Market Overview:

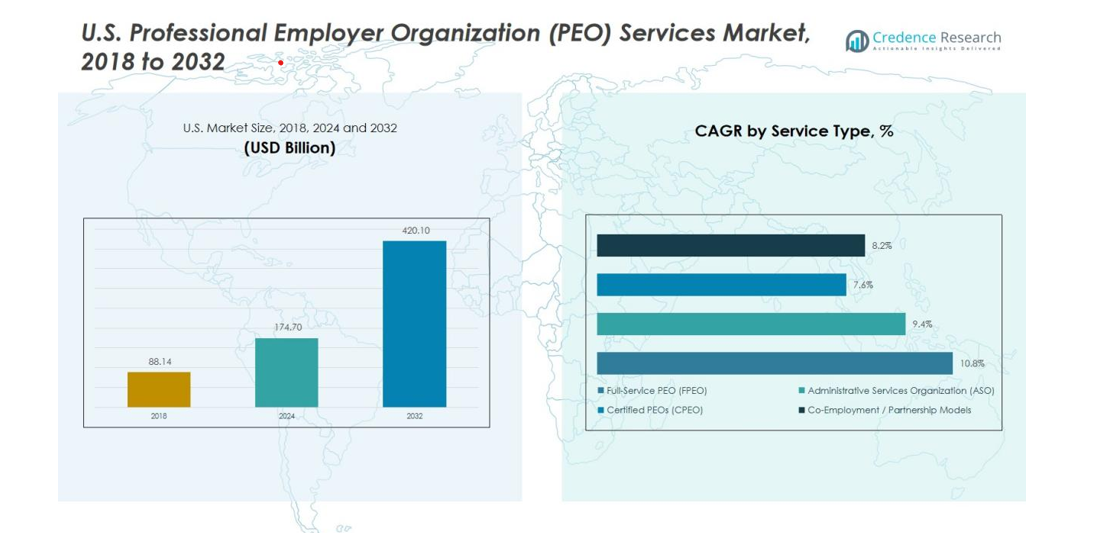

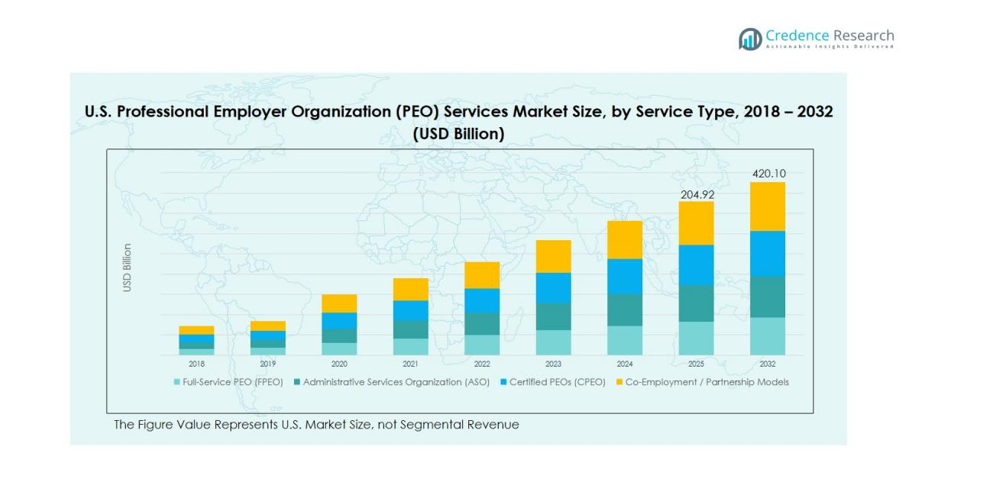

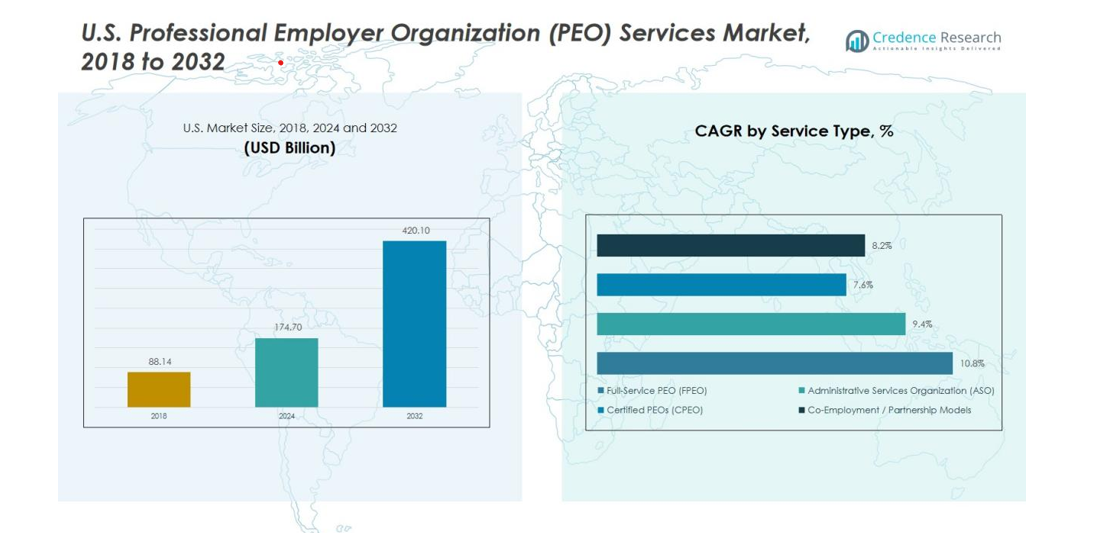

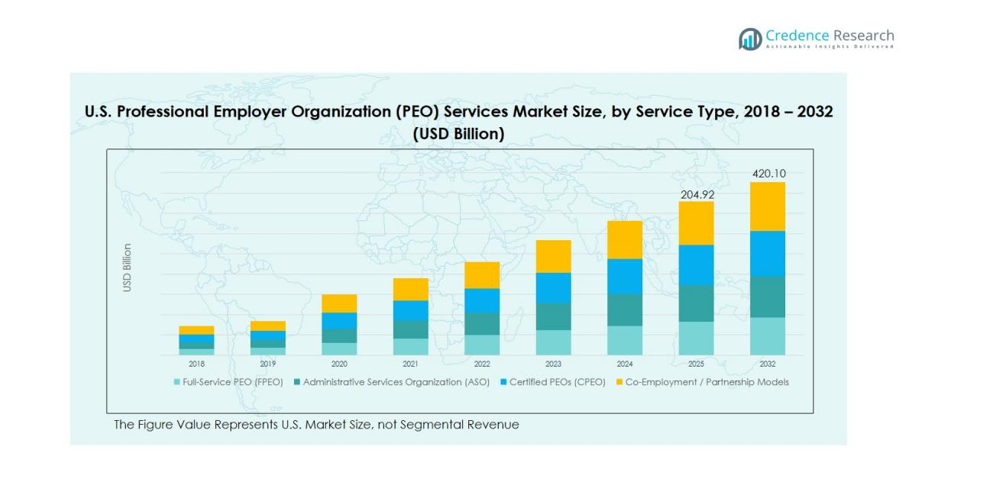

The U.S. Professional Employer Organization (PEO) Services Market size was valued at USD 88.14 million in 2018 to USD 174.70 million in 2024 and is anticipated to reach USD 420.10 million by 2032, at a CAGR of 10.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Professional Employer Organization (PEO) Services Market Size 2024 |

USD 174.70 million |

| U.S. Professional Employer Organization (PEO) Services Market, CAGR |

10.80% |

| U.S. Professional Employer Organization (PEO) Services Market Size 2032 |

USD 420.10 million |

Key drivers include rising regulatory complexities in employment laws, growing focus on risk mitigation, and the expanding remote and hybrid work culture. Businesses are increasingly outsourcing HR operations to manage multi-state compliance, employee benefits, and tax filing requirements efficiently. The integration of advanced digital platforms, data analytics, and cloud-based HR management systems further boosts the scalability and transparency of PEO offerings, strengthening market expansion.

Regionally, strong market penetration is observed across major economic hubs such as California, Texas, Florida, and New York, where a large base of SMEs operates across diverse sectors. States with dynamic labor markets and stringent compliance norms drive adoption, while emerging regions across the Midwest and South are witnessing steady uptake due to increasing business formation and talent outsourcing trends.

Market Insights:

- The U.S. Professional Employer Organization (PEO) Services Market was valued at USD 88.14 million in 2018, reached USD 174.70 million in 2024, and is projected to attain USD 420.10 million by 2032, growing at a CAGR of 10.80% during the forecast period.

- California accounted for 22% of the market in 2024, followed by Texas with 18% and Florida with 15%, driven by dense SME networks, strong economic diversity, and advanced regulatory frameworks supporting PEO expansion.

- The Midwest region is expected to record the fastest growth with a 14% share by 2032, supported by industrial diversification, emerging start-up ecosystems, and increased digital adoption across secondary business hubs.

- Payroll and tax administration dominated the market with a 32% share in 2024, reflecting growing dependence on outsourced compliance and payment accuracy solutions among SMEs.

- Human resource management followed with a 27% share, supported by the integration of cloud-based HR systems and employee retention strategies that enhance overall workforce efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Cost-Effective Human Resource Management Solutions

The U.S. Professional Employer Organization (PEO) Services Market benefits from strong demand among small and medium-sized enterprises seeking affordable HR management support. Many SMEs lack the resources for in-house payroll, compliance, and benefits teams, driving reliance on PEO partnerships. These services help reduce administrative costs, enhance compliance efficiency, and improve employee retention. The ability of PEOs to consolidate HR processes under one platform strengthens their appeal across industries, from healthcare to IT services.

- For instance, Insperity’s HR360 solution achieved an 80% reduction in onboarding time for new hires through its integrated performance management and onboarding workflows, enabling faster productivity for organizations implementing the solution across multiple client industries in 2025.

Increasing Complexity of Employment Laws and Regulatory Compliance

Frequent changes in labor laws, tax codes, and workplace safety standards push businesses to seek professional HR guidance. The U.S. PEO Services Market provides compliance expertise, helping clients manage multi-state employment and evolving wage laws. Employers leverage PEOs to reduce exposure to legal risks and penalties while ensuring adherence to federal and state regulations. This trust in compliance assurance continues to drive market adoption among risk-sensitive sectors such as manufacturing and finance.

- For instance, ADP SmartCompliance employs more than 1,000 associates focused on evolving compliance legislation across 11,000 jurisdictions

Growing Adoption of Cloud-Based and Data-Driven HR Technologies

Digital transformation plays a major role in reshaping PEO operations. PEOs integrate cloud-based HR systems, analytics, and automation tools to deliver real-time workforce management insights. These innovations improve payroll accuracy, data security, and decision-making efficiency. The market’s shift toward digital platforms enhances scalability, supporting the growing remote workforce across the United States.

Expanding Remote and Hybrid Work Culture Across Industries

Post-pandemic workforce changes have created lasting demand for flexible employment structures. The U.S. PEO Services Market benefits from this trend by helping firms manage dispersed teams efficiently. PEOs handle benefits, payroll, and compliance for employees located across multiple states, supporting business continuity. This flexibility positions PEOs as strategic partners in sustaining workforce agility and national operational reach.

Market Trends:

Increasing Integration of Digital HR Technologies and Data Analytics

The U.S. Professional Employer Organization (PEO) Services Market is witnessing a major shift toward digital transformation, with technology becoming central to service delivery. PEOs are adopting advanced HR software, automation tools, and artificial intelligence to streamline payroll, benefits administration, and employee performance tracking. Cloud-based platforms enable secure access to employee data, improve communication, and ensure transparency between PEOs and client firms. Data analytics tools support predictive workforce planning, helping organizations make informed HR and compliance decisions. The integration of automated compliance checks reduces manual errors and enhances operational efficiency. It strengthens client trust by ensuring accuracy in payroll, taxes, and benefits management, making technology a key differentiator among service providers.

- For instance, Paychex Flex, as of August 2025, delivers secure, cloud-based HR management and supports more than 730,000 clients in the United States.

Growing Focus on Employee Experience, Retention, and Flexible Work Models

Evolving workforce expectations are redefining how PEOs structure their services. The U.S. PEO Services Market is emphasizing employee well-being, professional development, and benefits customization to improve satisfaction and retention. Many PEOs are expanding mental health support, financial wellness programs, and personalized insurance options to meet diverse employee needs. The rise of hybrid and remote work models has increased demand for scalable HR solutions that can support geographically dispersed teams. PEOs are developing platforms that ensure seamless digital onboarding, performance monitoring, and compliance for remote employees. It is fostering stronger collaboration between employers and workers, reinforcing PEOs’ role in shaping future workforce management practices across the United States.

- For Instance, Insperity’s cloud-based HR platform, including its Premier and HR360 solutions, facilitates digital onboarding for remote employees across its client base. A Forrester Consulting study commissioned by Insperity in 2025 found that using its HR360 solution can lead to a significant reduction in onboarding time.

Market Challenges Analysis:

Regulatory Uncertainty and Complex Compliance Environment

The U.S. Professional Employer Organization (PEO) Services Market faces challenges from evolving federal and state labor regulations. Frequent policy updates related to taxation, healthcare, benefits, and employee classification increase the risk of non-compliance. PEOs must continuously update systems and train staff to align with regulatory changes, which raises operational costs. Differing state employment laws complicate multi-state workforce management and tax reporting. It places pressure on PEOs to maintain high levels of legal expertise and compliance infrastructure. The lack of standardized federal oversight further adds complexity to consistent service delivery across regions.

High Competition and Limited Awareness Among Small Enterprises

Intense competition among national and regional PEO providers limits pricing flexibility and profit margins. Many small businesses remain unaware of the benefits of outsourcing HR and compliance functions. This limited awareness restricts market expansion in developing business regions. It also challenges smaller PEOs to differentiate themselves through service quality and technology adoption. High customer acquisition costs and long client onboarding processes create barriers for new entrants. Maintaining service consistency across varied client industries further tests the scalability and reputation of PEO providers.

Market Opportunities:

Expanding Demand from Small and Medium-Sized Enterprises Across Emerging Sectors

The U.S. Professional Employer Organization (PEO) Services Market holds strong potential from growing adoption among small and medium-sized enterprises. SMEs in technology, healthcare, logistics, and retail are seeking structured HR support to manage expanding workforces. Rising awareness of cost savings and compliance benefits is driving demand across start-ups and fast-growing firms. PEOs offering scalable and industry-specific solutions can attract new clients seeking flexibility and expertise. It creates opportunities for tailored service models designed to meet unique workforce requirements. The expansion of SMEs across suburban and regional markets will further widen the client base for PEO providers.

Integration of Artificial Intelligence and Automation in HR Processes

Automation and artificial intelligence present major growth avenues for PEO firms. AI-powered analytics improve workforce insights, benefits forecasting, and compliance tracking. The U.S. PEO Services Market is adopting intelligent tools to enhance employee engagement and streamline payroll accuracy. These technologies enable faster decision-making and reduce manual intervention across HR functions. It allows PEOs to deliver value-added services that improve client retention and satisfaction. Growing investment in digital transformation positions PEOs to lead in next-generation workforce management solutions.

Market Segmentation Analysis:

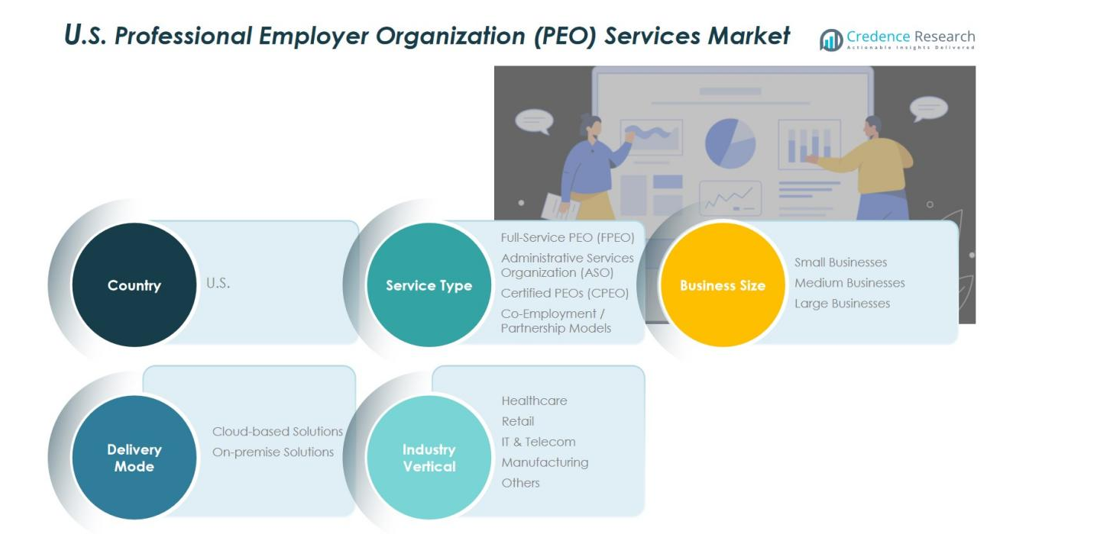

By Service Type

The U.S. Professional Employer Organization (PEO) Services Market is segmented into human resource management, payroll and tax administration, regulatory compliance, employee benefits administration, risk management, and other support services. Payroll and tax administration hold the dominant share due to growing complexity in multi-state taxation and wage compliance. Human resource management follows closely, supported by rising demand for workforce planning and employee engagement solutions. It continues to evolve through AI-enabled HR analytics and automation that enhance productivity and reduce administrative costs for client businesses.

- For Instance, ADP provides integrated multi-state payroll and tax compliance capabilities, including its SmartCompliance offering, for its more than 1.1 million global clients, assisting with tax filing in all 50 U.S. states.

By Business Size

Small and medium-sized enterprises represent the largest client base for PEO providers. These businesses rely on PEOs to manage HR operations efficiently while focusing on core business activities. Large enterprises are gradually adopting PEO partnerships to streamline compliance across multiple states and subsidiaries. It highlights the market’s growing adaptability to diverse organizational structures and workforce needs.

- For instance, TriNet, a leading PEO provider, served approximately 360,681 worksite employees through thousands of small and medium-sized clients across the US as of December 31, 2024, enabling these businesses to streamline HR functions and scale effectively with a single-platform solution for payroll, benefits, and risk management.

By Industry Vertical

PEO adoption is highest in the information technology, healthcare, and financial services sectors. These industries face complex compliance and workforce management requirements, creating consistent demand for outsourced HR support. Manufacturing, retail, and construction sectors are expanding their use of PEOs to optimize labor management and improve benefits administration. It strengthens overall market growth by broadening service applicability across various economic sectors.

Segmentations:

By Service Type

- Human Resource Management

- Payroll and Tax Administration

- Regulatory Compliance

- Employee Benefits Administration

- Risk Management

- Other Support Services

By Business Size

- Small Businesses

- Medium Businesses

- Large Enterprises

By Delivery Mode

- Online/Cloud-Based

- On-Premise

- Hybrid

By Industry Vertical

- Information Technology

- Healthcare

- Manufacturing

- Financial Services

- Retail and Consumer Goods

- Construction

- Education

- Others

By State

- California

- Texas

- Florida

- New York

- Illinois

- Pennsylvania

- Ohio

- Georgia

- North Carolina

Regional Analysis:

Strong Market Presence Across Key Economic States

The U.S. Professional Employer Organization (PEO) Services Market shows strong concentration in states with large and diverse business ecosystems such as California, Texas, Florida, and New York. These regions host a significant number of small and medium-sized enterprises that depend on outsourced HR, payroll, and compliance management. The technology, healthcare, and financial sectors lead demand in these states, supported by high employment density and regulatory complexity. PEO providers benefit from established business networks, skilled workforces, and favorable growth conditions in these markets. It continues to expand through partnerships and digital transformation initiatives tailored for regional client needs.

Expanding Adoption Across Emerging Business Hubs

States such as Georgia, North Carolina, Arizona, and Colorado are witnessing rising demand for PEO services due to their growing business formations and strong startup ecosystems. The U.S. PEO Services Market is expanding its footprint in these areas through hybrid delivery models that blend digital HR solutions with localized support. Favorable business climates and government incentives for SMEs are attracting PEO providers to these regions. The presence of diverse industries, from logistics to education, strengthens adoption potential. It offers PEOs opportunities to develop customized solutions that cater to specific state-level employment laws and workforce structures.

Increasing Penetration in the Midwest and Southern Regions

The Midwest and Southern states are emerging as new growth frontiers for PEO adoption, driven by industrial diversification and remote workforce expansion. Manufacturing, retail, and healthcare companies in these regions are outsourcing HR operations to improve compliance efficiency and reduce administrative costs. The U.S. PEO Services Market is leveraging technology-enabled platforms to reach businesses in secondary cities and suburban areas. Lower operational costs and expanding internet connectivity support service penetration. It enhances market competitiveness by enabling PEO providers to offer affordable, scalable solutions across geographically dispersed client bases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Professional Employer Organization (PEO) Services Market features strong competition among established players offering comprehensive HR, payroll, and compliance management solutions. Key participants include Insperity, Inc., Automatic Data Processing, Inc. (ADP), TriNet Group, Inc., Paychex PEO Services, Justworks Inc., Deel, and Papaya Global. These companies focus on expanding digital platforms, enhancing automation, and integrating advanced analytics to strengthen service delivery. Strategic partnerships and acquisitions help them expand client portfolios and enter new regional markets. It emphasizes technology-driven scalability, compliance expertise, and personalized employee benefits to maintain competitive differentiation. Growing demand from small and medium-sized enterprises continues to drive innovation, pushing market leaders to deliver integrated, cloud-based solutions that enhance efficiency and retention.

Recent Developments:

- In July 2025, Insperity partnered with Wingspan to launch “Insperity Contractor Management powered by Wingspan,” a platform designed to streamline contractor engagement for businesses.

- In August 2025, Insperity rebranded its HR solutions portfolio and announced “Insperity HRScale” via a strategic partnership with Workday, with plans for early adopter availability in 2026.

Report Coverage:

The research report offers an in-depth analysis based on Service Type, Business Size, Delivery Mode, Industry Vertical and State. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Professional Employer Organization (PEO) Services Market will continue expanding with growing adoption among small and medium-sized enterprises seeking scalable HR solutions.

- Digital transformation will play a vital role, with AI, automation, and analytics reshaping HR management and compliance monitoring.

- Cloud-based platforms will dominate service delivery, improving efficiency, accessibility, and data transparency for both clients and employees.

- Remote and hybrid work trends will sustain demand for PEOs that support distributed and multi-state workforces.

- Compliance challenges linked to evolving labor regulations will drive demand for expert-managed HR services.

- PEO providers will strengthen cybersecurity measures to ensure data integrity and build client trust.

- Employee-centric services, including wellness and benefits customization, will enhance retention and engagement strategies.

- Strategic mergers and partnerships will expand service portfolios and geographic reach for key market players.

- Industry-specific PEO models will gain traction, targeting sectors like healthcare, IT, and financial services.

- Sustainability-focused HR practices and ethical employment standards will emerge as key differentiators in the competitive landscape.