Market overview

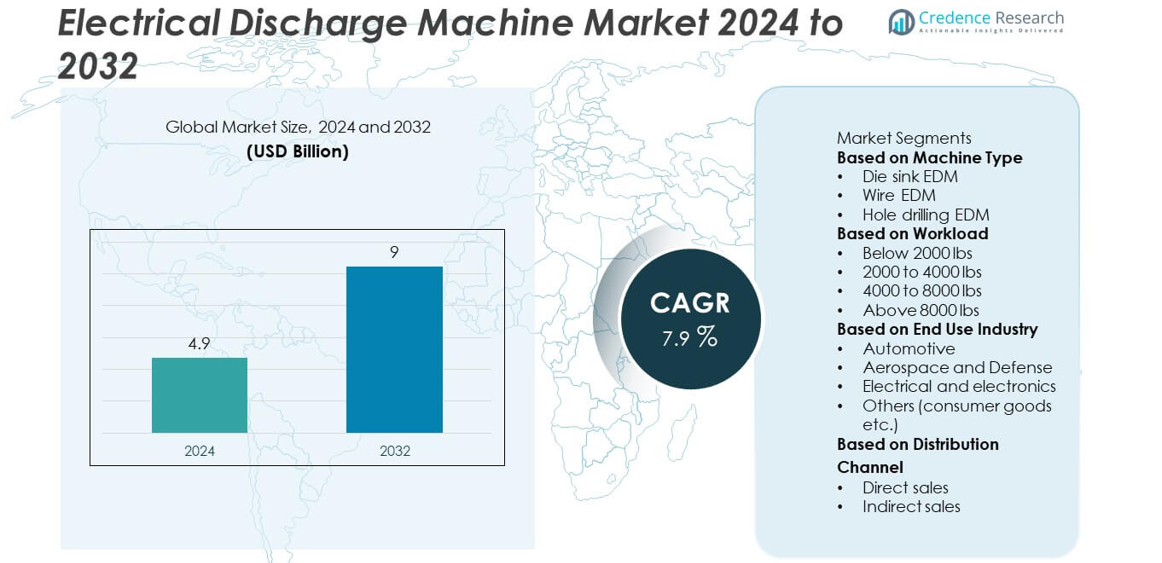

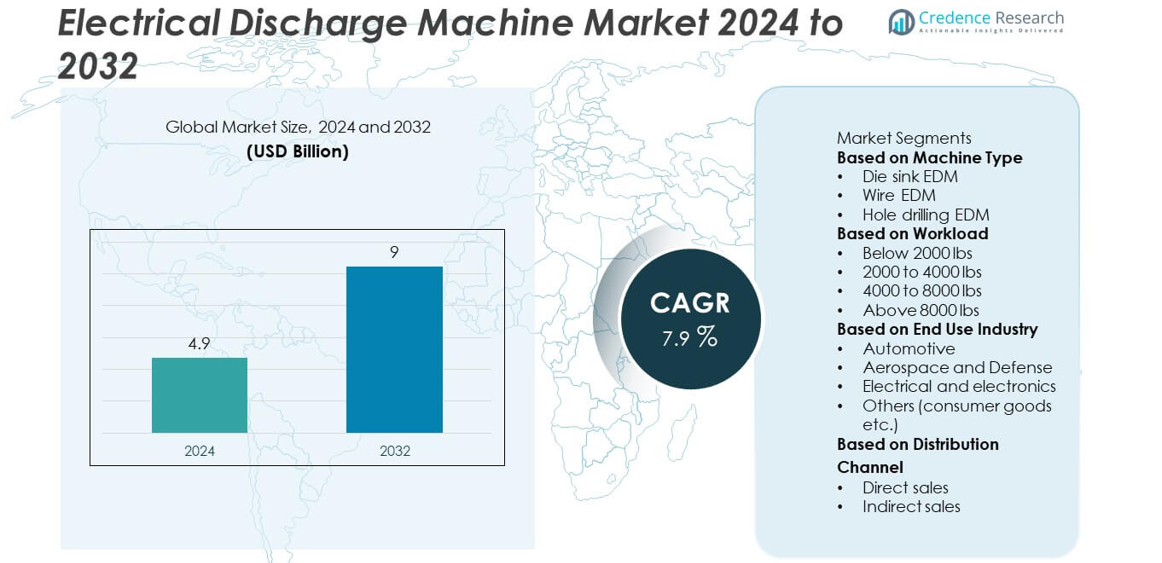

The Electrical Discharge Machine (EDM) market was valued at USD 4.9 billion in 2024 and is projected to reach USD 9 billion by 2032, growing at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Discharge Machine Market Size 2024 |

USD 4.9 billion |

| Electrical Discharge Machine Market, CAGR |

7.9% |

| Electrical Discharge Machine Market Size 2032 |

USD 9 billion |

The electrical discharge machine market is led by key players such as Mitsubishi Electric, GF Machining Solutions, Fanuc, CHMER, AccuteX, Makino, Excetek, Agie, Zimmer & Kreim, and FEOB. These companies focus on advanced automation, precision engineering, and digital control integration to enhance machining efficiency. North America led the market with a 34% share in 2024, supported by strong aerospace and automotive manufacturing bases. Europe followed with 28%, driven by high adoption of CNC-based EDM systems in precision engineering. Asia Pacific held 30% share, emerging as the fastest-growing region due to industrial expansion and rising investments in manufacturing automation.

Market Insights

- The electrical discharge machine market was valued at USD 4.9 billion in 2024 and is projected to reach USD 9 billion by 2032, growing at a CAGR of 7.9%.

- Rising demand for precision machining in automotive, aerospace, and electronics industries drives market expansion, supported by the growing use of advanced CNC-based EDM systems.

- The market is witnessing trends such as automation, hybrid EDM technologies, and integration with Industry 4.0 solutions to improve accuracy, efficiency, and production flexibility.

- Major players including Mitsubishi Electric, GF Machining Solutions, Fanuc, and Makino focus on innovation, energy efficiency, and digital connectivity to maintain competitiveness.

- North America led with 34% share in 2024, followed by Europe with 28% and Asia Pacific with 30%, while the wire EDM segment dominated with 47% share; however, high equipment costs and skilled labor shortages remain key restraints to broader adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machine Type

The wire EDM segment dominated the electrical discharge machine market in 2024 with a 47% share, driven by its precision and versatility in producing intricate shapes and tight tolerances. Wire EDM is widely used in mold and die manufacturing, as well as in the aerospace and electronics industries, where high accuracy is essential. Its ability to cut hard metals without causing deformation makes it preferred for complex part production. Growing adoption of automated and multi-axis wire EDM systems further enhances productivity, supporting steady demand across advanced manufacturing sectors.

- For instance, GF Machining Solutions launched the CUT X wire EDM, featuring AI-based thermal stabilization and high pitch positional accuracy of plus/minus one micron within a temperature change of plus/minus two-point-five degrees C over twelve hours. The system has a maximum workpiece weight of eight hundred kg and can utilize a variety of wire types and diameters to enable micro-tolerance machining.

By Workload

The 2000 to 4000 lbs segment held the largest market share of around 38% in 2024, owing to its suitability for medium-duty industrial applications. This category serves diverse sectors, including automotive component manufacturing, precision tooling, and general engineering. Machines in this range provide a balanced combination of power, efficiency, and cost-effectiveness. Manufacturers favor this workload capacity for producing medium-sized molds, dies, and precision parts. The segment benefits from advancements in CNC technology and integration with digital monitoring systems, which improve machining accuracy and reduce operational downtime.

- For instance, Mitsubishi Electric introduced the MV4800-ST wire EDM, designed to handle workpieces up to 6,600 lbs with an optional maximum submerged cutting height of 32 inches. The machine uses a linear shaft motor drive system for highly accurate table movement and can achieve very fine surface finishes.

By End Use Industry

The automotive industry led the electrical discharge machine market in 2024, accounting for 41% of total share. The sector’s demand for high-precision components, such as engine parts, fuel injectors, and transmission tools, drives segment dominance. EDM technology enables automakers to achieve complex geometries and tight surface tolerances that conventional machining cannot match. Growing emphasis on electric vehicle production and lightweight metal components further strengthens adoption. Continuous investment in automation and precision tooling across major automotive manufacturing hubs reinforces the leading position of the automotive segment in the EDM market.

Key Growth Drivers

Growig Demand for Precision Machining

The increasing need for high-precision components in industries such as aerospace, automotive, and medical devices is driving demand for electrical discharge machines. EDM systems provide superior accuracy and surface finish compared to conventional machining methods. Their capability to shape hard metals and complex geometries without mechanical stress enhances their appeal in tool and die manufacturing. As product miniaturization and quality standards tighten, manufacturers continue to adopt EDM technology to meet tolerance requirements and ensure consistent, high-performance output across production lines.

- For instance, Makino developed the UP6 H.E.A.T. Wire Electrical Discharge Machine (EDM), featuring a positional accuracy of 1 µm. It has a work envelope of 650 mm x 470 mm x 320 mm and utilizes a stationary work table design for enhanced accuracy.

Expansion of the Aerospace and Defense Sector

Rising aircraft production and defense modernization programs are fueling EDM adoption for critical component fabrication. The technology’s ability to machine heat-resistant alloys and composite materials is vital for engine parts, turbine blades, and intricate defense components. Governments and OEMs are investing heavily in precision manufacturing to enhance reliability and performance. This trend supports steady demand for advanced EDM systems with multi-axis capabilities, automated controls, and improved energy efficiency, ensuring consistent growth in high-value industrial applications.

- For instance, Mitsubishi Electric introduced the EA8S Advance die-sinking EDM, which is capable of machining aerospace-grade materials like Inconel and titanium. The system has a maximum electrode weight of 25 kg and a Z-axis travel of 250 mm.

Adoption of Automation and CNC Integration

Manufacturers are increasingly integrating CNC technology and automation into EDM systems to improve accuracy and reduce labor dependency. Automated EDM solutions enable continuous operation, minimize errors, and shorten production cycles. The shift toward smart manufacturing and Industry 4.0 is accelerating the development of digitally controlled EDM machines equipped with sensors and remote monitoring features. These innovations enhance productivity and energy efficiency while allowing real-time process optimization, making EDM systems more appealing for large-scale and precision-focused manufacturing environments.

Key Trends and Opportunities

Advancement in Hybrid EDM Technologies

Hybrid EDM machines that combine electrical discharge machining with milling or laser processes are gaining traction. These systems enhance flexibility, surface quality, and machining speed while reducing tool wear. The integration of multiple machining techniques allows manufacturers to perform complex operations in a single setup, improving efficiency and precision. This trend aligns with the rising demand for multi-functional equipment across the aerospace and automotive industries. The growing focus on hybrid machining creates new opportunities for innovation and higher-value product development in the EDM market.

- For instance, GF Machining Solutions offers high-performance 5-axis milling machines like the MIKRON MILL E 700 U, featuring a 20,000 RPM spindle for efficient, productive processing. For more demanding applications, the company’s MIKRON MILL P 500 U offers a 42,000 RPM spindle and achieves high accuracy and fine surface finishes.

Rising Adoption of 3D EDM and Additive Manufacturing Integration

Manufacturers are exploring EDM-compatible 3D manufacturing to achieve higher precision in post-processing of printed metal parts. EDM’s compatibility with additive components allows for detailed finishing and improved dimensional accuracy. This integration supports faster prototyping and production of complex geometries for industrial and medical applications. The rise of hybrid additive-subtractive systems combining 3D printing and EDM expands design flexibility while reducing waste. As demand for customized, high-performance components grows, this trend is set to redefine precision engineering processes globally.

- For instance, DMG MORI developed the LASERTEC 4300 DED hybrid system, which integrates additive metal deposition using a powder nozzle with 6-sided turn-mill operations on a single platform.

Key Challenges

High Initial Investment and Operating Costs

Electrical discharge machines require significant capital investment, limiting adoption among small and mid-sized manufacturers. The cost of advanced EDM equipment, CNC controls, and consumables like electrodes and dielectric fluids adds to overall expenditure. Regular maintenance and power consumption further elevate operational costs. Although EDM delivers exceptional accuracy and efficiency, many manufacturers hesitate due to budget constraints. To overcome this challenge, leading suppliers are developing cost-effective, energy-efficient models that balance performance and affordability for diverse production environments.

Skill Shortage and Process Complexity

The EDM process demands skilled operators and precise control to ensure optimal machining outcomes. A shortage of trained professionals and growing dependence on advanced software-based systems present challenges for manufacturers. Incorrect parameter settings can lead to tool wear, part damage, and extended downtime. As EDM technologies become more complex, continuous training and upskilling are essential to maintain productivity. Industry partnerships and training programs are being developed to address this gap and support broader adoption of advanced EDM systems globally.

Regional Analysis

North America

North America held a 34% share of the electrical discharge machine market in 2024, driven by advanced manufacturing infrastructure and strong demand for precision machining. The United States leads the region due to high adoption of EDM systems in aerospace, automotive, and defense production. Continuous investment in automation and Industry 4.0 technologies enhances market growth. Canada also contributes significantly through its expanding automotive tooling and mold manufacturing sectors. The presence of key aerospace manufacturers and the shift toward high-accuracy machining solutions further strengthen the regional market outlook.

Europe

Europe accounted for 28% share of the electrical discharge machine market in 2024. The region benefits from a well-established industrial base and a growing focus on precision engineering. Germany, France, and Italy dominate production due to strong automotive and aerospace manufacturing ecosystems. Advancements in CNC-controlled EDM systems and energy-efficient machinery support regional expansion. Strict quality standards and emphasis on sustainability encourage the adoption of high-performance EDM technologies. Increasing investments in automation and hybrid machining further reinforce Europe’s position as a major hub for precision machining innovation.

Asia Pacific

Asia Pacific captured 30% share of the electrical discharge machine market in 2024, emerging as the fastest-growing region globally. China, Japan, and South Korea lead demand due to their robust automotive, electronics, and mold manufacturing industries. The region’s expansion is supported by rising industrialization, cost-effective manufacturing, and government initiatives promoting advanced production technologies. India and Southeast Asian countries are witnessing growing investments in precision tooling and metal fabrication. Continuous innovation by regional manufacturers and adoption of automated EDM systems further enhance the market’s competitive landscape across Asia Pacific.

Latin America

Latin America held 5% share of the electrical discharge machine market in 2024. Growth is driven by increasing adoption of EDM technology in automotive component manufacturing and metalworking industries. Brazil and Mexico lead the regional market, supported by expanding industrial automation and local tooling capabilities. The region benefits from a growing demand for precision molds and dies for consumer goods and electronics. However, limited access to advanced technology and high equipment costs remain challenges. Strategic collaborations and investments from global EDM suppliers are gradually improving market accessibility in Latin America.

Middle East & Africa

The Middle East and Africa accounted for 3% share of the electrical discharge machine market in 2024. Growth is primarily supported by rising infrastructure development, industrial diversification, and defense manufacturing initiatives. The United Arab Emirates and Saudi Arabia are key markets, focusing on developing advanced machining capabilities for aerospace and energy sectors. In Africa, South Africa and Egypt are witnessing gradual industrial modernization. Although adoption remains limited compared to other regions, increasing government initiatives and technology imports are expected to enhance EDM utilization in the coming years.

Market Segmentations:

By Machine Type

- Die sink EDM

- Wire EDM

- Hole drilling EDM

By Workload

- Below 2000 lbs

- 2000 to 4000 lbs

- 4000 to 8000 lbs

- Above 8000 lbs

By End Use Industry

- Automotive

- Aerospace and Defense

- Electrical and electronics

- Others (consumer goods etc.)

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the electrical discharge machine market is defined by strong participation from major players such as Mitsubishi Electric, GF Machining Solutions, Fanuc, CHMER, AccuteX, Makino, Excetek, Agie, Zimmer & Kreim, and FEOB. These companies focus on technological advancement, automation, and digital integration to strengthen their global presence. Continuous innovations in CNC control, multi-axis machining, and energy-efficient EDM systems drive product differentiation. Manufacturers are expanding their portfolios with high-speed wire EDM, die-sink, and hole-drilling models to serve precision-driven industries. Strategic mergers, partnerships, and R&D investments are enabling players to enhance performance and sustainability in production environments. Growing demand for hybrid EDM technologies and the integration of Industry 4.0 capabilities are intensifying competition, with firms focusing on software-enabled process optimization, cost efficiency, and superior accuracy to meet evolving industrial requirements worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Mitsubishi Electric unveiled a new flagship wire-cut EDM line called the MG series, replacing its MV line after 13 years. The company aims to sell 1,200 units annually with enhanced threading reliability and energy savings.

- In July 2025, GF Machining Solutions formally rebranded as UNITED MACHINING, as part of a strategic acquisition by United Grinding Group, bringing its EDM and precision machining business under a unified group identity.

- In May 2025, GF Machining Solutions introduced its CUT X series wire EDM (models 350 & 500) equipped with AI-driven thermal management, interchangeable wire guides (open and closed) in under 15 minutes, and enhanced internal sealing for temperature stability.

- In January 2025, Mitsubishi Electric launched the MV4800-ST wire EDM capable of submerged machining up to 32 inches in height, with new corner control and dual pulse control features to boost precision and throughput

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Workload, End Use Industry, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automated and CNC-integrated EDM systems will continue to accelerate.

- Hybrid EDM technologies combining milling and laser machining will gain traction.

- Demand for high-precision components in aerospace and medical sectors will drive growth.

- Integration of Industry 4.0 and smart monitoring systems will enhance process control.

- Manufacturers will focus on energy-efficient and low-maintenance EDM machines.

- Rising use of EDM in electric vehicle component production will create new opportunities.

- Compact and portable EDM machines will see increasing demand in small workshops.

- Software-driven optimization and digital twin technology will improve machining accuracy.

- Expanding manufacturing infrastructure in Asia Pacific will boost market competitiveness.

- Strategic collaborations and R&D investments will shape innovation in high-speed EDM solutions.