Market Overview

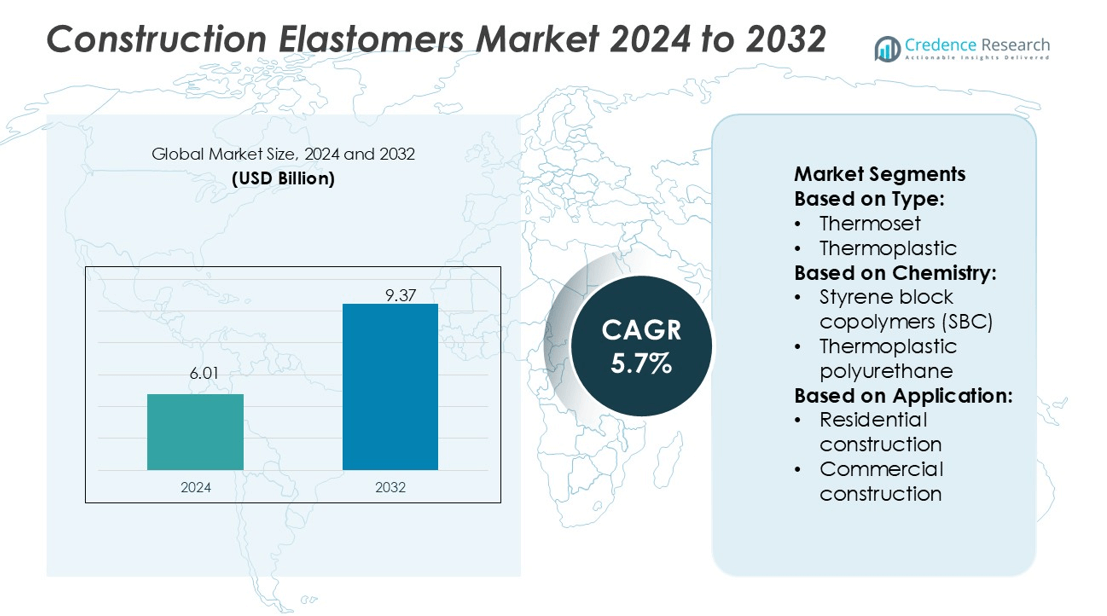

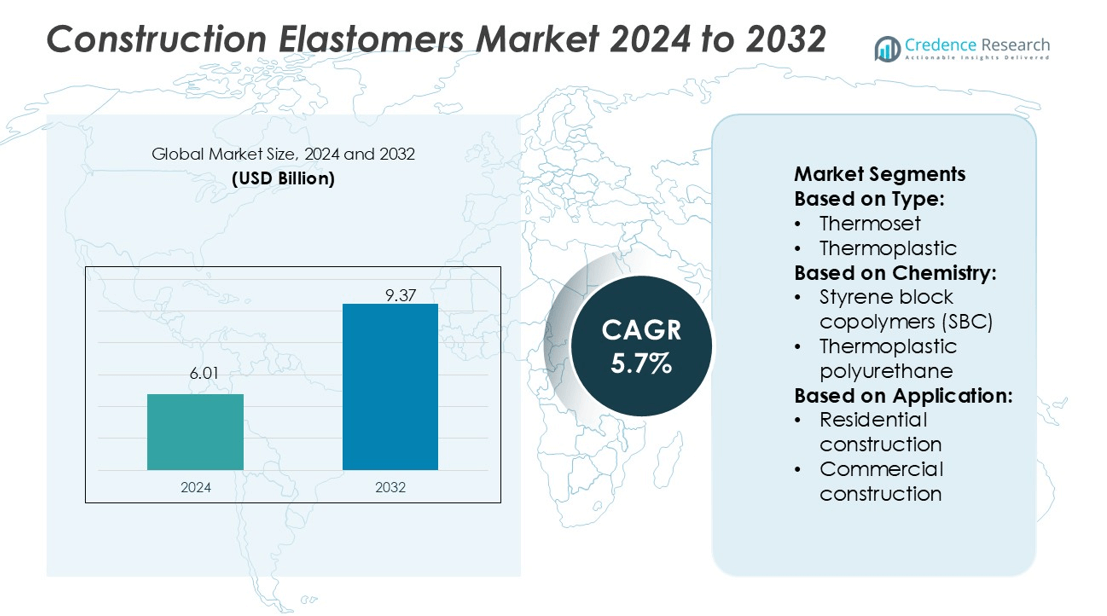

Construction Elastomers Market size was valued USD 6.01 billion in 2024 and is anticipated to reach USD 9.37 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Elastomers Market Size 2024 |

USD 6.01 billion |

| Construction Elastomers Market CAGR |

5.7% |

| Construction Elastomers Market Size 2032 |

USD 9.37 billion |

The construction elastomers market is dominated by key players such as BASF SE, Dow Inc., ExxonMobil Chemical, Lanxess AG, Continental AG, Michelin Group, Synthos S.A., Sumitomo Chemical Co., Ltd., Nizhnekamskneftekhim, and The Goodyear Tire & Rubber Company. These companies focus on product innovation, sustainable elastomer development, and expansion of thermoplastic technologies to meet growing global demand. Advanced R&D efforts target improved flexibility, recyclability, and environmental performance. Asia-Pacific leads the global market with a 36% share, driven by rapid urbanization, large-scale infrastructure investments, and government-backed smart city initiatives. The region’s expanding construction activity continues to position it as the key growth hub for elastomer manufacturers worldwide.

Market Insights

- The Construction Elastomers Market size was valued at USD 6.01 billion in 2024 and is projected to reach USD 9.37 billion by 2032, registering a CAGR of 5.7% during the forecast period.

- Growing demand for sustainable, energy-efficient, and recyclable materials in residential and commercial construction is driving market expansion worldwide.

- Advancements in thermoplastic elastomers and increased R&D investments are promoting trends toward lightweight, durable, and eco-friendly building solutions.

- The market faces restraints from raw material price volatility and environmental regulations affecting the recyclability of thermoset elastomers.

- Asia-Pacific dominates the global market with a 36% share, followed by North America with 28%; thermoplastic elastomers remain the leading segment with 58% share due to high performance, cost efficiency, and widespread adoption across modern construction applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Thermoplastic elastomers dominate the Construction Elastomers Market, accounting for 58% of the global share. Their recyclability, high flexibility, and compatibility with multiple substrates make them a preferred material in infrastructure projects. These elastomers are widely used in sealing systems, adhesives, and roofing membranes. Their easy processability and reduced curing time offer cost efficiency and environmental benefits. The rising adoption of lightweight materials in green buildings continues to drive thermoplastic elastomer demand.

- For instance, Synthos’ SSBR line in Poland runs at 90,000 tonnes per year, supplying such applications. Their ease of processing and shorter curing times reduce costs and environmental footprint.

By Chemistry

Styrene block copolymers (SBC) hold the largest share at 32%, driven by their high elasticity, UV resistance, and superior adhesion. SBC-based products are extensively used in waterproof coatings, asphalt modification, and flooring applications. Thermoplastic polyurethane (TPU) follows, gaining traction for its abrasion resistance and durability in expansion joints and industrial flooring. Growing demand for long-lasting, weather-resistant materials in residential and commercial projects supports the expansion of these chemistries.

- For instance, Michelin has produced a 4-tonne prototype batch of SBR using 100 % recycled styrene monomer at its Bassens plant.That demonstrates its ability to convert recycled styrene into high-performance SBC materials.

By Application

Non-residential construction leads the segment, capturing 64% of total market share. Elastomers are increasingly used in commercial, industrial, and infrastructure developments for sealants, insulation, and vibration-damping applications. The segment benefits from rapid urbanization and smart city initiatives, particularly in Asia-Pacific and North America. Government investments in sustainable infrastructure and green building certifications also fuel elastomer adoption in large-scale projects. Residential applications continue to grow steadily due to improved material accessibility and renovation activities.

Key Growth Drivers

Rising Demand for Sustainable and Energy-Efficient Materials

The growing emphasis on sustainable construction is driving demand for eco-friendly elastomers. Thermoplastic elastomers are increasingly used due to their recyclability, low VOC emissions, and high energy efficiency. Governments promoting green building certifications such as LEED and BREEAM are accelerating this adoption. Manufacturers are investing in bio-based elastomer formulations to meet environmental standards. These materials enhance building performance by improving insulation and reducing energy costs, making them a preferred choice in modern construction practices focused on durability and sustainability.

- For instance, Dow’s “Transform the Waste” strategy aims to convert 3 million metric tons per year of waste and alternative feedstocks into circular and renewable solutions by 2030.

Expanding Infrastructure Development and Urbanization

Rapid urbanization and industrialization, particularly in emerging economies, are major growth drivers for construction elastomers. Expanding infrastructure projects such as smart cities, highways, and commercial complexes demand advanced materials that offer flexibility and long service life. In countries like India and China, large-scale housing and public development programs significantly increase elastomer usage in sealants, adhesives, and waterproof membranes. Their superior weather resistance and structural strength make them suitable for diverse climatic conditions, supporting long-term infrastructure goals and global construction sector expansion.

- For instance, Sumitomo’s Tafthren® high-performance elastomer (a polypropylene-compatible elastomer) achieves sub-micron domain blending even when more than 50 vol % is used, avoiding phase inversion issues.

Advancements in Material Technology and Performance Innovation

Continuous innovation in elastomer chemistry has led to enhanced product performance and expanded applications. The development of thermoplastic vulcanizates (TPVs) and silicone-based elastomers has improved resistance to heat, UV radiation, and environmental stress. Major companies such as BASF SE and Dow Inc. focus on R&D to produce lightweight, high-strength materials tailored for complex architectural designs. The integration of nanotechnology and smart materials in elastomer production enhances flexibility, adhesion, and durability. These advancements are enabling wider adoption in high-performance and specialized construction applications worldwide.

Key Trends & Opportunities

Shift Toward Lightweight and Modular Construction Materials

The construction industry is witnessing a strong shift toward lightweight and modular materials for faster installation and cost efficiency. Elastomers play a crucial role in prefabricated and modular buildings, where flexibility and ease of molding are key. Growing adoption of thermoplastic elastomers in sealing and vibration damping supports these construction techniques. This trend offers opportunities for manufacturers to design elastomers compatible with offsite and rapid construction systems. The demand is expected to rise further with increasing adoption of modern construction technologies worldwide.

- For instance, BASF launched the Elastollan® 1400 TPU series, which offers stable processing behavior and improved hydrolysis resistance with defined compression set behavior in extrusion and injection molding trials.

Growing Integration of Smart Building Technologies

The rise of smart buildings and intelligent infrastructure is creating new growth avenues for elastomer applications. These materials are now engineered to enhance insulation, noise control, and environmental protection in sensor-based buildings. Silicone and polyurethane elastomers are increasingly integrated into energy-efficient façades and automated sealing systems. Manufacturers focusing on compatibility with smart infrastructure systems can capture high-value opportunities. This integration supports sustainability targets while ensuring improved building comfort and performance, aligning with modern construction technology trends.

- For instance, Lanxess launched its Adiprene Green polyether-based polyurethane systems with renewable feedstocks, offering hardness ranges from 80 Shore A to 60 Shore D and a free monomer MDI content below 0.1 wt %.

Expansion of Green Construction Initiatives

Global efforts toward carbon neutrality and reduced resource consumption are fostering the use of sustainable elastomer materials. Governments and construction firms are adopting bio-based and recyclable elastomers for green infrastructure projects. The introduction of eco-friendly manufacturing processes and reduced reliance on petroleum-based raw materials align with ESG goals. Growing awareness of life cycle assessment (LCA) and circular construction practices offers significant opportunities for elastomer producers to innovate and lead in environmentally responsible construction materials.

Key Challenges

High Raw Material Costs and Price Volatility

Fluctuating prices of petrochemical-derived raw materials pose a significant challenge for construction elastomer manufacturers. The reliance on crude oil-based feedstocks increases vulnerability to supply chain disruptions and market instability. Cost fluctuations affect profit margins and pricing competitiveness, particularly for small- and mid-scale producers. Manufacturers are investing in alternative raw materials and localized sourcing strategies to mitigate these risks. However, achieving cost stability while maintaining performance standards remains a major challenge in sustaining long-term market growth.

Environmental Regulations and Recycling Limitations

Strict environmental regulations regarding polymer disposal and recycling hinder market expansion. Although thermoplastic elastomers are recyclable, complex cross-linking in thermoset variants makes reuse difficult. Many regions enforce waste management policies that increase compliance costs for manufacturers. Developing efficient recycling technologies for mixed elastomer waste is still a major technical hurdle. Companies are focusing on chemical recycling and circular production models, but the high cost and slow adoption of these solutions continue to challenge market scalability and sustainability goals.

Regional Analysis

North America

North America accounts for 28% of the global construction elastomers market share, driven by strong infrastructure investments and housing renovation projects. The United States leads the region due to high adoption of thermoplastic elastomers in roofing membranes, sealants, and insulation systems. The presence of leading manufacturers such as Dow Inc. and ExxonMobil supports technological innovation and product development. Increasing demand for sustainable and energy-efficient materials further accelerates regional growth. Government programs promoting green construction, such as LEED certification, continue to boost elastomer usage in both commercial and residential projects.

Europe

Europe holds 24% of the global market share, supported by advanced construction standards and strong environmental regulations. Countries like Germany, France, and the United Kingdom drive demand for elastomers in building insulation, waterproofing, and flooring systems. The region’s focus on circular economy practices encourages the use of recyclable thermoplastic elastomers. Manufacturers such as BASF SE and Arkema focus on developing bio-based elastomer solutions aligned with EU sustainability goals. Renovation projects under the European Green Deal and energy-efficient housing directives are expanding elastomer demand across industrial and civil construction sectors.

Asia-Pacific

Asia-Pacific dominates the construction elastomers market with a 36% share, fueled by rapid urbanization and infrastructure development. China, India, and Japan lead regional consumption, driven by expanding commercial and residential construction activities. Government-backed initiatives like India’s Smart Cities Mission and China’s Belt and Road projects continue to boost elastomer adoption. Local manufacturers increasingly invest in thermoplastic and silicone elastomers to meet demand for lightweight, high-performance materials. Growing use in waterproof coatings, sealants, and adhesives further enhances market potential. Rising disposable income and green building trends are supporting long-term growth across the region.

Latin America

Latin America represents 7% of the global market share, with Brazil and Mexico leading adoption. Expanding industrialization and government infrastructure investments drive regional demand for construction elastomers. The materials are used extensively in roofing, waterproof membranes, and sealant applications to enhance structural durability. Economic recovery and foreign investment in housing and commercial projects contribute to market expansion. Local production capacities are growing, with regional firms focusing on thermoplastic elastomer products to reduce import dependency. The emphasis on energy-efficient construction and sustainable urban growth further strengthens the market outlook in this region.

Middle East & Africa

The Middle East & Africa region holds 5% of the global construction elastomers market share, driven by large-scale infrastructure projects and urban development. Countries such as the UAE, Saudi Arabia, and South Africa show strong demand in commercial and industrial construction. The rise of smart city projects and energy-efficient building codes promotes the use of high-performance elastomers in sealing and insulation. Regional construction companies increasingly prefer thermoplastic materials for their durability and weather resistance. Investments in mega projects like NEOM and Expo City Dubai continue to create substantial growth opportunities across the market.

Market Segmentations:

By Type:

By Chemistry:

- Styrene block copolymers (SBC)

- Thermoplastic polyurethane

By Application:

- Residential construction

- Commercial construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction elastomers market features strong competition among leading players such as Synthos S.A., Michelin Group, Dow Inc., Nizhnekamskneftekhim, Sumitomo Chemical Co., Ltd., Continental AG, The Goodyear Tire & Rubber Company, BASF SE, Lanxess AG, and ExxonMobil Chemical. The construction elastomers market is highly competitive, driven by continuous innovation and technological advancement. Companies focus on developing high-performance materials that meet sustainability standards and enhance building efficiency. The industry is witnessing strong demand for thermoplastic elastomers due to their recyclability, flexibility, and superior resistance to heat and weathering. Manufacturers are investing in bio-based and low-VOC formulations to align with green construction goals and regulatory frameworks. Strategic partnerships, mergers, and capacity expansions are common as firms aim to strengthen regional presence and cater to rising infrastructure projects. Product innovation and customization remain critical for market differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Synthos S.A.

- Michelin Group

- Dow Inc.

- Nizhnekamskneftekhim

- Sumitomo Chemical Co., Ltd.

- Continental AG

- The Goodyear Tire & Rubber Company

- BASF SE

- Lanxess AG

- ExxonMobil Chemical

Recent Developments

- In July 2025, New Holland Construction introduces W100D Compact Wheel Loader with an all-new operator-centric cab and cab features. Constructed with landscapers, agricultural operators, snow removers and others in mind, the W100D is a dependable powerhouse with a deliberate design to provide productivity and performance in a small class size where there has been scarce choice.

- In January 2025, Volvo CE introduces New Generation Excavators in Southeast Asia to enhance efficiency, productivity and safety of the customers. The New Generation 5 models include: EC210, EC220, EC230, EC300 and EC360 and they will be sold throughout the region starting January 2025.

- In March 2024, Dow launched a new polyolefin elastomer (POE) based alternative for use in the automotive industry to reflect the industry’s change toward animal-free products.

- In February 2024, LANXESS India expanded Rhenodiv production plant in Jhagadia. This milestone demonstrates lANXESS’s dedication to environmental responsibility, process safety, sustainability, and innovation in tyre and elastomer manufacture.

Report Coverage

The research report offers an in-depth analysis based on Type, Chemistry, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and recyclable elastomers will continue to rise in green construction projects.

- Advancements in thermoplastic technologies will enhance product performance and material flexibility.

- Governments promoting energy-efficient building standards will support steady market expansion.

- Infrastructure modernization and urbanization in developing economies will drive long-term growth.

- Increasing R&D investments will lead to the development of bio-based and low-emission elastomers.

- The adoption of elastomers in modular and prefabricated construction will expand significantly.

- Integration of smart building materials will create new opportunities for advanced elastomer applications.

- Manufacturers will focus on circular economy practices to improve sustainability and resource efficiency.

- Strategic collaborations between chemical companies and construction firms will accelerate product innovation.

- Rising awareness of carbon-neutral construction materials will shape the market’s future direction.