Market Overview

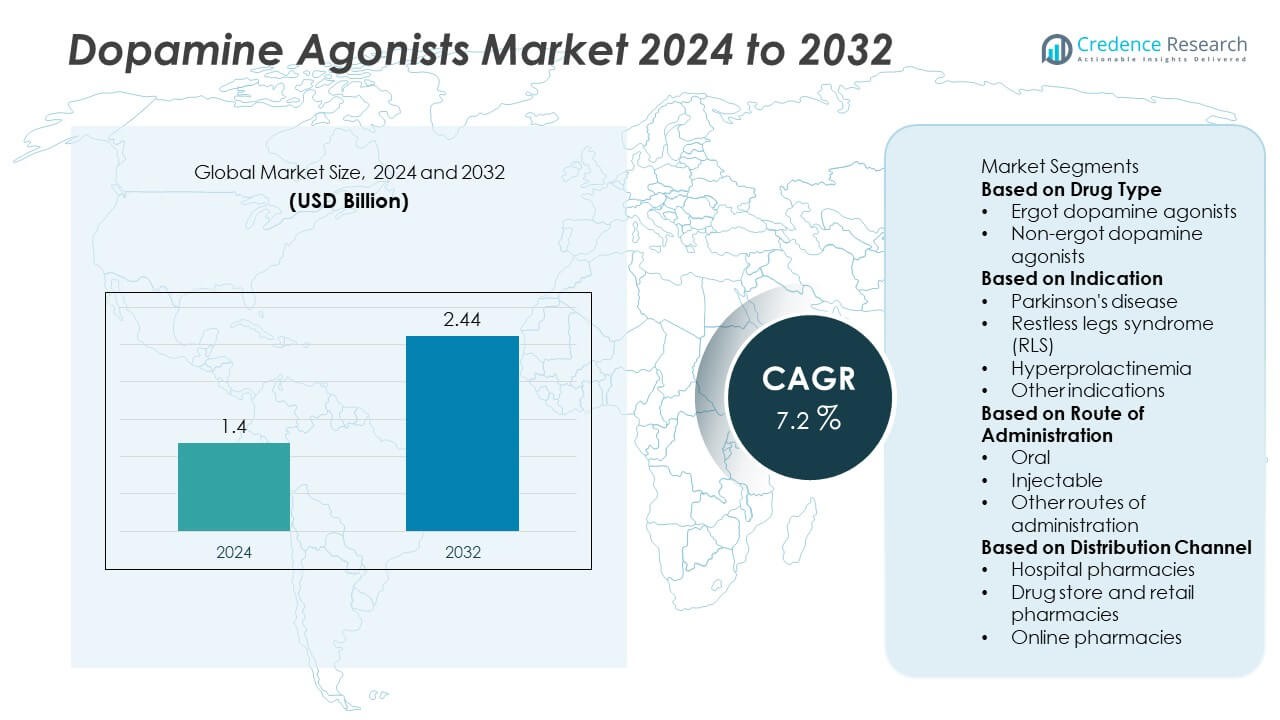

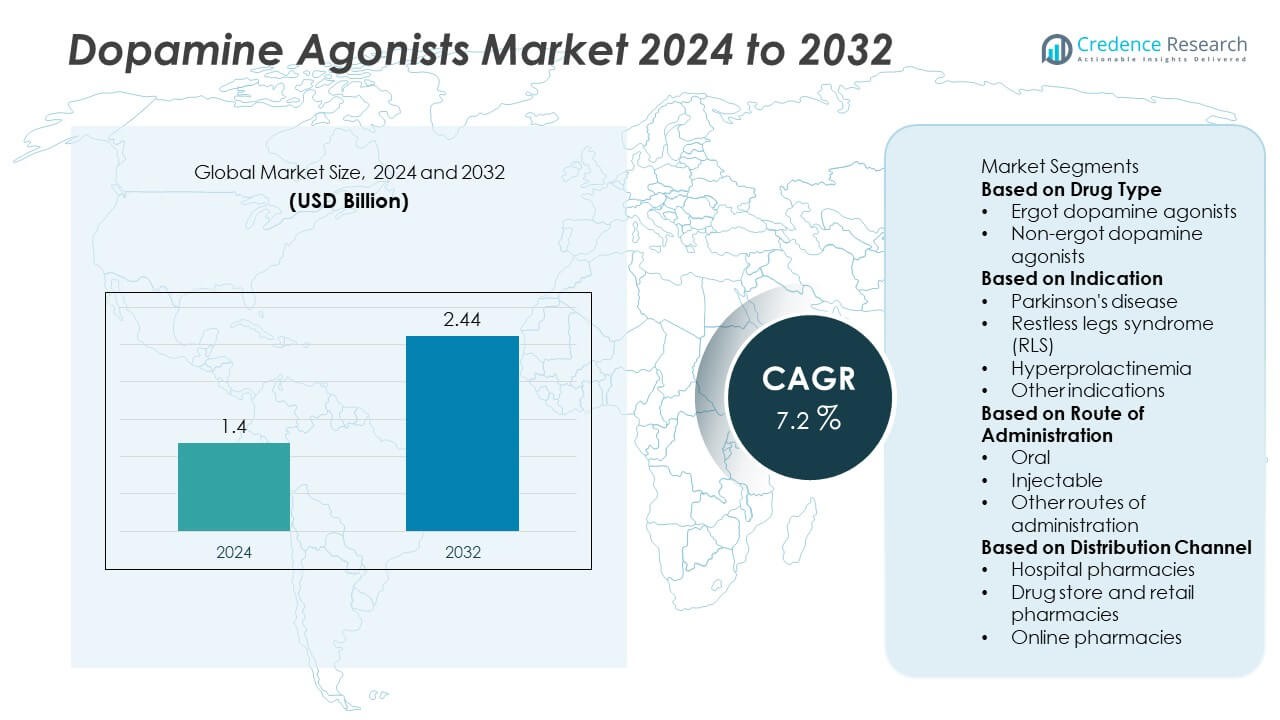

The Dopamine Agonists market was valued at USD 1.4 billion in 2024 and is projected to reach USD 2.44 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dopamine Agonists Market Size 2024 |

USD 1.4 Billion |

| Dopamine Agonists Market, CAGR |

7.2% |

| Dopamine Agonists Market Size 2032 |

USD 2.44 Billion |

The Dopamine Agonists market is led by major companies including Novartis, Pfizer, GlaxoSmithKline (GSK), Boehringer Ingelheim Pharmaceuticals, AbbVie, Kirin Holdings Company, Adamas Pharma, Amneal Pharmaceuticals, Bertek Pharmaceuticals (Mylan), and Avvisto Therapeutics (VeroScience). These players focus on advancing non-ergot and extended-release formulations to improve patient outcomes and treatment adherence in neurological disorders such as Parkinson’s disease and restless leg syndrome. North America dominated the market with a 38% share in 2024, driven by advanced healthcare infrastructure and high treatment adoption, followed by Europe with 30% and Asia-Pacific with 23%, supported by growing healthcare access and an expanding elderly population.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dopamine Agonists market was valued at USD 1.4 billion in 2024 and is projected to reach USD 2.44 billion by 2032, growing at a CAGR of 7.2%.

- Growth is driven by the rising prevalence of Parkinson’s disease and restless leg syndrome, along with increasing adoption of non-ergot and extended-release drug formulations.

- Key trends include growing investment in R&D for next-generation dopaminergic therapies and the expansion of generic drug availability across developing markets.

- Major players such as Novartis, Pfizer, and Boehringer Ingelheim lead through innovation, collaborations, and strategic acquisitions aimed at strengthening their neurological treatment portfolios.

- North America leads with a 38% share, followed by Europe with 30% and Asia-Pacific with 23%, while the non-ergot dopamine agonists segment holds 68% share, driven by better safety and long-term patient tolerance.

Market Segmentation Analysis:

By Drug Type

The non-ergot dopamine agonists segment dominated the Dopamine Agonists market in 2024 with a 68% share. These agents, including pramipexole and ropinirole, are preferred due to their improved safety profile and reduced cardiovascular risks compared to ergot derivatives. Their ability to provide sustained symptom control in Parkinson’s disease and restless leg syndrome drives adoption. Pharmaceutical advancements and fewer adverse effects have enhanced patient compliance. Ergot dopamine agonists continue to be used in limited cases, primarily where alternative therapies are less effective or unavailable.

- For instance, Boehringer Ingelheim’s Mirapex (pramipexole) has demonstrated significant efficacy in long-term Parkinson’s therapy, with some clinical studies in advanced-stage patients showing a reduction in “off” time by an average of approximately 2.5 hours per day compared to placebo.

By Indication

The Parkinson’s disease segment held the largest market share of 71% in 2024. The growing global prevalence of Parkinson’s, driven by aging populations and lifestyle factors, boosts demand for dopamine agonist therapies. These drugs are widely prescribed for managing motor fluctuations and reducing reliance on levodopa in early and advanced disease stages. Restless leg syndrome and hyperprolactinemia also represent significant treatment areas, benefiting from growing awareness and early diagnosis. Continuous innovation in drug delivery and dosage optimization further supports market expansion across neurological applications.

- For instance, AbbVie’s Duopa therapy, a carbidopa and levodopa intestinal gel, is an established treatment for advanced Parkinson’s patients through its advanced continuous delivery system, with clinical trials confirming its efficacy in improving mobility.

By Route of Administration

The oral segment accounted for 63% of the Dopamine Agonists market share in 2024. Oral formulations are preferred for their ease of administration, patient convenience, and cost-effectiveness. Extended-release tablets and capsules ensure consistent plasma levels and improved symptom management, contributing to better adherence. Injectable routes, including transdermal and subcutaneous forms, are gaining traction for patients requiring rapid or controlled delivery. Pharmaceutical innovation in sustained-release and targeted formulations continues to enhance therapeutic outcomes, supporting broader clinical adoption across varied neurological conditions.

Key Growth Drivers

Rising Prevalence of Parkinson’s Disease and Neurological Disorders

The increasing prevalence of Parkinson’s disease and related neurological conditions is a major driver of the Dopamine Agonists market. An aging global population and improved diagnostic capabilities have led to higher treatment rates. Dopamine agonists play a vital role in managing motor dysfunction and reducing dependency on levodopa in early disease stages. Growing awareness of early intervention and improved access to neurological care continue to expand the patient base, supporting sustained demand for both branded and generic dopamine agonist therapies.

- For instance, Teva Pharmaceuticals generic ropinirole tablets are distributed globally, with clinical studies consistently showing improvements on the UPDRS scale for Parkinson’s disease, reflecting the industry’s role in enhancing the availability of effective dopamine agonist therapies worldwide.

Advancements in Drug Formulation and Delivery Systems

Continuous innovation in drug formulation, including extended-release and transdermal delivery systems, is boosting market growth. These advancements improve drug bioavailability, enhance patient compliance, and reduce side effects. Pharmaceutical companies are focusing on developing long-acting formulations to provide steady symptom control, particularly for Parkinson’s disease and restless leg syndrome. The shift toward patient-centric therapeutics with better tolerability profiles strengthens the market position of next-generation dopamine agonists, increasing adoption across both developed and emerging healthcare systems.

- For instance, UCB’s Neupro transdermal patch, containing rotigotine, offers 24-hour continuous dopaminergic stimulation. The RECOVER trial, which was published in 2010, showed that Neupro significantly improved early-morning motor symptoms compared to a placebo, with a treatment difference of 3.1 points on the UPDRS Part III scale.

Growing Research and Development Investments

Rising R&D spending on neurodegenerative disease treatments is accelerating innovation in dopamine agonist therapy. Biopharmaceutical companies are developing novel compounds with improved selectivity and reduced toxicity. Strategic collaborations and clinical trials focused on combination therapies aim to enhance therapeutic outcomes. Government and private funding for neurological research further stimulate market expansion. These efforts are improving the efficacy of dopamine agonists and expanding their application range beyond Parkinson’s disease to other dopaminergic disorders, reinforcing long-term market growth prospects.

Key Trends & Opportunities

Shift Toward Non-Ergot and Extended-Release Formulations

A notable trend is the shift toward non-ergot dopamine agonists, driven by their safer profiles and lower risk of cardiac complications. Extended-release formulations are gaining popularity for their convenience and sustained symptom control. These developments enhance patient adherence and reduce fluctuations in drug concentration. Manufacturers are capitalizing on this shift by expanding their portfolios with once-daily or transdermal options, addressing unmet needs in chronic neurological care while improving the overall therapeutic experience.

- For instance, Kyowa Kirin’s Nourianz (istradefylline) is prescribed as an adjunctive treatment to levodopa/carbidopa for adult Parkinson’s patients experiencing “off” episodes, improving daily “on” time without troublesome dyskinesia by an average of 0.68 hours (41 minutes) in pooled Phase III trials.

Rising Adoption in Emerging Economies

Emerging markets such as India, China, and Brazil present significant growth opportunities for dopamine agonists. Increasing healthcare infrastructure, awareness of neurological diseases, and government support for affordable medication access drive expansion. Generic manufacturers are introducing cost-effective alternatives, making treatment more accessible. As urban populations grow and healthcare expenditure increases, these regions are expected to contribute substantially to market share, offering strong potential for long-term business development and geographic diversification for leading pharmaceutical companies.

- For instance, Dr. Reddy’s Laboratories markets pramipexole and ropinirole tablets as part of its generics portfolio in countries such as India and other emerging markets, aiming to improve accessibility in regional public health programs.

Key Challenges

Adverse Effects and Safety Concerns

Despite their benefits, dopamine agonists are associated with side effects such as hallucinations, sleep disturbances, and impulse control disorders. These safety concerns often limit long-term patient compliance. Physicians must carefully balance efficacy with risk management, especially among elderly patients. The need for close monitoring and dose adjustment adds complexity to treatment. Manufacturers are addressing this challenge by developing targeted and extended-release formulations that reduce side effects, yet safety issues remain a significant barrier to wider adoption.

Patent Expirations and Generic Competition

Patent expirations of major dopamine agonist brands are intensifying market competition. The entry of generic versions has driven price reductions, pressuring revenue growth for established pharmaceutical companies. While generics improve accessibility, they also reduce incentives for large-scale R&D investments. Companies are responding through reformulation, lifecycle management, and partnerships to sustain profitability. However, balancing innovation with cost efficiency remains challenging as market dynamics increasingly favor affordable, high-quality alternatives.

Regional Analysis

North America

North America dominated the Dopamine Agonists market with a 38% share in 2024. The region’s growth is driven by a high prevalence of Parkinson’s disease, advanced healthcare infrastructure, and strong awareness of neurological disorders. The U.S. leads the market, supported by rapid adoption of innovative formulations and the presence of major pharmaceutical companies. Increasing investments in research and development, along with a growing elderly population, continue to drive demand. Favorable reimbursement policies and early access to novel therapies further strengthen the region’s leadership in dopamine agonist treatments.

Europe

Europe accounted for a 30% share of the Dopamine Agonists market in 2024. The region benefits from a strong network of neurology centers, well-established pharmaceutical industries, and government support for neurodegenerative disease management. Countries such as Germany, the U.K., and France are key contributors to market growth. Increasing focus on patient-centric treatment options and the development of non-ergot drugs are fueling adoption. Ongoing clinical trials and public funding for Parkinson’s research further support Europe’s position as a major hub for advanced dopaminergic therapy innovation.

Asia-Pacific

Asia-Pacific held a 23% share of the Dopamine Agonists market in 2024. The region’s rapid expansion is driven by growing awareness of neurological disorders, improving healthcare access, and rising elderly populations in China, Japan, and India. Pharmaceutical companies are expanding their presence through affordable generic drugs and partnerships with local distributors. Government initiatives aimed at improving neurological care infrastructure further enhance market prospects. Increasing diagnosis rates and adoption of extended-release formulations contribute to the region’s steady growth in both hospital and retail pharmaceutical sectors.

Latin America

Latin America captured a 6% share of the Dopamine Agonists market in 2024. Rising healthcare spending, expanding access to neurological specialists, and greater availability of branded generics support market growth. Brazil and Mexico are leading contributors, driven by rising Parkinson’s disease incidence and increased treatment awareness. However, limited reimbursement coverage and affordability constraints hinder full market penetration. Pharmaceutical companies are focusing on cost-effective distribution and educational programs to strengthen patient access and improve compliance across urban and semi-urban areas within the region.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the Dopamine Agonists market in 2024. Market expansion is supported by improving healthcare systems and rising diagnosis of neurological conditions in the UAE, Saudi Arabia, and South Africa. Increasing collaborations between global drug manufacturers and local healthcare providers are enhancing treatment availability. However, limited awareness and high therapy costs restrict widespread adoption. Growing investments in hospital infrastructure and government health initiatives aimed at chronic disease management are expected to create gradual growth opportunities across the region.

Market Segmentations:

By Drug Type

- Ergot dopamine agonists

- Non-ergot dopamine agonists

By Indication

- Parkinson’s disease

- Restless legs syndrome (RLS)

- Hyperprolactinemia

- Other indications

By Route of Administration

- Oral

- Injectable

- Other routes of administration

By Distribution Channel

- Hospital pharmacies

- Drug store and retail pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dopamine Agonists market includes key players such as Novartis, Pfizer, GlaxoSmithKline (GSK), Boehringer Ingelheim Pharmaceuticals, AbbVie, Kirin Holdings Company, Adamas Pharma, Amneal Pharmaceuticals, Bertek Pharmaceuticals (Mylan), and Avvisto Therapeutics (VeroScience). These companies compete through product innovation, strategic collaborations, and expansion of therapeutic portfolios targeting Parkinson’s disease, restless leg syndrome, and other neurological disorders. Leading players focus on developing non-ergot and extended-release formulations with improved safety and efficacy. Mergers and acquisitions strengthen market positions and enhance global distribution networks. Continuous investment in research and clinical trials supports pipeline diversification, particularly in next-generation dopaminergic compounds. Additionally, generic manufacturers are expanding accessibility by introducing cost-effective alternatives, intensifying competition across both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Novartis

- Pfizer

- GlaxoSmithKline (GSK)

- Boehringer Ingelheim Pharmaceuticals

- AbbVie

- Kirin Holdings Company

- Adamas Pharma

- Amneal Pharmaceuticals

- Bertek Pharmaceuticals (Mylan)

- Avvisto Therapeutics (VeroScience)

Recent Developments

- In August 2024, AbbVie completed its acquisition of Cerevel Therapeutics, bringing the company and its promising Parkinson’s therapy under the AbbVie umbrella.

- In August 2024, Avvisto Therapeutics posted an updated Cycloset patient brochure and savings details.

- In 2024, Boehringer Ingelheim revised the Mirapex ER (pramipexole) prescribing information in the US.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Indication, Route of Administration, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dopamine agonists will rise with the growing incidence of Parkinson’s disease worldwide.

- Development of extended-release and transdermal formulations will improve patient compliance.

- Non-ergot dopamine agonists will continue to dominate due to better safety profiles.

- Increasing focus on personalized neurology treatments will drive innovation in drug development.

- Collaborations between pharmaceutical companies and research institutions will enhance product pipelines.

- Expansion of generic drug manufacturing will make therapies more affordable in emerging markets.

- Advancements in biotechnology will lead to more targeted and effective dopaminergic therapies.

- Growing elderly populations will increase treatment demand across all major regions.

- Regulatory approvals for novel formulations will strengthen market penetration and competitiveness.

- North America and Asia-Pacific will remain key growth regions, supported by advanced healthcare and expanding access.