Market Overview

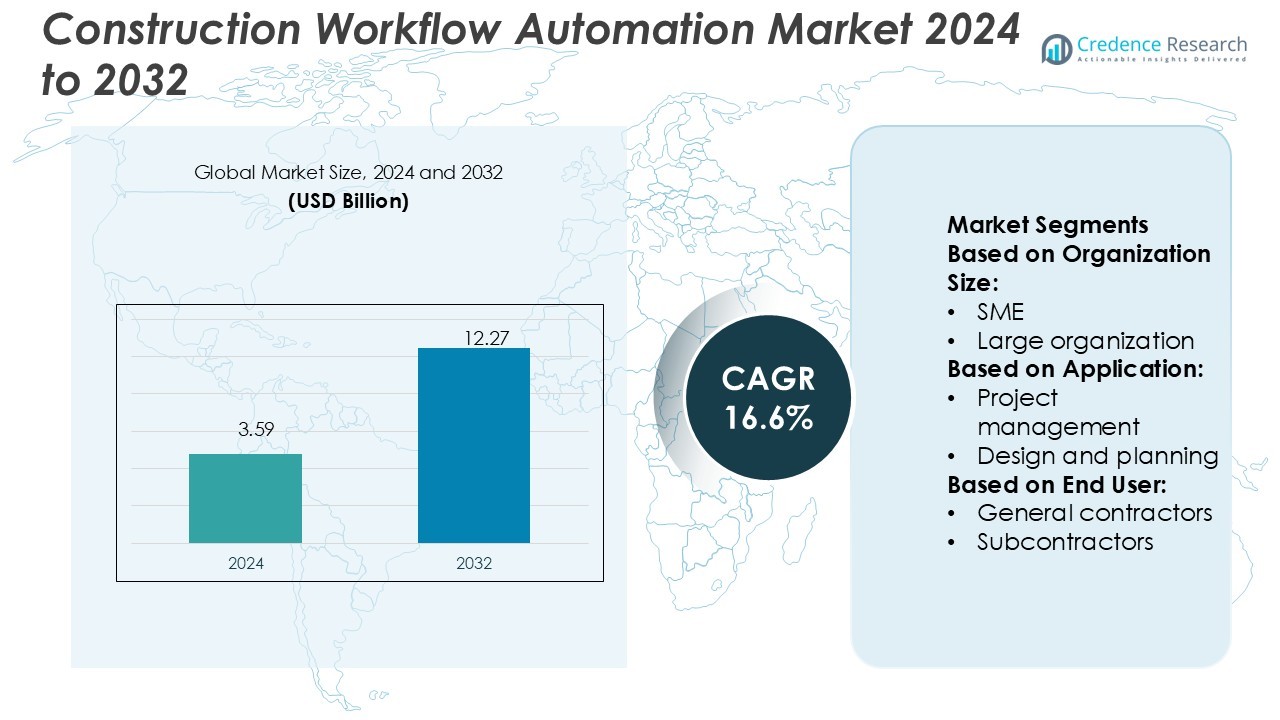

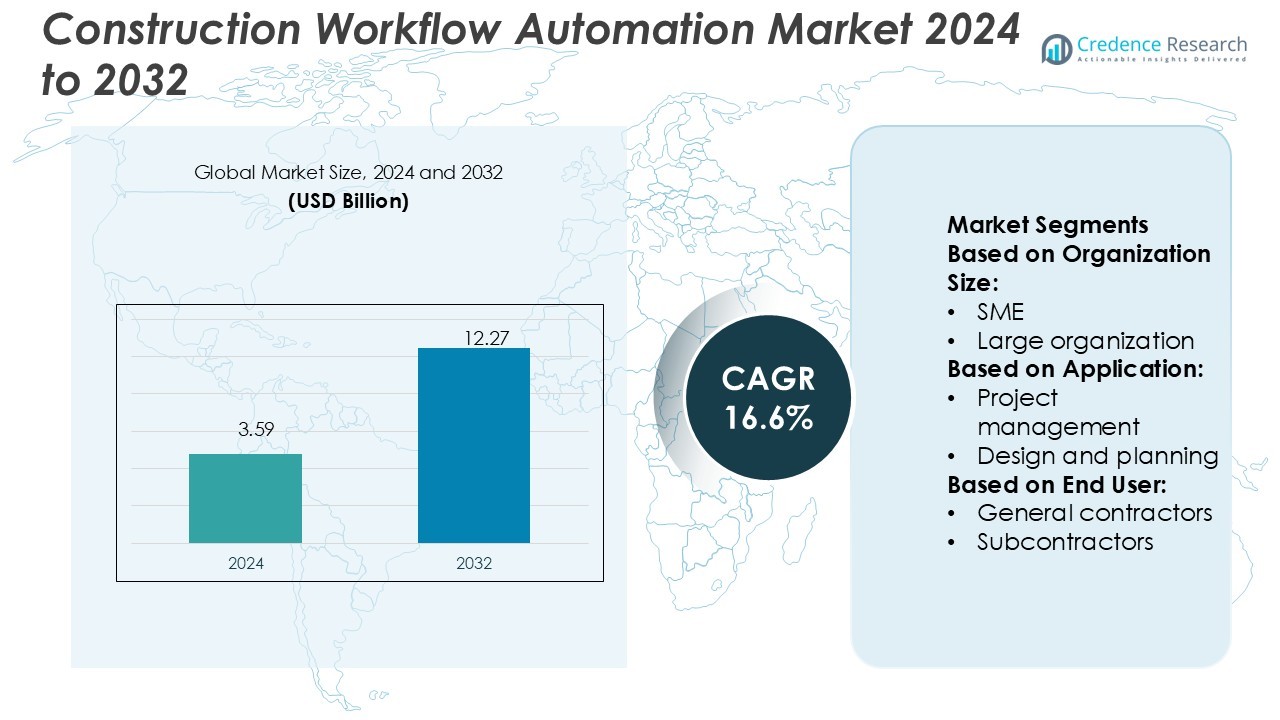

Construction Workflow Automation Market size was valued USD 3.59 billion in 2024 and is anticipated to reach USD 12.27 billion by 2032, at a CAGR of 16.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Workflow Automation Market Size 2024 |

USD 3.59 Billion |

| Construction Workflow Automation Market, CAGR |

16.6% |

| Construction Workflow Automation Market Size 2032 |

USD 12.27 Billion |

The Construction Workflow Automation Market is driven by major players including Trimble, RIB Software SE, Procore, Autodesk, CoConstruct, Oracle, SAP SE, Bentley Systems, Buildertrend, and Bluebeam, Inc. These companies focus on cloud-based project management, real-time analytics, and automation solutions to enhance productivity and cost control. Their strategies center on integrating AI-driven platforms and expanding global footprints through partnerships and acquisitions. Among all regions, North America leads the market with a 33% share, supported by rapid digital adoption, a mature construction ecosystem, and strong investment in smart infrastructure. The region’s contractors and developers prioritize advanced workflow solutions to improve efficiency, compliance, and collaboration across complex projects. This leadership position continues to influence product development and market direction globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Workflow Automation Market was valued at USD 3.59 billion in 2024 and is projected to reach USD 12.27 billion by 2032, growing at a CAGR of 16.6%.

- Strong drivers include the rapid adoption of cloud platforms, AI integration, and automation to enhance project efficiency and reduce operational delays.

- Market trends highlight growing investment in digital twin technology, mobile-first solutions, and workflow interoperability to support complex construction projects.

- The competitive landscape is shaped by major players focusing on innovation, partnerships, and global expansion to strengthen their technological capabilities.

- North America leads the market with a 33% regional share, driven by advanced digital infrastructure and smart project adoption, while large organizations dominate the segment share due to higher investment capacity and large-scale project needs.

Market Segmentation Analysis:

By Organization Size

Large organizations hold the dominant share in the construction workflow automation market. This dominance stems from their strong investment capacity and focus on digital transformation. These organizations use automation to streamline scheduling, resource allocation, and compliance management. Advanced platforms enhance real-time visibility and reduce delays in complex projects. Companies are also integrating AI-driven solutions for better cost tracking and performance insights. SMEs are steadily adopting affordable cloud-based tools, but large organizations remain the primary drivers due to their scale, structured operations, and regulatory requirements.

- For instance, RIB Software’s MTWO platform is an integrated 5D BIM construction management solution used to improve efficiency, accuracy, and cost control on large-scale projects. The platform connects people, processes, and data throughout a project’s lifecycle, automating workflows like procurement and enabling BIM simulations.

By Application

Project management represents the leading segment in application share. It plays a central role in coordinating tasks, budgets, and timelines across all project stages. Automation tools simplify planning, documentation, and real-time collaboration. Contractors rely on these systems to minimize errors, optimize labor, and maintain compliance. Design and planning are also gaining traction with BIM integration and cloud-based modeling. Operations and maintenance applications are rising as companies focus on lifecycle management. Project management remains dominant due to its direct impact on cost control and productivity.

- For instance, Procore reports that over 1 million projects have been managed on its platform, which collectively represents more than $1 trillion in construction volume. This highlights the significant scale of its project management domain in the construction industry.

By End-user

General contractors account for the largest market share among end users. They adopt automation tools to manage complex workflows, subcontractor coordination, and compliance tracking. Real-time dashboards, resource allocation modules, and cost estimation systems improve operational control. Subcontractors are increasing adoption but face budget limitations. Owners and architects also leverage automation for progress tracking and quality control. General contractors lead due to their central project role, responsibility for delivery, and growing need for integrated solutions to handle multi-site projects efficiently.

Key Growth Drivers

Rising Demand for Real-Time Project Tracking

Construction firms are adopting workflow automation tools to enhance real-time visibility across project lifecycles. Digital platforms enable seamless communication between contractors, architects, and project managers. This reduces delays, improves decision-making speed, and ensures faster issue resolution. Integration with IoT devices and cloud systems also boosts reporting accuracy. Automated dashboards and analytics simplify compliance tracking and budget control. The demand for precise, real-time data is pushing more companies toward automated project management platforms to minimize manual dependencies and costly inefficiencies.

- For instance, SAP reports that over 33,000 cloud customers use its Business Technology Platform (BTP) to integrate data, automation, and AI services across their enterprise workflows. This platform helps customers extend and innovate their business processes by providing a comprehensive suite of cloud services.

Increasing Adoption of Cloud-Based Solutions

Cloud-based workflow automation platforms are driving large-scale transformation in the construction industry. These solutions enable remote collaboration, document sharing, and process standardization across multiple sites. Their scalability supports both small and large organizations, reducing IT infrastructure costs. Automation tools also allow quick deployment and integration with existing project management software. Enhanced security features and data accessibility make cloud platforms more attractive. This strong shift toward cloud adoption is a key factor behind growing investment in digital construction workflows.

- For instance, Buildertrend’s AI-powered Client Updates feature reduced average update creation time from 60 minutes to 6.5 minutes, a 97 % time savings.

Growing Focus on Productivity and Cost Optimization

Rising material costs and labor shortages are pushing firms to improve operational efficiency. Automated workflows reduce repetitive manual tasks and increase task accuracy. Project teams can track schedules, budgets, and resource allocation in real time. Automation reduces rework, shortens project timelines, and improves quality control. This enhances profit margins while maintaining compliance with project standards. As competition intensifies, more construction companies are prioritizing automation to achieve higher productivity and lower operational costs.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

The construction sector is leveraging AI and predictive analytics to enhance project planning and execution. Predictive tools identify potential delays, safety risks, and cost overruns early. AI-based workflow platforms improve resource allocation and productivity forecasting. These technologies support data-driven decision-making and reduce uncertainty in large projects. Companies are increasingly integrating AI into automation platforms to gain a competitive edge and optimize outcomes.

- For instance, Bluebeam Revu’s Auto Align tool, an AI-powered feature released in April 2024, reduces drawing alignment time by up to 80% compared to manual methods when overlaying or comparing documents.

Rising Use of BIM and IoT Technologies

Building Information Modeling (BIM) and IoT are creating new opportunities in workflow automation. BIM provides detailed digital representations that streamline collaboration among stakeholders. IoT sensors monitor site conditions, equipment use, and safety compliance in real time. Combined with automation platforms, these technologies improve planning accuracy and reduce project risks. The convergence of BIM and IoT strengthens end-to-end construction lifecycle management, driving efficiency and transparency.

- For instance, Spotfire 12 integrates streaming data with visual analytics. In addition to this core functionality, Spotfire offers Cloud Actions, which enables users to trigger automated workflows and write back to operational systems directly from a dashboard visualization.

Expansion of Modular and Prefabrication Workflows

The shift toward modular and prefabricated construction is boosting automation demand. Standardized processes require precise coordination between design, manufacturing, and installation teams. Workflow automation tools help synchronize timelines and ensure quality control. Automated scheduling and logistics management enable faster project delivery. This trend aligns with growing demand for sustainable and cost-efficient building practices, creating new market opportunities.

Key Challenges

High Implementation Costs and Resistance to Change

Many construction firms face challenges adopting workflow automation due to high upfront costs. Smaller contractors often lack the financial capacity to invest in advanced digital platforms. Workforce resistance to technology-driven change also slows adoption. Transitioning from traditional methods requires training, process redesign, and cultural shifts. This combination of cost pressure and organizational inertia remains a significant barrier to rapid automation uptake.

Data Security and Integration Complexities

Automating construction workflows involves managing sensitive project and financial data. Weak cybersecurity measures can expose firms to breaches and compliance risks. Integration with legacy systems and multiple platforms adds technical complexity. Ensuring interoperability across cloud solutions, BIM tools, and IoT devices can be challenging. Companies must invest in secure, standardized integration frameworks to fully realize automation benefits while maintaining data protection.

Regional Analysis

North America

North America holds a 33% market share in the Construction Workflow Automation Market. Strong adoption of digital construction platforms, BIM tools, and cloud-based collaboration drives growth. The U.S. leads regional adoption due to advanced infrastructure and rising labor productivity initiatives. Major contractors integrate AI-powered project management systems to reduce delays and costs. For instance, firms deploy automation platforms to manage real-time reporting, scheduling, and compliance tracking. The region also benefits from increasing investment in green and smart building projects, boosting the need for automated workflows across commercial and infrastructure segments.

Europe

Europe accounts for 27% of the market share and demonstrates strong regulatory-driven adoption. Countries like Germany, the U.K., and France lead in deploying digital workflow solutions for construction. Strict energy efficiency laws and advanced safety regulations push contractors to adopt automated documentation and project control tools. The region focuses on integrating digital twins and BIM for enhanced transparency and productivity. Leading construction firms leverage cloud-based dashboards for multi-site coordination and compliance. The growing investment in infrastructure modernization across Western and Northern Europe further supports market expansion.

Asia Pacific

Asia Pacific dominates the market with a 29% share, driven by rapid urbanization and infrastructure investments. China, India, Japan, and Australia are major contributors to regional demand. Governments promote digital construction platforms to streamline project delivery timelines and optimize workforce management. Large-scale public infrastructure projects, such as smart cities and transport systems, encourage automation adoption. Local and international contractors are deploying workflow automation to control cost overruns and improve project efficiency. The region’s rising construction volume continues to attract global technology providers and software developers.

Latin America

Latin America represents a 3% share of the global market. The region is gradually adopting digital platforms to overcome productivity challenges in construction. Brazil and Mexico lead adoption due to growing infrastructure investments and private sector modernization. Contractors focus on cost control, safety compliance, and better coordination through automated tools. Integration of project management platforms helps reduce inefficiencies in complex infrastructure projects. International solution providers are expanding their presence through strategic collaborations and training programs, enhancing regional awareness and accelerating market growth.

Middle East & Africa

The Middle East & Africa region holds an 8% market share, supported by rising smart city initiatives and mega infrastructure projects. Countries like the UAE, Saudi Arabia, and South Africa are early adopters of advanced construction software. Government-backed projects such as NEOM are accelerating automation demand to meet strict project timelines. The region is witnessing increased partnerships between local contractors and global technology firms to enhance operational efficiency. Workflow automation is also helping address skilled labor shortages by improving process visibility and reducing manual intervention.

Market Segmentations:

By Organization Size:

By Application:

- Project management

- Design and planning

By End User:

- General contractors

- Subcontractors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Construction Workflow Automation Market is shaped by key players such as Trimble, RIB Software SE, Procore, Autodesk, CoConstruct, Oracle, SAP SE, Bentley Systems, Buildertrend, and Bluebeam, Inc. The Construction Workflow Automation Market is defined by rapid innovation and increasing digital adoption. Companies are investing in cloud-based platforms, AI-driven project management, and real-time analytics to enhance collaboration and efficiency. The market is witnessing strong competition as providers aim to deliver end-to-end workflow solutions that integrate seamlessly with existing construction processes. Strategic alliances, mergers, and technology upgrades are common strategies to expand market presence and strengthen service capabilities. Focus areas include improving scheduling accuracy, reducing operational delays, enhancing compliance tracking, and enabling data-driven decision-making across all construction phases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trimble

- RIB Software SE

- Procore

- Autodesk

- CoConstruct

- Oracle

- SAP SE

- Bentley Systems

- Buildertrend

- Bluebeam, Inc.

Recent Developments

- In July 2024, Celonis launched an AI-driven process orchestration solution to deliver end-to-end process optimization, developed in partnership with Emporix. The Emporix Orchestration Engine uses real-time process intelligence to streamline operations and boost agility.

- In July 2024, Adobe Inc. announced breakthrough innovations in its Adobe Illustrator and Adobe Photoshop. These industry-leading apps speed up everyday creative workflows and offer more control to creators.

- In April 2024, Autodesk, Inc. announced an interoperability agreement with the Nemetschek Group aimed at enhancing open collaboration and efficiency within the architecture, engineering, construction, operations (AECO), and media and entertainment (M&E) sectors.

- In January 2024, Kyndryl Holdings, Inc. introduced AI-enabled workflow orchestration services aimed at automating business processes. This solution harnesses artificial intelligence to enhance operational efficiency, streamline productivity, and improve the user experience within digital workplaces. Key features include an intuitive interface, real-time process visibility, robust access controls, and advanced encryption, making it easier to manage complex workflows.

Report Coverage

The research report offers an in-depth analysis based on Organization Size, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of AI and machine learning for predictive project planning.

- Cloud-based platforms will dominate construction workflow automation deployments.

- Digital twin technology will play a key role in real-time project monitoring.

- Automation tools will reduce operational delays and improve cost efficiency.

- Integration with IoT devices will enhance data accuracy and workflow visibility.

- Mobile-first solutions will support faster decision-making on construction sites.

- Regulatory compliance will drive the need for automated documentation and reporting.

- Companies will focus on interoperability to connect multiple project management systems.

- Increased investment in cybersecurity will protect automated workflows and data.

- Automation will become essential for sustainable and smart infrastructure development.