Market Overview

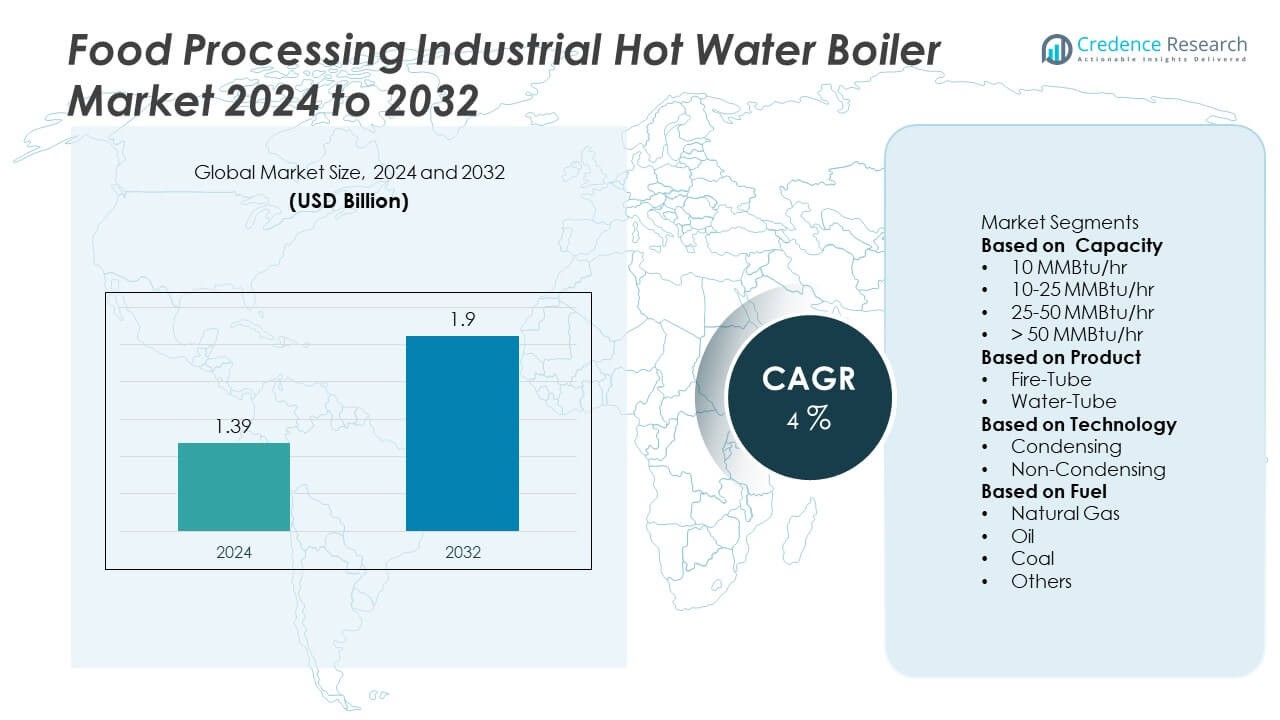

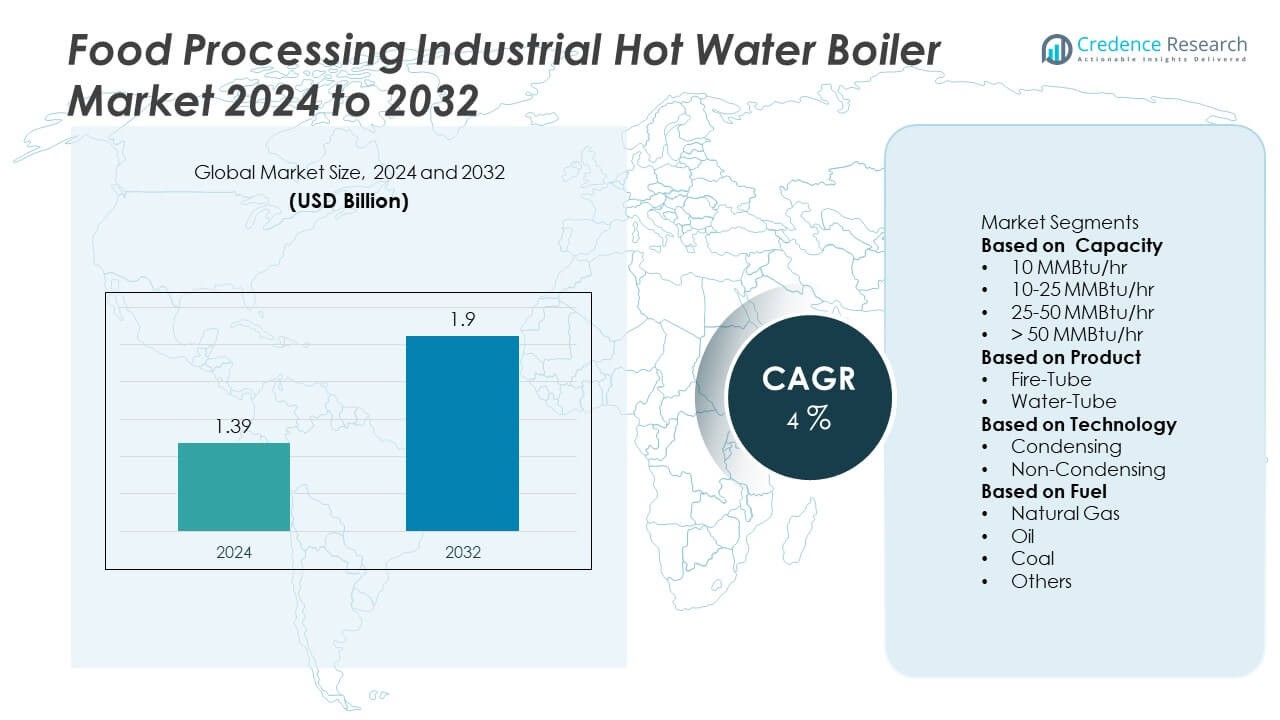

The Food Processing Industrial Hot Water Boiler Market was valued at USD 1.39 billion in 2024 and is projected to reach USD 1.9 billion by 2032, growing at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Processing Industrial Hot Water Boiler Market Size 2024 |

USD 1.39 Billion |

| Food Processing Industrial Hot Water Boiler Market, CAGR |

4% |

| Food Processing Industrial Hot Water Boiler Market Size 2032 |

USD 1.9 Billion |

The Food Processing Industrial Hot Water Boiler Market is led by major companies including Hurst Boiler & Welding, Clayton Industries, FERROLI, Fulton, Johnston Boiler, Bosch Thermotechnology, Cleaver-Brooks, Hoval, Babcock & Wilcox Enterprises, and Forbes Marshall. These players focus on energy efficiency, automation, and compliance with food safety and emission standards. North America dominated the market with a 36% share in 2024, driven by strong industrial infrastructure and modernization of food processing facilities. Europe followed with 30%, supported by strict environmental regulations and adoption of condensing technology. Asia-Pacific held 27%, emerging as the fastest-growing region due to industrial expansion and government incentives promoting sustainable energy systems in food manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Processing Industrial Hot Water Boiler Market was valued at USD 1.39 billion in 2024 and is projected to reach USD 1.9 billion by 2032, growing at a CAGR of 4%.

- Growth is driven by increasing demand for energy-efficient and low-emission heating systems across food and beverage processing plants.

- Condensing boiler technology and automation trends are reshaping the industry, improving efficiency and reducing operational costs for manufacturers.

- Key players such as Hurst Boiler & Welding, Bosch Thermotechnology, Cleaver-Brooks, and Fulton focus on innovation, digital monitoring, and compliance with sustainability regulations.

- North America led with 36% share in 2024, followed by Europe at 30% and Asia-Pacific at 27%, while the 10–25 MMBtu/hr capacity segment dominated with 44% share due to its suitability for medium-scale food production facilities.

Market Segmentation Analysis:

By Capacity

The 10–25 MMBtu/hr capacity segment dominated the Food Processing Industrial Hot Water Boiler Market with a 44% share in 2024. This capacity range is widely used in medium to large-scale food processing facilities for heating, sterilization, and cleaning applications. It offers an optimal balance between efficiency and output, making it suitable for operations such as dairy processing, beverage production, and meat packaging. Rising demand for continuous and stable hot water supply in automated production lines and compliance with hygiene standards drive adoption within this capacity range.

- For instance, Clayton delivered a skid-mounted E-100 steam generation package (≈10 M Btu/hr equivalent) to a confectioner, which ramped from cold start to full output within 5 minutes.

By Product

Fire-tube boilers held the largest share of 58% in 2024, driven by their compact design, lower maintenance costs, and suitability for low to medium-pressure applications in food processing. They provide efficient heat transfer, quick startup, and consistent performance for operations requiring steady thermal energy. Water-tube boilers, while used in high-capacity facilities, remain secondary due to higher installation and maintenance costs. Growing modernization of small and mid-sized food plants continues to favor fire-tube boilers, especially in bakery, beverage, and ready-meal manufacturing sectors.

- For instance, Cleaver-Brooks installed three CBEX fire-tube boilers with advanced controls and a Master Panel in a food & beverage plant, enabling centralized control of steam generation.

By Technology

Condensing boilers accounted for a 55% share in 2024, leading the market due to superior thermal efficiency and lower emissions. These systems recover latent heat from exhaust gases, reducing fuel consumption and improving sustainability performance in food processing operations. Non-condensing boilers still serve traditional facilities but are gradually being replaced by energy-efficient models. The industry’s focus on sustainability, coupled with government incentives for low-emission equipment, continues to drive widespread adoption of condensing technology across modern food production facilities worldwide.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Systems

Food and beverage manufacturers are increasingly adopting energy-efficient hot water boilers to reduce operational costs and carbon emissions. Modern condensing boilers with advanced heat recovery systems offer higher thermal efficiency and lower fuel consumption. Growing emphasis on sustainability and compliance with global energy efficiency regulations is accelerating replacement of traditional units. The need for consistent, controlled heating in processing and cleaning operations continues to drive adoption across dairy, beverage, and meat processing industries.

- For instance, Arla Foods installed a new electric boiler at its Danmark Protein facility in Videbæk in February 2025. This project is expected to cut annual CO2e emissions by an estimated 3,500 tonnes, with the figure set to rise when fully operational.

Expansion of Processed Food Manufacturing Facilities

Rapid industrialization and expansion of food production capacities are key growth drivers for the market. Companies are upgrading their processing lines with modern hot water boiler systems to meet hygiene and safety standards. Rising global consumption of packaged and ready-to-eat foods has increased the demand for reliable heat supply. Investments in automation and continuous production systems further support the integration of high-performance boilers into new and existing plants.

- For instance, Ingredion invested $100 million in its Indianapolis plant to install an energy cogeneration system that improves operational efficiency, increases reliability, and reduces greenhouse gas emissions. Ingredion’s former Stockton plant was sold to Alto Ingredients in 2021, and the Indianapolis plant is the focus of current cogeneration efforts.

Government Regulations Promoting Sustainable Operations

Environmental regulations promoting low-emission and energy-efficient equipment are driving market growth. Governments are encouraging the use of cleaner fuels and condensing boiler systems to minimize greenhouse gas emissions. Incentives and subsidies for green energy projects support adoption, especially in Europe and North America. Compliance with standards related to food safety and energy management, such as ISO 50001, also boosts demand for technologically advanced boiler systems across industrial food processing facilities.

Key Trends & Opportunities

Adoption of Condensing and Hybrid Boiler Technologies

The industry is witnessing a growing shift toward condensing and hybrid boiler systems that optimize fuel efficiency and reduce emissions. Manufacturers are focusing on systems that combine gas, steam, and waste heat recovery to maximize thermal output. These advanced boilers meet both sustainability targets and operational reliability standards. The trend is particularly strong in developed markets where industries are prioritizing long-term energy savings and regulatory compliance.

- For instance, a dairy facility replaced a conventional boiler with a condensing unit paired with a heat exchanger to recover heat from flue gas, a proven technology in the food and beverage industry.

Integration of Automation and IoT-Based Monitoring

Smart automation and IoT-enabled control systems are emerging as major opportunities for market growth. These technologies allow remote performance monitoring, predictive maintenance, and real-time energy management. Automation enhances efficiency, reduces downtime, and ensures consistent heating for sensitive food processing tasks. Manufacturers are investing in digital control interfaces and data-driven diagnostics to offer intelligent boiler systems tailored to large-scale food plants.

- For instance, Miura’s steam boilers use the BL Micro Controller, which monitors key metrics and sends alerts via cellular and other means through the Miura Online Maintenance (MOM) system to proactively identify anomalies.

Key Challenges

High Initial Investment and Installation Costs

The significant upfront cost of installing advanced boiler systems remains a major barrier for small and mid-sized food processors. Energy-efficient and condensing models, while cost-effective in the long term, require high initial capital for equipment, piping, and automation integration. This cost sensitivity limits adoption in emerging economies. Manufacturers are addressing this by offering modular systems and financing solutions to make upgrades more accessible.

Operational Safety and Maintenance Concerns

Hot water boilers in food processing facilities require strict maintenance and safety compliance. Improper operation can lead to system failures, pressure hazards, or hygiene risks. Maintaining consistent performance in high-demand production environments also increases maintenance frequency. Lack of skilled technicians in developing regions adds to the challenge. Manufacturers are focusing on safer designs and automated monitoring to ensure compliance with industrial safety standards and minimize operational risks.

Regional Analysis

North America

North America held the largest share of 36% in the Food Processing Industrial Hot Water Boiler Market in 2024. The region’s dominance is driven by well-established food processing industries and strict energy efficiency regulations. The United States leads market growth, supported by modernization of processing plants and growing adoption of condensing boiler systems. High demand for reliable heating in dairy, meat, and beverage sectors continues to boost sales. Government incentives promoting low-emission equipment and integration of automation technologies are strengthening regional competitiveness and sustainability in industrial boiler installations.

Europe

Europe accounted for 30% of the market share in 2024, driven by strong environmental regulations and widespread adoption of energy-efficient heating solutions. The region benefits from advanced food manufacturing infrastructure and ongoing transition toward carbon-neutral operations. Germany, France, and the United Kingdom are key markets, emphasizing condensing and hybrid boiler systems. Government initiatives promoting renewable energy integration and stricter emission standards under the EU Green Deal are accelerating system upgrades. The region’s growing focus on sustainable food processing further supports steady market expansion across both small and large-scale facilities.

Asia-Pacific

Asia-Pacific captured a 27% share of the global market in 2024 and is expected to witness the fastest growth during the forecast period. Rapid urbanization, rising food consumption, and expanding manufacturing capacities drive strong demand for industrial boilers. China, India, and Japan lead adoption due to increasing investments in food and beverage production. Energy-efficient and mid-capacity boiler systems are gaining traction as manufacturers focus on reducing fuel costs and improving production efficiency. Government support for industrial modernization and stricter emission control measures continue to accelerate regional growth.

Latin America

Latin America accounted for a 4% share of the Food Processing Industrial Hot Water Boiler Market in 2024. Growth in the region is supported by the expansion of food and beverage production facilities, particularly in Brazil, Mexico, and Argentina. The demand for cost-effective and reliable heating systems is increasing as manufacturers modernize processing lines. Rising energy prices are encouraging adoption of efficient boiler technologies. However, limited access to advanced equipment and lower capital availability in smaller industries remain key constraints affecting faster market penetration across the region.

Middle East & Africa

The Middle East & Africa held a 3% share of the global Food Processing Industrial Hot Water Boiler Market in 2024. Regional growth is fueled by increasing investments in food manufacturing and growing urban demand for packaged foods. GCC nations such as Saudi Arabia and the UAE are focusing on expanding domestic food production, driving demand for efficient heating solutions. In Africa, development programs and foreign investments in agro-processing sectors are supporting gradual adoption. The region’s shift toward industrial self-sufficiency and modern production facilities will further enhance market opportunities.

Market Segmentations:

By Capacity

- 10 MMBtu/hr

- 10-25 MMBtu/hr

- 25-50 MMBtu/hr

- > 50 MMBtu/hr

By Product

By Technology

- Condensing

- Non-Condensing

By Fuel

- Natural Gas

- Oil

- Coal

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Food Processing Industrial Hot Water Boiler Market features key players such as Hurst Boiler & Welding, Clayton Industries, FERROLI, Fulton, Johnston Boiler, Bosch Thermotechnology, Cleaver-Brooks, Hoval, Babcock & Wilcox Enterprises, and Forbes Marshall. These companies compete through technological innovation, product efficiency, and after-sales service reliability. Leading manufacturers are focusing on condensing and hybrid boiler technologies that improve thermal performance and lower emissions. Strategic partnerships with food and beverage producers help expand their regional footprint and tailor solutions for specific processing needs. North American and European companies emphasize energy-efficient and automated systems to comply with environmental regulations, while Asia-Pacific manufacturers are strengthening their presence through cost-effective, high-capacity designs. Continuous R&D investments in digital control integration and sustainability-driven engineering remain central to maintaining competitive advantage in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Fulton promoted its steam boiler decarbonisation technologies at BeerX 2025, aimed at food and beverage plants including breweries.

- In 2025, Bosch Thermotechnology replaced the boiler system at Lactalis-UK’s Stranraer dairy plant, achieving 190 m³ water savings with the new UL-S steam boiler system.

- In May 2024, Miura Co. has finalized the acquisition of Cleaver-Brooks, a prominent U.S.-based boiler manufacturer as part of its strategy to strengthen its foothold in the global commercial and industrial boiler market.

- In February 2024, Babcock Wanson Group has strengthened its presence in Germany with the acquisition of the VKK Group, a leading player in industrial boiler technology.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Product, Technology, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and low-emission boilers will continue to rise in food processing.

- Adoption of condensing and hybrid technologies will expand to meet sustainability goals.

- Automation and IoT integration will enhance real-time monitoring and performance control.

- Manufacturers will invest in compact, high-efficiency designs for space-constrained facilities.

- Replacement of traditional systems with advanced units will accelerate across developed regions.

- Asia-Pacific will experience the fastest growth due to industrial expansion and modernization.

- Partnerships between boiler manufacturers and food producers will increase to optimize operations.

- Government incentives for clean energy equipment will boost sustainable technology adoption.

- The shift toward digital maintenance platforms will reduce downtime and operational costs.

- Continuous R&D in materials and heat recovery systems will strengthen global competitiveness.