Market Overview:

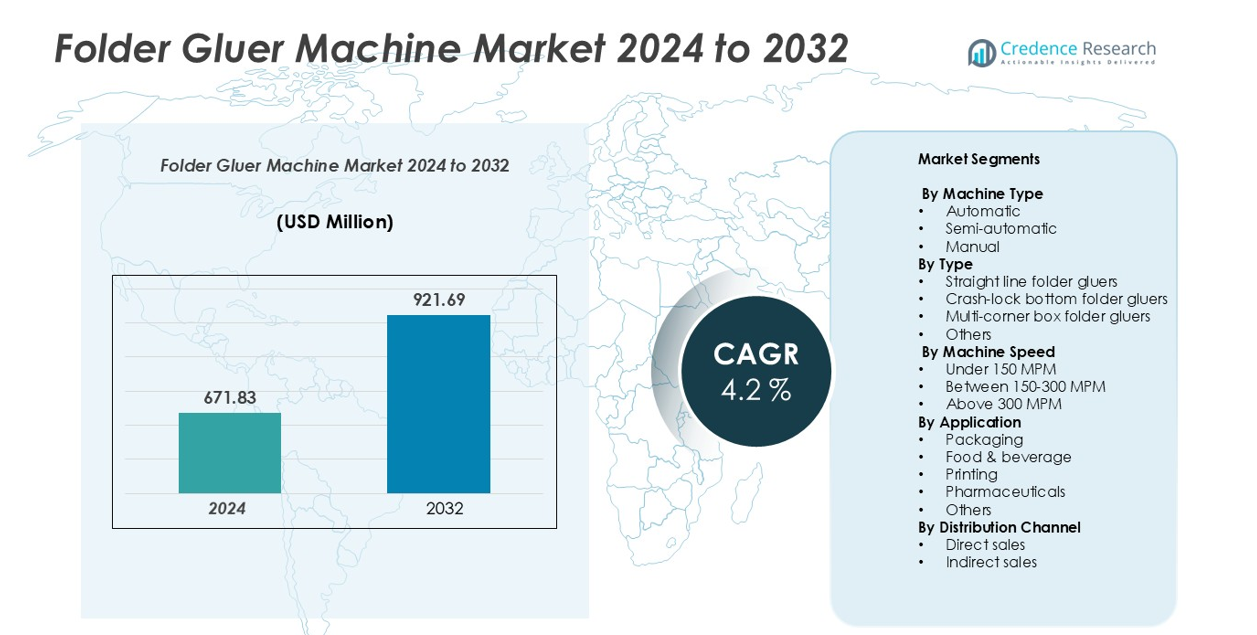

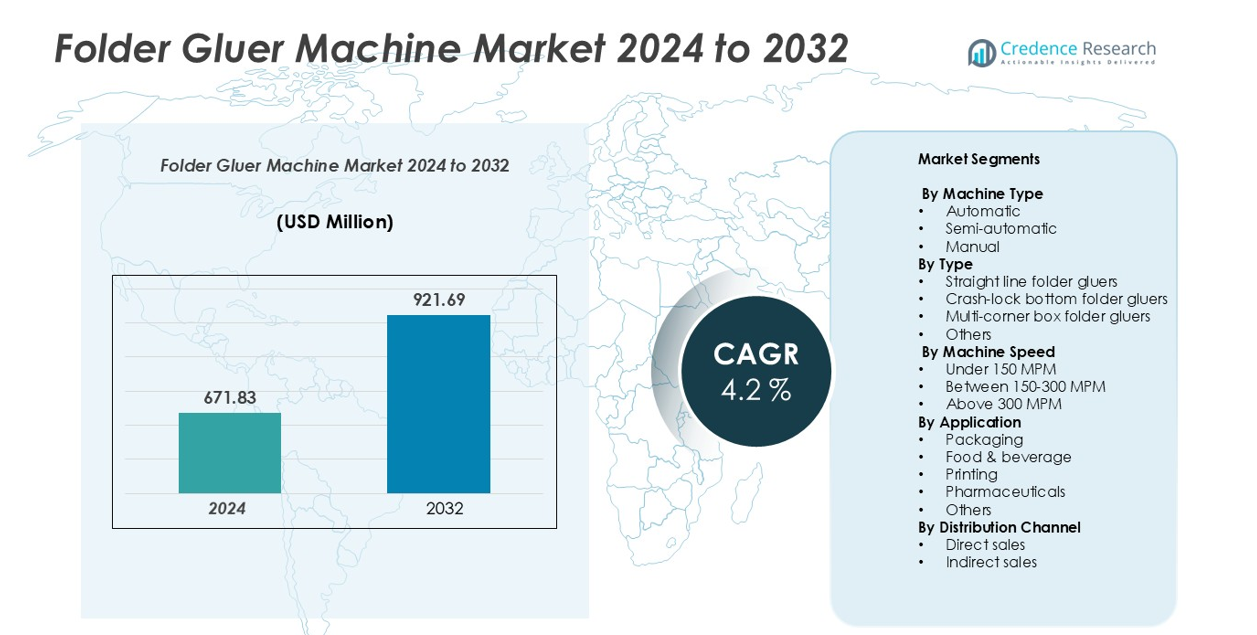

The folder gluer machine market size was valued at USD 671.83 million in 2024 and is anticipated to reach USD 921.69 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Folder Gluer Machine Market Size 2024 |

USD 671.83 million |

| Folder Gluer Machine Market, CAGR |

4.2% |

| Folder Gluer Machine Market Size 2032 |

USD 921.69 million |

The folder gluer machine market is dominated by leading global players including Bobst Group, Heidelberg, Koenig & Bauer, Brausse Group, Duran Machinery, Lamina System, Sipack, Masterwork Machinery Co., Emba Machinery, Gietz, SBL Machinery, Shanghai Eternal Machinery, and Vega Group. These companies focus on technological innovation, high-speed automation, and energy-efficient solutions to address diverse packaging needs across industries. North America holds approximately 28% of the global market, driven by advanced manufacturing and e-commerce sectors, while Europe accounts for around 26%, led by Germany, Italy, and France with strong adoption of sustainable and automated machines. Asia Pacific is the fastest-growing region with a 30% market share, fueled by rising industrialization and e-commerce demand in China, India, and Southeast Asia. Latin America (10%) and the Middle East & Africa (6%) show steady growth, supported by increasing adoption of semi-automatic and automatic folder gluers.

Market Insights

- The global folder gluer machine market was valued at USD 671.83 million in 2024 and is projected to reach USD 921.69 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Rising demand for automated and high-speed folding and gluing solutions is driving growth, particularly in food and beverage, pharmaceuticals, and e-commerce packaging sectors.

- Key trends include increasing adoption of eco-friendly and sustainable packaging, integration of smart and IoT-enabled machines, and growing demand for customized high-precision packaging solutions.

- The market is highly competitive with leading players such as Bobst Group, Heidelberg, Koenig & Bauer, Brausse Group, and Duran Machinery focusing on innovation, automation, and global expansion to maintain market share.

- Regionally, Asia Pacific leads with approximately 30% market share, followed by North America at 28%, Europe at 26%, Latin America at 10%, and Middle East & Africa at 6%. Straight line folder gluers and automatic machines dominate the segment share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machine Type

The folder gluer machine market is segmented into automatic, semi-automatic, and manual machines. Among these, automatic machines hold the dominant share, accounting for a significant portion of the market due to their high efficiency, consistent output quality, and ability to handle large production volumes. The rising demand for automation in packaging lines, coupled with labor cost optimization and reduced operational errors, is driving the adoption of automatic folder gluers. Semi-automatic and manual machines continue to serve small-scale and customized production requirements, but their market share remains limited compared to fully automated systems.

- For instance, Retrofit ERSX solution is a product line designed to upgrade and modernize their existing specialty folder gluer machines, thereby enhancing the durability and capacity of the equipment. This process is claimed by JD Engineers to significantly reduce maintenance costs, downtime, waste, and energy consumption, with some customers reportedly achieving up to a 70% reduction in power use.

By Type

Based on type, the market includes straight line folder gluers, crash-lock bottom folder gluers, multi-corner box folder gluers, and others. Straight line folder gluers emerge as the dominant sub-segment, capturing the largest market share due to their versatility, high-speed operations, and compatibility with a wide range of carton sizes. Demand is driven by the expanding e-commerce and retail packaging sectors, which require rapid folding and gluing solutions for standard boxes. Crash-lock bottom and multi-corner box machines are witnessing growth in niche applications, especially for premium packaging and specialized product formats.

- For instance, The Diana Easy folder gluer has a maximum production speed of up to 350 meters per minute. A typical operational speed is at least 300 meters per minute. This high speed, combined with its ergonomic design, enables fast and efficient processing of straight-line boxes and a wide range of other applications.

By Machine Speed

Folder gluer machines are classified by speed into under 150 MPM, between 150-300 MPM, and above 300 MPM. The 150-300 MPM segment dominates the market, reflecting the balance between productivity and cost-effectiveness for most industrial applications. This speed range is widely adopted in food, beverage, and general packaging industries that require moderate to high-volume output without compromising quality. Machines under 150 MPM cater to small-scale operations, while above 300 MPM is specialized for high-capacity production lines, often in large FMCG and pharmaceutical packaging facilities, where speed and precision are critical drivers.

Key Growth Drivers

Rising Demand for Automated Packaging Solutions

The increasing demand for automation in packaging operations is a primary growth driver for the folder gluer machine market. Industries are shifting toward automated systems to enhance efficiency, reduce labor dependency, and maintain consistent product quality. Automatic folder gluers, in particular, enable high-speed folding and gluing of cartons, which is critical for large-scale production in food, beverage, pharmaceutical, and e-commerce sectors. Companies adopting these systems benefit from reduced operational errors, faster turnaround times, and improved workflow integration. The growing focus on operational cost reduction, coupled with the need to meet stringent delivery timelines in competitive markets, is pushing manufacturers to invest in advanced folder gluer technologies, thereby expanding market adoption and driving overall industry growth.

- For instance, DGM Global’s SMARTFOLD 650-PC automatic folder gluer achieves a maximum speed of 400 meters per minute. This high-speed capability enables efficient folding and gluing of small and medium-sized cartons for large-scale production in sectors such as pharmaceuticals, food and beverage, and cosmetics. The machine can handle various materials, including solid board and E, F, and N flute corrugated board.

Expansion of E-commerce and Retail Packaging

The rapid expansion of e-commerce and retail sectors has significantly boosted the demand for folder gluer machines. Online retail requires large volumes of standardized cartons for product shipments, which drives the need for efficient folding and gluing solutions. Similarly, modern retail packaging emphasizes speed, precision, and aesthetic appeal, which folder gluers can deliver consistently. The adoption of innovative designs, customized packaging, and sustainable corrugated solutions further fuels market growth. Companies are increasingly deploying straight line and crash-lock bottom folder gluers to meet the rising production demands while maintaining structural integrity and presentation quality. This surge in packaging requirements across global logistics and retail chains remains a strong growth driver for the market.

- For instance, Heidelberg’s own materials confirm the Diana Easy 115 folder gluer can reach speeds of up to 350 meters per minute. The machine’s high speed also makes it suitable for efficient e-commerce packaging operations.

Technological Advancements in Machine Efficiency

Advancements in folder gluer machine technology are fueling market growth by improving operational efficiency, accuracy, and reliability. Modern machines incorporate features such as servo-driven mechanisms, intelligent sensors, and automated adjustment systems that enable precise folding, gluing, and handling of various carton sizes. These innovations reduce material wastage, lower maintenance needs, and increase overall throughput. Additionally, integration with Industry 4.0 and IoT-enabled monitoring allows real-time performance tracking and predictive maintenance, further optimizing production efficiency. Manufacturers focusing on innovation and customization are driving adoption across multiple end-use industries, reinforcing the market’s growth trajectory and positioning advanced folder gluer machines as essential equipment in contemporary packaging operations.

Key Trends & Opportunities

Shift Towards Sustainable and Eco-friendly Packaging

A major trend shaping the folder gluer machine market is the increasing emphasis on sustainable and eco-friendly packaging. With rising consumer awareness and stringent environmental regulations, industries are adopting recyclable, biodegradable, and lightweight carton materials. Folder gluer machines capable of handling these new materials efficiently are gaining traction, creating opportunities for manufacturers to offer specialized solutions. Innovations in folding and gluing techniques allow for minimal material waste while maintaining package durability. Companies that invest in energy-efficient machines or designs compatible with sustainable substrates can capture growing demand in food, beverage, and e-commerce packaging, driving both market growth and environmental compliance.

- For instance, BOBST developed the SPO 1575, an automatic flatbed die-cutter for corrugated materials, in the 1960s. Later, in 1970, BOBST combined this with flexographic printing to create the SPO-FLEXO. While the DYNAMIC 130 is a BOBST machine, production years cited in machine listings are from the mid-1970s and later.

Integration of Digital and Smart Manufacturing Solutions

The adoption of digital and smart manufacturing solutions presents a significant opportunity for the folder gluer machine market. IoT-enabled machines, remote monitoring systems, and predictive maintenance tools allow manufacturers to optimize production processes, reduce downtime, and improve product quality. Smart machines also facilitate integration with automated packaging lines, enhancing overall operational efficiency. This trend is particularly relevant for large-scale packaging facilities in FMCG, pharmaceutical, and e-commerce industries. Companies offering connected and intelligent folder gluers are likely to gain a competitive advantage, as end-users increasingly prioritize operational transparency, real-time analytics, and adaptive production capabilities.

- For instance, packaging manufacturers commonly utilize automated systems with sensors and machine learning to optimize the folding and gluing process. Some advanced systems use precision-controlled nozzles and real-time vision systems to apply adhesive, minimizing waste. Other automation and machine learning solutions, such as those that use SMED (Single-Minute Exchange of Die) principles, reduce setup times and improve operational efficiency.

Customization and High-precision Packaging Demand

The growing need for customized and high-precision packaging is creating new opportunities in the folder gluer machine market. Premium products, fragile items, and complex carton designs require machines that can handle intricate folding patterns and multi-corner boxes with accuracy. Folder gluers with adjustable settings and modular designs enable manufacturers to meet diverse packaging specifications efficiently. This trend is prominent in sectors such as cosmetics, pharmaceuticals, and electronics, where packaging not only protects products but also enhances brand appeal. Investments in flexible, precision-oriented machinery allow companies to cater to niche markets while optimizing production costs, expanding market potential.

Key Challenges

High Initial Investment and Maintenance Costs

One of the key challenges in the folder gluer machine market is the significant initial investment required for acquiring advanced machinery. Automatic and high-speed folder gluers often involve substantial capital expenditure, which can be a barrier for small and medium-sized enterprises. In addition, maintenance costs, spare parts, and specialized technician requirements further increase the total cost of ownership. These financial considerations can limit adoption in cost-sensitive markets or regions, particularly where production volumes do not justify large-scale automation. Manufacturers must balance performance, efficiency, and affordability to address this challenge and drive wider market penetration.

Limited Skilled Workforce for Operation and Maintenance

Another critical challenge is the scarcity of skilled operators and technicians capable of handling sophisticated folder gluer machines. The complexity of modern automated and high-speed machines requires expertise in programming, adjustment, and routine maintenance. A lack of trained personnel can result in operational inefficiencies, machine downtime, and increased production errors. This challenge is particularly pronounced in emerging markets where workforce training programs are limited. Addressing this issue requires investment in operator training, certification programs, and simplified machine interfaces to ensure smooth operations and maximize machine performance.

Regional Analysis

North America

North America holds a leading share of the folder gluer machine market, accounting for around 28% of global demand. The U.S. and Canada drive growth due to advanced packaging, e-commerce, and pharmaceutical industries. Rising adoption of automatic and high-speed machines enhances productivity, reduces labor dependency, and ensures consistent quality. Technological advancements such as IoT-enabled monitoring, predictive maintenance, and energy-efficient operations support market expansion. Key end-use sectors, including food and beverage, retail, and pharmaceuticals, increasingly rely on modern folder gluers. Strong industrial infrastructure and innovation position North America as a technologically advanced and dominant regional market.

Europe

Europe commands approximately 26% of the global folder gluer machine market, led by Germany, Italy, and France. High demand is driven by mature packaging industries, rising e-commerce, and a strong focus on sustainable and eco-friendly solutions. Straight line and crash-lock bottom folder gluers dominate due to versatility and high-speed performance. Adoption of automation, integration with Industry 4.0, and strict quality standards enhance efficiency and reduce material waste. Key sectors such as food and beverage, pharmaceuticals, and consumer goods drive growth. Europe’s established industrial base, technological advancements, and sustainability initiatives maintain its strong regional market share.

Asia Pacific

Asia Pacific is the fastest-growing region, capturing around 30% of the folder gluer machine market. Growth is driven by China, India, Japan, and Southeast Asia, fueled by expanding e-commerce, packaging, and pharmaceutical industries. Rising industrialization, cost-effective manufacturing, and demand for high-speed and automatic machines support market adoption. Multi-corner and crash-lock bottom machines are increasingly preferred for specialized packaging applications. Government initiatives promoting automation and smart manufacturing encourage further investment. With large-scale production requirements and expanding consumer goods sectors, Asia Pacific is set to maintain its increasing market share in the global folder gluer machine industry.

Latin America

Latin America accounts for roughly 10% of the global folder gluer machine market, led by Brazil, Mexico, and Argentina. Growth is driven by rising packaging demand in food, beverage, and consumer goods industries. Manufacturers are adopting semi-automatic and automatic folder gluers to improve efficiency and meet quality standards. Expanding retail and e-commerce sectors further boost adoption. Although industrialization is slower than in North America and Europe, strategic investments in modern machinery and the need for streamlined production processes support steady growth. The region’s market share is gradually increasing, offering opportunities for equipment suppliers targeting emerging demand.

Middle East & Africa

The Middle East & Africa (MEA) region holds approximately 6% of the global folder gluer machine market, experiencing steady growth. Demand is mainly driven by food, beverage, and pharmaceutical packaging in countries such as UAE, Saudi Arabia, and South Africa. Investments in automated and semi-automatic machines aim to enhance efficiency, ensure consistent quality, and meet export standards. Adoption of straight line and crash-lock bottom folder gluers is rising across retail and industrial packaging applications. Urbanization, infrastructure development, and growing industrial capabilities support incremental growth, gradually increasing the region’s market share and creating opportunities for equipment suppliers.

Market Segmentations:

By Machine Type

- Automatic

- Semi-automatic

- Manual

By Type

- Straight line folder gluers

- Crash-lock bottom folder gluers

- Multi-corner box folder gluers

- Others

By Machine Speed

- Under 150 MPM

- Between 150-300 MPM

- Above 300 MPM

By Application

- Packaging

- Food & beverage

- Printing

- Pharmaceuticals

- Others

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The folder gluer machine market is highly competitive, characterized by the presence of established global players and emerging regional manufacturers. Leading companies such as Bobst Group, Heidelberg, Koenig & Bauer, Brausse Group, and Duran Machinery dominate the market with technologically advanced, high-speed, and automated machines. These players focus on continuous innovation, product customization, and integration with Industry 4.0 solutions to enhance operational efficiency and meet diverse packaging requirements. Strategic initiatives such as mergers, acquisitions, collaborations, and regional expansion strengthen market positioning and broaden customer reach. Additionally, mid-sized and local manufacturers, including Lamina System, Sipack, and Masterwork Machinery, contribute to competition by offering cost-effective and flexible solutions. The market emphasizes technological differentiation, reliability, energy efficiency, and after-sales service, compelling all players to adopt aggressive R&D, marketing, and customer support strategies to maintain and expand their market share globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Brausse Group

- Heidelberg

- Duran Machinery

- Bobst Group

- Sipack

- Lamina System

- Shanghai Eternal Machinery

- Koenig & Bauer

- SBL Machinery

- Vega Group

- Masterwork Machinery Co.

- Gietz

- Emba Machinery

Recent Developments

- In January 2024, Bobst introduced the NOVAFOLD 110, an advanced folder-gluer designed to produce intricate box designs at speeds reaching 300 meters per minute. Featuring innovative automation and connectivity, this model enhances production efficiency and flexibility. According to the Association for Packaging and Processing Technologies (PMMI), innovations like these are crucial for meeting the growing demand for high-speed, efficient packaging solutions.

- In March 2023, Heidelberg introduced its new Powermatrix 106 CSB die-cutter, which integrates seamlessly with folder-gluer lines. This innovation aims to improve efficiency in packaging production by streamlining the die-cutting and folder-gluing processes.

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Type, Machine Speed, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and high-speed folder gluer machines is expected to grow across industries.

- Adoption of smart and IoT-enabled machines will increase operational efficiency and predictive maintenance.

- E-commerce and retail packaging will continue to drive investments in high-capacity folding and gluing solutions.

- Sustainable and eco-friendly packaging materials will influence machine design and functionality.

- Multi-corner and crash-lock bottom folder gluers will see higher adoption for specialized packaging applications.

- Asia Pacific is likely to remain the fastest-growing regional market due to industrialization and manufacturing expansion.

- Manufacturers will focus on technological innovation, including energy-efficient and low-maintenance machines.

- Semi-automatic and manual machines will continue to serve small-scale and niche production requirements.

- Integration with Industry 4.0 solutions will enable real-time monitoring and improved production workflow.

- Competition among global players will intensify, driving product differentiation and regional expansion strategies.