Market Overview

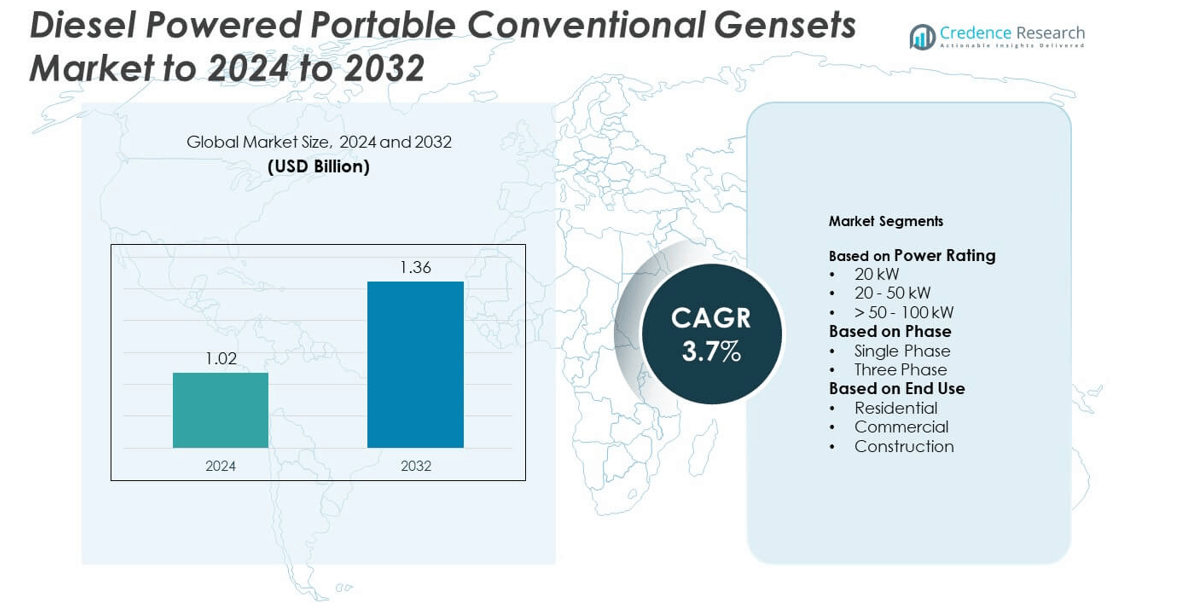

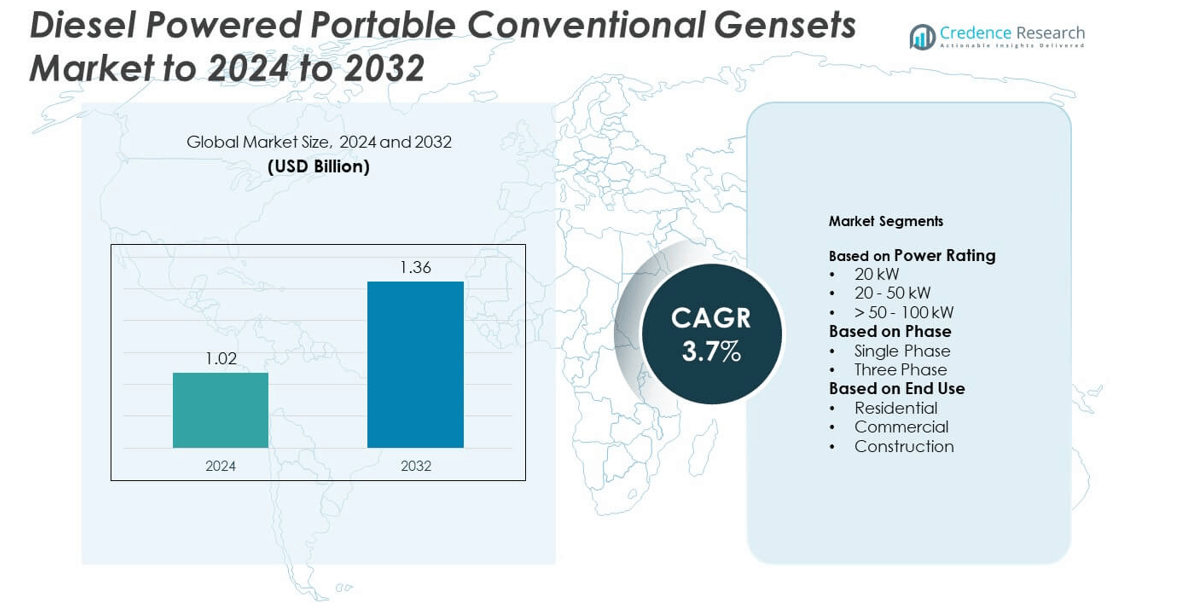

Diesel Powered Portable Conventional Gensets market size was valued at USD 1.02 billion in 2024 and is anticipated to reach USD 1.36 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Powered Portable Conventional Gensets Market Size 2024 |

USD 1.02 billion |

| Diesel Powered Portable Conventional Gensets Market, CAGR |

3.7% |

| Diesel Powered Portable Conventional Gensets Market Size 2032 |

USD 1.36 billion |

The Diesel Powered Portable Conventional Gensets market is characterized by strong competition among leading manufacturers such as Atlas Copco, Generac Power Systems, YANMAR, HIMOINSA, Pramac, Kirloskar, and Champion Power Equipment. These companies focus on improving fuel efficiency, durability, and compliance with emission standards to enhance product performance and global reach. Strategic partnerships, product innovation, and expansion into developing markets are key competitive strategies. Asia-Pacific led the global market with a 34% share in 2024, supported by rapid urbanization, industrialization, and growing infrastructure investments, while North America followed with a 31% share driven by rising demand for emergency and standby power applications.

Market Insights

- The Diesel Powered Portable Conventional Gensets market was valued at USD 1.02 billion in 2024 and is projected to reach USD 1.36 billion by 2032, growing at a CAGR of 3.7%.

- Rising demand for reliable and portable backup power in construction, industrial, and residential sectors drives market expansion globally.

- Increasing integration of smart monitoring technologies and hybrid diesel-solar models is shaping future product innovation and sustainability trends.

- The market remains moderately competitive, with players focusing on emission compliance, cost-effective production, and service network expansion to maintain leadership.

- Asia-Pacific led with a 34% share in 2024, followed by North America with 31%, while the 20–50 kW power rating segment dominated with 44% share due to its balance between portability and power efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The 20–50 kW segment dominated the Diesel Powered Portable Conventional Gensets market in 2024 with a 44% share. This range offers an ideal balance between power output and fuel efficiency, making it suitable for small to medium-scale applications. These gensets are widely used in commercial outlets, construction sites, and rural electrification projects. Their ability to handle multiple electrical loads with stable frequency and voltage drives demand. Increasing adoption in remote and temporary setups, along with easy maintenance and mobility, further strengthens this segment’s position in the overall market landscape.

- For instance, Caterpillar’s XQ35 mobile generator provides 27–30 ekW of power and has a sound level of 63 dB(A) at 7 meters. The unit is equipped with a 24-hour dual-wall fuel tank but can be connected to an external fuel supply for a longer runtime.

By Phase

The three-phase segment led the market in 2024, accounting for nearly 62% of the total share. These gensets deliver higher power output and support heavy-duty equipment, making them the preferred choice for industrial and construction operations. Their efficiency in transmitting large electrical loads over long distances enhances operational reliability. The growing infrastructure and industrial expansion projects across Asia-Pacific and the Middle East have accelerated their use. Rising demand for stable backup power in manufacturing and construction further supports the dominance of three-phase gensets.

- For instance, HIMOINSA’s HYW-45 T5 three-phase set, running at 1,500 rpm, delivers 41 kVA at its Prime Power (PRP) rating and 45 kVA at its Emergency Standby Power (ESP) rating. The unit features AVR-based electronic regulation and an IP23-rated enclosure.

By End Use

The construction segment held the largest market share of around 46% in 2024. Diesel-powered portable gensets are essential at construction sites lacking grid connections, ensuring uninterrupted operation of tools and machinery. Their robustness, portability, and capacity to run for extended hours under harsh conditions make them indispensable. Rapid urbanization and infrastructure development in emerging economies continue to boost segment demand. Additionally, ongoing investments in roads, housing, and industrial facilities reinforce the use of these gensets for reliable on-site power supply.

Key Growth Drivers

Rising Demand for Reliable Backup Power

The growing need for reliable and continuous electricity supply is a major driver for diesel-powered portable conventional gensets. Frequent power outages and grid instability, especially in developing regions, boost demand across residential, commercial, and construction sectors. These gensets ensure uninterrupted operations during blackouts and in remote areas without grid connectivity. Their ability to provide consistent performance and quick start-up response makes them vital for critical applications such as emergency power backup, outdoor events, and field operations.

- For instance, Generac’s GP6500E supplies 6,500 running watts and 8,125 starting watts, and is transfer-switch compatible for outage backup.

Expanding Construction and Infrastructure Projects

Rapid infrastructure development and expanding construction activities worldwide drive genset demand. Construction sites often operate in areas lacking grid access, requiring portable power solutions for machinery, lighting, and tools. Diesel gensets offer robust performance, high torque, and endurance in challenging site conditions. The growing number of urban development projects, industrial facilities, and transportation networks continues to strengthen market growth. This segment benefits from rising investments in public infrastructure and commercial real estate development.

- For instance, Atlas Copco’s QAS generator range features various models with different tank capacities and fuel consumption rates. Some smaller models, like the QAS 25, have a 72.5-gallon tank and consume 1.63 gal/h at full load, while larger models, like the QAS 700, have a 707-gallon tank and consume 36.92 gal/h at full load.

Increasing Industrial and Commercial Applications

The industrial and commercial sectors are increasingly adopting diesel portable gensets for operational reliability. Manufacturing units, data centers, and retail facilities depend on backup generators to avoid downtime. Diesel gensets provide high energy efficiency and extended runtime, reducing operational disruptions. Their compatibility with automation and telematics systems enhances monitoring and maintenance efficiency. The ongoing industrial expansion and focus on uninterrupted business continuity reinforce their adoption in both established and emerging economies.

Key Trends and Opportunities

Integration of Smart Monitoring Technologies

Manufacturers are integrating advanced digital monitoring and control systems in diesel gensets to enhance performance and reliability. Smart sensors, IoT-based diagnostics, and remote monitoring allow users to track fuel levels, load performance, and maintenance schedules in real time. These features improve efficiency and reduce downtime. The trend toward connected and intelligent power solutions creates new opportunities for product differentiation and service-based revenue models in the genset industry.

- For instance, Kohler’s generator controllers support various Modbus connectivity options, including Modbus TCP over Ethernet and RS-485/Modbus RTU. Availability depends on the specific model: advanced controllers like the APM802 include built-in Ethernet for Modbus TCP, while other models may require a Modbus/Ethernet converter (GM41143-S2) for network connectivity. RS-485 ports for Modbus RTU are a standard feature on many of their controllers.

Growing Demand in Emerging Economies

Rapid industrialization and urbanization across Asia-Pacific, Africa, and Latin America offer strong growth opportunities. Expanding construction activities, coupled with unreliable grid infrastructure, make diesel gensets essential for continuous operations. Government-led housing and infrastructure programs further boost demand. Increasing rural electrification initiatives also contribute to adoption, as portable gensets serve as primary power sources in remote and developing areas. Manufacturers targeting these high-growth regions benefit from large-scale demand and cost-sensitive markets.

- For instance, Kirloskar’s 30 kVA KG1-30WS lists 7.6 L/h fuel use at full load and a 65-liter tank, aligning with remote-area deployment needs.

Key Challenges

Stringent Emission Regulations

Tightening environmental regulations on diesel emissions pose a major challenge for manufacturers. Governments worldwide are enforcing limits on nitrogen oxides, particulate matter, and carbon emissions from diesel engines. Compliance requires costly engine upgrades and advanced filtration systems, increasing production expenses. These regulations are pushing manufacturers to explore hybrid and cleaner alternatives. However, adapting to new emission standards while maintaining product affordability remains a key constraint for the market’s short-term growth.

Fluctuating Fuel Prices and Operating Costs

Volatility in diesel fuel prices significantly impacts operating costs, creating uncertainty for users and suppliers. Rising fuel expenses can discourage adoption in cost-sensitive applications such as residential and small-scale commercial use. Maintenance costs and noise concerns further add to operational challenges. This price instability encourages some customers to shift toward alternative energy sources, including natural gas and solar-powered solutions. Managing fuel efficiency and optimizing load operations are essential to maintaining competitiveness in this environment.

Regional Analysis

North America

North America held a 31% share of the Diesel Powered Portable Conventional Gensets market in 2024. The region’s dominance is driven by strong demand for reliable backup power across residential, commercial, and construction sectors. Frequent weather-related power disruptions and increasing adoption in emergency response units further support growth. The United States remains the largest contributor, supported by widespread infrastructure modernization and rising outdoor applications. Manufacturers focus on fuel-efficient and low-emission models to comply with environmental regulations while ensuring reliable performance in diverse operating conditions.

Europe

Europe accounted for 27% of the global market share in 2024. The region’s growth is influenced by construction expansion, industrial development, and adoption of standby power solutions across commercial facilities. Countries such as Germany, the United Kingdom, and France lead the market due to reliable manufacturing standards and stringent emission norms. The shift toward hybrid diesel systems and portable gensets with advanced monitoring technologies is accelerating. Increased focus on sustainability and efficient power management encourages manufacturers to develop cleaner, compliant gensets suitable for both urban and remote deployment.

Asia-Pacific

Asia-Pacific dominated the global market with a 34% share in 2024. Rapid urbanization, industrialization, and infrastructure expansion across China, India, and Southeast Asia are driving strong genset adoption. Growing construction activities, coupled with unreliable grid power in rural areas, enhance demand for portable diesel gensets. Governments’ focus on improving energy access and supporting construction in developing economies further supports market expansion. Local manufacturers are increasingly producing cost-effective and durable models suited to regional requirements, making Asia-Pacific the key growth engine for global diesel-powered portable genset demand.

Latin America

Latin America captured a 5% share of the global Diesel Powered Portable Conventional Gensets market in 2024. The market benefits from growing infrastructure development and demand for off-grid power in countries such as Brazil, Mexico, and Argentina. Construction of residential and commercial buildings in urban centers drives consistent genset usage. Expanding industrial sectors and rising energy demand in remote areas support continued adoption. However, high import costs and limited local manufacturing remain constraints, encouraging regional players to focus on affordable and fuel-efficient solutions for broader market penetration.

Middle East & Africa

The Middle East and Africa region accounted for 3% of the market share in 2024. Rapid construction growth, mining activities, and frequent grid instability drive diesel genset demand across the region. The UAE and Saudi Arabia lead adoption due to large-scale infrastructure and energy projects, while African nations rely on portable gensets for remote electrification. Demand for durable and long-runtime models is increasing across industrial and commercial sites. Ongoing investments in oil, gas, and public utilities continue to strengthen the region’s role as a growing market for portable diesel gensets.

Market Segmentations:

By Power Rating

- 20 kW

- 20 – 50 kW

- > 50 – 100 kW

By Phase

By End Use

- Residential

- Commercial

- Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Diesel Powered Portable Conventional Gensets market features several prominent players including Atlas Copco, Whisper Power, Kirloskar, Allmand Bros, YANMAR, Pramac, Chicago Pneumatic, Rishabh Engineering, Champion Power Equipment, Generac Power Systems, Bobcat Company, HIMOINSA, Changzhou ITC Power Equipment Manufacturing, Powerhouse Diesel Generators, and Himalayan Power Machine. The market is highly competitive, with companies focusing on efficiency, compact design, and fuel economy to enhance product performance. Leading manufacturers emphasize innovation in engine technology, emission reduction, and extended runtime to meet evolving regulatory and user demands. Strategic partnerships, product line expansions, and customization for construction, residential, and commercial applications are key competitive strategies. Market participants are also investing in telematics integration and smart diagnostics to improve reliability and ease of maintenance. Regional expansion, cost-effective manufacturing, and after-sales service development remain critical for sustaining market presence and ensuring long-term customer loyalty in an increasingly technology-driven environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Atlas Copco

- Whisper Power

- Kirloskar

- Allmand Bros

- YANMAR

- Pramac

- Chicago Pneumatic

- Rishabh Engineering

- Champion Power Equipment

- Generac Power Systems

- Bobcat Company

- HIMOINSA

- Changzhou ITC Power Equipment Manufacturing

- Powerhouse Diesel Generators

- Himalayan Power Machine

Recent Developments

- In 2025, Atlas Copco Released its largest ZBC container energy storage system for prime power pairing with gensets.

- In 2024, Allmand Bros Unveiled the Hybrid LT-Series light tower at The ARA Show; also showcased Maxi-Power generators.

- In 2023, Caterpillar Launched the Cat XQ330 mobile diesel generator set for North American markets. It met the U.S. EPA Tier 4 Final emission standards, highlighting Caterpillar’s commitment to producing cleaner, conventional diesel gensets.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Phase, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by demand for reliable off-grid power.

- Construction and infrastructure development projects will continue to boost genset adoption.

- Manufacturers will focus on developing fuel-efficient and low-emission diesel engines.

- Integration of IoT and remote monitoring features will enhance equipment reliability.

- Hybrid diesel-solar models will gain traction in regions with strong renewable policies.

- Emerging economies in Asia-Pacific and Africa will remain major demand centers.

- Product miniaturization and improved mobility will attract residential and small business users.

- Replacement demand for aging genset fleets will create consistent sales opportunities.

- Regulatory pressure will encourage innovation toward cleaner combustion and noise reduction.

- Strategic collaborations among OEMs and rental providers will expand market accessibility globally.