Market overview

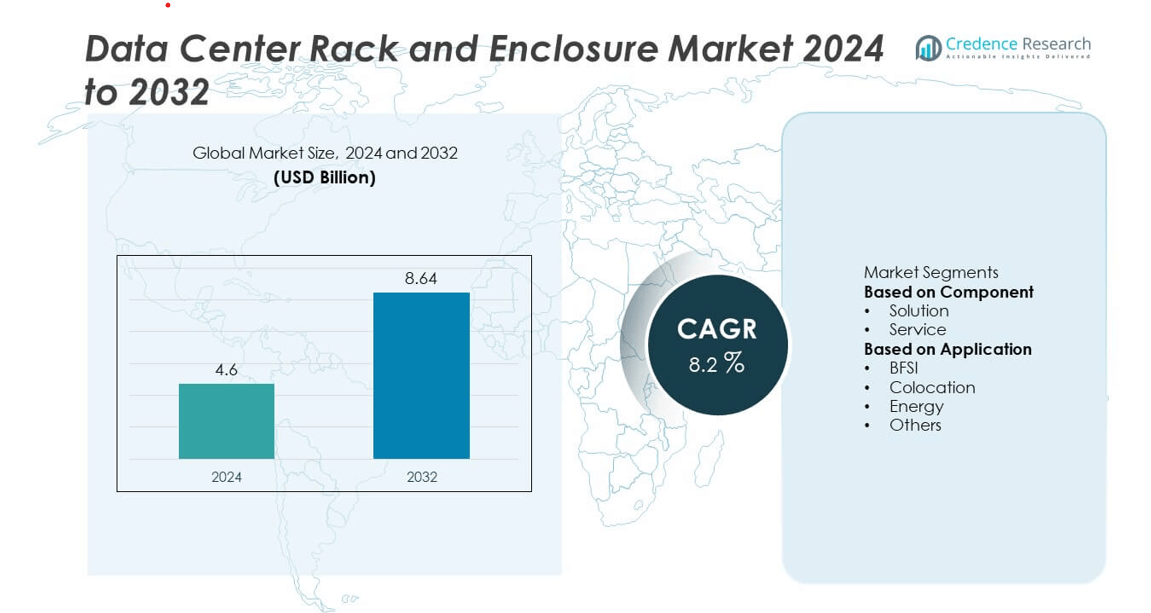

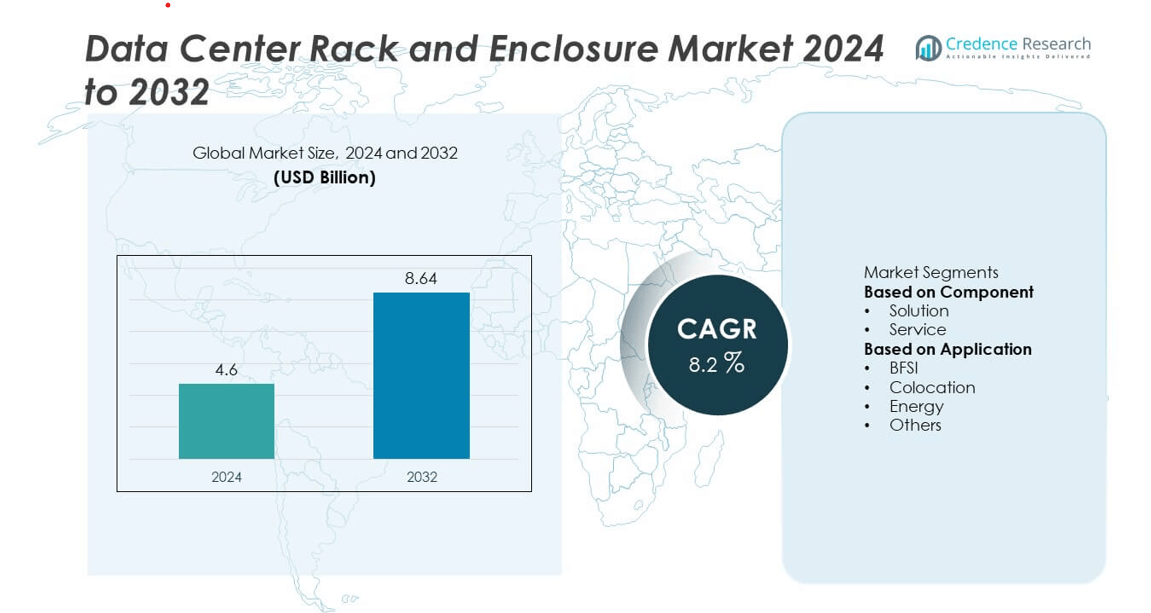

The Data Center Rack and Enclosure market was valued at USD 4.6 billion in 2024 and is projected to reach USD 8.64 billion by 2032, growing at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Rack and Enclosure Market Size 2024 |

USD 4.6 billion |

| Data Center Rack and Enclosure Market , CAGR |

8.2% |

| Data Center Rack and Enclosure Market Size 2032 |

USD 8.64 billion |

The data center rack and enclosure market is led by prominent players such as Vertiv, Schneider Electric, Fujitsu, IBM, Legrand, Eaton, Panduit, Rittal, HPE, and Blackbox. These companies dominate through innovations in modular rack designs, advanced cooling systems, and energy-efficient enclosures that cater to high-performance computing and hyperscale data centers. North America held the largest market share of 38% in 2024, driven by rapid cloud adoption and the expansion of hyperscale facilities. Europe followed with 27% share, supported by stringent data security regulations, while Asia Pacific accounted for 25%, emerging as the fastest-growing region due to strong data center investments in China, India, and Japan.

Market Insights

- The data center rack and enclosure market was valued at USD 4.6 billion in 2024 and is projected to reach USD 8.64 billion by 2032, growing at a CAGR of 8.2%.

- Rising demand for scalable IT infrastructure and efficient cooling systems drives strong adoption across colocation and hyperscale data centers.

- Key trends include modular rack designs, integration of smart monitoring systems, and the shift toward edge data center deployments.

- Major players such as Vertiv, Schneider Electric, and Rittal focus on innovation, energy efficiency, and sustainable manufacturing to strengthen competitiveness.

- North America led the market with 38% share in 2024, followed by Europe with 27% and Asia Pacific with 25%, while the solution segment dominated with 69% share, supported by growing investments in advanced rack management and power distribution systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the data center rack and enclosure market in 2024 with a 71% share, driven by the growing need for high-density storage and optimized cooling systems. Organizations increasingly adopt advanced rack solutions to manage rising data traffic and enhance energy efficiency. Modular and scalable rack designs are gaining traction among hyperscale and enterprise data centers. The demand for integrated power management and cable organization features further strengthens this segment’s dominance. Continuous innovation in rack architecture supports better airflow, load capacity, and equipment protection, fueling market growth.

- For instance, the Vertiv VR3100 and VR3350 racks support static loads up to 3,000 pounds and dynamic loads up to 2,500 pounds. The Vertiv DCE Rack System also supports a dynamic load of up to 2,500 pounds, but its static load capacity is up to 4,000 pounds.

By Application

The colocation segment led the data center rack and enclosure market in 2024, accounting for a 44% share, due to increasing demand for shared infrastructure and cost-effective data storage. Colocation providers are expanding facilities to support cloud computing, AI, and edge deployments. The need for customizable and high-density racks suitable for diverse clients drives adoption. Companies prefer colocation centers to minimize capital expenditure while maintaining reliability and scalability. Rising digital transformation across industries and growing data volume from hybrid cloud operations further boost investment in colocation-focused rack and enclosure solutions.

- For instance, Rittal’s VX IT server rack systems offer modular designs with precision cooling and cable management features that, in the dynamic version, support up to 1,500 kilograms of IT equipment per rack, providing high availability and scalability for AI-ready environments.

Key Growth Drivers

Rising Demand for High-Density Computing

The increasing adoption of cloud computing, artificial intelligence, and big data analytics is driving the need for high-density server setups. Data centers require advanced racks and enclosures capable of handling greater power loads and optimized cooling efficiency. As enterprises shift toward virtualization and hyper-converged infrastructure, scalable rack systems become essential for managing heat and ensuring system reliability. The trend toward compact, energy-efficient data centers continues to propel the demand for advanced rack solutions that support higher compute density and operational flexibility.

- For instance, Schneider Electric introduced its NetShelter SX high-density racks designed to support power loads up to 20 kW per rack, integrating advanced airflow management systems and intelligent PDUs that improve energy efficiency and cooling performance across hyperscale data centers.

Expansion of Hyperscale and Edge Data Centers

The rapid growth of hyperscale facilities and edge data centers is a key driver for the rack and enclosure market. Hyperscale operators require thousands of racks designed for modular scalability, efficient power distribution, and easy maintenance. Meanwhile, edge computing’s rise demands smaller, flexible enclosures for localized data processing. Growing deployment of 5G networks and IoT devices further accelerates this need. Manufacturers are developing modular and pre-configured solutions to meet the performance, cooling, and space requirements of both hyperscale and edge environments.

- For instance, Vertiv develops modular data center systems with integrated liquid cooling and busway power distribution solutions designed for hyperscale and high-density computing.

Growing Focus on Energy Efficiency and Cooling Optimization

Energy consumption and heat management are major concerns in modern data centers. The rising cost of power and environmental sustainability goals are pushing operators to adopt racks with advanced airflow and liquid-cooling integration. Innovative designs now include built-in sensors and intelligent power management for optimizing thermal efficiency. Companies are focusing on green data center strategies, emphasizing sustainable infrastructure and reduced carbon footprints. This increasing focus on energy efficiency is driving demand for high-performance, eco-friendly rack and enclosure systems across global data centers.

Key Trends and Opportunities

Integration of Smart Monitoring and IoT Technologies

Smart racks equipped with IoT sensors and AI-based monitoring tools are becoming essential in modern data centers. These systems provide real-time insights into temperature, power usage, and humidity, helping optimize performance and prevent downtime. The integration of predictive maintenance technologies enhances reliability and reduces operational costs. As automation grows, the demand for intelligent rack systems capable of self-regulation and remote management is expanding. This trend represents a major opportunity for innovation and differentiation among data center equipment manufacturers.

- For instance, Rittal developed its CMC III monitoring system integrated into rack enclosures, featuring up to 50 connected IoT sensors for temperature, power, and door access control. This platform enables data centers to remotely track operational metrics and predict equipment failures, improving uptime reliability and reducing maintenance intervals by up to 25% through data-driven optimization.

Shift Toward Modular and Prefabricated Infrastructure

Modular data center designs are gaining traction due to their scalability, faster deployment, and cost efficiency. Prefabricated rack and enclosure systems simplify installation, allowing operators to expand capacity without disrupting operations. This approach aligns with the growing demand for flexibility in colocation and enterprise data centers. Modular enclosures also support high-density computing and hybrid workloads, making them ideal for cloud and edge deployments. The increasing preference for plug-and-play infrastructure creates strong opportunities for manufacturers offering customizable, modular rack solutions.

- For instance, Schneider Electric partnered with Compass Datacenters to deliver modular prefabricated rack systems supporting deployments of up to 1.2 MW per module. The integration of Schneider’s EcoStruxure™ architecture enabled real-time energy monitoring and seamless scalability across hyperscale environments, reducing construction lead times by 50% and lowering operational energy consumption through optimized load management.

Key Challenges

High Capital Investment and Maintenance Costs

The deployment of advanced rack and enclosure systems involves significant upfront costs, particularly for liquid-cooled or high-density configurations. Small and medium-sized enterprises often face budget constraints that limit adoption. Regular maintenance, upgrades, and cooling optimization add to operational expenses. Although long-term savings are achievable through energy efficiency, the initial investment remains a major barrier. Manufacturers are responding with cost-effective, modular solutions to improve affordability, but capital intensity continues to challenge broader market penetration.

Thermal Management and Space Constraints

As computing power increases, managing heat and optimizing rack space have become critical challenges. High-density data centers require precise airflow and cooling distribution to maintain performance and prevent equipment damage. Limited floor space in urban or edge facilities further complicates rack placement and cooling efficiency. Ineffective thermal management can lead to power inefficiencies and downtime. To address this, companies are investing in innovative cooling designs, such as liquid immersion and rear-door heat exchangers, to maintain operational stability and efficiency.

Regional Analysis

North America

North America held a 38% share of the data center rack and enclosure market in 2024, driven by strong demand from hyperscale operators and cloud service providers. The United States leads the region with extensive investments in data center expansion and modernization. Growing adoption of AI, 5G, and edge computing technologies is fueling demand for high-density racks with advanced cooling systems. Canada also contributes steadily through rising colocation and enterprise data center projects. The presence of leading technology firms and sustainable infrastructure initiatives further strengthens North America’s position in the global market.

Europe

Europe accounted for 27% share of the data center rack and enclosure market in 2024, supported by rapid digital transformation and strict energy-efficiency regulations. The United Kingdom, Germany, and the Netherlands dominate regional growth due to expanding cloud infrastructure and colocation services. The region’s focus on sustainable data center design has accelerated the adoption of energy-efficient and modular rack solutions. Increased investment in green data centers and renewable power integration is further boosting demand. Ongoing digital initiatives under the European Union’s Digital Strategy continue to drive modernization of existing data center infrastructure.

Asia Pacific

Asia Pacific captured 25% share of the data center rack and enclosure market in 2024, emerging as the fastest-growing region globally. Rapid urbanization, digitalization, and the expansion of cloud computing across China, India, Japan, and South Korea are driving strong growth. Governments and enterprises are investing in large-scale data center projects to support the rising demand for digital services and 5G networks. Increasing use of modular and scalable rack systems supports the region’s need for high-capacity data infrastructure. The surge in hyperscale and edge data centers positions Asia Pacific as a critical growth engine for the market.

Latin America

Latin America held 6% share of the data center rack and enclosure market in 2024, driven by growing demand for cloud-based services and digital transformation. Brazil and Mexico lead the region with rising investments in hyperscale and colocation facilities. The region’s increasing adoption of hybrid cloud infrastructure and modernization of IT networks support steady market expansion. However, limited availability of reliable power and high operational costs pose challenges. Ongoing investments from global cloud providers and government-backed digital initiatives are expected to strengthen Latin America’s role in global data center development.

Middle East & Africa

The Middle East and Africa accounted for 4% share of the data center rack and enclosure market in 2024, supported by growing investments in IT infrastructure and digital connectivity. The United Arab Emirates and Saudi Arabia lead regional growth through smart city initiatives and large-scale data center projects. In Africa, countries such as South Africa and Kenya are seeing rising demand for colocation and cloud services. Government efforts to expand digital economies and improve broadband access are driving further investments. Increasing focus on energy-efficient and modular rack systems is expected to enhance regional market development.

Market Segmentations:

By Component

By Application

- BFSI

- Colocation

- Energy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the data center rack and enclosure market is characterized by strong participation from major players such as Fujitsu, Vertiv, Legrand, IBM, Rittal, Eaton, Panduit, Blackbox, Schneider Electric, and HPE. These companies focus on developing modular, energy-efficient, and scalable rack solutions that support high-density computing environments. Continuous innovation in thermal management, cable organization, and power distribution enhances system performance and reliability. Strategic partnerships with cloud providers and data center operators are expanding market reach and integration capabilities. Companies are also investing in intelligent rack systems equipped with sensors for monitoring airflow, temperature, and power consumption. The growing demand for edge data centers and hyperscale facilities intensifies competition, encouraging players to prioritize customization, sustainability, and space optimization. Mergers, acquisitions, and global expansion strategies remain key to maintaining technological leadership and catering to evolving enterprise and colocation infrastructure requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fujitsu

- Vertiv

- Legrand

- IBM

- Rittal

- Eaton

- Panduit

- Blackbox

- Schneider Electric

- HPE

Recent Developments

- In June 2025, Schneider Electric and NVIDIA partnered to co-develop AI-optimized rack reference architectures supporting workloads up to 132 kW per rack, incorporating liquid cooling and power architectures.

- In July 2024, Vertiv launched the MegaMod CoolChip, a modular data center designed for AI. The new product uses liquid cooling, including direct-to-chip cooling, and can be customized to meet the needs of AI compute providers. It also supports a hybrid approach with both air and liquid cooling. The MegaMod CoolChip can be used as a modular retrofit or a standalone data center, with capacities reaching multiple megawatts.

- In November 2023, Eaton Corporation launched Rack PDU G4, a new, innovative rack power distribution solution for data centers and edge facilities. By accommodating power demands for a broad range of equipment and facility types, the new rack solution allows data center operators to deploy a single PDU across multiple locations, saving time, reducing costs and simplifying power management

Report Coverage

The research report offers an in-depth analysis based on Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of modular and scalable rack systems will enhance operational flexibility.

- Demand for liquid-cooled enclosures will rise to support high-density computing environments.

- Integration of AI-based monitoring tools will improve rack performance and energy efficiency.

- Edge data center expansion will drive need for compact and ruggedized rack solutions.

- Sustainable materials and eco-friendly manufacturing will gain importance among vendors.

- Increasing use of prefabricated data center modules will accelerate deployment efficiency.

- Cloud service providers will continue to dominate demand for advanced rack infrastructure.

- Adoption of 5G networks will increase data center rack installations in telecom facilities.

- Hybrid and multi-cloud environments will boost demand for customizable enclosure designs.

- Continuous innovation in thermal management will define competitiveness in future data center infrastructures.