Market Overview:

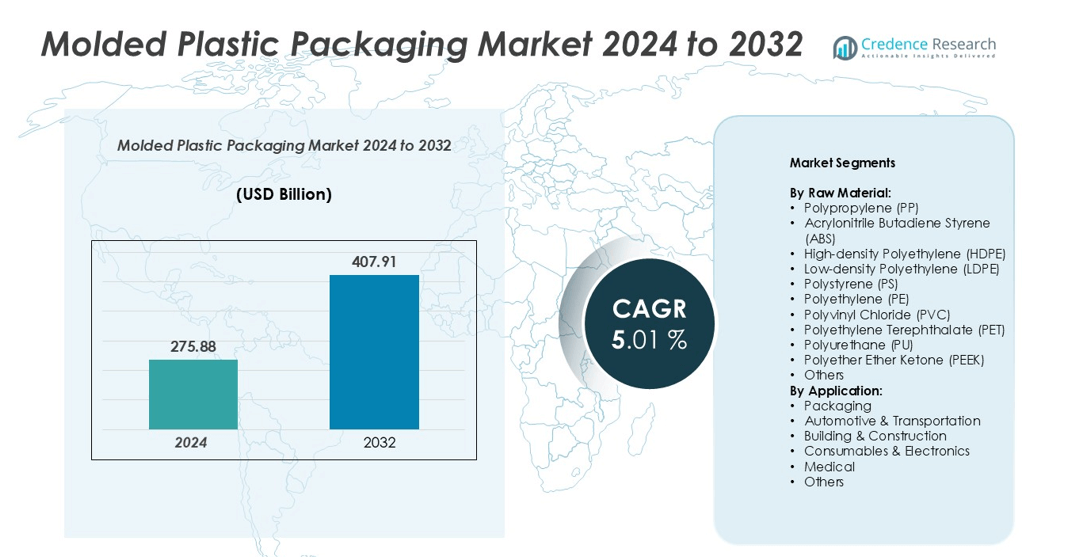

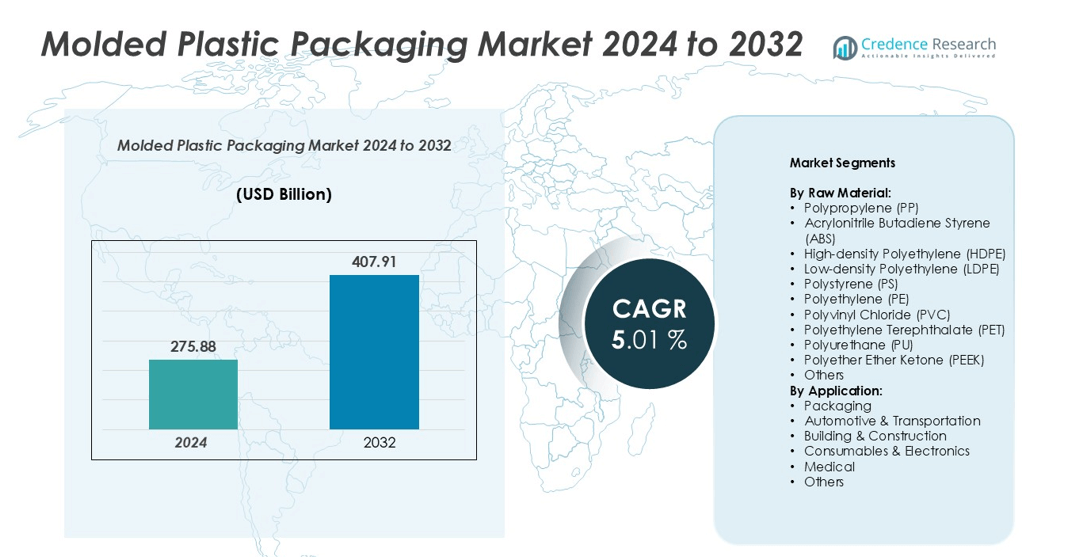

The Molded Plastic Packaging market size was valued at USD 275.88 billion in 2024 and is anticipated to reach USD 407.91 billion by 2032, growing at a CAGR of 5.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Molded Plastic Packaging Market Size 2024 |

USD 275.88 billion |

| Molded Plastic Packaging Market, CAGR |

5.01% |

| Molded Plastic Packaging Market Size 2032 |

USD 407.91 billion |

The molded plastic packaging market is dominated by major players such as Dow, Inc., BASF SE, SABIC, LyondellBasell Industries Holdings B.V., ExxonMobil Corporation, and Berry Global, Inc., which collectively account for a significant portion of the global market share. These companies lead through advanced material innovations, large-scale production capacities, and strong global distribution networks. Asia-Pacific remains the leading region, holding approximately 38% of the global market share, driven by rapid industrialization, expanding consumer markets, and cost-effective manufacturing. North America and Europe follow, supported by technological advancements, sustainability initiatives, and a mature packaging infrastructure that fosters continuous innovation.

Market Insights

- The molded plastic packaging market was valued at USD 275.88 billion in 2024 and is projected to reach USD 407.91 billion by 2032, growing at a CAGR of 5.01% during the forecast period.

- Rising demand from the food, beverage, and healthcare industries, coupled with the need for lightweight, durable, and cost-efficient packaging materials, drives market growth globally.

- Increasing adoption of sustainable and recyclable polymers, along with advancements in molding technologies, shapes current market trends toward eco-friendly and smart packaging solutions.

- The market is moderately consolidated, with key players such as Dow, BASF SE, SABIC, LyondellBasell, and Berry Global competing through innovation, capacity expansion, and sustainability-driven product development.

- Asia-Pacific holds the largest regional share at 38%, followed by North America (26%) and Europe (23%), while packaging applications dominate the market among all segments due to extensive use across consumer and industrial goods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Raw Material:

Polypropylene (PP) dominates the molded plastic packaging market, accounting for a significant market share owing to its superior chemical resistance, cost-effectiveness, and versatility in molding. Its extensive use in food, beverage, and consumer goods packaging drives demand. High-density polyethylene (HDPE) and polyethylene terephthalate (PET) also contribute notably due to their strength, recyclability, and suitability for rigid packaging applications. Rising sustainability concerns are promoting the adoption of recyclable polymers like PET and PE, while advanced materials such as PEEK are gaining traction in specialized, high-performance packaging solutions.

- For instance, SABIC’s PP impact copolymer grade 413MNK45 offers a melt flow rate of 45 g/10 min and high stiffness, enabling production of thin-wall containers with enhanced durability.

By Application:

The packaging segment holds the largest share of the molded plastic packaging market, driven by growing demand from the food, beverage, personal care, and pharmaceutical industries. The segment benefits from molded plastics’ lightweight properties, durability, and ability to form complex shapes suitable for consumer packaging. Automotive and transportation applications are expanding as manufacturers utilize molded plastics for durable and cost-efficient components. Meanwhile, the medical and electronics sectors are witnessing increasing use due to enhanced hygiene standards, precision molding capabilities, and superior material performance under stringent conditions.

- For instance, Amcor’s PowerPost™ PET bottle technology produces bottles that are up to one-third lighter, which improves material efficiency and reduces carbon emissions. The technology’s innovative vacuum-absorbing base is designed for hot-fill beverages, not internal pressure, and helps maintain the bottle’s shape as the contents.

Key Growth Drivers

Rising Demand from Food and Beverage Industry

The food and beverage industry remains a major growth driver for the molded plastic packaging market. Increasing global consumption of packaged food, ready-to-eat meals, and bottled beverages has fueled the need for lightweight, durable, and cost-effective packaging materials. Molded plastics such as polypropylene (PP) and polyethylene terephthalate (PET) are preferred for their barrier properties, which help preserve freshness and extend shelf life. Furthermore, innovations in design flexibility and thermoforming technologies allow manufacturers to create appealing, brand-specific packaging. The growing preference for single-serve and on-the-go products further accelerates demand for molded plastic packaging solutions across developed and emerging economies.

- For instance, Berry Global offers a variety of high-barrier packaging for oxygen-sensitive products, though not in standard thermoformed PET beverage bottles. An oxygen transmission rate (OTR) below 0.1 cc/m²/day is actually characteristic of highly specialized, multi-layered or metallized films, which provide a superior barrier compared to standard PET. To achieve a similar shelf life for oxygen-sensitive beverages, Berry Global would employ different technologies, such as multilayer co-extrusion with barrier polymers like EVOH or specialized coatings.

Expanding Use of Sustainable and Recyclable Materials

The shift toward sustainable packaging solutions is driving significant innovation in the molded plastic packaging market. Manufacturers are increasingly adopting recyclable and biodegradable polymers to reduce carbon emissions and comply with stringent environmental regulations. The development of bio-based plastics and the integration of circular economy practices are supporting long-term market growth. Companies are investing in advanced recycling technologies, such as chemical recycling and closed-loop systems, to enhance plastic recovery and reuse. This sustainability-driven transformation not only aligns with consumer preferences for eco-friendly packaging but also enables businesses to strengthen their environmental, social, and governance (ESG) credentials, creating competitive advantages in global markets.

- For instance, The ALPLA Group operates a wholly-owned HDPE recycling plant in Toluca, Mexico, that produces up to 30,000 tonnes of recycled HDPE (rHDPE) annually for non-food packaging. For PET recycling in Mexico, ALPLA is a partner in joint ventures for food-grade rPET production.

Technological Advancements in Packaging Design and Manufacturing

Technological innovation is a key enabler in the molded plastic packaging market’s expansion. The adoption of advanced molding techniques—such as injection molding, blow molding, and thermoforming—has improved precision, material efficiency, and production speed. Automation, robotics, and digital modeling tools enable mass customization and quality consistency while reducing operational costs. In addition, the use of lightweight composites and smart materials supports the development of functional packaging with features like tamper resistance and enhanced durability. These advancements are particularly beneficial for sectors such as healthcare, electronics, and automotive, where precision and performance are critical, thus expanding the application scope of molded plastic packaging globally.

Key Trends & Opportunities

Integration of Smart and Functional Packaging

The integration of smart packaging technologies is emerging as a significant trend in the molded plastic packaging market. Smart packaging, incorporating sensors, QR codes, and RFID tags, enhances traceability, freshness monitoring, and consumer engagement. This trend is particularly strong in the food, beverage, and pharmaceutical industries, where product authenticity and safety are crucial. The growing adoption of Internet of Things (IoT)-enabled packaging solutions presents new opportunities for manufacturers to differentiate their products and add value beyond basic containment. As digital transformation accelerates, the demand for intelligent molded plastic packaging with data-driven capabilities is expected to expand considerably.

- For instance, Avery Dennison, a major provider of radio-frequency identification (RFID) technology, manufactures Ultra-High Frequency (UHF) inlays capable of being read in batches at rates of up to 1,000 tags per second under optimal conditions. By enabling rapid, item-level scanning, this technology significantly improves inventory accuracy and supply chain visibility for industries like retail and logistics.

Growth of E-commerce and Consumer Convenience Packaging

The rapid growth of e-commerce and direct-to-consumer retail is creating vast opportunities for molded plastic packaging. The need for lightweight, impact-resistant, and tamper-proof packaging suitable for long-distance shipping drives innovation in molded plastic design. Consumer preference for convenient, resealable, and portion-controlled packaging further supports demand. Molded plastics offer the flexibility and durability required for online retail logistics while ensuring product integrity during transit. This trend is also encouraging the development of reusable and returnable packaging systems, aligning with sustainability goals and reducing the environmental footprint of e-commerce supply chains.

- For instance, Sealed Air’s Instapak foam-in-place solutions include multiple foam formulations designed for varying levels of compressive strength to provide superior product protection. Specific compressive strength figures vary by formulation and application, with options available for everything from general-duty cushioning to heavy-duty blocking and bracing.

Key Challenges

Environmental and Regulatory Pressures

The molded plastic packaging industry faces significant challenges from increasing environmental concerns and stringent government regulations on plastic usage. Growing restrictions on single-use plastics, rising waste management costs, and public scrutiny over pollution have compelled manufacturers to redesign products and adopt sustainable materials. Compliance with evolving regulations—such as extended producer responsibility (EPR) policies—requires major investments in recycling infrastructure and innovation. Balancing performance, cost-efficiency, and eco-friendliness remains a persistent challenge, particularly for companies operating across multiple jurisdictions with varying environmental standards.

Volatility in Raw Material Prices

Fluctuations in the prices of crude oil and petrochemical feedstocks directly affect the cost structure of molded plastic packaging. Polypropylene (PP), polyethylene (PE), and polyethylene terephthalate (PET)—the key raw materials—are derived from petroleum, making the industry vulnerable to global oil market instability. Price volatility impacts production margins and limits long-term contract stability for packaging manufacturers. Additionally, rising energy and transportation costs add to the financial burden. To mitigate these challenges, companies are increasingly focusing on material optimization, alternative polymer sources, and supply chain diversification strategies to ensure steady and cost-effective production.

Regional Analysis

North America

North America accounts for approximately 26% of the global molded plastic packaging market share, driven by high consumption of packaged food, beverages, and personal care products. The United States leads the region, supported by advanced manufacturing infrastructure and strong adoption of sustainable packaging materials. Technological advancements in injection and blow molding enhance production efficiency and design flexibility. Additionally, stringent FDA packaging standards encourage the use of durable, food-safe plastics. The growing demand for recyclable materials and lightweight packaging solutions continues to strengthen North America’s position as a mature and innovation-driven market.

Europe

Europe represents around 23% of the global molded plastic packaging market share, fueled by strong regulatory support for sustainable packaging and the presence of major packaging manufacturers. Germany, France, and the United Kingdom dominate due to robust demand from the food, pharmaceutical, and cosmetics sectors. The European Union’s circular economy policies and single-use plastic restrictions are driving the transition toward recyclable and bio-based polymers. Continuous R&D investments in eco-friendly packaging materials and automation technologies further enhance Europe’s competitive advantage, positioning it as a sustainability leader in the molded plastic packaging industry.

Asia-Pacific

Asia-Pacific leads the global molded plastic packaging market with an estimated 38% market share, driven by rapid industrialization, urbanization, and a booming consumer base. China, India, and Japan are key contributors, supported by expanding food processing, electronics, and e-commerce sectors. The region benefits from low-cost raw materials, large-scale manufacturing capacity, and technological advancements in packaging automation. Rising disposable incomes and increasing demand for convenience foods are further propelling market growth. Multinational companies continue to invest heavily in regional production facilities, reinforcing Asia-Pacific’s dominance as the largest and fastest-growing market for molded plastic packaging.

Latin America

Latin America holds about 7% of the global molded plastic packaging market share, primarily led by Brazil and Mexico. The region’s growth is driven by expanding consumer goods, retail, and beverage industries. Increasing urbanization and rising demand for affordable and lightweight packaging materials contribute to steady market expansion. Manufacturers are gradually adopting sustainable and recyclable materials in response to global environmental trends. However, challenges such as volatile raw material prices and limited recycling infrastructure persist. Ongoing economic development and investments in local production facilities are expected to support the region’s long-term growth potential.

Middle East & Africa

The Middle East and Africa account for approximately 6% of the global molded plastic packaging market share, with the United Arab Emirates, Saudi Arabia, and South Africa leading regional demand. Growth is supported by expanding food, beverage, and healthcare industries, along with rising consumer spending and retail sector development. Efforts to diversify economies and establish local polymer manufacturing plants are improving supply chain stability. Increasing awareness of sustainable packaging practices and government-led industrial initiatives further promote market expansion. While still emerging, the region offers considerable growth opportunities for global packaging manufacturers.

Market Segmentations:

By Raw Material:

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- High-density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Polyether Ether Ketone (PEEK)

- Others

By Application:

- Packaging

- Automotive & Transportation

- Building & Construction

- Consumables & Electronics

- Medical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The molded plastic packaging market is highly competitive, characterized by the presence of global players focusing on innovation, sustainability, and product differentiation. Leading companies such as Dow, Inc., BASF SE, SABIC, LyondellBasell Industries Holdings B.V., and ExxonMobil Corporation dominate the market through extensive product portfolios and strong distribution networks. These players emphasize research and development to enhance material performance, recyclability, and lightweight packaging solutions. Companies like Berry Global, Inc. and Magna International, Inc. are expanding their capabilities through strategic mergers, acquisitions, and partnerships to strengthen market presence. Sustainability initiatives, including the use of bio-based polymers and circular recycling systems, are becoming central to competitive strategies. Moreover, regional manufacturers such as IAC Group and Master Molded Products Corporation focus on cost optimization and customized solutions to cater to local demand. The overall competition is driven by innovation, scale efficiency, and alignment with global environmental regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow, Inc.

- Magna International, Inc.

- BASF SE

- IAC Group

- Huntsman International LLC.

- SABIC

- Berry Global, Inc.

- Eastman Chemical Company

- ExxonMobil Corporation

- LyondellBasell Industries Holdings B.V.

- Master Molded Products Corporation

- INEOS Group

- DuPont de Nemours, Inc.

Recent Developments

- In February 2024, Kreate announced its takeover of a supplier of injection molded plastics based in Georgetown, TX. The move is anticipated to significantly enhance the production capacity of the company and enhance its logistics network.

- In April 2023, Nexa3D acquired Addifab, the parent company of Freeform Injection Molding. The acquisition strengthens the ability of Addifab’s high-temperature soluble and high-impact resins to be used in conjunction with Nexa3D’s ultrafast 3D printers to produce advanced tools that can be used with any type of injection molding feedstock.

- In March 2023, ABC Technologies Holdings Inc. acquired WMG Technologies for a sum of USD 165 million. ABC Technologies Holdings Inc. offers products to its clients in three categories: fluids, HVAC, outside systems, interior systems, and others. Likewise, WMGT supplies sophisticated tooling for injection-molded exterior and interior parts, lighting molds, and optic inserts to significant global automotive OEMs at tier-1 and tier-2 levels. Additionally, it offers a wide range of other outside goods.

Report Coverage

The research report offers an in-depth analysis based on Raw Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The molded plastic packaging market will continue expanding due to increasing global demand for packaged consumer goods.

- Rising focus on recyclable and bio-based plastics will shape future product innovations.

- Automation and advanced molding technologies will enhance production efficiency and reduce costs.

- The food and beverage sector will remain the largest end-user segment driving consistent market growth.

- Growing e-commerce and logistics industries will boost demand for durable and lightweight packaging solutions.

- Asia-Pacific will maintain its dominance, supported by rapid industrialization and manufacturing expansion.

- Regulatory emphasis on sustainability will accelerate adoption of circular economy practices in packaging.

- Collaboration between packaging manufacturers and raw material suppliers will improve supply chain efficiency.

- Smart and functional packaging with tracking and safety features will gain traction across multiple industries.

- Continuous R&D investments will lead to the development of high-performance, energy-efficient molded plastic packaging materials.