Market Overview:

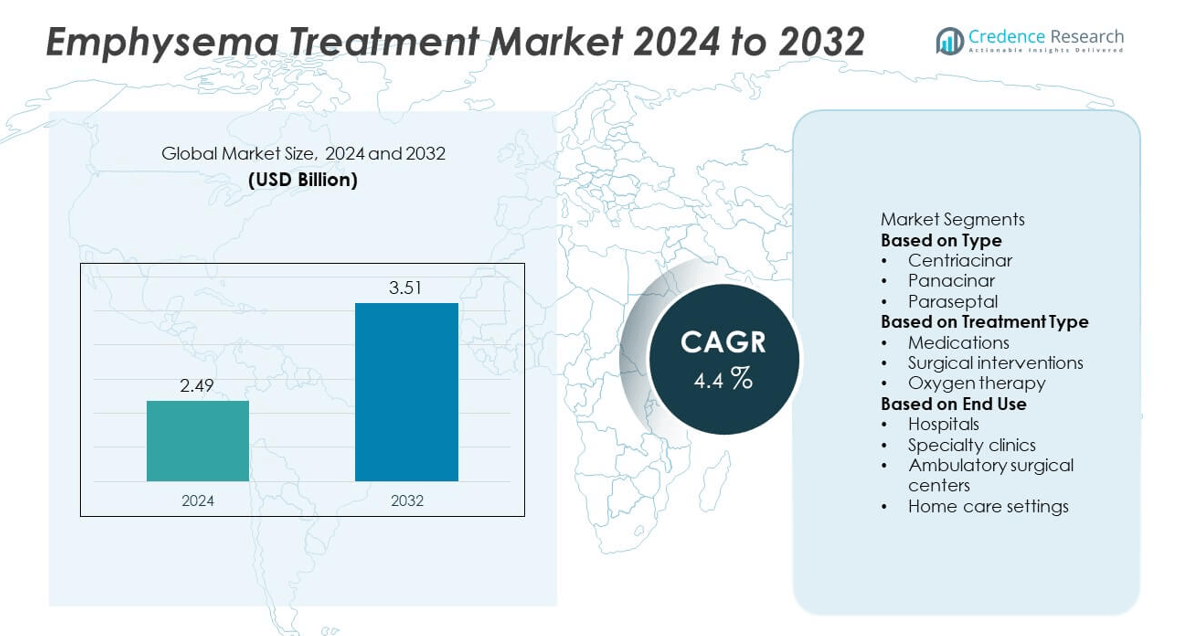

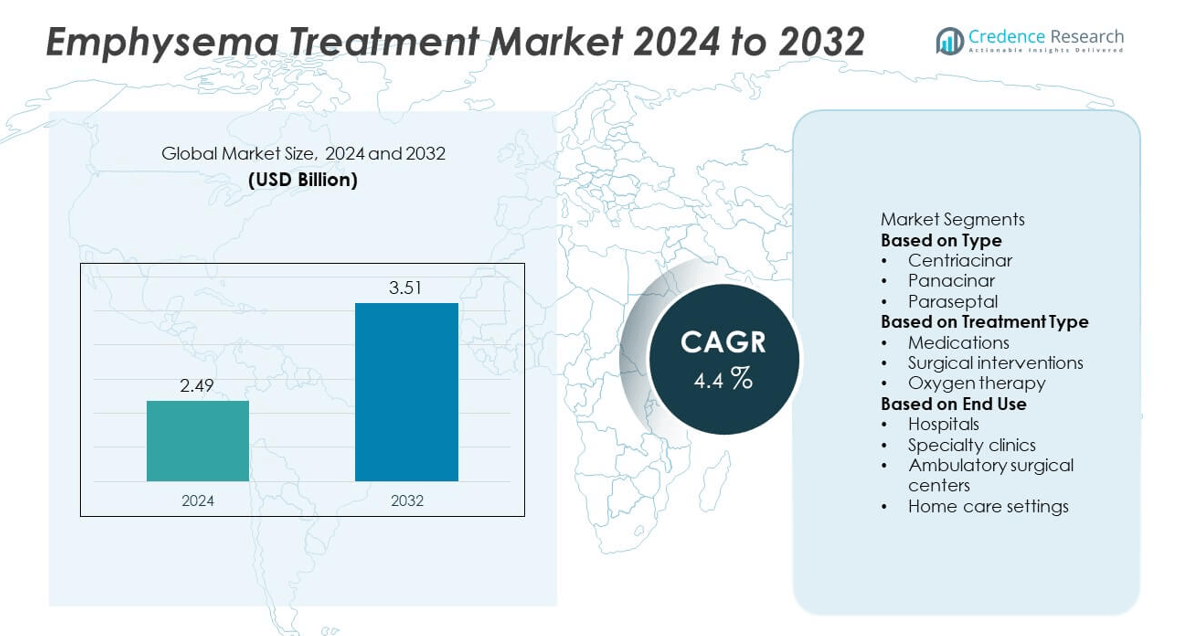

The Emphysema Treatment Market was valued at USD 2.49 billion in 2024 and is projected to reach USD 3.51 billion by 2032, expanding at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Emphysema Treatment Market Size 2024 |

USD 2.49 billion |

| Emphysema Treatment Market, CAGR |

4.4% |

| Emphysema Treatment Market Size 2032 |

USD 3.51 billion |

The emphysema treatment market is driven by major players such as Grifols, Medtronic, AstraZeneca, Boston Scientific Corporation, Boehringer Ingelheim, Abbott Laboratories, Chiesi Farmaceutici, Koninklijke Philips, Baxter International, and GlaxoSmithKline. These companies focus on developing advanced bronchodilators, oxygen therapy systems, and minimally invasive treatment devices to enhance patient outcomes. Continuous innovation in biologics and digital respiratory monitoring solutions strengthens their competitive edge. North America led the global market with a 39% share in 2024, supported by robust healthcare infrastructure, high COPD prevalence, and strong adoption of advanced therapies. Europe followed with 28%, driven by well-established medical systems and increasing awareness of chronic respiratory care.

Market Insights

- The emphysema treatment market was valued at USD 2.49 billion in 2024 and is projected to reach USD 3.51 billion by 2032, growing at a CAGR of 4.4%.

- Rising COPD prevalence and increased adoption of inhalation and oxygen therapies are major growth drivers.

- Key trends include the integration of digital respiratory monitoring, minimally invasive bronchoscopic treatments, and ongoing R&D in regenerative medicine.

- The market is competitive, with leading players such as Grifols, Medtronic, AstraZeneca, Boehringer Ingelheim, and GlaxoSmithKline investing in advanced biologics and portable respiratory devices.

- North America led with a 39% share, followed by Europe at 28% and Asia Pacific at 23%, while centriacinar emphysema and medications segments dominated with 49% and 56% shares, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The centriacinar segment dominated the emphysema treatment market with a 49% share in 2024. This dominance is due to its high occurrence among smokers and individuals exposed to airborne pollutants. The condition primarily affects the upper lobes of the lungs, requiring long-term management through bronchodilators and corticosteroids. Growing urban air pollution and increased smoking rates, especially in developing countries, are major factors driving segment demand. Rising diagnosis rates supported by advanced imaging techniques further strengthen the market position of centriacinar emphysema treatment globally.

- For instance, Koninklijke Philips developed its IntelliVue MX750 patient monitoring system, which can be configured to continuously track parameters such as oxygen saturation and respiratory rate. With additional modules, it can also measure end-tidal CO2. The monitor is intended for a wide range of patients, including adults, pediatrics, and neonates, in critical care settings.

By Treatment Type

The medications segment held the largest 56% share in 2024, driven by the widespread use of bronchodilators, corticosteroids, and phosphodiesterase-4 inhibitors. These drugs remain the first line of treatment for symptom control and disease progression management. Pharmaceutical innovation and the introduction of combination inhaler therapies are key growth drivers. Expanding availability of generic drugs and improved patient adherence to inhalation therapy also support this segment’s leadership. Increasing R&D in targeted biologics continues to enhance long-term outcomes for patients with moderate to severe emphysema.

- For instance, AstraZeneca conducted the Phase III RESOLUTE trial for its biologic therapy, benralizumab, in patients with chronic obstructive pulmonary disease (COPD) with elevated eosinophils. The trial failed to meet its primary endpoint, but benralizumab is an approved treatment for other eosinophil-driven diseases, such as severe eosinophilic asthma.

By End Use

Hospitals accounted for the leading 44% share in 2024, reflecting their role in advanced diagnosis, treatment, and post-procedure care. Hospital facilities are preferred for surgical interventions such as lung volume reduction and transplantation. The availability of multidisciplinary respiratory care units and specialized pulmonologists supports their dominance. Growing hospital admissions for COPD-related complications and access to modern oxygen therapy systems further boost this segment. Increasing healthcare expenditure and improved reimbursement policies continue to strengthen hospital-based emphysema treatment adoption across major markets.

Key Growth Drivers

Rising Prevalence of COPD and Smoking-Related Disorders

The growing incidence of chronic obstructive pulmonary disease (COPD) and smoking-related lung damage is a major driver of emphysema treatment demand. According to WHO, COPD affects over 390 million people globally, with emphysema being a major contributor. Increasing exposure to tobacco smoke, air pollution, and occupational irritants accelerates disease progression. This has led to higher diagnosis rates and the expansion of long-term treatment programs, boosting demand for medications, oxygen therapy, and minimally invasive interventions worldwide.

- For instance, Boehringer Ingelheim expanded its COPD research portfolio by developing tiotropium-olodaterol combination therapy tested across 1,700 patients in the TONADO clinical program. The dual bronchodilator demonstrated sustained lung function improvement with a mean increase of 128 milliliters in forced expiratory volume (FEV1) after 24 weeks of treatment.

Technological Advancements in Diagnostic and Treatment Methods

Continuous innovation in diagnostic imaging and treatment approaches is transforming emphysema management. Advanced CT imaging enables early and accurate disease detection, while robotic-assisted and bronchoscopic lung volume reduction procedures offer less invasive alternatives to surgery. These innovations reduce hospitalization time and improve patient outcomes. The introduction of digital respiratory monitoring devices also enhances patient adherence. Together, these advancements increase treatment precision, patient comfort, and global accessibility to modern emphysema care solutions.

- For instance, the Olympus Spiration™ Valve System, used in bronchoscopic lung volume reduction, has demonstrated improvements in lung function, reduction of hyperinflation, and enhanced quality of life in patients with severe emphysema.

Rising Geriatric Population and Healthcare Investments

An aging global population is significantly driving emphysema treatment growth, as older adults are more susceptible to chronic respiratory disorders. Increased healthcare spending, particularly in developed regions, has expanded access to advanced therapies and specialized pulmonary care. Governments and private institutions are funding respiratory health programs and hospital infrastructure upgrades. This shift, along with improved awareness of early intervention and home-based oxygen support systems, strengthens market expansion across both developed and emerging economies.

Key Trends & Opportunities

Shift Toward Minimally Invasive and Regenerative Therapies

Minimally invasive treatments such as bronchoscopic lung volume reduction and regenerative cell therapies are gaining momentum. These approaches reduce recovery time and improve lung functionality with fewer complications. Regenerative medicine, including stem cell-based interventions, offers new possibilities for repairing damaged lung tissue. Rising clinical trials and FDA approvals for novel interventional devices and biologics present significant opportunities for manufacturers to enhance patient outcomes and expand market presence globally.

- For instance, Medtronic offers its superDimension™ Navigation System used for electromagnetic navigation bronchoscopy (ENB) procedures to aid in the diagnosis of lung lesions. The system helps physicians navigate to hard-to-reach areas of the lung, allowing for biopsy and marking of targets for radiotherapy or surgery.

Integration of Digital Health and Remote Monitoring

The adoption of digital respiratory devices and telehealth platforms is reshaping emphysema care delivery. Smart inhalers, AI-based lung function trackers, and mobile monitoring tools improve treatment adherence and data accuracy. Healthcare providers are increasingly leveraging connected systems for real-time patient assessment. This trend aligns with the growing preference for home-based care, creating opportunities for technology developers and medical device firms to deliver integrated digital solutions for chronic lung disease management.

- For instance, Abbott Laboratories launched the FreeStyle Libre 3 sensor platform, a continuous glucose monitoring (CGM) system that offers minute-to-minute glucose readings. The system uses a Bluetooth-enabled sensor to automatically stream real-time data to a compatible smartphone app, enhancing diabetes oversight for both patients and physicians.

Key Challenges

High Cost of Advanced Treatment and Limited Accessibility

The cost of advanced emphysema treatments, including surgical and biologic interventions, remains a major challenge. Patients in low- and middle-income regions often lack access to high-cost therapies and oxygen support infrastructure. Limited reimbursement coverage further restricts adoption. Despite technological progress, affordability and healthcare disparities hinder market penetration, especially in regions with weak public health systems. Manufacturers are under pressure to develop cost-effective solutions to address unmet needs across diverse patient populations.

Limited Curative Options and Disease Complexity

Emphysema remains a progressive and irreversible condition, posing a significant challenge for complete disease management. Current therapies focus on symptom relief and slowing lung function decline rather than curing the disease. The multifactorial nature of emphysema, involving genetic and environmental causes, complicates drug development. Moreover, patient variability in response to treatment limits standardized care outcomes. This complexity continues to challenge researchers and pharmaceutical companies in developing targeted and effective long-term therapeutic solutions.

Regional Analysis

North America

North America held the leading 39% share of the emphysema treatment market in 2024. The region’s dominance is driven by a high prevalence of COPD, well-established healthcare infrastructure, and strong adoption of advanced therapies. The U.S. contributes the majority of regional revenue due to early diagnosis programs and widespread use of combination inhalers and surgical interventions. Government initiatives supporting smoking cessation and reimbursement for pulmonary rehabilitation further enhance treatment accessibility. Continuous technological innovation and clinical research in biologics and minimally invasive procedures strengthen North America’s leadership position in the global market.

Europe

market demand across major economies such as Germany, France, and the U.K. The region benefits from strong healthcare coverage and high awareness of chronic lung diseases. Increasing adoption of portable oxygen concentrators and non-invasive ventilation supports home-based care expansion. Furthermore, collaborative research on regenerative therapies and early screening programs under EU-funded health initiatives reinforce Europe’s market position and accelerate the development of effective long-term treatment solutions.

Asia Pacific

Asia Pacific captured a 23% share of the emphysema treatment market in 2024 and is expected to grow fastest during the forecast period. Rising pollution levels, high smoking rates, and increasing industrialization contribute to higher disease prevalence in China, India, and Japan. Expanding healthcare investments and government efforts to improve access to respiratory treatments drive market growth. The rapid development of telemedicine and affordable generic drug availability further enhance patient reach. Growing awareness of early diagnosis and emphasis on low-cost oxygen therapy continue to strengthen Asia Pacific’s emerging role in the global market.

Latin America

Latin America represented a 6% share of the emphysema treatment market in 2024. Market growth is driven by increasing urban air pollution and smoking-related disorders, particularly in Brazil and Mexico. Public healthcare programs promoting COPD awareness and early diagnosis are improving access to treatment. However, limited funding for advanced therapies and uneven infrastructure in rural areas constrain growth. International partnerships and private healthcare expansions are helping bridge this gap. Rising adoption of cost-effective medications and portable oxygen delivery systems continues to enhance treatment accessibility across the region.

Middle East & Africa

The Middle East & Africa region held a 4% share of the emphysema treatment market in 2024. Growing air pollution, rising tobacco consumption, and increasing geriatric populations contribute to higher disease incidence. Market expansion is supported by the development of specialized respiratory care centers in Gulf Cooperation Council (GCC) countries. However, limited diagnostic capabilities and affordability issues restrict access in several African nations. Government healthcare reforms, improving hospital infrastructure, and partnerships with international medical device companies are expected to enhance treatment availability and gradually improve patient outcomes in the coming years.

Market Segmentations:

By Type

- Centriacinar

- Panacinar

- Paraseptal

By Treatment Type

- Medications

- Surgical interventions

- Oxygen therapy

By End Use

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

- Home care settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The emphysema treatment market is characterized by the strong presence of leading companies such as Grifols, Medtronic, AstraZeneca, Boston Scientific Corporation, Boehringer Ingelheim, Abbott Laboratories, Chiesi Farmaceutici, Koninklijke Philips, Baxter International, and GlaxoSmithKline. These players compete through innovations in inhalation therapies, biologics, and respiratory care devices. Companies are focusing on expanding portfolios with advanced bronchodilators, portable oxygen systems, and minimally invasive surgical tools. Strategic collaborations, clinical trials, and regulatory approvals are central to strengthening market positions. Leading firms are also integrating digital health solutions for remote patient monitoring and personalized respiratory care. Moreover, investments in regenerative and stem-cell-based therapies highlight a growing shift toward long-term disease management approaches, further intensifying competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Grifols

- Medtronic

- AstraZeneca

- Boston Scientific Corporation

- Boehringer Ingelheim

- Abbott Laboratories

- Chiesi Farmaceutici

- Koninklijke Philips

- Baxter International

- GlaxoSmithKline

Recent Developments

- In September 2025, AstraZeneca announced that its Phase III RESOLUTE trial of benralizumab (100 mg) in moderate to very severe COPD did not achieve its primary endpoint of annualised exacerbation rate in patients with elevated blood eosinophil counts.

- In February 2025, Grifols completed recruitment for Cohort 2 in its first-in-human Phase 1/2 clinical study (Alpha1-15) of a subcutaneous (SQ) option for alpha-1 antitrypsin deficiency in emphysema patients, marking a shift from intravenous to SQ delivery.

- In May 2024, AstraZeneca plc and Amgen reported data from the Phase IIa COURSE study of tezepelumab in moderate to very severe COPD (including emphysema patients) showing a 17% numerical reduction in annualised rate of moderate or severe exacerbations versus placebo at Week 52, and 46% reduction in the subgroup with eosinophils ≥ 300 cells/µL.

- In July 2023, Grifols, S.A. met its enrollment target of 339 patients in its SPARTA Phase 3 study evaluating two weekly dose regimens (60 mg/kg/week and 120 mg/kg/week) of its Prolastin®-C (alpha1-proteinase inhibitor [human]) in patients with emphysema due to alpha-1-antitrypsin deficiency.

Report Coverage

The research report offers an in-depth analysis based on Type, Treatment Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to increasing COPD and smoking-related disease prevalence.

- Advancements in biologics and regenerative therapies will improve long-term disease management.

- Digital respiratory monitoring devices will gain wider adoption for remote patient care.

- Minimally invasive bronchoscopic treatments will replace traditional surgical procedures.

- Pharmaceutical companies will focus on developing combination inhalers with higher efficacy.

- Rising awareness of early diagnosis will support better treatment outcomes globally.

- Healthcare infrastructure improvements in Asia Pacific will drive faster market expansion.

- Strategic partnerships among biotech and medical device firms will enhance innovation.

- Home-based oxygen therapy adoption will increase due to aging populations.

- Ongoing research in stem cell and gene therapy will create new treatment possibilities for emphysema.