Market Overview

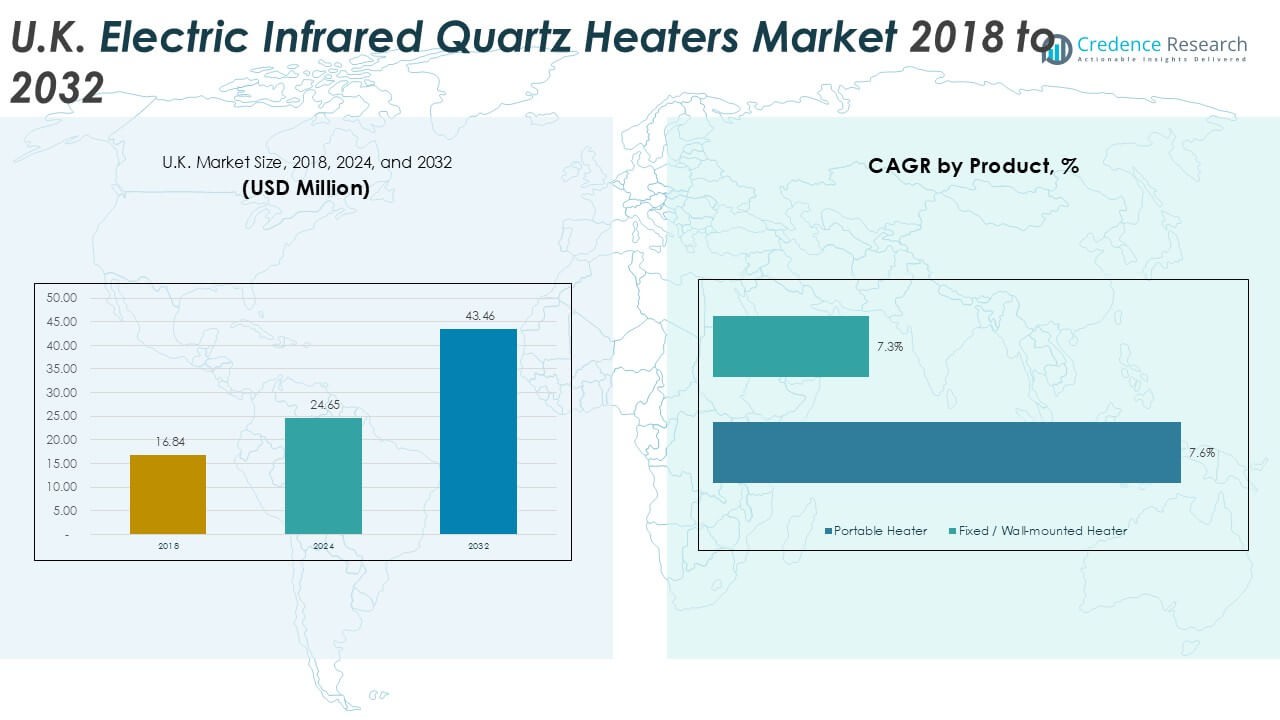

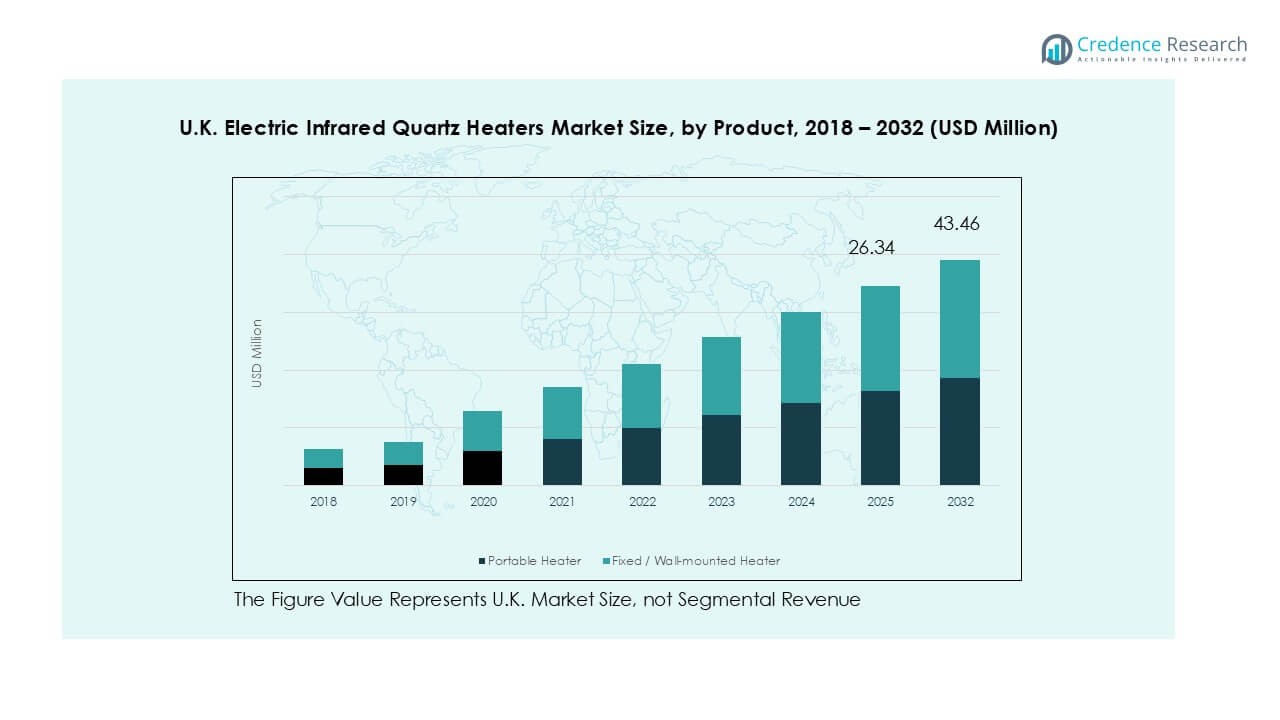

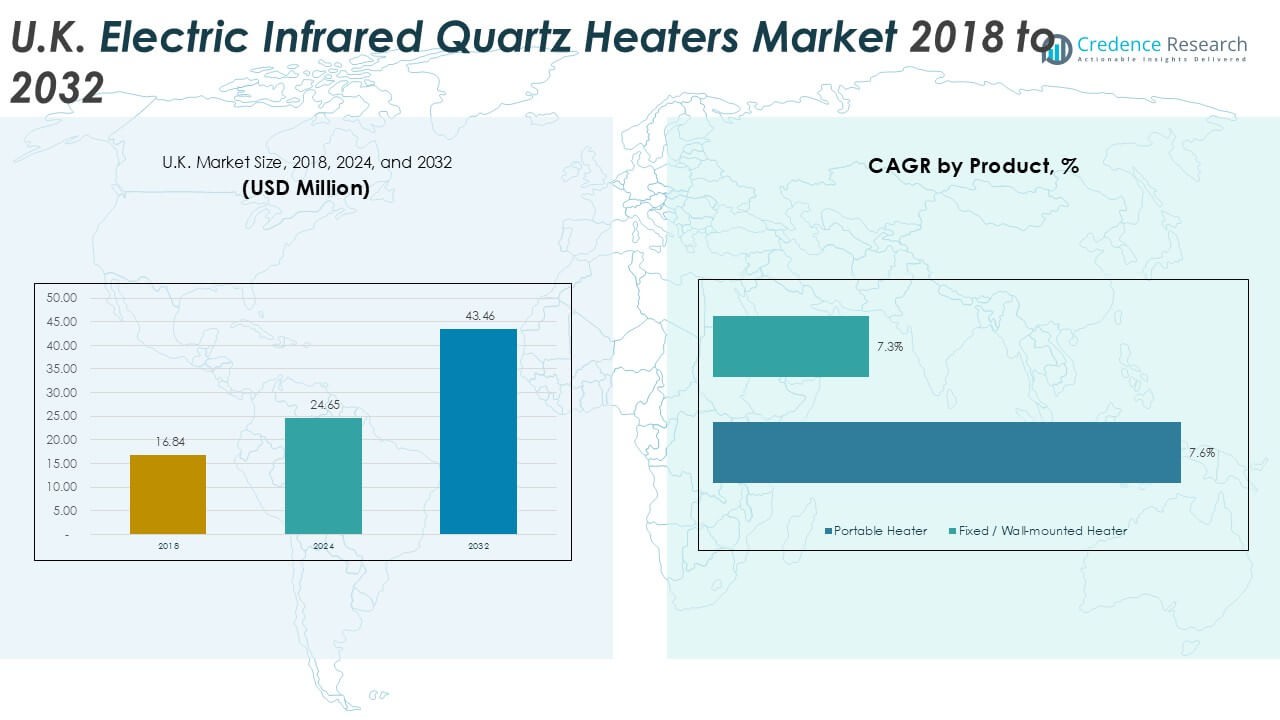

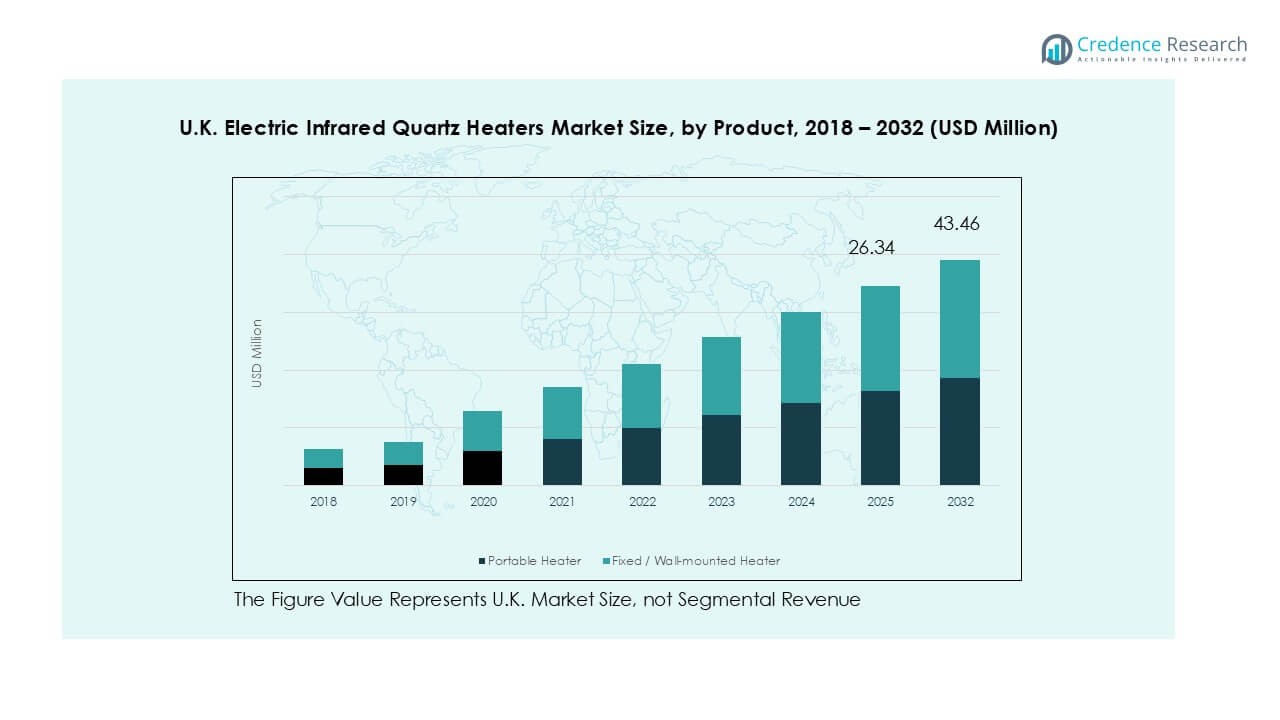

The U.K. Electric Infrared Quartz Heater market size was valued at USD 16.84 million in 2018 and increased to USD 24.65 million in 2024. It is anticipated to reach USD 43.46 million by 2032, growing at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Electric Infrared Quartz Heaters Market Size 2024 |

USD 24.65 Million |

| U.K. Electric Infrared Quartz Heaters Market, CAGR |

7.5% |

| U.K. Electric Infrared Quartz Heaters Market Size 2032 |

USD 43.46 Million |

The U.K. electric infrared quartz heater market is led by key players such as Infrared Heating UK, Honeywell International Inc., Lasko Products, LLC, TPI Corporation, City Electrical Factors Ltd, Broughton EAP, and CLARKE INTERNATIONAL. These companies focus on energy-efficient designs, advanced safety features, and smart connectivity to strengthen their market presence. England, including Greater London and the South East, emerged as the leading region with a 47% market share in 2024, driven by strong residential demand, modern infrastructure, and widespread adoption of eco-friendly heating solutions. Growing e-commerce sales and supportive energy-efficiency policies further enhance competition and regional expansion opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.K. electric infrared quartz heater market was valued at USD 24.65 million in 2024 and is projected to reach USD 43.46 million by 2032, growing at a CAGR of 7.5%.

- Rising demand for energy-efficient and low-emission heating systems drives market growth, supported by carbon reduction goals and increasing electricity costs.

- Smart and Wi-Fi-enabled infrared heaters are gaining popularity, with consumers favoring portable models that held a 61% share in 2024.

- The market is moderately competitive, with key players such as Infrared Heating UK, Honeywell International Inc., and Lasko Products focusing on smart designs and safety innovation.

- England, including Greater London and the South East, led the market with a 47% share in 2024, followed by Scotland and Northern England at 26%, reflecting strong regional demand for compact and efficient heating solutions across residential and commercial sectors.

Market Segmentation Analysis:

By Product

The portable heater segment dominated the U.K. electric infrared quartz heater market in 2024, accounting for nearly 61% of the total share. Its dominance is driven by compact design, ease of mobility, and energy efficiency, making it suitable for residential and small commercial use. Consumers prefer portable units for quick heating and flexibility in room placement. Increasing demand for space-saving and plug-and-play appliances also supports this segment. Meanwhile, fixed or wall-mounted heaters are gaining traction in offices and retail spaces due to their sleek design and permanent installation benefits.

- For instance, Dimplex’s wall-mounted Q-Rad electric radiator features dual-element technology and Adaptive Start control, which learns the thermal characteristics of a room to minimize wasted energy.

By Wattage

The 1000–1500Watt segment held the largest share of around 48% in 2024, offering the best balance between energy use and heating performance. This range is widely preferred for medium-sized rooms, providing rapid and consistent warmth while maintaining reasonable electricity consumption. The growing shift toward energy-efficient heating appliances aligns with consumer awareness of utility savings. Models above 1500 Watts cater to larger commercial areas, while sub-1000Watt heaters remain popular in compact residential spaces and portable setups where lower energy output is sufficient.

- For instance, De’Longhi’s HMP1500 Mica Thermic heater delivers a 1,500-watt output and covers areas up to 400 square feet, supported by dual-heat settings and automatic thermostat adjustment for optimal power regulation.

By Distribution Channel

The offline distribution channel dominated the U.K. market in 2024 with nearly 67% share, supported by strong retail networks and consumer preference for in-person product demonstrations. Physical stores allow buyers to assess heating efficiency, build quality, and design before purchase. Brand-exclusive outlets and home appliance stores enhance market visibility. However, the online channel is expanding rapidly due to increasing e-commerce adoption, convenience, and access to discounts. Growing online retail penetration, particularly through Amazon and Argos, is expected to narrow the gap between offline and online sales in coming years.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Solutions

Energy efficiency remains a major growth driver for the U.K. electric infrared quartz heater market. Consumers are increasingly shifting toward heating solutions that reduce electricity consumption while maintaining performance. Infrared quartz heaters directly warm people and objects instead of the surrounding air, ensuring faster heating and less energy loss. This efficiency aligns with the U.K. government’s carbon reduction and net-zero goals, boosting adoption across residential and commercial spaces. Growing awareness of energy-saving technologies and rising electricity prices further encourage the replacement of conventional convection systems with modern, infrared-based alternatives.

- For instance, the Honeywell HCE840B model is a ceramic space heater that delivers up to 1,500 watts of warmth. It uses ceramic technology to produce heat.

Expanding Residential Construction and Home Renovation Activities

The expansion of residential infrastructure and ongoing home renovation projects are key contributors to market growth. The U.K.’s growing urban population and increasing focus on comfort-oriented living spaces drive demand for compact, efficient, and stylish heating systems. Infrared quartz heaters are favored for their sleek design, quick installation, and minimal maintenance needs. Rising disposable income and growing awareness of modern heating technologies also strengthen residential adoption. The surge in smart home integration further supports demand, with consumers opting for heaters compatible with digital thermostats and home automation systems.

- For instance, Glen Dimplex’s Q-Rad Smart Electric series connects with the Dimplex Control app, offering programmable heating schedules and adaptive start control that adjusts power draw between 500 and 1,500 watts for optimized comfort and energy savings in residential applications.

Technological Advancements and Product Innovation

Technological innovation has become central to market expansion. Manufacturers are introducing advanced features such as smart controls, Wi-Fi connectivity, and programmable thermostats to enhance energy management and user convenience. Safety enhancements like tip-over protection, automatic shutoff, and overheat sensors are also increasing consumer confidence. The integration of eco-friendly materials and efficient quartz elements further supports sustainability goals. Continuous improvements in heat distribution and compact design make these heaters ideal for both urban apartments and commercial environments. Such product diversification helps brands capture varied consumer preferences in the competitive U.K. heating landscape.

Key Trends & Opportunities

Shift Toward Smart and Connected Heating Systems

The growing trend of smart home adoption creates new opportunities for infrared heater manufacturers. Consumers increasingly prefer devices that can be remotely controlled or integrated into existing home automation systems. Wi-Fi-enabled quartz heaters with mobile app compatibility provide users real-time temperature adjustments and energy usage insights. This connectivity improves comfort while reducing wasteful energy consumption. The shift toward digital control interfaces, voice-activated operation, and AI-assisted power regulation positions the market for continued innovation and enhanced user engagement.

- For instance, Dyson’s Hot+Cool HP07 integrates Wi-Fi connectivity and HEPA filtration, allowing control through the MyDyson app and voice assistants like Alexa and Google Home.

Increasing Focus on Eco-Friendly and Low-Emission Heating

Sustainability is emerging as a central trend in the U.K. heating market. Infrared quartz heaters produce no direct emissions, supporting the nation’s decarbonization efforts. Manufacturers are also incorporating recyclable materials and low-VOC coatings to align with green building standards. Growing consumer preference for eco-certified appliances drives innovation toward renewable-compatible power sources, such as solar-assisted systems. As regulatory pressure on carbon output tightens, brands emphasizing eco-performance and compliance with energy labeling standards will gain a competitive edge in upcoming years.

Key Challenges

High Upfront Costs and Price Sensitivity

Despite their efficiency, electric infrared quartz heaters carry higher upfront costs compared to traditional convection systems. This pricing gap limits adoption among price-sensitive consumers, especially in low-income or rental households. Many users still perceive infrared technology as premium, which restricts mass-market penetration. The cost of advanced smart or wall-mounted models further adds to the challenge. Manufacturers face pressure to balance affordability with innovation, requiring cost-effective design and localized production strategies to expand reach and competitiveness in the U.K. market.

Seasonal Demand Fluctuations and Market Saturation

The market’s dependence on seasonal demand presents a major challenge. Sales typically peak during colder months, leading to uneven annual revenue distribution. Mild winters or delayed cold seasons can reduce heater sales and impact inventory planning. Additionally, the U.K. market shows early signs of saturation in mature urban areas, where penetration of electric heaters is already high. To sustain growth, manufacturers must diversify applications beyond residential heating, such as in outdoor hospitality and commercial spaces, while strengthening after-sales service and replacement demand.

Regional Analysis

England (Including Greater London & South East)

England dominated the U.K. electric infrared quartz heater market in 2024 with a 47% share. The region’s strong residential and commercial infrastructure, high energy costs, and cold winter conditions drive widespread heater adoption. Greater London and the South East see growing demand for portable and wall-mounted units due to urban housing density and limited space. Rising awareness of energy-efficient and low-emission appliances further boosts installations. Expansion of smart home ecosystems and government incentives for sustainable heating systems continue to strengthen market penetration across metropolitan and suburban households.

Scotland & Northern England

Scotland and Northern England accounted for 26% of the market share in 2024, supported by longer heating seasons and colder climates. These areas show high adoption of infrared quartz heaters in both residential and hospitality sectors. Consumers prefer energy-efficient models that reduce heating bills during extended winter months. Government energy-efficiency schemes and growing replacement of oil-based heating systems enhance market momentum. Localized distribution networks and increasing smart home integration across major cities like Edinburgh, Glasgow, and Newcastle contribute to consistent demand for advanced quartz-based heating solutions.

Wales & West Midlands

Wales and the West Midlands held nearly 16% share of the U.K. market in 2024. The demand is largely driven by home renovation projects, energy retrofitting programs, and growing awareness of efficient heating alternatives. Rising disposable income and government incentives for low-carbon heating systems support the regional market. Portable infrared quartz heaters dominate due to flexibility and affordability. Increasing availability through retail and e-commerce channels enhances accessibility. Expanding tourism and hospitality sectors also contribute to demand in rural and coastal areas where quick, efficient heating is essential during cold seasons.

Northern Ireland, East Midlands & Other Regions

Northern Ireland, East Midlands, and other regions collectively represented around 11% of the total market share in 2024. Growth in these areas is supported by expanding residential infrastructure and increasing adoption of compact, plug-and-play heating units. Consumers in these regions seek affordable, energy-efficient solutions suited for smaller homes and rural dwellings. Retail partnerships and government-led energy transition initiatives promote the use of low-emission appliances. As awareness of indoor comfort and sustainability grows, these emerging markets are expected to experience steady expansion in both household and small commercial applications.

Market Segmentations:

By Product

- Portable Heater

- Fixed / Wall-mounted Heater

By Wattage

- Below 1000 Watt

- 1000–1500 Watt

- Above 1500 Watt

By Distribution Channel

By Geography

- England (including Greater London & South East)

- Scotland & Northern England

- Wales & West Midlands

- Northern Ireland, East Midlands & Other Regions

Competitive Landscape

The U.K. electric infrared quartz heater market features a moderately competitive landscape with both domestic and international players competing through product innovation, energy efficiency, and smart technology integration. Leading companies such as Infrared Heating UK, Honeywell International Inc., Lasko Products, LLC, TPI Corporation, and City Electrical Factors Ltd dominate the market through extensive distribution networks and diverse product portfolios. Local manufacturers like Broughton EAP and CLARKE INTERNATIONAL strengthen competition by offering cost-effective and portable solutions tailored to residential and commercial needs. Companies focus on developing smart, Wi-Fi-enabled, and eco-friendly heaters to align with sustainability and energy-efficiency goals. Strategic partnerships, e-commerce expansion, and adherence to U.K. energy regulations further shape the competitive environment. Continuous investment in design innovation and after-sales services enhances brand loyalty and market penetration across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Pelonis is referenced as a key player in energy-efficient, budget-friendly heaters, with recent product updates focusing on improved safety features, digital controls, and portable formats to address shifting consumer demand in North America and Asia-Pacific.

- In 2025, Twin-Star International continued leading the U.S. electric fireplace and heater market, with innovations including the 3D Flame Effect, PanoGlow®, CoolGlow®, Safer Plug®, and Safer Sensor.

Report Coverage

The research report offers an in-depth analysis based on Product, Wattage, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient heating systems will continue to grow across residential and commercial sectors.

- Smart infrared heaters with Wi-Fi and voice control features will gain wider adoption.

- Government initiatives promoting low-carbon heating will support long-term market expansion.

- Manufacturers will focus on integrating eco-friendly materials and recyclable components.

- Portable heaters will maintain dominance due to flexibility and user convenience.

- Wall-mounted and designer models will see rising demand in modern urban homes.

- E-commerce platforms will play a key role in expanding product accessibility.

- Technological advancements will enhance safety, automation, and energy optimization.

- Regional growth will strengthen in Scotland and the West Midlands with increased infrastructure development.

- Strategic collaborations between local and global brands will drive innovation and market competitiveness.