Market Overview

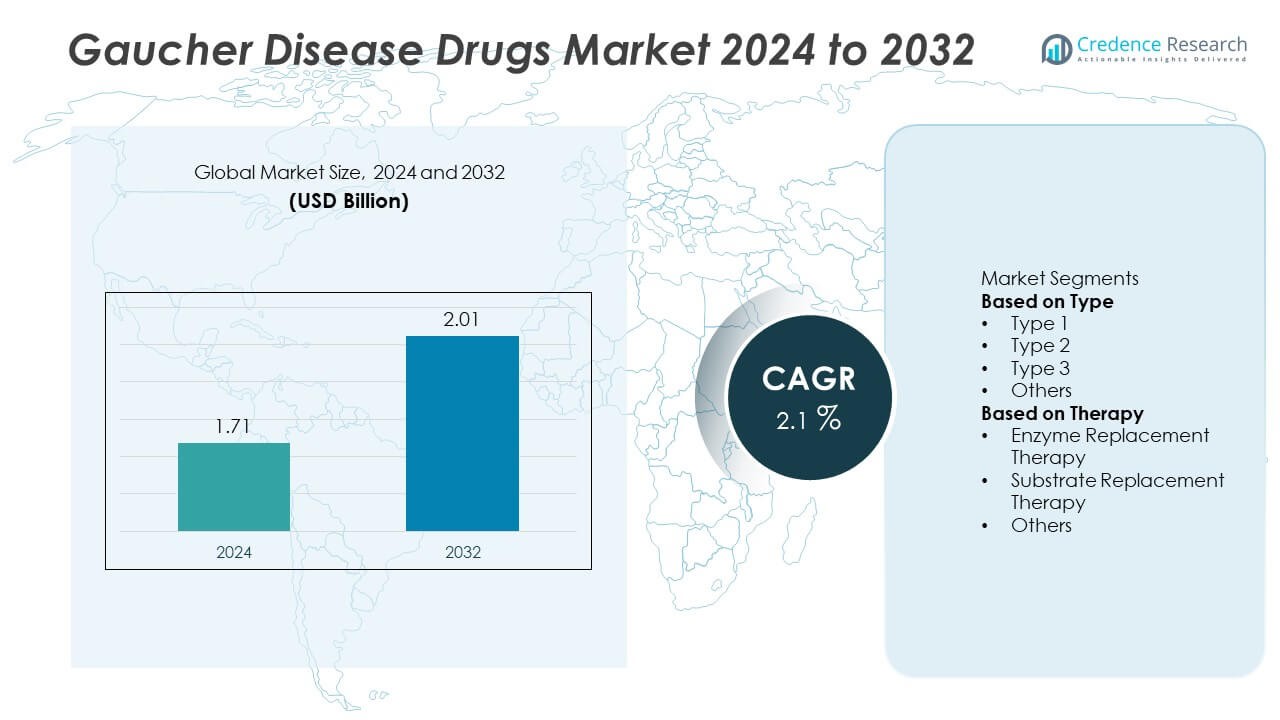

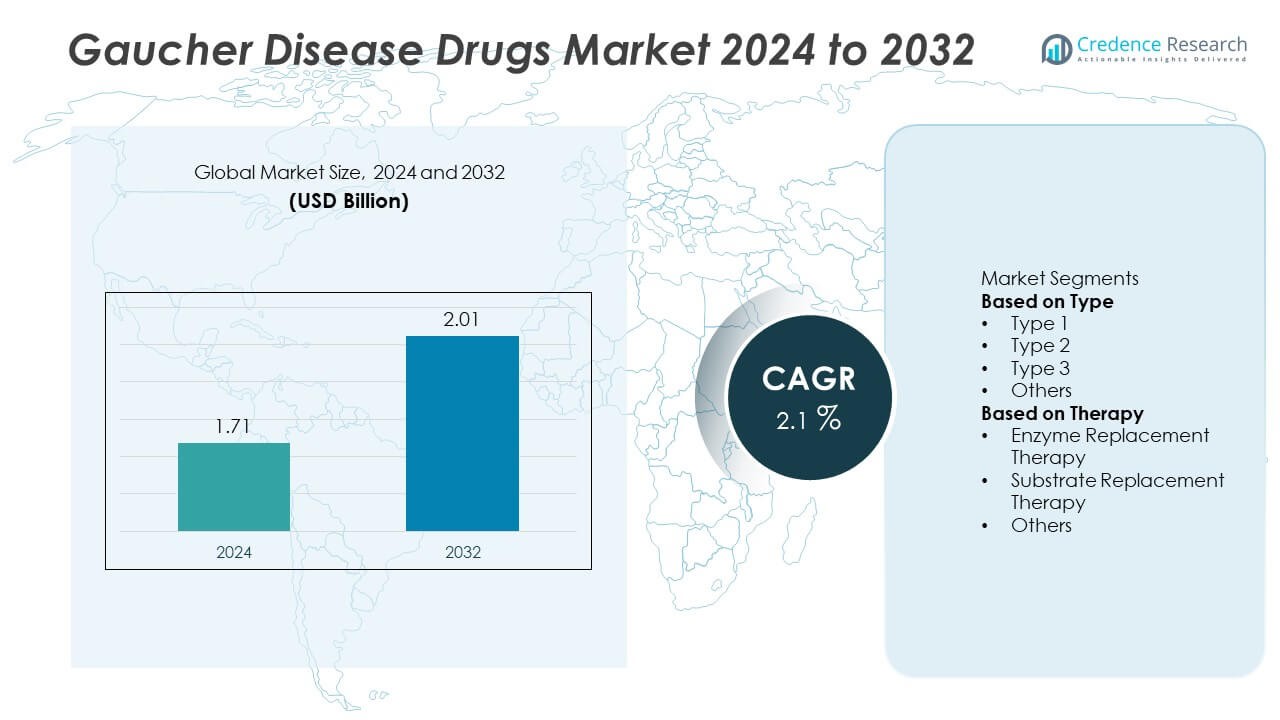

The Gaucher Disease Drugs market was valued at USD 1.71 billion in 2024 and is projected to reach USD 2.01 billion by 2032, growing at a CAGR of 2.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gaucher Disease Drugs market Size 2024 |

USD 1.71 Billion |

| Gaucher Disease Drugs market, CAGR |

2.1% |

| Gaucher Disease Drugs market Size 2032 |

USD 2.01 Billion |

The Gaucher Disease Drugs market is driven by leading companies such as Sanofi, Takeda Pharmaceutical Company Limited, Pfizer Inc., Johnson & Johnson Services, Inc., ERAD Therapeutics, BioMarin Pharmaceutical Inc., Amicus Therapeutics, Protalix BioTherapeutics, Greenovation Biotech GmbH, and Genzyme Corporation. These players focus on developing enzyme replacement and substrate reduction therapies that improve patient outcomes and treatment efficiency. North America led the global market with a 43% share in 2024, supported by strong healthcare infrastructure, favorable reimbursement systems, and early adoption of innovative therapies. Europe followed with a 30% share, driven by government-backed orphan drug programs and active R&D in rare disease treatment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Gaucher Disease Drugs market was valued at USD 1.71 billion in 2024 and is projected to reach USD 2.01 billion by 2032, growing at a CAGR of 2.1%.

- Rising prevalence of rare genetic disorders and advancements in enzyme and substrate replacement therapies are driving global market growth.

- The enzyme replacement therapy segment led the market with a 65% share, supported by strong clinical efficacy and widespread regulatory approvals.

- Leading players such as Sanofi, Takeda, and Pfizer dominate through extensive R&D, established product lines, and strategic partnerships focused on novel biologic development.

- North America accounted for 43% share, followed by Europe at 30% and Asia Pacific at 17%, driven by strong healthcare infrastructure, supportive policies for orphan drugs, and increasing treatment access in developing markets.

Market Segmentation Analysis:

By Type

The Type 1 segment dominated the Gaucher Disease Drugs market in 2024 with a 72% share. Type 1, the non-neuronopathic form, is the most common and treatable variant, driving strong demand for enzyme replacement and substrate reduction therapies. Patients with Type 1 Gaucher disease often experience manageable symptoms such as anemia and organ enlargement, which respond well to current medications like imiglucerase and velaglucerase alfa. The growing awareness of early genetic screening, coupled with improved diagnostic techniques, continues to expand treatment access, especially in developed healthcare markets across North America and Europe.

- For instance, Sanofi Genzyme’s Cerezyme therapy, used in over 90 countries, has demonstrated significant long-term improvements in hematologic and visceral symptoms for Type 1 Gaucher disease. A clinical trial showed an 11% average decrease in liver volume and a 1.9 g/dL average increase in hemoglobin after 6 months of dosing.

By Therapy

The enzyme replacement therapy (ERT) segment held a leading 65% share of the Gaucher Disease Drugs market in 2024. ERT remains the gold standard treatment due to its proven efficacy in managing hematologic and visceral symptoms. Drugs such as Cerezyme, VPRIV, and Elelyso dominate the segment owing to their long-term effectiveness and clinical safety profiles. The increasing adoption of recombinant enzyme products and government support for rare disease treatments are driving growth. Meanwhile, substrate replacement therapy (SRT) is gaining momentum as an oral alternative, offering improved convenience and adherence among patients with mild to moderate disease forms.

- For instance, Protalix BioTherapeutics reported that in one study, its Elelyso (taliglucerase alfa) reduced spleen volume by an average of 50.1% (30 U/kg dose) and 64.6% (60 U/kg dose) in treatment-naive adult patients after 36 months of treatment.

Key Growth Drivers

Rising Prevalence of Genetic and Rare Diseases

The growing prevalence of genetic disorders, including Gaucher disease, is driving demand for advanced treatment options. Improved diagnostic tools, newborn screening programs, and greater clinical awareness have led to earlier detection. This has increased patient access to effective therapies, particularly in developed markets. Pharmaceutical companies are expanding R&D efforts to develop next-generation enzyme and substrate therapies, addressing both efficacy and safety needs. The rising patient registry initiatives also support data-driven development and targeted treatment strategies worldwide.

- For instance, Takeda Pharmaceutical operates the Gaucher Outcomes Survey (GOS), a long-term observational registry initiated by Shire in 2010 to evaluate the effectiveness of velaglucerase alfa and gain a better understanding of the natural history of Gaucher disease.

Advancements in Enzyme and Substrate Therapy

Continuous innovation in enzyme replacement therapy (ERT) and substrate reduction therapy (SRT) is boosting market growth. New formulations such as recombinant enzymes and oral SRT drugs are improving treatment convenience and patient compliance. These therapies have shown enhanced pharmacokinetics, reduced immunogenicity, and better outcomes in managing organ and hematologic complications. Global biopharma companies are also focusing on next-generation biologics and small-molecule therapies, further diversifying treatment options for Gaucher disease patients.

- For instance, Amicus Therapeutics developed the two-component therapy, cipaglucosidase alfa and miglustat, which acts to deliver a stabilized recombinant enzyme for enhanced cellular uptake in patients with Pompe disease.

Increasing Government and Institutional Support for Rare Disease Treatment

Governments and health organizations are increasingly supporting rare disease management through reimbursement programs and regulatory incentives. Policies promoting orphan drug development have accelerated new product approvals, especially in the U.S. and Europe. Financial assistance and national health coverage are making advanced Gaucher disease treatments more accessible. In addition, nonprofit organizations and patient advocacy groups are raising awareness, funding research, and promoting early diagnosis, thereby contributing to broader treatment adoption across multiple regions.

Key Trends and Opportunities

Emergence of Gene Therapy and Novel Biologics

Gene therapy is emerging as a transformative trend in the Gaucher Disease Drugs market. Research on adeno-associated virus (AAV)-based delivery systems and genome editing offers potential for long-term correction of glucocerebrosidase deficiency. Biopharmaceutical firms are investing in preclinical and clinical programs aimed at achieving one-time curative treatments. Additionally, advancements in biologics, such as monoclonal antibodies and improved recombinant enzymes, are expanding therapeutic possibilities, signaling a shift toward precision and personalized medicine approaches.

- For instance, BioMarin Pharmaceutical previously had an AAV-based gene therapy candidate, BMN 293, for hypertrophic cardiomyopathy, which demonstrated functional improvements in preclinical mouse models before being discontinued.

Expansion in Emerging Markets and Digital Health Integration

Expanding healthcare access and rising awareness in emerging markets such as India, China, and Brazil are creating new growth opportunities. Pharmaceutical companies are partnering with local distributors and governments to improve drug availability and affordability. Digital health platforms are enhancing patient management through remote monitoring and adherence tracking. These developments are bridging gaps in rare disease care, supporting better clinical outcomes, and driving global market expansion over the forecast period.

- For instance, Takeda Pharmaceutical has launched a diagnostic program, ILLUMINATE, in India to aid in the early detection of Lysosomal Storage Disorders, including Gaucher disease. The program, which is managed independently by PerkinElmer, aims to improve diagnostic pathways and outcomes in centers across ten states.

Key Challenges

High Cost of Treatment and Limited Accessibility

The high cost of enzyme and substrate replacement therapies remains a significant challenge in the Gaucher Disease Drugs market. Treatments often exceed affordability for patients without insurance or reimbursement coverage. This limits accessibility in low- and middle-income countries. Additionally, the chronic nature of therapy requires lifelong treatment, increasing overall healthcare expenditure. Manufacturers face mounting pressure to reduce pricing through biosimilars, tiered pricing strategies, and government-supported access programs to ensure equitable treatment availability.

Supply Chain and Manufacturing Complexity

Manufacturing biologics such as recombinant enzymes involves high complexity, strict quality standards, and costly infrastructure. Any disruption in production or supply chain logistics can delay patient treatment and impact revenue. Cold chain requirements further add operational challenges, particularly in regions with underdeveloped healthcare systems. Companies must invest in scalable manufacturing and robust distribution networks to ensure a consistent global drug supply while maintaining regulatory compliance and product quality.

Regional Analysis

North America

North America dominated the Gaucher Disease Drugs market in 2024 with a 43% share. The region’s leadership is supported by strong healthcare infrastructure, advanced diagnostic capabilities, and favorable reimbursement policies for rare disease treatments. The United States holds the largest market portion, driven by high awareness, ongoing clinical research, and the presence of major biopharmaceutical players such as Sanofi and Takeda. Increasing adoption of enzyme and substrate replacement therapies, coupled with supportive regulatory frameworks like the Orphan Drug Act, continues to strengthen regional market growth. Canada’s growing investment in genetic disease management also supports consistent expansion.

Europe

Europe accounted for a 30% share of the Gaucher Disease Drugs market in 2024. The region benefits from well-established rare disease treatment programs and strong government support for orphan drug development. Countries such as Germany, the United Kingdom, and France are leading due to robust healthcare systems and widespread patient access to enzyme replacement therapies. The European Medicines Agency’s (EMA) incentives for orphan drugs encourage R&D investment. Ongoing clinical trials, expanding newborn screening initiatives, and growing patient registries are driving steady adoption across both Western and Eastern Europe.

Asia Pacific

Asia Pacific held a 17% share of the Gaucher Disease Drugs market in 2024 and is emerging as the fastest-growing regional market. Increasing awareness, improving healthcare infrastructure, and expanding access to orphan drugs are fueling market growth in countries such as Japan, China, and India. Government-led healthcare reforms and collaborations with global pharmaceutical firms are enhancing treatment availability. Japan leads regional adoption due to strong research capabilities and favorable reimbursement systems. Rising demand for affordable therapies and growing clinical trial participation across developing economies further accelerate the region’s market expansion.

Latin America

Latin America captured a 6% share of the Gaucher Disease Drugs market in 2024. The region is witnessing gradual growth driven by increased awareness of genetic disorders and expanding access to specialty healthcare. Brazil and Mexico are the primary contributors due to improving healthcare funding and partnerships with international drug manufacturers. Public health initiatives promoting early diagnosis and the use of enzyme replacement therapies are gaining traction. However, high treatment costs and limited reimbursement coverage continue to challenge widespread adoption, particularly in lower-income countries within the region.

Middle East and Africa

The Middle East and Africa together accounted for a 4% share of the Gaucher Disease Drugs market in 2024. The region’s growth is driven by increasing investment in rare disease programs and the introduction of orphan drug frameworks. Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the UAE, are enhancing access through public–private healthcare partnerships. Awareness campaigns and genetic counseling initiatives are improving early diagnosis rates. However, limited availability of specialized treatment centers and high therapy costs continue to restrict adoption across several parts of Africa, keeping the market moderately concentrated in developed urban regions.

Market Segmentations:

By Type

- Type 1

- Type 2

- Type 3

- Others

By Therapy

- Enzyme Replacement Therapy

- Substrate Replacement Therapy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Gaucher Disease Drugs market includes key players such as Sanofi, Takeda Pharmaceutical Company Limited, Pfizer Inc., Johnson & Johnson Services, Inc., ERAD Therapeutics, BioMarin Pharmaceutical Inc., Amicus Therapeutics, Protalix BioTherapeutics, Greenovation Biotech GmbH, and Genzyme Corporation. These companies are actively developing enzyme replacement and substrate reduction therapies to improve treatment efficacy and patient outcomes. Sanofi and Takeda dominate the market through their well-established products like Cerezyme and VPRIV, supported by global distribution networks. Emerging players such as Protalix and ERAD Therapeutics are focusing on novel biologics and oral formulations to enhance accessibility and reduce treatment burden. Strategic collaborations, R&D investments, and orphan drug designations are strengthening product pipelines and accelerating innovation. As competition intensifies, companies are emphasizing personalized medicine approaches, biosimilar development, and expanded market presence across both developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Protalix BioTherapeutics continued its long-standing focus on its plant cell-based expression system, ProCellEx, to lower the production costs for its recombinant proteins.

- In May 2025, ERAD Therapeutics disclosed its investigational biologic approach that crosses the blood-brain barrier to treat neurological complications of Gaucher disease, targeting both systemic and CNS manifestations.

- In January 2025, Sanofi announced progress in its Venglustat (GCS inhibitor) program for neuronopathic Gaucher disease (Type 3), advancing into late-stage trials.

- In 2025, Johnson & Johnson (via its Actelion subsidiary) supported clinical patient registry studies tracking long-term outcomes with enzyme replacement therapies in Gaucher patients.

Report Coverage

The research report offers an in-depth analysis based on Type, Therapy and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth due to increasing awareness and early diagnosis of Gaucher disease.

- Enzyme replacement and substrate reduction therapies will remain the main treatment focus.

- Research in gene therapy will create opportunities for long-term and potentially curative solutions.

- Government initiatives supporting rare disease treatment will enhance patient access to therapies.

- North America and Europe will maintain dominance due to advanced healthcare infrastructure and reimbursement support.

- Asia Pacific will witness the fastest expansion with improving healthcare and growing pharmaceutical investments.

- Strategic partnerships between biotech firms and research institutions will accelerate innovation.

- Biosimilars will emerge as cost-effective alternatives, improving affordability in developing markets.

- Personalized treatment approaches based on genetic profiling will improve patient outcomes.

- Digital health integration and real-world data monitoring will enhance treatment efficiency and compliance.