Market Overview

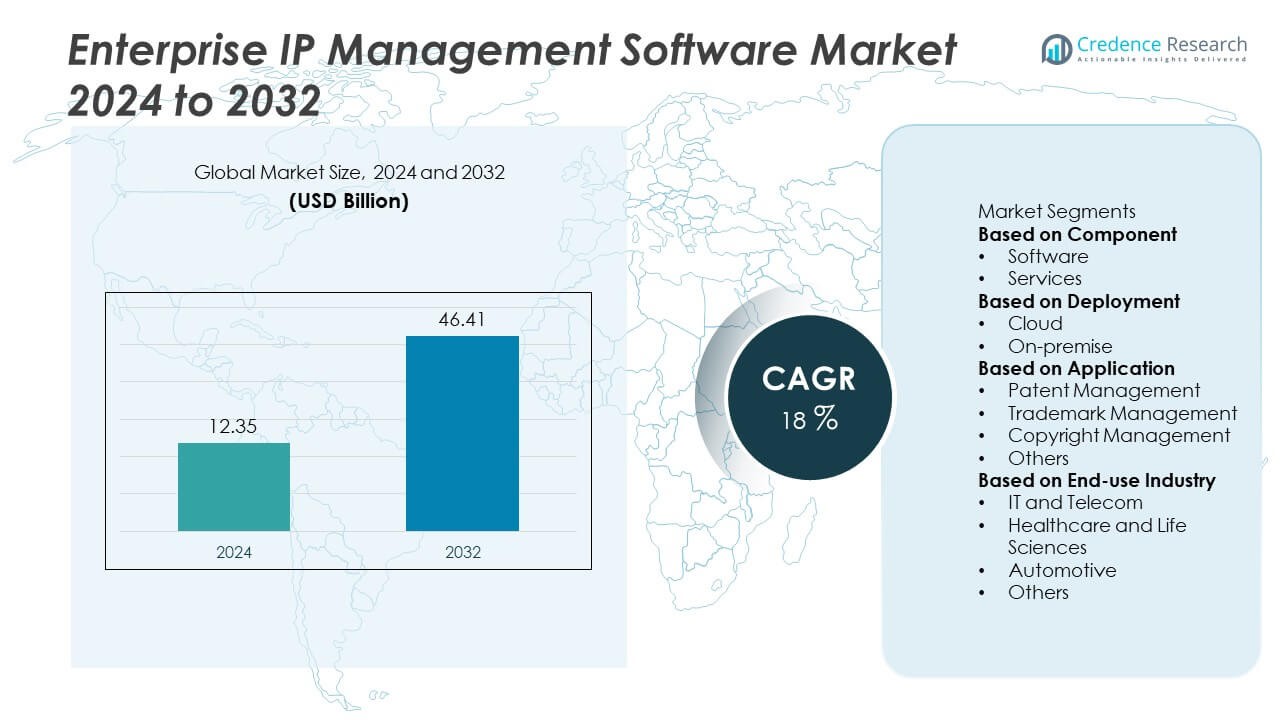

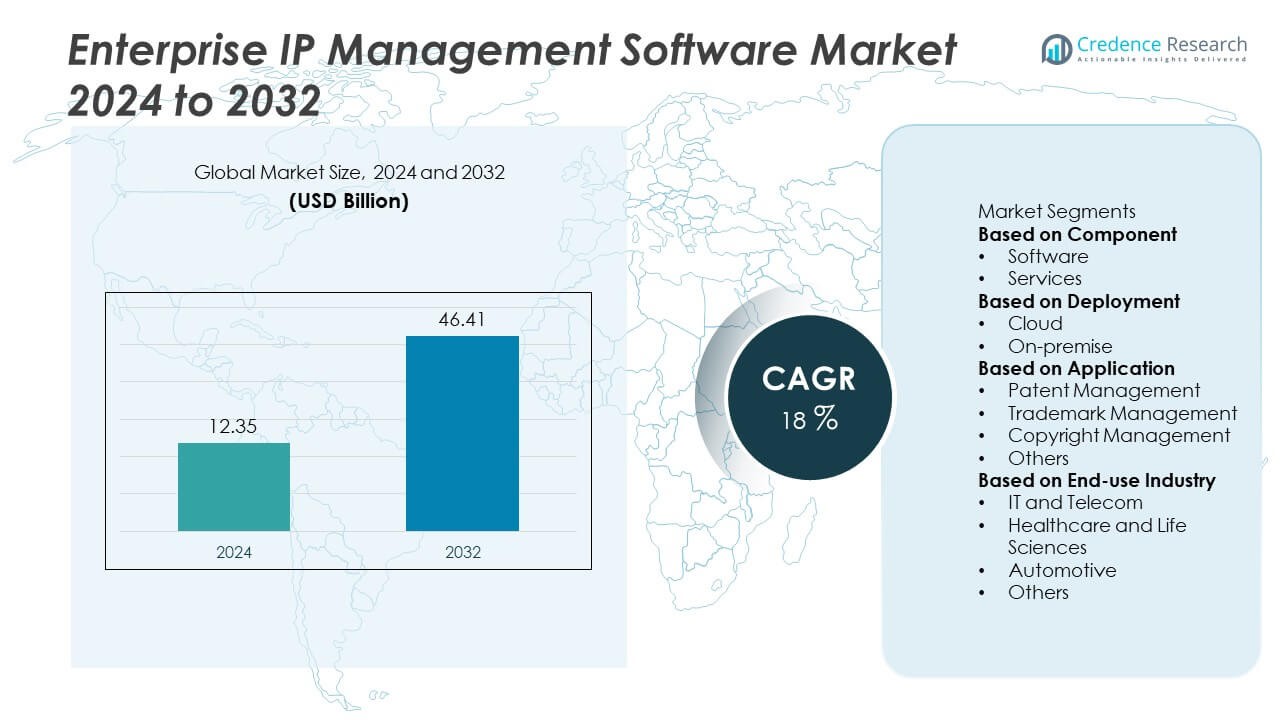

Enterprise IP Management Software market size reached USD 12.35 billion in 2024 and is projected to rise to USD 46.41 billion by 2032, supported by an 18% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise IP Management Software Market Size 2024 |

USD 12.35 Billion |

| Enterprise IP Management Software Market, CAGR |

18% |

| Enterprise IP Management Software Market Size 2032 |

USD 46.41 Billion |

Top players in the Enterprise IP Management Software market include Clarivate Plc, Anaqua, Inc., CPA Global, Questel, Dennemeyer Group, IPfolio, Patsnap, LexisNexis IP Solutions, AppColl, Inc., and WebTMS, each expanding their capabilities through AI-enabled analytics, cloud platforms, and automated compliance tools. These companies strengthen their position by offering integrated portfolio management, infringement monitoring, and valuation features that support global IP strategies. North America leads the market with a 37% share due to strong patent activity, advanced digital infrastructure, and high adoption of cloud-based IP solutions. Europe follows with a 29% share supported by unified IP frameworks and strong regulatory compliance needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 12.35 billion in 2024 and will rise to USD 46.41 billion by 2032 at an 18% CAGR, supported by rising digital adoption across enterprises.

- Growing patent filings and strong demand for automated software solutions drive expansion, with the software segment holding a 67% share due to advanced workflow control and faster compliance management.

- Key trends include rapid cloud migration and increasing use of AI for predictive analytics, lifecycle tracking, and infringement monitoring, which improves accuracy and decision-making.

- Competitive activity intensifies as major players enhance analytics tools, expand cloud ecosystems, and strengthen cybersecurity capabilities, while cost barriers and integration challenges act as restraints for SMEs.

- Regionally, North America leads with a 37% share driven by strong innovation activity, followed by Europe at 29% supported by unified IP frameworks; Asia Pacific holds 23% and grows fastest due to rising patent volumes and digital transformation.

Market Segmentation Analysis:

By Component

Software holds a 67% market share and remains the dominant component within the Enterprise IP Management Software market. Strong demand for automated IP portfolio tracking, digital filing, and real-time monitoring drives widespread adoption across large enterprises and technology-focused industries. Software platforms support centralized control, faster decision-making, and enhanced compliance management. Service offerings gain steady traction as companies seek consulting, integration, and system optimization support, but their share remains lower due to higher deployment costs and limited scalability compared with software solutions. Growing focus on workflow automation and unified dashboards strengthens the leading position of software in this segment.

- For instance, Clarivate expanded its IP platform by leveraging the over 165 million enhanced patent records in the Derwent World Patents Index to train enhanced AI-based classification engines, enabling faster document sorting across global filings.

By Deployment

Cloud deployment leads the segment with a 58% market share due to rising preferences for scalable platforms, lower upfront costs, and simplified remote access. Enterprises adopt cloud-based IP management tools to support distributed teams, improve collaboration, and enhance security through automated updates and real-time threat monitoring. On-premise systems maintain relevance among organizations handling highly confidential patent portfolios, but the share continues to decline as companies shift toward flexible subscription-based models. Growth in digital transformation projects, cybersecurity advancements, and API-driven integrations reinforces the dominant role of cloud deployment in this segment.

- For instance, Anaqua’s AQX platform handled more than 850,000 cloud-based docketing updates in a single quarter, improving cycle efficiency for global clients.

By Application

Patent management dominates the application segment with a 42% market share as companies prioritize structured patent filing, renewal tracking, and infringement monitoring. Increasing patent volumes across technology, biotech, and engineering sectors boost the need for automated tools that manage lifecycle workflows and global compliance. Trademark and copyright management solutions gain gradual adoption, but their share remains lower due to fewer registrations and simpler workflows. The “others” category, including design management and licensing modules, supports niche requirements. Strong innovation activity, rising R&D spending, and global IP protection needs drive the leadership of patent management within this segment.

Key Growth Drivers

Rising Global Patent and Trademark Filings

Growing innovation activity across technology, biotechnology, electronics, and automotive industries drives higher patent and trademark registrations. Enterprises handle larger and more complex IP portfolios, which increases demand for centralized platforms that manage filings, renewals, and compliance across multiple jurisdictions. Companies adopt digital tools to reduce administrative workloads, improve accuracy, and limit legal risks. The rising pace of R&D investments, along with expanding cross-border patent applications, strengthens the need for automated IP lifecycle management solutions. This trend positions IP management software as an essential asset for organizations seeking protection in competitive markets.

- For instance, CPA Global (now part of Clarivate) offers IP management solutions, including its FoundationIP system, which is designed to help clients manage their intellectual property portfolios and associated deadlines through features such as data integration and automated workflow processes.

Increasing Adoption of AI and Automation in IP Workflows

AI-driven tools enable faster prior-art searches, automated classification, predictive analytics, and risk assessment, which significantly improve IP decision-making. Enterprises deploy automation to streamline workflows, reduce manual errors, and shorten prosecution timelines. Machine learning models support real-time monitoring of infringement risks and portfolio valuation, which increases operational efficiency. These capabilities enhance visibility across global IP assets and support strategic planning for licensing, commercialization, and competitive intelligence. This shift toward intelligent automation accelerates the adoption of modern IP management platforms in both large enterprises and SMEs.

- For instance, Clarivate integrated AI-based similarity detection that analyzed 40 million patent claims to enhance predictive accuracy during prior-art searches.

Growing Demand for Compliance and Risk Management

Rising regulatory complexity and frequent changes in IP laws across global markets increase the need for reliable compliance tools. Enterprises must track renewal deadlines, manage global filings, and avoid costly lapses in protection, which drives interest in structured platforms with automated reminders and audit trails. Advanced IP management systems support secure document storage, reporting, and standardized workflows that help organizations meet legal and procedural requirements. Increasing litigation risks and the need for transparent IP ownership records further strengthen demand for secure, compliance-focused IP software solutions.

Key Trends & Opportunities

Expansion of Cloud-Based IP Management Platforms

Cloud adoption continues to expand as enterprises prioritize scalability, remote accessibility, and lower deployment costs. Cloud platforms offer seamless integration with analytics tools, collaboration features, and automated updates that enhance operational performance. SMEs benefit from subscription-based models that reduce IT overhead, while large enterprises gain flexible environments to manage global portfolios. Vendors also introduce AI-powered cloud modules that support intelligent search, portfolio analytics, and automated reporting. This trend offers strong growth opportunities for providers offering secure, high-performance cloud ecosystems.

- For instance, WebTMS enhanced its cloud module by offering its clients the ability to import data and automatically update their trademark records using official data from over 180 jurisdictions, with the platform capable of handling portfolios of varying sizes, including those with more than 300,000 records.

Growing Focus on IP Monetization and Licensing Opportunities

Companies increasingly treat intellectual property as a strategic asset rather than a compliance requirement. The rise in licensing, technology transfers, and patent monetization creates demand for platforms that track valuations, manage revenue streams, and support negotiation workflows. IP management software with analytics, competitive benchmarking, and market intelligence tools helps organizations unlock new revenue channels. This shift encourages businesses to strengthen portfolio optimization strategies and leverage unused assets. Vendors offering advanced monetization modules gain an advantage in meeting this evolving market need.

- For instance, Questel’s licensing data scope includes over 30,000 registered licensing agreements available in full text, some of which contain royalty rates, offering structured data for analysis of commercialization pipelines.

Key Challenges

High Implementation Costs and Integration Complexity

Many enterprises face financial and operational challenges when implementing IP management systems. Deployment involves software licensing, customization, data migration, and integration with legacy systems, which increases project complexity. Smaller businesses often hesitate due to budget constraints and limited IT resources. Integrating with legal management tools, patent databases, and enterprise resource planning systems adds further technical challenges. These factors slow adoption, especially in developing markets, where cost sensitivity and infrastructure limitations remain significant barriers.

Data Security and Confidentiality Concerns

Enterprises manage sensitive IP information, including patent drafts, licensing agreements, and proprietary documents, which increases risk exposure. Cybersecurity threats, unauthorized access, and data breaches create concerns about adopting cloud-based systems. Organizations require strong encryption, compliance with international data protection laws, and robust access controls to protect valuable portfolios. Vendors must invest in advanced security frameworks and certifications to build trust. Despite technological advances, security fears remain a major challenge that delays transition from on-premise systems to modern cloud platforms.

Regional Analysis

North America

North America leads the Enterprise IP Management Software market with a 37% share driven by strong patent activity, high R&D spending, and early adoption of AI-enabled IP platforms. The United States hosts a large concentration of technology, biotechnology, and pharmaceutical companies that manage extensive global IP portfolios. These enterprises prioritize automation, cloud migration, and analytics-driven decision support to streamline complex workflows. Strong regulatory frameworks and rising litigation risks further strengthen adoption. Canada contributes steady growth as SMEs increase investment in digital tools. Robust digital infrastructure and innovation programs maintain North America’s leadership position in this market.

Europe

Europe holds a 29% market share supported by strong IP protection norms and rising filings across automotive, chemicals, electronics, and life sciences industries. The region benefits from unified IP frameworks introduced by the European Patent Office, which encourage enterprises to adopt centralized software platforms for compliance and cross-border portfolio management. Germany, France, and the United Kingdom remain the top adopters due to advanced manufacturing and research ecosystems. The region also sees rising demand for cloud-based IP systems as companies prioritize efficiency and data standardization. Robust digital transformation strategies strengthen Europe’s competitive position.

Asia Pacific

Asia Pacific accounts for a 23% share and represents the fastest-growing regional market due to expanding patent volumes and strong government support for innovation. China, Japan, South Korea, and India drive adoption as enterprises manage growing patent filings across electronics, semiconductors, and biotechnology sectors. The region’s rapid digitalization and rising investment in R&D encourage companies to deploy automated IP platforms for structured lifecycle control. Cloud-based solutions gain traction among SMEs seeking cost-effective and scalable tools. Increasing international patent collaborations and expanding technology exports reinforce Asia Pacific’s rising role in global IP management.

Latin America

Latin America holds a 6% share, with demand growing steadily as enterprises modernize legal and administrative systems. Brazil and Mexico lead adoption driven by rising interest in patent protection across pharmaceuticals, automotive components, and manufacturing industries. Companies invest in digital tools to improve accuracy in filings, renewal tracking, and compliance with evolving IP regulations. While digital infrastructure gaps persist, cloud-based IP management solutions help reduce deployment barriers. Collaboration with international partners and expanding innovation programs support gradual market expansion. Regional governments promoting stronger IP enforcement further enhance growth prospects in Latin America.

Middle East & Africa

The Middle East & Africa region accounts for a 5% market share, driven by rising economic diversification efforts and growing innovation ecosystems in sectors such as technology, energy, and healthcare. The United Arab Emirates and Saudi Arabia lead adoption as enterprises strengthen patent strategies and invest in cloud-first digital platforms. Organizations adopt IP software to manage filings across multiple jurisdictions and reduce operational risks. Africa shows early-stage adoption, led by South Africa, where technology startups prioritize structured IP workflows. Expanding digital infrastructure and government initiatives to enhance IP protection support gradual growth across the region.

Market Segmentations:

By Component

By Deployment

By Application

- Patent Management

- Trademark Management

- Copyright Management

- Others

By End-use Industry

- IT and Telecom

- Healthcare and Life Sciences

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis shows a strong presence of leading players such as Clarivate Plc, Anaqua, Inc., CPA Global, Questel, Dennemeyer Group, IPfolio, Patsnap, LexisNexis IP Solutions, AppColl, Inc., and WebTMS, each expanding their capabilities across global IP ecosystems. These companies focus on AI-driven portfolio analytics, automated compliance workflows, and cloud-based deployment models to deliver faster insights and improve lifecycle management. Vendors strengthen their positions through strategic acquisitions, integration of advanced search tools, and partnerships with law firms and enterprises managing large IP portfolios. Innovation in predictive analytics, infringement monitoring, and valuation modules helps providers support competitive decision-making. Growing demand for cybersecurity, workflow automation, and cross-border filing support pushes companies to invest in scalable, secure platforms that meet complex regulatory needs. As enterprises prioritize digital transformation and global protection strategies, competition intensifies among vendors offering comprehensive, user-friendly, and analytics-rich software solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clarivate Plc

- Anaqua, Inc.

- CPA Global

- Questel

- Dennemeyer Group

- IPfolio

- Patsnap

- LexisNexis IP Solutions

- AppColl, Inc.

- WebTMS

Recent Developments

- In May 2025, Anaqua acquired RightHub®, Inc., a provider of IP management software and services, strengthening its presence in the UK, Sweden and Denmark.

- In March 2025, Clarivate announced a strategic partnership with Iprova to integrate Iprova’s invention-creation suite with Clarivate’s IPfolio software, enabling smoother transition from invention capture to patent workflow.

- In June 2024, Anaqua, Inc. launched its AI-powered AQX® 11 platform, its most significant release in 20 years, designed to help corporations and law firms maximise value from their IP assets.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Application, End-use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI-driven IP analytics will gain wider adoption to support faster decision-making.

- Cloud-based IP platforms will expand as enterprises shift toward flexible digital systems.

- Automation will streamline global filing, renewal tracking, and compliance workflows.

- IP monetization tools will grow as companies focus on licensing and portfolio valuation.

- Cybersecurity enhancements will become essential to protect sensitive IP assets.

- Integration with legal tech and enterprise systems will strengthen operational efficiency.

- SMEs will adopt scalable subscription-based IP solutions at a faster pace.

- Cross-border IP collaboration will increase, driving demand for unified global platforms.

- Predictive tools will help enterprises identify infringement risks and competitive threats.

- Data-driven portfolio optimization will guide long-term innovation and investment strategies.