Market Overview

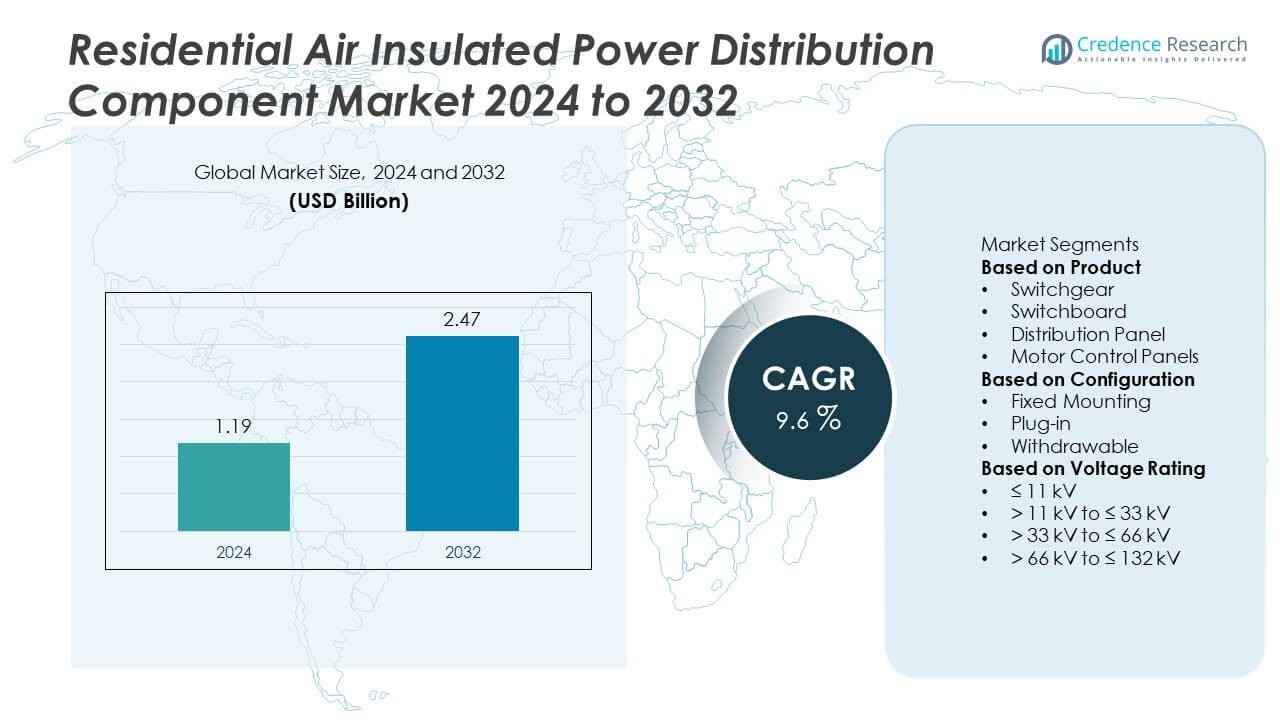

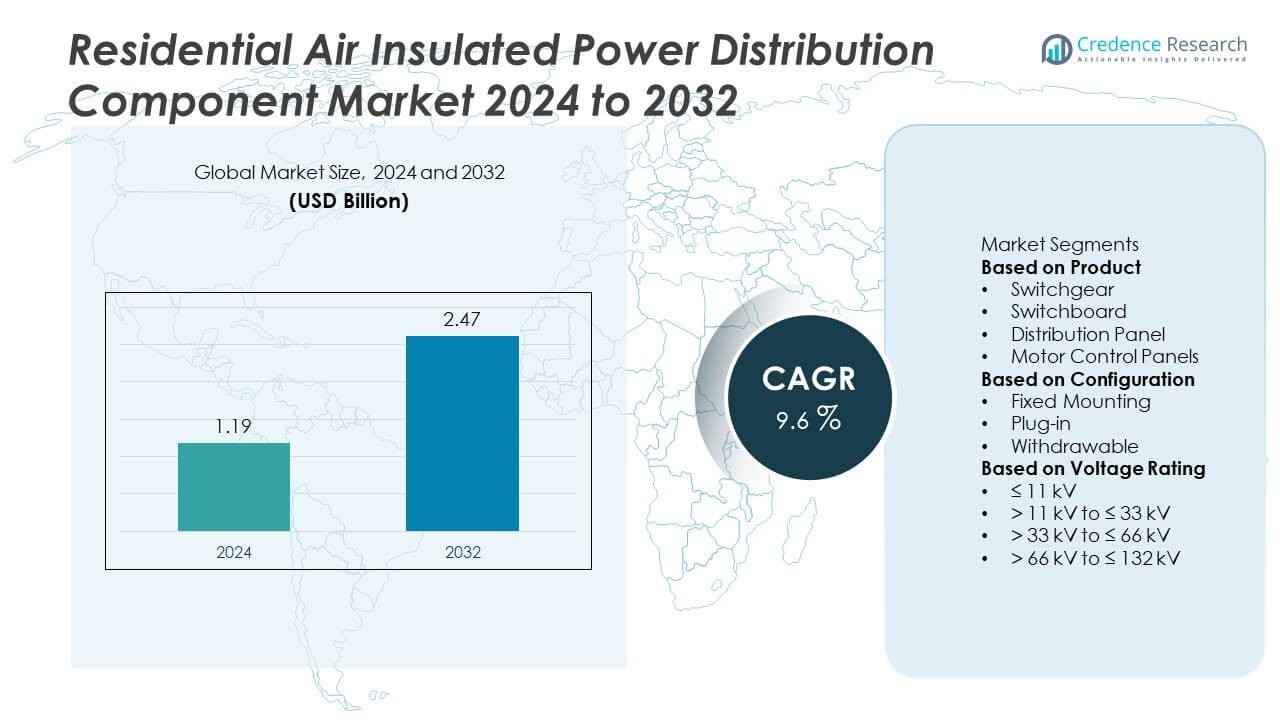

The Residential Air Insulated Power Distribution Component market was valued at USD 1.19 billion in 2024 and is projected to reach USD 2.47 billion by 2032, growing at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Air Insulated Power Distribution Component Market Size 2024 |

USD 1.19 Billion |

| Residential Air Insulated Power Distribution Component Market, CAGR |

9.6% |

| Residential Air Insulated Power Distribution Component Market Size 2032 |

USD 2.47 Billion |

The residential air insulated power distribution component market is led by major players such as Eaton, Hitachi Energy, L&T Electrical & Automation, G&W Electric, Lucy Group Ltd., Meiden Europe GmbH, CG Power & Industrial Solutions Ltd., ABB, ALSTOM SA, and GE Grid Solutions. These companies dominate through advancements in compact switchgear, smart distribution panels, and digital monitoring technologies designed for modern housing. They focus on developing energy-efficient and modular systems to meet global electrification and safety standards. North America led the market with a 32% share in 2024, driven by strong adoption of smart home and grid modernization projects. Asia-Pacific followed with a 31% share, supported by rapid residential infrastructure growth and electrification initiatives in China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The residential air insulated power distribution component market was valued at USD 1.19 billion in 2024 and is projected to reach USD 2.47 billion by 2032, growing at a CAGR of 9.6%.

- Growing electrification in residential buildings and the adoption of smart home infrastructure are driving demand for safe and energy-efficient power distribution systems.

- Technological trends such as IoT-enabled monitoring, modular switchgear, and eco-friendly insulation materials are reshaping product innovation.

- The market is moderately competitive, with key players like Eaton, ABB, and Hitachi Energy focusing on compact, low-maintenance, and digitally integrated solutions.

- North America led the market with a 32% share in 2024, followed by Asia-Pacific with 31%, while the switchgear segment dominated with a 41% share due to its reliability and widespread use in residential electrical distribution networks.

Market Segmentation Analysis:

By Product

The switchgear segment dominated the residential air insulated power distribution component market with a 41% share in 2024. Its dominance is driven by growing demand for safe and reliable electrical distribution systems in modern residential infrastructures. Air-insulated switchgear offers compact design, easy installation, and enhanced fault protection, making it ideal for residential complexes and smart homes. Increasing urbanization and government initiatives for electrification are boosting adoption. The distribution panel segment follows, supported by rising use in low-voltage power management for energy-efficient and space-saving home installations.

- For instance, Eaton launched its medium-voltage Xiria E switchgear, featuring vacuum interrupters rated up to 24 kV and 630 A, designed for compact residential substations.

By Configuration

The fixed mounting configuration segment held a 48% share of the residential air insulated power distribution component market in 2024. This configuration is widely used due to its cost efficiency, simple structure, and low maintenance requirements in residential settings. Fixed-mounted systems ensure stable power distribution and are preferred in low-voltage applications for safety and reliability. Plug-in systems are growing steadily, driven by modular residential construction and easier installation processes. Withdrawable configurations are gaining traction in advanced building designs requiring flexibility and quick maintenance access.

- For instance, G&W Electric’s Viper-S recloser offers a dielectric withstand rating of 50 kV and mechanical endurance exceeding 10,000 operations, improving reliability in utility distribution grids.

By Voltage Rating

The ≤ 11 kV segment accounted for a 56% share of the residential air insulated power distribution component market in 2024. Its dominance is attributed to extensive application in residential power systems, where low-voltage distribution ensures safety and cost-effectiveness. The demand for ≤ 11 kV components is rising in urban housing projects and smart city developments. The > 11 kV to ≤ 33 kV range is gaining momentum in large housing estates and multi-residential complexes, supporting stable electricity distribution. Higher voltage ranges remain limited to specialized residential areas with extensive power loads.

Key Growth Drivers

Rising Urbanization and Residential Electrification

Rapid urbanization and expanding residential infrastructure are major drivers of the residential air insulated power distribution component market. Governments are investing heavily in electrification projects and smart housing developments, boosting demand for reliable and efficient power distribution systems. Air-insulated components are preferred for their compact design, safety, and easy installation in residential complexes. Growing electricity consumption in households and the shift toward modern electrical networks further accelerate market adoption.

- For instance, Hitachi Energy is a significant supplier of power infrastructure in India and manufactures air-insulated switchgear units used to enhance network reliability. The Saubhagya electrification program also aimed to improve low-voltage network reliability in residential zones across India.

Increasing Adoption of Smart Homes and Energy Efficiency Standards

The growing trend of smart homes and implementation of energy efficiency regulations drive market growth. Air-insulated switchgear and distribution panels support intelligent monitoring and control of electrical systems, ensuring safe and efficient power usage. Integration with IoT-based energy management platforms enhances reliability and user convenience. Rising awareness about reducing energy losses and improving safety in residential power networks fuels demand for advanced, air-insulated systems compliant with international efficiency standards.

- For instance, ABB has enabled digital load management through cloud analytics in smart buildings, integrating different product families, such as the System pro M compact® miniature circuit breakers and the Emax 2 smart breakers for industrial or larger commercial applications, as part of a comprehensive energy management solution.

Government Initiatives for Grid Modernization

Government efforts toward modernizing power distribution grids and promoting renewable energy integration are supporting market expansion. Investments in upgrading residential electrical infrastructure and replacing outdated systems with compact, air-insulated alternatives drive steady demand. Subsidies and incentives for energy-efficient home electrification projects encourage adoption of modern switchgear and distribution panels. These initiatives enhance safety, minimize outages, and improve load management, contributing to long-term growth in residential energy networks.

Key Trends & Opportunities

Integration of Smart Monitoring and Control Technologies

Integration of smart monitoring systems and IoT-enabled sensors in air-insulated components is emerging as a key trend. These technologies allow real-time performance analysis, predictive maintenance, and remote control, improving operational reliability. Residential developers are increasingly adopting smart switchboards and distribution panels for automation compatibility. This trend supports the broader smart home ecosystem, offering opportunities for manufacturers to develop digitally integrated power management solutions with enhanced connectivity and safety.

- For instance, Siemens employs IoT-enabled SENTRON devices for power monitoring in buildings, which can transmit data for analysis via local networks or cloud platforms like MindSphere. Some SENTRON devices are capable of storing and transmitting mean values for intervals as short as 10 seconds to higher-level systems.

Shift Toward Eco-Friendly and Compact Designs

The market is witnessing a strong shift toward eco-friendly, compact, and modular air-insulated systems. Manufacturers are focusing on developing recyclable materials and low-emission insulation technologies to reduce environmental impact. Compact configurations enable easier installation in space-constrained residential environments. This transition aligns with sustainability goals and green building certifications, creating opportunities for innovation in lightweight, energy-efficient, and durable residential power distribution systems.

- For instance, Schneider Electric’s SM AirSeT line features a sustainable alternative to the SF6 gas used in traditional switchgear by using pure air and vacuum insulation. This provides a compact, digitally connected solution that maintains the same size and operating mechanisms as the SM6 range.

Key Challenges

High Initial Installation and Equipment Costs

High upfront investment remains a major challenge for the residential air insulated power distribution component market. Advanced switchgear and smart panels involve higher costs compared to traditional systems, limiting adoption in low- and middle-income residential projects. The expense of integrating IoT-enabled systems and advanced insulation materials increases overall project budgets. This cost barrier can restrict market penetration, particularly in developing regions with budget-sensitive construction sectors.

Complex Installation and Maintenance Requirements

Air-insulated systems require precise installation and regular maintenance to ensure reliability and safety. Improper installation or inadequate maintenance can lead to insulation degradation, affecting performance and lifespan. Limited technical expertise and lack of standardized installation practices in some regions create operational challenges. These factors increase maintenance costs and discourage adoption among smaller residential developers, necessitating training programs and standardized practices to improve market adoption rates.

Regional Analysis

North America

North America held a 32% share of the residential air insulated power distribution component market in 2024. The region’s dominance is driven by strong demand for smart housing, grid modernization, and reliable residential power systems. The U.S. leads the market due to rapid adoption of intelligent switchgear and energy-efficient distribution panels. Ongoing government initiatives to upgrade outdated electrical infrastructure and promote energy conservation are boosting demand. Growing investments in smart home automation and the integration of IoT-enabled components further support market growth across both single-family and multi-residential developments.

Europe

Europe accounted for a 28% share of the residential air insulated power distribution component market in 2024. The region benefits from stringent energy efficiency regulations and extensive adoption of smart grid technology. Countries such as Germany, France, and the U.K. are leading adopters of compact air-insulated systems in modern housing projects. EU directives promoting sustainable and safe electrical infrastructure are driving steady replacement of conventional systems. Increasing investments in renewable integration and advanced power monitoring also strengthen the regional market, particularly within urban housing developments and multi-unit dwellings.

Asia-Pacific

Asia-Pacific captured a 31% share of the residential air insulated power distribution component market in 2024. Rapid urbanization, growing electrification, and expansion of residential infrastructure in China, India, and Japan are driving strong demand. Governments are prioritizing smart city and housing initiatives, boosting installations of low-voltage and medium-voltage air-insulated systems. Local manufacturers are developing cost-effective and energy-efficient switchgear solutions suited for dense urban environments. Rising disposable incomes, coupled with a growing focus on energy-efficient housing, positions Asia-Pacific as the fastest-growing regional market during the forecast period.

Middle East & Africa

The Middle East & Africa region held a 5% share of the residential air insulated power distribution component market in 2024. Market growth is supported by expanding residential construction, urbanization, and government-led electrification projects. Gulf countries such as Saudi Arabia and the UAE are adopting modern power distribution systems to support large-scale housing and smart community projects. Africa’s ongoing electrification programs are further promoting the adoption of compact air-insulated systems. The growing emphasis on safety, durability, and renewable integration strengthens market potential across the region’s developing residential sectors.

Latin America

Latin America accounted for a 4% share of the residential air insulated power distribution component market in 2024. Growth is driven by increasing residential infrastructure development in Brazil, Mexico, and Chile. Governments are focusing on grid modernization and improved energy reliability to meet rising power consumption. Local manufacturers are adopting air-insulated systems for their cost-effectiveness and safety benefits in compact housing environments. The region’s growing awareness of energy-efficient solutions and expanding smart home projects are expected to further drive adoption of air-insulated distribution panels and switchgear systems.

Market Segmentations:

By Product

- Switchgear

- Switchboard

- Distribution Panel

- Motor Control Panels

By Configuration

- Fixed Mounting

- Plug-in

- Withdrawable

By Voltage Rating

- ≤ 11 kV

- > 11 kV to ≤ 33 kV

- > 33 kV to ≤ 66 kV

- > 66 kV to ≤ 132 kV

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the residential air insulated power distribution component market includes key players such as Eaton, Hitachi Energy, L&T Electrical & Automation, G&W Electric, Lucy Group Ltd., Meiden Europe GmbH, CG Power & Industrial Solutions Ltd., ABB, ALSTOM SA, and GE Grid Solutions. These companies compete through innovation in compact designs, enhanced safety standards, and digital integration for smart home applications. Leading manufacturers are focusing on developing eco-friendly and energy-efficient switchgear and distribution panels to align with sustainability goals. Strategic collaborations with housing developers and electrical contractors strengthen their regional presence and service networks. Companies are also investing in IoT-enabled and modular air-insulated systems to enhance monitoring, efficiency, and installation flexibility. Continuous R&D and technological upgrades aimed at improving voltage stability and minimizing maintenance costs are key strategies driving competitiveness in this rapidly expanding residential power distribution market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eaton

- Hitachi Energy

- L&T Electrical & Automation

- G&W Electric

- Lucy Group Ltd.

- Meiden Europe GmbH

- CG Power & Industrial Solutions Ltd.

- ABB

- ALSTOM SA

- GE Grid Solutions

Recent Developments

- In October 2025, Eaton introduced next-generation 800 VDC power architecture to support AI-ready electrical infrastructure.

- In 2025, Hitachi Energy announced its first 1100 kV GIS order in China, strengthening UHV grid capacity.

- In September 2023, ABB introduced the 500 mm panel variant of its UniGear ZS1, an air-insulated medium-voltage switchgear, during ADIPEC 2023. This launch underscores ABB’s dedication to delivering intelligent, secure, and eco-friendly solutions for energy and asset health management.

- In January 2023, Eaton and AMP joined forces to upgrade the power distribution system for the Xeni Gwet’in First Nations. This collaboration, backed by federal funding and the local community, emphasizes clean energy projects for indigenous groups.

Report Coverage

The research report offers an in-depth analysis based on Product, Configuration, Voltage Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with increasing urbanization and residential electrification projects.

- Demand for smart and energy-efficient home power systems will continue to rise.

- IoT-enabled and digitally monitored switchgear will gain wider adoption.

- Manufacturers will invest in modular and compact product designs for modern housing.

- Asia-Pacific will emerge as the fastest-growing market driven by rapid urban infrastructure expansion.

- North America will maintain leadership with grid modernization and smart home integration.

- Sustainable and recyclable insulation materials will gain preference in product development.

- Partnerships between manufacturers and housing developers will strengthen distribution networks.

- Government incentives for energy efficiency will encourage adoption of advanced systems.

- Technological advancements will reduce maintenance costs and improve system reliability.