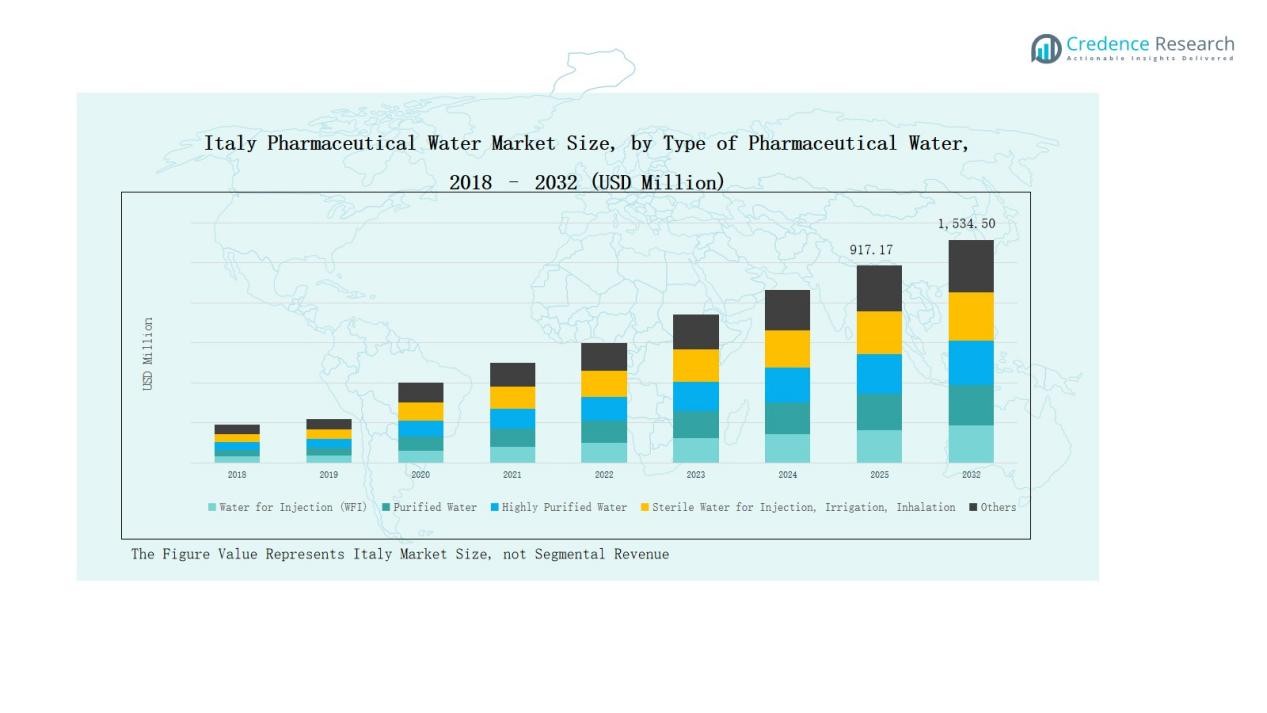

The Italy Pharmaceutical Water Market was valued at USD 460.92 million in 2018, grew to USD 817.32 million in 2024, and is projected to reach USD 1,534.50 million by 2032, expanding at a CAGR of 7.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Pharmaceutical Water Market Size 2024 |

USD 817.32 Million |

| Italy Pharmaceutical Water Market, CAGR |

7.63% |

| Italy Pharmaceutical Water Market Size 2032 |

USD 1,534.50 Million |

The Italy Pharmaceutical Water Market is led by major players such as Baldwin Technology Company Italy, Linde Gas Italia, Tenova S.p.A., Aquatechnik S.r.l., Hydor S.p.A., Aqualink, Acqua & Energia, Evoqua Water Technologies Italia, ARALDITE Tecnologia e Servizi, and WaterAlliance Italia. These companies focus on advanced purification systems, automation, and sustainable water management technologies to meet stringent GMP and EMA standards. Among all regions, Northern Italy emerged as the leading market in 2024, capturing 46% of the national share, supported by its strong pharmaceutical manufacturing base, modern infrastructure, and concentration of research-driven production facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Pharmaceutical Water Market grew from USD 460.92 million in 2018 to USD 817.32 million in 2024 and is expected to reach USD 1,534.50 million by 2032, at a 63% CAGR.

- Water for Injection (WFI) led the market by type in 2024 with a 6% share, driven by its critical use in injectable formulations and compliance with European Pharmacopeia standards.

- By technology, Reverse Osmosis (RO) dominated with a 2% share, supported by its cost-efficiency, scalability, and ability to maintain pharmaceutical-grade purity levels.

- The Pharmaceutical & Biotechnology Manufacturing segment accounted for the highest application share of 4% in 2024, driven by biologics and vaccine production growth.

- Northern Italy led regionally with a 46% market share, supported by strong pharmaceutical infrastructure, advanced purification technology adoption, and concentration of leading manufacturing facilities.

Market Segment Insights

By Type of Pharmaceutical Water:

The Water for Injection (WFI) segment dominated the Italy Pharmaceutical Water Market in 2024 with a 38.6% share. Its leadership is driven by strict regulatory standards and high demand from parenteral drug manufacturers. WFI’s purity and sterility make it essential in injectable formulations and medical device cleaning. Increasing biologics and vaccine production in Italy further boosts this segment’s growth, supported by advanced distillation and membrane-based generation technologies ensuring compliance with European Pharmacopeia norms.

By Treatment Technology:

The Reverse Osmosis (RO) segment held the largest share of 41.2% in 2024. RO technology remains the preferred choice due to its cost-efficiency, scalability, and ability to remove a wide range of contaminants. Pharmaceutical companies adopt multi-stage RO systems to meet stringent purity standards for both purified and WFI water. Rising modernization of water treatment plants and increased focus on reducing chemical usage enhance adoption, strengthening RO’s dominance in pharmaceutical and biotechnology applications across Italy.

For instance, CROS systems manufactured in Italy utilize advanced multi-stage RO combined with ultrafiltration to produce both Purified Water (PW) and Water for Injection (WFI), meeting stringent pharmaceutical purity standards.

By Application:

The Pharmaceutical & Biotechnology Manufacturing segment accounted for the highest market share of 57.4% in 2024. This dominance stems from rising drug and biologics production, which demands large volumes of ultrapure water for formulation and cleaning processes. Manufacturers prioritize reliable and automated purification systems to maintain consistency and compliance. The growing presence of biopharmaceutical facilities and contract drug manufacturers in Italy continues to drive investment in high-quality pharmaceutical water systems supporting GMP-certified production lines.

- For instance, Merck KGaA expanded its pharmaceutical water system investments at its Italian sites, driven by the rising demand for ultrapure water in both drug formulation and sterile cleaning applications essential for GMP-certified production lines.

Key Growth Driver

Expanding Biopharmaceutical and Injectable Drug Production

The Italy Pharmaceutical Water Market is primarily driven by the rising production of biopharmaceuticals and injectable formulations. Manufacturers require high volumes of sterile and ultrapure water to ensure drug safety and efficacy. The surge in vaccine, biosimilar, and parenteral drug manufacturing has intensified demand for Water for Injection (WFI) systems. Continuous facility upgrades, supported by European GMP guidelines, encourage pharmaceutical firms to invest in advanced purification technologies that meet rigorous microbial and endotoxin control standards.

- For instance, ILC Dover LP introduced Water for Injection (WFI) systems specifically tailored for the biotherapeutics sector in July 2022, highlighting the need for highly purified water for safe drug production.

Stringent Regulatory Standards for Water Quality

Strict regulatory frameworks from agencies such as the European Medicines Agency (EMA) and Italian Ministry of Health fuel demand for compliant pharmaceutical water systems. Companies must ensure their water meets Pharmacopeia-grade quality requirements for critical applications. Compliance pressure drives the adoption of validated purification technologies, including distillation and reverse osmosis. These regulations not only safeguard product integrity but also encourage modernization of purification infrastructure, creating steady growth opportunities for solution providers across Italy’s regulated pharmaceutical landscape.

Rising Investments in Pharmaceutical Infrastructure

Ongoing expansion of pharmaceutical and biotechnology manufacturing facilities across Italy strengthens market growth. Both domestic firms and global companies are increasing capital investments to enhance cleanroom operations, sterile manufacturing, and quality control capabilities. Pharmaceutical water systems form an essential part of these infrastructure upgrades. Government-backed incentives supporting innovation, sustainability, and export-oriented production also accelerate system adoption. The growth of CMOs and CDMOs further amplifies demand for reliable, scalable, and energy-efficient water treatment solutions.

- For instance, Novo Nordisk committed over €2 billion to upgrade its Anagni production site in Italy, focusing on expanding sterile fill-finish capacity to meet growing demand.

Key Trend & Opportunity

Adoption of Sustainable Water Purification Systems

Sustainability is a major trend shaping the Italy Pharmaceutical Water Market. Companies are shifting toward eco-efficient purification technologies to minimize water waste, energy use, and chemical consumption. Integration of closed-loop and zero-liquid discharge systems reduces environmental impact while maintaining compliance with quality standards. This transition creates opportunities for suppliers offering green solutions, such as low-energy reverse osmosis, hybrid membrane setups, and heat recovery distillation units, aligning with Europe’s sustainability objectives and corporate ESG initiatives.

- For instance, Veolia Water Technologies has supported pharmaceutical companies in Italy by integrating zero-liquid discharge (ZLD) systems and advanced membrane technologies, significantly cutting water waste and chemical use while ensuring regulatory compliance.

Integration of Automation and Digital Monitoring

Automation and digital monitoring are emerging as key opportunities within the market. Pharmaceutical manufacturers increasingly use smart control systems, IoT-enabled sensors, and AI-driven monitoring tools to maintain continuous validation of water purity. Real-time analytics help detect system deviations, reduce downtime, and optimize energy usage. The shift toward Industry 4.0-based water systems enhances reliability and compliance. This trend also opens growth potential for technology providers offering integrated digital platforms and predictive maintenance solutions tailored for regulated environments.

- For instance, Merck KGaA introduced an IoT-enabled water purification unit integrated with predictive maintenance software to alert operators before filter performance drops.

Key Challenge

High Capital and Maintenance Costs

The installation and maintenance of pharmaceutical-grade water systems demand significant investment. Distillation and multi-stage RO units require complex setups, continuous validation, and periodic replacement of critical components. Small and mid-sized pharmaceutical firms often face financial constraints in adopting advanced systems. High energy consumption and maintenance overheads also add operational burdens. These factors limit widespread adoption, especially among companies with limited budgets, despite the clear necessity for high-quality and compliant water generation infrastructure.

Technical Complexity and Skilled Workforce Shortage

Operating and maintaining pharmaceutical water systems require specialized technical expertise. Processes such as system sanitization, conductivity control, and microbial testing demand trained professionals. Italy faces a shortage of skilled technicians capable of handling automated purification technologies. The lack of qualified staff increases risks of system errors, contamination, and regulatory non-compliance. This challenge slows adoption of advanced purification systems in smaller facilities and highlights the need for workforce training and technical education in pharmaceutical water management.

Compliance Risks and Validation Burden

Frequent regulatory audits and stringent validation requirements create challenges for pharmaceutical water system operators. Maintaining consistent quality and documentation for WFI and purified water systems involves continuous testing, monitoring, and record-keeping. Failure to meet standards can lead to costly production delays or regulatory penalties. The complexity of validation processes for new technologies further slows system upgrades. Companies must balance innovation with compliance, which often requires significant time and resources to ensure alignment with EMA and GMP guidelines.

Regional Analysis

Northern Italy

Northern Italy accounted for 46% of the total share in the Italy Pharmaceutical Water Market in 2024. The region dominates due to its concentration of major pharmaceutical and biotechnology hubs in Lombardy, Emilia-Romagna, and Veneto. Strong infrastructure, research centers, and manufacturing facilities drive steady demand for high-purity and injection-grade water. The presence of multinational companies supports adoption of advanced purification technologies such as reverse osmosis and distillation. Continuous facility modernization and regulatory compliance efforts reinforce Northern Italy’s leadership within the national pharmaceutical water landscape.

Central Italy

Central Italy captured 29% of the total share in 2024. The market expansion in this region is supported by growing biopharmaceutical research activities in Lazio and Tuscany. Public–private collaboration in academic and clinical research drives the need for consistent purified water quality. Hospitals and life science laboratories increasingly invest in automated water treatment systems for research and testing. Central Italy benefits from government support for innovation and infrastructure improvement in health technology. It continues to emerge as a key center for pharmaceutical R&D operations in the country.

Southern Italy

Southern Italy held 18% of the total market share in 2024. The region is gradually strengthening its pharmaceutical production capacity, particularly in Campania and Puglia. Local manufacturing expansion, combined with increased adoption of cost-efficient purification systems, supports growth. Water for Injection and purified water remain critical for sterile drug formulation in regional facilities. Government-backed industrial development programs enhance technology access for small manufacturers. It shows steady improvement in infrastructure and compliance standards, positioning Southern Italy as an emerging contributor to national market growth.

Islands (Sicily and Sardinia)

The Islands segment, covering Sicily and Sardinia, represented 7% of the total share in 2024. Though smaller in scale, the region is witnessing gradual adoption of water purification systems in hospital laboratories and small-scale production units. Investments in healthcare modernization and quality assurance standards drive selective demand for pharmaceutical water systems. Universities and regional biotech incubators also contribute to system utilization in academic settings. It continues to show long-term potential through public sector initiatives promoting sustainable water management and advanced healthcare research infrastructure.

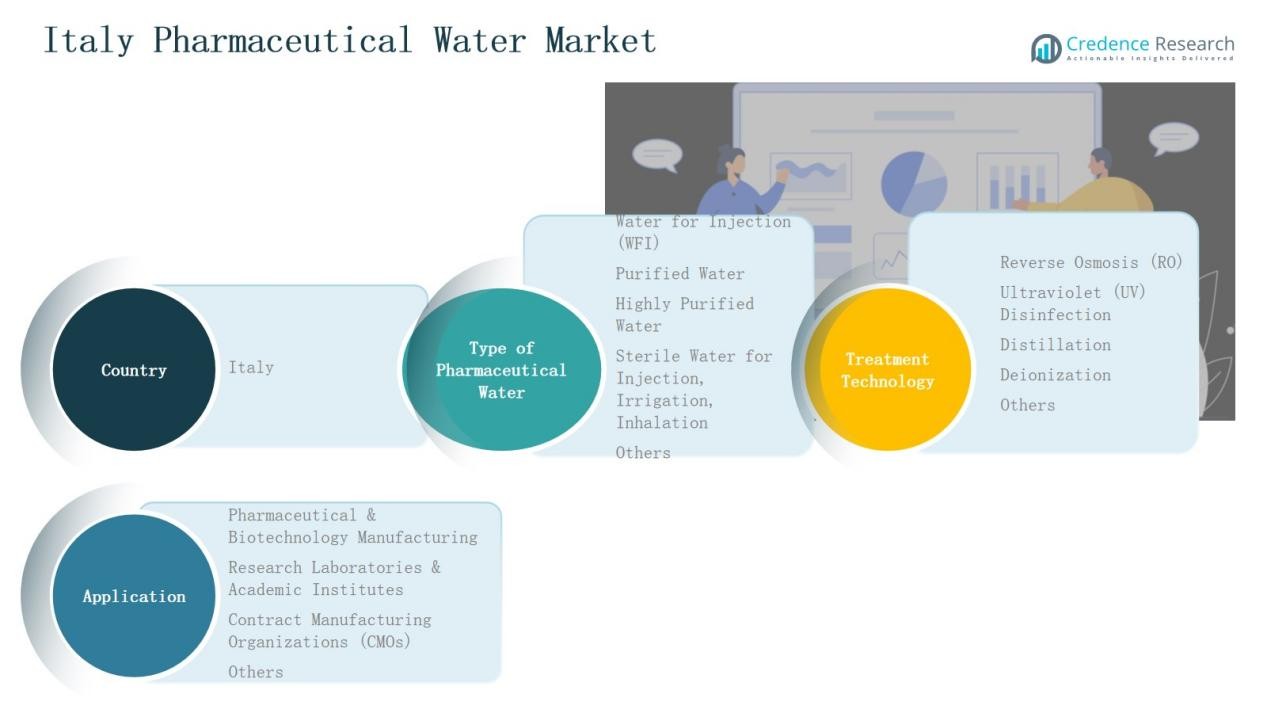

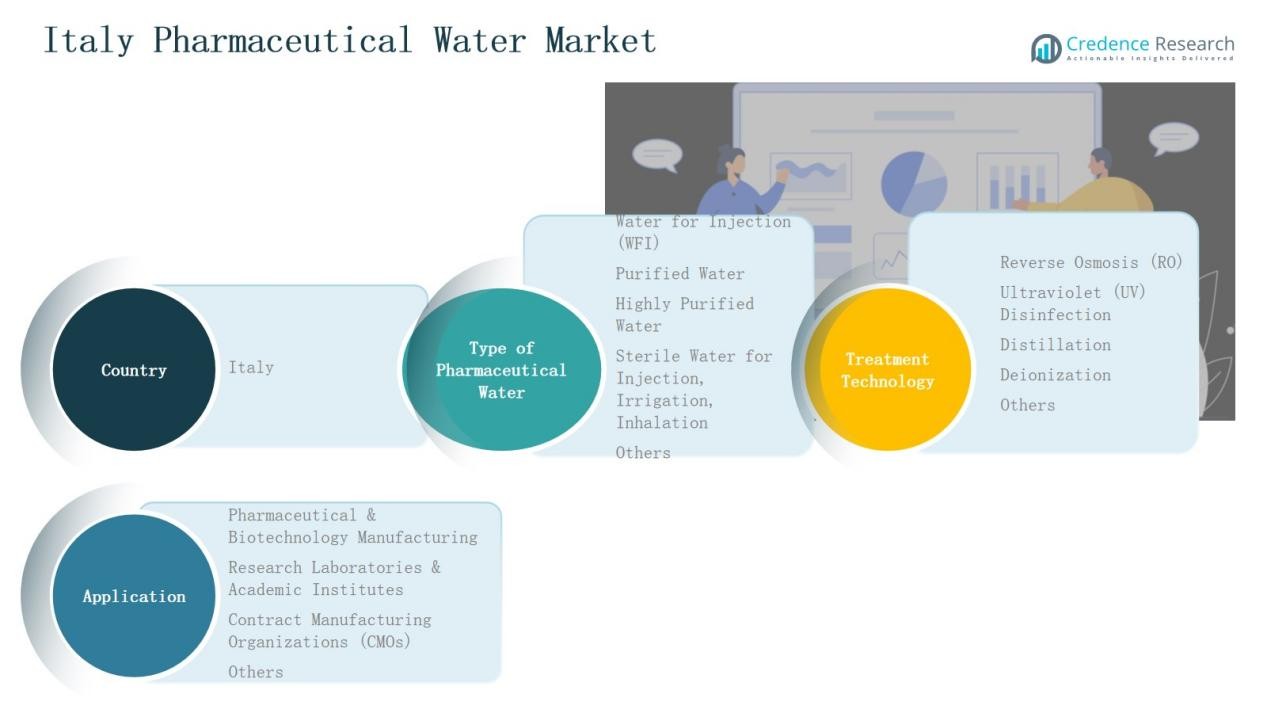

Market Segmentations:

By Type of Pharmaceutical Water:

- Water for Injection (WFI)

- Purified Water

- Highly Purified Water

- Sterile Water for Injection, Irrigation, and Inhalation

- Others

By Treatment Technology:

- Reverse Osmosis (RO)

- Ultraviolet (UV) Disinfection

- Distillation

- Deionization

- Others

By Application

- Pharmaceutical & Biotechnology Manufacturing

- Research Laboratories & Academic Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

By Region:

- Northern Italy

- Centralern Italy

- Southern Italy

- Islands Italy

Competitive Landscape

The competitive landscape of the Italy Pharmaceutical Water Market is characterized by the presence of both domestic manufacturers and global technology providers offering advanced water purification and distribution solutions. Key players such as Baldwin Technology Company Italy, Linde Gas Italia, Tenova S.p.A., Aquatechnik S.r.l., Hydor S.p.A., and Evoqua Water Technologies Italia maintain strong market positions through technological innovation and compliance-driven product portfolios. Companies focus on developing energy-efficient systems, automation integration, and validated purification technologies to meet strict regulatory standards. Strategic partnerships with pharmaceutical and biotechnology firms enhance their market reach and service reliability. Local firms emphasize customized system design and after-sales support, while international players leverage R&D capabilities and global certifications to expand presence. Increasing competition encourages investment in smart monitoring systems and sustainability-focused purification units, shaping a dynamic and innovation-led business environment across Italy’s pharmaceutical water treatment industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Baldwin Technology Company Italy

- Linde Gas Italia

- Tenova S.p.A.

- Aquatechnik S.r.l.

- Hydor S.p.A.

- Aqualink

- Acqua & Energia

- Evoqua Water Technologies Italia

- ARALDITE Tecnologia e Servizi

- WaterAlliance Italia

Recent Developments

- In April 2025, CNR (National Research Council, Italy) and MEDICA S.p.A. launched a graphene-oxide filtration technology targeting PFAS and emerging contaminants. The product is branded Graphisulfone® and scales up for semi-industrial production.

- In August 2025, IMCD acquired Tillmanns (Italy) to strengthen presence in water & industrial / food / specialty sectors, including water applications.

- In March 2024, Medica S.p.A., in collaboration with CNR and Hera Group, launched a pilot plant in Ferrara aimed at micropollutant removal and enhancing high-purity water treatment processes for pharmaceutical and biomedical uses.

- In February 2024, Veolia Water Technologies launched PoIaris™ 2.0, a next-generation system for producing Water for Injection (WFI) and pure water streams, enhancing efficiency and compliance in the Italy Pharmaceutical Water Market.

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmaceutical Water, Treatment Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity and sterile water systems will increase with rising biologics production.

- Pharmaceutical firms will invest more in automated and digitally monitored purification technologies.

- Reverse osmosis and distillation systems will continue to dominate system installations across facilities.

- Sustainability initiatives will drive adoption of energy-efficient and low-waste purification solutions.

- Expansion of CMOs and CDMOs will boost demand for scalable pharmaceutical water systems.

- Regulatory compliance requirements will strengthen system validation and quality monitoring practices.

- Growth in vaccine and injectable drug manufacturing will sustain market momentum.

- Research laboratories and universities will expand purified water usage for testing and analysis.

- Investments in regional pharmaceutical infrastructure will support new purification plant installations.

- Collaboration between equipment suppliers and pharmaceutical producers will enhance innovation in water treatment design.