Market Overview

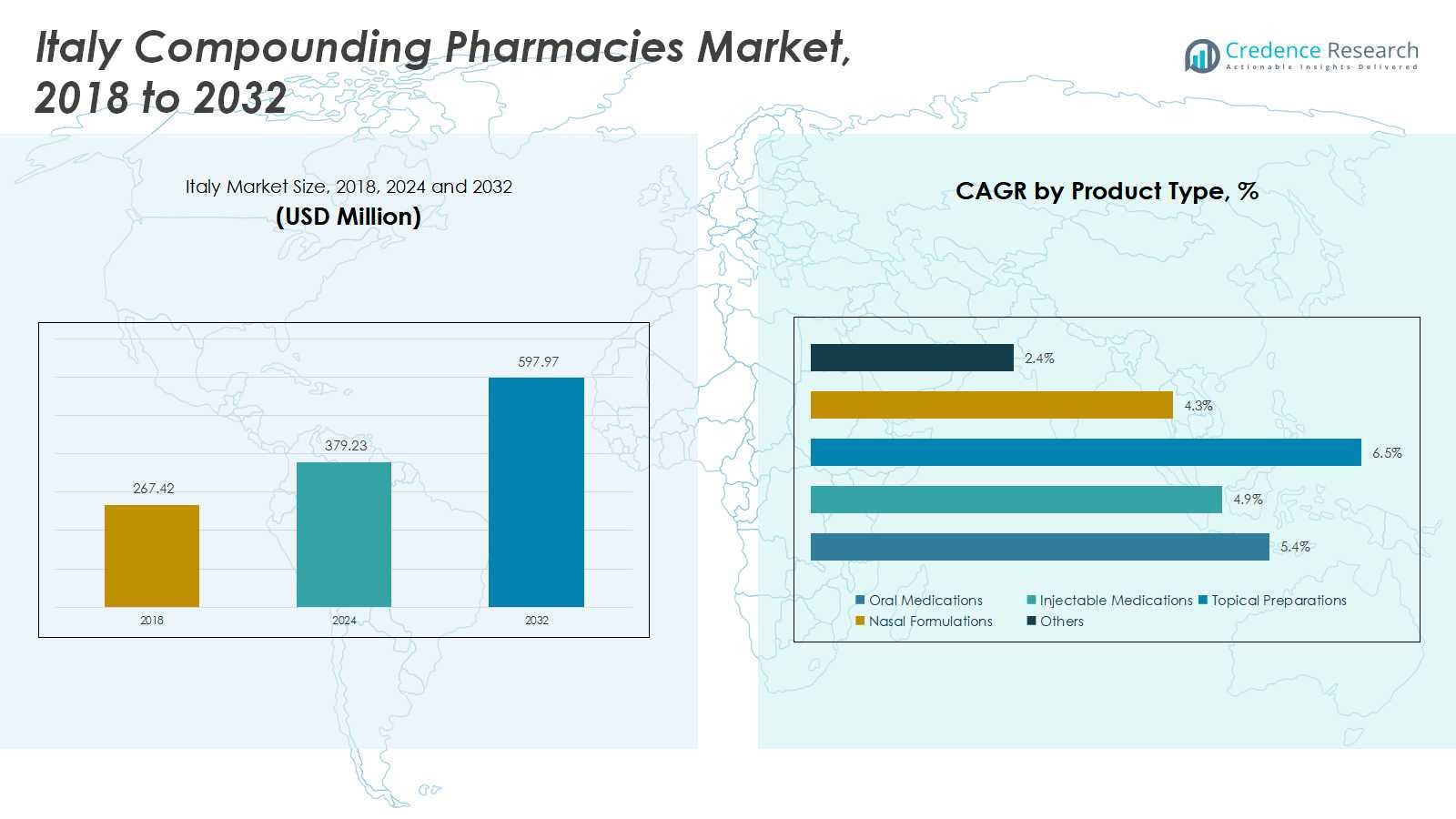

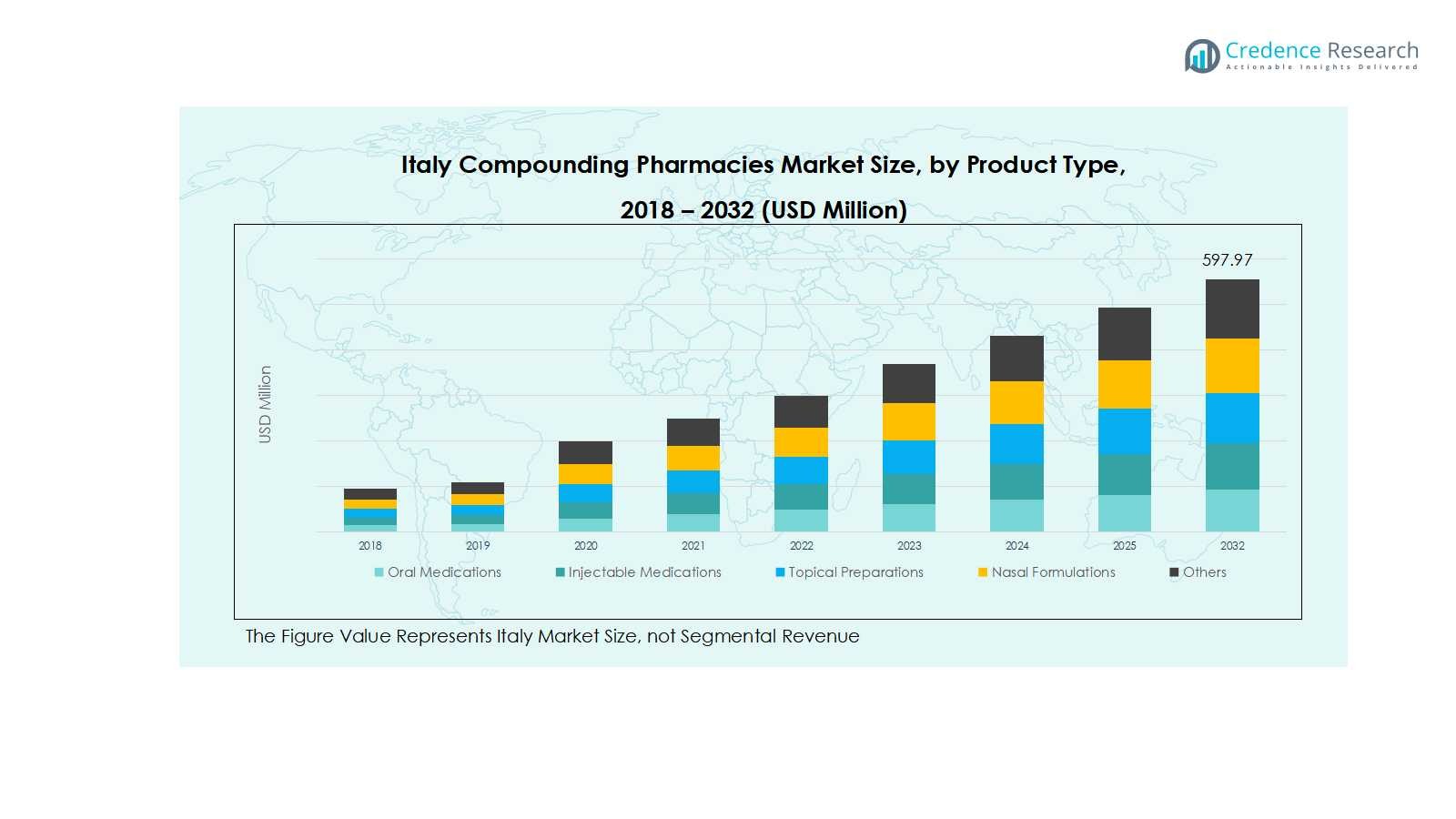

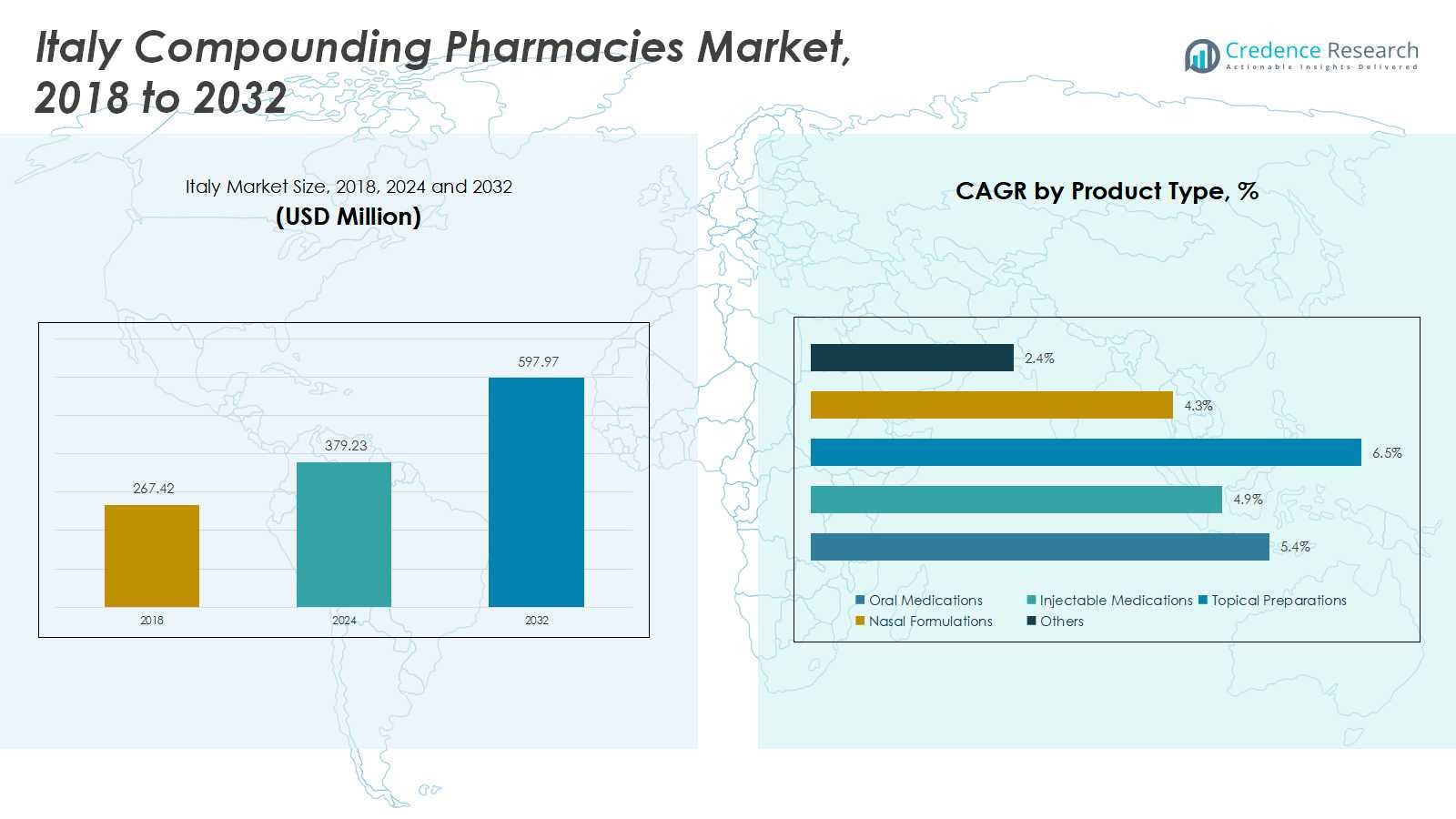

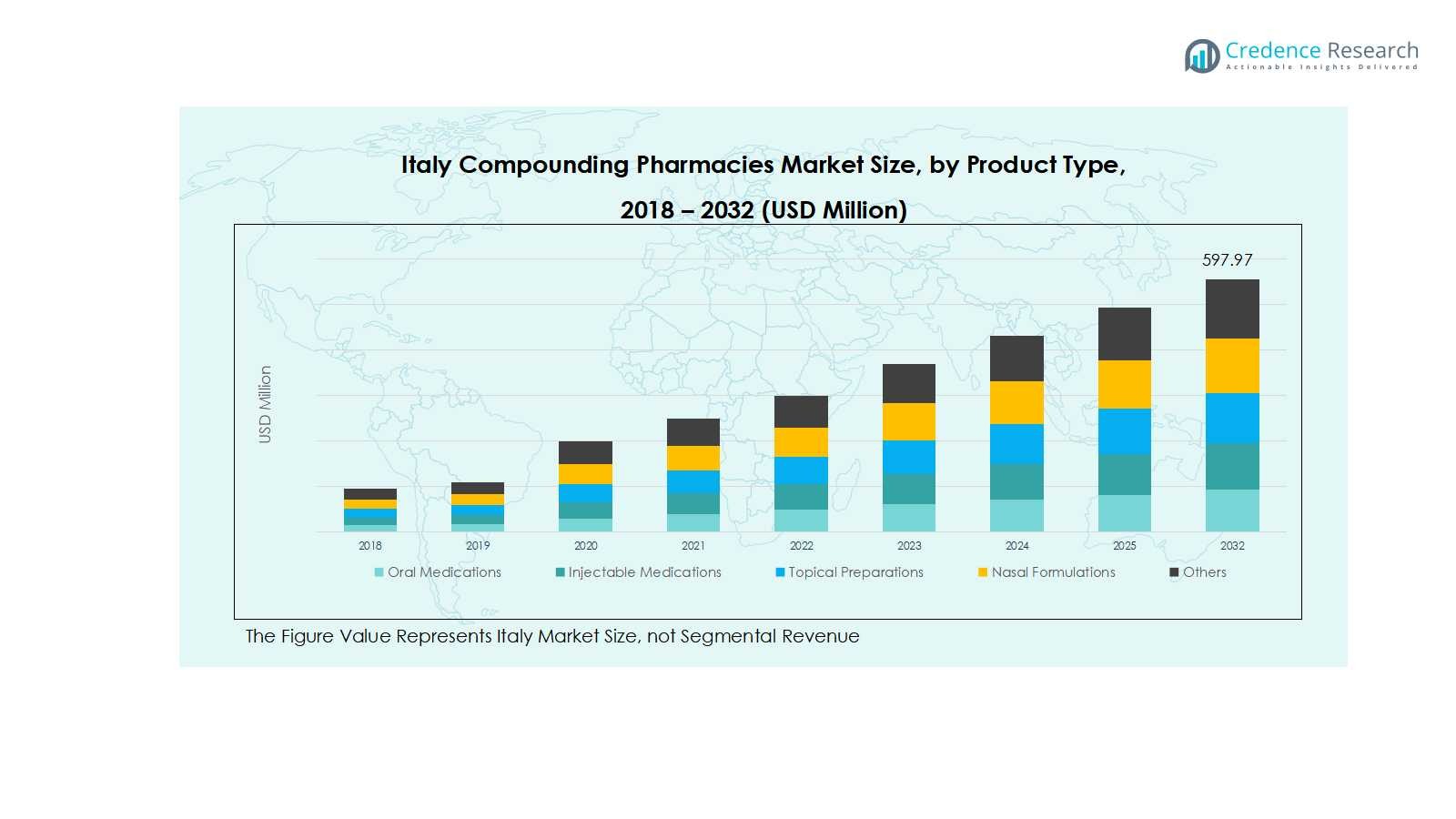

Italy Compounding Pharmacies Market size was valued at USD 267.42 Million in 2018, growing to USD 379.23 Million in 2024, and is anticipated to reach USD 597.97 Million by 2032, at a CAGR of 5.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Compounding Pharmacies Market Size 2024 |

USD 379.23 Million |

| Italy Compounding Pharmacies Market, CAGR |

5.45% |

| Italy Compounding Pharmacies Market Size 2032 |

USD 597.97 Million |

The Italy Compounding Pharmacies Market is highly competitive, led by key players such as Fidia Farmaceutici S.p.A., Angelini Pharma, Italfarmaco S.p.A., Chiesi Farmaceutici S.p.A., and Zambon Group. These companies focus on innovation in personalized therapies, expansion of sterile and non-sterile compounding capabilities, and partnerships with specialty clinics and hospitals to enhance service quality. They are also investing in advanced compounding technologies, digital prescription management systems, and high-quality formulation standards to maintain a strong market presence. Northern Italy emerges as the leading region in the market, commanding 38% of the total share, driven by robust healthcare infrastructure, a concentration of specialty clinics, and strong patient demand for personalized oral, injectable, and sterile formulations. The combination of established market players and a high-demand region ensures sustained growth and competitive dynamics in the Italy Compounding Pharmacies Market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Compounding Pharmacies Market was valued at USD 379.23 Million in 2024 and is projected to reach USD 597.97 Million by 2032, growing at a CAGR of 5.45% during the forecast period. Northern Italy leads the regional market with a 38% share, followed by Central Italy at 27%, Southern Italy at 20%, and the islands of Sicily and Sardinia at 15%.

- Rising demand for personalized medications and tailored therapies is driving market growth, particularly in oral and injectable formulations for chronic and hormone-related conditions.

- The market is witnessing trends such as increasing focus on biologics, specialty drugs, and adoption of advanced compounding technologies to enhance precision and safety.

- Competitive analysis indicates strong presence of key players including Fidia Farmaceutici S.p.A., Angelini Pharma, Italfarmaco S.p.A., Chiesi Farmaceutici S.p.A., and Zambon Group, with investments in partnerships and technology driving market dominance.

- Regulatory compliance requirements and high operational costs remain major restraints, impacting smaller pharmacies and limiting large-scale expansion.

Market Segmentation Analysis:

By Product Type:

Oral medications dominate the Italy Compounding Pharmacies Market, accounting for 42% of the segment share. The growth is driven by increasing patient preference for personalized oral therapies, particularly for chronic conditions such as cardiovascular diseases and diabetes. Injectable medications hold a significant share as well, fueled by the rising demand for biologics and hormone therapies. Topical preparations and nasal formulations are gaining traction due to enhanced patient compliance and targeted therapy delivery. Overall, innovations in formulation technology and the ability to customize dosages continue to propel the oral and injectable medication sub-segments forward.

- For instance, Grünenthal’s nasal spray production capabilities support pharmaceutical clients globally with innovative delivery systems designed for diseases affecting the respiratory and central nervous system

By Pharmacy Type:

503A pharmacies are the dominant sub-segment, capturing around 65% of the pharmacy type share in Italy. These pharmacies primarily serve local prescriptions with personalized formulations, benefiting from regulatory flexibility that allows tailored medication preparation. The growth of 503B pharmacies, holding the remaining share, is supported by increasing commercial demand for sterile compounded drugs, particularly in hospitals and specialty clinics. Key drivers for both sub-segments include rising awareness of personalized medicine, expansion of outpatient services, and advances in compounding technology, which enable pharmacies to meet patient-specific therapeutic requirements efficiently.

- For instance, 503B facilities played a critical role during the COVID-19 pandemic by scaling production of sterile saline solutions and chemotherapy agents to maintain healthcare supply chains.

By Sterility:

Sterile compounding holds the largest share at approximately 58% of the sterility segment in Italy. This dominance is driven by the growing demand for injectable medications, ophthalmic solutions, and intravenous therapies, particularly in hospitals and specialty clinics. Non-sterile compounding, while smaller, is growing steadily due to the rising use of topical creams, oral liquids, and nutritional supplements. The main drivers for sterile compounding include stringent safety standards, increasing prevalence of chronic diseases requiring injectable therapies, and advancements in aseptic techniques, which collectively ensure patient safety and efficacy in high-demand therapeutic areas.

Key Growth Drivers

Rising Demand for Personalized Medicine

The growing emphasis on personalized medicine is a major driver in the Italy Compounding Pharmacies Market. Patients increasingly seek tailored therapies that address specific health conditions, genetic profiles, and dosage requirements. This trend is particularly prominent in chronic diseases, hormone replacement therapy, and pain management, where standardized treatments often fail to meet individual needs. Compounding pharmacies are uniquely positioned to provide customized formulations, enhancing patient adherence and treatment efficacy. The rise in awareness about personalized therapies among healthcare providers and patients further accelerates market growth.

- For instance, Roseway Labs, a UK-based compounding pharmacy working with private doctors, specializes in personalized bioidentical hormone replacement therapy (BHRT) and other customized formulations, highlighting the demand for precision medicine in hormone therapy.

Expansion of Outpatient and Specialty Clinics

The expansion of outpatient and specialty clinics across Italy significantly fuels market growth. These facilities require a consistent supply of compounded medications, particularly injectable and sterile preparations, to support targeted therapies and advanced treatment protocols. Increased patient throughput and complex therapeutic demands encourage collaboration with local and 503B compounding pharmacies. Additionally, outpatient services focusing on dermatology, pain management, and hormone therapies are driving consistent demand. This growth is reinforced by healthcare infrastructure improvements and a focus on patient-centric care.

Technological Advancements in Compounding Processes

Innovations in compounding technologies, including automated mixing systems, aseptic processing, and precise dosage formulation, are key growth enablers. These advancements improve accuracy, safety, and efficiency, allowing pharmacies to meet regulatory standards while handling complex formulations. Technological adoption reduces preparation errors, enhances sterility, and enables scalable production for high-demand medications. Furthermore, digital tools for prescription management and formulation tracking streamline operations. Collectively, these technological improvements boost market confidence, expand service capabilities, and drive higher adoption of compounded medications.

- For instance, CurifyLabs’ Compounding System Solution, which integrates advanced robotics and 3D printing for personalized non-sterile formulations like troches and orodispersible films, ensuring precise dosing and real-time process monitoring compliant with USP standards.

Key Trends and Opportunities

Increasing Biologic and Specialty Drug Compounding

Italy’s compounding pharmacies are increasingly focusing on biologics and specialty drugs to cater to complex treatment needs. Rising prevalence of chronic and rare diseases has created demand for injectable and sterile formulations beyond conventional therapies. Compounding pharmacies are leveraging advanced formulations to customize biologic dosages and create patient-specific solutions, enhancing therapeutic outcomes. This trend also opens opportunities for collaborations with hospitals and specialty clinics seeking reliable, customized medication supply chains, positioning compounding pharmacies as strategic partners in innovative healthcare delivery.

- For instance, Fagron NV has integrated robotic dispensing units to enhance dosage precision and reduce contamination risks, improving therapeutic outcomes through advanced automation.

Opportunities in Geriatric and Pediatric Care

Targeting geriatrics and pediatrics presents a significant opportunity for Italy’s compounding pharmacies. Older adults and children often require unique dosage forms and strengths not available commercially, creating demand for personalized oral liquids, topical creams, and injectable therapies. Pharmacies providing these solutions improve patient adherence and safety, fostering trust among healthcare providers and caregivers. With Italy’s aging population and growing pediatric care awareness, compounding pharmacies can expand services, develop specialized formulations, and strengthen market penetration in these high-demand demographic segments.

- For instance, Acef S.p.A., a pharmaceutical company based in Italy, specializes in galenic compounding and offers customized pediatric oral suspensions and adult topical formulations to meet unique patient needs, enabling better dosage precision for children and elderly patients.

Key Challenges

Regulatory Compliance Complexity

Navigating complex regulatory frameworks poses a challenge for Italy’s compounding pharmacies. Compliance with stringent guidelines for sterile preparation, labeling, and quality assurance requires significant investment in training, technology, and process validation. Non-compliance can result in operational restrictions, penalties, or reputational damage. Smaller pharmacies face difficulties in scaling operations while maintaining regulatory adherence. These regulatory complexities necessitate continuous monitoring of changing policies and investments in quality management systems, which can impact operational efficiency and overall market growth.

High Operational Costs and Resource Constraints

High operational costs and limited access to specialized resources challenge market growth in Italy. Compounding pharmacies must invest in advanced equipment, aseptic facilities, and skilled personnel to meet safety and quality standards, driving up expenses. Additionally, sourcing high-quality active pharmaceutical ingredients (APIs) and maintaining inventory for diverse formulations adds to operational complexity. These cost pressures can limit expansion, particularly for smaller pharmacies, and impact competitive pricing. Efficient resource management and strategic partnerships are crucial to mitigate these constraints and sustain market growth.

Regional Analysis

Northern Italy

Northern Italy holds a dominant position in the country’s compounding pharmacies market, accounting for 38% of the total share. The region benefits from a strong healthcare infrastructure, a higher concentration of specialty clinics, and significant patient demand for personalized therapies. Cities such as Milan, Turin, and Bologna are hubs for outpatient services and advanced medical facilities, supporting growth in oral, injectable, and sterile formulations. The presence of established 503A and 503B pharmacies, along with increasing adoption of advanced compounding technologies, further drives the market in Northern Italy, ensuring continued expansion across multiple therapeutic areas.

Central Italy

Central Italy contributes 27% to the country’s compounding pharmacies market share, driven by growing demand in urban centers like Rome, Florence, and Perugia. The region’s focus on specialty clinics, dermatology centers, and outpatient care enhances the adoption of injectable and topical formulations. Central Italy also witnesses increasing patient awareness of personalized medications, boosting demand for hormone replacement therapies and pain management solutions. Investments in modern compounding facilities and partnerships between local pharmacies and healthcare institutions support both sterile and non-sterile compounding, solidifying Central Italy’s position as a key growth region in the national market.

Southern Italy

Southern Italy holds 20% of the Italy compounding pharmacies market share, supported by rising patient demand in cities such as Naples, Bari, and Palermo. The growth is driven by increased awareness of personalized medicine, expanding outpatient services, and the gradual development of specialty clinics. Oral medications and non-sterile compounding formulations see strong adoption, particularly for chronic disease management. Despite challenges in infrastructure compared to Northern and Central regions, Southern Italy’s market is expanding due to regional healthcare initiatives, partnerships with larger pharmacy chains, and gradual modernization of compounding practices, contributing to steady market growth.

Islands (Sicily and Sardinia)

The islands of Sicily and Sardinia account for 15% of the Italy compounding pharmacies market share. Market growth in these regions is driven by increasing patient demand for specialized therapies, including injectable medications and topical preparations, particularly in urban centers such as Palermo, Cagliari, and Catania. Local pharmacies are enhancing their service portfolios to meet demographic-specific needs, including pediatric and geriatric formulations. While logistical challenges exist, the rising adoption of compounding technologies and partnerships with mainland pharmacies facilitate consistent supply and quality. These factors collectively strengthen Sicily and Sardinia’s contribution to the national compounding pharmacies market.

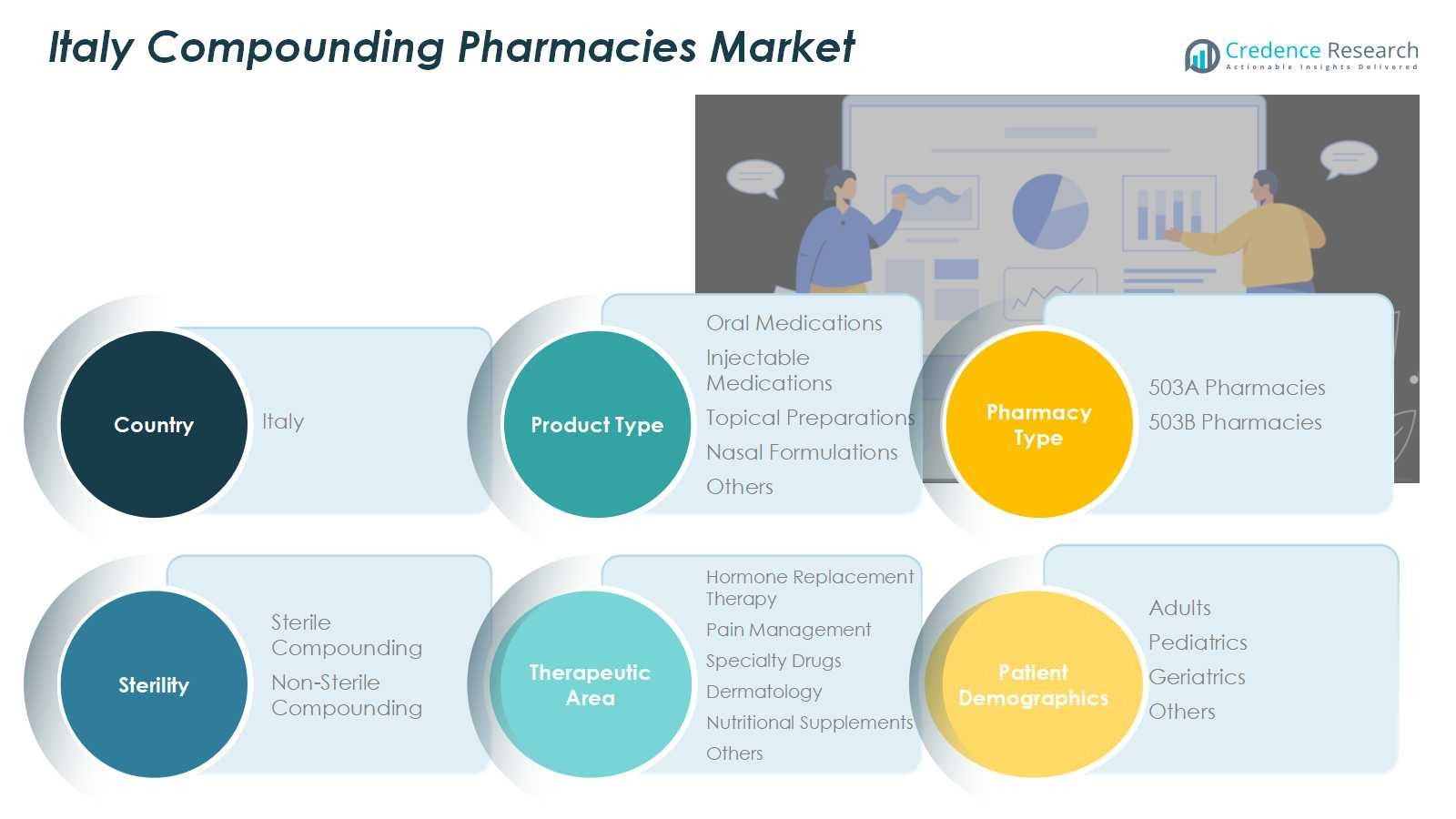

Market Segmentations:

By Product Type

- Oral Medications

- Injectable Medications

- Topical Preparations

- Nasal Formulations

- Others

By Pharmacy Type

- 503A Pharmacies

- 503B Pharmacie

By Sterility

- Sterile Compounding

- Non-Sterile Compounding

By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Patient Demographics

- Adults

- Pediatrics

- Geriatrics

- Others

By Region

- Northern Italy

- Southern Italy

- Central Italy

- Islands Italy

Competitive Landscape

Competitive landscape in the Italy Compounding Pharmacies Market includes key players such as Fidia Farmaceutici S.p.A., Angelini Pharma, Italfarmaco S.p.A., Chiesi Farmaceutici S.p.A., and Zambon Group. The market is characterized by intense competition among established national and regional players, focusing on product innovation, personalized therapy solutions, and expansion of sterile and non-sterile compounding capabilities. Companies are increasingly investing in advanced compounding technologies, digital prescription management systems, and collaborations with specialty clinics and hospitals to enhance service quality and operational efficiency. Strategic initiatives such as mergers, acquisitions, and partnerships allow players to strengthen their geographic presence and diversify product portfolios. Additionally, emphasis on regulatory compliance, high-quality formulations, and patient-centric solutions helps companies differentiate themselves, driving sustained growth in a market that continues to evolve with increasing demand for tailored medications and specialized therapeutic services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fidia Farmaceutici S.p.A.

- Angelini Pharma

- Italfarmaco S.p.A.

- Chiesi Farmaceutici S.p.A.

- Zambon Group

- IBSA Institute Biochimique SA

- Sigma Tau

- Molmed S.p.A

- Kedrion Biopharma

Recent Developments

- In July 2025, SOMAÍ, a leading EU-GMP vertically integrated multi-country operator, partnered with Materia Medica Processing, Italy’s premier pharmaceutical cannabis company, to introduce its pharmaceutical-grade, EU-GMP-certified cannabinoid medicines to Italian patients and healthcare professionals.

- In August 2025, Tilray Medical’s FL Group formed a strategic partnership with Molteni, a major pharmaceutical firm specializing in pain and substance dependence therapies, to expand access to cannabis extracts across Italy.

- In March 2025, the Regional Administrative Court for Lazio issued a ruling in favor of a pharmaceutical company distributing medicines in Italy, annulling the Ministry of Health’s decision to modify its proposed advertising.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pharmacy Type, Sterility, Therapeutic Area, Patient Demographics and Region. Investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand for personalized medications.

- Increasing adoption of advanced compounding technologies will enhance accuracy and efficiency

- Expansion of specialty clinics and outpatient services will drive consistent demand for compounded drugs.

- Growth in hormone replacement therapy and pain management treatments will support market expansion.

- Sterile compounding will continue to dominate due to higher demand for injectable and intravenous therapies.

- Oral and topical formulations will see rising use for chronic and dermatological conditions.

- Aging population and pediatric care needs will create new opportunities for tailored medications.

- Strategic collaborations between pharmacies and healthcare providers will strengthen market presence.

- Regulatory compliance and quality standards will encourage investment in advanced facilities.

- Market players will focus on innovation and patient-centric solutions to remain competitive.