Market Overview

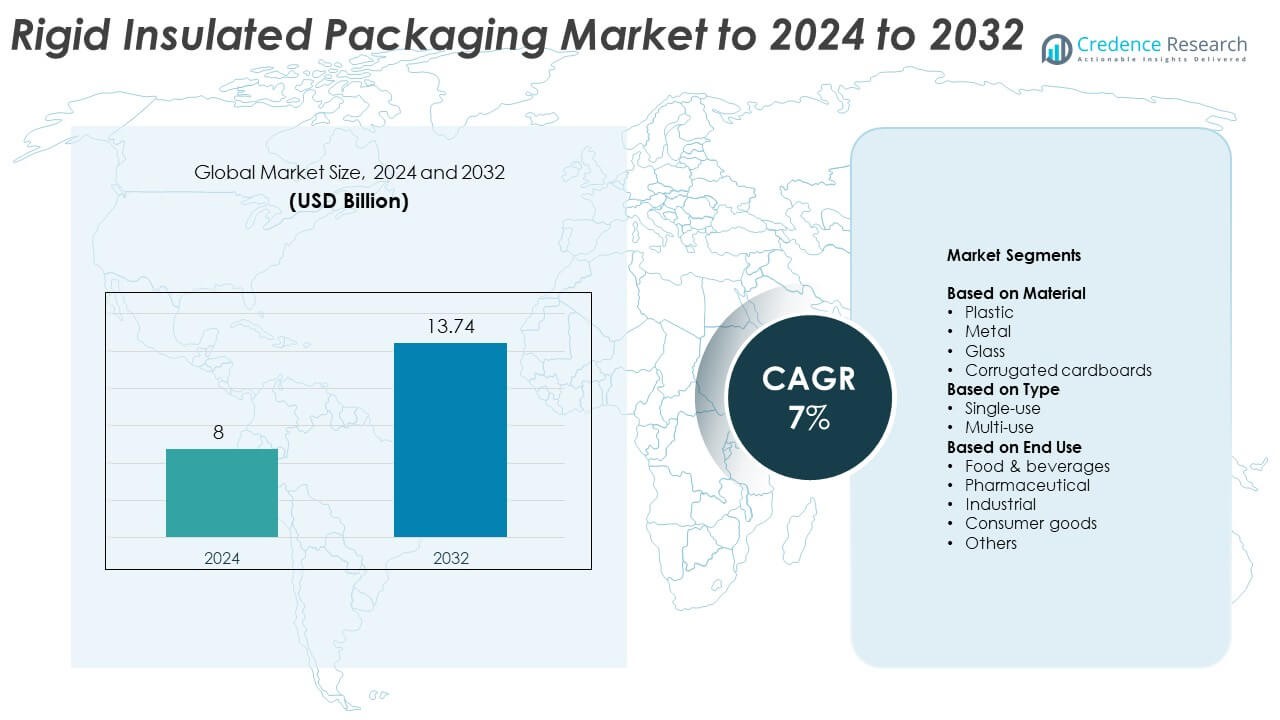

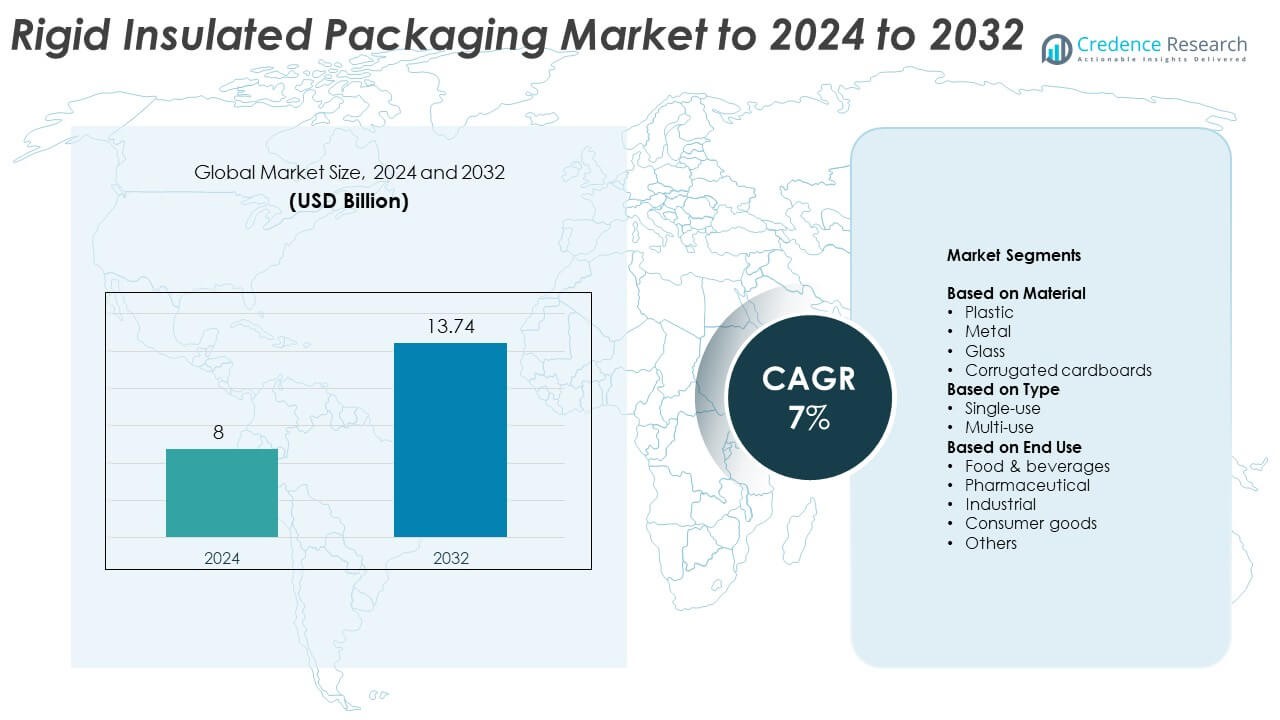

The global Rigid Insulated Packaging Market size was valued at USD 8 billion in 2024 and is anticipated to reach USD 13.74 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rigid Insulated Packaging Market Size 2024 |

USD 8 Billion |

| Rigid Insulated Packaging Market, CAGR |

7% |

| Rigid Insulated Packaging Market Size 2032 |

USD 13.74 Billion |

The rigid insulated packaging market is dominated by major players such as Cold Chain Technologies, Huhtamaki, Sonoco ThermoSafe, Insulated Products Corporation, Ranpak, MARKO FOAM PRODUCTS, Exeltainer, Cold Ice Inc., TEMPACK, IPG, Smurfit Westrock, Thermal Packaging Solutions Ltd., Lifoam, and Cryopak. These companies lead through innovations in thermal insulation, sustainable materials, and cold chain packaging solutions. Strategic collaborations with logistics and pharmaceutical industries enhance their market reach and reliability. North America emerged as the leading region in 2024, accounting for 34.2% of the global share, driven by strong demand from food, beverage, and healthcare sectors, supported by advanced cold chain infrastructure and regulatory emphasis on product safety.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global rigid insulated packaging market was valued at USD 8 billion in 2024 and is projected to reach USD 13.74 billion by 2032, growing at a CAGR of 7%.

- Rising demand for temperature-sensitive packaging in food, beverage, and pharmaceutical industries is a key market driver.

- Technological advancements in recyclable materials and multi-use insulation designs are shaping future market trends and opportunities.

- The market is highly competitive, with companies focusing on sustainable packaging innovations, R&D investments, and regional expansion to gain advantage.

- North America led the market with 34.2% share in 2024, followed by Europe with 28.6% and Asia Pacific with 24.8%, while the plastic segment dominated with a 54.3% share.

Market Segmentation Analysis:

By Material

The plastic segment dominated the rigid insulated packaging market in 2024, accounting for around 54.3% of the total share. Its dominance is driven by high durability, lightweight characteristics, and superior insulation efficiency. Plastic materials, such as polyethylene and polypropylene, are preferred for temperature-sensitive goods due to their moisture resistance and cost-effectiveness. The growing demand for recyclable and bio-based plastic variants further strengthens the segment’s position. Industries are increasingly adopting advanced plastic-based insulated packaging to ensure extended shelf life and maintain product integrity during transportation.

- For instance, Knauf Industries reports EPP thermal conductivity at 0.039 W/mK. This supports high insulation with low weight. The spec underpins PP/EPP dominance in cold-chain boxes.

By Type

The single-use segment held the largest share of approximately 63.5% in 2024, driven by the widespread use in food delivery, pharmaceuticals, and e-commerce logistics. Single-use insulated packaging offers better convenience, lower contamination risk, and high temperature retention for perishable goods. The surge in online food delivery services and vaccine distribution programs has accelerated its adoption. Additionally, the demand for cost-efficient, disposable packaging solutions in urban areas continues to support market growth, while regulatory efforts to promote recyclable single-use options are shaping product innovation.

- For instance, Sonoco ThermoSafe’s ChillTech systems hold 2–8 °C for 48–144 hours. Payloads range from 5 L to 40 L, ISTA 7D/7E qualified. Single-use shippers meet tight lane durations.

By End Use

The food and beverages segment led the market with a 46.8% share in 2024, owing to the increasing demand for temperature-controlled storage and transportation of perishable items. Rigid insulated packaging ensures product freshness, reduces spoilage, and supports safe delivery of dairy, meat, and ready-to-eat foods. The growing expansion of online grocery and meal kit services has intensified adoption in this category. Beverage manufacturers are also integrating high-performance insulated containers to maintain product quality in extended distribution cycles, strengthening the segment’s leadership in the global market.

Key Growth Drivers

Rising Demand for Temperature-Sensitive Goods

The growing need for temperature-controlled transportation of food, beverages, and pharmaceuticals is a major growth driver. Consumers increasingly rely on insulated packaging to preserve product freshness and safety across longer distances. Expanding cold chain logistics networks and e-commerce deliveries of perishable goods further fuel this demand. The adoption of rigid insulated containers that maintain internal temperature stability ensures product integrity, making them essential for industries requiring consistent thermal performance.

- For instance, Va-Q-tec offers the va-Q-one product line of single-use thermal transport boxes in several configurations, with different boxes designed to maintain different temperature ranges. These include options for deep-frozen shipments as low as -70 °C (using dry ice) and others for controlled room temperature, such as +15 °C to +25 °C (using phase change materials).

Expansion of Online Food Delivery and E-commerce

The surge in online food delivery and retail distribution has significantly increased demand for efficient insulated packaging. Rigid insulated containers offer protection against heat, moisture, and external impacts during transit. The rapid growth of e-commerce platforms and doorstep delivery models has led to higher consumption of reusable and single-use insulated boxes. Companies in the food and beverage sector are prioritizing thermal packaging to enhance customer satisfaction and reduce spoilage rates in the last-mile delivery segment.

- For instance, DeltaTrak’s mini PDF logger stores 12,288 data points. Single-use models support trips up to 85 days. Reliable logging secures cold-chain deliveries.

Growing Focus on Sustainable Packaging Materials

The shift toward recyclable and eco-friendly packaging materials is driving innovation in the market. Manufacturers are developing rigid insulated solutions using recyclable plastics, molded pulp, and biodegradable composites to reduce environmental impact. Governments are also supporting sustainable production through regulations and incentives promoting waste reduction. This growing emphasis on circular economy practices is encouraging companies to redesign packaging systems with reduced carbon footprints while maintaining thermal efficiency and product protection.

Key Trends & Opportunities

Technological Advancements in Insulation Materials

Continuous innovation in insulation technologies is shaping the market landscape. The use of vacuum insulation panels, expanded polystyrene, and polyurethane foams enhances temperature retention and durability. Smart insulated packaging with temperature monitoring sensors is also gaining traction across food and pharmaceutical industries. These technological upgrades provide better control, longer shelf life, and improved supply chain transparency, opening new opportunities for packaging manufacturers to serve high-value sectors.

- For instance, Peli BioThermal’s Crēdo GO is qualified to ISTA 7D. Systems provide 24–120 hours across multiple temperature ranges. Advanced VIP and PCM extend protection.

Rising Adoption of Multi-Use Packaging Solutions

The growing shift toward reusable and multi-use insulated packaging offers significant market potential. Businesses are increasingly adopting returnable packaging systems to minimize waste and lower long-term operational costs. Multi-use containers deliver consistent insulation performance and support sustainability targets by reducing reliance on disposable materials. The logistics and cold storage sectors are major beneficiaries of this trend, as they seek durable packaging alternatives for multiple delivery cycles.

- For instance, CSafe’s Silverpod MAX RE, a reusable pallet shipper, provides over 120 hours of qualified thermal protection in the +2 °C to +8 °C temperature range.

Key Challenges

High Production and Material Costs

Rigid insulated packaging often involves advanced materials such as polyurethane foam or vacuum panels, which raise production expenses. The cost-intensive manufacturing process, combined with the need for precise temperature control, limits adoption among small-scale users. Volatility in raw material prices, particularly plastics and metals, further affects profitability. These factors challenge market expansion, especially in price-sensitive regions where cheaper, non-insulated packaging remains preferred.

Environmental and Recycling Limitations

Although sustainability is a major focus, recycling rigid insulated packaging remains complex due to multi-layered materials. Separation and recovery of insulation components are difficult, leading to increased waste disposal challenges. Limited infrastructure for handling insulated waste hampers large-scale recycling initiatives. This constraint pushes manufacturers to explore new material compositions and eco-friendly alternatives that can balance insulation efficiency with recyclability.

Regional Analysis

North America

North America held the largest share of 34.2% in the rigid insulated packaging market in 2024, driven by strong demand from the food, beverage, and pharmaceutical industries. The region benefits from advanced cold chain infrastructure and widespread adoption of temperature-sensitive packaging solutions. Growing e-commerce activities and increasing consumption of ready-to-eat meals further support market growth. The United States dominates the regional market, while Canada is witnessing growing adoption in healthcare logistics and perishable goods transportation, supported by sustainability-focused packaging innovations.

Europe

Europe accounted for 28.6% of the global market share in 2024, driven by strict environmental regulations and a strong focus on sustainable packaging materials. Countries such as Germany, France, and the U.K. are leading in the adoption of recyclable and multi-use insulated packaging solutions. The food delivery and pharmaceutical industries remain key demand generators. The European Union’s emphasis on circular economy principles encourages the use of eco-friendly materials, while innovation in lightweight, reusable packaging further supports long-term market expansion across the region.

Asia Pacific

Asia Pacific captured 24.8% of the rigid insulated packaging market in 2024, supported by rapid industrialization and expanding food delivery networks. The region’s growth is fueled by strong demand from China, Japan, and India, where rising disposable incomes and urbanization boost packaged food consumption. Increasing pharmaceutical exports and temperature-sensitive logistics also contribute to market expansion. Growing awareness of sustainable materials and government initiatives promoting green packaging technologies are encouraging regional manufacturers to invest in recyclable rigid insulated packaging solutions.

Latin America

Latin America represented 7.3% of the global market share in 2024, driven by expanding food processing industries and the growth of cold chain logistics. Brazil and Mexico dominate the regional demand due to increasing exports of perishable food products. The rise of quick-service restaurants and online grocery platforms supports insulated packaging adoption. However, limited recycling infrastructure and fluctuating raw material costs pose challenges. Manufacturers are focusing on affordable, durable packaging alternatives to cater to evolving regional consumer and industrial needs.

Middle East & Africa

The Middle East & Africa accounted for 5.1% of the rigid insulated packaging market share in 2024, supported by growing demand from the pharmaceutical and food delivery sectors. The region’s hot climate drives the need for temperature-controlled packaging to ensure product safety during distribution. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are investing in advanced cold chain systems. Increasing healthcare infrastructure and packaged food imports are further supporting market growth, while local manufacturers are gradually adopting recyclable insulated packaging materials.

Market Segmentations:

By Material

- Plastic

- Metal

- Glass

- Corrugated cardboards

By Type

By End Use

- Food & beverages

- Pharmaceutical

- Industrial

- Consumer goods

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rigid insulated packaging market features strong competition among leading players such as Cold Chain Technologies, Huhtamaki, Sonoco ThermoSafe, Insulated Products Corporation, Ranpak, MARKO FOAM PRODUCTS, Exeltainer, Cold Ice Inc., TEMPACK, IPG, Smurfit Westrock, Thermal Packaging Solutions Ltd., Lifoam, and Cryopak. The competitive environment is driven by innovation in insulation materials, improved temperature control performance, and sustainability-focused product design. Companies are emphasizing lightweight, recyclable, and multi-use packaging solutions to align with global environmental standards. Strategic collaborations with logistics and pharmaceutical firms are enhancing product distribution efficiency and cold chain reliability. Continuous investment in research and development supports advanced thermal management technologies and energy-efficient production processes. Market participants are expanding manufacturing capabilities and strengthening regional presence to meet growing demand across the food, beverage, healthcare, and industrial sectors. Competitive differentiation increasingly depends on material innovation, operational scalability, and compliance with evolving regulatory frameworks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Sonoco announced the divestiture of its ThermoSafe temperature-controlled packaging business to Arsenal Capital Partners

- In 2023, Cryopak introduced Eco Gel, a biodegradable gel pack made from a proprietary blend of natural components.

- In 2023, Huhtamaki launched several sustainable innovations. It introduced fiber-based egg cartons made from 100% recycled North American materials as an alternative to foam packaging.

Report Coverage

The research report offers an in-depth analysis based on Material, Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of eco-friendly and recyclable insulated materials.

- Demand from the food delivery and e-commerce sectors will continue to strengthen.

- Pharmaceutical and healthcare logistics will increasingly rely on advanced thermal packaging.

- Manufacturers will invest in vacuum insulation and smart temperature monitoring technologies.

- Multi-use insulated packaging systems will gain traction to support sustainability goals.

- Asia Pacific will emerge as the fastest-growing regional market driven by industrial expansion.

- Government regulations will encourage the use of biodegradable and reusable materials.

- Partnerships between packaging producers and logistics firms will enhance cold chain efficiency.

- Technological innovation will improve insulation performance and reduce material costs.

- The focus on reducing carbon footprints will drive new product development across industries.