Market Overview

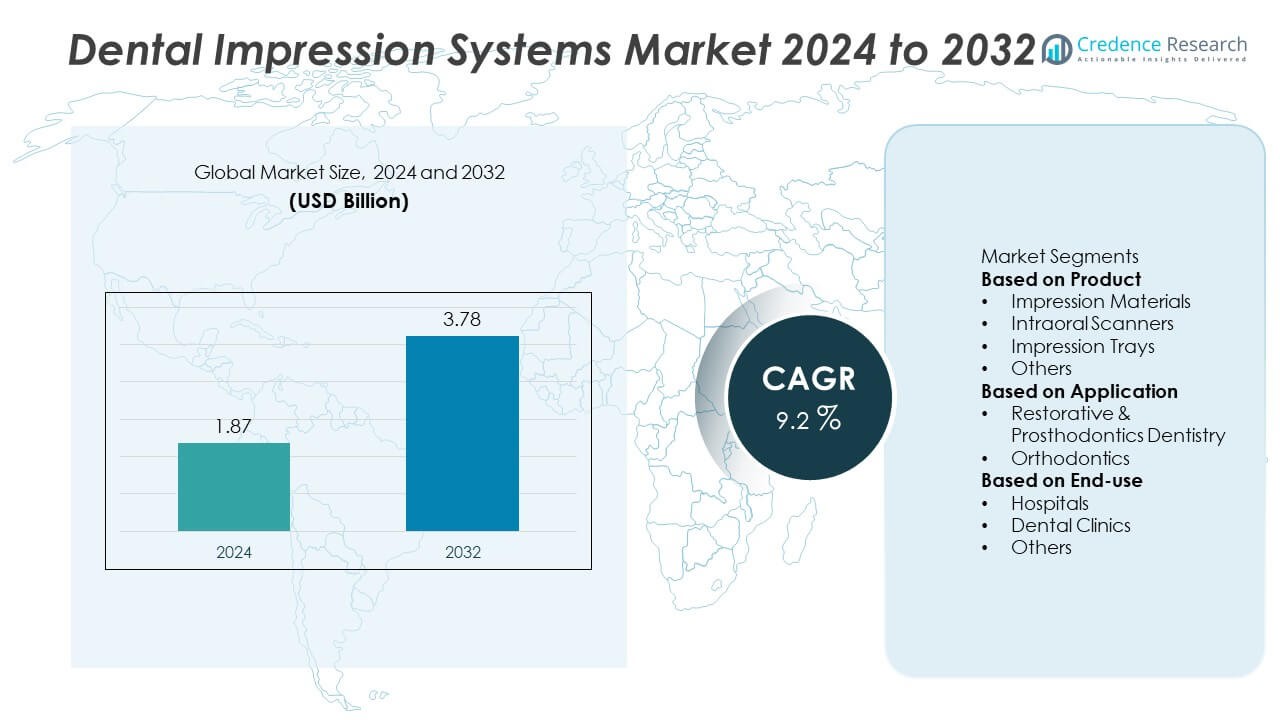

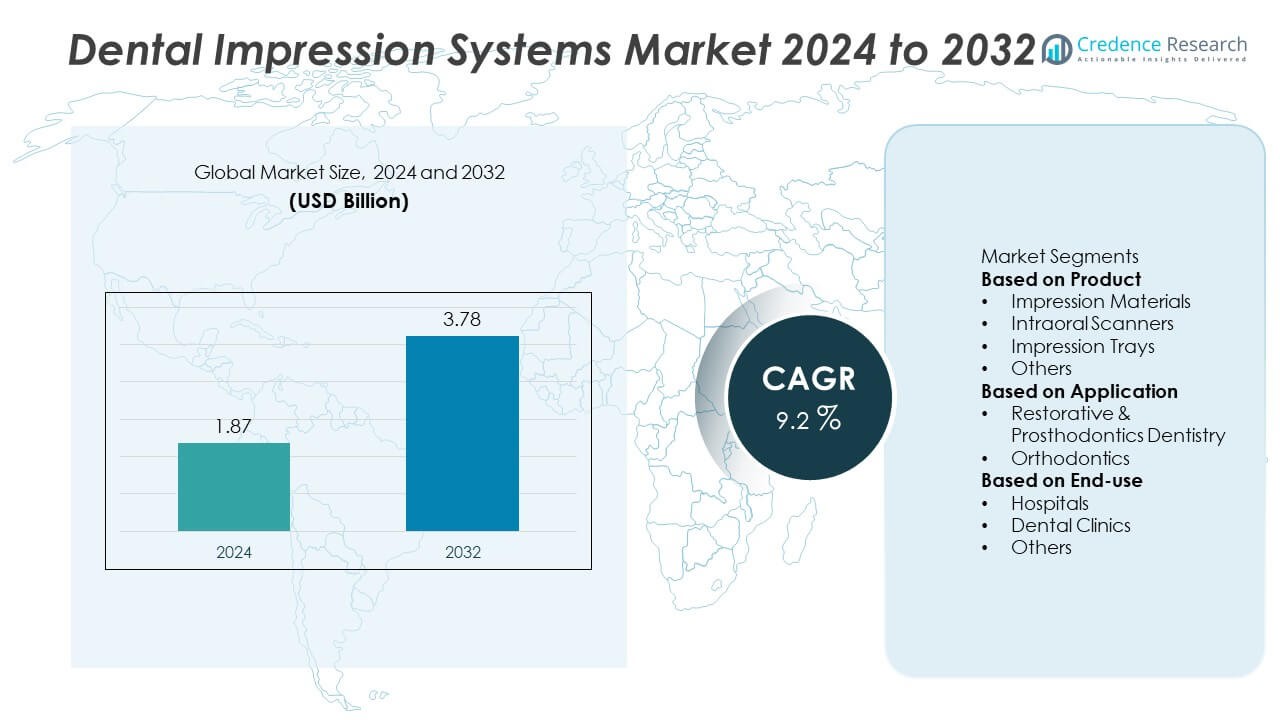

The Dental Impression Systems market size was valued at USD 1.87 billion in 2024 and is anticipated to reach USD 3.78 billion by 2032, growing at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Impression Systems market Size 2024 |

USD 1.87 Billion |

| Dental Impression Systems market, CAGR |

9.2% |

| Dental Impression Systems market Size 2032 |

USD 3.78 Billion |

The Dental Impression Systems market is dominated by leading companies including Dentsply Sirona, 3M Company, Envista (Kerr Corporation), Henry Schein Inc., Ivoclar Vivadent, 3Shape, Coltene Group, Ultradent Products Inc., Mitsui Chemicals (Kulzer GmbH), and Septodont Holding. These firms maintain strong market positions through advancements in digital impression systems, CAD/CAM integration, and precision scanning technologies. North America led the market with a 38% share in 2024, driven by advanced dental infrastructure and high adoption of digital tools. Europe followed with a 31% share, supported by aesthetic dentistry trends, while Asia-Pacific accounted for 23%, fueled by growing dental tourism and rising oral healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dental Impression Systems market was valued at USD 1.87 billion in 2024 and is projected to reach USD 3.78 billion by 2032, growing at a CAGR of 9.2% during the forecast period.

- Rising demand for digital dentistry and restorative treatments is driving market growth, supported by advancements in intraoral scanners and CAD/CAM integration.

- The market is witnessing trends such as increased adoption of AI-based imaging, biocompatible impression materials, and cloud-connected dental systems.

- Key players including Dentsply Sirona, 3M, and 3Shape are investing in product innovation, digital workflow platforms, and global distribution expansion to enhance competitiveness.

- North America leads with a 38% share, followed by Europe at 31% and Asia-Pacific at 23%; by product, intraoral scanners dominate with 45% share due to their precision, speed, and growing adoption in restorative and orthodontic applications.

Market Segmentation Analysis:

By Product

The intraoral scanners segment dominated the Dental Impression Systems market in 2024, accounting for a 49% share. These scanners are increasingly adopted for their precision, speed, and ability to create digital impressions without discomfort. They enhance workflow efficiency by reducing manual errors and improving patient experience. Advancements in 3D imaging and CAD/CAM integration have further accelerated their adoption among dental professionals. The shift toward digital dentistry and the demand for efficient, chairside impression systems continue to drive this segment’s leadership across both developed and emerging dental markets.

- For instance, 3Shape’s TRIOS 5 Wireless intraoral scanner captures 2,400 3D images per second with real-time AI-driven noise reduction, achieving accuracy that meets clinically accepted standards.

By Application

The restorative and prosthodontics dentistry segment led the market in 2024, holding a 63% share. The dominance is attributed to rising cases of tooth loss, aging populations, and the growing preference for dental restorations such as crowns, bridges, and implants. High accuracy and repeatability offered by modern impression systems improve treatment outcomes in restorative procedures. The expanding availability of advanced prosthodontic materials and digital tools supports market growth. Increasing patient awareness about aesthetic dentistry and personalized dental care further strengthens demand in this segment.

- For instance, Dentsply Sirona’s CEREC Primescan 2 integrates with DS Core and CEREC Primemill, processing scan data at a resolution of 20 μm and completing a single crown restoration workflow in under 40 minutes. The platform supports automated margin detection and real-time AI calibration, enhancing precision in full prosthodontic restorations.

By End-use

Dental clinics accounted for the largest 58% share of the Dental Impression Systems market in 2024. Clinics are increasingly adopting digital impression systems to improve treatment precision, reduce chair time, and enhance patient comfort. The growing number of independent dental practices and specialized orthodontic centers supports widespread technology penetration. Accessibility to affordable intraoral scanners and software platforms also encourages adoption among small and mid-sized clinics. The integration of digital workflows, including CAD/CAM design and 3D printing, positions dental clinics as the primary end users driving consistent market growth.

Key Growth Drivers

Growing Shift Toward Digital Workflows

The transition from traditional impression materials to digital workflows is a major driver in the Dental Impression Systems market. Intraoral scanners and CAD/CAM technologies enhance accuracy, speed, and patient comfort. These systems reduce manual errors by integrating directly with dental design and milling software. Clinics adopting digital impressions benefit from improved precision and workflow efficiency. As global dentistry moves toward digital transformation, the preference for advanced impression systems is accelerating across both developed and emerging markets.

- For instance, Dentsply Sirona’s Primescan 2 features dynamic deep scanning with a measurement depth of up to 20 mm, capturing over 1 million 3D points per second. The scanner transmits data directly to DS Core cloud, enabling same-day restorations and a fully connected workflow between clinic and laboratory systems.

Rising Demand for Restorative and Aesthetic Treatments

Increased awareness of dental aesthetics and restorative procedures is boosting demand for precision impression systems. An aging population, rising cases of tooth loss, and higher disposable incomes are fueling this trend. Digital systems allow dentists to deliver more accurate crowns, bridges, and implants with minimal adjustments. They also improve collaboration between laboratories and clinics. The expansion of cosmetic and restorative dentistry globally positions this segment as a key driver of market growth.

- For instance, Ivoclar’s PrograScan PS7 scanner can capture upper and lower jaw models simultaneously in 10 seconds with an accuracy of 5 µm. It seamlessly integrates with the IPS e.max CAD workflow, which can reduce chairside adjustments, and is used for aesthetic restorations like veneers and implant-supported prosthetics.

Technological Advancements in Scanning Devices

Ongoing innovations in intraoral scanning technology are strengthening market growth. Modern scanners offer faster image capture, higher accuracy, and seamless integration with 3D printing and CAD/CAM workflows. Features such as AI-driven visualization, wireless connectivity, and real-time data feedback improve clinical outcomes. Portable and compact devices are becoming more affordable, supporting adoption among small and mid-sized dental clinics. These advancements are making digital impression systems a standard tool in modern dental practices.

Key Trends & Opportunities

Integration of AI and 3D Printing Capabilities

Artificial intelligence and 3D printing are transforming the dental impression systems landscape. AI enhances image accuracy, margin detection, and predictive modeling, while 3D printing accelerates custom prosthetic fabrication. Combined, these technologies streamline the production of aligners, crowns, and implants. They reduce turnaround time, increase patient satisfaction, and minimize laboratory dependency. As digital dentistry grows, AI and additive manufacturing integration will define the next stage of workflow efficiency and personalization.

- For instance, Kulzer GmbH, a subsidiary of Mitsui Chemicals, developed the cara Print 4.0 pro 3D system, which uses light-curing resin technology to fabricate a fully 3D-printed denture in just under 2 hours.

Expansion Across Emerging Economies

Emerging markets such as China, India, and Brazil are becoming key growth regions. Rising healthcare investment, growing awareness of oral hygiene, and expansion of modern dental clinics are supporting demand. Cost-effective digital scanners and localized training programs are encouraging adoption. Government initiatives promoting digital healthcare infrastructure further accelerate this transition. The shift from conventional methods to digital impressions in these economies provides strong opportunities for global and regional manufacturers alike.

- For instance, Envista’s KaVo OP 3D platform is used in dental centers in India, providing high-accuracy 3D scanning and digital training. The program includes remote calibration support, reducing scanner downtime and helping clinics transition to digital impression workflows.

Growth in Chairside CAD/CAM Integration

The growing trend of chairside CAD/CAM systems is creating new opportunities for the market. Dentists can now scan, design, and produce restorations within a single appointment. This reduces patient visits and improves service turnaround. The integration of dental impression systems with CAD/CAM enhances workflow automation and treatment precision. As clinics seek to improve efficiency and patient convenience, demand for integrated chairside digital ecosystems continues to expand globally.

Key Challenges

High Cost of Advanced Equipment

The high capital cost of digital impression systems remains a significant challenge for adoption. Intraoral scanners and CAD/CAM platforms require substantial investment, which is difficult for smaller dental practices to afford. Additionally, maintenance, software licensing, and training add to operational expenses. Although these systems offer long-term savings and improved outcomes, upfront costs limit accessibility in developing regions. Manufacturers are focusing on affordability and subscription-based models to mitigate this restraint.

Limited Technical Expertise and Integration Issues

The lack of technical knowledge among dental professionals hinders the effective use of digital impression systems. Many practitioners face challenges in integrating new tools with existing practice management software. Training gaps and workflow disruptions slow down adoption rates. Compatibility issues between different digital systems also create inefficiencies. To address this, companies are developing user-friendly interfaces and providing extensive training support. However, bridging the digital skill gap remains a key obstacle for market expansion.

Regional Analysis

North America

North America held a 38% share of the Dental Impression Systems market in 2024, driven by advanced dental care infrastructure and early adoption of digital technologies. The United States leads the region with high utilization of intraoral scanners and CAD/CAM systems in both clinics and laboratories. Growing demand for cosmetic dentistry, supported by insurance coverage and high consumer spending on oral care, enhances market growth. Canada also contributes through technological innovation and dental digitalization programs. Continuous advancements in digital workflows and the presence of major manufacturers reinforce North America’s market leadership.

Europe

Europe accounted for a 30% share of the Dental Impression Systems market in 2024, supported by strong regulatory standards, a well-established dental care system, and widespread acceptance of digital dentistry. Germany, France, and the United Kingdom are leading contributors due to rising adoption of intraoral scanners and CAD/CAM-integrated restorations. Increasing preference for minimally invasive and aesthetic treatments is driving the demand for precise impression technologies. Government initiatives promoting oral healthcare and the modernization of dental practices are further strengthening market expansion across the European region.

Asia-Pacific

Asia-Pacific captured a 23% share of the Dental Impression Systems market in 2024, emerging as the fastest-growing region. Expanding middle-class populations and growing awareness of oral health are key growth factors. China, Japan, and India lead regional adoption due to rising dental tourism and rapid digital transformation in healthcare. Increased investment in modern dental clinics and training for digital workflows further supports growth. The availability of cost-effective intraoral scanners and rising demand for restorative dentistry are positioning Asia-Pacific as a major hub for future market expansion.

Latin America

Latin America held a 6% share of the Dental Impression Systems market in 2024, driven by increasing dental tourism and the modernization of private clinics. Brazil and Mexico dominate the regional market due to growing patient awareness of cosmetic and restorative dentistry. Adoption of intraoral scanners is expanding as clinics focus on improving diagnostic accuracy and efficiency. However, limited affordability and high equipment costs pose challenges in some economies. Growing partnerships between global manufacturers and local distributors are improving accessibility and driving steady regional growth.

Middle East & Africa

The Middle East and Africa accounted for a 3% share of the Dental Impression Systems market in 2024. The region’s growth is supported by expanding dental care infrastructure and rising investments in healthcare modernization. The UAE and Saudi Arabia lead adoption due to growing cosmetic dentistry trends and the establishment of digital dental centers. Africa’s market is gradually expanding, supported by increasing urbanization and awareness of oral hygiene. Although high equipment costs and limited training remain barriers, ongoing government support and private investments are fostering steady regional market development.

Market Segmentations:

By Product

- Impression Materials

- Intraoral Scanners

- Impression Trays

- Others

By Application

- Restorative & Prosthodontics Dentistry

- Orthodontics

By End-use

- Hospitals

- Dental Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dental Impression Systems market features key players such as Ivoclar Vivadent, Envista (Kerr Corporation), Henry Schein Inc., Coltene Group, 3Shape, Ultradent Products Inc., 3M Company, Septodont Holding, Mitsui Chemicals (Kulzer GmbH), and Dentsply Sirona. These companies compete through technological innovation, digital workflow integration, and product portfolio diversification. Market leaders are focusing on the development of high-precision intraoral scanners and advanced impression materials that enhance accuracy and patient comfort. Strategic collaborations with dental laboratories and software developers are driving adoption of CAD/CAM systems and digital impression technologies. Continuous R&D investment in material science, imaging technologies, and cloud-based data management strengthens competitiveness. Additionally, mergers, acquisitions, and distribution expansions are supporting global reach, while product customization and training programs for clinicians help manufacturers capture emerging opportunities in digital dentistry and restorative applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Dentsply Sirona celebrated 40 years of CEREC and emphasized connectivity of its CEREC and DS Core ecosystem to support integrated digital impression and restoration workflows.

- In March 2025, Ivoclar introduced Ivotion Base Print, its first 3D printing material intended for permanent dental work, compatible with existing digital workflows for denture bases.

- In 2025, Dentsply Sirona rolled out an expanded AI-powered CEREC workflow and new milling units (CEREC Primemill, Primemill Lite, CEREC Go) to enhance single-visit dentistry.

- In 2024, Dentsply Sirona launched PrimeScan 2, a cloud-native intraoral scanner that sends scan data directly to the DS Core platform, enabling seamless cloud workflows.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital impression technologies will continue to replace traditional methods across dental practices.

- AI and machine learning integration will enhance accuracy and treatment planning in dental workflows.

- Demand for intraoral scanners will rise due to faster procedures and improved patient comfort.

- Cloud-based data storage and remote collaboration will become standard in dental diagnostics.

- Manufacturers will focus on developing eco-friendly and biocompatible impression materials.

- The adoption of CAD/CAM systems will grow as digital dentistry becomes mainstream.

- Strategic partnerships between software firms and dental manufacturers will strengthen innovation.

- Emerging markets in Asia-Pacific will experience rapid growth driven by expanding dental tourism.

- Continuous training programs will improve clinician adoption of advanced digital systems.

- Regulatory support for digital healthcare transformation will accelerate global market expansion.