Market overview

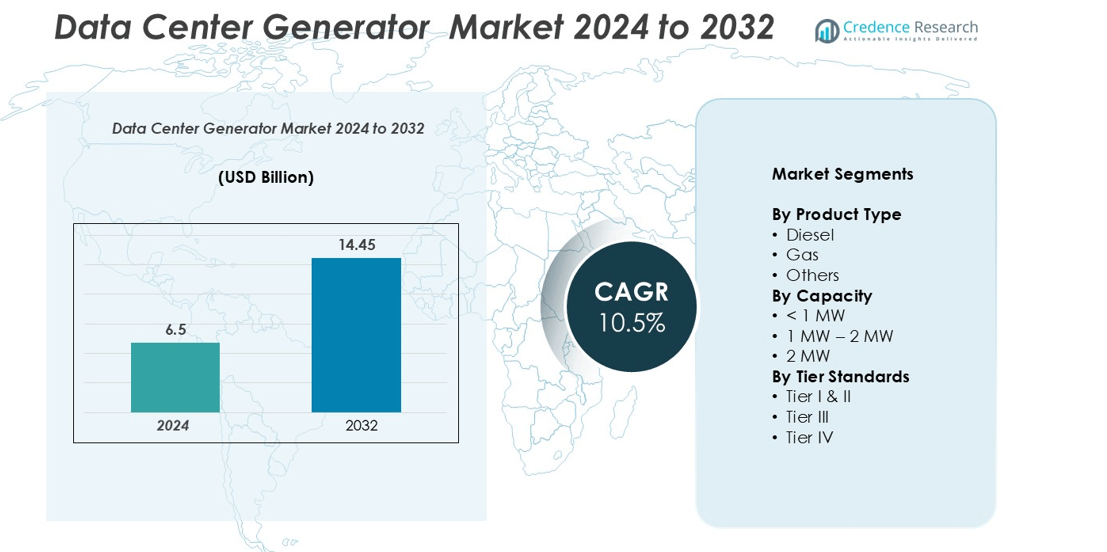

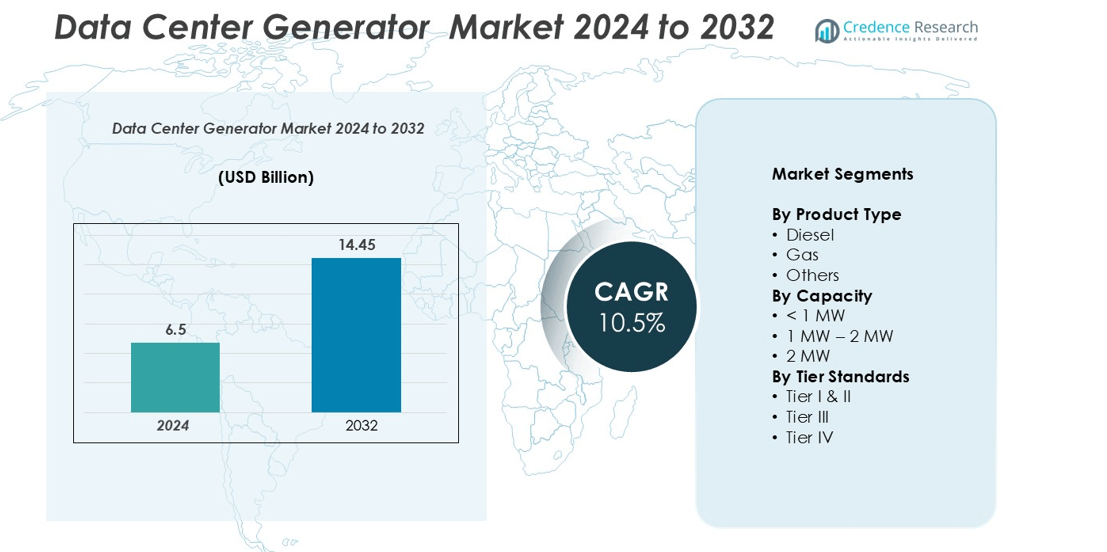

The data center generator market size was valued at USD 6.5 billion in 2024 and is anticipated to reach USD 14.45 billion by 2032, at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Generator Market Size 2024 |

USD 6.5 billion |

| Data Center Generator Market, CAGR |

10.5% |

| Data Center Generator Market Size 2032 |

USD 14.45 billion |

The global data center generator market is led by major players such as Caterpillar, Cummins Inc., KOHLER, Generac Power Systems, Inc., and Rolls-Royce plc, which collectively account for a significant share of the market due to their strong technological capabilities and extensive product portfolios. Other notable participants include Atlas Copco, HIMOINSA, MITSUBISHI MOTORS CORPORATION, Piller (Langley Holdings plc), and Eurodiesel Services, focusing on energy-efficient and low-emission generator solutions. North America emerged as the leading regional market in 2024, holding over 35% of the global share, driven by the high concentration of hyperscale data centers and advanced backup power infrastructure.

Market Insights

- The global data center generator market was valued at USD 6.5 billion in 2024 and is projected to reach USD 14.45 billion by 2032, growing at a CAGR of 10.5% during the forecast period.

- Growing data center construction, increasing demand for uninterrupted power supply, and rising investments in hyperscale and edge facilities are driving market growth globally.

- Key trends include the adoption of low-emission gas generators, integration of smart monitoring systems, and a shift toward sustainable and hybrid energy solutions to meet carbon-neutral goals.

- The market is moderately consolidated, with Caterpillar, Cummins Inc., KOHLER, and Rolls-Royce plc dominating, while new entrants focus on regional expansion and advanced product innovation.

- North America leads with over 35% market share, followed by Asia-Pacific (30%) and Europe (25%); by segment, diesel generators and >2 MW capacity units hold the largest shares due to reliability and high power demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The data center generator market by product type is segmented into diesel, gas, and others. The diesel generator segment dominated the market in 2024, accounting for the largest revenue share of over 65%, owing to its high reliability, quick start capability, and suitability for large-scale data centers requiring uninterrupted power backup. Diesel generators are preferred for their robust performance during grid outages and lower upfront costs. However, the gas generator segment is expected to witness significant growth, driven by the rising focus on sustainability and stricter emission regulations promoting cleaner energy alternatives.

- For instance, Caterpillar’s large diesel engines and generator sets, with a power output generally ranging from 1,000 to over 6,000 horsepower, are manufactured at their facility in Lafayette, Indiana. The main manufacturing building is approximately 1.3 million square feet within a larger campus of about 1.6 million square feet, and the site currently employs around 1,900 people with a recent expansion expected to add more jobs.

By Capacity:

Based on capacity, the market is categorized into <1 MW, 1 MW–2 MW, and >2 MW. The >2 MW segment held the dominant market share exceeding 45% in 2024, as hyperscale and large enterprise data centers demand high-capacity generators to ensure seamless operations. Increasing data traffic, cloud expansion, and growing adoption of AI-driven workloads are propelling demand for high-capacity power systems. Meanwhile, the 1 MW–2 MW category is projected to expand steadily due to the rising number of medium-sized data centers and colocation facilities prioritizing energy efficiency and operational reliability.

- For instance, Generac’s new product lineup includes five generators ranging from 2.25 MW to 3.25 MW, available in both diesel and natural gas configurations, tailored for hyperscale, colocation, enterprise, and edge environments.

By Tier Standards:

In terms of tier standards, the market is divided into Tier I & II, Tier III, and Tier IV. The Tier III segment led the market with a share of more than 50% in 2024, supported by the growing construction of Tier III data centers offering high availability and redundant power systems. These facilities balance cost and uptime requirements, making them the preferred choice for enterprises and colocation providers. The Tier IV segment is expected to grow rapidly as hyperscale operators invest in fault-tolerant infrastructure with 99.995% uptime to support mission-critical applications and advanced digital services.

Key Growth Drivers

Rising Data Center Construction Worldwide

The rapid expansion of data centers globally is a major driver of the data center generator market. Increasing digital transformation, cloud computing adoption, and the surge in data consumption from AI, IoT, and edge computing applications have intensified the demand for reliable backup power systems. Hyperscale data centers, in particular, require high-capacity generators to ensure seamless operations during grid failures. Moreover, governments and enterprises are heavily investing in IT infrastructure to enhance data security and storage capabilities. This rise in construction activities across North America, Europe, and Asia-Pacific continues to fuel generator demand, ensuring operational continuity and reducing downtime risks.

- For instance, in 2025, Big Tech companies—primarily Amazon—led a significant data center construction boom in Virginia, filing permits for 54 new facilities in the state so far this year (as of reports published mid-year), an amount which would raise Amazon’s global data center count by nearly 16% annually.

Growing Need for Uninterrupted Power Supply

Data centers require consistent and uninterrupted power to prevent data loss, operational disruptions, and hardware damage. Power outages, even for a few minutes, can result in significant financial losses and reputational damage for operators. Generators play a critical role in maintaining uptime by providing reliable backup during grid instability or natural disasters. The increasing dependency of businesses on cloud-based operations, online services, and digital communication drives the adoption of robust power backup systems. This necessity for continuous power availability, especially in colocation and hyperscale facilities, is propelling steady growth in the data center generator market.

- For instance, in 2024, AVK, in partnership with the Power Systems division of Rolls-Royce (under the mtubrand), sold and delivered over 500 generators powered by HVO to the data center sector, providing nearly 1.3 gigawatts of standby power capacity.

Increasing Investments in Hyperscale and Edge Data Centers

The proliferation of hyperscale and edge data centers is creating strong demand for efficient and scalable power solutions. Hyperscale facilities require multiple high-capacity generators to support extensive IT loads, while edge data centers need compact and efficient units for decentralized operations. The growing integration of AI, 5G, and IoT technologies accelerates the need for low-latency data processing, which in turn boosts regional data center deployment. These developments are increasing investments in advanced generator technologies that offer high fuel efficiency, reduced emissions, and improved load management, driving significant growth across developed and emerging markets.

Key Trends & Opportunities

Shift Toward Sustainable and Low-Emission Generators

The global emphasis on sustainability is driving a notable shift toward low-emission and eco-friendly data center generators. Traditional diesel generators are being gradually replaced or supplemented by natural gas, bi-fuel, and hybrid systems that reduce carbon footprints. Market players are investing in technologies that improve fuel efficiency, enable renewable energy integration, and comply with stringent environmental standards. This transition aligns with the sustainability goals of major cloud providers and colocation operators aiming for carbon neutrality. Consequently, the adoption of cleaner power solutions presents a lucrative opportunity for manufacturers developing next-generation green generator technologies.

- For instance, Rolls-Royce’s mtu Series 4000 generator sets, each with a maximum output of 2,640 kVA, were installed in the European Commission’s Jean Monnet 2 building in Luxembourg to provide emergency backup power.

Integration of Digital Monitoring and Smart Control Systems

The growing adoption of digital monitoring and smart control systems is transforming generator management in data centers. Advanced technologies, including IoT-enabled sensors, predictive maintenance software, and AI-based analytics, allow real-time tracking of generator performance, fuel consumption, and maintenance needs. These solutions enhance operational efficiency, reduce downtime, and lower maintenance costs. The increasing demand for automation and remote management, particularly in hyperscale and multi-site data centers, presents new opportunities for generator manufacturers to offer value-added digital solutions and service-based business models, improving reliability and customer satisfaction.

- For instance, Cummins’ PowerCommand Cloud™ system enables remote monitoring of generator sets, transfer switches, and auxiliary power system components, providing real-time information and critical notifications to operators

Key Challenges

Environmental Concerns and Emission Regulations

Stringent environmental regulations related to emissions and noise pollution pose a significant challenge for the data center generator market. Diesel generators, which dominate the sector, emit carbon dioxide, nitrogen oxides, and particulate matter, leading to compliance issues in regions with strict environmental laws. Regulatory bodies are enforcing limits on backup generator usage and mandating cleaner technologies. Manufacturers must invest heavily in R&D to develop eco-friendly alternatives, such as gas-based or hybrid generators, which can increase operational costs. Balancing performance with sustainability remains a critical challenge for industry participants.

High Initial Investment and Maintenance Costs

The high capital investment required for installing and maintaining data center generators is another major challenge. Large-scale data centers often need multiple high-capacity units to ensure redundancy, significantly raising upfront costs. In addition, ongoing maintenance, fuel expenses, and compliance testing add to the total cost of ownership. For small and medium-sized enterprises, these expenses can be a financial burden. Moreover, the need for skilled technicians and continuous monitoring further elevates operational costs. Addressing these cost-related challenges through modular designs, fuel-efficient technologies, and service-based models is essential for sustained market growth.

Regional Analysis

North America:

North America dominated the data center generator market in 2024, accounting for over 35% of the global share, driven by the high concentration of hyperscale and colocation data centers in the United States. Major cloud service providers, such as Amazon Web Services, Microsoft, and Google, are expanding their facilities to meet growing digital demands. The region’s frequent power disruptions and stringent uptime requirements further increase the adoption of advanced backup power systems. Additionally, strong investments in green data centers and renewable-powered backup solutions are enhancing market growth across the U.S. and Canada.

Europe:

Europe held a market share of around 25% in 2024, supported by the rapid expansion of data center infrastructure in countries such as Germany, the U.K., and the Netherlands. The region’s growing focus on sustainability and strict environmental regulations are accelerating the shift toward low-emission and gas-powered generators. The rising adoption of cloud computing, digital transformation initiatives, and edge data centers further strengthen demand. Moreover, the integration of smart monitoring systems and hybrid energy models is gaining traction, aligning with Europe’s push for carbon-neutral data center operations by 2030.

Asia-Pacific:

The Asia-Pacific region captured 30% of the market share in 2024 and is expected to witness the fastest growth during the forecast period. Rapid digitalization, expanding IT infrastructure, and government-led data localization policies are driving large-scale data center developments in China, India, Japan, and Singapore. The rising demand for hyperscale facilities and the increasing presence of global cloud providers are boosting generator installations. Additionally, frequent power outages in developing economies emphasize the need for reliable backup power, while manufacturers are investing in localized production to meet the region’s growing requirements.

Latin America:

Latin America accounted for 6% of the global market share in 2024, with Brazil and Mexico leading regional growth. The increasing adoption of cloud computing, digital banking, and e-commerce is driving the establishment of new data centers. However, inconsistent grid reliability and infrastructure challenges have heightened reliance on backup generators. Global players are partnering with regional operators to expand capacity and deploy energy-efficient generator systems. Furthermore, favorable government policies promoting IT infrastructure investments are expected to strengthen the market outlook in the coming years.

Middle East & Africa:

The Middle East & Africa region represented 4% of the market share in 2024, fueled by rapid digital transformation and data center investments in the UAE, Saudi Arabia, and South Africa. The growing deployment of hyperscale and colocation facilities to support cloud and AI-driven services is increasing the demand for reliable power backup systems. Frequent power instability in certain areas further supports generator adoption. Additionally, ongoing smart city projects and expanding telecom infrastructure are creating new opportunities for generator manufacturers focused on high-performance and fuel-efficient solutions.

Market Segmentations:

By Product Type

By Capacity

By Tier Standards

- Tier I & II

- Tier III

- Tier IV

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The data center generator market is highly competitive, with several global and regional players focusing on technological innovation, product efficiency, and strategic partnerships to strengthen their market presence. Key companies such as Caterpillar, Cummins Inc., KOHLER, Generac Power Systems, and Rolls-Royce plc dominate the market, offering a wide range of high-performance diesel and gas generators tailored for hyperscale and enterprise data centers. These players emphasize advanced control systems, reduced emissions, and improved fuel efficiency to meet evolving regulatory and sustainability requirements. Emerging companies like HIMOINSA, Atlas Copco, and Eurodiesel Services are expanding through localized manufacturing and service support. Strategic initiatives, including collaborations with data center developers, R&D investments in hybrid systems, and the integration of digital monitoring technologies, are driving competitive differentiation. The market is expected to witness intensified competition as players focus on eco-friendly and modular generator solutions to align with global carbon-neutral targets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Atlas Copco

- Caterpillar

- Cummins, Inc.

- Eurodiesel Services

- Generac Power Systems, Inc.

- HIMOINSA

- KOHLER

- MITSUBISHI MOTORS CORPORATION

- Piller (Langley Holdings plc)

- Rolls Royce plc

Recent Developments

- In January 2023, EdgeCloudLink launched off-grid, hydrogen-powered modular data centers using 3D printing, featuring 1MW units, liquid cooling, and diesel-free sustainable operations in Mountain View.

- In May 2023, Kohler Power Systems released a web-based Power Solutions Center, providing generator sizing, BIM files, drawings, and performance data directly via KohlerPower.com.

- In April 2025, Neysa Networks and NTT Data signed an agreement with the Telangana government to develop an AI data center cluster facility in Hyderabad, India, with a capacity of 400 MW

Report Coverage

The research report offers an in-depth analysis based on Product Type, Capacity, Tier Standards and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The data center generator market will continue to grow steadily, driven by the rising global demand for reliable backup power.

- Expansion of hyperscale and edge data centers will create strong opportunities for high-capacity generator installations.

- Manufacturers will increasingly adopt sustainable technologies, focusing on low-emission and hybrid generator systems.

- Integration of smart monitoring and predictive maintenance will enhance generator efficiency and uptime.

- Gas and bi-fuel generators will gain traction as operators shift toward cleaner energy sources.

- Modular and scalable generator designs will become more popular to meet flexible power needs.

- Regional data localization policies will boost data center construction in emerging economies.

- Collaboration between generator manufacturers and data center developers will increase to ensure optimized power solutions.

- Technological advancements will reduce fuel consumption and improve overall lifecycle performance.

- The market will see growing competition as key players invest in innovation and regional expansion