Market Overview

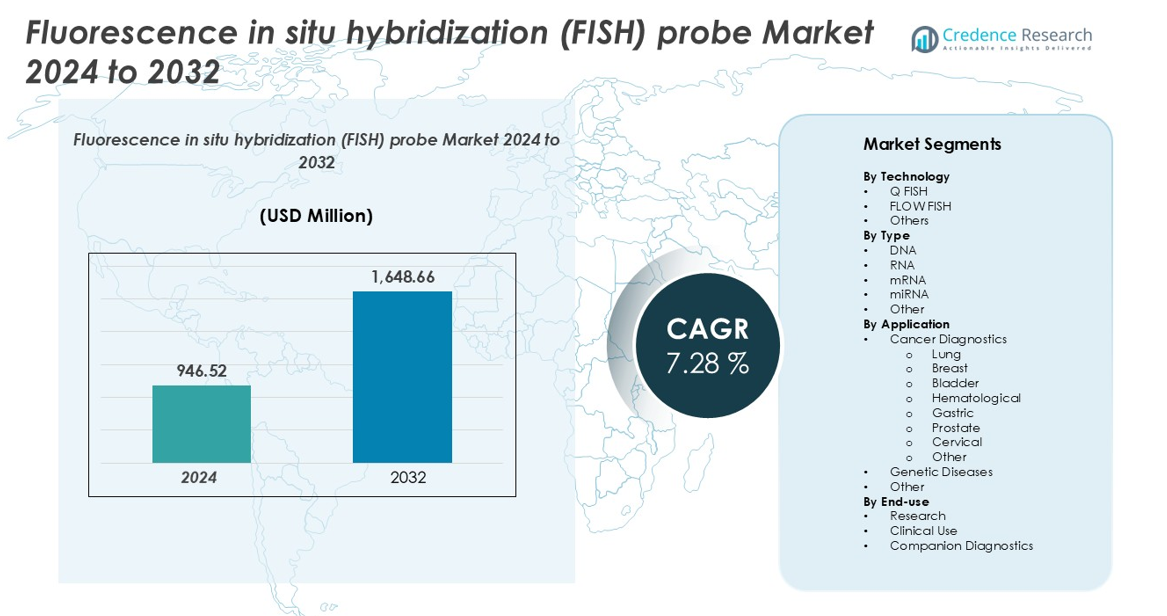

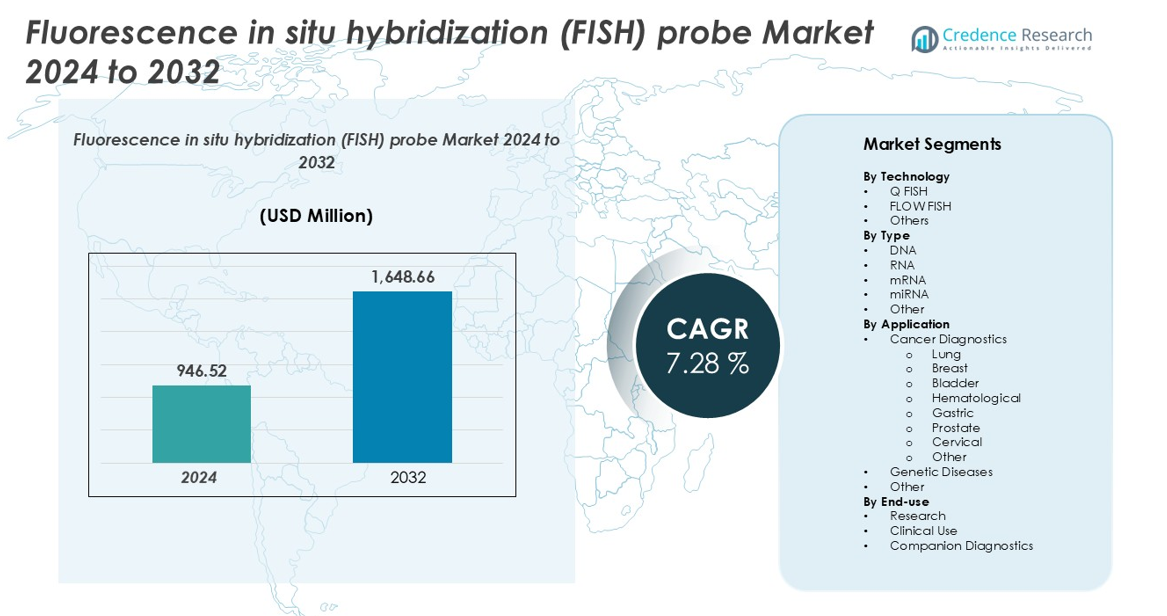

Fluorescence in situ hybridization (FISH) probe market size was valued at USD 946.52 million in 2024 and is anticipated to reach USD 1,648.66 million by 2032, at a CAGR of 7.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorescence in situ hybridization (FISH) probe market Size 2024 |

USD 946.52 million |

| Fluorescence in situ hybridization (FISH) probe market, CAGR |

7.28% |

| Fluorescence in situ hybridization (FISH) probe market Size 2032 |

USD 1,648.66 million |

The fluorescence in situ hybridization (FISH) probe market is dominated by leading players such as Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent Technologies, BioDot, Horizon Diagnostics, QIAGEN, Abnova Corporation, LGC Biosearch Technologies, Genemed Biotechnologies, Oxford Gene Technology, Biocare Medical, and GSP Research Institute. These companies maintain a strong competitive edge through continuous innovation, strategic collaborations, and expanded product portfolios, offering high-specificity DNA, RNA, and miRNA probes for clinical and research applications. North America leads the market, capturing approximately 44% of the global share, driven by advanced healthcare infrastructure, high adoption of molecular diagnostics, and rising demand for personalized medicine. Europe follows closely with a significant share due to widespread implementation of FISH in oncology and genetic disease diagnostics, while Asia-Pacific is the fastest-growing region, fueled by expanding healthcare access, increasing awareness of genetic disorders, and government support for advanced diagnostics.

Market Insights

- The fluorescence in situ hybridization (FISH) probe market was valued at USD 946.52 million in 2024 and is projected to reach USD 1,648.66 million by 2032, growing at a CAGR of 7.28% during the forecast period.

- Market growth is driven by increasing prevalence of cancer and genetic disorders, rising demand for personalized medicine, and growing adoption of molecular diagnostics across clinical and research applications.

- Key trends include the integration of AI-based imaging and digital analysis, development of multiplex FISH probes, and expansion of companion diagnostics, enabling faster, more accurate results.

- The competitive landscape is dominated by Thermo Fisher Scientific, PerkinElmer, Agilent Technologies, BioDot, Horizon Diagnostics, and QIAGEN, with players focusing on R&D, collaborations, and product portfolio expansion to maintain market leadership.

- North America leads with around 44% market share, followed by Europe, while Asia-Pacific shows the fastest growth; DNA-based probes dominate the type segment, and cancer diagnostics lead the application segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

In the fluorescence in situ hybridization (FISH) probe market, Q FISH holds a dominant position, accounting for the largest market share due to its high sensitivity and quantitative capabilities in chromosomal analysis. The FLOW FISH segment is witnessing steady growth, driven by increasing adoption in hematological studies and research applications. The “Others” category, including advanced imaging-based FISH techniques, is gaining traction for specialized research. Key drivers across the technology segment include rising demand for accurate genetic analysis, increasing research funding, and the integration of automated platforms that enhance throughput and reproducibility.

- For instance, in 2024, the FLOW-FISH segment held the largest share of 35.81% of the fluorescent in situ hybridization probe industry and is reported to be the fastest-growing segment over the forecast period.

By Type

DNA-based FISH probes dominate the market, representing the largest share, as they are widely used for chromosomal mapping and cancer diagnostics. RNA and mRNA probes are experiencing growth owing to their critical role in detecting gene expression and transcriptional abnormalities. miRNA probes are emerging as a significant sub-segment in personalized medicine and biomarker studies. Drivers of the type segment include increasing prevalence of genetic disorders, the need for precise molecular diagnostics, and expanding research in oncology and rare diseases, which demand high specificity and reliable detection methods.

- For instance, within the in-situ hybridization (ISH) market, DNA FISH technology commands the largest share, primarily attributed to its superior sensitivity and accuracy in detecting genetic anomalies, such as gene amplifications, deletions, and chromosomal rearrangements.

By Application

Within applications, cancer diagnostics constitute the largest market segment, with breast and lung cancer sub-segments leading due to high incidence rates and the critical need for early detection. Hematological cancers are also a significant contributor, supported by the adoption of FISH in blood disorder diagnosis. Genetic diseases represent another growing application area, driven by increased screening for inherited disorders and congenital abnormalities. Market growth is fueled by rising cancer prevalence, growing awareness of genetic testing, and technological advancements that allow rapid, sensitive, and multiplexed detection in both clinical and research settings.

Key Growth Drivers

Rising Prevalence of Cancer and Genetic Disorders

The increasing incidence of cancer and genetic disorders is a primary growth driver for the FISH probe market. FISH technology enables precise detection of chromosomal abnormalities, gene rearrangements, and mutations, making it indispensable in oncology and genetic diagnostics. For instance, it allows early detection of hematological malignancies and solid tumors, guiding targeted treatment decisions. The growing patient population, coupled with increasing awareness and adoption of molecular diagnostics, drives demand for FISH probes across hospitals, diagnostic laboratories, and research institutes. Additionally, government and private funding for cancer research and genetic screening programs is expanding, further encouraging the use of advanced FISH assays. As personalized medicine gains prominence, clinicians increasingly rely on FISH to provide tailored therapies, reinforcing its critical role in improving diagnostic accuracy and patient outcomes.

- For instance, Abbott’s PathVysion HER-2 DNA Probe Kit II has been used to count HER-2 gene signals per cell nucleus (e.g. by scoring 10 to 20 fluorescent dots per nucleus in breast tumor samples).

Technological Advancements in FISH Probes

Technological innovations are significantly propelling the FISH probe market. Advancements such as multiplex FISH, high-throughput imaging, automated platforms, and digital analysis tools enhance sensitivity, accuracy, and reproducibility of results. These innovations reduce turnaround time and enable simultaneous detection of multiple genetic markers, making them ideal for both clinical and research applications. Companies are also developing probes with higher specificity for DNA, RNA, and miRNA targets, catering to precision medicine initiatives. The integration of artificial intelligence and image analysis software is further improving interpretation and diagnostic efficiency. As laboratories seek cost-effective and efficient solutions, these technological advancements drive widespread adoption of FISH probes, positioning them as a preferred tool in oncology diagnostics, cytogenetic research, and drug discovery pipelines.

- For instance, its Invitrogen brand, offers FISH Tag™ detection kits that use spectrally distinct fluorescent dyes to enable the simultaneous detection of multiple nucleic acid targets.

Expansion of Research and Clinical Applications

The expanding scope of research and clinical applications is boosting the FISH probe market. Beyond oncology, FISH is increasingly used in prenatal diagnostics, hematological disorders, and infectious disease studies. Research institutions and pharmaceutical companies leverage FISH for gene mapping, biomarker discovery, and drug development, contributing to market growth. Clinical laboratories adopt FISH for companion diagnostics, guiding targeted therapies and monitoring treatment response. The growing collaboration between academic institutes, diagnostic labs, and biotech companies is accelerating the development and deployment of novel probes. Rising investments in translational research, combined with the need for accurate molecular diagnostics, support sustained market expansion, making FISH probes integral to advancing healthcare and improving patient outcomes globally.

Key Trend & Opportunity

Integration of Digital and AI-based Imaging

The integration of digital imaging and artificial intelligence (AI) in FISH analysis is emerging as a significant trend. AI-powered image analysis platforms enhance signal detection, reduce human error, and enable automated quantification of chromosomal aberrations. Digital solutions also facilitate remote diagnostics, allowing experts to analyze results across geographies, improving accessibility. Companies are developing software tools that combine machine learning algorithms with high-resolution microscopy, enabling faster and more accurate interpretation of complex samples. This trend not only streamlines laboratory workflows but also opens opportunities for scalable diagnostic services and telemedicine applications. The convergence of AI and FISH technologies is expected to drive adoption, create new market segments, and support precision medicine initiatives globally.

- For instance, Thermo Fisher Scientific’s Amira 3D Pro Software uses AI and deep learning for segmentation and offers advanced filters for pre-processing to enhance complex life science and biomedical image data.

Growing Demand for Personalized Medicine

Personalized medicine is creating a lucrative opportunity for the FISH probe market. Clinicians increasingly rely on genetic profiling to design targeted therapies, particularly in oncology. FISH probes enable identification of specific genetic mutations, translocations, and copy number variations, guiding therapy selection and monitoring treatment response. The rise of companion diagnostics further enhances market potential, as pharmaceutical companies pair targeted therapies with diagnostic assays. Increasing awareness among healthcare providers and patients regarding precision medicine benefits, combined with regulatory support for companion diagnostics, is driving market expansion. This trend encourages the development of novel probes for emerging biomarkers, creating opportunities for innovation and revenue growth across both research and clinical applications.

- For instance, The Vysis CLL FISH Probe Kit is used to detect genetic abnormalities in blood samples from CLL patients via FISH, including specific deletions and gains. It is also indicated for detecting the deletion of the LSI TP53 probe target (17p-) to help identify patients eligible for treatment with Venclexta® (venetoclax).

Key Challenge

High Cost of FISH Probes and Equipment

The high cost of FISH probes and associated instrumentation remains a significant market challenge. Laboratories, particularly in emerging regions, often face budget constraints that limit adoption. The expense of automated imaging systems, high-resolution microscopes, and proprietary probes can be a barrier for small-scale research facilities and diagnostic centers. Additionally, recurring costs for consumables and maintenance further increase operational expenditure. These financial constraints may slow market penetration, especially in price-sensitive regions. Companies are challenged to balance technological sophistication with affordability. Overcoming this barrier requires strategies such as developing cost-effective probes, optimizing reagent usage, and introducing scalable automated solutions that can reduce overall testing costs without compromising accuracy.

Technical Complexity and Requirement for Skilled Personnel

FISH assays involve complex protocols, including hybridization, washing, and signal interpretation, which require highly skilled personnel. Misinterpretation of results can lead to diagnostic inaccuracies, limiting confidence among clinicians. Training laboratory staff and ensuring proficiency in handling advanced imaging systems and multiplex assays remain challenging for many institutions. The demand for experienced cytogeneticists and molecular biologists adds to operational constraints, particularly in regions with limited expertise. This challenge may hinder rapid adoption and scalability of FISH technologies. Market players need to address this through user-friendly automated systems, robust training programs, and AI-assisted analysis tools to simplify workflows, reduce errors, and improve accessibility in clinical and research settings.

Regional Analysis

North America

North America leads the global FISH probe market, holding the largest share in 2024. The United States drives growth due to high cancer prevalence, substantial research funding, and advanced healthcare infrastructure. Strong regulatory support and the presence of leading biotechnology and diagnostic companies foster innovation and adoption of FISH technologies. Increasing demand for personalized medicine, companion diagnostics, and early disease detection further propels market expansion. Robust investment in genomic research and growing awareness among healthcare professionals strengthen North America’s dominant position in the FISH probe market.

Europe

Europe holds a significant share in the FISH probe market, led by Germany, the UK, and France. Widespread adoption of personalized medicine, robust diagnostic infrastructure, and active participation in clinical trials drive demand. Government initiatives supporting genomic research and early disease screening enhance the development and application of FISH technologies. Increasing prevalence of cancer and genetic disorders encourages healthcare providers to integrate molecular diagnostics in clinical practice. Collaborations between academic institutions and biotechnology companies further support innovation and reinforce Europe’s strong position in the global FISH probe market.

Asia-Pacific

Asia-Pacific is the fastest-growing FISH probe market, led by China, India, and Japan. Rising healthcare infrastructure, increasing awareness of genetic disorders, and government support for advanced diagnostics fuel growth. Expanding adoption of molecular diagnostics in hospitals and research centers drives market penetration. Investment in biotechnology, growing research activities, and initiatives to improve access to precision medicine contribute to the region’s rapid expansion. Asia-Pacific’s combination of large patient populations and dynamic healthcare development positions it as a key growth region in the global FISH probe market.

Latin America

Latin America accounts for a growing share of the FISH probe market, with Brazil as the primary contributor. The expansion is driven by increasing adoption of personalized medicine and targeted therapies. Advancements in healthcare infrastructure, rising biotechnology investments, and enhanced diagnostic capabilities support market growth. Countries like Argentina and Chile are adopting modern molecular diagnostics and participating in clinical research, further stimulating demand. Collaborative initiatives between public and private organizations aim to improve accessibility and application of FISH technologies, strengthening the region’s presence in the global market.

Middle East & Africa

The Middle East and Africa (MEA) market is developing steadily, with countries like the UAE and Saudi Arabia leading adoption. Growth is supported by increasing healthcare investments, focus on genetic research, and rising demand for advanced diagnostic technologies. FISH probes are increasingly integrated into clinical and research applications to improve disease detection and personalized treatment. Partnerships with international organizations and investments in healthcare infrastructure facilitate the dissemination of molecular diagnostics across the region. The MEA market is expected to grow gradually as awareness and utilization of FISH technologies continue to expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Technology

By Type

By Application

- Cancer Diagnostics

- Lung

- Breast

- Bladder

- Hematological

- Gastric

- Prostate

- Cervical

- Other

- Genetic Diseases

- Other

By End-use

- Research

- Clinical Use

- Companion Diagnostics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fluorescence in situ hybridization (FISH) probe market is highly competitive, with several global and regional players actively striving for technological leadership and market expansion. Key companies, including Thermo Fisher Scientific Inc., PerkinElmer Inc., Agilent Technologies, BioDot, Horizon Diagnostics, and QIAGEN, focus on developing advanced probes, automated imaging systems, and multiplex FISH solutions for clinical diagnostics and research applications. Strategic initiatives such as mergers, acquisitions, partnerships, and collaborations with academic and biotech institutions enhance R&D capabilities and accelerate product innovation. Market differentiation is achieved through high-specificity DNA, RNA, and miRNA probes, AI-assisted analysis software, and cost-effective solutions to streamline laboratory workflows. Continuous product launches, strong regulatory compliance, and emphasis on personalized medicine further intensify competition. Companies with a robust global distribution network and ability to meet the growing demand for oncology and genetic diagnostics maintain a competitive edge in the evolving FISH probe market.

Key Player Analysis

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Agilent Technologies, Inc.

- BioDot

- Horizon Diagnostics

- Abnova Corporation

- LGC Biosearch Technologies

- Genemed Biotechnologies, Inc.

- Oxford Gene Technology IP Limited

- Biocare Medical, LLC

- QIAGEN (Exiqon A/S)

- GSP Research Institute, Inc.

Recent Developments

- In April 2025, Empire Genomics, a Biocare Medical company, partnered with BioDot to launch the first pre-optimized hematology FISH probe panels and controls for the CellWriter S platform.

- In April 2023, researchers at the University of Montpellier launched high-throughput smFISH (HT-smFISH), a streamlined and cost-effective technique for imaging hundreds to thousands of single endogenous RNA molecules in 96-well plates. This technique enables large-scale RNA analysis with high precision and efficiency.

Report Coverage

The research report offers an in-depth analysis based on Technology, Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The FISH probe market is expected to expand steadily due to rising demand for early cancer detection.

- Increasing adoption of personalized medicine will drive the need for precise genetic diagnostics.

- Growth in research activities and genomic studies will fuel demand for advanced FISH probes.

- Integration of AI and digital imaging will enhance diagnostic accuracy and workflow efficiency.

- Multiplex FISH technologies will enable simultaneous detection of multiple genetic markers.

- Emerging markets in Asia-Pacific and Latin America will witness rapid adoption of FISH assays.

- Expansion of companion diagnostics will create opportunities for targeted therapy applications.

- Continuous development of high-specificity DNA, RNA, and miRNA probes will support clinical applications.

- Collaborations between biotech companies and research institutions will accelerate innovation.

- Regulatory support and increasing awareness of genetic disorders will sustain long-term market growth.