Market Overview

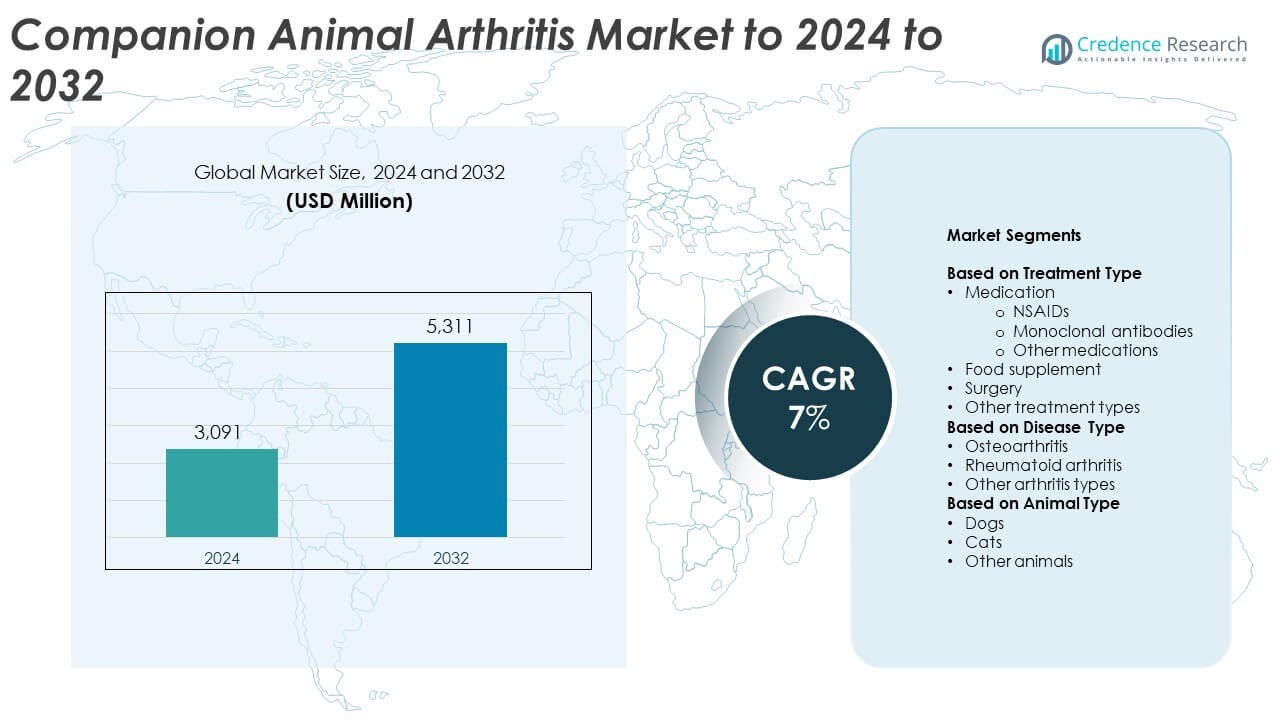

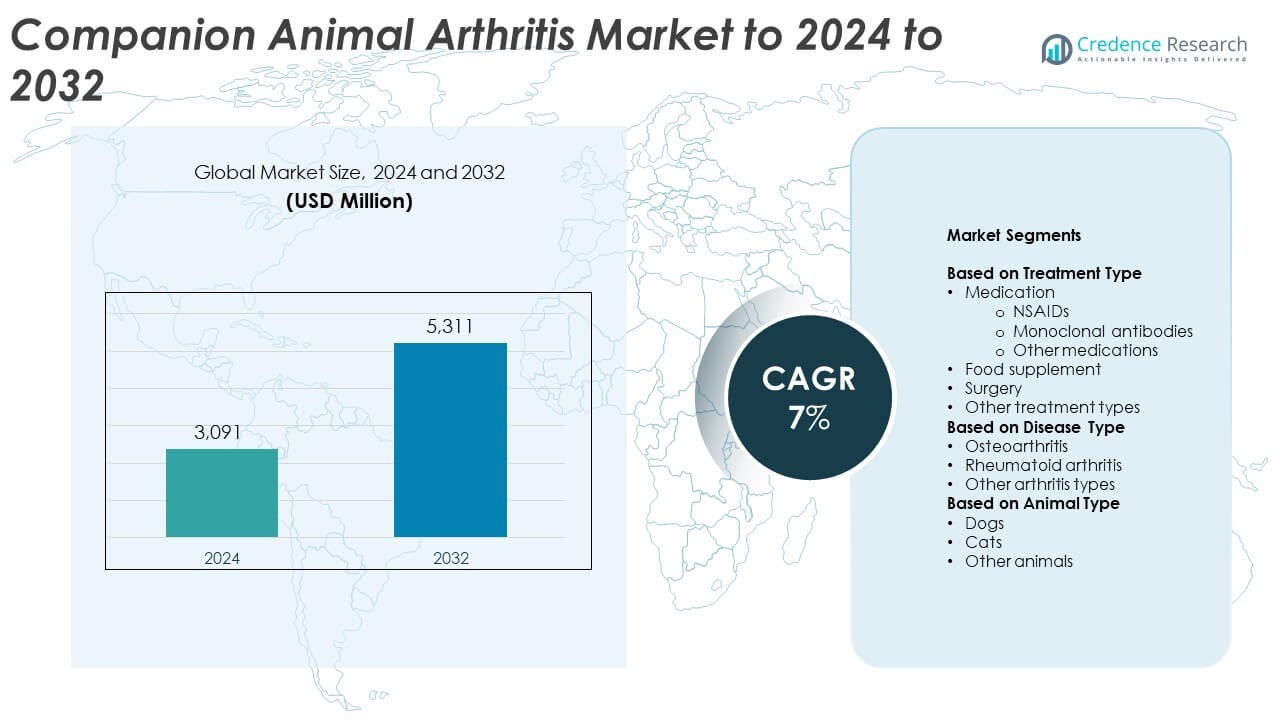

The Companion Animal Arthritis Market size was valued at USD 3,091 Million in 2024 and is anticipated to reach USD 5,311 Million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Animal Arthritis Market Size 2024 |

USD 3,091 Million |

| Companion Animal Arthritis Market, CAGR |

7% |

| Companion Animal Arthritis Market Size 2032 |

USD 5,311 Million |

The companion animal arthritis market is led by major players such as Zoetis, Bayer AG, Dechra Pharmaceuticals, Elanco Animal Health, Boehringer Ingelheim, CEVA Santé Animale, and Vetoquinol. These companies dominate through extensive portfolios of NSAIDs, monoclonal antibodies, and regenerative therapies aimed at improving mobility and long-term joint health in pets. North America leads the global market with a 37.2% share, supported by advanced veterinary infrastructure and high pet healthcare spending. Europe follows with 29.6%, driven by strong adoption of biologics and preventive supplements. Asia Pacific is emerging rapidly with 21.8% due to expanding pet ownership and growing awareness of arthritis management, while Latin America and the Middle East & Africa collectively represent the remaining share, reflecting gradual improvements in veterinary access and product availability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The companion animal arthritis market was valued at USD 3,091 million in 2024 and is projected to reach USD 5,311 million by 2032, expanding at a CAGR of 7% during the forecast period.

• Rising pet ownership and increased expenditure on veterinary healthcare drive market growth, supported by greater awareness of arthritis management in aging pets.

• Growing adoption of monoclonal antibodies, regenerative therapies, and nutraceutical supplements is transforming treatment approaches, emphasizing safety and long-term mobility improvement.

• The market is moderately consolidated, led by Zoetis, Bayer AG, Dechra Pharmaceuticals, Elanco, and Boehringer Ingelheim, with companies investing in advanced biologics and targeted anti-inflammatory solutions.

• North America leads with a 39.2% share, followed by Europe at 28.7% and Asia Pacific at 21.5%, while medications hold 62.4% of the treatment segment and dogs account for 68.9% of animal-type demand, reflecting strong dominance in pet arthritis therapeutics.

Market Segmentation Analysis:

By Treatment Type

Medication dominated the Companion Animal Arthritis Market with a 62.4% share in 2024, driven by the widespread use of non-steroidal anti-inflammatory drugs (NSAIDs) and monoclonal antibodies for pain relief and inflammation control. NSAIDs remain the primary treatment choice due to their proven efficacy and affordability. Monoclonal antibodies, such as those targeting nerve growth factors, are gaining adoption for their long-term pain management benefits without gastrointestinal side effects. The rising veterinary focus on early-stage pharmacological intervention supports sustained demand for advanced therapeutic drugs across companion animal care practices.

- For instance, Boehringer Ingelheim’s meloxicam showed higher clinical success than placebo by days 8 and 15 in dogs with osteoarthritis, with significantly better owner and investigator ratings.

By Disease Type

Osteoarthritis accounted for 74.6% of the market share in 2024, making it the dominant disease segment. The high prevalence of degenerative joint disorders in aging pets, particularly dogs and large-breed animals, is fueling diagnostic and therapeutic demand. Increasing awareness among pet owners and veterinarians regarding early diagnosis and treatment options is further driving segment growth. Continuous advancements in regenerative and biologic therapies, along with improved imaging techniques, have enhanced disease monitoring and supported the growing clinical management of osteoarthritis cases in companion animals.

- For instance, Zoetis’ frunevetmab trial in 126 cats reported a CSOM success rate of 80.3% versus 44.7% for placebo at day 56.

By Animal Type

Dogs led the market with a 68.9% share in 2024, attributed to their higher susceptibility to joint degeneration and injury-related arthritis compared to other animals. The growing number of pet dogs worldwide, combined with increased spending on veterinary care, continues to boost segment growth. Large and overweight breeds are particularly prone to mobility issues, accelerating the demand for pain-relief and joint-support therapies. The introduction of targeted biologics and dietary supplements tailored for canine osteoarthritis management has further strengthened the dominance of dogs in the overall companion animal arthritis treatment landscape.

Key Growth Drivers

Rising Pet Ownership and Expenditure on Animal Health

The growing global pet population and increasing willingness of owners to spend on veterinary care are major market growth drivers. Pet humanization has encouraged higher adoption of advanced therapies and preventive care for arthritis management. This shift toward specialized veterinary services is boosting demand for prescription drugs, biologics, and supplements that improve mobility and comfort. The rising awareness about joint health maintenance in aging pets further accelerates product innovation and drives long-term revenue opportunities for manufacturers and veterinarians alike.

- For instance, According to VetStem Biopharma’s communications, the company has facilitated over 40,000 stem cell treatments for animals across more than 60 species, having processed over 16,500 patient samples.

Advancements in Veterinary Therapeutics

Continuous innovation in arthritis therapeutics, including monoclonal antibodies, regenerative therapies, and long-acting pain management drugs, is transforming treatment outcomes. These advancements enhance drug efficacy, safety, and convenience for both animals and pet owners. The introduction of targeted therapies reduces inflammation and chronic pain more effectively than conventional drugs. Improved research in animal immunology and biotechnology supports the expansion of novel treatment classes, making veterinary arthritis management more precise and accessible across clinics and hospitals.

- For instance, Hill’s j/d study enrolled 26 test and 18 control dogs and evaluated stepwise carprofen dose reductions over three-week intervals, demonstrating feasibility of dose lowering with omega-3–rich diets.

Growing Prevalence of Osteoarthritis in Aging Pets

The increasing incidence of osteoarthritis among elderly dogs and cats is a major growth catalyst for the market. Age-related joint wear, obesity, and lifestyle changes contribute to higher diagnosis rates. Veterinarians emphasize early detection and preventive interventions, leading to growing demand for medications and supplements. As pet lifespans extend through better nutrition and healthcare, chronic musculoskeletal conditions are becoming more common, reinforcing the need for continuous treatment solutions and improved arthritis management protocols globally.

Key Trends & Opportunities

Rising Demand for Natural and Nutraceutical Solutions

There is a growing shift toward natural joint-support supplements and nutraceutical formulations. Pet owners are increasingly preferring glucosamine, chondroitin, and omega-3–based products to manage mild arthritis and support long-term mobility. These formulations offer safe, side-effect-free alternatives to synthetic medications. The trend is encouraging manufacturers to expand portfolios with herbal and functional ingredients, driving product diversification and expanding opportunities within preventive arthritis care segments in veterinary retail channels.

- For instance, Norbrook’s Loxicom specifies 0.2 mg/kg on day 1, then 0.1 mg/kg once daily; pivotal trials included 277 dogs over 14 days.

Expansion of Biologic and Regenerative Therapies

Regenerative medicine is emerging as a transformative trend in veterinary arthritis treatment. Stem-cell and platelet-rich plasma therapies are gaining clinical validation for repairing cartilage and reducing inflammation. These therapies provide long-term relief compared to conventional drugs. Increasing adoption across veterinary hospitals and specialty clinics highlights the growing confidence in advanced biologic interventions, creating a promising frontier for companies investing in research and development within the companion animal therapeutics space.

- For instance, Zomedica’s original Assisi Loop PEMF devices offer a minimum of 150 15-minute treatments per unit, after which the non-rechargeable battery runs out.

Key Challenges

High Cost of Advanced Therapeutics

The significant cost associated with biologic and regenerative arthritis treatments limits their adoption among pet owners. Advanced therapies, while effective, often involve expensive procedures and repeated clinical visits. This financial burden restricts market accessibility, particularly in emerging regions with low veterinary insurance coverage. The high price point of monoclonal antibody treatments and stem-cell therapies continues to be a barrier to widespread commercialization, slowing potential market penetration despite proven therapeutic outcomes.

Limited Awareness in Developing Regions

Awareness of early arthritis symptoms and advanced treatment options remains low in many developing markets. Pet owners often overlook early-stage mobility issues, resulting in delayed diagnosis and limited therapeutic intervention. Inadequate veterinary infrastructure and low adoption of preventive care further constrain growth. Strengthening educational outreach programs and expanding veterinary service networks are essential to improve disease detection and promote timely arthritis management across underserved regions.

Regional Analysis

North America

North America dominated the companion animal arthritis market with a 39.2% share in 2024. The region’s leadership is driven by high pet ownership rates, strong veterinary infrastructure, and early adoption of advanced therapeutics. Widespread availability of monoclonal antibody treatments and nutraceutical supplements supports robust market penetration. Rising expenditure on animal healthcare, coupled with growing awareness of preventive care, further strengthens demand. The presence of leading veterinary pharmaceutical companies and extensive insurance coverage for pet treatments continues to foster innovation and sustained revenue growth across the United States and Canada.

Europe

Europe held a 28.7% market share in 2024, supported by growing pet humanization and strict animal welfare regulations. Increasing preference for biologics and natural supplements in countries such as Germany, France, and the United Kingdom is fueling market expansion. Government-backed initiatives promoting veterinary health awareness and accessible pet insurance plans are strengthening treatment uptake. Advances in regenerative therapies and collaboration between academic and commercial research institutions enhance arthritis management capabilities, contributing to steady market growth across major European economies.

Asia Pacific

Asia Pacific accounted for a 21.5% share in 2024, driven by a rapid rise in pet adoption and expanding veterinary care networks across China, Japan, and India. Growing disposable incomes and rising awareness of pet health management are encouraging owners to seek professional arthritis treatments. Regional manufacturers are investing in cost-effective medications and supplements to meet local demand. The market benefits from urbanization and the emergence of organized veterinary clinics offering advanced diagnostics and biologic therapies, particularly in developed urban centers.

Latin America

Latin America captured a 6.8% market share in 2024, with Brazil and Mexico being key contributors. The growing pet population and improving access to veterinary care are driving market growth. Increasing efforts by regional distributors to supply affordable pain management and nutritional supplements have expanded market reach. Awareness campaigns about joint health are promoting early diagnosis of arthritis among companion animals. However, limited availability of advanced biologic therapies and low insurance coverage slightly constrain growth potential in rural areas.

Middle East & Africa

The Middle East and Africa region held a 3.8% market share in 2024, characterized by gradual improvements in veterinary infrastructure and growing pet care awareness. Rising urbanization and the increasing popularity of companion animals in countries such as South Africa and the United Arab Emirates are supporting market development. The demand for cost-effective medications and dietary supplements continues to grow, driven by greater interest in pet wellness. However, uneven access to veterinary professionals and high treatment costs remain challenges to broader market expansion across the region.

Market Segmentations:

By Treatment Type

- Medication

- NSAIDs

- Monoclonal antibodies

- Other medications

- Food supplement

- Surgery

- Other treatment types

By Disease Type

- Osteoarthritis

- Rheumatoid arthritis

- Other arthritis types

By Animal Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the companion animal arthritis market include Zoetis, Inc., Bayer AG, Dechra Pharmaceuticals plc, Vibrac, Eltech K-Laser s.r.l., American Regent, CEVA Santé Animale, Medivet, Elanco Animal Health, Vetoquinol SA, Nutramax Laboratories Veterinary Sciences, Norbrook Laboratories, TVM, and Boehringer Ingelheim. The market is characterized by strong research collaboration, targeted product innovation, and expansion of therapeutic portfolios across both pharmaceutical and nutraceutical categories. Companies are focusing on developing next-generation monoclonal antibodies, regenerative therapies, and long-acting anti-inflammatory formulations to enhance treatment efficacy and compliance. Advanced pain management solutions and biologic-based interventions are gaining preference due to their superior safety and prolonged benefits. Continuous investment in clinical trials, regulatory approvals, and regional distribution networks strengthens market penetration, particularly in North America and Europe. Strategic mergers, licensing partnerships, and veterinary education programs further consolidate competitive positioning while driving sustained growth in the global companion animal arthritis therapeutics landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In Oct 2023, Zoetis launched Librela (bedinvetmab injection) in the U.S. to control osteoarthritis pain in dogs. Approved by the FDA May 2023, the once-monthly injectable medication is a monoclonal antibody that targets nerve growth factor (NGF) to alleviate pain and is administered via subcutaneous injection.

- In 2023, TVM (a Dechra Pharmaceuticals group company): Introduced DogStem, the first and only licensed stem cell therapy for canine osteoarthritis in Europe, designed to reduce pain and enhance mobility.

- In 2023, Elanco launched AdTab (lotilaner), a non-prescription oral monthly flea and tick product for dogs and cats in Europe.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Disease Type, Animal Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness greater adoption of monoclonal antibody therapies for long-term pain relief.

- Veterinary clinics will increasingly use regenerative and stem-cell treatments for joint repair.

- Nutraceuticals and natural supplements will gain wider acceptance among health-conscious pet owners.

- Digital monitoring tools and wearables will support early arthritis detection and mobility tracking.

- Collaboration between pharmaceutical companies and veterinary hospitals will enhance treatment innovation.

- Rising pet insurance coverage will improve access to advanced arthritis therapies.

- Manufacturers will focus on developing affordable formulations for emerging markets.

- Aging pet populations will drive continuous demand for chronic arthritis management.

- Veterinary telemedicine will expand treatment access and post-care monitoring globally.

- Research into genetic markers and precision medicine will refine personalized arthritis treatments for companion animals.