Market Overview

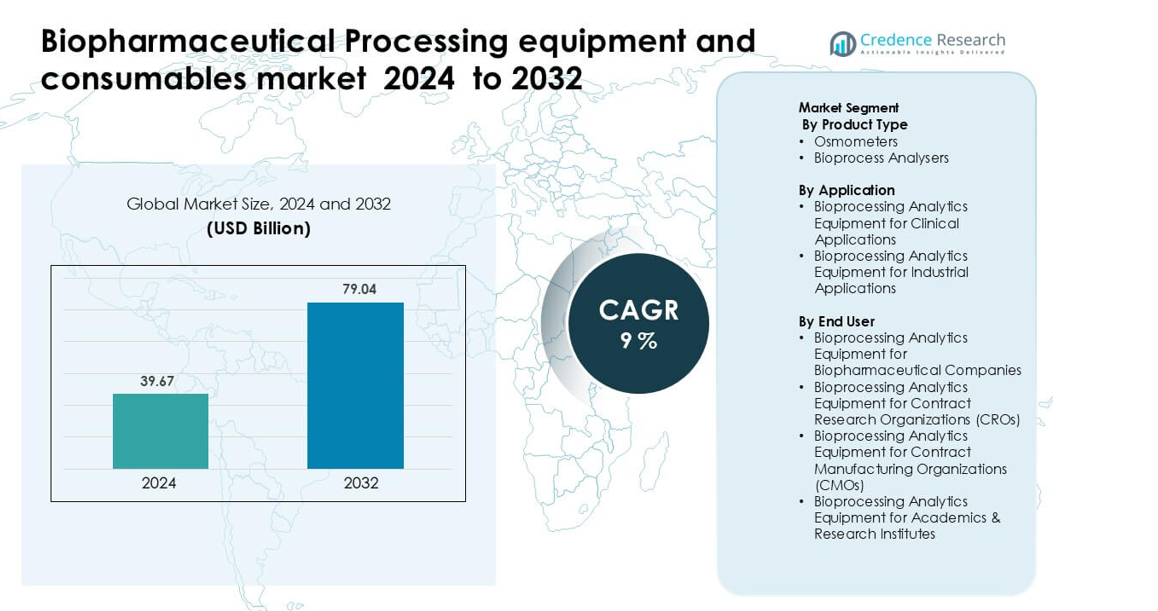

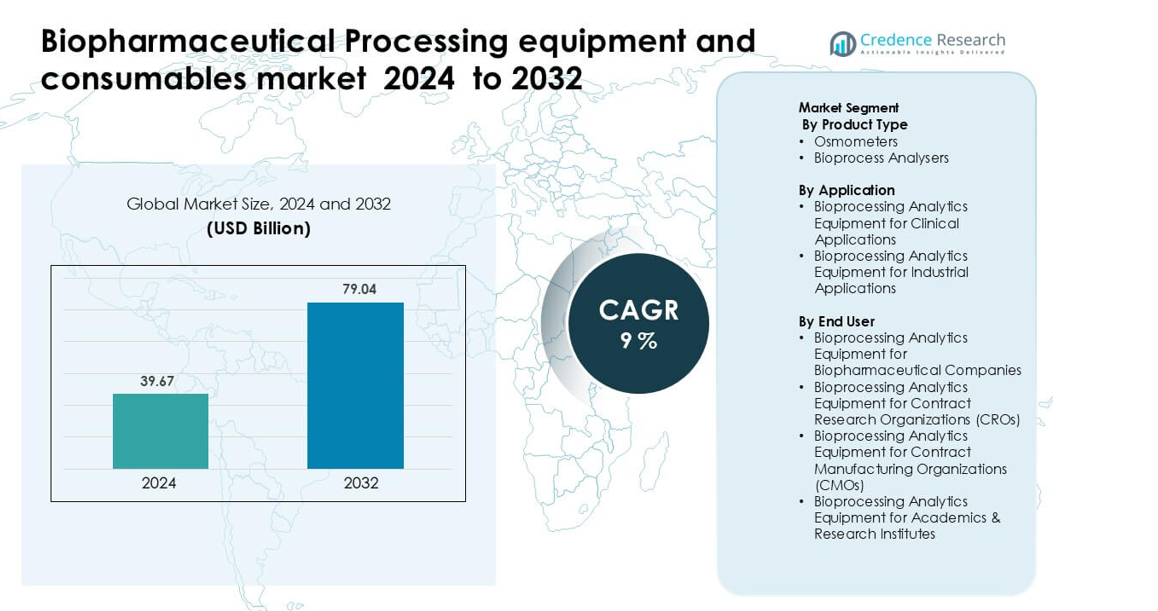

Biopharmaceutical Processing equipment and consumables market was valued at USD 39.67 billion in 2024 and is anticipated to reach USD 79.04 billion by 2032, growing at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biopharmaceutical Processing Equipment and Consumables Market Size 2024 |

USD 39.67 billion |

| Biopharmaceutical Processing Equipment and Consumables Market, CAGR |

9% |

| Biopharmaceutical Processing Equipment and Consumables Market Size 2032 |

USD 79.04 billion |

The biopharmaceutical processing equipment and consumables market is led by major players such as Agilent Technologies, Solaris Biotechnology, 3M Company, Sartorius, Repligen, Bio-Rad Laboratories, Thermo Fisher Scientific, Eppendorf, Merck KGaA, and Danaher. These companies expand their presence through advanced single-use systems, high-precision analytical instruments, automated bioprocess solutions, and strong global distribution networks. Strategic partnerships with biopharma manufacturers and continuous investment in digital bioprocessing strengthen their competitive positions. North America remained the leading region in 2024 with about 38% market share, driven by robust biologics pipelines, strong R&D activity, and rapid adoption of automation and PAT-enabled manufacturing.

Market Insights

- Biopharmaceutical Processing equipment and consumables market was valued at USD 39.67 billion in 2024 and is anticipated to reach USD 79.04 billion by 2032, growing at a CAGR of 9% during the forecast period.

- Market growth is driven by rising biologics, vaccines, and cell-therapy production, which increases demand for single-use systems, filtration units, analysers, and automated process-control tools; osmometers led product type demand with about 56% share in 2024.

- Key trends include expansion of continuous bioprocessing, rapid adoption of digital monitoring, and strong shift toward flexible single-use workflows, supported by higher regulatory focus on real-time analytics and contamination-free operations.

- The competitive landscape includes Agilent Technologies, Solaris Biotechnology, 3M Company, Sartorius, Repligen, Bio-Rad Laboratories, Thermo Fisher Scientific, Eppendorf, Merck KGaA, and Danaher, each expanding through automation, consumable innovation, and strategic partnerships.

- North America led with about 38% share, followed by Europe at 31% and Asia Pacific at 24%, reflecting strong biologics pipelines, major manufacturing expansions, and higher adoption of automated bioprocess equipment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Osmometers dominated the product type segment in 2024 with about 56% share. Demand increased as biopharmaceutical producers relied on precise osmolality control to ensure product stability and batch consistency. Adoption grew further due to rising monoclonal antibody and cell-therapy production, where osmolality monitoring supports quality compliance. Bioprocess analysers also expanded as manufacturers focused on real-time analytics for reducing deviations and improving process yields. Growth across this segment was driven by stricter regulatory expectations and increasing use of automated, sensor-based monitoring in upstream and downstream workflows.

- For instance, Advanced Instruments’ OsmoTECH XT single-sample micro‑osmometer can measure osmolality up to 4,000 mOsm/kg in just ~150 seconds, helping mAb manufacturers maintain tight control over high‑concentration formulations.

By Application

Bioprocessing analytics equipment for industrial applications held the largest share in 2024 at nearly 63%. This dominance resulted from high-volume biologics manufacturing, where companies required continuous quality checks and inline monitoring to avoid batch failures. Strong growth came from expanded vaccine facilities, biosimilar plants, and advanced therapy production. Clinical applications continued to rise due to increased clinical trial complexity and growing biomarker-based studies. Demand across both categories was supported by higher analytical precision needs and rising investments in digital bioprocessing platforms.

- For instance, in a continuous perfusion bioreactor run spanning 50 days, the MarqMetrix Raman system tracked critical process parameters including glucose, lactate, ammonium, product titer, and viability in real time even at cell densities reaching 100–130 million cells per mL.

By End User

Biopharmaceutical companies led the end-user segment in 2024 with about 48% share. These firms invested heavily in analytical equipment to support large-scale biologics pipelines, boost process robustness, and meet global regulatory standards. CROs and CMOs grew rapidly as outsourcing increased across clinical studies and commercial manufacturing. Academic and research institutes also adopted advanced analysers to support cell-line development and translational studies. Overall growth was fueled by rising biologics R&D activity, demand for faster release testing, and the shift toward integrated, data-rich bioprocessing environments.

Key Growth Drivers

Rising Biologics and Advanced Therapy Production

The biopharmaceutical processing equipment and consumables market grows steadily as global demand for monoclonal antibodies, vaccines, recombinant proteins, and cell- and gene-therapy products increases. Manufacturers expand capacity to support large biologics pipelines, which boosts demand for bioreactors, filtration systems, sensors, single-use consumables, and analytical tools. The surge in mRNA and viral-vector production strengthens investments in upstream and downstream equipment designed for higher yields and compliance. Companies also adopt automated and closed-system technologies to reduce contamination risks and improve efficiency. This expansion creates sustained demand across both commercial manufacturing and clinical supply chains.

- For instance, Thermo Fisher Scientific doubled its viral‑vector manufacturing capacity through its Plainville, Massachusetts site, which features a 2,000 L pilot bioreactor along with 11 cGMP drug‑substance suites.

Shift Toward Single-Use and Flexible Manufacturing Systems

Key growth arises from the rapid move toward single-use systems that reduce cleaning needs, shorten turnaround time, and enhance operational agility. Biopharmaceutical firms prefer disposable bioreactors, tubing, filters, and sampling devices because they support multi-product facilities and faster scaling. Flexible manufacturing becomes essential as companies launch smaller-volume, high-value therapies such as CAR-T cells. Adoption also increases due to reduced cross-contamination and better alignment with regulatory expectations. As facilities modernize, demand for compatible sensors, connectors, and analytics expands, strengthening the market for both equipment and consumables.

- For instance, Sartorius’ single‑use platform includes BIOSTAT STR bioreactors with working volumes up to 2,000 L, allowing seamless scale‑up from lab to commercial production without the need for cleaning validation between campaigns.

Expansion of Bioprocess Automation and Real-Time Analytics

Automation drives strong market growth as companies implement real-time monitoring, advanced sensors, and data-driven control systems. Automated process analytics lower failure rates, improve reproducibility, and support continuous manufacturing. PAT frameworks gain wider use, prompting higher demand for bioprocess analysers, osmometers, and integrated monitoring solutions. Digital twins, AI-based prediction tools, and inline multi-parameter sensors improve decision-making and reduce reliance on manual sampling. This shift helps manufacturers meet strict quality standards while improving productivity, making automation a central driver for modern biopharmaceutical production.

Key Trend and Opportunities

Increasing Adoption of Continuous and Hybrid Processing

Continuous bioprocessing gains traction as companies aim to reduce costs, improve yields, and simplify scale-up. Hybrid models that combine batch and continuous steps also grow due to flexibility and quicker implementation. Large manufacturers adopt continuous chromatography, perfusion bioreactors, and inline sensors to boost throughput and maintain product quality. This transition opens opportunities for suppliers offering high-precision monitoring tools, robust single-use components, and scalable process equipment. Growing regulatory support and proven case studies further accelerate uptake across biologics and biosimilars production.

- For instance, Sartorius’ hybrid continuous‑intensified perfusion system has achieved cell densities of 80–110 × 10^6 cells/mL, translating to 3–4 g/L/day productivity, giving around 8 kg of mAb from a 500 L bioreactor in 15 days.

Growth of Personalized and Precision Therapies

The rise of personalized therapies creates strong opportunities for equipment tailored to small-batch, high-value manufacturing. Cell- and gene-therapy developers require compact bioreactors, closed-system consumables, rapid sterility tools, and automated analytics to run safe and compliant workflows. This trend pushes suppliers to develop modular, flexible units that support quick product changeovers. Increased demand for autologous therapies drives innovation in point-of-care manufacturing, decentralized production systems, and advanced QC devices. As clinical pipelines expand, suppliers benefit from long-term demand for specialized consumables and monitoring technologies.

- For instance, Sartorius’ Ambr® 250 Modular system offers single‑use vessels with working volumes of 100–250 mL, which are used by T‑cell developers to rapidly optimize process parameters such as pH, dissolved oxygen and feed rates via integrated sensors, and the system has been demonstrated to support automated control of critical process parameters.

Key Challenge

High Capital Costs and Operational Complexity

Biopharmaceutical processing equipment requires significant upfront investment, especially for large stainless-steel bioreactors, filtration systems, analyzers, and automation platforms. Smaller developers and emerging biotechs face budget constraints, slowing adoption of advanced technologies. Operational complexity adds further strain, as facilities must align with strict regulatory requirements, validation procedures, and specialized workforce needs. The cost of integrating digital tools, retrofitting legacy systems, and maintaining cleanrooms increases overall expenditure. These barriers make cost optimization and modular system design critical challenges for industry growth.

Supply Chain Constraints and Single-Use Material Shortages

Supply chain disruptions pose major risks, particularly for critical consumables such as filters, bags, connectors, and tubing used in single-use systems. Global shortages during peak biologics demand highlight vulnerability in resin availability, sterilization capacity, and transportation networks. Manufacturers rely on limited suppliers, increasing lead times and reducing flexibility. Delays impact clinical production, batch scheduling, and the ability to scale rapidly. Ensuring redundancy, localizing supply chains, and diversifying material sources remain essential challenges for sustaining the reliability of modern bioprocessing operations.

Regional Analysis

North America

North America led the biopharmaceutical processing equipment and consumables market in 2024 with about 38% share. Growth came from strong biologics pipelines, large investments in cell- and gene-therapy facilities, and rapid adoption of single-use technologies. The U.S. benefited from advanced R&D capabilities, a large base of biopharmaceutical companies, and strong regulatory support for digital and automated manufacturing. Canadian manufacturers expanded capacity in biologics and vaccines, adding steady demand. The region’s focus on automation, PAT frameworks, and high-precision analytics continued to strengthen market growth across both equipment and consumables.

Europe

Europe held roughly 31% share in 2024, driven by strong manufacturing hubs in Germany, France, Switzerland, and the U.K. The region expanded bioprocessing capabilities through investments in biosimilars, advanced therapy medicinal products, and modular multi-product plants. Adoption of continuous processing and single-use components increased as manufacturers prioritized efficiency and regulatory compliance. EU initiatives supporting innovation and localized biologics production boosted demand for bioreactors, filtration systems, and analytical instruments. Growing academic-industry collaborations further supported consumables use across pilot-scale and clinical-stage facilities.

Asia Pacific

Asia Pacific accounted for nearly 24% share in 2024 and remained the fastest-growing region. China and India expanded biopharmaceutical manufacturing, supported by government incentives, rising biologics consumption, and new vaccine facilities. South Korea and Japan strengthened their positions in biosimilars and cell-therapy production, increasing demand for advanced bioprocess equipment. The region saw rapid adoption of single-use systems due to lower cost and flexible manufacturing needs. Strong investment inflows, expanding CRO/CMO networks, and growing clinical trial activity further accelerated growth in equipment and consumables.

Latin America

Latin America held about 4% share in 2024, supported by expanding biologics production in Brazil, Mexico, and Argentina. Investments in vaccine manufacturing and public-sector health programs increased adoption of essential bioprocessing equipment. The region focused on upgrading QC laboratories and strengthening fill-finish capacities, driving demand for consumables and analytical instruments. Collaborations with global biopharmaceutical companies supported technology transfer and capacity building. Despite slower adoption of advanced automation, the market continued to grow due to rising healthcare needs and expansion of local manufacturing capabilities.

Middle East & Africa

The Middle East & Africa region captured around 3% share in 2024, driven by emerging biopharmaceutical initiatives in the UAE, Saudi Arabia, and South Africa. Governments increased investments in local vaccine and biosimilar production to reduce import dependency. Growing partnerships with international manufacturers supported facility upgrades and adoption of modern bioprocess equipment. The region expanded cold-chain infrastructure and QC capabilities, boosting demand for filtration, sampling, and monitoring consumables. While market maturity remained low, rising healthcare spending and strategic biomanufacturing programs supported gradual market expansion.

Market Segmentations:

By Product Type

- Osmometers

- Bioprocess Analysers

By Application

- Bioprocessing Analytics Equipment for Clinical Applications

- Bioprocessing Analytics Equipment for Industrial Applications

By End User

- Bioprocessing Analytics Equipment for Biopharmaceutical Companies

- Bioprocessing Analytics Equipment for Contract Research Organizations (CROs)

- Bioprocessing Analytics Equipment for Contract Manufacturing Organizations (CMOs)

- Bioprocessing Analytics Equipment for Academics & Research Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the biopharmaceutical processing equipment and consumables market features leading players such as Agilent Technologies, Solaris Biotechnology, 3M Company, Sartorius, Repligen, Bio-Rad Laboratories, Thermo Fisher Scientific, Eppendorf, Merck KGaA, and Danaher. These companies strengthen their positions through advanced bioreactors, high-precision analytical systems, filtration products, and single-use technologies that support modern biologics and cell-therapy manufacturing. Major players invest in automation, inline monitoring, and digital process-control platforms to meet rising quality expectations and reduce batch variability. Strategic moves such as acquisitions, capacity expansions, and collaborations with biopharmaceutical producers enhance technological depth and global reach. Many suppliers focus on developing scalable, contamination-resistant consumables and modular equipment to support flexible manufacturing needs. As biologics pipelines expand, competition intensifies around cost-efficient single-use solutions, high-throughput analysers, and integrated platforms that improve productivity and regulatory compliance across commercial and clinical production environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Agilent Technologies, Inc. Agilent opened a new Biopharma Experience Center in Hyderabad, India. The site showcases chromatography, mass spectrometry, cell analysis, and digital workflows to help biopharma teams design and optimize processing and QC methods.

- In June 2025, Sartorius AG Sartorius Stedim Biotech completed a multi-year expansion at its Aubagne, France campus. The project nearly doubled cleanroom space and added automated production lines and logistics for 2D and 3D single-use bags used for cell culture, storage, and fluid transport in bioprocessing.

- In November 2024, Solaris Biotechnology Srl Solaris reported its successful debut at Analytica China 2024 in Shanghai. The company highlighted its bench, pilot, and industrial bioreactors and fermenters for bioprocessing customers across pharma, biotech, and alternative proteins in the APAC region.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced bioprocess equipment will rise as biologics pipelines expand.

- Single-use technologies will gain wider adoption across clinical and commercial manufacturing.

- Automation and real-time analytics will become standard in next-generation bioprocess facilities.

- Continuous and hybrid processing will see stronger integration in upstream and downstream workflows.

- Cell- and gene-therapy production will drive need for small-batch, flexible systems and specialized consumables.

- Digital twins and AI-driven process optimization will improve efficiency and reduce batch variability.

- Suppliers will invest in modular, scalable equipment to support multi-product facilities.

- Sustainability initiatives will increase demand for energy-efficient systems and recyclable consumables.

- Emerging markets will accelerate capacity expansion, strengthening global equipment distribution networks.

- Supply chain diversification will remain a priority to prevent shortages of critical single-use materials.