Market Overview

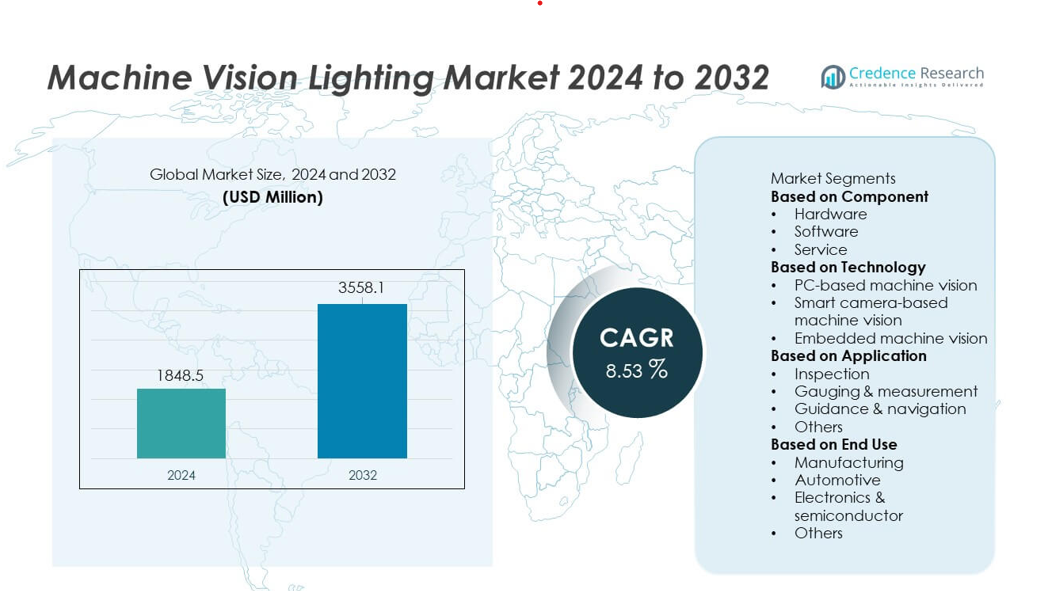

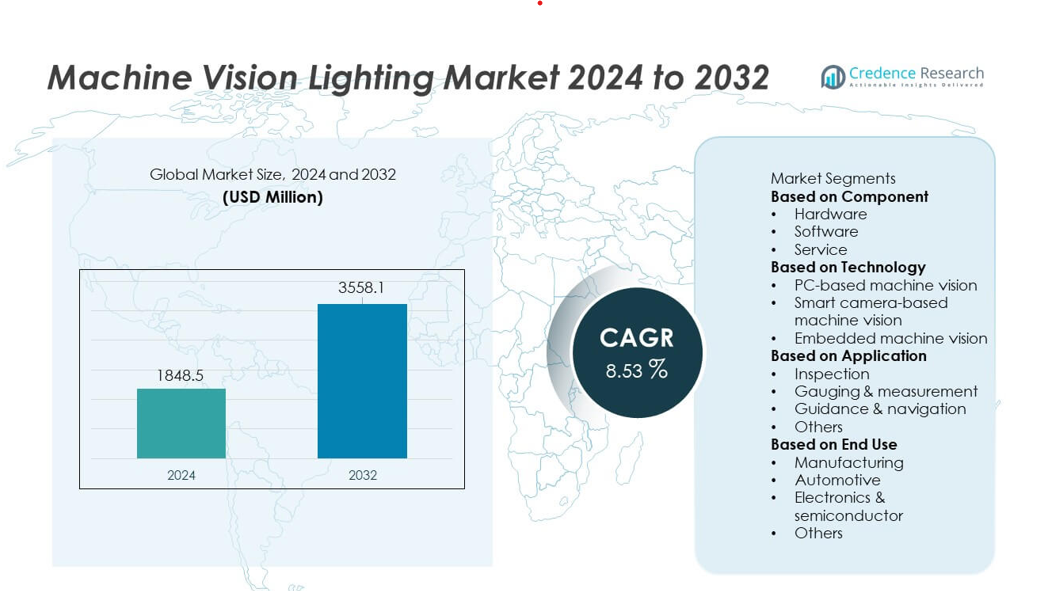

The Machine Vision Lighting market was valued at USD 1,848.5 million in 2024 and is projected to reach USD 3,558.1 million by 2032, registering a CAGR of 8.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Machine Vision Lighting Market Size 2024 |

USD 1,848.5 million |

| Machine Vision Lighting Market, CAGR |

8.53% |

| Machine Vision Lighting Market Size 2032 |

USD 3,558.1 million |

The top players in the Machine Vision Lighting market include Cognex Corporation, Keyence Corporation, Omron Corporation, Banner Engineering Corp., Advanced Illumination Inc., Smart Vision Lights, Spectrum Illumination, CCS Inc., Basler AG, and Matrox Imaging. These companies expand their presence through high-performance LED modules, multi-spectral lighting, and integrated illumination systems that support advanced inspection and automation workflows. North America leads the market with a 38% share, driven by strong adoption of robotics and precision inspection technologies. Europe follows with a 30% share due to stringent quality standards and Industry 4.0 initiatives, while Asia Pacific holds a 24% share as the fastest-growing region supported by rapid industrialization and electronics manufacturing growth.

Market Insights

- The Machine Vision Lighting market reached USD 1,848.5 million in 2024 and will reach USD 3,558.1 million by 2032 at a CAGR of 8.53%, supported by rising automation across industries.

- Growth is driven by strong adoption of precision inspection tools, with hardware holding a 64% share and inspection applications leading with 58%, as manufacturers aim for higher accuracy and quality control.

- Key trends include increasing use of multi-spectral and smart LED lighting, along with rapid adoption of lighting integrated with AI, robotics, and high-speed imaging systems.

- Competition intensifies as key players expand product portfolios, enhance illumination stability, and integrate lighting with machine vision cameras, while high installation costs and integration complexity remain key restraints.

- Regional performance is led by North America at 38%, followed by Europe at 30% and Asia Pacific at 24%, reflecting strong manufacturing activity, advanced automation adoption, and rapid industrial expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Hardware leads the component segment with a 64% share, driven by strong demand for lighting modules, controllers, lenses, and illumination accessories that support precise imaging workflows. Industries rely on robust hardware to achieve consistent brightness, stable contrast, and enhanced defect detection across high-speed production lines. Software adoption grows as manufacturers integrate advanced image-processing algorithms and AI-based analysis. Service offerings expand as companies seek installation, calibration, and maintenance support. Rising automation in electronics, automotive, and packaging sectors strengthens hardware demand, positioning it as the core enabler of high-accuracy machine vision performance.

- For instance, Cognex Corporation enhanced its In-Sight vision hardware line, such as the In-Sight 3800, with processor upgrades and AI-based edge learning technology delivering high-speed performance, enabling high-speed inspections in industries including automotive and semiconductor plants.

By Technology

PC-based machine vision dominates this segment with a 52% share, supported by its ability to process complex algorithms, handle multiple cameras, and manage large data volumes. Manufacturers prefer PC-based systems for tasks requiring high flexibility, strong computing power, and custom integration. Smart camera–based machine vision sees growing usage in compact and cost-efficient applications where ease of deployment is essential. Embedded machine vision rises as industries adopt edge processing to reduce latency and enhance real-time decision-making. Increasing need for faster inspection and higher throughput continues to drive strong adoption of PC-based platforms.

- For instance, Basler AG offers PC-based vision systems capable of streaming 12-megapixel images at up to 180 frames per second using its boost series with CoaXPress 2.0 interface, with one model (boA4096-180) providing that exact performance. Other 12 MP models in the series offer different frame rates, such as 68 fps or 93 fps.

By Application

Inspection remains the leading application with a 58% share, driven by its essential role in defect detection, surface analysis, assembly verification, and product quality control. Machine vision lighting ensures uniform illumination that improves accuracy across high-speed manufacturing environments. Gauging and measurement gain traction as industries require precise dimensional checks for components used in electronics, automotive, and medical devices. Guidance and navigation expand with the growth of robotics and automated material-handling systems. Other applications, such as code reading and pattern recognition, continue to rise as automation deepens across industrial operations.

Key Growth Drivers

Rising Automation and Demand for High-Precision Inspection

Industries increasingly adopt automation and require machine vision lighting to support accurate inspection, defect detection, and quality assurance. Manufacturers rely on high-intensity and uniform illumination to improve image clarity and reduce processing errors. Automotive, electronics, and packaging sectors drive strong demand as they expand automated production lines. Consistent lighting enhances detection of micro-defects, surface irregularities, and complex product features. As factories shift toward smart manufacturing, the need for reliable lighting solutions that ensure consistent performance across high-speed workflows continues to intensify.

- For instance, Smart Vision Lights introduced its LMX75 series with an output of up to 90,000 lux in OverDrive™ mode with standard lenses, enabling high-intensity illumination for high-speed applications.

Advancements in LED Technology and Smart Lighting Solutions

Continuous improvements in LED efficiency, lifespan, and illumination control accelerate adoption of advanced lighting systems. High-power LEDs deliver brighter and more stable illumination, enabling better image contrast and higher inspection accuracy. Smart lighting technologies allow dynamic adjustments in intensity, wavelength, and pattern, supporting complex vision tasks. These innovations enhance flexibility across diverse industrial applications, including semiconductor inspection, pharmaceutical packaging, and precision assembly. Improved energy efficiency also reduces operating costs, making LED-based machine vision lighting products more appealing for large-scale installations.

- For instance, Advanced Illumination provides high-intensity LED lighting solutions, such as the BL168 series, which enables precision inspection in machine vision applications by providing uniform illumination and high power density for line scanning applications.

Growth of Robotics and Industrial AI Integration

Rising deployment of industrial robots and AI-based inspection systems drives demand for lighting solutions that support real-time analysis. Machine vision lighting enhances the accuracy of automated pick-and-place operations, robotic navigation, and defect classification. AI-driven systems depend on stable illumination to extract detailed visual information from complex surfaces. As manufacturers adopt collaborative robots and autonomous production cells, lighting becomes essential for ensuring consistent performance. This trend strengthens the need for adaptable and high-quality illumination across modern industrial environments.

Key Trends & Opportunities

Adoption of Multi-Spectral and Hyper-Spectral Lighting Technologies

Multi-spectral and hyper-spectral lighting gain momentum as manufacturers require advanced imaging capabilities beyond visible light. These systems enhance detection of contaminants, material inconsistencies, and sub-surface defects that traditional lighting cannot identify. They create strong opportunities in food inspection, medical device manufacturing, and semiconductor production. The ability to capture detailed spectral information improves reliability and reduces false detection rates. As industries prioritize higher accuracy and compliance with strict safety standards, demand for specialized spectral lighting solutions continues to expand.

- For instance, hyperspectral imaging units are capable of capturing hundreds of contiguous spectral bands, which enables accurate detection of polymer contamination in medical components or sorting in recycling.

Expansion of Vision-Guided Robotics and Smart Factory Solutions

Smart factories rely heavily on advanced lighting systems that support automated workflows, predictive maintenance, and real-time monitoring. Vision-guided robots require consistent illumination for navigation, object tracking, and precision assembly. This trend drives opportunities for manufacturers offering adaptive lighting that integrates seamlessly with robotic systems. Growth in Industry 4.0 initiatives accelerates the adoption of lighting that pairs with edge computing, AI-driven vision, and digital twins. As companies shift toward fully automated production environments, demand for intelligent lighting solutions grows significantly.

- For instance, Cognex enhanced its robotic inspection systems with strobe lighting modules to support high-speed pick-and-place operations by precisely freezing motion during image acquisition, allowing systems to inspect thousands of parts per minute.

Key Challenges

High Installation Costs and Integration Complexity

Machine vision lighting systems often require precise installation, calibration, and integration with cameras, sensors, and software. This complexity increases upfront costs, especially for small and medium-sized manufacturers. Customized lighting setups may be needed for challenging applications, adding to system design expenses. Budget constraints slow adoption in cost-sensitive industries. Additionally, integrating lighting into high-speed or multi-camera systems requires technical expertise. These factors collectively restrict wider penetration of advanced lighting technologies in developing markets.

Performance Limitations in Complex or Variable Environments

Lighting performance declines in environments with reflective surfaces, variable ambient light, or rapidly changing conditions. Achieving stable illumination becomes challenging when inspecting shiny metals, transparent materials, or irregular textures. These limitations affect detection accuracy and increase false rejection rates. Manufacturers must invest in specialized lighting designs such as polarizers, diffusers, and structured illumination, increasing system complexity. Environmental variability in harsh industrial settings further complicates consistent lighting delivery. Overcoming these challenges requires improved design innovations and adaptive illumination technologies.

Regional Analysis

North America

North America leads the Machine Vision Lighting market with a 38% share, driven by strong adoption of industrial automation, advanced quality-control systems, and high investment in robotics. The region’s automotive, semiconductor, and electronics industries rely on precision lighting to support high-speed inspection and defect detection. Extensive use of machine vision in packaging, pharmaceuticals, and food processing further boosts demand. A well-established manufacturing base and early integration of AI-driven inspection platforms strengthen market expansion. Continuous upgrades to smart factory infrastructure and rising emphasis on operational accuracy position North America as a dominant contributor to global growth.

Europe

Europe holds a 30% share, supported by strong manufacturing capabilities across automotive, aerospace, and industrial equipment sectors. Germany, France, Italy, and the UK lead adoption due to high-quality standards and widespread use of automated inspection lines. The region emphasizes precision engineering, driving demand for advanced machine vision lighting solutions in metrology and production monitoring. Growing implementation of Industry 4.0 technologies encourages investment in smart illumination systems. Strict regulatory requirements in food, pharmaceuticals, and electronics also accelerate adoption. Europe’s commitment to high-efficiency manufacturing and technological innovation sustains steady market growth.

Asia Pacific

Asia Pacific accounts for a 24% share and stands as the fastest-growing region due to rapid industrialization, expanding electronics production, and strong robotics adoption. China, Japan, South Korea, and Taiwan drive high demand as manufacturing facilities implement machine vision systems for precision inspection. Growth in automotive production, semiconductor fabrication, and consumer electronics assembly strengthens regional expansion. Governments support digital transformation through smart factory initiatives, increasing demand for advanced lighting technologies. Rising labor costs and automation needs further push industries toward vision-guided inspection, making Asia Pacific a major growth engine.

Latin America

Latin America holds a 5% share, influenced by expanding industrial automation efforts in Brazil and Mexico. Manufacturing sectors such as automotive components, packaging, and food processing gradually adopt machine vision lighting to improve inspection accuracy and reduce defects. Economic constraints limit large-scale adoption, but increasing investments in modernizing production facilities support steady growth. As local industries pursue higher quality standards and operational efficiency, use of illumination systems for defect detection and measurement gains traction. Growing interest in automation technologies and gradual infrastructure improvements reinforce long-term market potential.

Middle East & Africa

The Middle East & Africa region holds a 3% share, driven by rising automation in manufacturing hubs within the UAE, Saudi Arabia, and South Africa. Industries adopt machine vision lighting to enhance inspection accuracy in packaging, pharmaceuticals, and electronics assembly. Expanding industrial projects and economic diversification efforts support technology adoption in Gulf countries. Africa shows gradual uptake as factories modernize production lines, though cost barriers persist. Growing investment in smart manufacturing and increased focus on product quality contribute to incremental demand for advanced lighting systems across the region.

Market Segmentations:

By Component

- Hardware

- Software

- Service

By Technology

- PC-based machine vision

- Smart camera-based machine vision

- Embedded machine vision

By Application

- Inspection

- Gauging & measurement

- Guidance & navigation

- Others

By End Use

- Manufacturing

- Automotive

- Electronics & semiconductor

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Cognex Corporation, Keyence Corporation, Omron Corporation, Banner Engineering Corp., Advanced Illumination Inc., Smart Vision Lights, Spectrum Illumination, CCS Inc., Basler AG, and Matrox Imaging. These companies strengthen their market position by offering high-intensity LED lighting, multi-spectral illumination, and advanced control systems tailored for precision inspection. Many invest in R&D to develop compact, energy-efficient, and AI-compatible lighting solutions that support high-speed machine vision applications. Strategic priorities include expanding global distribution networks, integrating lighting with smart cameras, and enhancing compatibility with robotics and automated production lines. Companies also focus on wavelength-specific illumination, structured lighting, and thermal management improvements to boost accuracy and extend product lifespan. Rising demand for high-throughput inspection pushes manufacturers to deliver lighting systems with improved uniformity, stability, and durability, intensifying competition across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Cognex Corporation introduced OneVision™, a breakthrough cloud-based platform designed to transform how manufacturers build, train, and scale AI-powered machine vision applications.

- In 2025, Keyence Corporation developed advanced 3D vision systems known for precise inspections using multiple cameras and projectors. Their systems emphasize easy setup with automatic calibration and robust algorithms that maintain stable detection regardless of the object’s position or orientation.

- In 2025, Spectrum Illumination continued innovating high-performance LED lighting for industrial machine vision, supplying customizable lighting modules to enhance image quality for tasks requiring precise inspection.

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for machine vision lighting will grow as factories expand automation and precision inspection.

- LED-based illumination will advance further, offering higher brightness and longer operational life.

- Multi-spectral and hyper-spectral lighting will gain traction for detecting complex and sub-surface defects.

- Integration of lighting with AI-powered vision systems will enhance real-time inspection accuracy.

- Vision-guided robotics will drive strong demand for adaptive and intelligent lighting solutions.

- Compact, energy-efficient lighting designs will see wider adoption in space-constrained production environments.

- Manufacturers will invest in lighting optimized for high-speed imaging and 3D inspection workflows.

- Emerging markets will adopt machine vision lighting as industrial automation accelerates.

- Smart factory initiatives will boost demand for network-connected and programmable lighting systems.

- Greater focus on quality, consistency, and predictive maintenance will shape future product development.