Market Overview

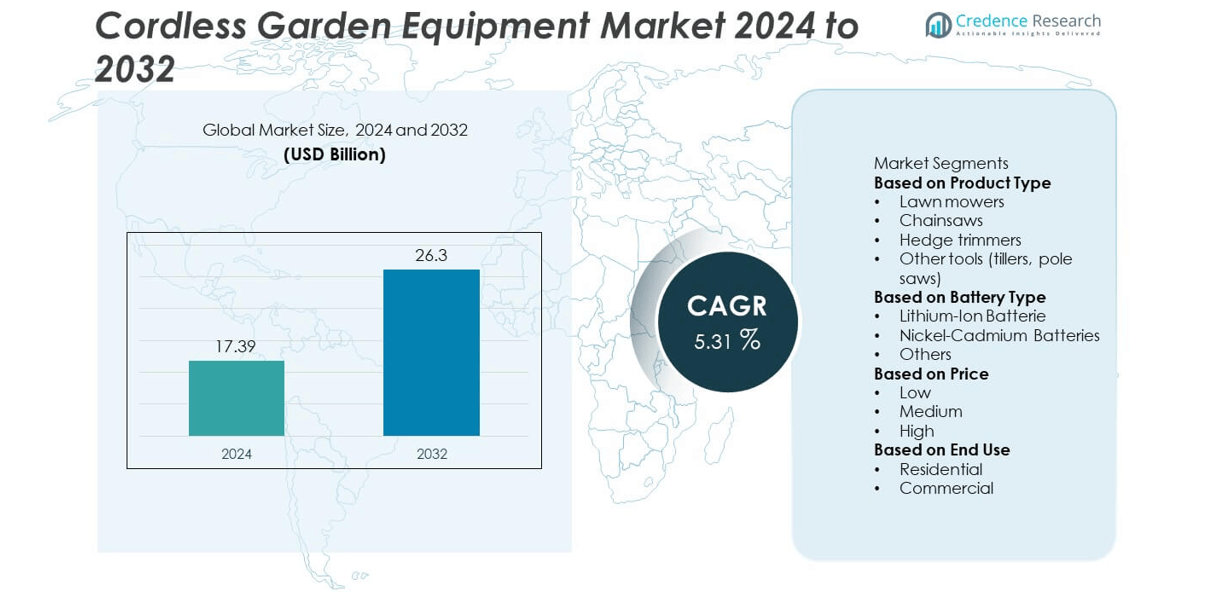

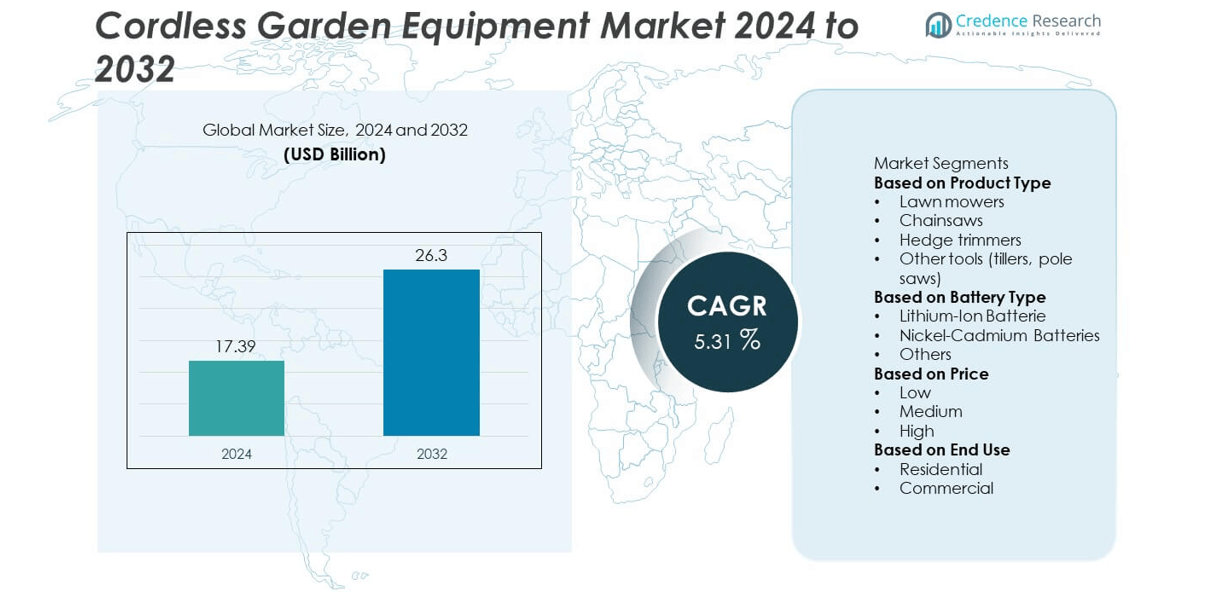

The cordless garden equipment market was valued at USD 17.39 billion in 2024 and is projected to reach USD 26.3 billion by 2032, growing at a CAGR of 5.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cordless Garden Equipment Market Size 2024 |

USD 17.39 billion |

| Cordless Garden Equipment Market, CAGR |

5.31% |

| Cordless Garden Equipment Market Size 2032 |

USD 26.3 billion |

The cordless garden equipment market is led by prominent players such as Husqvarna, Makita, Greenworks, John Deere, AL-KO, MTD, EGO, Bosch, Honda, and Black+Decker. These companies dominate through advanced lithium-ion technology, broad product portfolios, and strong distribution networks. Husqvarna and Makita maintain leadership with high-performance tools and smart connectivity features, while John Deere and MTD excel in professional landscaping solutions. North America remains the leading region with a 37% market share in 2024, supported by strong residential adoption and technological innovation. Europe, holding a 31% share, follows closely due to eco-friendly regulations and high cordless tool penetration.

Market Insights

- The cordless garden equipment market was valued at USD 17.39 billion in 2024 and is projected to reach USD 26.3 billion by 2032, growing at a CAGR of 5.31%.

- Growth is driven by increasing demand for eco-friendly, low-noise garden tools and the rapid shift from fuel-based to battery-powered models in residential and commercial landscaping.

- Key trends include the adoption of smart and connected cordless tools, advancements in lithium-ion battery efficiency, and expanding online retail channels enhancing product accessibility.

- The market is competitive, with major players such as Husqvarna, Makita, Greenworks, Bosch, and John Deere focusing on R&D, sustainable manufacturing, and ergonomic product innovation to strengthen market presence.

- Regionally, North America led with 37% share in 2024, followed by Europe at 31% and Asia-Pacific at 23%; among segments, lawn mowers dominated with 41% share, while lithium-ion batteries led with 72% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The lawn mowers segment dominated the cordless garden equipment market with a 41% share in 2024. The dominance stems from their extensive use in residential lawns and commercial landscaping. Technological improvements, including brushless motors and self-propelled designs, have enhanced performance and runtime. Rising adoption of smart and robotic cordless mowers also supports growth in developed regions. The demand for low-maintenance, noise-free lawn solutions further strengthens segment leadership across North America and Europe.

- For instance, Husqvarna introduced the Automower 450X NERA robotic mower, which can manage lawns up to 5,000 m² and uses an EPOS satellite navigation system that can offer centimetre-level cutting accuracy.

By Battery Type

The lithium-ion battery segment accounted for a 72% share in 2024, making it the leading battery type. This dominance is driven by higher energy density, fast charging, and longer life cycles compared to nickel-cadmium batteries. Manufacturers are focusing on lightweight lithium-ion systems to improve tool balance and efficiency. Increasing replacement of fuel-based tools with eco-friendly, battery-powered alternatives continues to boost lithium-ion adoption. Growing integration of smart battery management systems also enhances durability and performance.

- For instance, Makita developed its 40V MAX XGT lithium-ion platform for professional-grade tools that can be equipped with a dual-battery configuration on certain equipment like mowers and trimmers.

By Price

The medium-price segment held the largest 46% share in 2024, reflecting balanced demand between affordability and advanced functionality. Consumers in both residential and semi-professional categories prefer mid-range cordless tools that offer durability without premium costs. Expanding e-commerce channels and promotional bundling of garden kits further encourage adoption in this range. Manufacturers are launching mid-tier products with extended battery life and ergonomic designs, meeting user expectations for value and performance while sustaining steady replacement demand.

Key Growth Drivers

Rising Adoption of Eco-Friendly and Noise-Free Equipment

Growing environmental awareness and stricter emission regulations are accelerating the shift from fuel-powered to cordless garden tools. Users prefer battery-operated equipment due to lower noise, zero emissions, and reduced maintenance. Governments promoting sustainable landscaping practices in urban and residential projects further boost adoption. As consumers seek cleaner and quieter outdoor solutions, the demand for advanced cordless models with long battery life continues to grow, especially across Europe and North America.

- For instance, Bosch’s ProCORE18V series with advanced thermal management allows high-power output (e.g., the 8.0 Ah model delivers up to 1,800 W equivalent), enabling power tools to operate consistently for demanding professional tasks by minimizing the risk of thermal cut-off.

Technological Advancements in Battery Performance

Continuous improvements in lithium-ion technology have enhanced energy density, charging speed, and durability. These innovations enable cordless garden tools to match the power of traditional gasoline models while offering better convenience. Manufacturers are integrating smart battery systems and rapid chargers to extend runtime and efficiency. This performance evolution makes cordless tools suitable for both residential and professional landscaping applications, accelerating market growth across key regions.

- For instance, STIHL developed the AP 500 S lithium-ion battery with 337 Wh capacity and over 2,400 charging cycles, doubling lifespan compared to standard lithium packs.

Expanding Home Gardening and Landscaping Activities

Rising interest in home gardening, lawn care, and outdoor aesthetics drives strong demand for cordless tools. Post-pandemic lifestyle changes and increased home ownership have expanded DIY gardening trends. Lightweight, portable, and easy-to-use cordless products appeal to homeowners seeking low-effort solutions. Landscaping service providers are also investing in battery-powered tools to meet green standards, further boosting commercial adoption and reinforcing steady market expansion.

Key Trends & Opportunities

Integration of Smart and Connected Features

Manufacturers are integrating IoT-enabled features such as Bluetooth connectivity, usage tracking, and automated performance control in cordless garden tools. Smart monitoring allows users to check battery levels, optimize operation, and receive maintenance alerts through mobile apps. These advancements enhance efficiency and reduce downtime, offering premium value to tech-savvy consumers. The growing trend of connected outdoor tools creates opportunities for brands to differentiate through digital innovation.

- For instance, Greenworks Tools offers its Greenworks Commercial Connect app, which provides remote connectivity for professional-grade devices like robotic lawnmowers and ride-on mowers, and also connects with Bluetooth-enabled batteries.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online retail platforms are becoming vital for cordless garden equipment sales, supported by detailed product reviews and virtual demonstrations. Major manufacturers are focusing on direct-to-consumer strategies to improve customer engagement and aftersales support. This shift expands reach in developing regions where retail infrastructure is limited. Seasonal promotions and bundled product offerings online continue to increase accessibility and brand visibility.

- For instance, Stanley Black & Decker has a global presence and a distribution network that includes more than 175 countries, with sales and operations in key areas around the globe. The company employs a hybrid distribution model, selling its products through various channels including retailers, third-party distributors, independent dealers, direct sales, and e-commerce.

Key Challenges

High Initial Costs of Advanced Cordless Tools

Despite long-term savings, high upfront costs limit cordless tool adoption among price-sensitive consumers. Premium models with advanced batteries and digital features remain expensive compared to corded or fuel-based tools. Small landscaping businesses and residential users often hesitate to invest in such equipment. Manufacturers must balance pricing and innovation to broaden customer acceptance across emerging markets.

Limited Battery Runtime and Performance Constraints

Battery limitations continue to affect operational efficiency during long working hours, especially for professional applications. Frequent recharging and reduced performance under heavy workloads challenge usability. Although fast-charging and swappable batteries help, they increase equipment costs. Enhancing battery capacity and durability remains essential for improving user satisfaction and ensuring widespread adoption in commercial landscaping.

Regional Analysis

North America

North America held the largest 37% share in 2024, driven by high household gardening participation and well-developed landscaping industries. The U.S. leads regional demand with widespread adoption of battery-powered lawn mowers and hedge trimmers for residential use. Government regulations promoting eco-friendly outdoor equipment and noise restrictions in urban areas further support market expansion. Strong presence of leading brands and availability of advanced lithium-ion tools enhance accessibility. Continuous innovation and smart tool integration by manufacturers strengthen regional leadership in the cordless garden equipment market.

Europe

Europe accounted for a 31% share in 2024, supported by growing emphasis on sustainable gardening practices and energy-efficient outdoor tools. Countries like Germany, the U.K., and France are leading adopters due to strict environmental regulations and consumer preference for low-emission products. The rise of robotic and connected lawn equipment boosts regional growth. Increasing government initiatives promoting green spaces and residential landscaping further contribute to demand. Manufacturers focusing on ergonomic, noise-free, and durable cordless models continue to strengthen market penetration across European households.

Asia-Pacific

Asia-Pacific captured a 23% share in 2024, making it the fastest-growing regional market. Rising disposable incomes and expanding urbanization in China, Japan, and India drive household adoption of cordless garden equipment. The increasing popularity of home gardening and small-scale landscaping supports sales of lightweight and affordable tools. Local manufacturers are introducing cost-effective lithium-ion models tailored to regional climate and garden sizes. Growing e-commerce channels and awareness of eco-friendly technologies also contribute to market expansion across developing economies.

Latin America

Latin America held an 6% share in 2024, driven by increasing landscaping activities in residential and commercial sectors. Brazil and Mexico lead the regional market, supported by expanding middle-class households and rising interest in home improvement projects. The shift toward electric and cordless garden tools aligns with regional sustainability goals. However, limited product availability and higher prices of premium models slightly restrain broader adoption. Growing partnerships between global brands and local distributors are improving market accessibility and consumer awareness.

Middle East & Africa

The Middle East & Africa accounted for a 3% share in 2024, reflecting gradual adoption of cordless garden tools. Urban landscaping projects and tourism-driven infrastructure developments in the UAE, Saudi Arabia, and South Africa support market growth. Rising investments in green building initiatives and public gardens also contribute to demand. However, limited awareness and lower household adoption rates remain challenges. Manufacturers are targeting the region with durable, heat-resistant, and easy-maintenance cordless products suitable for harsh climatic conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

- Lawn mowers

- Chainsaws

- Hedge trimmers

- Other tools (tillers, pole saws)

By Battery Type

- Lithium-Ion Batterie

- Nickel-Cadmium Batteries

- Others

By Price

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cordless garden equipment market features leading players such as Husqvarna, Makita, Greenworks, John Deere, AL-KO, MTD, EGO, Bosch, Honda, and Black+Decker. These companies compete through product innovation, battery technology advancements, and expanding distribution networks. Manufacturers are prioritizing long-lasting lithium-ion systems, ergonomic designs, and connected smart tool features to enhance user convenience. Strategic collaborations with battery suppliers and continuous investment in R&D are driving competitive differentiation. Many players focus on expanding their presence in emerging markets through e-commerce platforms and regional dealerships. Sustainability initiatives, including reduced carbon footprints and recyclable tool components, are becoming central to brand strategies. The competition remains intense, as established brands strengthen their portfolios and new entrants introduce cost-effective, feature-rich cordless solutions for both residential and professional users.

Key Player Analysis

- Husqvarna

- Makita

- Greenworks

- John Deere

- AL-KO

- MTD

- EGO

- Bosch

- Honda

- Black+Decker

Recent Developments

- In October 2025, Greenworks introduced its POWERALL™ 24V lineup – over 150 tools and bundles, with brushless motors delivering ~20% more power and 35% longer runtime.

- In 2024, Makita released two new 40V MAX XGT® outdoor-power equipment essentials: a dedicated shaft edger and a 24″ articulating pole hedge trimmer as part of its push to enable professionals to shift from gas to cordless.

- In June 2023, Makita expanded its 18V LXT® cordless outdoor-power-equipment system by introducing a new 24″ trimmer (XHU10) with dual-action blades and up to 100 minutes run time on an 18V battery

Report Coverage

The research report offers an in-depth analysis based on Product Type, Battery Type, Price, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cordless garden equipment market is projected to expand steadily through 2032, supported by strong consumer adoption and steady product innovation.

- Growing environmental awareness and the shift toward electric tools will continue to drive demand across both residential and professional landscaping applications.

- Battery innovations, especially in lithium-ion technology, will enhance runtime, reduce charging time, and strengthen product efficiency.

- Key players will invest in R&D, digital features, and smart connectivity to stay competitive and meet user convenience demands.

- Cost reduction through scalable production and efficient supply chains will support higher penetration in emerging economies.

- Sustainability goals and noise-reduction regulations will accelerate the phase-out of fuel-powered garden tools globally.

- The medium-price and lawn mower segments will maintain dominance due to balanced value and functionality.

- North America will remain the leading region, while Asia-Pacific will record the fastest growth through urbanization and lifestyle changes.

- Strategic partnerships and mergers among manufacturers will expand product availability and distribution.

- Battery recycling programs and eco-friendly manufacturing practices will shape the industry’s long-term sustainability framework.