Market Overview

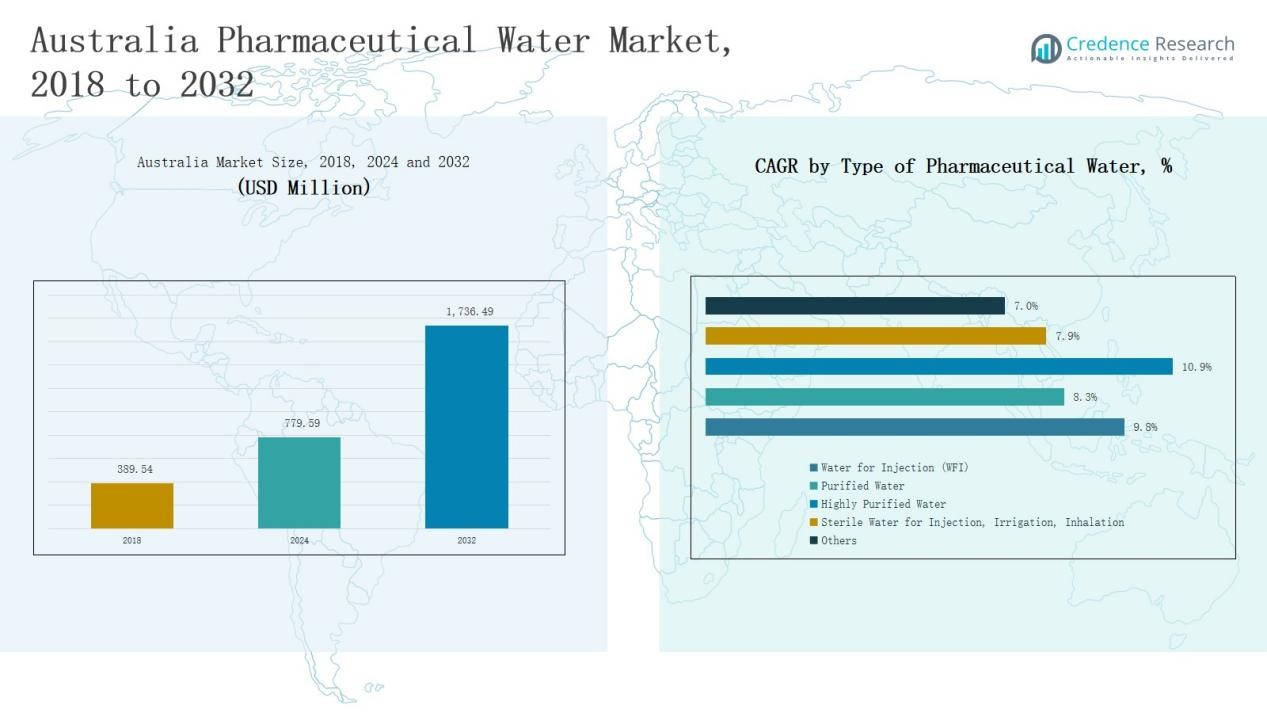

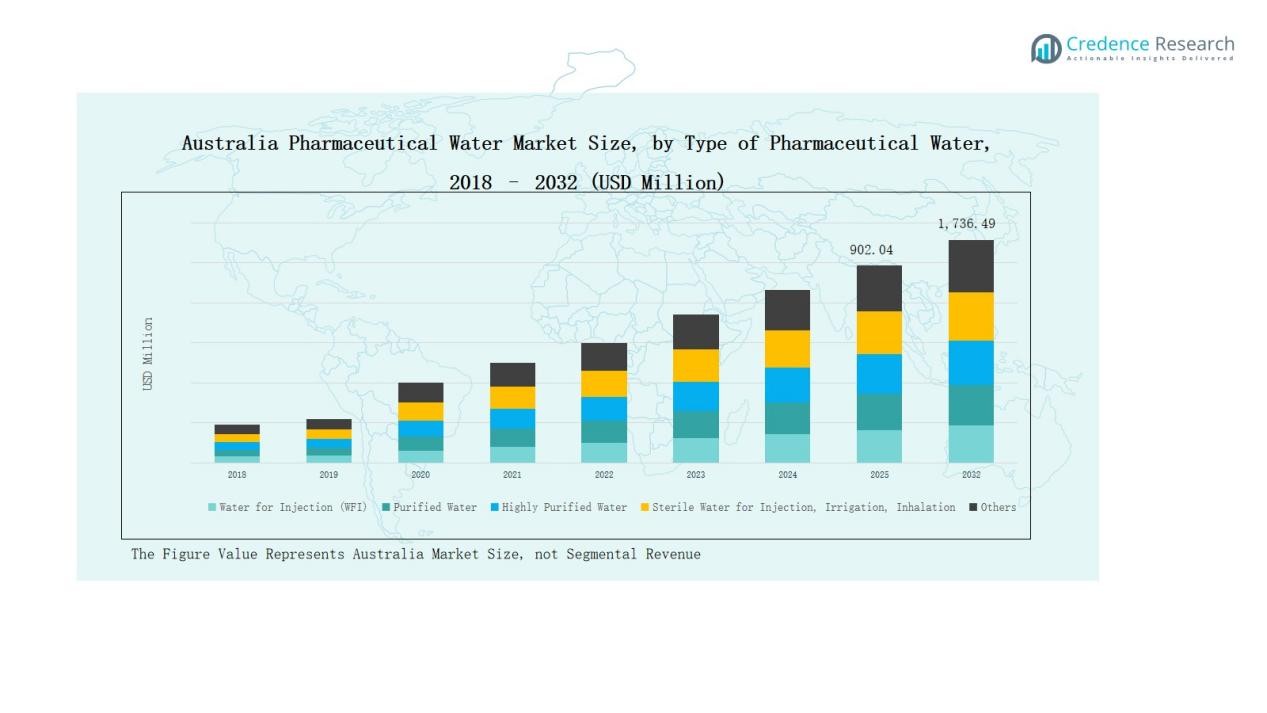

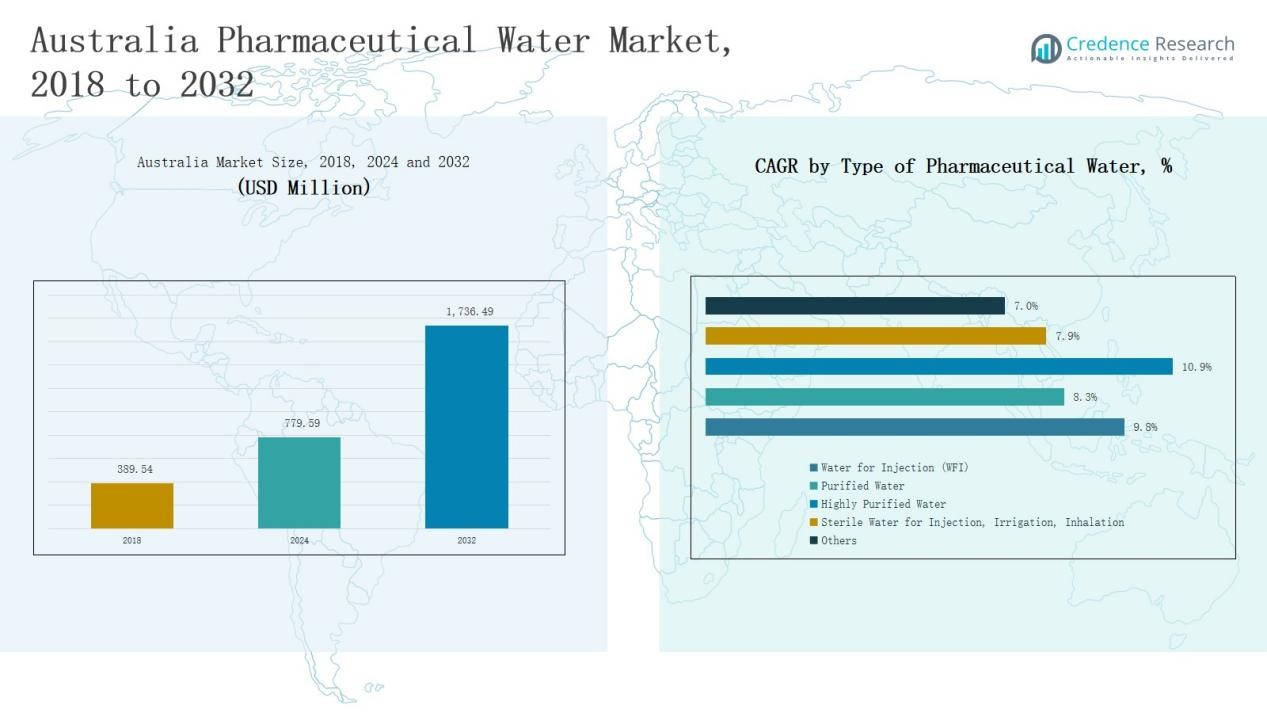

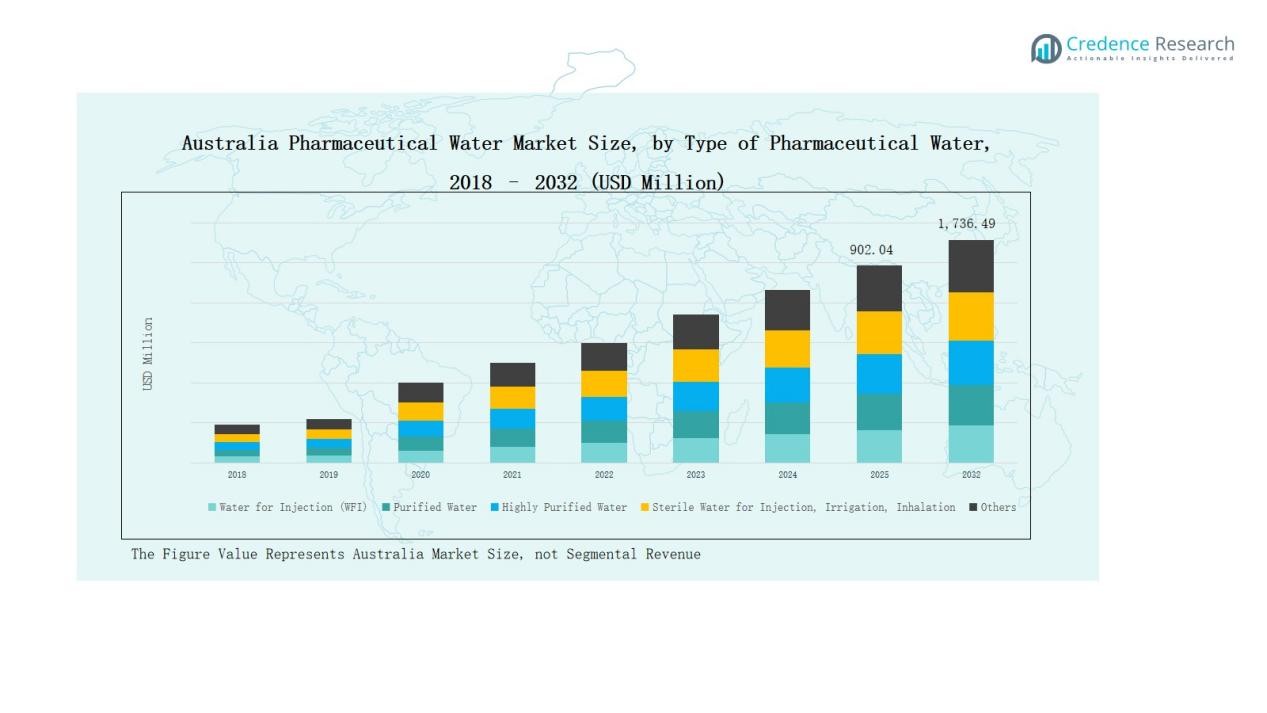

Australia Pharmaceutical Water Market size was valued at USD 389.54 million in 2018, grew to USD 779.59 million in 2024, and is anticipated to reach USD 1,736.49 million by 2032, expanding at a CAGR of 9.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Pharmaceutical Water Market Size 2024 |

USD 779.59 Million |

| Australia Pharmaceutical Water Market, CAGR |

9.81% |

| Australia Pharmaceutical Water Market Size 2032 |

USD 1,736.49 Million |

The Australia Pharmaceutical Water Market is led by prominent players such as Veolia Water Technologies Australia, Ecolab Australia, Danaher Corporation Australia, SUEZ Water Technologies & Solutions Australia, Aquatec Maxcon, GEL Group, Trility, ClearWater Solutions Australia, GE Water & Process Technologies Australia, and Evoqua Water Technologies Australia. These companies strengthen their market positions through advanced purification technologies, automation, and compliance-focused solutions that meet TGA and GMP standards. Their emphasis on innovation, sustainability, and digital water management supports efficient operations across pharmaceutical and biotechnology facilities. New South Wales emerged as the leading region in 2024, capturing a 33% market share, driven by strong industrial concentration, robust infrastructure, and continuous investment in high-purity water systems for pharmaceutical production and research applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Pharmaceutical Water Market grew from USD 389.54 million in 2018 to USD 779.59 million in 2024 and is projected to reach USD 1,736.49 million by 2032, expanding at a CAGR of 9.81%.

- Water for Injection (WFI) led the market in 2024 with a 42% share, driven by its essential role in sterile drug manufacturing and increasing biologics production.

- Reverse Osmosis (RO) technology accounted for a 38% share due to its efficiency, reliability, and compliance with GMP standards in pharmaceutical purification processes.

- Pharmaceutical & Biotechnology Manufacturing dominated applications with a 55% share, supported by expanding vaccine and injectable production facilities across Australia.

- New South Wales led regionally with a 33% share in 2024, supported by strong pharmaceutical infrastructure, active R&D centers, and significant investment in advanced water purification systems.

Market Segment Insights

By Type of Pharmaceutical Water

Water for Injection (WFI) dominated the Australia Pharmaceutical Water Market in 2024 with a 42% share. The segment’s leadership stems from its critical use in parenteral drug manufacturing, sterile formulations, and biologics production. Strict quality standards by the TGA and growing demand for injectable medicines drive consistent investment in high-purity water systems. Rising biologics and vaccine production further strengthen WFI’s dominance in Australia’s pharmaceutical water infrastructure.

- For instance, Pfizer Australia upgraded its Melbourne plant during 2024, integrating high-purity water loops designed to meet TGA-grade WFI standards for injectable drug production.

By Treatment Technology

Reverse Osmosis (RO) held the largest share of 38% in 2024 within the Australia Pharmaceutical Water Market. RO systems are favored for their cost efficiency, high contaminant removal rate, and compliance with GMP standards. Widespread adoption in both purified and WFI systems enhances their utility across pharmaceutical plants. The demand for low-maintenance and energy-efficient water purification systems continues to strengthen RO’s market position.

- For instance, Veolia Water Technologies introduced its improved Orion RO system optimized for pharmaceutical-grade applications in Australia, offering enhanced energy recovery and membrane lifespan.

By Application

Pharmaceutical & Biotechnology Manufacturing accounted for a 55% share of the Australia Pharmaceutical Water Market in 2024. This segment leads due to the extensive need for purified and WFI-grade water in drug formulation, quality testing, and cleaning processes. Expansion of biologics, vaccines, and sterile injectables manufacturing boosts demand for advanced water systems. Rising R&D spending by pharmaceutical firms further sustains this segment’s dominance.

Key Growth Driver

Expanding Biopharmaceutical and Vaccine Production

Australia’s growing focus on biologics and vaccine manufacturing drives high demand for pharmaceutical-grade water. The expansion of domestic production facilities, especially after COVID-19, has increased the need for reliable Water for Injection (WFI) systems. Biopharmaceutical companies are investing in advanced purification technologies to meet stringent sterility standards. This surge in biologics manufacturing capacity continues to strengthen the country’s pharmaceutical water infrastructure and system upgrades.

- For instance, HRS Heat Exchangers supplied advanced cooling heat exchanger technology to one of Australia’s largest pharmaceutical manufacturers, enhancing WFI system efficiency in biopharmaceutical production environments.

Regulatory Emphasis on Water Quality Compliance

Strict regulatory standards set by the Therapeutic Goods Administration (TGA) and adherence to GMP norms support market growth. Pharmaceutical manufacturers must ensure consistent water purity for drug formulation, cleaning, and quality control. This compliance requirement encourages adoption of advanced treatment technologies such as reverse osmosis and distillation. Continuous audits and rising regulatory scrutiny further push companies to modernize existing water systems and validation processes.

- For instance, CSL Limited deployed an automated water quality monitoring system in its Broadmeadows site in late 2023 to meet GMP-compliant microbial control standards across its biopharmaceutical manufacturing lines.

Increasing Investments in Facility Modernization

Rising capital investments by domestic and multinational pharmaceutical firms are transforming production capabilities in Australia. Companies are upgrading old water treatment infrastructure with automated systems that ensure reliability and reduced operational risk. The integration of digital monitoring and predictive maintenance improves efficiency and minimizes downtime. These investments reflect a broader trend toward sustainable, compliant, and energy-efficient pharmaceutical water management solutions.

Key Trend & Opportunity

Adoption of Smart and Automated Water Systems

Automation and digitalization are reshaping pharmaceutical water operations in Australia. Smart systems that monitor conductivity, temperature, and microbial levels in real time help achieve consistent compliance. The integration of IoT and AI in water management allows predictive maintenance and reduced human error. This technological shift presents strong opportunities for suppliers offering intelligent control systems and cloud-based monitoring solutions.

- For instance, Hunter Water in New South Wales began piloting 500 advanced digital water meters in December 2024, providing real-time consumption data refreshed every 30 minutes to enhance leak detection and water management.

Growing Demand for Sustainable Water Treatment Solutions

Sustainability is becoming a strategic focus in the Australian pharmaceutical sector. Companies are investing in eco-efficient systems that minimize water wastage and energy use. The adoption of closed-loop purification and energy recovery technologies supports green manufacturing initiatives. Growing pressure to meet environmental standards creates new opportunities for vendors developing low-impact, sustainable water treatment solutions.

- For instance, Veolia installed an AnoxKaldnes® Moving Bed Biofilm Reactor system at AstraZeneca’s manufacturing site in Sweden, achieving 97% removal of total organic carbon and 99% phosphorus from wastewater.

Key Challenge

High Initial Capital and Maintenance Costs

The installation of advanced pharmaceutical water systems requires significant upfront investment and ongoing maintenance expenses. Many small and mid-sized manufacturers find it difficult to afford high-end purification setups. Costs related to validation, monitoring, and system upgrades further strain budgets. These financial barriers often delay modernization and limit adoption of advanced water treatment technologies.

Complex Regulatory and Validation Procedures

Compliance with TGA and international standards such as USP and EP involves complex documentation and testing. Continuous validation and system qualification processes increase administrative and operational load. Any deviation from required parameters can lead to production delays or penalties. Navigating these strict regulatory frameworks remains a persistent challenge for manufacturers in Australia.

Shortage of Skilled Technical Workforce

The pharmaceutical water industry in Australia faces a shortage of professionals trained in advanced purification technologies. Operation and maintenance of high-purity systems demand expertise in automation, microbiology, and validation protocols. Limited availability of skilled staff increases operational risks and maintenance errors. This workforce gap highlights the need for targeted technical training and capacity development in the sector.

Regional Analysis

New South Wales

New South Wales led the Australia Pharmaceutical Water Market in 2024 with a 33% share. The region’s dominance stems from a dense cluster of pharmaceutical and biotechnology manufacturing units across Sydney and nearby industrial zones. Strong government support for medical research and health innovation enhances infrastructure growth. Major production facilities rely on advanced water purification systems for compliance with GMP standards. Increasing expansion by multinational companies further boosts investment in high-purity water technologies. It remains the central hub for pharmaceutical production and regulatory compliance in Australia.

Victoria

Victoria accounted for a 28% share of the Australia Pharmaceutical Water Market in 2024. The state’s well-established pharmaceutical base in Melbourne drives significant adoption of Water for Injection (WFI) and purified water systems. Research institutions and academic laboratories contribute to continuous technological innovation in water treatment. Strong collaborations between public health agencies and private manufacturers promote capacity expansion. It continues to attract investments in sustainable and automated purification systems supporting advanced drug development.

Queensland

Queensland captured a 17% share in the Australia Pharmaceutical Water Market in 2024. Rapid growth in contract manufacturing organizations and medical research facilities strengthens the region’s demand for purified and sterile water systems. The Brisbane industrial corridor houses several production plants adopting digitalized water monitoring solutions. Government incentives for healthcare manufacturing promote infrastructure modernization. It shows steady expansion in pharmaceutical-grade water facilities aligned with environmental sustainability goals.

Western Australia

Western Australia held a 12% share in the Australia Pharmaceutical Water Market in 2024. The region’s growth is supported by increasing bioprocessing and sterile product manufacturing activities. Companies are upgrading treatment technologies to meet TGA quality requirements and ensure consistent purity. Water scarcity challenges encourage the use of energy-efficient purification systems. It benefits from rising investment in advanced utilities and pharmaceutical infrastructure.

South Australia and Others

South Australia, along with Tasmania and the Northern Territory, collectively accounted for a 10% share in 2024. The region’s pharmaceutical presence is smaller but steadily developing through niche manufacturing and research initiatives. New projects in medical devices and biopharma stimulate moderate demand for purified water systems. Collaboration between universities and technology suppliers fosters innovation in compact treatment units. It continues to witness gradual adoption of modern purification solutions to support local production and testing facilities.

Market Segmentations:

By Type of Pharmaceutical Water

- Water for Injection (WFI)

- Purified Water

- Highly Purified Water

- Sterile Water for Injection, Irrigation, Inhalation

- Others

By Treatment Technology

- Reverse Osmosis (RO)

- Ultraviolet (UV) Disinfection

- Distillation

- Deionization

- Others

By Application

- Pharmaceutical & Biotechnology Manufacturing

- Research Laboratories & Academic Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Others

Competitive Landscape

The Australia Pharmaceutical Water Market features a moderately consolidated competitive landscape dominated by global and regional players specializing in advanced water treatment technologies. Leading companies such as Veolia Water Technologies Australia, Ecolab Australia, Danaher Corporation Australia, and SUEZ Water Technologies & Solutions Australia maintain strong market positions through extensive product portfolios, turnkey solutions, and regulatory compliance expertise. Local firms like Aquatec Maxcon, Trility, and GEL Group contribute through customized installations and efficient service networks. Competition centers on technology innovation, system reliability, and cost-effective maintenance contracts. Companies increasingly invest in automation, IoT-enabled monitoring, and energy-efficient purification systems to meet evolving TGA and GMP standards. Strategic partnerships with pharmaceutical manufacturers, combined with growing emphasis on sustainability and validation services, continue to shape the competitive environment. The market is expected to witness rising collaboration between technology providers and biopharma producers to ensure compliance, reduce operational costs, and enhance process water quality.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Veolia Water Technologies Australia

- Ecolab Australia

- Danaher Corporation Australia

- SUEZ Water Technologies & Solutions Australia

- Aquatec Maxcon

- GEL Group

- Trility

- ClearWater Solutions Australia

- GE Water & Process Technologies Australia

- Evoqua Water Technologies Australia

Recent Developments

- In July 2024, De.mem Limited completed the acquisition of Auswater Systems Pty Ltd.

- In March 2025, Centurion acquired WestWater Enterprises (Australia) to expand its water treatment capabilities.

- In August 2025, AxFlow acquired Advanced Pump Technologies Pty Ltd (APT Water) in Australia, gaining strength in fluid handling and filtration systems.

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmaceutical Water, Treatment Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity water systems will increase with expanding biologics and vaccine production.

- Pharmaceutical companies will adopt automated monitoring to improve water quality control.

- Energy-efficient and sustainable purification systems will gain wider acceptance.

- Local manufacturers will upgrade infrastructure to meet stricter TGA and GMP standards.

- Partnerships between global technology providers and domestic firms will strengthen market capability.

- Investment in digital validation and real-time data tracking will improve compliance efficiency.

- Growth of contract manufacturing organizations will boost demand for modular water systems.

- Research institutes will drive innovation in compact and eco-friendly water treatment units.

- Training programs will expand to address the shortage of skilled water system operators.

- Increasing focus on sustainability will lead to adoption of closed-loop and low-waste purification models.