Market Overview

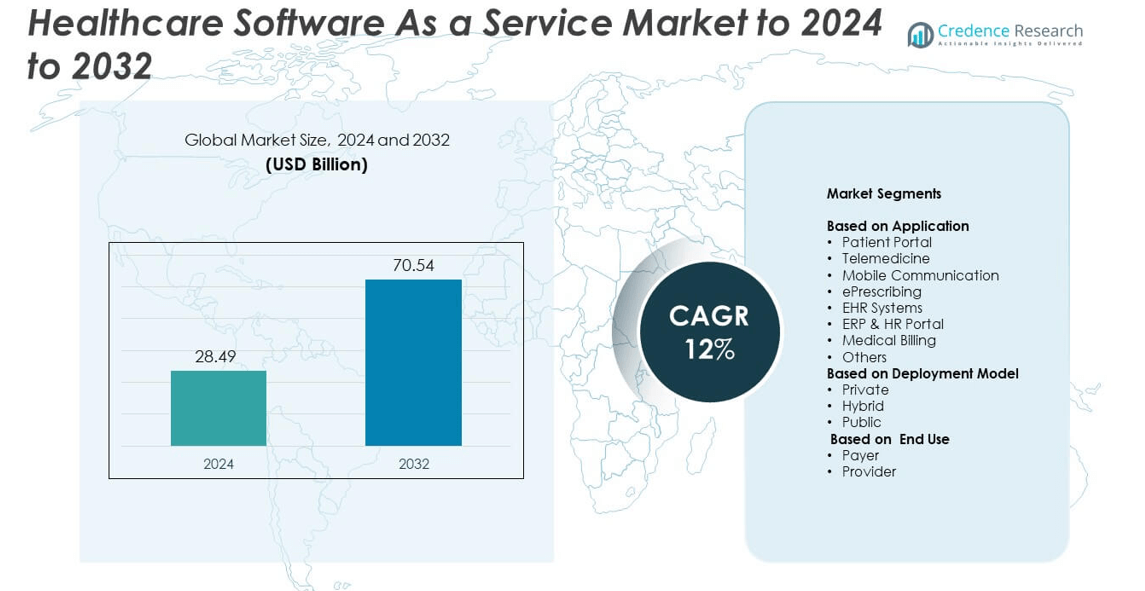

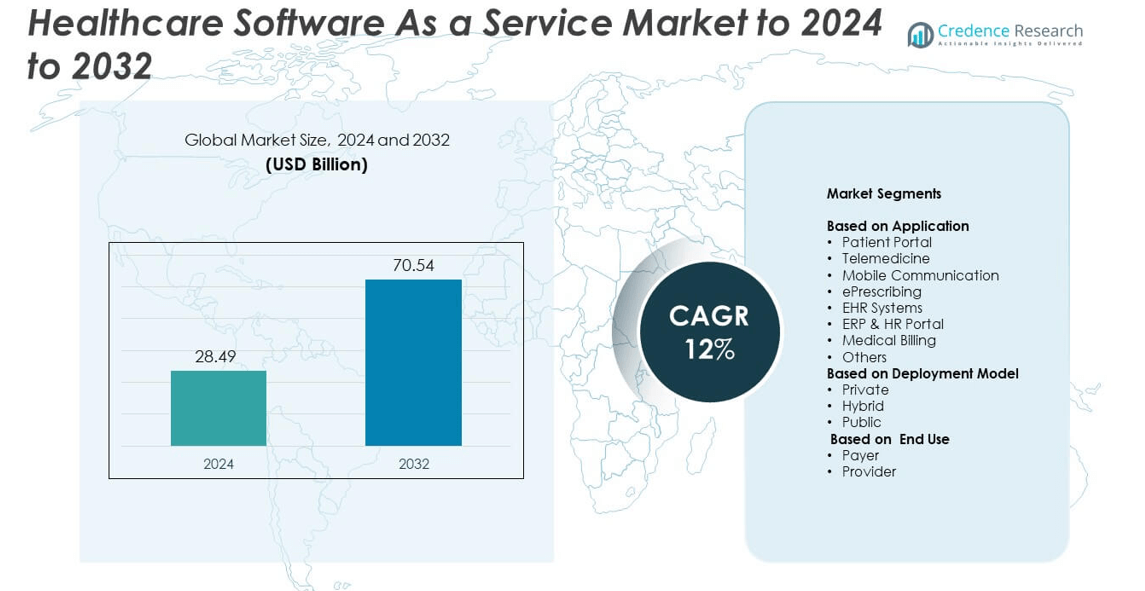

The Healthcare Software as a Service market size was valued at USD 28.49 billion in 2024 and is anticipated to reach USD 70.54 billion by 2032, growing at a CAGR of 12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Software as a Service Market Size 2024 |

USD 28.49 billion |

| Healthcare Software as a Service Market, CAGR |

12% |

| Healthcare Software as a Service Market Size 2032 |

USD 70.54 billion |

The Healthcare Software as a Service market is dominated by key players such as Oracle, Salesforce, IBM, Microsoft, SAP, Cisco Systems, Google, and Adobe. These companies lead through continuous innovation in cloud-based healthcare solutions, AI-powered analytics, and secure data management systems. Their focus on interoperability, mobile accessibility, and compliance with healthcare regulations has strengthened global adoption. North America remains the leading region, accounting for 38% of the total market share in 2024, supported by advanced healthcare infrastructure and rapid digital transformation. Europe and Asia-Pacific follow, driven by expanding telehealth adoption and healthcare modernization initiatives.

Market Insights

- The Healthcare Software as a Service market was valued at USD 28.49 billion in 2024 and is projected to reach USD 70.54 billion by 2032, growing at a CAGR of 12%.

- Rising adoption of cloud-based healthcare platforms and telemedicine solutions is driving market growth, supported by regulatory initiatives promoting digital health transformation.

- Integration of AI, data analytics, and interoperability features in SaaS platforms is transforming patient care and operational efficiency across hospitals and clinics.

- The market is moderately consolidated, with major players focusing on innovation, cybersecurity, and strategic partnerships to expand service portfolios globally.

- North America holds 38% of the market share, followed by Europe with 27% and Asia-Pacific with 24%, while the EHR systems segment leads overall with a 32% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

EHR systems held the dominant share of 32% in the Healthcare Software as a Service market in 2024. Their dominance is driven by rapid digital transformation in hospitals and clinics, emphasizing patient data accuracy and interoperability. Integration of EHR with AI-based analytics and cloud storage enhances clinical decision-making and operational efficiency. Telemedicine and patient portals also gained traction due to rising demand for virtual care and personalized engagement tools. Vendors increasingly focus on offering scalable and secure SaaS-based platforms to support data-driven healthcare delivery across multiple care settings.

- For instance, In 2023, Oracle Cerner’s Real World Testing reported an average of 1,683,108 “Problems added” per month and 2,646,318 “Problems rejected” per month in the Problem reconciliation workflow.

By Deployment Model

The private cloud segment accounted for the largest share of 45% in 2024, owing to its enhanced data security, customization, and regulatory compliance advantages. Healthcare organizations prefer private SaaS deployment to ensure greater control over patient data while maintaining HIPAA and GDPR compliance. Hybrid models are gaining momentum due to their flexibility in integrating on-premises systems with cloud solutions. Public cloud adoption remains steady among small and mid-sized facilities seeking cost-effective scalability and simplified IT management through subscription-based access.

- For instance, Epic states that across its community there are over 60,000 active interfaces connecting to more than 2,000 vendors.

By End Use

The provider segment dominated the market with a 68% share in 2024, driven by increasing adoption of SaaS platforms by hospitals, clinics, and diagnostic centers for patient record management and telehealth services. Providers benefit from real-time analytics, automated billing, and seamless interoperability across systems. SaaS tools improve operational efficiency and enable remote collaboration among care teams. The payer segment is also expanding as insurance companies implement SaaS solutions for claims processing, member engagement, and fraud detection to enhance service quality and administrative accuracy.

Key Growth Drivers

Rising Demand for Cloud-Based Healthcare Solutions

The growing preference for cloud-based healthcare platforms is a primary growth driver. Hospitals and clinics are rapidly moving from traditional software to scalable SaaS systems that reduce IT costs and improve accessibility. Cloud deployment enables secure storage, real-time data sharing, and faster updates. Increasing focus on interoperability and value-based care further boosts adoption. Vendors are offering HIPAA-compliant, AI-integrated solutions that enhance clinical decision-making and streamline patient management, driving widespread implementation across healthcare networks.

- For instance, Oracle Cerner Real World Testing found that 82% (3,288/3,994) of patient visits involved sending or receiving a C-CDA document during transitions of care. The testing successfully met its target of 50% or more.

Growing Adoption of Telehealth and Remote Monitoring

The surge in telemedicine adoption has accelerated SaaS uptake in healthcare. Remote monitoring systems supported by SaaS platforms enable continuous patient engagement, especially in chronic disease management and post-discharge care. These solutions offer real-time data access for physicians and patients, improving diagnostic accuracy and reducing readmissions. Integration with mobile apps and wearable devices is expanding telehealth reach, while government initiatives supporting virtual care enhance market penetration. This trend strengthens digital transformation efforts within the healthcare ecosystem.

- For instance, Epic reports that its USCDI v3 APIs have been called over 8 billion times by app developers.

Regulatory Push for Digital Health Transformation

Global healthcare regulations encouraging electronic data management and interoperability drive SaaS deployment. Governments promote digital records and cloud-based solutions to improve transparency, data traceability, and care coordination. Regulations like the U.S. HITECH Act and Europe’s GDPR encourage secure, standardized SaaS platforms in healthcare. Vendors are focusing on compliance-ready solutions to meet these evolving legal requirements. Such mandates are compelling healthcare organizations to upgrade legacy systems, ensuring faster and safer adoption of SaaS technologies across clinical operations.

Key Trends and Opportunities

Integration of Artificial Intelligence and Analytics

Artificial intelligence and predictive analytics are increasingly integrated into healthcare SaaS platforms. AI algorithms help analyze large clinical datasets, identify health trends, and automate administrative tasks. Predictive tools enhance early diagnosis and personalized treatment planning. Vendors are embedding machine learning models to optimize workflow efficiency and detect anomalies in patient data. This trend offers opportunities for advanced clinical insights and supports evidence-based medical decisions, enabling healthcare providers to deliver more efficient and accurate patient care.

- For instance, Siemens claims that over 2 million imaging exams have been processed by AI-Rad Companion globally.

Rising Demand for Interoperability and Connected Systems

Healthcare organizations are prioritizing connected SaaS ecosystems that enable seamless data exchange across departments and systems. Interoperability between EHR, telemedicine, and billing platforms ensures unified patient records and faster decision-making. Standardized APIs and integration tools support collaboration between providers and payers. This trend drives partnerships among SaaS vendors and healthcare institutions. Growing investments in Health Information Exchanges (HIEs) are also creating opportunities for cross-platform compatibility, ultimately improving patient outcomes and operational transparency.

- For instance, Epic supports more than 60,000 interfaces across 2,000+ vendors, enabling broad system interoperation.

Expansion of Mobile and Patient-Centric Platforms

The rising use of mobile applications in healthcare is creating new SaaS opportunities. Patients increasingly rely on mobile portals to access records, schedule appointments, and track health metrics. SaaS providers are developing mobile-friendly interfaces with secure access and real-time updates. This mobility enhances patient engagement and satisfaction while enabling providers to extend care beyond clinical settings. The trend aligns with the shift toward personalized healthcare, encouraging innovation in mobile-driven SaaS delivery models.

Key Challenges

Data Security and Privacy Concerns

Cybersecurity risks remain a major challenge in healthcare SaaS adoption. The exchange of sensitive patient data across cloud platforms exposes organizations to potential breaches and compliance violations. Maintaining data encryption, user authentication, and access control are essential to building trust. Frequent ransomware attacks have made providers more cautious. Vendors must continuously update security protocols and obtain certifications to meet regulatory standards, ensuring compliance with global frameworks such as HIPAA and GDPR.

Integration with Legacy Systems

Many healthcare organizations still rely on outdated IT systems, posing challenges for SaaS integration. Compatibility issues arise when connecting modern cloud solutions to legacy infrastructure. These barriers increase implementation time and operational costs. Limited in-house IT expertise further slows migration. Vendors are addressing these gaps by offering hybrid models and migration tools to ensure smoother transitions. Overcoming these integration challenges is vital to achieving seamless interoperability and unlocking the full benefits of SaaS adoption in healthcare.

Regional Analysis

North America

North America held the largest share of 38% in the Healthcare Software as a Service market in 2024. The region’s growth is driven by advanced healthcare infrastructure, high adoption of digital technologies, and supportive government policies promoting interoperability. Major SaaS providers such as Oracle Health, Salesforce, and Athenahealth have expanded cloud-based healthcare platforms across the United States and Canada. The growing demand for telehealth, patient engagement systems, and AI-integrated analytics further supports market expansion. Increasing investments in healthcare IT modernization continue to strengthen the region’s dominant position during the forecast period.

Europe

Europe accounted for 27% of the Healthcare Software as a Service market share in 2024. Strong regulatory support for digital health transformation and emphasis on secure data management fuel market growth. Countries like Germany, the United Kingdom, and France are investing in cloud-based EHR and telemedicine platforms to improve patient outcomes. Initiatives such as the European Health Data Space are encouraging interoperability and data-driven care coordination. The rising focus on cross-border healthcare data sharing and the presence of leading SaaS vendors enhance market competitiveness across the region.

Asia-Pacific

Asia-Pacific captured a 24% share of the Healthcare Software as a Service market in 2024, showing the fastest growth rate. Rapid digitalization of healthcare systems in China, India, Japan, and Australia is driving adoption. Governments are promoting cloud-based platforms to improve rural healthcare accessibility and reduce administrative costs. The expansion of telehealth and mobile health applications has accelerated SaaS deployment across hospitals and clinics. Growing partnerships between global vendors and regional providers, along with increasing investments in healthcare IT infrastructure, are further propelling the region’s strong growth outlook.

Latin America

Latin America held a 7% share of the Healthcare Software as a Service market in 2024. The region is experiencing gradual adoption of cloud-based healthcare platforms, driven by efforts to modernize public health systems. Brazil and Mexico lead the adoption, supported by growing telemedicine use and private healthcare investments. SaaS vendors are targeting mid-sized hospitals with cost-efficient subscription models. Government digital health initiatives and regional collaborations are improving system interoperability. Although infrastructure challenges persist, the region’s focus on affordable and accessible digital healthcare solutions supports steady market expansion.

Middle East & Africa

The Middle East and Africa accounted for 4% of the Healthcare Software as a Service market share in 2024. Growth is supported by increasing digital transformation projects in Gulf Cooperation Council countries and rising healthcare investments in South Africa. Governments are prioritizing cloud-based systems to enhance efficiency and data security in public hospitals. Telehealth expansion and AI-enabled patient management tools are gaining traction. Strategic partnerships between global SaaS vendors and local healthcare providers are improving service reach, positioning the region as an emerging market with long-term development potential.

Market Segmentations:

By Application

- Patient Portal

- Telemedicine

- Mobile Communication

- ePrescribing

- EHR Systems

- ERP & HR Portal

- Medical Billing

- Others

By Deployment Model

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Leading companies such as Oracle, Salesforce, Inc., IBM, Microsoft, SAP, Cisco Systems, Inc., Google, Adobe, ServiceNow, Workday, Inc., Veeva Systems, Health Catalyst, CareCloud, Inc., Simplify Healthcare, Hyland, and Suki AI, Inc. collectively shape the competitive landscape of the Healthcare Software as a Service market. The competition is defined by technological innovation, data security, and integration capabilities across healthcare ecosystems. Companies focus on expanding AI-powered analytics, improving interoperability, and enhancing patient engagement solutions. Strategic partnerships with hospitals and insurance providers are increasing platform adoption. Vendors emphasize modular, compliance-ready architectures to meet regional regulatory standards. Continuous investments in R&D, cybersecurity, and cloud optimization are strengthening service reliability and scalability. Market players are also expanding global presence through mergers, acquisitions, and regional collaborations. The overall competitive environment remains moderately consolidated, with firms differentiating through specialization in clinical analytics, mobile SaaS, and data-driven healthcare management solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle

- Salesforce, Inc.

- IBM

- Microsoft

- SAP

- Cisco Systems, Inc.

- Google

- Adobe

- ServiceNow

- Workday, Inc.

- Veeva Systems

- Health Catalyst

- CareCloud, Inc.

- Simplify Healthcare

- Hyland

- Suki AI, Inc.

Recent Developments

- In 2024, Health Catalyst Acquired Lumeon, a UK-based healthcare SaaS provider, to enhance its ability to automate operational workflows. It also achieved HITRUST r2 and SOC 2 Type II compliance for its platforms.

- In 2024, Simplify Healthcare launches SimplifyX™, delivering AI-native SaaS solutions 50% faster and 10X better across multiple industries.

- In 2024, Hyland introduced an advanced healthcare cloud imaging SaaS solution and NilShare to enhance image collaboration.

Report Coverage

The research report offers an in-depth analysis based on Application, Deployment Model, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with growing demand for cloud-based healthcare platforms.

- Integration of AI and predictive analytics will enhance clinical decision-making.

- Telemedicine and remote patient monitoring will remain key growth areas.

- Hybrid cloud models will gain traction for flexibility and security benefits.

- Increasing interoperability will improve data exchange across healthcare systems.

- Mobile and patient-centric SaaS platforms will drive higher engagement rates.

- Strategic partnerships between IT vendors and healthcare providers will strengthen innovation.

- Regulatory compliance and data privacy measures will shape product development.

- Emerging economies will see rapid adoption due to digital health initiatives.

- Continuous cybersecurity advancements will ensure safer SaaS implementation globally.