Market Overview

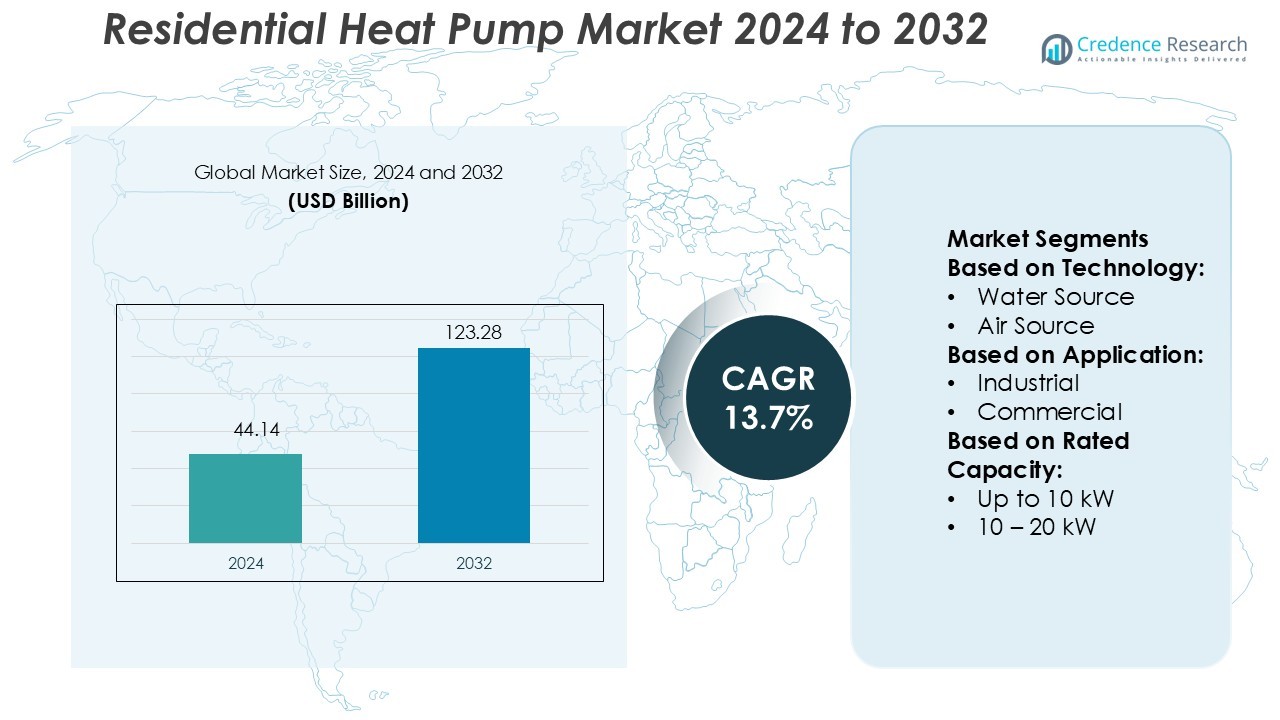

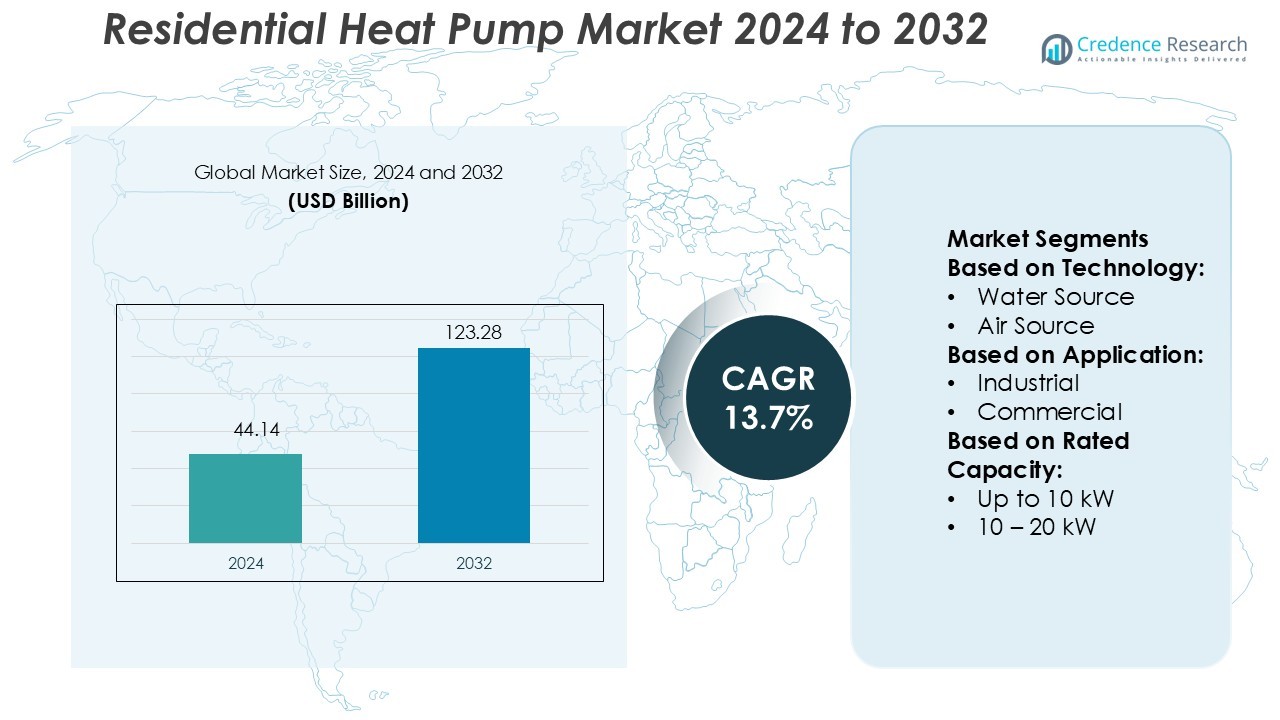

Residential Heat Pump Market size was valued USD 44.14 billion in 2024 and is anticipated to reach USD 123.28 billion by 2032, at a CAGR of 13.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Heat Pump Market Size 2024 |

USD 44.14 Billion |

| Residential Heat Pump Market, CAGR |

13.7% |

| Residential Heat Pump Market Size 2032 |

USD 123.28 Billion |

The residential heat pump market is characterized by strong competition among top manufacturers focused on innovation and energy efficiency. Companies are expanding their portfolios with inverter-driven systems, hybrid units, and smart integration capabilities to meet evolving energy standards. Europe leads the global market with a 41% share, supported by strict decarbonization goals, incentive programs, and widespread retrofitting activities. North America follows with steady adoption driven by rebate schemes and electrification initiatives, while Asia Pacific is emerging as a major growth hub through rapid urbanization and technology adoption. Strategic investments, product differentiation, and policy support continue to define the competitive landscape.

Market Insights

- The Residential Heat Pump Market reached USD 44.14 billion in 2024 and will hit USD 123.28 billion by 2032, growing at a 13.7% CAGR.

- Energy efficiency goals and electrification programs drive large-scale adoption across developed markets. Rebates, incentives, and stricter regulations support strong sales momentum.

- Manufacturers focus on inverter-driven and hybrid systems with smart controls to meet rising efficiency standards and reduce emissions.

- Europe leads with a 41% share, supported by retrofit programs and decarbonization targets. North America shows stable growth through rebates, while Asia Pacific emerges as a fast-expanding hub.

- Competitive intensity remains high as top players invest in R&D and product differentiation. Policy frameworks and infrastructure gaps act as restraints in some regions, but strong government backing supports long-term expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Air source heat pumps hold the dominant share of the residential heat pump market with 46%. Their popularity is driven by lower installation costs, flexible applications, and easier retrofitting in existing buildings. These systems operate efficiently in various climates, reducing energy bills and carbon emissions. Manufacturers are improving inverter compressors and low-GWP refrigerants, making air source systems more efficient and eco-friendly. Ground source and hybrid systems are growing steadily as consumers seek higher performance and sustainability benefits, particularly in regions with stable ground temperatures and supportive regulatory policies.

- For instance, Colmac’s CxV series air-source heat pumps can produce 140 °F (60 °C) water at an ambient air temperature of 10 °F (-12 °C), and the 5 hp unit continues to operate down to -1 °F (-18 °C) producing 120 °F water.

By Application

Residential applications account for the largest share of the market at 52%. Rising urban housing projects and growing consumer demand for efficient heating and cooling systems drive this dominance. Single-family homes lead adoption due to easier installation and higher system compatibility with standalone units. Energy savings, lower carbon footprints, and financial incentives further boost demand. Commercial and healthcare applications follow, supported by rising investments in sustainable infrastructure and energy efficiency targets for buildings.

- For instance, Lochinvar’s Veritus™ Air Source Heat Pump Water Heater achieves a high coefficient of performance (COP). According to ENERGY STAR certification data for the AHP350 model, the unit has a certified COP of 4.3.

By Rated Capacity

The “Up to 10 kW” segment holds the leading market share of 58%. Its dominance is supported by widespread use in residential single-family homes and small buildings. These units provide adequate heating and cooling for average-sized households while offering lower upfront costs and high energy efficiency. The compact design and easier installation also support faster market adoption. The 10–20 kW capacity segment is gaining traction, especially in multi-family buildings and small commercial spaces, driven by increased demand for scalable and reliable heat pump solutions.

Key Growth Drivers

Rising Demand for Energy-Efficient Solutions

The growing focus on energy efficiency is driving the adoption of residential heat pumps. Consumers are shifting to low-carbon solutions to reduce energy bills and comply with stricter emission regulations. Governments offer subsidies, tax credits, and incentive programs to promote sustainable heating systems. For instance, the U.S. Inflation Reduction Act and EU’s Heat Pump Accelerator Program are increasing installation rates. Advanced inverter technologies and low-GWP refrigerants enhance performance and efficiency, making heat pumps more attractive. This rising demand creates strong market growth momentum worldwide.

- For instance, Glen Dimplex’s certain high-end models can report a heat output of up to 138.1 kW under B0/W35 conditions. Other specific models can achieve maximum Coefficient of Performance (COP) values reaching 4.7, while high-temperature units can produce max flow temperatures of up to 62 °C.

Government Regulations and Decarbonization Goals

Government-led climate initiatives and decarbonization targets strongly support heat pump deployment. Policies such as building performance standards, renewable energy directives, and carbon pricing encourage the transition from fossil-fuel systems. Many countries are banning gas boiler installations in new homes, accelerating heat pump adoption. For example, the U.K. Boiler Upgrade Scheme provides grants to homeowners replacing old heating systems. These measures align with net-zero goals and create a stable policy environment for market expansion. Regulatory support remains a critical driver of sustained market growth.

- For instance, Mitsubishi Electric heat pump models can achieve a Coefficient of Performance (COP) of about 4.0 under specific, optimal operating conditions. This means that for every 1 kW of electrical energy consumed, the unit can produce about 4 kW of heat output by transferring an additional 3 kW of heat from the outside air.

Technological Advancements and Smart Integration

Technological improvements are making residential heat pumps more efficient and versatile. Modern systems now integrate with smart thermostats, IoT platforms, and renewable energy sources to optimize energy use. Variable-speed compressors and advanced control algorithms enable stable heating performance even in extreme climates. For instance, smart grid integration allows dynamic load management, reducing peak demand. Manufacturers also focus on compact designs and hybrid configurations to suit different building types. This continuous innovation enhances consumer appeal and strengthens market competitiveness.

Key Trends & Opportunities

Integration with Renewable Energy Systems

The integration of heat pumps with solar PV and other renewable energy systems is a rising trend. Hybrid solutions lower dependence on the grid and reduce overall energy costs for homeowners. Grid-interactive systems can store excess renewable power and use it efficiently for heating. Governments and utilities support such projects through net metering and incentive programs. Manufacturers are developing compatible inverters and battery solutions to improve flexibility. This trend offers opportunities for smart energy ecosystems and long-term cost savings.

- For instance, Lennox offers its SunSource® Solar-Ready option on the XP21-048-230 4-ton heat-pump, enabling homeowners to add solar modules and support heat-pump operation with solar electricity.

Expansion of Smart Home Ecosystems

The growing smart home ecosystem offers major opportunities for the heat pump market. Consumers prefer connected systems that provide remote monitoring, predictive maintenance, and automated controls. Integration with voice assistants and energy management platforms enhances comfort and convenience. Utility companies are collaborating with OEMs to implement demand response programs. These programs encourage energy-efficient behavior and grid stability. As IoT adoption expands, smart-enabled heat pumps will capture a larger market share and improve energy performance across residential buildings.

- For instance, Carrier’s new variable-refrigerant-flow system Opti-V features up to 29.7 SEER2 and 12.2 HSPF2, supports up to nine indoor units from one outdoor unit, and operates down to -22 °F ambient.

Retrofitting and Replacement Market Growth

The retrofitting and replacement segment is becoming a strong growth opportunity. Aging building stocks in Europe, North America, and parts of Asia drive demand for efficient heating solutions. Governments offer financial incentives for homeowners replacing fossil-fuel systems with heat pumps. Technological advancements allow easier installation in existing buildings without major modifications. This segment supports decarbonization goals and offers manufacturers a profitable avenue for expansion. Retrofitting also helps utilities reduce grid strain by improving energy efficiency in old structures.

Key Challenges

High Upfront Installation Costs

The high initial investment remains a major barrier to heat pump adoption. Equipment, installation, and system integration costs are higher compared to conventional heating systems. Many homeowners hesitate despite long-term savings due to the high entry cost. In regions with lower electricity prices or fewer incentives, ROI periods are longer. Although subsidies and financing options ease the burden, cost remains a key concern for mass adoption. Reducing capital costs through innovation and economies of scale is crucial for wider market penetration.

Grid Capacity and Infrastructure Constraints

Rising heat pump adoption increases demand on local electricity grids. Many regions lack the infrastructure to handle high winter peak loads from electric heating. This creates grid stability issues and limits deployment in some areas. Utilities need significant investment in grid upgrades and load management systems. Delays in infrastructure modernization can slow down market growth. Coordination between manufacturers, policymakers, and utilities is essential to address capacity constraints and ensure sustainable expansion of residential heat pump installations.

Regional Analysis

North America

North America holds a 24% share of the residential heat pump market, supported by strong regulatory policies and energy efficiency goals. The U.S. and Canada are witnessing rising adoption driven by tax credits, state-level incentives, and electrification programs. The Inflation Reduction Act provides significant rebates, boosting consumer demand. Cold climate heat pumps with variable-speed technology improve efficiency even in extreme temperatures. Major manufacturers expand distribution networks to meet growing retrofit demand. Rising construction of energy-efficient homes and smart home integration further strengthens market penetration across the region.

Europe

Europe dominates the global residential heat pump market with a 41% share, driven by strict decarbonization targets and gas boiler phase-out regulations. Countries like Germany, France, and the U.K. lead adoption with strong incentive programs and carbon reduction policies. The European Heat Pump Accelerator and national subsidy schemes promote large-scale installations. Demand for air-to-water heat pumps continues to surge due to retrofitting activities in old buildings. Advancements in hybrid systems and integration with solar PV support the energy transition. High energy prices and regulatory certainty further drive rapid market expansion across the region.

Asia Pacific

Asia Pacific accounts for a 27% share of the residential heat pump market, fueled by rapid urbanization, population growth, and energy security goals. China, Japan, and South Korea lead regional adoption, supported by government-led clean energy programs. Heat pump installations are rising in new residential complexes and smart cities. Technological innovations in inverter systems and hybrid units address varied climate conditions. Increasing middle-class income and demand for energy-efficient appliances strengthen the market. Policy incentives and local manufacturing expansions position the region as a key growth hub in the global heat pump landscape.

Latin America

Latin America represents a 4% share of the residential heat pump market, with steady adoption in countries like Brazil, Mexico, and Chile. Growing demand for efficient cooling and heating systems in residential buildings supports market growth. Warm climate regions favor air source heat pumps for their lower operational costs. Government initiatives promoting renewable energy and green building certifications create opportunities. Local distributors and international manufacturers are expanding their presence through cost-effective solutions. While adoption remains at an early stage, increasing energy efficiency awareness is expected to accelerate future growth in the region.

Middle East & Africa

The Middle East & Africa hold a 4% share of the residential heat pump market, primarily driven by demand for cooling solutions and energy cost savings. The UAE, Saudi Arabia, and South Africa are early adopters, supported by green building initiatives and government energy diversification programs. Air source heat pumps are preferred for their adaptability to warm climates. Rising construction of residential complexes and eco-friendly housing developments boosts market penetration. High initial costs and limited awareness remain challenges, but increasing investments in sustainable infrastructure are expected to support future market expansion.

Market Segmentations:

By Technology:

By Application:

By Rated Capacity:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the Residential Heat Pump Market is shaped by key players including Colmac Industries, Lochinvar, Glen Dimplex Group, Mitsubishi Electric Corporation, Lennox International Inc., Kensa Heat Pump, Carrier, Daikin, LG Electronics, and Bosch Thermotechnology Corp. The residential heat pump market is becoming increasingly dynamic, driven by technological innovation, policy support, and changing consumer preferences. Manufacturers are prioritizing energy efficiency, smart integration, and the use of low-GWP refrigerants to comply with evolving environmental regulations. Strategic expansion through partnerships, acquisitions, and capacity building is common, helping companies strengthen their global reach. Many firms are investing in R&D to enhance inverter technology and hybrid system capabilities for varied climate conditions. Intense competition is pushing pricing strategies, product differentiation, and service quality. Regional markets in Europe and North America remain mature, while Asia Pacific is emerging as a fast-growing competitive hub.

Key Player Analysis

- Colmac Industries

- Lochinvar

- Glen Dimplex Group

- Mitsubishi Electric Corporation

- Lennox International Inc.

- Kensa Heat Pump

- Carrier

- Daikin

- LG Electronics

- Bosch Thermotechnology Corp.

Recent Developments

- In October 2024, Bosch Home Comfort has introduced its new IDS Ultra Cold Climate Heat Pump, first presented at the Consumer Electronics Show (CES) and AHR Expo held this year in January. This innovation is efficient all around the year, and the focus is on bringing energy-efficient heating and cooling for different U.S. regions.

- In September 2024, Samsung Electronics introduced the Bespoke AI Laundry Combo to the European market. The Bespoke AI Laundry Combo will be controlled by AI, heat pump technology, and a 7” display to deliver a convenient, entertaining laundry experience that is also energy efficient.

- In March 2024, Kensa Heat Pump introduced an enhanced Shoebox NX residential ground source heat pump. Th product has a 4.6 coefficient of performance and can generate 65 degrees Celsius of hot water. the company claims it to be the smallest heat pump and can deliver passive cooling at a less cost than air conditioning for households in summer.

- In January 2023, Johnson Controls acquired Hybrid Energy AS. Hybrid Energy’s innovative technology will provide customers with fresh, cost-effective solutions while tackling decarbonization and sustainability efforts in Europe and beyond.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Rated Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow rapidly as governments tighten energy efficiency and emission standards.

- Adoption will rise with stronger incentives and rebate programs supporting heat pump installations.

- Integration with renewable energy systems will make heat pumps more attractive to homeowners.

- Smart home and IoT compatibility will drive higher demand for connected heating solutions.

- Retrofitting and replacement of old systems will offer strong revenue opportunities.

- Advancements in inverter and hybrid technologies will improve performance in all climate zones.

- Manufacturers will expand production capacity to meet rising global demand.

- Grid-interactive and flexible load management solutions will gain importance in urban areas.

- Consumer awareness of sustainable heating solutions will continue to increase.

- Asia Pacific will emerge as a major growth hub, while Europe will maintain market leadership.