Market Overview

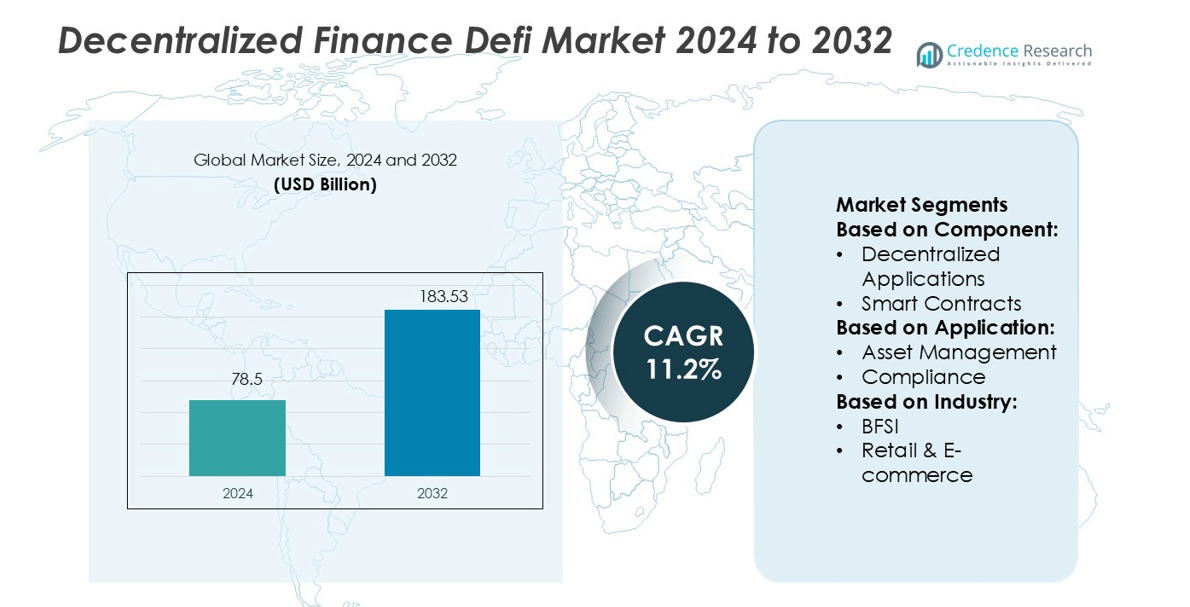

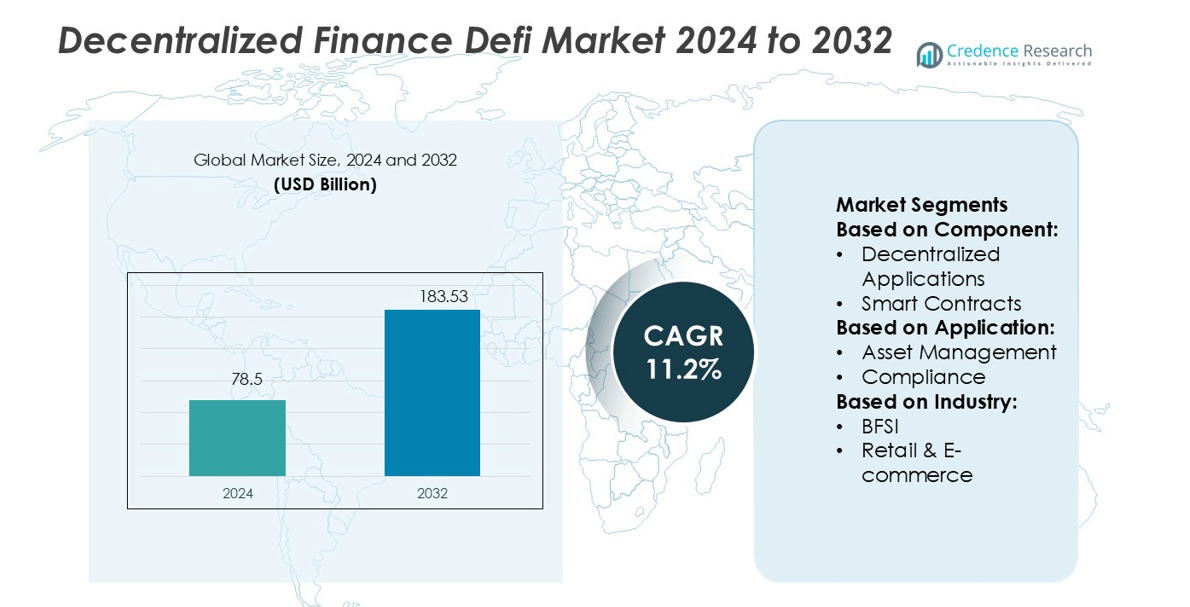

Decentralized Finance Defi Market size was valued USD 78.5 billion in 2024 and is anticipated to reach USD 183.53 billion by 2032, at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decentralized Finance (DeFi) Market Size 2024 |

USD 78.5 billion |

| Decentralized Finance (DeFi) Market, CAGR |

11.2% |

| Decentralized Finance (DeFi) Market Size 2032 |

USD 183.53 billion |

The decentralized finance (DeFi) market is driven by top players such as Synthetix, SushiSwap, Balancer, Bancor Network, MakerDAO, Aave, Uniswap, Badger DAO, Curve Finance, and Compound Labs, Inc. These companies lead in decentralized lending, liquidity provision, automated market making, and synthetic asset trading. Their strong technical capabilities and ecosystem integrations enhance transaction efficiency and attract significant liquidity inflows. North America dominates the global DeFi market with a 38.4% share, supported by advanced blockchain infrastructure, early regulatory engagement, and strong institutional participation. This leadership position reflects the region’s ability to scale decentralized applications rapidly and sustain innovation-driven growth.

Market Insights

- The decentralized finance (DeFi) market was valued at USD 78.5 billion in 2024 and is projected to reach USD 183.53 billion by 2032, growing at a CAGR of 11.2%.

- Rising demand for decentralized lending, staking, and liquidity services is driving market expansion, supported by strong institutional adoption and blockchain innovation.

- Integration of Layer-2 scaling, tokenization of real-world assets, and cross-chain interoperability are shaping new market trends and broadening platform capabilities.

- North America holds a 38.4% market share, leading global adoption due to advanced infrastructure and early regulatory support, while dApps dominate the component segment with 62% share.

- Regulatory uncertainty, security risks, and compliance barriers remain key restraints, though strong competition among major players enhances ecosystem maturity and positions the market for sustained growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Decentralized Applications (dApps) hold the dominant share of the decentralized finance (DeFi) market, accounting for over 62% of total revenue. dApps enable peer-to-peer financial transactions without intermediaries, driving adoption across lending, staking, and trading platforms. Their flexibility, interoperability, and transparency support rapid market expansion. Smart contracts play a key supporting role by automating financial agreements and ensuring secure execution. The increasing integration of blockchain with Layer-2 scaling solutions enhances transaction speed, reduces costs, and boosts user participation, further strengthening the dApps segment’s market leadership.

- For instance, Synthetix has leveraged Optimism Layer-2 to lower transaction costs from 2.60 to 0.24 per trade and reduce confirmation time to under 0.3 seconds, enabling high-frequency derivatives trading on its platform.

By Application

Asset management represents the largest application segment with 39% share of the DeFi market. Investors increasingly prefer decentralized asset management platforms for real-time tracking, custody control, and automated portfolio execution. These platforms offer enhanced liquidity and yield opportunities through staking, liquidity pools, and synthetic assets. Compliance and KYT solutions are growing as regulators push for better risk controls. Payment platforms and DeFi gaming are also expanding, leveraging smart contracts for secure and fast transactions. The asset management segment dominates due to its broad utility and investment appeal.

- For instance, SushiSwap Route Processor RP4, which integrates liquidity from over 12 external DEXes (such as Curve, Algebra, Quickswap) to optimize swaps across pools and minimize slippage.

By Industry

BFSI leads the market with 44% share, supported by the sector’s rapid integration of DeFi into lending, insurance, and digital banking services. Financial institutions use DeFi protocols to improve transparency, reduce operational costs, and expand customer access to decentralized financial products. Retail and e-commerce companies increasingly adopt DeFi for payment processing and loyalty programs. Media and automotive industries are exploring blockchain-based monetization and financing models. The BFSI segment dominates due to strong institutional investment, regulatory focus, and rapid digital transformation across global financial ecosystems.

Key Growth Drivers

Rapid Shift Toward Decentralized Financial Ecosystems

The rising demand for transparent, peer-to-peer financial solutions is driving DeFi adoption. Decentralized protocols remove intermediaries, enabling faster transactions and lower fees. Institutional and retail investors are drawn to the sector’s yield generation, liquidity pools, and staking opportunities. Blockchain interoperability and Layer-2 scaling solutions further enhance network performance. This shift strengthens financial inclusion, especially in emerging markets with limited banking infrastructure. The growing trust in decentralized governance models supports steady market growth.

- For instance, Balancer in its Composable Stable Pools architecture allows pools of up to 8 tokens with custom weightings, and enables internal rebalancing using external yield sources, reducing external trades.

Increased Institutional Participation and Investment

Major financial institutions are investing in DeFi platforms to diversify portfolios and streamline operations. Tokenized assets, on-chain lending, and decentralized exchanges are attracting institutional capital. Strategic partnerships between blockchain startups and banks are increasing transaction volumes and platform credibility. This capital inflow fuels product innovation, infrastructure upgrades, and regulatory engagement. The entry of regulated entities also improves market maturity and risk management. Institutional participation accelerates DeFi’s evolution into a mainstream financial ecosystem.

- For instance, Badger also adopted a multi-strategy merging framework, enabling a single Sett to integrate 3 distinct underlying yield strategies (e.g. Curve, Convex, Yearn) while sharing a common accounting layer.

Advancements in Blockchain Infrastructure

The development of faster, scalable, and more secure blockchain networks is a key growth enabler. Enhanced smart contract capabilities improve automation and reliability across DeFi protocols. Cross-chain bridges, zero-knowledge proofs, and Layer-2 solutions reduce congestion and transaction costs. These advancements attract developers, liquidity providers, and end users. Improved security frameworks also strengthen user confidence. As infrastructure matures, DeFi platforms can handle larger transaction volumes, expand utility, and support a wider range of financial services globally.

Key Trends & Opportunities

Expansion of Tokenization and Real-World Assets

Tokenizing real-world assets such as bonds, real estate, and commodities creates new revenue opportunities for DeFi platforms. Investors can trade fractionalized assets on-chain, improving liquidity and accessibility. This trend bridges traditional finance with blockchain, attracting regulated financial players. As token standards evolve, more institutions are expected to adopt decentralized asset issuance. The growth of security tokens and compliance frameworks supports large-scale market participation. Tokenization broadens DeFi’s utility beyond cryptocurrencies.

- For instance, Curve’s crvUSD protocol introduced a hybrid soft liquidation mechanism and its LLAMMA AMM engine, enabling users to exchange stablecoins and debt collateral with under 2 on-chain calls per swap in many cases.

Rise of Regulated DeFi and Compliance Solutions

Regulatory clarity is emerging as a major growth opportunity. Platforms integrating Know Your Transaction (KYT), Anti-Money Laundering (AML), and identity verification are gaining investor trust. Governments and regulators are collaborating with blockchain providers to develop compliant frameworks. This regulated environment attracts institutional investors and enhances long-term market stability. Compliance-focused DeFi platforms can access broader markets, including cross-border payments and lending. This trend aligns DeFi with global financial standards.

- For instance, Bancor’s v3 architecture was initially designed to enable instant impermanent loss protection, eliminating the prior 100-day vesting period seen in Bancor v2.1.

Integration of AI and Automation

AI-driven analytics and automation tools are improving decision-making and risk management in DeFi platforms. Automated portfolio rebalancing, predictive lending models, and smart contract auditing enhance efficiency. AI also supports fraud detection and liquidity forecasting, improving user confidence. This integration enables scalable growth and diversified use cases. As AI models mature, DeFi platforms will deliver more secure, personalized, and efficient financial services.

Key Challenges

Regulatory Uncertainty and Compliance Barriers

Unclear and fragmented regulatory frameworks pose a significant challenge to DeFi expansion. Many jurisdictions lack clear guidelines for token issuance, decentralized exchanges, and liquidity protocols. This creates compliance risks for investors and developers. Uncertainty limits institutional participation and slows infrastructure development. Cross-border regulatory differences further complicate operational scaling. Addressing these barriers requires coordinated efforts between regulators, financial institutions, and DeFi providers.

Security Vulnerabilities and Systemic Risks

DeFi platforms remain targets for hacks, exploits, and smart contract failures. Weak security layers and untested protocols lead to high financial losses. The absence of centralized oversight increases exposure to systemic risks. Flash loan attacks and bridge vulnerabilities highlight the sector’s technical fragility. Security breaches undermine investor confidence and delay mainstream adoption. Strengthening audit standards, real-time monitoring, and insurance mechanisms is critical to sustaining long-term growth.

Regional Analysis

North America

North America holds a 38.4% share of the global decentralized finance (DeFi) market, making it the leading region. Strong institutional participation, advanced blockchain infrastructure, and favorable venture capital funding drive growth. The U.S. and Canada host several top DeFi platforms, supported by robust developer communities and early regulatory engagement. Major banks and fintech firms are integrating DeFi protocols to expand their service portfolios. High adoption of tokenized assets and compliance-focused platforms further strengthen the region’s position. Regulatory clarity and capital inflows are expected to sustain its leadership during the forecast period.

Europe

Europe accounts for a 27.6% share of the global DeFi market. The region benefits from strong regulatory frameworks, including MiCA (Markets in Crypto-Assets Regulation), which supports compliance-driven growth. Germany, the UK, and France lead in blockchain adoption and institutional investment. DeFi platforms are increasingly used for asset tokenization, cross-border payments, and decentralized lending. Strategic alliances between traditional banks and blockchain startups accelerate innovation. A focus on sustainable finance and digital euro developments further boosts adoption. Europe’s balanced regulatory approach positions it as a stable and expanding DeFi hub.

Asia Pacific

Asia Pacific holds a 23.2% share of the global DeFi market. Rapid fintech adoption, strong developer ecosystems, and large unbanked populations drive growth. China, Singapore, and South Korea lead in blockchain deployment, while India and Vietnam show rising retail participation. Regional governments are exploring regulated DeFi frameworks to support innovation while managing risks. High mobile penetration and growing use of stablecoins expand financial access. Startups and exchanges are driving ecosystem growth through new tokenization and lending models. Asia Pacific is expected to be the fastest-growing region due to its strong digital infrastructure.

Latin America

Latin America captures a 6.3% share of the global DeFi market. Economic instability and limited traditional banking access are accelerating DeFi adoption. Brazil, Mexico, and Argentina lead in decentralized payment solutions and stablecoin usage. DeFi platforms provide affordable cross-border transactions, lending, and remittances. Grassroots adoption and mobile-first strategies play a key role in market expansion. Regulatory frameworks remain under development, but governments are showing growing interest in blockchain innovation. As financial inclusion initiatives increase, Latin America is positioned for steady DeFi growth over the forecast period.

Middle East & Africa

The Middle East & Africa region accounts for a 4.5% share of the global DeFi market. The adoption is driven by demand for alternative financial systems and cross-border payment solutions. The UAE, Saudi Arabia, and South Africa lead in blockchain experimentation and regulatory initiatives. Governments are exploring central bank digital currencies (CBDCs) to boost financial innovation. Limited traditional banking infrastructure creates opportunities for DeFi-driven financial inclusion. Strategic collaborations between global blockchain firms and local financial institutions are accelerating ecosystem development. The region is expected to see gradual but consistent growth.

Market Segmentations:

By Component:

- Decentralized Applications

- Smart Contracts

By Application:

- Asset Management

- Compliance

By Industry:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The decentralized finance (DeFi) market is shaped by key players including Synthetix, SushiSwap, Balancer, Bancor Network, MakerDAO, Aave, Uniswap, Badger DAO, Curve Finance, and Compound Labs, Inc. The decentralized finance (DeFi) market is becoming increasingly competitive, driven by rapid technological innovation, rising liquidity inflows, and expanding use cases across multiple sectors. Protocols are focusing on enhancing scalability, security, and interoperability to attract both institutional and retail investors. Decentralized exchanges, lending platforms, and stablecoin ecosystems are evolving to offer faster transactions and lower fees. Strategic partnerships and ecosystem integrations are enabling broader market reach and stronger infrastructure. Governance models and community-led development further enhance flexibility and resilience. As regulatory clarity improves and capital inflows rise, competition is expected to intensify, accelerating DeFi’s shift toward mainstream adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Synthetix

- SushiSwap

- Balancer

- Bancor Network

- MakerDAO

- Aave

- Uniswap

- Badger DAO

- Curve Finance

- Compound Labs, Inc.

Recent Developments

- In October 2025, Swiss Financial Market Supervisory Authority (FINMA) granted a payment institution license to Sygnum Bank, making it the first regulated digital asset bank and enabling it to offer decentralized finance services, including custody, trading, and lending, to institutional clients (Sygnum Bank press release).

- In July 2025, PayPal’s move allowed PYUSD to be used in DeFi lending, trading, and liquidity pools across Ethereum-based protocols. This step marks a significant bridge between traditional payments and decentralized finance ecosystems.

- In January 2025, Centrifuge and Plume Network extended institutional-grade tokenized-asset access through the Nest protocol, enabling users to source AAA-rated yield products backed by regulated instruments.

- In April 2024, Copper and Truflation announced a strategic partnership aimed at driving innovation within the decentralized finance (DeFi) space. Copper, a digital asset custodian known for its institutional-grade custody and collateral management solutions, will collaborate with Truflation, a provider of real-time financial data and indexing for Real World Assets (RWA)

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- DeFi platforms will expand into traditional finance, increasing institutional adoption.

- Regulatory clarity will strengthen investor confidence and platform credibility.

- Layer-2 scaling solutions will enhance transaction speed and reduce network costs.

- Tokenization of real-world assets will broaden investment opportunities.

- AI and automation will improve risk management and operational efficiency.

- Cross-chain interoperability will enable seamless asset movement across networks.

- Decentralized identity solutions will support secure and compliant transactions.

- Stablecoins will play a larger role in payments and lending applications.

- Security frameworks will evolve to address protocol vulnerabilities.

- DeFi will become a core part of global digital financial infrastructure.