Market Overview:

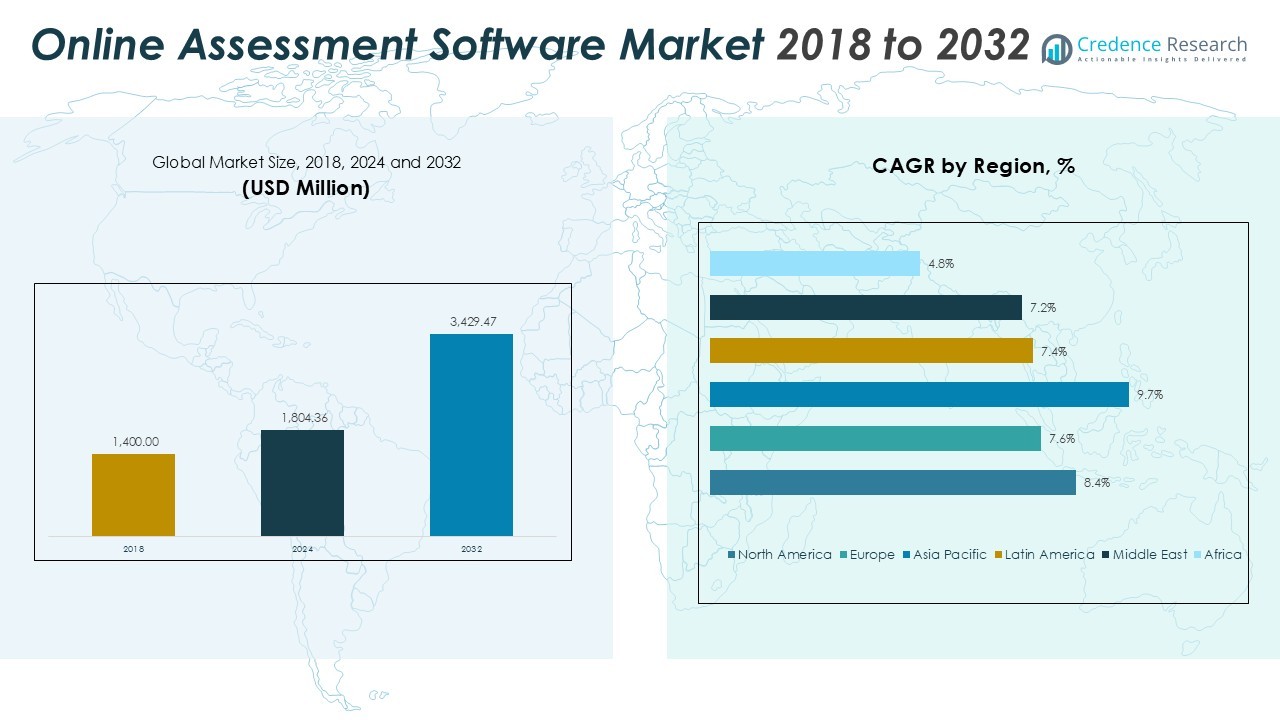

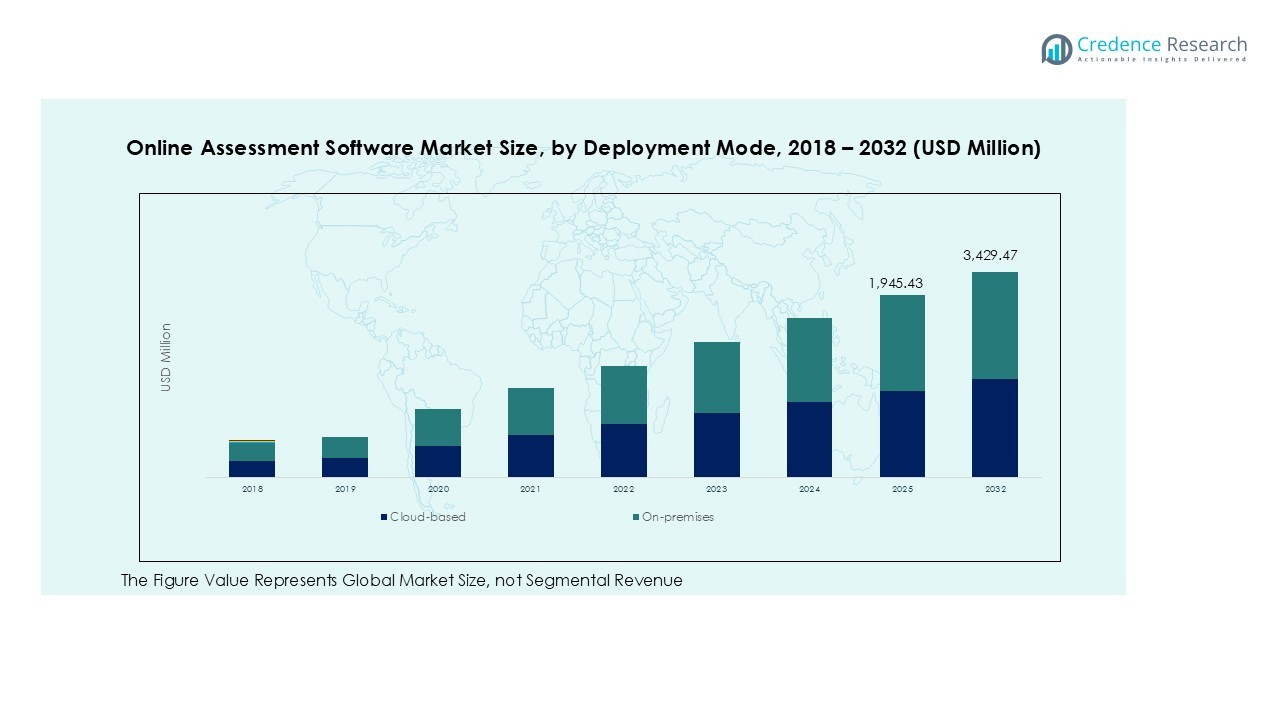

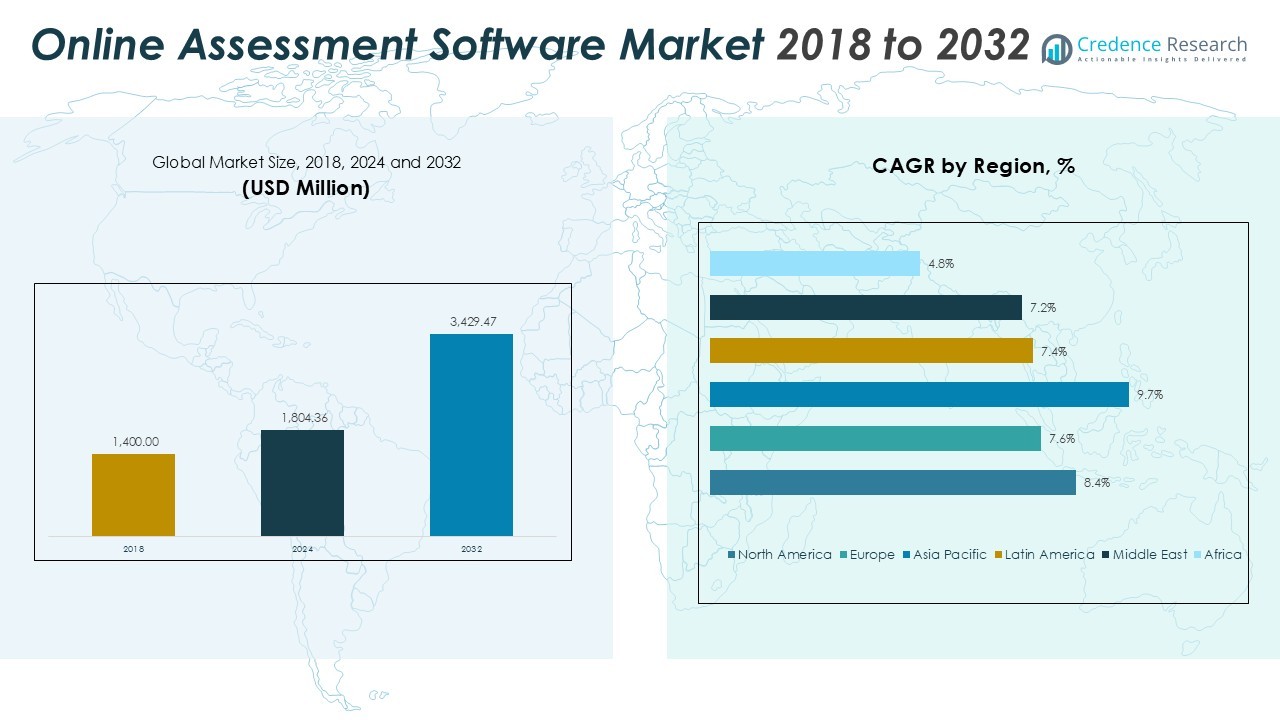

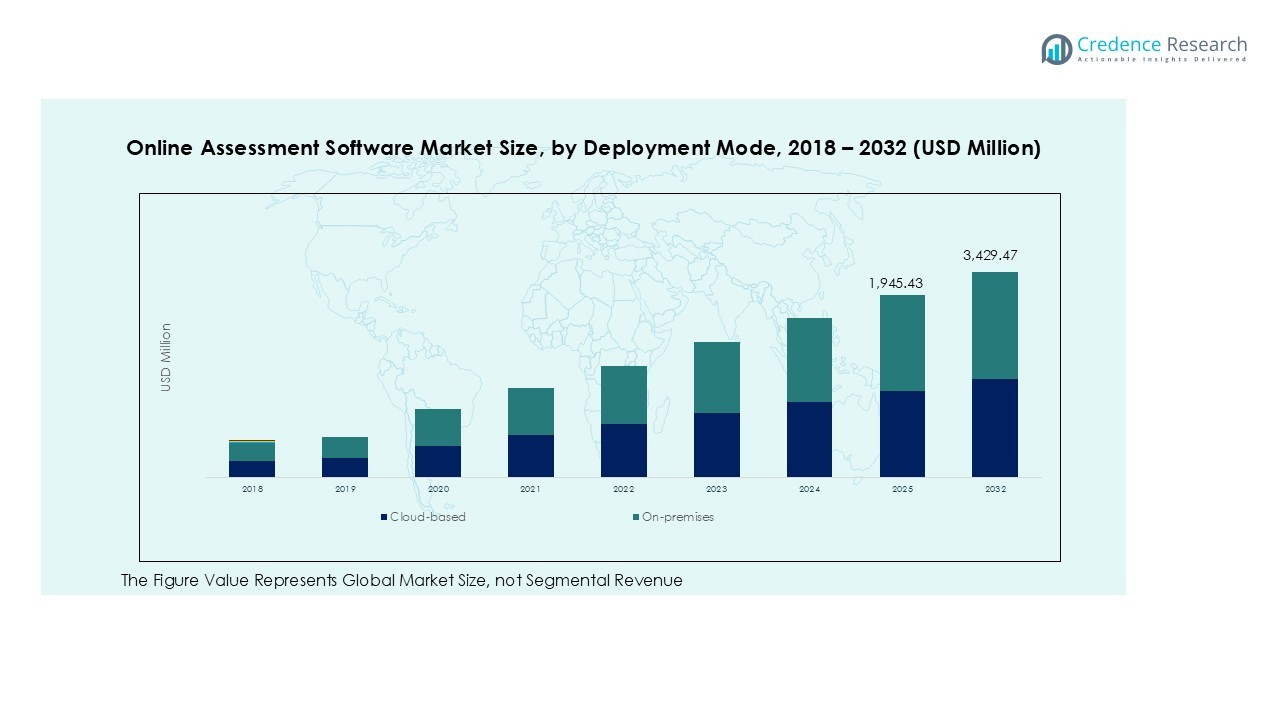

The Global Online Assessment Software Market size was valued at USD 1,400 million in 2018 to USD 1,804.36 million in 2024 and is anticipated to reach USD 3,429.47 million by 2032, at a CAGR of 8.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Online Assessment Software Market Size 2024 |

USD 1,804.36 Million |

| Online Assessment Software Market, CAGR |

8.44% |

| Online Assessment Software Market Size 2032 |

USD 3,429.47 Million |

Key factors driving this growth include the rapid shift toward online and remote education, the growing integration of artificial intelligence and analytics in testing platforms, and the need for standardized performance evaluation systems. Organizations and academic institutions are increasingly investing in automated testing solutions that ensure transparency, reduce bias, and improve decision-making efficiency. The surge in digital transformation across industries has also accelerated the use of online assessment tools for recruitment, training, and certification.

Regionally, North America holds the dominant share due to its advanced digital infrastructure and early adoption of e-learning technologies. Europe follows with steady growth, supported by government initiatives in education modernization. The Asia Pacific region is expected to record the fastest expansion, propelled by growing internet penetration, expanding education sectors, and increasing demand for skill-based learning solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Online Assessment Software Market continues to grow rapidly due to widespread adoption of remote learning and digital workforce evaluation tools.

- Integration of artificial intelligence and advanced analytics enhances assessment accuracy, adaptive testing, and actionable insights for educators and employers.

- Cloud-based platforms dominate deployment, offering scalability, remote access, and operational efficiency, while on-premises solutions remain relevant for data-sensitive organizations.

- Education remains the largest end-user segment, supported by schools, universities, and vocational institutes adopting digital platforms for standardized assessments.

- North America holds the largest market share, driven by advanced digital infrastructure, early e-learning adoption, and strong government support for education quality and workforce development.

- Asia Pacific is projected to witness the fastest growth, propelled by expanding internet penetration, government initiatives in digital education, and rising demand for scalable, affordable assessment solutions.

- Latin America, the Middle East, and Africa show growing adoption despite infrastructure challenges, supported by cloud-based solutions, government-backed digital education programs, and increasing corporate training requirements.

Market Drivers:

Rising Demand for Remote Learning and Workforce Digitization

The growing shift toward remote education and virtual workplaces is a major factor driving the Global Online Assessment Software Market. Institutions and organizations seek digital platforms that ensure fair, secure, and flexible evaluation processes. It enables users to conduct large-scale assessments without geographical barriers, maintaining accuracy and efficiency. The expansion of remote learning programs in schools, universities, and enterprises continues to strengthen adoption, supported by global investment in e-learning infrastructure.

- For instance, Examity has maintained academic integrity by proctoring over 20 million exams worldwide since its founding in 2013.

Integration of Advanced Analytics and Artificial Intelligence

The incorporation of AI-driven analytics is transforming online assessments by enhancing precision and insight. It allows educators and employers to measure not only knowledge but also behavioral and cognitive skills. The technology supports adaptive testing, automated grading, and predictive analytics that improve decision-making in education and recruitment. Increasing reliance on real-time data and intelligent scoring tools reinforces the market’s technological advancement and appeal to end users.

- For Instance, Pearson’s generative AI study tools were used in millions of interactions globally, giving students AI-powered features like summarization and step-by-step guidance to help them with their studies.

Growing Focus on Efficiency and Cost Optimization

Organizations and academic institutions are adopting digital assessment platforms to reduce costs and improve operational efficiency. The software eliminates manual paperwork, minimizes logistical efforts, and shortens evaluation timelines. It enables faster feedback and performance tracking, supporting large-scale learning and hiring programs. The emphasis on automation and data accuracy continues to make digital assessments a preferred alternative to traditional testing methods.

Government Support and Expanding Digital Infrastructure

Rising investments in digital education and government initiatives to promote online learning environments are strengthening market growth. It benefits from policies that encourage the use of technology in education and certification programs. Expanding internet penetration and cloud-based infrastructure make online testing accessible across diverse regions. The growing support for educational innovation and digital literacy is expected to sustain long-term market expansion.

Market Trends:

Trend toward AI-Enabled Adaptive and Personalized Assessment Tools

The market shows strong momentum in deploying artificial intelligence to deliver adaptive testing that adjusts difficulty in real time based on learner responses. It powers personalization via algorithms that evaluate prior performance data, response times, and behavioral indicators to tailor questions for accuracy and fairness. It improves feedback speed and identifies learning gaps, helping educators and employers refine curricula and training modules. Institutions increasingly prefer platforms that integrate automated grading, intelligent analytics dashboards, and predictive metrics to track progress and forecast outcomes. The move away from uniform question sets toward individualized assessment paths enhances engagement and reduces test anxiety among users.

- For instance, Duolingo uses its proprietary AI-powered Birdbrain engine, which analyzes over 500 million daily responses to dynamically adjust language learning content for more than 83 million monthly active users, significantly improving engagement and retention rates .

Emerging Focus on Secure Assessment Experience, Integration, and Accessibility

Security, privacy, and system interoperability dominate recent developments. Online assessment software now often includes facial recognition, biometric identity verification, keystroke dynamics, browser lockdowns, and video monitoring to detect anomalous behavior and prevent fraud. It fuses with learning management systems, student information systems, and HR suites to deliver seamless workflows in educational, corporate, and certification ecosystems. Mobile compatibility and multilingual interfaces receive growing attention so it can serve diverse learners with variable connectivity conditions. Platforms embed accessibility features—screen-reader support, flexible timing, and alternative question formats—to ensure equity for test-takers with disabilities or in low-bandwidth areas.

- For instance, Respondus Monitor was deployed at 1,500 universities last year to deliver fully automated proctoring across campuses, integrating seamlessly with major LMS platforms for secure, scalable exam delivery.

Market Challenges Analysis:

Data Security Concerns and Integrity Issues in Online Testing

The Global Online Assessment Software Market faces major challenges related to data security, user authentication, and test integrity. Institutions and organizations remain concerned about breaches, unauthorized access, and content leaks during high-stakes examinations. It must ensure compliance with global data protection standards and deploy advanced encryption, multi-factor authentication, and proctoring systems to maintain trust. The rise in cyber threats and fraudulent testing practices creates a continuous need for security upgrades. Limited awareness of cybersecurity protocols among users further complicates the implementation of robust protection frameworks.

Limited Digital Infrastructure and User Adaptability Constraints

Uneven access to stable internet connections and inadequate digital infrastructure in developing regions restrict market penetration. It also struggles with resistance to technology adoption among educators and organizations accustomed to traditional testing formats. The cost of software licensing and system integration remains high for small institutions, reducing affordability. Inconsistent technical support and language barriers hinder smooth platform utilization. Training users to handle online tools effectively is essential to ensure accurate results and reliable participation. These operational barriers continue to limit the market’s scalability in underdeveloped education systems.

Market Opportunities:

Expansion Across Emerging Economies and Education Digitization

The Global Online Assessment Software Market presents strong opportunities in emerging economies where digital learning is gaining momentum. Governments are investing in education technology and remote evaluation frameworks to improve accessibility and quality. It benefits from rapid internet adoption, smartphone penetration, and expanding online education platforms. Schools, universities, and training centers in Asia Pacific, Latin America, and Africa are implementing digital assessment tools to meet growing student populations. Increasing partnerships between local education ministries and global EdTech providers can accelerate long-term adoption. The expansion of regional language support and affordable subscription models further enhances market reach.

Integration with Corporate Training and Professional Certification

Corporate digital transformation creates vast opportunities for online assessment solutions in employee training, recruitment, and certification programs. It enables organizations to measure skills, ensure compliance, and streamline hiring through automated evaluation systems. The growing focus on continuous learning and competency-based development supports higher adoption of scalable assessment platforms. Enterprises seek real-time analytics and performance insights to optimize talent strategies and workforce readiness. Integration with learning management systems and HR analytics tools strengthens its commercial appeal. Rising demand for secure and standardized certification programs will continue to open new revenue channels across professional and industrial sectors.

Market Segmentation Analysis:

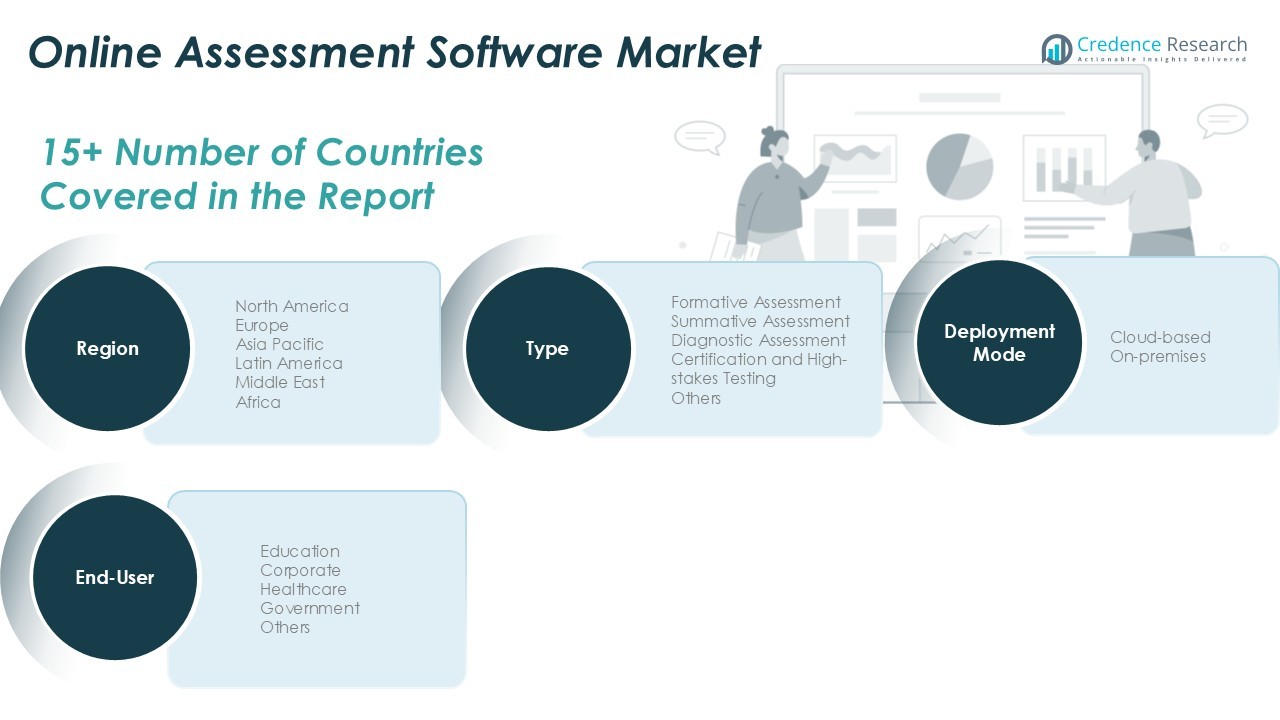

By Type

The Global Online Assessment Software Market categorizes offerings by type to meet diverse evaluation requirements. Formative assessment leads adoption due to its continuous feedback capability, followed by summative assessment for formal evaluation. Diagnostic assessment and certification/high-stakes testing gain traction in academic and professional certification environments. It allows institutions and organizations to implement solutions aligned with learning objectives, compliance standards, and performance measurement needs.

- For instance, McGraw Hill’s ALEKS platform has been used by more than 50 million students in K-12 and higher education courses worldwide.

By Deployment Mode

Cloud-based platforms dominate deployment mode, offering scalability, remote accessibility, and cost efficiency. On-premises solutions retain relevance for organizations requiring enhanced data control and security. It supports integration with existing IT infrastructure, enabling hybrid models across education and corporate sectors. The deployment choice depends on infrastructure readiness, data governance policies, and organizational priorities.

- For instance, Amazon Web Services spans 38 geographic regions as of September 2025.

By End-User

The education segment holds the largest market share, fueled by the growth of e-learning and remote assessment adoption. Corporate users follow, utilizing online assessments for recruitment, employee training, and skill development initiatives. Healthcare and government sectors increasingly implement these solutions to streamline evaluation, certification, and compliance processes. It delivers standardized testing, reduces manual effort, and provides actionable insights through analytics dashboards, ensuring efficient and accurate assessments across sectors.

Segmentations:

By Type:

- Formative Assessment

- Summative Assessment

- Diagnostic Assessment

- Certification and High-stakes Testing

- Others

By Deployment Mode:

By End-user:

- Education

- Corporate

- Healthcare

- Government

- Others

By Region / Country:

- North America:S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Online Assessment Software Market size was valued at USD 513.80 million in 2018 to USD 654.25 million in 2024 and is anticipated to reach USD 1,241.82 million by 2032, at a CAGR of 8.15% during the forecast period. North America holds the largest market share of 38% in the Global Online Assessment Software Market. It benefits from widespread digital infrastructure, early adoption of e-learning platforms, and strong presence of major technology providers. The region’s educational institutions and enterprises actively implement cloud-based testing systems to streamline assessment processes. Government emphasis on education quality and workforce development continues to drive investments in online testing solutions. Growing demand for certification, corporate training, and remote hiring assessments further supports market expansion across the U.S. and Canada.

United Kingdom

The UK Online Assessment Software Market size was valued at USD 51.63 million in 2018 to USD 64.31 million in 2024 and is anticipated to reach USD 121.16 million by 2032, at a CAGR of 8.24% during the forecast period. The UK accounts for 9% of the overall Global Online Assessment Software Market share. It demonstrates strong growth due to the rapid digital transformation within its education and professional training sectors. The country’s universities, vocational institutes, and corporations are adopting online platforms to enhance transparency and efficiency in testing. Growing government initiatives toward digital education and standardized evaluation methods strengthen adoption. Continuous innovation in AI-based analytics and secure proctoring features reinforces its market position in Europe.

Asia Pacific

The Asia Pacific Online Assessment Software Market size was valued at USD 289.45 million in 2018 to USD 387.64 million in 2024 and is anticipated to reach USD 805.72 million by 2032, at a CAGR of 9.47% during the forecast period. The region captures 31% share of the Global Online Assessment Software Market, supported by expanding e-learning adoption and internet penetration. Rapid economic growth in China, India, and Southeast Asia increases demand for scalable and affordable assessment platforms. Governments promote digital literacy and online testing infrastructure to meet rising education standards. It benefits from growing partnerships between EdTech firms and academic institutions. Increasing use of mobile devices and cloud-based systems accelerates accessibility, particularly in rural and emerging areas.

Latin America

The Latin America Online Assessment Software Market size was valued at USD 96.20 million in 2018 to USD 128.47 million in 2024 and is anticipated to reach USD 257.85 million by 2032, at a CAGR of 8.72% during the forecast period. Latin America represents an 11% market share within the Global Online Assessment Software Market. It shows growing adoption of online assessments across schools, universities, and corporate training programs. Governments in Brazil, Mexico, and Chile are investing in digital education frameworks to improve academic transparency and student performance tracking. It faces infrastructural challenges but gains momentum with the spread of affordable cloud solutions. Increasing focus on professional certification and employee evaluation supports steady market penetration.

Middle East

The Middle East Online Assessment Software Market size was valued at USD 67.45 million in 2018 to USD 88.30 million in 2024 and is anticipated to reach USD 170.21 million by 2032, at a CAGR of 8.45% during the forecast period. The region holds a 7% share of the Global Online Assessment Software Market. The rise in e-learning initiatives and education reform programs across Gulf countries strengthens demand. Universities and training institutes adopt digital testing platforms to align with global academic standards. It gains traction through partnerships between government education ministries and technology providers. Investments in AI-driven learning analytics and secure assessment systems enhance its growth outlook. Increasing interest in remote workforce evaluation tools further expands market potential.

Africa

The Africa Online Assessment Software Market size was valued at USD 42.12 million in 2018 to USD 55.91 million in 2024 and is anticipated to reach USD 106.63 million by 2032, at a CAGR of 8.16% during the forecast period. Africa contributes 4% to the Global Online Assessment Software Market. The region is at an early adoption stage but shows rising potential due to government-backed digital education projects. Educational institutions are embracing low-cost, cloud-based assessment platforms to enhance efficiency and reduce manual workloads. It benefits from expanding internet connectivity and mobile access across urban and semi-urban regions. Growing emphasis on skills-based learning and vocational training fuels future market growth despite infrastructure limitations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ComplyWorks

- Conduct Exam Technologies

- ETS

- ExamSoft Worldwide LLC

- HireVue

- Pipplet

- ProProfs

- Questionmark

- Quizworks

- Transformica

- Vervoe

Competitive Analysis:

The Global Online Assessment Software Market features a highly competitive landscape with both established leaders and emerging players. Leading companies such as ETS, ExamSoft Worldwide LLC, and HireVue maintain significant market share through extensive product portfolios, advanced analytics, and strong customer support. Emerging players like ProProfs, Vervoe, and Questionmark gain traction by offering specialized, user-friendly, and cost-effective solutions tailored to specific industries and assessment types. It faces continuous innovation pressure, driving firms to enhance platform features, integrate AI-driven analytics, and ensure secure, scalable solutions. Strategic initiatives such as mergers, acquisitions, partnerships, and regional expansions allow companies to broaden their technological capabilities, enter new markets, and strengthen their competitive positioning. The market’s dynamics revolve around innovation, customer-centricity, and agility, enabling players to adapt to evolving educational and corporate assessment demands while capturing emerging opportunities.

Recent Developments:

- In October 2025, Veriforce’s ComplyWorks division hosted a System Navigation Webinar for General Contractor Training, focusing on enhancements in contractor compliance workflows and digital safety management.

- In August 2025, HireVue introduced its “Talent Engagement Agent,” an AI-powered solution designed to accelerate hiring by connecting candidates to best-fit roles while balancing quality and speed.

Report Coverage:

The research report offers an in-depth analysis based on Type, Deployment Mode, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Online Assessment Software Market will continue to expand due to rising adoption of digital learning and remote evaluation across educational institutions and enterprises.

- Increasing integration of artificial intelligence and machine learning will enhance adaptive testing and personalized assessment experiences.

- Cloud-based platforms will gain further prominence, driven by scalability, remote access, and seamless integration with existing IT infrastructure.

- Security and data privacy measures will become more sophisticated, including biometric authentication, proctoring tools, and encryption protocols.

- The corporate sector will increasingly adopt online assessment tools for recruitment, employee training, and competency evaluation.

- Emerging markets in Asia Pacific, Latin America, and the Middle East will offer significant growth opportunities due to rising internet penetration and digital literacy initiatives.

- Mobile-friendly and multilingual platforms will expand accessibility and usability for diverse learners and remote workforces.

- Collaboration with learning management systems and human resource software will create comprehensive assessment ecosystems.

- Continuous innovation in analytics dashboards and reporting tools will provide actionable insights for educators and employers.

- The market will see increased strategic partnerships, mergers, and acquisitions aimed at technological enhancement, geographic expansion, and improved service offerings.