Market Overview

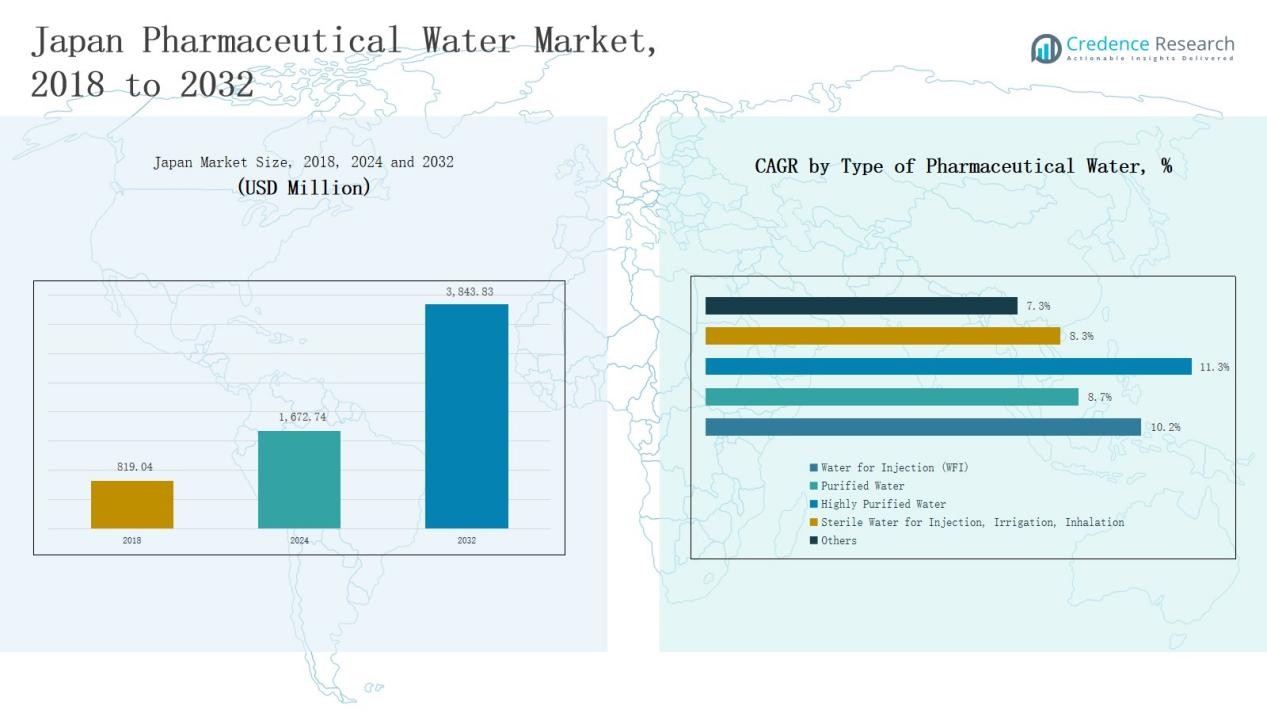

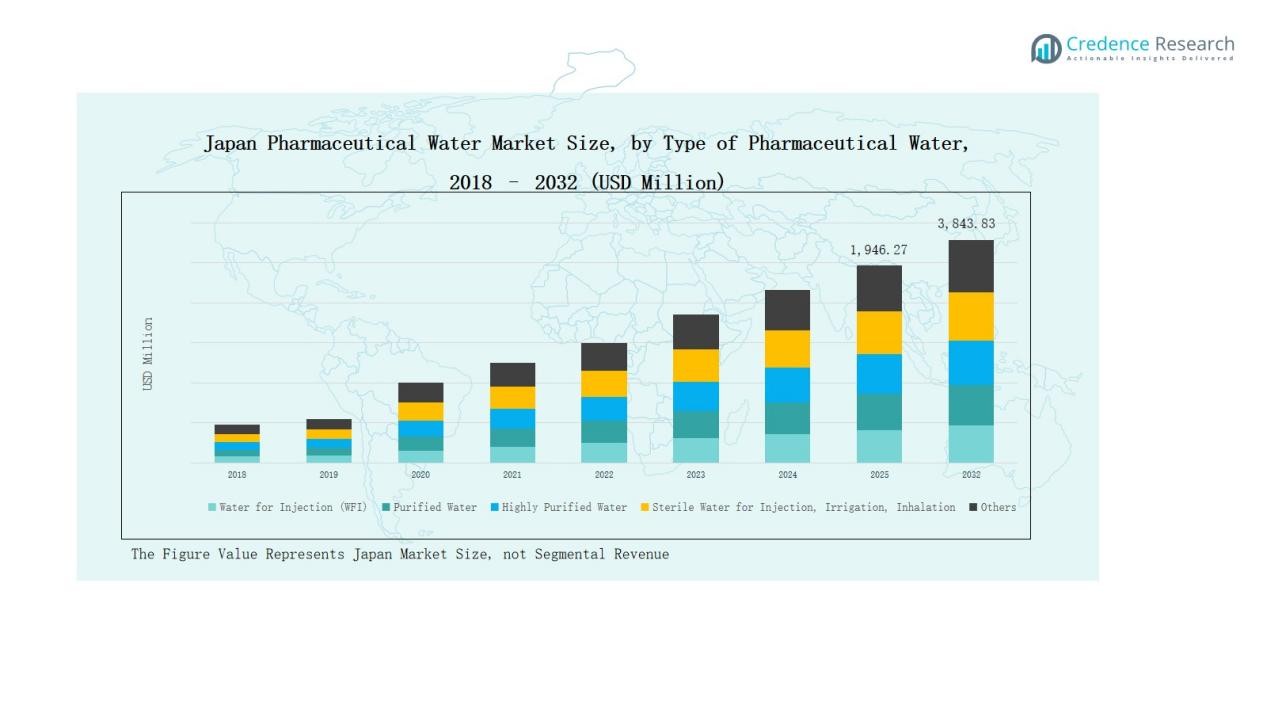

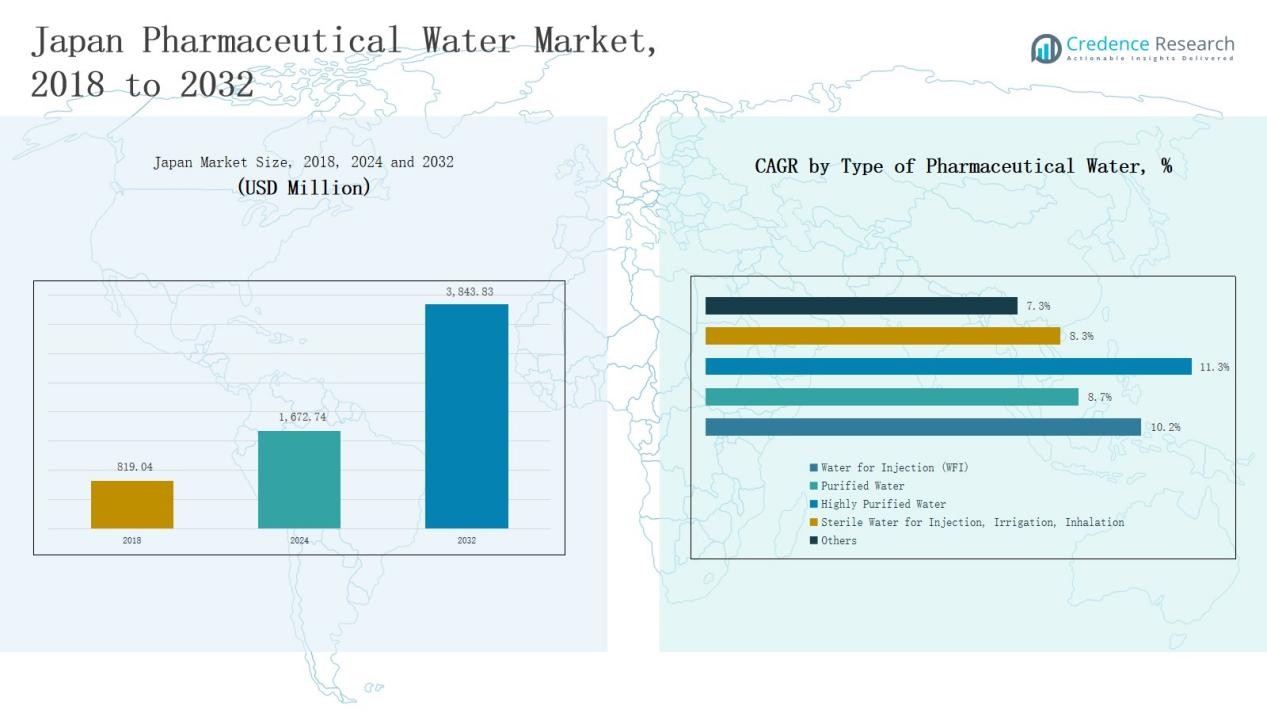

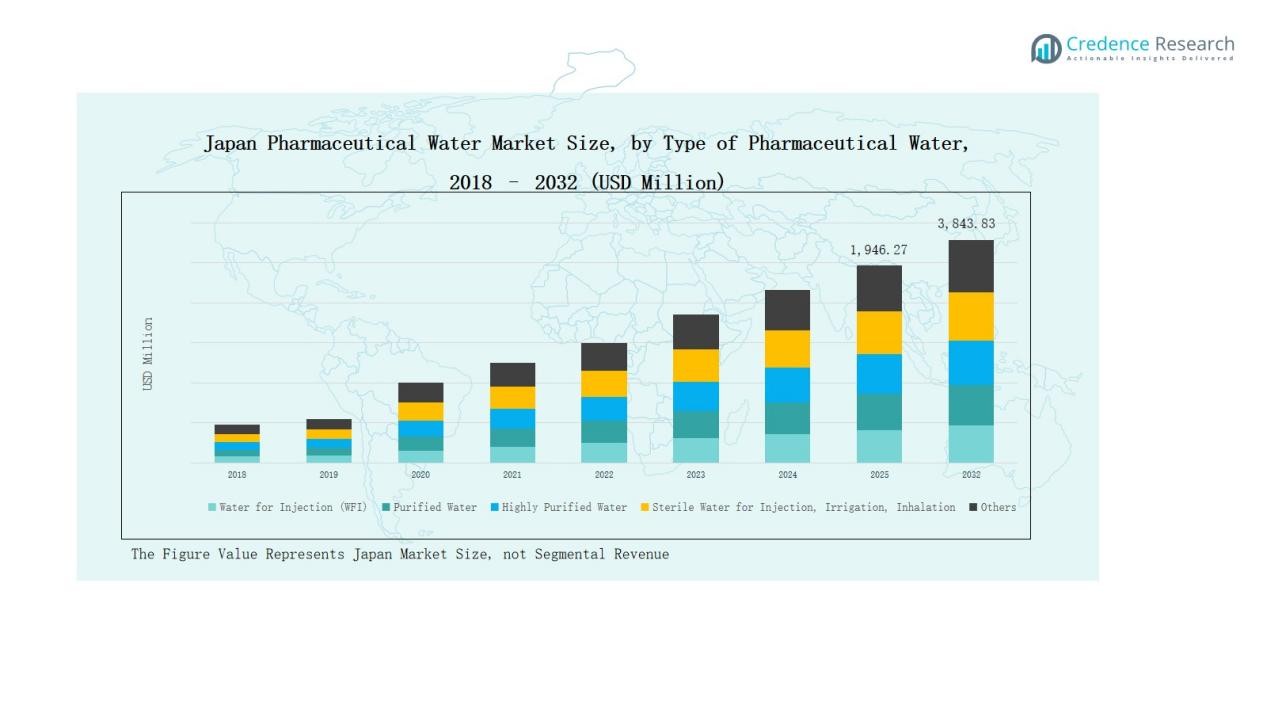

Japan Pharmaceutical Water Market size was valued at USD 819.04 million in 2018, grew to USD 1,672.74 million in 2024, and is anticipated to reach USD 3,843.83 million by 2032, expanding at a CAGR of 10.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Pharmaceutical Water Market Size 2024 |

USD 1,672.74 Million |

| Japan Pharmaceutical Water Market, CAGR |

10.21% |

| Japan Pharmaceutical Water Market Size 2032 |

USD 3,843.83 Million |

The Japan Pharmaceutical Water Market is driven by key players such as Mitsubishi Chemical Aqua Solutions Co., Ltd., Organo Corporation, Kurita Water Industries Ltd., Metawater Corporation, Veolia Japan, BWT Pharma Japan, Ovivo Water, Hitachi Plant Services Co., Ltd., Daikin Industries Ltd., and Kanadevia Corporation. These companies focus on advanced purification technologies, automation, and GMP-compliant system design to support pharmaceutical and biotechnology production. Their strategic partnerships and emphasis on digital monitoring strengthen their competitive positions across the country. The Kanto region emerged as the leading regional market in 2024, capturing a 38% share, supported by its concentration of pharmaceutical manufacturers, strong R&D infrastructure, and advanced production facilities adhering to Japan’s strict regulatory standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Pharmaceutical Water Market grew from USD 819.04 million in 2018 to USD 1,672.74 million in 2024 and is projected to reach USD 3,843.83 million by 2032, expanding at a CAGR of 10.21%.

- Water for Injection (WFI) dominated the market in 2024 with a 41% share, driven by high demand in sterile drug and vaccine production under strict GMP standards.

- Reverse Osmosis (RO) led the treatment technology segment with a 46% share, supported by its efficiency, low maintenance, and compatibility with multi-stage purification systems.

- Pharmaceutical & Biotechnology Manufacturing remained the largest application segment with a 57% share, supported by expanding biologics and injectable production facilities.

- The Kanto region held a 38% share in 2024, leading the market due to strong R&D infrastructure, advanced production capabilities, and concentration of pharmaceutical companies.

Market Segment Insights

By Type of Pharmaceutical Water:

Water for Injection (WFI) dominated the Japan Pharmaceutical Water Market in 2024, accounting for 41% of the total share. Its dominance stems from high demand in sterile drug formulation, vaccine production, and parenteral solutions. Pharmaceutical manufacturers prefer WFI due to its compliance with stringent Japanese Pharmacopoeia and GMP standards. Rising investments in biologics and injectables continue to expand the WFI infrastructure, reinforcing its leadership in the country’s pharmaceutical water production landscape.

By Treatment Technology:

Reverse Osmosis (RO) led the Japan Pharmaceutical Water Market in 2024 with a 46% market share. RO systems are widely used for removing impurities, ions, and microorganisms from source water, providing high reliability and cost efficiency. Pharmaceutical producers favor RO for its scalability, low maintenance, and compatibility with multi-stage purification systems. Increasing automation, coupled with digital monitoring for water quality validation, supports the growing adoption of RO systems across Japan’s pharmaceutical facilities.

- For instance, Veolia’s IonPro-LX system was deployed for Menicon’s high-purity water production in Singapore to meet stringent pharmaceutical standards, including conductivity and microbial limits.

By Application:

Pharmaceutical & Biotechnology Manufacturing held the leading position in 2024, capturing 57% of the Japan Pharmaceutical Water Market. The segment benefits from strong pharmaceutical production capacity, biologics expansion, and continuous process manufacturing. Water of controlled purity is essential for formulation, cleaning, and quality assurance. Growing demand for sterile injectables, biosimilars, and vaccines accelerates system installations, while government emphasis on innovation and GMP compliance further strengthens water infrastructure in manufacturing operations.

- For instance, Daiichi Sankyo’s DS-5670 mRNA vaccine program (approved in August 2023) will require sterile water infrastructure to support its development, fill/finish, and scaling processes.

Key Growth Drivers

Expanding Pharmaceutical and Biotech Production

Japan’s growing pharmaceutical and biotechnology sectors drive significant demand for high-purity water systems. The increasing production of vaccines, injectables, and biologics requires reliable Water for Injection (WFI) and Purified Water infrastructure. Companies invest heavily in automated purification technologies to meet PMDA and GMP standards. Continuous facility upgrades, R&D expansion, and the rise of contract manufacturing reinforce the country’s need for advanced water treatment systems that ensure product safety, consistency, and regulatory compliance across pharmaceutical operations.

- For instance, Veolia Water Technologies supplies the Orion™ system in Japan, which uses reverse osmosis and continuous electrodeionization to produce purified water and cold WFI compliant with Japanese pharmacopoeia and cGMP requirements, ensuring microbial control through regular hot water sanitization

Rising Regulatory Emphasis on Quality Compliance

Strict enforcement of water quality standards by Japan’s PMDA and Ministry of Health fuels market growth. Pharmaceutical companies are upgrading purification technologies and validation processes to ensure full compliance with global pharmacopoeia standards. Enhanced monitoring, microbial testing, and data integrity frameworks encourage the installation of advanced filtration and disinfection systems. The alignment of Japanese regulations with international benchmarks strengthens export competitiveness and boosts long-term investment in reliable, compliant pharmaceutical water systems.

- For instance, Merck’s Milli-Q IQ 7000 delivers 18.2 MΩ·cm water with <2 ppb TOC, and Merck provides IQ/OQ/PQ files to support GLP/cGMP validation.

Increasing Adoption of Advanced Treatment Technologies

Manufacturers are adopting high-efficiency purification methods such as Reverse Osmosis (RO), UV disinfection, and Electrodeionization (EDI). These technologies improve water quality while reducing operational costs and chemical dependency. Demand for sustainable systems with automated controls, real-time monitoring, and digital reporting continues to grow. This technological shift enhances system reliability and productivity, supporting Japan’s goal of building energy-efficient, environmentally responsible pharmaceutical facilities capable of meeting evolving purity and validation standards.

Key Trends & Opportunities

Shift Toward Sustainable and Energy-Efficient Systems

Japanese pharmaceutical companies increasingly prioritize sustainability in water management. New systems integrate low-energy RO membranes, heat recovery in distillation, and minimal chemical usage. This trend aligns with Japan’s environmental goals and corporate carbon reduction commitments. Suppliers introducing eco-designed, modular systems gain a competitive edge. These innovations reduce operational costs while meeting pharmaceutical purity standards, creating long-term opportunities for green technology providers in the pharmaceutical water treatment segment.

- For instance, Takeda’s manufacturing site in Osaka used data-driven initiatives to reduce distilled water consumption by over 450,000 liters annually and fresh water withdrawal by two million liters, also cutting city gas usage.

Expansion of Contract Manufacturing and Outsourcing

The rise of Contract Manufacturing Organizations (CMOs) in Japan creates new opportunities for pharmaceutical water system suppliers. CMOs require flexible, validated purification systems capable of serving multiple production lines. Growing outsourcing from domestic and international pharmaceutical firms drives demand for scalable, compliant, and automated solutions. This trend enhances the overall infrastructure for high-purity water generation and distribution, boosting collaboration between equipment manufacturers and service providers specializing in lifecycle management and system validation.

- For instance, Towa Pharmaceutical Group has been expanding its production system capacity and incorporates continuous flow precision synthesis technology which necessitates high-purity water systems with robust lifecycle management and validation support.

Key Challenges

High Capital and Maintenance Costs

The installation and upkeep of pharmaceutical water systems involve high capital investment and ongoing maintenance expenses. RO and distillation units require periodic validation, membrane replacement, and energy optimization. Small and mid-scale manufacturers often face financial barriers when upgrading to advanced purification systems. These cost constraints may slow the adoption of new technologies, particularly for firms focused on non-sterile production or lower-volume operations in Japan’s competitive pharmaceutical landscape.

Complex Validation and Regulatory Requirements

Stringent validation procedures for pharmaceutical water systems create significant operational challenges. Each stage, from design qualification to performance validation, must meet PMDA and GMP specifications. The process involves continuous documentation, microbial testing, and quality verification. Non-compliance risks regulatory penalties and production delays. Companies must invest in skilled personnel and digital quality management systems to manage complex audits, which increases both the operational burden and overall compliance cost.

Limited Availability of Skilled Technical Workforce

Japan faces a shortage of trained professionals capable of operating, maintaining, and validating advanced water treatment systems. The growing complexity of automation and digital monitoring technologies increases this skill gap. Pharmaceutical manufacturers struggle to retain qualified technicians with expertise in system calibration, microbial control, and data integrity. Without adequate technical talent, companies risk system downtime and compliance failures, slowing the pace of modernization and innovation in the pharmaceutical water sector.

Regional Analysis

Kanto Region

The Kanto region dominated the Japan Pharmaceutical Water Market in 2024 with a 38% share. It hosts major pharmaceutical and biotechnology companies concentrated in Tokyo, Kanagawa, and Saitama. Strong infrastructure, advanced manufacturing facilities, and regulatory focus support the adoption of high-purity water systems. The region’s extensive R&D and production activities create strong demand for Water for Injection (WFI) and Purified Water. Investments in digital monitoring and sustainability programs continue to strengthen its leadership in pharmaceutical water production and distribution.

Kansai Region

Kansai accounted for 25% of the market in 2024, driven by its industrial base in Osaka, Kyoto, and Hyogo. Pharmaceutical manufacturers in this region invest in automation and process innovation to meet quality standards. The presence of global and domestic drug producers boosts the installation of Reverse Osmosis (RO) and UV disinfection systems. Growing research collaborations with academic institutions promote the development of reliable water treatment technologies. It remains a key hub for innovation and compliance-focused pharmaceutical operations.

Chubu Region

The Chubu region held a 17% market share in 2024, supported by its expanding pharmaceutical production clusters in Nagoya and Shizuoka. Strong demand for biologics and contract manufacturing drives the installation of cost-effective water purification systems. Companies emphasize compact, modular setups that enhance process control and validation efficiency. It continues to benefit from strategic partnerships between water technology firms and pharmaceutical producers, improving both operational quality and compliance reliability.

Kyushu Region

Kyushu represented 12% of the market share in 2024. It benefits from government-backed initiatives encouraging pharmaceutical exports and manufacturing expansion. The region’s focus on clean manufacturing and environmental sustainability supports investments in advanced distillation and deionization technologies. Local companies leverage digital water management systems to improve performance and reduce downtime. It is emerging as an important manufacturing base for sterile and injectable product segments.

Tohoku and Hokkaido Regions

Tohoku and Hokkaido together captured a 8% share in 2024. These regions are seeing gradual growth due to increasing investments in healthcare and biopharmaceutical research. Government incentives encourage the development of regional production units using energy-efficient water purification systems. It demonstrates rising adoption of compact, compliant purification setups suitable for small and medium-scale operations. Continued expansion in medical R&D infrastructure is expected to strengthen their position within the pharmaceutical water ecosystem.

Market Segmentations:

By Type of Pharmaceutical Water:

- Water for Injection (WFI)

- Purified Water

- Highly Purified Water

- Sterile Water for Injection

- Sterile Water for Irrigation

- Sterile Water for Inhalation

- Others

By Treatment Technology:

- Reverse Osmosis (RO)

- Ultraviolet (UV) Disinfection

- Distillation

- Deionization

- Others

By Application:

- Pharmaceutical & Biotechnology Manufacturing

- Research Laboratories & Academic Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

By Region:

- Kanto

- Kansai

- Chubu

- Kyushu

- Tohoku and Hokkaido

Competitive Landscape

The Japan Pharmaceutical Water Market features strong competition among leading domestic and international companies offering advanced purification systems and compliance-driven solutions. Key players such as Mitsubishi Chemical Aqua Solutions Co., Ltd., Organo Corporation, Kurita Water Industries Ltd., Metawater Corporation, Veolia Japan, and BWT Pharma Japan maintain a dominant presence through innovation, technical expertise, and strategic partnerships with pharmaceutical producers. These companies focus on developing energy-efficient and automated purification technologies that meet strict PMDA and GMP requirements. Continuous R&D investments support improvements in system design, microbial control, and digital monitoring. The market also includes global suppliers like Ovivo Water and Hitachi Plant Services Co., Ltd., which emphasize integrated service models and lifecycle management. Growing demand for sustainable systems, validation services, and remote performance tracking continues to intensify competition, pushing suppliers to differentiate through quality assurance, customized solutions, and after-sales technical support across Japan’s expanding pharmaceutical landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In June 2024, Asahi Kasei launched a membrane-based Water for Injection (WFI) production system in Japan. The new technology replaces traditional distillation with an energy-efficient membrane purification process.

- In April 2024, ONO Pharmaceutical agreed to acquire Deciphera Pharmaceuticals (US), a deal announced to deepen ONO’s drug pipeline.

- In February 2025, Bain Capital acquired Mitsubishi Tanabe Pharma for ~¥510 billion.

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmaceutical Water, Treatment Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity water systems will increase with rising biologics and vaccine production.

- Pharmaceutical firms will adopt advanced digital monitoring for real-time water quality control.

- Sustainability initiatives will drive the use of energy-efficient and chemical-free purification systems.

- Reverse osmosis and electrodeionization technologies will continue to dominate treatment installations.

- Contract manufacturing growth will expand the need for modular and validated water systems.

- Local manufacturers will strengthen partnerships with global water technology providers.

- Regulatory updates will push companies to upgrade validation and documentation processes.

- Investments in automation and predictive maintenance will improve system reliability.

- Training programs will focus on developing skilled operators for advanced purification systems.

- Integration of IoT and AI in water management will enhance efficiency and compliance across pharmaceutical facilities.