Market Overview:

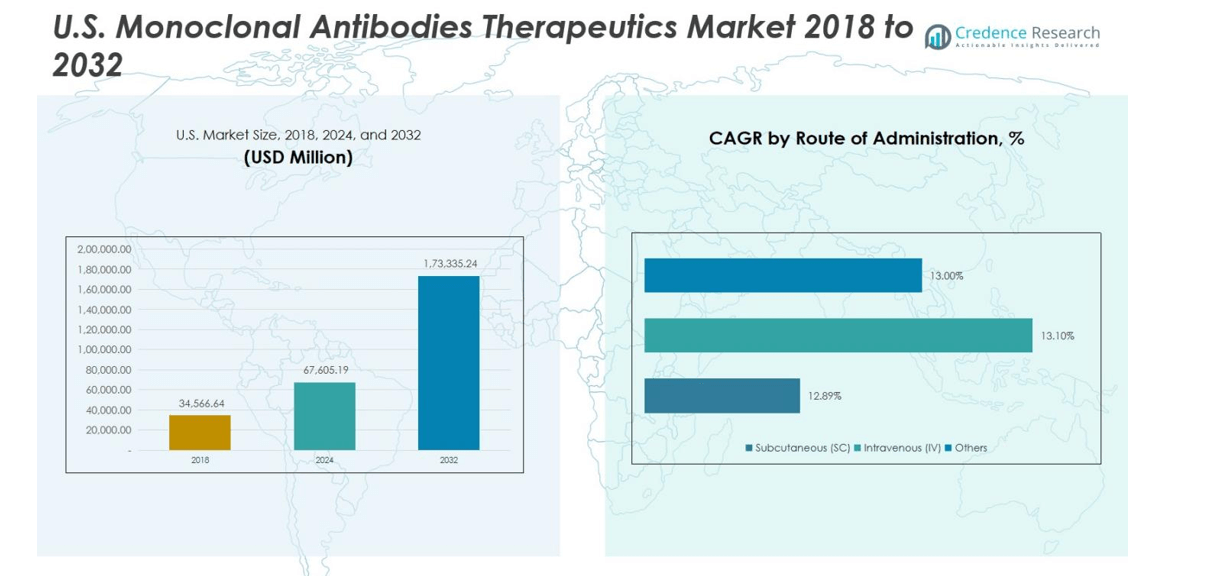

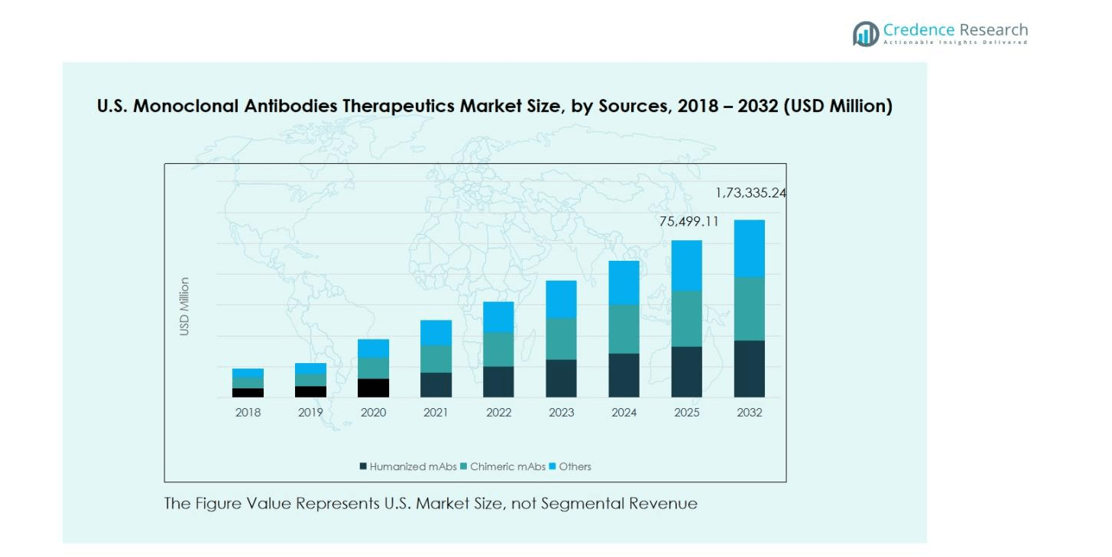

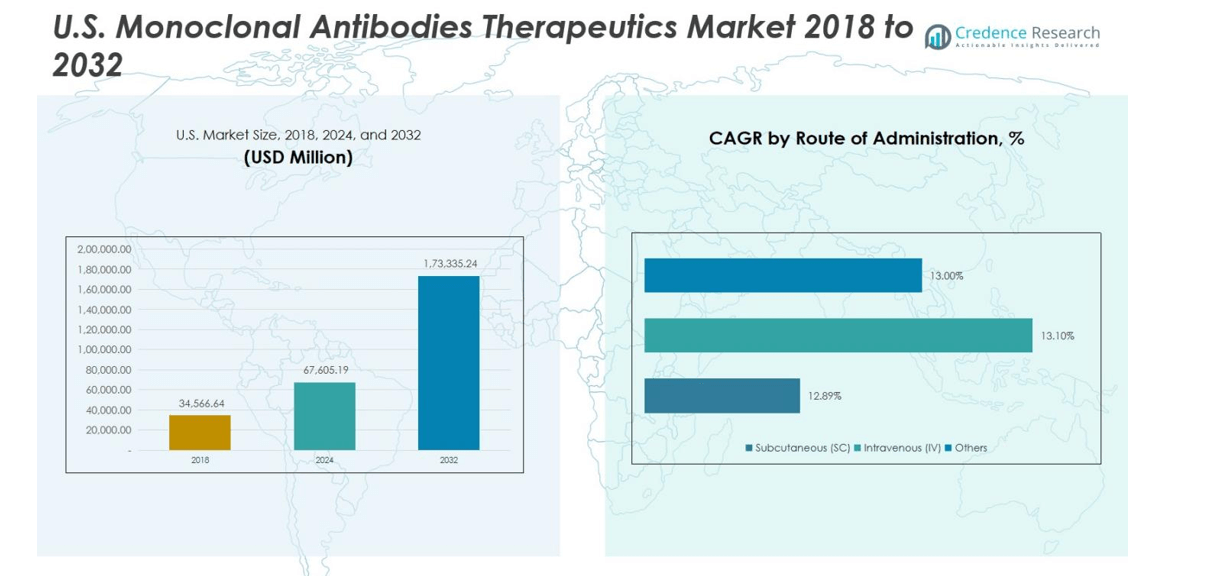

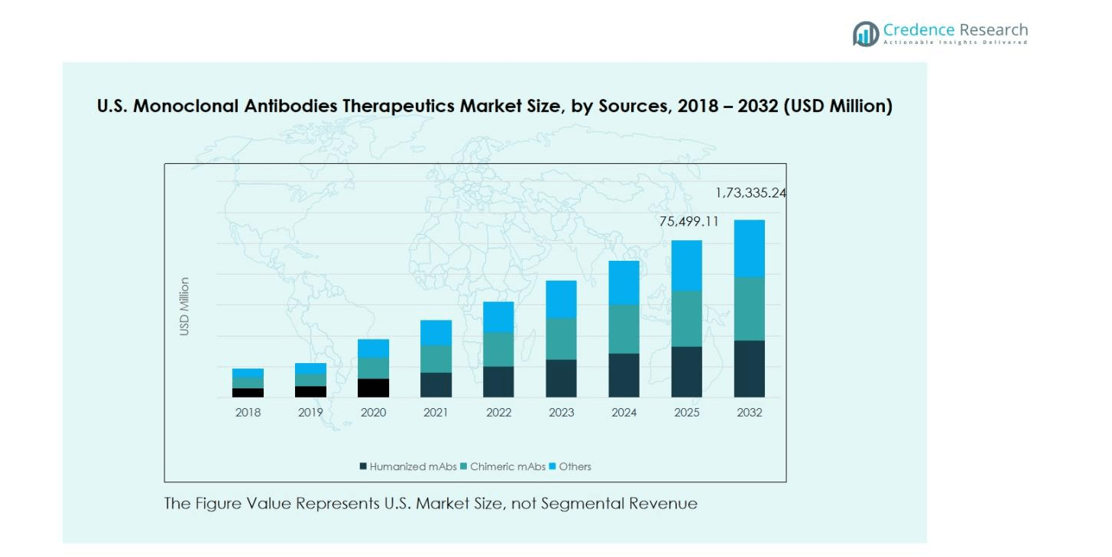

The U.S. Monoclonal Antibodies Therapeutics Market was valued at USD 34,566.64 million in 2018 and grew to USD 67,605.19 million in 2024. The market is anticipated to reach USD 173,335.24 million by 2032, reflecting a robust compound annual growth rate (CAGR) of 12.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Monoclonal Antibodies Therapeutics Market Size 2024 |

USD 67,605.19 million |

| U.S. Monoclonal Antibodies Therapeutics Market, CAGR |

12.2% |

| U.S. Monoclonal Antibodies Therapeutics Market Size 2032 |

USD 173,335.24 million |

The U.S. Monoclonal Antibodies Therapeutics Market is dominated by key players including F. Hoffmann-La Roche Ltd, Sanofi, Abbvie Inc., Bristol Myers Squibb Company, Novartis AG, AstraZeneca, Amgen Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc. These companies lead the market through robust research and development pipelines, strategic collaborations, and the introduction of innovative humanized and chimeric antibody therapies across oncology, autoimmune, and infectious disease segments. The Northeast U.S. emerges as the leading region, commanding 28% of the market share, supported by advanced healthcare infrastructure, a high concentration of biopharmaceutical firms, and strong clinical trial networks. Early adoption of cutting-edge therapies and substantial investments in biotechnology research further reinforce the Northeast’s dominant position, making it the focal point of growth and innovation in the U.S. monoclonal antibodies therapeutics market.

Market Insights

- The U.S. Monoclonal Antibodies Therapeutics Market was valued at USD 67,605.19 million in 2024 and is projected to reach USD 173,335.24 million by 2032, growing at a CAGR of 12.2%.

- Growth is driven by rising prevalence of cancer, autoimmune disorders, and chronic diseases, along with increasing adoption of personalized and targeted therapies.

- Market trends include expansion of immuno-oncology therapies, growing demand for subcutaneous and home-administered treatments, and technological advancements in antibody engineering.

- The competitive landscape is dominated by F. Hoffmann-La Roche Ltd, Sanofi, Abbvie Inc., Bristol Myers Squibb Company, Novartis AG, AstraZeneca, Amgen Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc., with robust R&D pipelines and strategic collaborations strengthening their market position.

- Regionally, the Northeast U.S. leads with a 28% market share, followed by the South and West at 25% each, and the Midwest at 22%, while Humanized mAbs hold the largest segment share of 55% in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

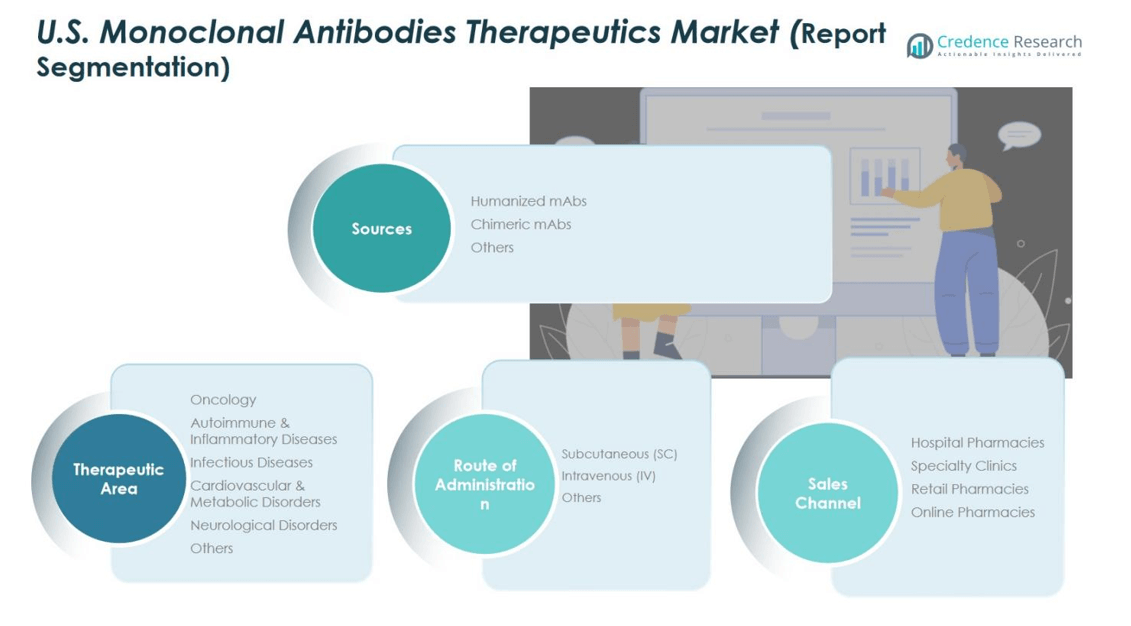

Market Segmentation Analysis:

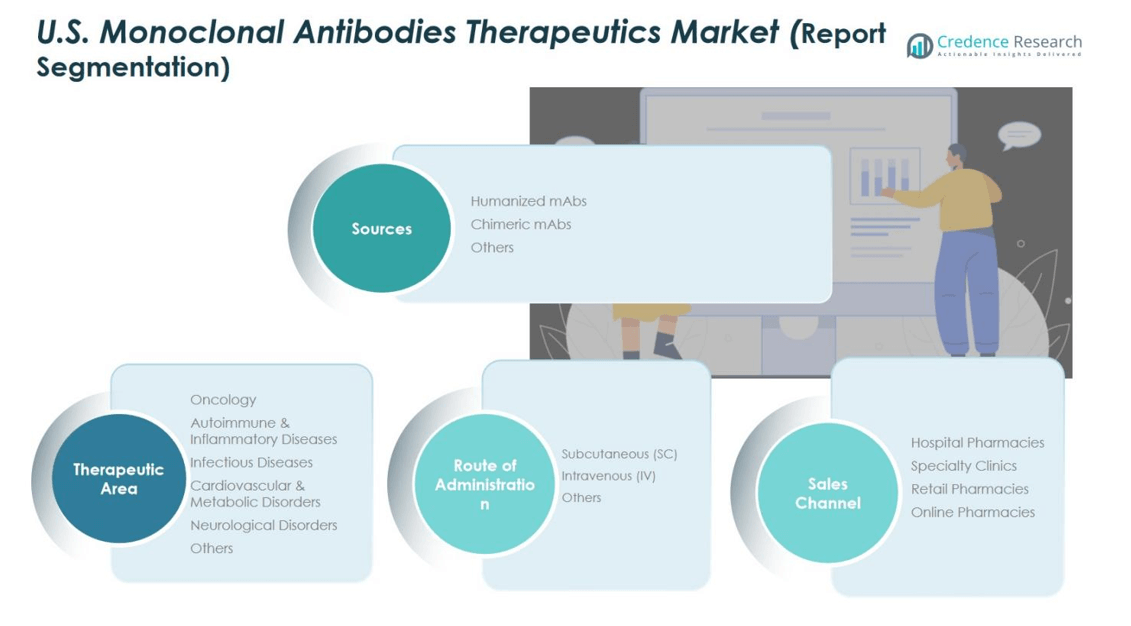

By Sources:

The Humanized mAbs segment dominates the U.S. Monoclonal Antibodies Therapeutics Market, accounting for 55% of the market share in 2024. This sub-segment’s growth is driven by their reduced immunogenicity and improved efficacy in treating chronic and complex conditions. Chimeric mAbs hold around 30% of the market, supported by established clinical applications in oncology and autoimmune disorders. The remaining 15% is captured by other antibody types. Increasing adoption of personalized therapies, technological advancements in antibody engineering, and growing prevalence of chronic diseases are key factors propelling the overall sources segment.

- For instance, Genentech’s Ocrevus Zunovo, an innovative subcutaneous formulation of ocrelizumab for multiple sclerosis, received FDA approval in September 2024, offering a fast 10-minute injection option and expanding patient access to this humanized mAb.

By Therapeutic Area:

Oncology remains the dominant therapeutic area, representing 45% of the U.S. market share in 2024. Rising cancer incidence, expansion of immuno-oncology treatments, and strong pipeline developments are driving segment growth. Autoimmune and inflammatory diseases follow with around 25% share, supported by the increasing prevalence of conditions such as rheumatoid arthritis and psoriasis. Infectious diseases, cardiovascular & metabolic disorders, and neurological disorders collectively account for the remaining 30%, fueled by targeted therapy adoption and advancements in monoclonal antibody applications.

- For instance, the FDA approved tarlatamab (Imdelltra) in 2024 as the first bispecific T-cell engager for extensive-stage small cell lung cancer, marking a significant breakthrough in immuno-oncology.

By Route of Administration:

Subcutaneous (SC) administration leads the market with a 60% share, driven by patient preference for self-administration, improved compliance, and reduced hospital visits. Intravenous (IV) administration holds around 35% of the market, supported by hospital-based treatments and established delivery of high-dose therapies. Other routes contribute approximately 5% of the market. Innovations in formulation, growing demand for at-home therapy options, and the convenience of SC injections continue to support segment expansion, reinforcing its position as the most widely used administration route.

Key Growth Drivers

Rising Prevalence of Chronic and Complex Diseases

The growing incidence of cancer, autoimmune disorders, and infectious diseases in the U.S. is a major driver for the monoclonal antibodies therapeutics market. Patients increasingly rely on targeted therapies for effective treatment, which has elevated demand for humanized and chimeric antibodies. Advancements in early diagnosis and screening programs have further expanded patient pools. The rising burden of chronic conditions, combined with the need for personalized and long-term treatment options, continues to drive revenue growth and encourage investment in innovative monoclonal antibody therapies.

- For instance, AstraZeneca’s Evusheld, a long-acting antibody combination for COVID-19, received marketing authorization recommendation in the European Union in 2022 for treating adults and adolescents at increased risk of severe infection.

Technological Advancements in Antibody Engineering

Innovations in recombinant DNA technology, antibody humanization, and bispecific antibodies are propelling market growth. These advancements enhance therapeutic efficacy, reduce immunogenicity, and enable development of complex therapies for previously untreatable conditions. Biopharmaceutical companies are investing in research to create next-generation antibodies that target multiple disease pathways simultaneously. Additionally, improvements in manufacturing efficiency and formulation stability have increased product accessibility, supporting market expansion. Technology-driven innovations strengthen the therapeutic potential of monoclonal antibodies and accelerate adoption across clinical applications.

- For instance, Akeso Bio developed cadonilimab, the first dual immune checkpoint inhibitor approved in China for metastatic cervical cancer, achieving over $76 million in sales within six months.

Expanding Adoption of Personalized Medicine

The shift toward precision medicine has boosted the monoclonal antibodies market, as therapies can now be tailored to individual patient profiles. Biomarker-driven treatment selection enhances outcomes in oncology, autoimmune diseases, and infectious conditions. Healthcare providers increasingly prefer therapies with predictable efficacy and safety, supporting monoclonal antibody utilization. Regulatory encouragement of targeted therapies, alongside growing patient awareness, contributes to widespread adoption. Personalized medicine initiatives not only improve clinical outcomes but also drive research investment, further fueling market growth.

Key Trends & Opportunities

Rising Investment in Immuno-Oncology

The immuno-oncology sector presents significant opportunities for monoclonal antibody therapeutics. Increasing clinical trials and regulatory approvals for checkpoint inhibitors and combination therapies are expanding treatment options. Pharmaceutical companies are actively investing in innovative antibody-based cancer therapies to capture unmet clinical needs. Growing collaborations between biotech firms and research institutions are accelerating pipeline development. This trend enhances the commercial potential of monoclonal antibodies, particularly in oncology, while providing long-term revenue opportunities and reinforcing the sector’s strategic importance in therapeutic innovation.

- For instance, Merck’s KEYTRUDA® (pembrolizumab) demonstrated long-term survival benefits in non-small cell lung cancer with a five-year follow-up showing clinically meaningful overall survival improvements, spotlighting its role as a standard of care.

Emerging Home-Based and Self-Administered Therapies

The demand for subcutaneous formulations and at-home administration of monoclonal antibodies is creating opportunities for market growth. Patients prefer convenient, self-administered treatments to reduce hospital visits and improve adherence. Healthcare providers are integrating home-based therapies into chronic disease management programs, further expanding accessibility. Biopharmaceutical companies are developing user-friendly delivery devices and prefilled pens to meet this need. This shift toward patient-centric administration enhances treatment compliance, reduces healthcare costs, and opens new market segments, particularly for chronic conditions requiring long-term therapy.

- For instance, Sanofi and Regeneron Pharmaceuticals have developed a 300 mg Dupixent pre-filled pen for subcutaneous self-administration at home, approved by the FDA for treating asthma and atopic dermatitis.

Key Challenges

High Treatment Costs and Reimbursement Barriers

Monoclonal antibody therapies are associated with high production costs, which translate into expensive treatments for patients. Limited insurance coverage and reimbursement constraints hinder accessibility, particularly for novel or complex therapies. Payers and healthcare systems often require rigorous cost-effectiveness evidence, slowing adoption. These financial barriers restrict patient access and challenge market growth, especially in outpatient and self-administered therapy segments. Companies must balance innovation with affordability and collaborate with payers to ensure broader coverage and sustainable market expansion.

Complex Regulatory Approval Processes

The monoclonal antibodies market faces challenges from stringent regulatory frameworks in the U.S., including lengthy clinical trials, safety evaluations, and approval timelines. Compliance with Good Manufacturing Practices (GMP) and evolving guidelines for biosimilars adds complexity to product development. Delays in regulatory approvals can impact market entry and revenue generation, while post-market surveillance requirements increase operational costs. Biopharmaceutical companies must invest in robust clinical and regulatory strategies to navigate these hurdles, making regulatory complexity a critical challenge for sustained market growth.

Regional Analysis

Northeast U.S.

The Northeast U.S. holds a significant share of 28% in the monoclonal antibodies therapeutics market, driven by advanced healthcare infrastructure and high concentration of leading biopharmaceutical companies. Strong R&D activities, robust clinical trial networks, and early adoption of innovative therapies contribute to regional growth. The presence of top-tier hospitals and oncology centers further enhances patient access to monoclonal antibody treatments. Additionally, state-level healthcare initiatives supporting chronic and rare disease management fuel demand. Rising investments in biotechnology research and growing awareness among patients and healthcare providers reinforce the Northeast’s leading position in the U.S. market.

Midwest U.S.

The Midwest region accounts for 22% of the U.S. monoclonal antibodies therapeutics market. The growth is supported by a strong network of academic medical centers and specialized hospitals focusing on oncology and autoimmune disorders. Increasing collaboration between research institutes and pharmaceutical companies accelerates the development and commercialization of monoclonal antibody therapies. Rising prevalence of chronic conditions and favorable reimbursement policies drive regional adoption. Additionally, investments in biopharma manufacturing facilities enhance local production and supply capabilities. The Midwest continues to benefit from technological advancements and clinical trial participation, strengthening its position in the national market.

South U.S.

The Southern U.S. represents 25% of the monoclonal antibodies therapeutics market, fueled by expanding healthcare facilities and increasing patient demand for targeted therapies. Rapid population growth, particularly in urban centers, and higher incidence of chronic diseases contribute to market expansion. The region witnesses growing adoption of subcutaneous and home-administered treatments, improving patient convenience and compliance. Collaboration between hospitals and specialty clinics, coupled with favorable state-level healthcare policies, supports wider access to monoclonal antibody therapies. Investments in biopharmaceutical research and manufacturing hubs further strengthen the South’s competitive position in the U.S. market.

West U.S.

The Western U.S. accounts for 25% of the market share, driven by the presence of leading biotechnology clusters and cutting-edge research institutions. High healthcare expenditure, early adoption of novel therapies, and a strong patient base for oncology and autoimmune treatments support growth. The region benefits from robust clinical trial activity and supportive regulatory frameworks facilitating faster therapy approvals. In addition, substantial investments in biopharmaceutical infrastructure and technology innovation enhance the development and distribution of monoclonal antibodies. Patient awareness programs and specialized healthcare centers further strengthen the West’s contribution to the overall U.S. market.

Market Segmentations:

By Sources

- Humanized mAbs

- Chimeric mAbs

- Others

By Therapeutic Area

- Oncology

- Autoimmune & Inflammatory Diseases

- Infectious Diseases

- Cardiovascular & Metabolic Disorders

- Neurological Disorders

- Others

By Route of Administration:

- Subcutaneous (SC)

- Intravenous (IV)

- Others

By Sales Channel

- Hospital Pharmacies

- Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By Region

- Northeast U.S.

- Mideast U.S.

- West U.S.

- South U.S.

Competitive Landscape

The competitive landscape of the U.S. Monoclonal Antibodies Therapeutics Market features key players such as F. Hoffmann-La Roche Ltd, Sanofi, Abbvie Inc., Bristol Myers Squibb Company, Novartis AG, AstraZeneca, Amgen Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc. These companies dominate the market through continuous product innovation, strategic collaborations, and expansions in manufacturing capabilities. They focus on developing advanced humanized and chimeric antibodies to address oncology, autoimmune, and infectious diseases. Investments in research and development, robust clinical trial pipelines, and regulatory approvals enhance their market positioning. Additionally, partnerships, mergers, and acquisitions strengthen their commercial footprint. Smaller biotech firms also contribute to competitive intensity by introducing niche therapies and biosimilars. Overall, the market remains highly dynamic, driven by innovation, strategic initiatives, and a growing demand for targeted monoclonal antibody therapies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hoffmann-La Roche Ltd

- Sanofi

- Abbvie Inc.

- Bristol Myers Squibb Company

- Novartis AG

- AstraZeneca

- Amgen Inc.

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Johnson & Johnson Services, Inc.

- Other Key Players

Recent Developments

- On October 22, 2025, Ipsen announced the acquisition of ImCheck Therapeutics for €350 million upfront, with milestone payments totaling up to €1 billion. The focus is on ICT01, a first-in-class monoclonal antibody for acute myeloid leukemia (AML), which has shown promising efficacy in Phase I/II trials.

- In February 2025, Novartis announced the acquisition of Anthos Therapeutics, a Boston-based, privately held, clinical-stage biopharmaceutical company, to advance the development of abelacimab, a late-stage medicine in development for the prevention of stroke and systemic embolism in patients with atrial fibrillation.

- In September 29, 2025, Genmab announced the acquisition of Merus for approximately $8 billion in cash. This acquisition gives Genmab access to petosemtamab, a late-stage experimental therapy for head and neck cancer, with potential market launch as early as 2027.

- In October 15, 2025, MilliporeSigma acquired the chromatography business of JSR Life Sciences to strengthen downstream processing solutions for monoclonal antibody purification and enhance capabilities in developing next-generation therapies.

Report Coverage

The research report offers an in-depth analysis based on Source, Therapeutic Area, Route of Administration, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising prevalence of cancer and chronic diseases.

- Increasing adoption of personalized medicine will drive demand for targeted therapies.

- Technological advancements in antibody engineering will enhance treatment efficacy and safety.

- Expansion of immuno-oncology therapies will create significant growth opportunities.

- Rising patient preference for subcutaneous and at-home administration will support market adoption.

- Strategic collaborations and partnerships among biopharmaceutical companies will strengthen the competitive landscape.

- Investment in clinical trials and R&D will accelerate the introduction of novel monoclonal antibodies.

- Government support and favorable healthcare policies will encourage broader access to therapies.

- Emerging biosimilars will provide cost-effective alternatives, increasing patient reach.

- Growing awareness among healthcare providers and patients will sustain long-term market expansion.