Market Overview

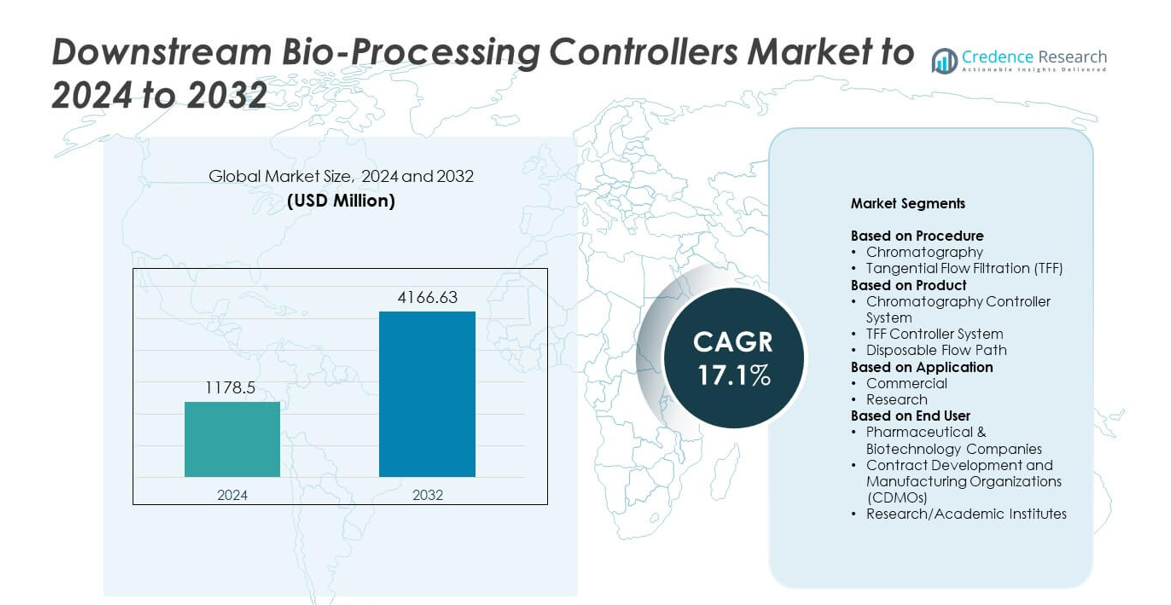

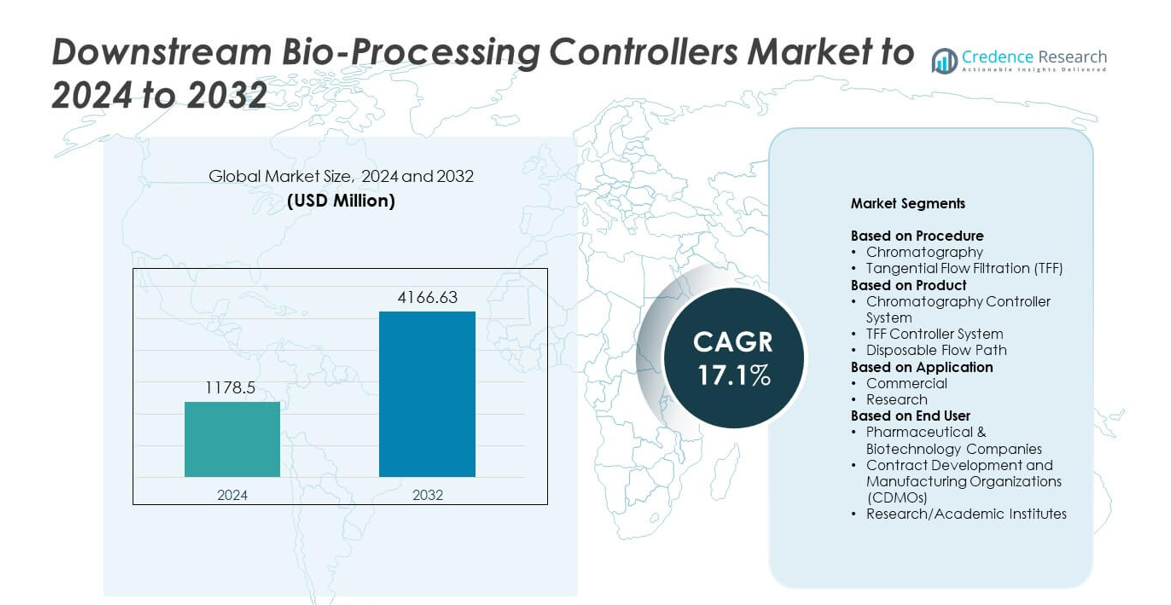

Downstream Bio-Processing Controllers Market size was valued USD 1178.5 million in 2024 and is anticipated to reach USD 4166.63 million by 2032, at a CAGR of 17.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Downstream Bio-Processing Controllers Market Size 2024 |

USD 1178.5 million |

| Downstream Bio-Processing Controllers Market, CAGR |

17.1% |

| Downstream Bio-Processing Controllers Market Size 2032 |

USD 4166.63 million |

The Downstream Bio-Processing Controllers Market is led by major companies including Thermo Fisher Scientific Inc., Sepragen Corporation, Merck Group (Merck KGaA), 3M Company, Sartorius AG, Ecolab Life Sciences, ARTeSYN Biosolutions Ireland Ltd, Danaher Corporation, Parker-Hannifin Corporation, GE Healthcare, and Repligen Corporation. These players compete through advanced automation features, improved purification control, and strong integration with single-use and continuous processing systems. North America remained the leading region in 2024 with about 41% share due to its large biologics manufacturing base and strong investment in high-precision downstream technologies. Europe followed with nearly 29% share, supported by established CDMOs and advanced therapeutic development across key markets.

Market Insights

- The Downstream Bio-Processing Controllers Market reached USD 1178.5 million in 2024 and is projected to hit USD 4166.63 million by 2032, growing at a CAGR of 17.1%.

- Strong demand for biologics and advanced therapies drives adoption as manufacturers seek higher purity, tighter control, and improved process efficiency across chromatography and TFF segments, with chromatography holding about 58% share.

- Single-use flow paths, real-time analytics, and continuous downstream processing represent key trends as companies upgrade to flexible and digitally connected purification systems.

- Market competition intensifies as global vendors expand automation capabilities, enhance software-driven control, and offer scalable solutions to support large-volume and multiproduct biologics manufacturing.

- North America leads with nearly 41% share, followed by Europe at 29% and Asia Pacific at 22%, driven by large-scale biologics production, strong CDMO networks, and rapid expansion of regional biomanufacturing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Procedure

Chromatography held the dominant share in 2024 with about 58%. Demand stayed strong because biomanufacturers relied on precise separation steps to maintain product purity across monoclonal antibodies, vaccines, and recombinant proteins. Chromatography systems supported high-resolution purification and offered better control during scale-up, which helped firms meet rising commercial batch volumes. Tangential Flow Filtration also expanded as continuous processing gained traction, yet chromatography remained the preferred method due to greater flexibility, higher yield stability, and strong alignment with regulatory quality expectations.

- For instance, Cytiva lists Capto S ImpAct chromatography resin with binding capacity above 100 mg MAb per mL.

By Product

Chromatography controller systems led the product segment in 2024 with nearly 52% share. These systems gained wider use as firms automated purification runs to reduce batch variation and improve throughput. Strong adoption came from large biologics plants that needed real-time monitoring and tighter control of column performance. TFF controller systems showed steady growth with the shift toward high-concentration biologics, while disposable flow paths advanced due to faster changeover needs. However, chromatography controllers stayed ahead because they supported complex purification steps across multiple downstream stages.

- For instance, Emerson’s DeltaV PK Controller allows control module scan times configured as low as 25 milliseconds.

By Application

Commercial applications dominated the market in 2024 with around 64% share. Growth rose as biopharma companies scaled production of monoclonal antibodies, viral vectors, and cell-based therapies. Commercial plants relied on advanced controllers to maintain batch consistency, meet regulatory standards, and improve process efficiency. Research settings continued to adopt flexible and modular systems for early-stage development, but commercial manufacturing held the lead because of higher equipment use intensity, greater investment capacity, and rising global demand for large-scale biologics output.

Key Growth Drivers

Rising Demand for Biologics Production

Biologics production expanded quickly as companies scaled monoclonal antibodies, cell therapies, and recombinant proteins. Downstream bio-processing controllers helped plants maintain tighter process control, which improved yield stability and reduced batch failures. Firms increased automation to meet growing global therapy demand, especially in oncology and immunology. The rising shift toward large-volume commercial manufacturing continued to push biopharma companies to adopt advanced controllers that supported consistent purification outcomes and regulatory compliance. This factor remained the strongest growth driver across major markets.

- For instance, Lonza’s Visp large-scale facility is designed to include six mammalian bioreactors each sized at 20,000 liters.

Shift Toward Automation and Digital Process Control

Manufacturers adopted advanced automation to reduce manual operations and improve downstream accuracy. Controllers enabled real-time monitoring of chromatography and TFF steps, which enhanced decision speed and minimized process deviation. Adoption grew as companies aimed to cut production costs and boost throughput in high-volume facilities. Strong interest in smart manufacturing, supported by digital sensors and analytical software, accelerated integration across global bioprocessing plants. This driver gained momentum as firms targeted higher reliability in large-scale biologics production.

- For instance, ABB’s Freelance DCS specifies configurable control cycle times starting from 5 milliseconds in process automation tasks.

Expansion of Advanced Therapy Manufacturing Capacity

Cell and gene therapy production saw rapid global investment, creating higher demand for precise downstream control. Advanced therapies required strict purification accuracy to maintain product safety and potency. Companies expanded new commercial sites that increasingly relied on automated controllers for handling complex purification tasks. Rising adoption of viral vectors and cell-based products pushed manufacturers to upgrade downstream systems. This driver supported strong growth as next-generation therapies moved from clinical pipelines into broader commercial availability.

Key Trends & Opportunities

Growth of Single-Use and Disposable Flow Technologies

Single-use assemblies expanded across downstream operations as firms sought faster changeovers and reduced contamination risk. Disposable flow paths gained traction for handling diverse product batches in multiproduct facilities. Adoption increased because single-use systems supported flexible capacity planning for both clinical and commercial biologics. Producers also targeted lower cleaning costs and shorter validation timelines. This trend created opportunities for manufacturers offering modular, pre-validated controller designs aligned with modern single-use architectures.

- For instance, Thermo Fisher’s HyPerforma single-use bioreactor specifies a rated liquid working volume of 2,000 liters.

Adoption of Continuous and Hybrid Downstream Processing

Continuous downstream processing gained visibility as companies aimed to enhance productivity and reduce bottlenecks. Controllers designed for continuous chromatography and TFF helped maintain stable operating conditions and higher throughput. Hybrid systems that combined batch and continuous modes also grew in acceptance. Manufacturers viewed this shift as an opportunity to cut cycle times, improve consistency, and support future large-scale biologics demand. The trend strengthened as firms explored more compact, energy-efficient purification platforms.

- For instance, Sartorius’ BioSMB PD multi-column chromatography platform can operate using from 1 up to 16 columns.

Integration of PAT and Real-Time Analytics

Process Analytical Technology (PAT) tools merged with downstream controllers to improve real-time decision making. Companies used integrated sensors and data tools to monitor critical quality parameters across purification steps. Growth in data-driven manufacturing offered opportunities for firms that supplied controllers with built-in analytics, predictive alerts, and adaptive control features. This trend aligned with broader digital transformation goals across global bioprocessing operations.

Key Challenges

High Cost of Advanced Automation and Integration

Many biomanufacturers faced high investment costs when upgrading or expanding downstream control systems. Complex integration with existing equipment increased project expenses, especially in aging facilities. Smaller firms struggled with budget limits despite the long-term efficiency benefits. Validation, qualification, and training needs added further cost pressure. These factors slowed adoption among mid-scale companies and remained a major challenge for broader market penetration.

Limited Skilled Workforce for Advanced Downstream Operations

Demand for trained personnel increased as downstream processes became more automated and data-driven. Many plants faced skill gaps in operating digital controllers, interpreting process analytics, and maintaining integrated systems. Workforce shortages created operational delays and raised error risks in high-value biologics production. The challenge grew as facilities expanded advanced therapy manufacturing lines that required even tighter control. This talent shortage stayed a major barrier to achieving smooth, large-scale adoption.

Regional Analysis

North America

North America held the largest share in 2024 with about 41% of the market. Strong biologics manufacturing capacity across the United States and Canada supported wide adoption of advanced downstream controllers. Growth came from expanded monoclonal antibody production, rising cell and gene therapy commercialization, and heavy investment in automated purification systems. Many leading biopharma companies operated large-scale facilities that relied on real-time monitoring and high-precision control. Regulatory focus on process consistency further encouraged use of advanced chromatography and TFF controllers, keeping the region at the forefront of technology uptake.

Europe

Europe accounted for nearly 29% share in 2024, driven by a strong network of contract development and manufacturing organizations and established biologics producers. Demand grew as firms expanded purification capacity for antibodies, vaccines, and viral vectors. Countries such as Germany, Switzerland, and the United Kingdom showed high adoption of automated downstream systems that improved batch reproducibility and reduced operational errors. Continuous processing and single-use chromatography systems gained momentum, supported by strong regulatory frameworks. The region maintained steady growth due to ongoing investment in advanced therapeutic development and modernization of existing bioprocessing facilities.

Asia Pacific

Asia Pacific held about 22% share in 2024 and grew rapidly due to expanding biologics manufacturing in China, India, South Korea, and Japan. Regional firms invested in new plants that adopted modern downstream controllers to match global quality standards. Strong government support for biopharma infrastructure encouraged wider use of automated chromatography and TFF platforms. Rising biosimilar production also pushed companies to improve purification efficiency. Increasing clinical activity and growth in CDMO services strengthened market momentum, positioning Asia Pacific as one of the fastest-growing regions for advanced downstream control systems.

Latin America

Latin America captured roughly 5% of the market in 2024, supported by emerging biologics production across Brazil, Mexico, and Argentina. Adoption of downstream controllers increased as regional manufacturers targeted higher process reliability and aligned with international quality norms. Growth came from rising interest in biosimilar development and expansion of public and private healthcare investment. However, limited automation budgets and uneven technical infrastructure slowed broader penetration. Despite these constraints, modernization initiatives and collaborations with global biopharma firms continued to support steady adoption of advanced downstream systems.

Middle East and Africa

Middle East and Africa accounted for about 3% share in 2024, reflecting early-stage but growing interest in bioprocessing technologies. Governments in the Gulf region increased investment in healthcare manufacturing to reduce import dependence, supporting gradual adoption of downstream controllers. South Africa and Saudi Arabia led regional biologics initiatives, focusing on vaccines and essential biologics production. Infrastructure gaps and fewer trained professionals limited rapid deployment, yet technology transfer programs and new research centers helped build capability. The region showed stable progress as local production capacity continued to expand.

Market Segmentations:

By Procedure

- Chromatography

- Tangential Flow Filtration (TFF)

By Product

- Chromatography Controller System

- TFF Controller System

- Disposable Flow Path

By Application

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Research/Academic Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Downstream Bio-Processing Controllers Market is shaped by leading companies such as Thermo Fisher Scientific Inc., Sepragen Corporation, Merck Group (Merck KGaA), 3M Company, Sartorius AG, Ecolab Life Sciences, ARTeSYN Biosolutions Ireland Ltd, Danaher Corporation, Parker-Hannifin Corporation, GE Healthcare, and Repligen Corporation. The market features strong competition driven by advanced automation capabilities, integrated digital controls, and enhanced purification accuracy. Vendors focus on developing systems that support real-time monitoring, reduced batch variation, and flexible processing across chromatography and TFF workflows. Many manufacturers invest in single-use compatibility and seamless connectivity with upstream equipment to support continuous and hybrid operations. Increased emphasis on software-driven control, modular design, and predictive analytics strengthens product differentiation. Companies also expand global service networks to support rapid installation, training, and compliance needs. Rising demand for high-throughput biologics and advanced therapy production encourages firms to innovate faster and offer scalable, regulatory-aligned controller platforms across major regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Fisher Scientific Inc.

- Sepragen Corporation

- Merck Group (Merck KGaA)

- 3M Company

- Sartorius AG (Sartorius Stedim Biotech S.A.)

- Ecolab Life Sciences (Purolite)

- ARTeSYN Biosolutions Ireland Ltd

- Danaher Corporation

- Parker-Hannifin Corporation

- GE Healthcare

- Repligen Corporation

Recent Developments

- In 2025, Merck Group (Merck KGaA) made a significant acquisition by signing a definitive agreement, to acquire the chromatography business of JSR Life Sciences.

- In 2024, Ecolab Life Sciences (Purolite) In collaboration with Repligen, commercially launched the DurA Cycle, a new Protein A chromatography affinity resin for large-scale commercial biologics manufacturing.

- In 2023, Danaher Corporation company notably partnered with the University of Pennsylvania’s Center for Cellular Immunotherapies to develop technologies that address manufacturing challenges for engineered cell therapies.

Report Coverage

The research report offers an in-depth analysis based on Procedure, Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as biologics and advanced therapies scale toward higher global volumes.

- Automation adoption will expand as manufacturers target tighter control and fewer manual steps.

- Continuous downstream processing will gain traction in large commercial facilities.

- Single-use flow paths will see wider use due to faster changeovers and lower contamination risk.

- PAT-enabled controllers will grow as firms rely more on real-time quality data.

- Digital twins will support predictive adjustments in downstream purification lines.

- CDMOs will invest heavily in flexible controller platforms for multiproduct operations.

- Hybrid batch-continuous systems will become more common in mid-scale plants.

- Integrated control software will advance as firms unify chromatography and TFF workflows.

- Emerging regions will accelerate adoption as biomanufacturing infrastructure matures.