Market Overview

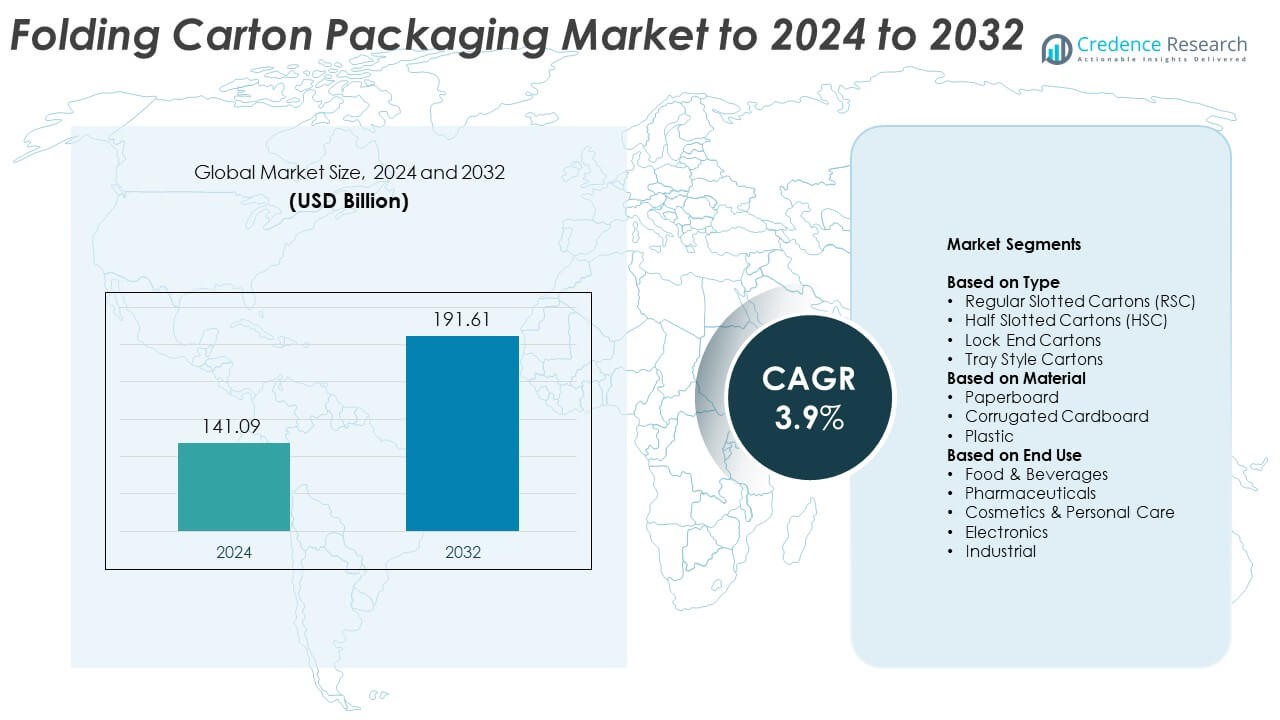

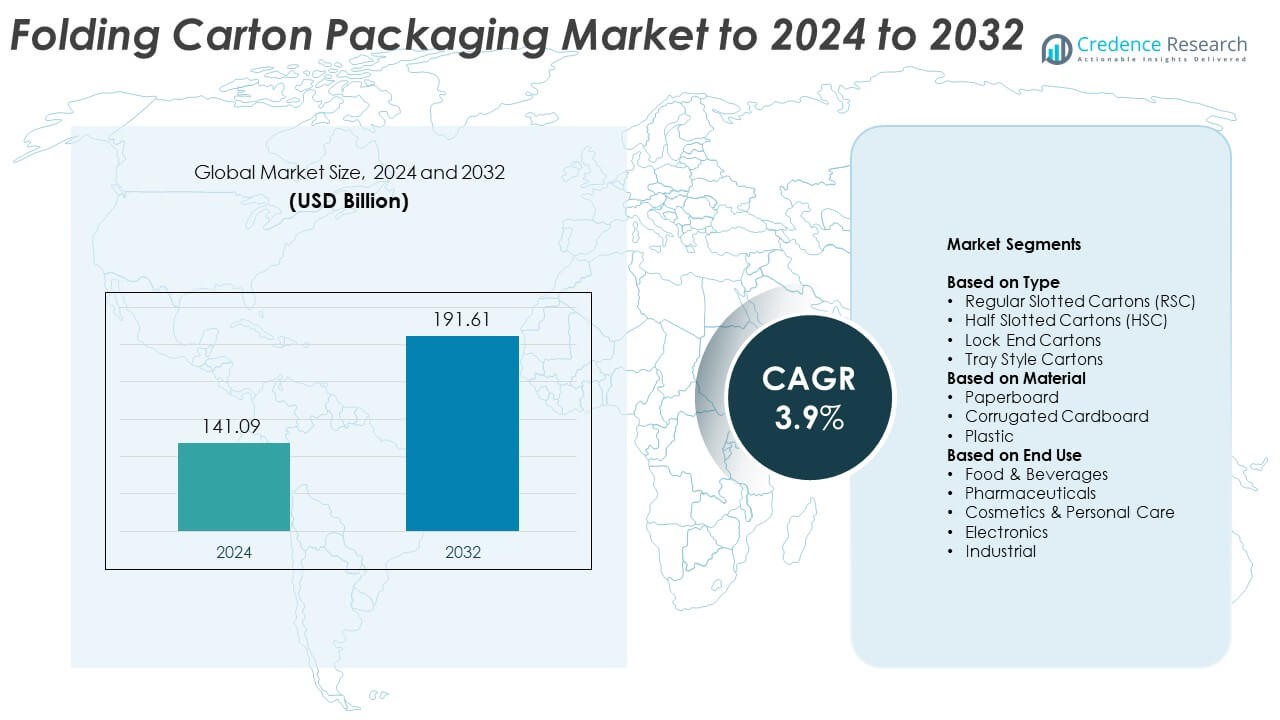

The Folding Carton Packaging Market size was valued at USD 141.09 billion in 2024 and is anticipated to reach USD 191.61 billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Folding Carton Packaging Market Size 2024 |

USD 141.09 Billion |

| Folding Carton Packaging Market, CAGR |

3.9% |

| Folding Carton Packaging Market Size 2032 |

USD 191.61 Billion |

The folding carton packaging market is shaped by major players such as WestRock, Smurfit Kappa Group, DS Smith, International Paper, Mondi plc, Graphic Packaging International, Stora Enso, Huhtamaki Group, Nippon Paper Group, Oji Holdings, ITC Limited, Ardagh Group, Sonoco Products, Crown Holdings, VTT, and Lotus Label. These companies compete through sustainability-driven innovation, advanced manufacturing processes, and expansion into high-growth end-use sectors like food, beverages, and pharmaceuticals. Asia Pacific led the global market with a 30% share in 2024, supported by rapid industrialization and demand for eco-friendly packaging. North America and Europe followed, accounting for 32% and 28% shares respectively, driven by strong regulatory frameworks, technological advancements, and a growing shift toward circular packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Folding Carton Packaging Market was valued at USD 141.09 billion in 2024 and is projected to reach USD 191.61 billion by 2032, growing at a CAGR of 3.9%.

- Increasing demand for sustainable and recyclable packaging materials is driving market growth, supported by rising consumer awareness and regulatory restrictions on plastic use.

- Advancements in digital printing, premium packaging design, and smart labeling trends are enhancing brand visibility and fueling adoption across consumer goods and e-commerce sectors.

- The market is moderately fragmented, with leading companies focusing on automation, eco-friendly materials, and strategic acquisitions to expand production capacity and market reach.

- Asia Pacific dominated with a 30% share in 2024, followed by North America at 32% and Europe at 28%, while the food and beverage segment accounted for 52% of total demand due to strong packaging needs in processed and convenience food categories.

Market Segmentation Analysis:

By Type

Regular Slotted Cartons (RSC) dominated the folding carton packaging market in 2024, holding a 39% share. These cartons are preferred due to their structural strength, low material waste, and easy assembly process. RSCs are widely used in logistics, retail, and e-commerce packaging, supporting bulk transportation with minimal damage risk. Growing demand for sustainable and recyclable packaging solutions enhances their adoption. Increasing automation in box manufacturing also supports large-scale RSC production, offering high efficiency and cost optimization for global packaging operations.

- For instance, The BOBST MASTERFOLD features an operating speed of up to 700 meters per minute. When producing 4- and 6-corner boxes, it can achieve a maximum output of 50,000 boxes per hour.

By Material

Paperboard accounted for the largest market share of 47% in 2024 within the folding carton packaging segment. It remains the preferred material due to its biodegradability, printability, and suitability for food-grade applications. Paperboard cartons offer superior branding flexibility and product protection, making them popular in the food, beverage, and cosmetics industries. The shift toward sustainable materials, supported by government regulations against plastic use, is driving market growth. Rising demand for premium and eco-friendly packaging further boosts the use of coated and uncoated paperboard variants.

- For instance, The Stora Enso Oulu board line has a total target capacity of 750,000 tonnes per year for folding boxboard (FBB) and coated unbleached kraft (CUK). Production began in early 2025, with the line expected to reach its full capacity by 2027.

By End Use

The food and beverages sector led the folding carton packaging market in 2024, capturing a 52% share. This dominance is driven by the growing need for portion-controlled, ready-to-eat, and takeaway food packaging. Folding cartons offer excellent protection, branding potential, and recyclability, making them ideal for this segment. Increasing demand for convenience packaging in quick-service restaurants and online food delivery platforms supports continued growth. The trend toward eco-friendly and compostable cartons further strengthens adoption across bakery, dairy, and beverage packaging applications.

Key Growth Drivers

Sustainability and Eco-Friendly Packaging Demand

Growing environmental awareness and stricter regulations are fueling demand for recyclable and biodegradable packaging. Folding cartons made from renewable paperboard and low-impact inks align with these sustainability goals. Brands in food, cosmetics, and pharmaceuticals are shifting toward eco-friendly packaging to meet consumer expectations. This shift enhances brand value and supports corporate sustainability targets, driving continuous growth in paper-based carton solutions worldwide.

- For instance, the merged entity Smurfit Westrock handles approximately 14 million tons of recovered paper each year, reflecting the combined reprocessing capacity of Smurfit Kappa and WestRock following their merger in 2024.

Rapid Expansion of E-Commerce and Retail Distribution

The surge in e-commerce platforms has increased the demand for durable and lightweight packaging. Folding cartons provide cost-effective protection for small to medium-sized goods during transit. Their easy customization supports brand visibility through digital printing and unique graphics. As online retail penetration deepens globally, manufacturers invest in automated carton production to meet large-scale packaging requirements efficiently.

- For instance, DS Smith reports 1.7 billion+ plastic items replaced with fiber-based alternatives since 2020/21.

Advancements in Printing and Finishing Technologies

Technological upgrades in digital and offset printing enhance the visual appeal and precision of folding cartons. Features such as embossing, foil stamping, and spot UV coating allow brands to deliver premium packaging experiences. These advancements reduce production waste and shorten design-to-market cycles. Increasing adoption of smart and interactive packaging also supports marketing innovation, further boosting folding carton use across high-end product categories.

Key Trends and Opportunities

Adoption of Smart and Connected Packaging

Smart packaging technologies, such as QR codes and NFC tags, are creating new opportunities in customer engagement. These tools enable product authentication, interactive promotions, and supply chain transparency. Folding carton manufacturers are integrating such features to enhance brand loyalty and traceability. The trend aligns with digital transformation in retail and helps brands connect directly with consumers post-purchase.

- For instance, RAIN Alliance counts 44.8 billion UHF RFID tag chips shipped in 2023, rising to 52.8 billion in 2024.

Shift Toward Premiumization and Customization

Rising consumer preference for luxury and personalized packaging drives innovation in design and material use. High-end printing, metallic finishes, and textured coatings are increasingly common in cosmetics and specialty foods. Brands are adopting folding cartons that reflect product value while maintaining recyclability. The growing focus on differentiation and shelf appeal continues to create opportunities for value-added packaging solutions.

- For instance, Graphic Packaging’s Kalamazoo “K2” CRB line targets about 550,000 tons/year after ramp-up.

Key Challenges

Volatility in Raw Material Prices

Frequent fluctuations in paperboard and pulp prices impact production costs and profit margins. Supply chain disruptions and regional shortages can intensify this challenge. Manufacturers often struggle to balance cost efficiency with sustainability targets. The need for stable sourcing strategies and circular material recovery systems has become critical to maintaining competitiveness.

Competition from Flexible and Rigid Alternatives

The growing availability of flexible pouches and rigid plastic containers poses a challenge to folding carton adoption. These alternatives often offer superior durability or cost advantages in specific applications. Packaging producers must continuously innovate in strength, moisture resistance, and design to retain market share. Sustained R&D and material engineering are essential to address these competitive pressures effectively.

Regional Analysis

North America

North America held a 32% share of the folding carton packaging market in 2024. The region benefits from strong demand in the food, beverage, and pharmaceutical sectors, supported by advanced recycling infrastructure and strict sustainability standards. Major packaging producers focus on lightweight, recyclable materials and digital printing technologies to meet eco-conscious consumer preferences. The rise of e-commerce and ready-to-eat food products continues to boost carton packaging demand. The United States dominates regional growth, while Canada follows with expanding investments in sustainable packaging solutions and circular economy practices.

Europe

Europe accounted for a 28% share of the global folding carton packaging market in 2024. The region’s growth is driven by strict environmental policies and the EU’s initiatives for reducing plastic waste. Demand is high in the food, cosmetics, and healthcare sectors due to increasing use of recyclable paperboard cartons. Countries such as Germany, France, and the UK lead innovation in bio-based coatings and digital printing technologies. Growing adoption of premium packaging and renewable materials supports steady expansion, with manufacturers focusing on energy-efficient production processes and reduced carbon emissions.

Asia Pacific

Asia Pacific dominated with a 30% share of the folding carton packaging market in 2024. Rapid industrialization, urbanization, and growth in food delivery services drive strong demand across China, India, and Japan. Expanding middle-class populations and rising disposable incomes have accelerated demand for branded and aesthetic packaging. Local manufacturers are investing in automation and eco-friendly materials to meet evolving sustainability standards. The region also benefits from low production costs and increasing exports of packaged goods, positioning Asia Pacific as the fastest-growing market in the global folding carton packaging industry.

Latin America

Latin America captured a 6% share of the folding carton packaging market in 2024. The region is witnessing steady growth due to increasing consumption of packaged food, beverages, and personal care products. Brazil and Mexico lead the market with expanding retail infrastructure and modernization of packaging production facilities. The transition from plastic to recyclable materials supports long-term growth. Regional players are focusing on affordability and sustainability to meet consumer and regulatory expectations, while multinational companies continue to invest in advanced printing and finishing technologies across key Latin American markets.

Middle East & Africa

The Middle East & Africa region held a 4% share of the folding carton packaging market in 2024. Growth is driven by expanding food and beverage processing industries, along with increasing investments in retail and pharmaceuticals. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are adopting paper-based packaging to align with global sustainability goals. Limited recycling infrastructure remains a challenge, but growing consumer awareness is fostering gradual adoption of eco-friendly materials. Rising imports of packaged goods and investments in local manufacturing are supporting steady regional expansion.

Market Segmentations:

By Type

- Regular Slotted Cartons (RSC)

- Half Slotted Cartons (HSC)

- Lock End Cartons

- Tray Style Cartons

By Material

- Paperboard

- Corrugated Cardboard

- Plastic

By End Use

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Electronics

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The folding carton packaging market features key players such as WestRock, Smurfit Kappa Group, DS Smith, International Paper, Mondi plc, Graphic Packaging International, Stora Enso, Huhtamaki Group, Nippon Paper Group, Oji Holdings, ITC Limited, Ardagh Group, Sonoco Products, Crown Holdings, VTT, and Lotus Label. The market is highly competitive, with companies focusing on sustainability, innovation, and advanced printing technologies to strengthen their global presence. Strategic mergers, acquisitions, and capacity expansions are commonly pursued to enhance production efficiency and geographic reach. Many producers emphasize recyclable materials and digital packaging solutions to align with environmental regulations and shifting consumer preferences. Continuous investment in automation, lightweight materials, and smart packaging design supports brand differentiation and operational excellence. Firms are also expanding partnerships with e-commerce and food sectors to capture growing demand for protective, high-quality, and visually appealing folding carton solutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- WestRock

- Smurfit Kappa Group

- DS Smith

- International Paper

- Mondi plc

- Graphic Packaging International

- Stora Enso

- Huhtamaki Group

- Nippon Paper Group

- Oji Holdings

- ITC Limited

- Ardagh Group

- Sonoco Products

- Crown Holdings

- VTT

- Lotus Label

Recent Developments

- In 2024, VTT introduced their origami packaging technology. These new packaging cartons offers lightweight and alternative solutions to traditional method of packaging while ensuring sustainability.

- In 2023, Lotus label introduced Petratto folding and glueing machine in their production line.

- In 2023, Smurfit Kappa Group Announced and completed its proposed combination with WestRock to create Smurfit WestRock, a new global leader in sustainable packaging. The merger was driven by strategic, commercial, and financial synergies.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing use of biodegradable and recyclable materials will strengthen sustainability across packaging applications.

- Integration of digital printing will enhance design flexibility and reduce production turnaround times.

- Rising e-commerce and online grocery delivery will increase demand for protective and customizable cartons.

- Premium packaging adoption will expand as brands focus on shelf appeal and customer engagement.

- Automation and robotics in folding carton manufacturing will improve efficiency and precision.

- Smart packaging features such as QR codes and NFC tags will enhance product traceability.

- Emerging economies will drive market expansion through rising consumption of packaged goods.

- Collaboration between paper producers and converters will support innovation in lightweight materials.

- Government initiatives promoting plastic reduction will accelerate the shift toward paperboard cartons.

- Continuous R&D investment will lead to advanced coatings that improve moisture and grease resistance.