Market Overview

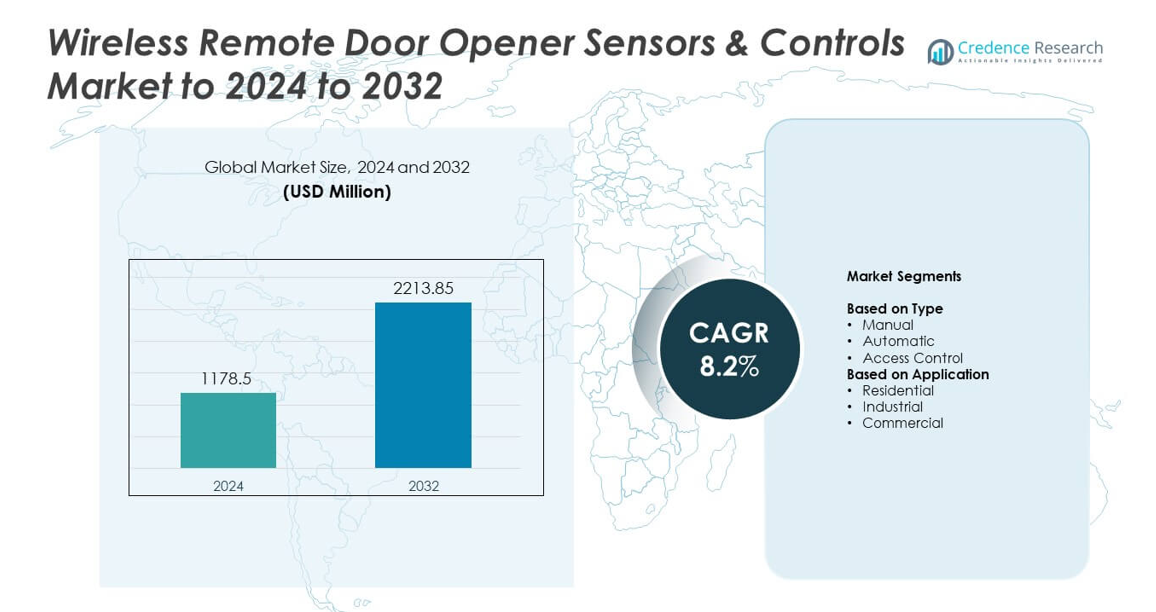

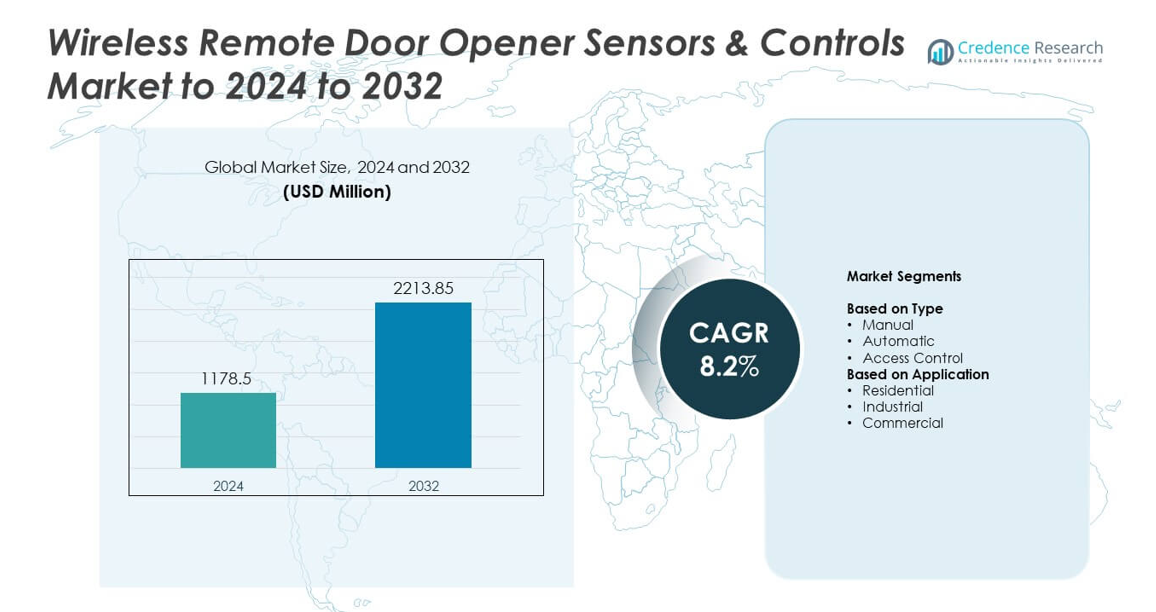

Wireless Remote Door Opener Sensors & Controls Market size was valued at USD 1178.5 Million in 2024 and is anticipated to reach USD 2213.85 Million by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless Remote Door Opener Sensors & Controls Market Size 2024 |

USD 1178.5 Million |

| Wireless Remote Door Opener Sensors & Controls Market, CAGR |

8.2% |

| Wireless Remote Door Opener Sensors & Controls Market Size 2032 |

USD 2213.85 Million |

The Wireless Remote Door Opener Sensors & Controls Market is led by major companies such as ASSA ABLOY, Overhead Door Corporation, Honeywell International Inc., Nice S.p.A, Vanderbilt Industries, Nortek Security & Control LLC, Hörmann Group, Allegion plc, and Chamberlain Group. These players compete by enhancing wireless sensing performance, expanding integration with smart building systems, and improving automated access technologies for commercial and residential use. Innovation in touchless entry, cloud-based management, and IoT connectivity supports stronger global adoption. North America remained the leading region in 2024 with a 38% share, driven by rapid smart infrastructure development and high investment in building automation.

Market Insights

- The Wireless Remote Door Opener Sensors & Controls Market was valued at USD 1178.5 Million in 2024 and is expected to reach USD 2213.85 Million by 2032, growing at a CAGR of 8.2%.

- Demand grows as touchless access systems, IoT connectivity, and smart automation support safer and more efficient entry management across commercial, residential, and industrial buildings.

- Key trends include rising adoption of AI-based sensing, cloud-managed access platforms, and retrofitting of older facilities with wireless, low-maintenance door control solutions.

- Competition intensifies as major players expand advanced automation features and improve battery efficiency, while segment insights show automatic systems holding 46% share and commercial applications leading with 41% share.

- Regional growth is led by North America with 38% share, followed by Europe at 31% and Asia Pacific at 24%, while Latin America and Middle East & Africa show gradual adoption due to expanding smart infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Automatic systems held the dominant share in 2024 with about 46% of the Wireless Remote Door Opener Sensors & Controls Market. Demand rose due to stronger adoption of hands-free access, motion-based activation, and energy-efficient door operations in high-traffic environments. These systems improved user safety and reduced contact-based risks, which encouraged wider use in public and private buildings. Manual and access-control-only units continued to serve cost-sensitive users, but automation remained the preferred choice because it supported compliance with modern building standards and enhanced convenience.

- For instance, dormakaba’s ED 100 and ED 250 swing door operators are endurance tested to 1,000,000 operating cycles, as specified in the official product data sheet.

By Application

Commercial facilities accounted for the largest share in 2024 with nearly 41% of the Wireless Remote Door Opener Sensors & Controls Market. Offices, retail chains, hospitals, and airports increased deployment to support smooth entry management, ADA compliance, and controlled traffic flow. Higher visitor volumes and rising investment in smart building upgrades strengthened demand across this segment. Residential and industrial applications saw steady adoption as homeowners and factories improved security, safety, and remote access capabilities through connected door-control systems.

- For instance, GEZE’s GC 365 combined radar and infrared detector is certified for reliable detection at installation heights up to 3,500 millimeters, supporting safe activation on commercial sliding doors.

Key Growth Drivers

Rising demand for touchless access solutions

Touchless entry systems gained strong momentum as businesses and households prioritized hygiene, safety, and convenience. Wireless sensors enabled doors to open without physical contact, which reduced contamination risks and improved user comfort. Rapid upgrades in smart buildings and public facilities supported the shift toward automated entry points. Wider awareness of contactless technologies and the need for seamless movement across high-traffic areas helped accelerate market adoption.

- For instance, ASSA ABLOY’s SL500 automatic sliding door operator offers opening and closing speeds variable up to 1.7 meters per second (for bi-parting, two-leaf doors) and programmable hold-open times from 0 to 60 seconds, enabling fast, contactless passage in high-traffic zones.

Expansion of smart home and IoT integration

Smart home ecosystems grew quickly, and wireless door opener controls became part of connected security setups. Users preferred systems that linked with mobile apps, voice assistants, and home hubs for remote monitoring and enhanced control. IoT-based sensors improved performance through real-time alerts, energy-efficient operation, and automation routines. This integration increased adoption across residential spaces seeking better safety and convenience.

- For instance, Chamberlain Group reports that over 10 millionpeople rely on the myQ app daily to control and monitor access points for their homes, communities, and businesses from anywhere in the world.

Growing safety and compliance requirements

Regulatory pressure for accessible and safe entry solutions encouraged larger use of wireless door opener sensors. Commercial buildings, hospitals, and public infrastructure invested in compliant systems to support smooth and barrier-free access. Improved technology offered better detection accuracy and reduced malfunctions, which lowered operational risks. These benefits made wireless systems essential for modernizing aging facilities and meeting updated safety codes.

Key Trends & Opportunities

Shift toward AI-enabled and adaptive sensing

AI-based sensing technology improved accuracy, adjusted detection zones, and reduced false triggers. Adaptive sensors analyzed movement patterns and optimized door operations in real time, which enhanced efficiency. These capabilities created opportunities for advanced automation in airports, malls, offices, and industrial units. Developers focused on machine-learning upgrades that supported energy savings and reduced maintenance costs.

- For instance, Optex’s OAM-EXPLORER industrial door sensor supports a maximum mounting height of 6 meters and uses three independent relay outputs that can be combined into nine different relay configurations, enabling advanced adaptive control.

Growth of cloud-based access management

Cloud platforms gained traction as businesses adopted centralized access control systems. Wireless sensors connected to cloud dashboards allowed facility managers to track door usage, modify permissions, and monitor system health remotely. This shift supported demand in multi-site enterprises, co-working spaces, and remote-managed properties. Scalable cloud solutions created new revenue streams for service providers offering analytics and subscription-based access control.

- For instance, Brivo reports that its cloud access platform is now the digital foundation for the world’s largest collection of customer facilities, protecting over 600 million square feet (\(\mathbf{600\ }\text{million}\mathbf{\ }\text{sq}\mathbf{\ }\text{ft}\)) across more than 60 countries.

Rising adoption in retrofitting projects

Older buildings increasingly installed wireless door opener sensors due to low wiring needs and easy integration. These solutions helped modernize facilities without major structural changes, which reduced upgrade costs. Retrofitting demand rose in offices, retail outlets, and healthcare facilities trying to improve accessibility. This trend opened opportunities for manufacturers offering compact, modular, and battery-efficient designs.

Key Challenges

High installation and maintenance complexity

Although wireless systems reduce wiring requirements, larger facilities still face integration challenges. Compatibility issues with legacy doors and existing access control systems can increase installation time. Maintenance becomes difficult when sensors require regular calibration or battery replacement. These factors raise lifecycle costs for enterprises and slow adoption in budget-sensitive markets.

Cybersecurity and data privacy risks

Connected door systems create vulnerabilities when not equipped with strong encryption and authentication. Unauthorized access attempts, sensor spoofing, or network breaches can compromise building security. Enterprises must invest in secure communication protocols and regular system updates to reduce risks. These concerns make some buyers cautious, especially in sectors handling sensitive data or critical infrastructure.

Regional Analysis

North America

North America held the leading share in 2024 with about 38% of the Wireless Remote Door Opener Sensors & Controls Market. Strong adoption of smart building systems, high investment in commercial infrastructure, and early use of touchless access technologies supported regional growth. Hospitals, corporate offices, and retail chains expanded automation to improve hygiene and accessibility standards. Demand increased further as homes integrated wireless access controls into broader IoT ecosystems. Robust supply chains and the presence of major technology providers also helped strengthen market penetration across the United States and Canada.

Europe

Europe accounted for nearly 31% of the Wireless Remote Door Opener Sensors & Controls Market in 2024. The region saw steady demand due to strict accessibility regulations, rising modernization efforts in public buildings, and greater focus on energy-efficient door automation. Commercial facilities, transportation hubs, and healthcare centers increased adoption to meet safety compliance and improve flow management. Smart home upgrades also supported residential uptake in countries like Germany, the United Kingdom, and France. Growing retrofitting activity in older buildings further contributed to wider deployment across the region.

Asia Pacific

Asia Pacific represented about 24% of the Wireless Remote Door Opener Sensors & Controls Market in 2024. Rapid urban development, expansion of commercial real estate, and rising investment in smart infrastructure drove strong demand. High-density public spaces such as airports, malls, and industrial facilities adopted wireless door sensors to enhance crowd management and operational efficiency. Increasing smart home penetration in China, Japan, and South Korea also boosted residential adoption. Government-backed digital infrastructure programs strengthened long-term growth prospects across major economies in the region.

Latin America

Latin America held nearly 4% of the Wireless Remote Door Opener Sensors & Controls Market in 2024. Growth remained supported by rising modernization in commercial buildings and gradual adoption of automated access systems in retail and healthcare sectors. Brazil and Mexico led demand as businesses improved security and upgraded entry points to support better visitor management. Economic constraints limited large-scale investments, but wireless systems gained traction due to easier installation and lower structural requirements. Expanding smart home interest contributed to emerging residential adoption across key urban areas.

Middle East and Africa

Middle East and Africa accounted for around 3% of the Wireless Remote Door Opener Sensors & Controls Market in 2024. Demand increased as commercial projects, airports, and hospitality developments adopted wireless access solutions to enhance visitor experience and improve security. Gulf countries invested in smart infrastructure that supported wider use of automated door systems. Adoption grew slowly in Africa due to budget constraints, although public facilities and corporate buildings showed rising interest. The region’s long-term growth remained linked to continued construction activity and expanding digital transformation initiatives.

Market Segmentations:

By Type

- Manual

- Automatic

- Access Control

By Application

- Residential

- Industrial

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Wireless Remote Door Opener Sensors & Controls Market is shaped by leading companies such as ASSA ABLOY, Overhead Door Corporation, Honeywell International Inc., Nice S.p.A, Vanderbilt Industries, Nortek Security & Control LLC, Hörmann Group, Allegion plc, and Chamberlain Group. These firms strengthen their competitive positions by advancing wireless sensing accuracy, enhancing battery efficiency, and expanding compatibility with modern access control ecosystems. Market competition focuses on developing touchless and automated door technologies that support smart building upgrades and remote management capabilities. Companies invest in cloud platforms, IoT connectivity, and AI-driven sensing to improve system reliability and deliver better user experience in high-traffic areas. Strategic partnerships with commercial builders, system integrators, and security service providers also support wider deployment across industries. Growing emphasis on safety compliance, accessibility, and digital transformation drives ongoing innovation, while expanding product portfolios help capture demand in residential, commercial, and industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ASSA ABLOY

- Overhead Door Corporation

- Honeywell International Inc.

- Nice S.p.A

- Vanderbilt Industries

- Nortek Security & Control LLC

- Hörmann Group

- Allegion plc

- Chamberlain Group

Recent Developments

- In October 2025, Chamberlain Group launched an updated line of smart video-enabled garage door openers, setting a new industry standard for smart garages.

- In 2025, Allegion launched new home security products under its Schlage brand, including the Schlage Sense Pro™ Smart Deadbolt and Schlage Arrive™ Smart WiFi Deadbolt, integrating cutting-edge technology with convenience (January 2025).

- In November 2024, Overhead Door Corporation partnered with Geokey to integrate Geokey’s mobile access control software with Overhead Door and Genie garage door openers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as smart buildings adopt more automated entry solutions.

- Demand for touchless access systems will rise due to growing hygiene and safety focus.

- IoT integration will strengthen remote monitoring and control features across applications.

- AI-driven sensing will improve accuracy, reduce false triggers, and enhance efficiency.

- Cloud-based access management will gain traction in multi-site commercial facilities.

- Retrofitting projects will grow as older buildings shift toward wireless access upgrades.

- Energy-efficient door automation will become a priority in sustainability-focused projects.

- Security upgrades will drive adoption in high-risk commercial and industrial environments.

- Residential smart home ecosystems will support broader use of wireless door controls.

- New regulations on accessibility and safety will accelerate long-term market adoption.