Market Overview

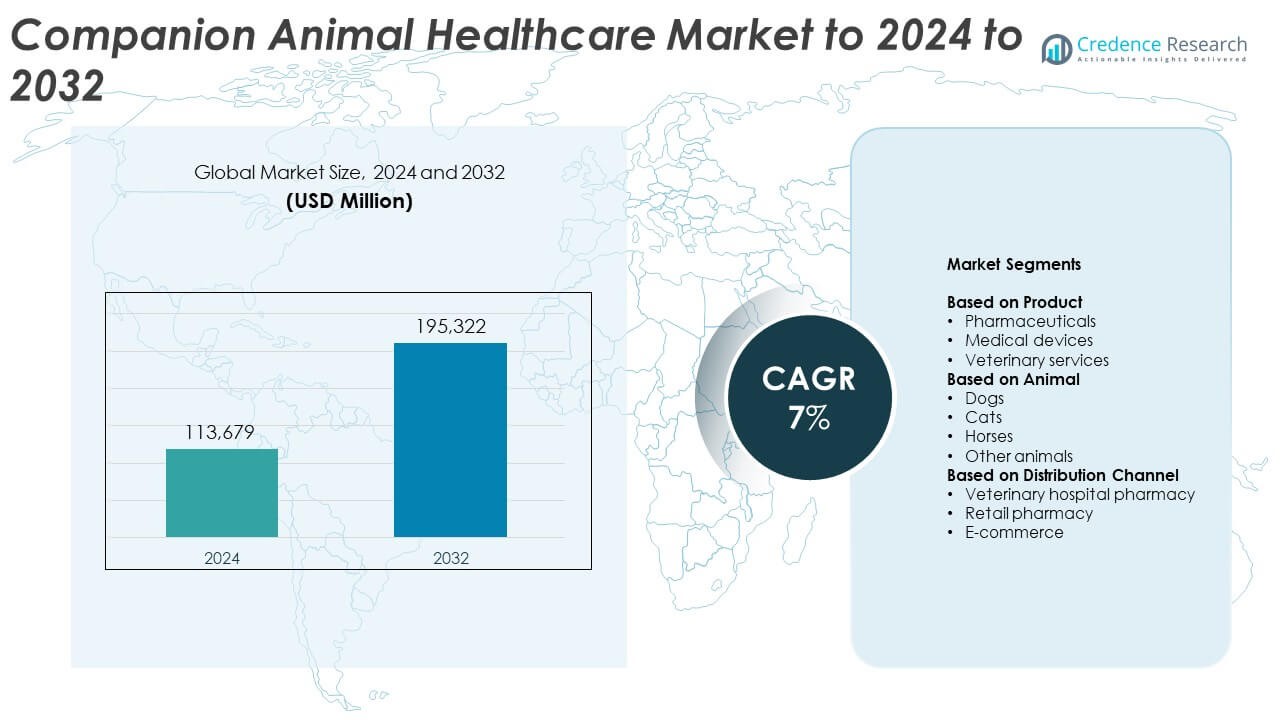

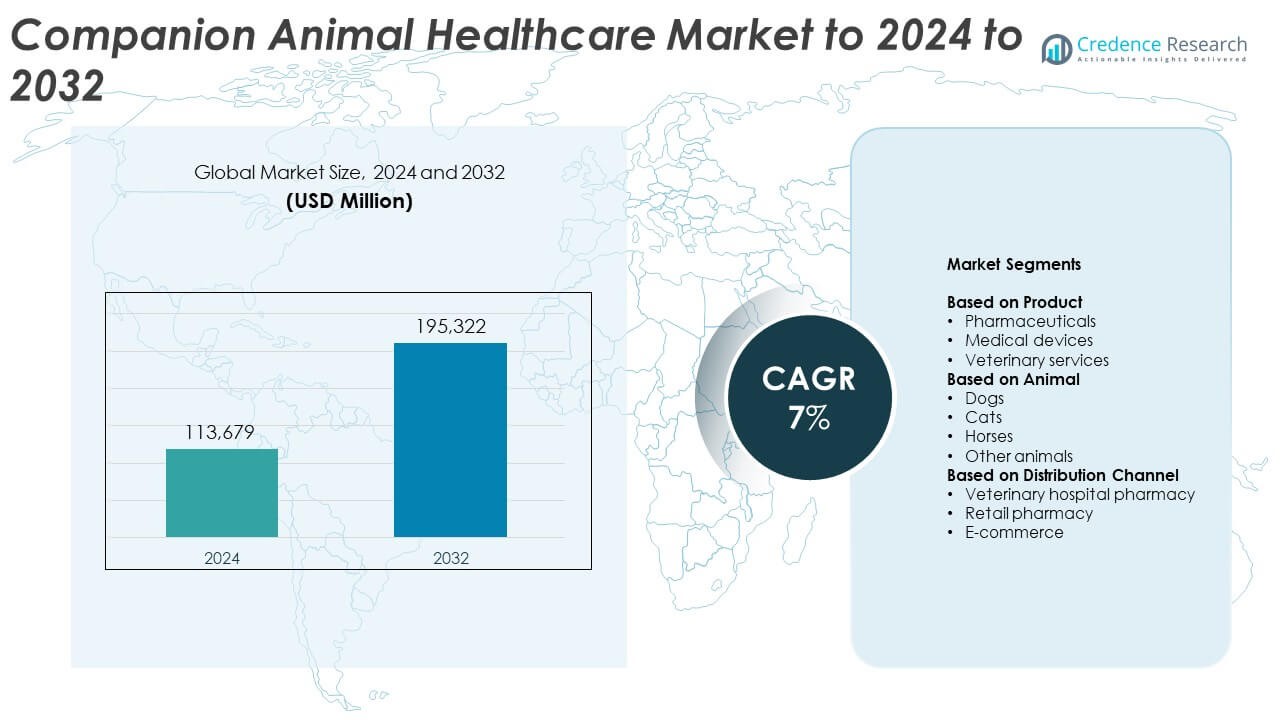

Companion Animal Healthcare Market size was valued at USD 113,679 million in 2024 and is anticipated to reach USD 195,322 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Animal Healthcare Market Size 2024 |

USD 113,679 Million |

| Companion Animal Healthcare Market, CAGR |

7% |

| Companion Animal Healthcare Market Size 2032 |

USD 195,322 Million |

The companion animal healthcare market is dominated by leading players such as Zoetis, Boehringer Ingelheim, Elanco, Merck, Ceva, and Virbac, along with IDEXX Laboratories, Dechra, and Mars Petcare. These companies focus on expanding their product portfolios across pharmaceuticals, diagnostics, and preventive care through innovation and strategic collaborations. North America led the global market in 2024 with a 41.2% share, supported by advanced veterinary infrastructure and high pet ownership rates. Europe followed with 27.4%, driven by strong regulatory frameworks and high insurance coverage, while Asia Pacific emerged as the fastest-growing region, holding a 19.3% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The companion animal healthcare market was valued at USD 113,679 million in 2024 and is projected to reach USD 195,322 million by 2032, registering a CAGR of 7% during the forecast period.

- Growing pet ownership, rising awareness of preventive care, and increasing veterinary expenditure are driving market expansion across pharmaceuticals, medical devices, and veterinary services.

- Technological advancements such as telemedicine, wearable health trackers, and biologics are reshaping animal health management and boosting early diagnosis and personalized treatments.

- The market remains moderately consolidated, with major players focusing on innovation, product diversification, and partnerships to enhance distribution reach and customer engagement.

- North America led the market with a 41.2% share in 2024, followed by Europe at 27.4% and Asia Pacific at 19.3%, while the pharmaceuticals segment dominated globally with a 54.2% share due to rising demand for therapeutics and vaccines.

Market Segmentation Analysis:

By Product

Pharmaceuticals dominated the Companion Animal Healthcare Market in 2024, accounting for 54.2% of the total share. The segment’s leadership stems from rising incidences of infectious, parasitic, and chronic diseases among pets, driving demand for antibiotics, anti-parasitic drugs, and vaccines. Continuous innovation in veterinary therapeutics and the introduction of advanced biologics further enhance treatment efficiency. For instance, Zoetis expanded its monoclonal antibody portfolio for osteoarthritis pain management in dogs, reinforcing pharmaceutical dominance through precision-based therapies and increasing preventive healthcare awareness among pet owners.

- For instance, Zoetis’s monoclonal antibody therapy Librela® (bedinvetmab) has already been used to treat over 1 million dogs with osteoarthritis pain since its launch.

By Animal

Dogs held the largest market share of 58.6% in 2024, driven by their higher ownership rates and increasing healthcare expenditure per pet. Growing cases of arthritis, obesity, and dermatological conditions among dogs boost demand for regular veterinary visits and chronic disease management. Preventive care programs and rising insurance coverage also support the segment’s expansion. For instance, Elanco introduced chewable preventive solutions addressing flea, tick, and heartworm infestations in dogs, emphasizing convenience and compliance in pet medication routines.

- For instance, Elanco Animal Health’s chewable preventive product Credelio Quattro™ offers broad-spectrum protection (six parasite types) and is approved for dogs and puppies aged 8 weeks and older weighing at least 3.3 lb.

By Distribution Channel

Veterinary hospital pharmacies led the market with a 47.3% share in 2024, supported by the availability of professional diagnosis, on-site prescriptions, and immediate access to treatments. Pet owners increasingly prefer hospital-based pharmacies for reliability and expert consultation. The growing network of veterinary clinics and multi-specialty centers strengthens the segment’s dominance. For instance, VCA Animal Hospitals expanded its clinical network across North America, offering integrated pharmaceutical dispensing and wellness programs, ensuring improved accessibility and continuity of companion animal healthcare services.

Key Growth Drivers

Rising Pet Ownership and Humanization of Animals

Growing pet adoption rates and the humanization trend are driving the companion animal healthcare market. Pet owners increasingly view animals as family members, prioritizing preventive care, wellness services, and advanced treatments. This shift boosts demand for pharmaceuticals, diagnostics, and veterinary services. Expanding pet insurance coverage and growing disposable incomes in developed and emerging economies further stimulate spending on healthcare, grooming, and nutrition. The emotional bond between owners and pets continues to push investments in quality veterinary care and health management solutions.

- For instance, Chewy ended fiscal 2024 with 20.5 million active customers, up year over year. Autoship accounted for >80% of Q4 sales.

Advancements in Veterinary Diagnostics and Therapeutics

Technological innovation in diagnostics and therapeutics is a major growth driver for the market. Rapid diagnostic assays, molecular testing, and digital imaging improve disease detection accuracy and treatment outcomes. Veterinary pharmaceutical companies are developing biologics, gene therapies, and precision medicine to target specific conditions in dogs and cats. Growing demand for preventive and early-stage disease management strengthens the adoption of these technologies across veterinary hospitals and clinics. Continuous R&D investments ensure improved efficacy, safety, and accessibility of advanced veterinary care solutions.

- For instance, IDEXX reported installed bases of 74.1k Catalyst, 51.8k hematology, and 21.3k SediVue analyzers as of 2024.

Expansion of Veterinary Infrastructure and Services

The increasing establishment of veterinary hospitals, clinics, and mobile services supports the market’s long-term expansion. Urbanization and pet population growth have led to improved access to professional veterinary care, especially in emerging markets. The integration of modern equipment, telehealth platforms, and specialized services enhances treatment convenience and efficiency. Collaboration between veterinary service providers and pharmaceutical companies drives comprehensive healthcare delivery. Governments and private organizations are also promoting vaccination programs and preventive care, fostering a stronger ecosystem for animal health management.

Key Trends & Opportunities

Growth of Pet Telemedicine and Digital Health Platforms

The rise of digital healthcare is transforming companion animal treatment and monitoring. Telemedicine platforms enable remote consultations, prescription renewals, and follow-up care, reducing barriers to veterinary access. Wearable health trackers and smart monitoring devices support real-time tracking of pet activity, diet, and vital signs. These innovations enhance preventive healthcare, allowing veterinarians to detect early signs of illness. The growing acceptance of online veterinary services and connected healthcare solutions creates strong opportunities for digital expansion in the sector.

- For instance, Vetster promotes a network of thousands of licensed practitioners serving pet owners 24/7.

Rising Demand for Preventive and Nutritional Health Products

Preventive care, including vaccines, supplements, and wellness diets, is gaining traction in pet healthcare. Owners are increasingly investing in products that promote long-term health and reduce disease risks. Nutraceuticals, probiotics, and tailored diets designed for specific breeds or conditions are witnessing high adoption. The emphasis on holistic wellness and immunity-boosting formulations aligns with consumer preferences for natural and functional ingredients. This growing trend is opening opportunities for manufacturers to innovate within the preventive healthcare and nutritional segment.

- For instance, Boehringer Ingelheim sold over 6 million NexGard PLUS doses since its 2023 launch, and donated 1.9 million doses to shelters.

Increasing Focus on Sustainable and Ethical Veterinary Practices

Sustainability has emerged as a major opportunity within the veterinary industry. Companies are prioritizing eco-friendly manufacturing, ethical sourcing, and reduced antibiotic use in companion animal products. Regulatory initiatives promoting responsible medicine use and waste management are encouraging innovation in sustainable healthcare models. Pet owners are also becoming conscious of environmental impact, influencing product preferences. This growing awareness supports the development of green veterinary pharmaceuticals and recyclable packaging, positioning sustainability as a competitive advantage in animal healthcare.

Key Challenges

High Cost of Veterinary Care and Limited Insurance Coverage

The rising cost of advanced veterinary treatments and diagnostics poses a major barrier to market growth. Many pet owners, especially in developing regions, face affordability issues due to limited insurance coverage. Specialized surgeries, chronic disease management, and innovative therapies significantly increase expenditure. The uneven distribution of insurance services across regions further restricts access to quality care. Addressing cost disparities through broader insurance programs and affordable treatment packages remains essential to sustaining market expansion.

Shortage of Skilled Veterinary Professionals

The growing demand for animal healthcare services is outpacing the availability of qualified veterinary professionals. Many regions face a shortage of veterinarians, technicians, and diagnostic experts, leading to treatment delays and uneven care quality. The rising complexity of medical procedures and diagnostic technologies adds pressure to existing staff. Training programs and academic investments are needed to bridge the skill gap. Strengthening veterinary education and workforce capacity will be critical for meeting the healthcare needs of expanding companion animal populations.

Regional Analysis

North America

North America held the largest share of 41.2% in the companion animal healthcare market in 2024. The region’s dominance is supported by high pet ownership rates, strong veterinary infrastructure, and rising expenditure on advanced healthcare. The United States leads due to widespread pet insurance coverage and the presence of major pharmaceutical players. Continuous innovation in therapeutics, vaccines, and diagnostic solutions further enhances market maturity. Canada also shows strong growth through expanding veterinary networks and government-backed pet health initiatives promoting preventive and wellness care for household animals.

Europe

Europe accounted for a 27.4% share of the companion animal healthcare market in 2024, driven by increasing pet adoption and stringent animal welfare regulations. Countries such as Germany, the United Kingdom, and France exhibit high spending on veterinary services and pharmaceuticals. Preventive medicine and nutritional health products are widely adopted as part of regional wellness programs. The growth of veterinary clinics and pet insurance penetration strengthens access to quality care. Sustainability-focused practices and demand for ethical veterinary products are further shaping Europe’s market development and long-term healthcare innovation.

Asia Pacific

Asia Pacific captured a 19.3% share in 2024, emerging as the fastest-growing regional market. Rising disposable incomes and growing awareness of pet health in countries like China, India, and Japan are fueling demand for veterinary drugs and services. Expanding urban pet populations and the rise of e-commerce platforms have increased accessibility to medical products. Investments in modern veterinary facilities and digital healthcare platforms further accelerate growth. Government programs promoting vaccination and parasite control also contribute to expanding healthcare adoption across developing economies in the region.

Latin America

Latin America held a 7.1% share of the global companion animal healthcare market in 2024. The regional growth is supported by increasing pet adoption in Brazil, Mexico, and Argentina, along with improving veterinary service networks. The market benefits from growing awareness of preventive healthcare and the availability of affordable pharmaceuticals. Expanding distribution channels, including retail pharmacies and online platforms, are enhancing product reach. Ongoing partnerships between local clinics and global animal health companies are improving veterinary access and treatment standards across emerging urban centers.

Middle East & Africa

The Middle East & Africa accounted for a 5% share in 2024, reflecting steady expansion supported by rising awareness of pet care and growing veterinary investments. Countries such as the United Arab Emirates, South Africa, and Saudi Arabia are witnessing increasing pet ownership and establishment of specialized veterinary clinics. The growing availability of imported pharmaceuticals and vaccines strengthens healthcare access. However, limited local manufacturing and lower insurance coverage restrict faster growth. Gradual modernization of veterinary infrastructure and government-led welfare programs are expected to enhance market opportunities in the coming years.

Market Segmentations:

By Product

- Pharmaceuticals

- Medical devices

- Veterinary services

By Animal

- Dogs

- Cats

- Horses

- Other animals

By Distribution Channel

- Veterinary hospital pharmacy

- Retail pharmacy

- E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The companion animal healthcare market features a highly competitive landscape, with leading companies such as Boehringer Ingelheim, Zoetis, Elanco, Merck, Ceva, Virbac, IDEXX Laboratories, Dechra, Vetoquinol, Mars, Phibro, PetIQ, HIPRA, Medtronic, B Braun, Neogen, Hester, Endovac, Hollard, Figo Pet Insurance, and Hartville shaping industry dynamics. Market competition is driven by innovation in biologics, vaccines, diagnostics, and digital veterinary solutions. Firms are expanding research pipelines and introducing targeted therapies for chronic and infectious diseases in pets. Strategic mergers, acquisitions, and partnerships are strengthening global distribution networks and improving regional market penetration. Technological advancements in molecular diagnostics, telemedicine, and wearable health devices are redefining animal care delivery. Additionally, increasing investment in sustainable production and regulatory compliance supports long-term growth. The emphasis on preventive healthcare, personalized treatment, and customer engagement continues to define the evolving competitive structure of the companion animal healthcare market worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boehringer Ingelheim

- Zoetis

- Elanco

- Merck

- Ceva

- Virbac

- IDEXX Laboratories

- Dechra

- Vetoquinol

- Mars

- Phibro

- PetIQ

- HIPRA

- Medtronic

- B Braun

- Neogen

- Hester

- Endovac

- Hollard

- Figo Pet Insurance

- Hartville

Recent Developments

- In 2023, Boehringer Ingelheim received FDA approval and launched Senvelgo (velagliflozin oral liquid medication), the first oral liquid solution for treating cats with diabetes.

- In 2023, Elanco Launched AdTab (lotilaner), a non-prescription oral monthly flea and tick product for dogs and cats, in Europe.

- In 2022, Vetoquinol launched Simplera® (florfenicol, terbinafine, mometasone furoate) otic solution for dogs.

Report Coverage

The research report offers an in-depth analysis based on Product, Animal, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The companion animal healthcare market will continue expanding due to rising pet ownership worldwide.

- Preventive healthcare and wellness services will gain strong adoption across all major regions.

- Veterinary telemedicine platforms will see wider use for remote consultations and follow-up care.

- Biologics, gene therapies, and personalized veterinary medicines will transform treatment options.

- Increased pet insurance coverage will improve affordability and access to advanced care.

- Nutraceuticals and functional diets will experience strong growth in preventive health management.

- Digital monitoring devices and wearable trackers will enhance continuous health assessment.

- Sustainability and ethical sourcing will shape product development and corporate strategies.

- Veterinary service networks will expand through mergers, partnerships, and technological integration.

- Rising awareness of zoonotic diseases will drive investments in preventive diagnostics and vaccines.