Market Overview

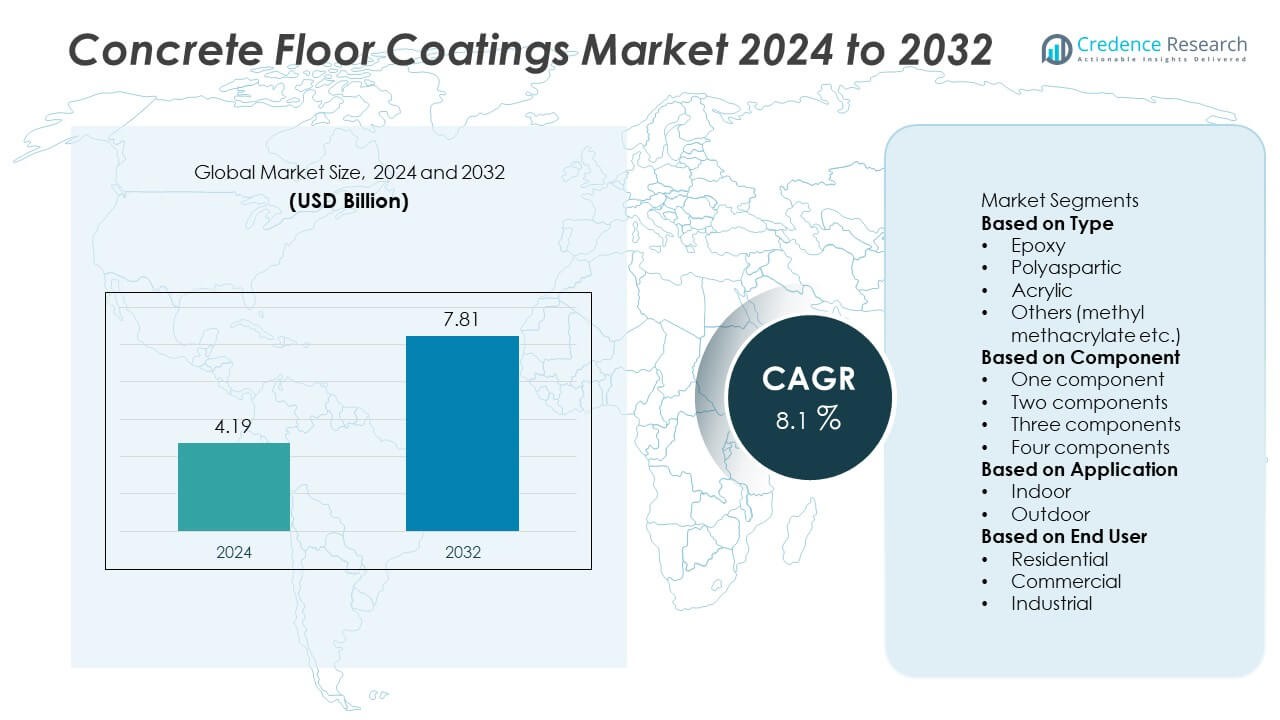

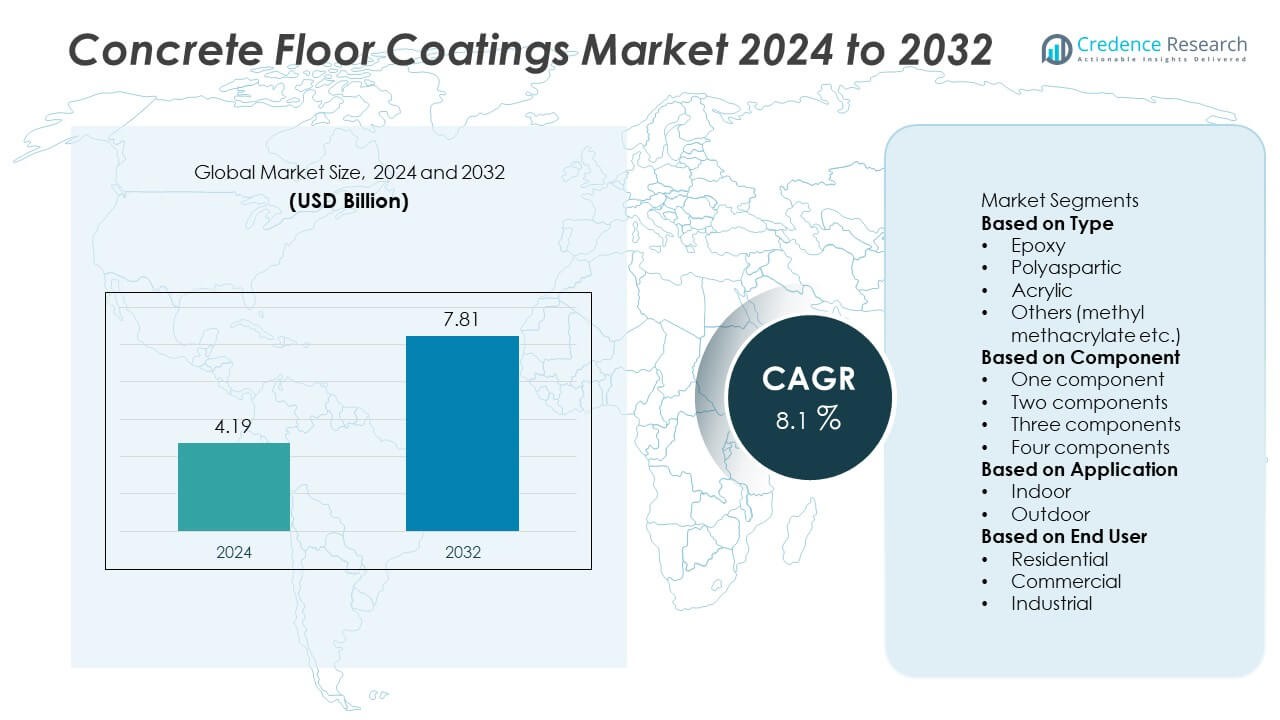

The Concrete Floor Coatings Market was valued at USD 4.19 billion in 2024 and is projected to reach USD 7.81 billion by 2032, registering a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Floor Coatings Market Size 2024 |

USD 4.19 Billion |

| Concrete Floor Coatings Market, CAGR |

8.1% |

| Concrete Floor Coatings Market Size 2032 |

USD 7.81 Billion |

The Concrete Floor Coatings market is dominated by leading companies such as PPG Industries, BASF, RPM International, Flowcrete Group, Hempel, Ardex Group, MC-Bauchemie, Asian Paints, Penntek Industrial Coatings, and Cipy Polyurethanes. These firms maintain leadership through advanced coating technologies, extensive product portfolios, and strategic expansion into emerging construction markets. In 2024, Asia-Pacific held the largest regional share of 38%, driven by rapid industrialization, infrastructure development, and increasing adoption of durable flooring in commercial spaces. North America accounted for 28%, supported by strong industrial renovation and demand for low-VOC coatings, while Europe captured 26%, driven by sustainability-focused building standards and the growing use of decorative and high-performance floor coatings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The concrete floor coatings market was valued at USD 4.19 billion in 2024 and is projected to reach USD 7.81 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- Market growth is driven by increasing demand for durable, chemical-resistant flooring solutions across industrial, commercial, and residential construction projects.

- The epoxy segment dominated with a 45% share, supported by its superior adhesion, high abrasion resistance, and long-lasting protective properties.

- The market is competitive, with leading players such as PPG Industries, BASF, and RPM International emphasizing sustainable product innovations and expanded global footprints.

- Asia-Pacific led with a 38% market share in 2024, followed by North America at 28% and Europe at 26%, driven by rapid urbanization, infrastructure investments, and adoption of eco-friendly coating technologies.

Market Segmentation Analysis:

By Type

The epoxy segment dominated the concrete floor coatings market in 2024, holding a 49% share. Epoxy coatings are favored for their superior adhesion, durability, and chemical resistance, making them ideal for industrial, commercial, and residential applications. They provide excellent protection against abrasions, impacts, and moisture, extending floor lifespan in high-traffic areas. Growing demand from warehouses, garages, and manufacturing facilities is strengthening this segment’s growth. The introduction of low-VOC, quick-curing, and decorative epoxy variants continues to enhance adoption, especially in regions emphasizing sustainable and long-lasting flooring solutions.

- For instance, PPG Industries launched a comprehensive line of flooring coatings in 2020, which included a 100% Solids Epoxy Coating designed for industrial floors. This self-leveling epoxy coating provides seamless application and durability for concrete protection.

By Component

The two-component segment accounted for a 57% share of the concrete floor coatings market in 2024, driven by its enhanced mechanical strength and superior performance over single-component systems. These coatings offer higher chemical and wear resistance, making them suitable for heavy-duty applications in factories, commercial spaces, and parking structures. The ability to form strong cross-linked polymer structures ensures better adhesion and longevity. Increasing industrial construction and rising renovation activities are further driving demand for two-component formulations, as they provide extended protection with improved gloss and smooth surface finish.

- For instance, BASF SE introduced its MasterTop 1327 two-component polyurethane system, engineered for comfortable, durable, and sound-deadening seamless surfaces. One variant, MasterTop 1327-20dB, is noted for its ability to reduce impact noise by up to 20 dB. The system is also elastic, allowing for crack-bridging properties.

By Application

The indoor segment led the market with a 62% share in 2024, supported by expanding residential, commercial, and industrial construction projects. Concrete floor coatings are widely used indoors to improve aesthetics, hygiene, and safety while providing resistance to stains, abrasions, and chemicals. The demand for polished and decorative finishes in retail stores, offices, and residential complexes boosts the use of epoxy and acrylic coatings. Growing adoption of eco-friendly, low-odor formulations and the rising trend of seamless flooring systems continue to support steady growth in the indoor application segment across global markets.

Key Growth Drivers

Rising Demand for Durable and Aesthetic Flooring Solutions

The growing preference for long-lasting and visually appealing flooring systems in industrial, commercial, and residential settings drives market expansion. Concrete floor coatings enhance surface durability, chemical resistance, and visual appeal. Industries such as automotive, food processing, and logistics increasingly adopt epoxy and polyaspartic coatings for their strength and smooth finish. Rising investments in modern infrastructure and renovation projects further accelerate demand. The combination of functionality and design aesthetics positions coated concrete floors as a preferred solution across multiple sectors.

- For instance, Asian Paints offers a range of durable SmartCare epoxy flooring products, which are designed for robust performance in industrial and commercial environments such as warehouses and showrooms.

Expansion of Industrial and Commercial Infrastructure

Rapid industrialization and commercial construction growth globally are fueling the adoption of concrete floor coatings. These coatings ensure high performance in heavy-duty environments, protecting against mechanical wear, oil spills, and thermal stress. Warehouses, manufacturing units, and retail complexes increasingly require coatings that improve operational efficiency and safety. Government-led infrastructure development and private investments in smart manufacturing facilities further support market growth. The surge in demand for efficient, low-maintenance flooring systems strengthens the role of coatings in industrial infrastructure.

- For instance, Hempel A/S offers a range of industrial flooring systems, including the Hempafloor Durable 300 polyurethane paint, which provides excellent abrasion resistance and is suitable for heavy traffic areas like warehouses and garages.

Shift Toward Sustainable and Low-VOC Formulations

Growing environmental awareness and regulatory pressure are driving the adoption of low-VOC and eco-friendly concrete floor coatings. Manufacturers are developing waterborne and solvent-free coatings to reduce emissions while maintaining performance. Green building certifications and sustainability goals are encouraging the use of coatings that meet LEED and REACH standards. This shift aligns with global trends toward environmentally responsible construction materials. The demand for sustainable coatings with high reflectivity and energy-saving benefits continues to boost innovation across the industry.

Key Trends & Opportunities

Adoption of Polyaspartic and Hybrid Coatings

The emergence of polyaspartic and hybrid coatings presents a key opportunity for market growth. These coatings offer faster curing times, superior UV resistance, and enhanced color stability compared to traditional epoxy systems. Their quick installation makes them ideal for commercial projects where downtime is critical. Increasing adoption in decorative and industrial flooring applications expands their market potential. As end-users seek durable, high-performance solutions, manufacturers are introducing polyaspartic blends tailored for diverse climatic and operational conditions.

- For instance, Penntek’s PT-300 Polyaspartic Topcoat, with a tensile strength of 41.3 MPa (6,000 psi) and 112% elongation, provides flexibility and resistance to cracking. It is able to endure thermal stress, protecting floors in residential, commercial, and industrial settings. This product offers a superior coating solution with demonstrated durability.

Integration of Decorative and Functional Coatings

The growing demand for multifunctional coatings that combine aesthetics and performance is shaping the market. Metallic, flake, and quartz-infused concrete coatings are gaining traction in retail and residential spaces for their decorative appeal and durability. These coatings provide seamless finishes while maintaining resistance to abrasion, impact, and chemicals. Advancements in pigment technology and customizable textures offer design flexibility. The trend toward visually appealing yet functional flooring systems creates strong growth opportunities across commercial and residential sectors.

- For instance, Cipy Polyurethanes offers the Cipicrete floor system, which has a compressive strength of over 80 MPa, as well as separate decorative and metallic floor coatings to provide both aesthetic versatility and mechanical endurance for commercial flooring projects.

Key Challenges

High Installation and Maintenance Costs

The high cost of materials, surface preparation, and skilled labor poses a major challenge to widespread adoption. Epoxy and polyaspartic coatings require professional installation to achieve desired performance and aesthetics. Periodic maintenance and reapplication add to lifecycle expenses. Small-scale projects or cost-sensitive sectors often opt for cheaper alternatives like tiles or vinyl. Manufacturers are focusing on developing user-friendly and cost-efficient coating systems to address these affordability challenges while maintaining product performance standards.

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials such as epoxy resins, hardeners, and additives affect production costs and profitability. Supply chain disruptions, geopolitical factors, and crude oil price variations further intensify cost pressures. Manufacturers struggle to maintain stable pricing without compromising product quality. These challenges impact smaller players more severely due to limited sourcing flexibility. The industry is responding through backward integration, sustainable sourcing, and local manufacturing strategies to mitigate raw material volatility and maintain competitiveness.

Regional Analysis

North America

North America held a 30% share of the concrete floor coatings market in 2024, driven by strong demand across commercial, industrial, and residential sectors. The United States leads the region due to extensive renovation and infrastructure modernization projects. High adoption of epoxy and polyaspartic coatings in warehouses, logistics centers, and automotive facilities supports market growth. The region’s strict building standards and preference for durable, low-maintenance surfaces further fuel adoption. Increasing focus on energy-efficient and sustainable coatings aligned with LEED certifications continues to enhance market penetration across both new construction and retrofit applications.

Europe

Europe accounted for 27% of the global market share in 2024, supported by rising industrial expansion and regulatory emphasis on eco-friendly construction materials. Germany, France, and the U.K. are major markets, driven by demand for chemical-resistant coatings in manufacturing and food processing facilities. The region’s adoption of low-VOC and waterborne formulations aligns with stringent EU environmental policies. Infrastructure renovation projects and the growth of modern retail spaces also support demand. Manufacturers are investing in advanced coating technologies that deliver aesthetics, safety, and long-term performance in compliance with European sustainability goals.

Asia-Pacific

Asia-Pacific dominated the concrete floor coatings market with a 34% share in 2024, fueled by rapid industrialization, construction growth, and urban infrastructure expansion. China, India, and Japan lead regional demand due to large-scale manufacturing and commercial projects. Increasing adoption of epoxy and polyaspartic coatings in factories, warehouses, and shopping complexes drives market expansion. Government investment in smart city initiatives and industrial modernization further enhances adoption. Rising consumer preference for aesthetic and durable flooring in residential spaces contributes to sustained growth, making Asia-Pacific the fastest-growing regional market for concrete floor coatings globally.

Middle East & Africa

The Middle East & Africa region captured a 5% market share in 2024, supported by major construction and infrastructure projects in Saudi Arabia, the UAE, and South Africa. High investments in commercial buildings, airports, and public spaces are driving demand for durable and UV-resistant coatings. The region’s extreme climatic conditions require coatings with superior chemical and thermal resistance. Increasing focus on modern architectural designs and flooring aesthetics enhances product demand. Ongoing government initiatives promoting industrial diversification, such as Saudi Vision 2030, continue to boost regional adoption of advanced floor coating solutions.

South America

South America held a 4% share of the concrete floor coatings market in 2024, led by Brazil, Argentina, and Chile. The region’s growing construction and industrial activities, particularly in logistics and automotive sectors, are driving steady demand. Economic recovery and investment in public infrastructure projects further support market expansion. The shift toward high-performance coatings for durability and chemical resistance is gaining momentum. However, limited local production capacity and fluctuating raw material prices remain challenges. Partnerships between regional contractors and global manufacturers are helping bridge technological gaps and strengthen market presence across South America.

Market Segmentations:

By Type

- Epoxy

- Polyaspartic

- Acrylic

- Others (methyl methacrylate etc.)

By Component

- One component

- Two components

- Three components

- Four components

By Application

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Concrete Floor Coatings market features major players such as MC-Bauchemie, Flowcrete Group, PPG Industries, RPM International, Hempel, Ardex Group, BASF, Penntek Industrial Coatings, Asian Paints, and Cipy Polyurethanes. These companies lead the market through innovation in high-performance coatings, strong regional distribution, and advanced formulation technologies. Key players focus on developing low-VOC, abrasion-resistant, and fast-curing products to meet industrial and commercial flooring demands. Strategic partnerships with construction firms and contractors enhance market reach and brand presence. Companies are also expanding sustainable and decorative coating lines to align with green building standards. Continuous investment in R&D, particularly in polyaspartic and hybrid epoxy technologies, strengthens competitiveness. Additionally, digital color matching, rapid installation systems, and tailored solutions for heavy-duty industrial flooring applications are central to maintaining market leadership across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, BASF and Sika launched Baxxodur® EC 151, a new amine hardener for epoxy coatings that reduces VOC emissions and accelerates cure time—coatings can be walk-on sooner.

- In 2025, MC-Bauchemie developed a novel thermal stress test method: its MC-DUR PowerCoat system maintained bonding after 2,500 thermal cycles between ~98 °C and ~25 °C.

- In March 2024, Flowcrete Group launched the LE (Low Emission) epoxy resin floor range containing less than 50 grams per liter of VOCs, meeting EU environmental flooring standards.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of low-VOC and eco-friendly coatings across all sectors.

- Polyaspartic and hybrid coatings will gain traction due to faster curing and UV stability.

- Decorative finishes with metallic and flake effects will expand in residential and retail spaces.

- Demand for coatings with improved abrasion and chemical resistance will keep increasing.

- Digital color-matching systems and rapid-installation technologies will enhance efficiency.

- Asia-Pacific will continue leading growth, supported by construction and industrial expansion.

- North America and Europe will strengthen sustainability-driven innovation and product standards.

- Manufacturers will focus on cost-efficient formulations to address installation and maintenance issues.

- Strategic partnerships between coating producers and contractors will improve market reach.

- Continuous R&D in nanotechnology and cross-link polymers will define next-generation coatings.