Market Overview:

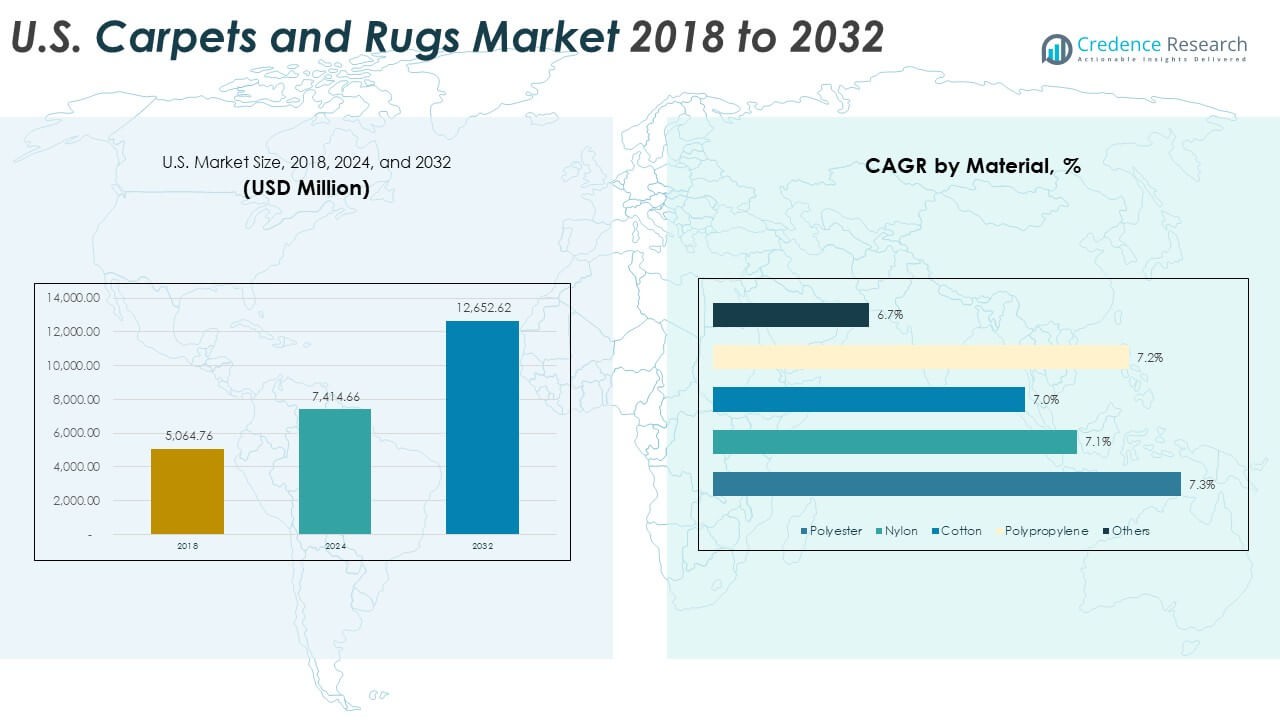

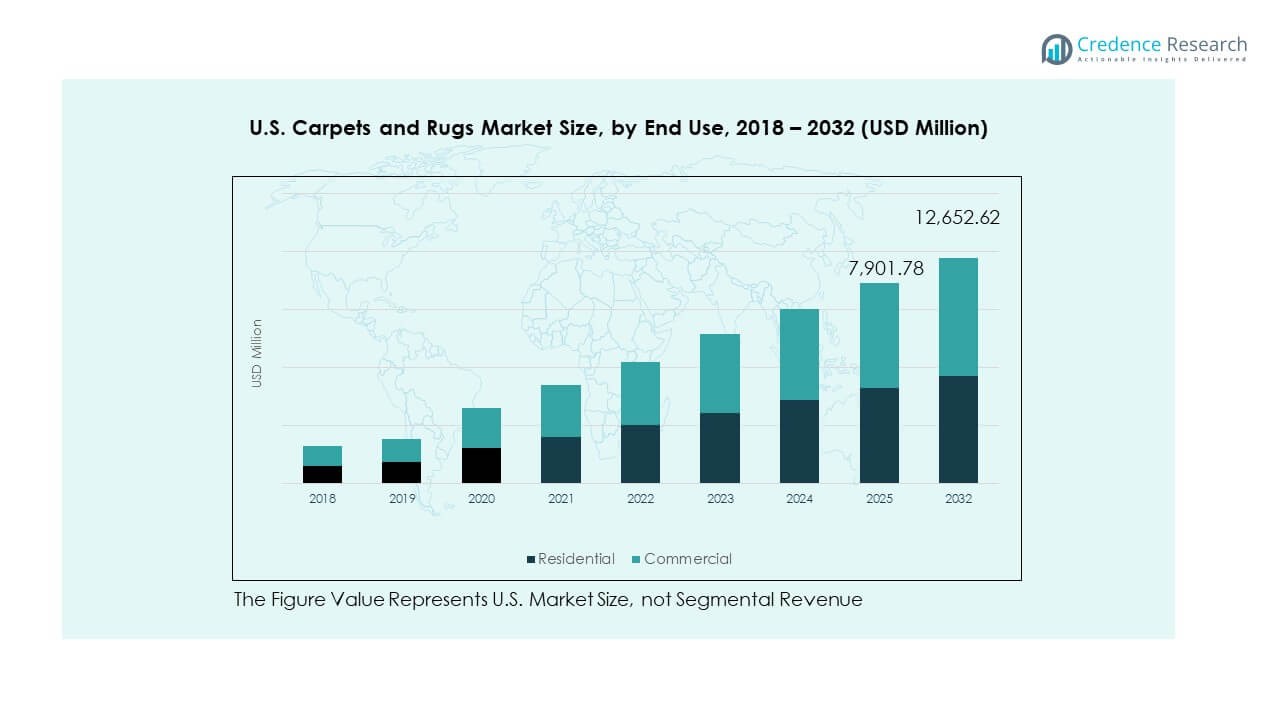

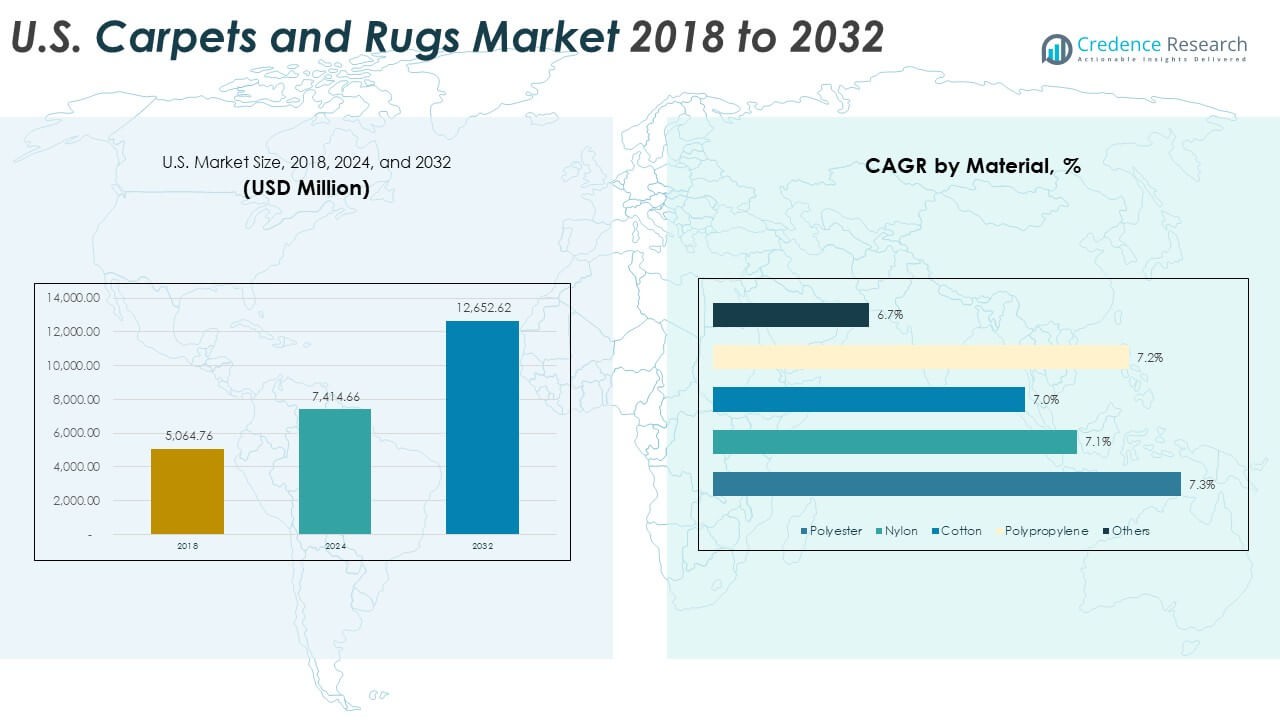

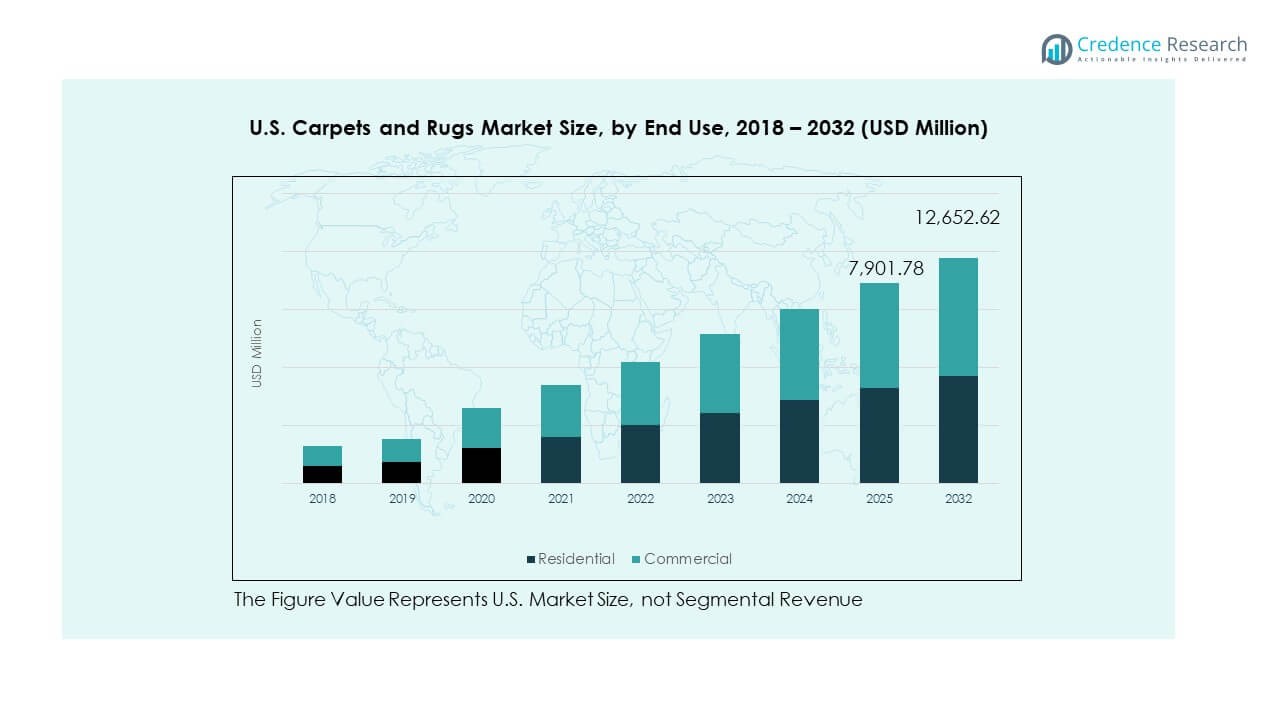

The U.S. Carpets and Rugs Market size was valued at USD 5,064.76 million in 2018 to USD 7,414.66 million in 2024 and is anticipated to reach USD 12,652.62 million by 2032, at a CAGR of 7.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Carpets and Rugs Market Size 2024 |

USD 7,414.66 Million |

| U.S. Carpets and Rugs Market, CAGR |

7.08% |

| U.S. Carpets and Rugs Market Size 2032 |

USD 12,652.62 Million |

The growth in the U.S. Carpets and Rugs Market is driven by rising consumer preference for home interior upgrades, particularly in residential applications. Increasing disposable income, urbanization, and innovations in sustainable materials and designs have contributed to the expansion of the market. Furthermore, demand for high-quality and durable carpets, alongside the growing trend of customization, are expected to drive long-term market growth. Additionally, advancements in e-commerce platforms are making carpets and rugs more accessible to a wider consumer base.

Geographically, North America holds a significant share of the U.S. Carpets and Rugs Market, with the U.S. being a key contributor. The demand in this region is bolstered by a well-established retail infrastructure, consumer preference for comfort and luxury, and technological advancements in carpet manufacturing. While mature markets in urban centers remain dominant, emerging trends in suburban and rural areas are creating new opportunities. The growing demand for eco-friendly and sustainable products is also gaining momentum, driving the adoption of innovative and environmentally conscious designs across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Carpets and Rugs Market was valued at USD 5,064.76 million in 2018, reached USD 7,414.66 million in 2024, and is projected to grow to USD 12,652.62 million by 2032, at a CAGR of 7.08%.

- The Midwest region dominates the U.S. Carpets and Rugs Market, holding a 52% share in 2024, driven by strong residential and commercial demand, particularly in urban and suburban developments. The Northeast holds 18%, supported by consistent renovation trends in urban centers. The South follows with 20%, benefiting from a booming housing market and growing consumer base.

- The fastest-growing region is the West, with a 10% share in 2024. It experiences rapid growth due to high-end residential demand, premium carpets, and eco-conscious consumer preferences in major metropolitan areas.

- The residential segment holds the majority of the market share, accounting for approximately 70%, driven by increasing demand for home renovations and personalized interior designs. The commercial segment holds 30%, influenced by office refurbishments and institutional demand.

- The U.S. Carpets and Rugs Market is expanding due to rising demand for high-quality, sustainable flooring solutions in both residential and commercial sectors, coupled with technological advancements in manufacturing and e-commerce growth.

Market Drivers:

Demand for Home Renovation and Interior Design

The U.S. Carpets and Rugs Market benefits from a growing demand for home renovations and interior design upgrades. As consumers seek more comfort and aesthetic appeal in their living spaces, carpets and rugs become integral to enhancing interior design. The increasing disposable income in the U.S. allows consumers to invest in higher-quality products that provide both functional and aesthetic value. Homeowners are particularly drawn to customizable designs that cater to individual preferences. Over time, this trend has expanded to both residential and commercial sectors, reinforcing the demand for carpets and rugs.

- For instance, Mohawk Industries, Inc. reported that its SmartStrand® carpets now incorporate annually renewable plant‑based materials and claim 100 % chlorine‑based stain removal without fibers losing durability. Homeowners are drawn to custom‑cut rug sizes and high‑end tufted carpets that integrate design‑forward aesthetics and functionality.

Technological Advancements in Manufacturing

Innovation in manufacturing technologies has played a crucial role in driving the growth of the U.S. Carpets and Rugs Market. The adoption of automated systems has led to increased efficiency and precision in production processes, ensuring higher product quality. Moreover, advancements in textile technology have improved the durability and performance of carpets. Consumers are also attracted to options that incorporate eco-friendly materials and sustainable production practices. These technological improvements continue to shape the market by making carpets and rugs more affordable while maintaining high quality.

- For example, Mohawk implemented IIoT‑enabled monitoring in its Summerville plant, aiming to roll out the model across five to six plants per year to increase manufacturing efficiency and fiber production. It streamlined tufting and backing operations through automation, reducing manual intervention in coating and finishing lines.

Preference for Sustainable and Eco-friendly Products

The shift towards sustainability is a significant driver for the U.S. Carpets and Rugs Market. Consumers are increasingly inclined to purchase eco-friendly and sustainable products that contribute to environmental preservation. As awareness about climate change and resource conservation grows, manufacturers are incorporating recycled materials and non-toxic dyes into their products. This trend is evident in both residential and commercial sectors, where businesses and consumers are demanding environmentally responsible products. The growing emphasis on sustainability provides a competitive advantage for companies offering eco-conscious options in the market.

Rising Urbanization and Population Growth

Urbanization is another key factor driving the U.S. Carpets and Rugs Market. The rapid expansion of urban areas increases the demand for home furnishings, including carpets and rugs. Additionally, population growth leads to more households, further boosting demand in both new homes and renovations. The increase in multifamily housing developments and commercial properties also stimulates the demand for durable and high-quality flooring solutions. As more people move into urban centers, the need for versatile flooring options to suit various living conditions and tastes continues to grow.

Market Trends:

Growing Popularity of Smart Carpets and Rugs

The U.S. Carpets and Rugs Market is witnessing a surge in demand for smart carpets and rugs that offer innovative features such as built-in sensors and temperature regulation. These smart products are designed to enhance convenience, offering features like dirt detection or integration with smart home systems. Consumers, particularly those seeking cutting-edge home technology, are eager to incorporate smart textiles into their homes. The rise of the Internet of Things (IoT) and smart home automation supports the growth of these high-tech flooring solutions, making them a notable trend in the market.

- For instance, academic work on textile‑based large‑area sensor networks embedded into carpets demonstrated real‑time walk‑activity detection and fall‑alert functions using under‑pad sensor arrays. Leading manufacturers explore IoT‑enabled carpets capable of foot‑traffic and moisture sensing, offering integration with building management systems.

Expansion of Customization Options

Customization is a significant trend in the U.S. Carpets and Rugs Market, driven by consumer desire for personalized home furnishings. Consumers are increasingly seeking carpets and rugs that reflect their individual style preferences. Companies are responding by offering a wide range of options, from bespoke sizes and shapes to unique color patterns and material choices. This trend has been bolstered by advancements in digital printing technology, which enables highly detailed and intricate designs. The ability to create custom-designed products allows brands to cater to niche markets and attract a broader customer base.

- For example, Carpet Kingdom offers bespoke rugs where clients choose yarn types, textures, sizes and color schemes, with rendering tools to preview final design. Digital printing technologies enable carpets with intricate patterns and multiple colors per piece, letting manufacturers meet unique interior‑design requirements.

Popularity of Luxury and High-Quality Carpets

In recent years, there has been a growing demand for luxury and high-quality carpets, particularly in upscale residential and commercial spaces. Premium carpets, often made from natural fibers such as wool or silk, are gaining popularity for their comfort, durability, and aesthetic appeal. Consumers are increasingly willing to invest in high-end carpets that offer long-lasting performance and superior craftsmanship. This trend is reflective of the rising demand for luxury home furnishings as consumers place greater importance on the quality and longevity of their purchases.

Shift Towards Online Retail and E-commerce

The U.S. Carpets and Rugs Market is experiencing a shift towards online retail and e-commerce platforms. More consumers are opting to purchase carpets and rugs online due to the convenience and ease of browsing a wide variety of products from the comfort of their homes. E-commerce platforms offer a range of benefits, such as home delivery and easy comparison shopping, which enhances the overall customer experience. As digital penetration increases and online shopping becomes more prevalent, retailers are adapting by investing in user-friendly websites and offering online customization options.

Market Challenges Analysis:

Price Fluctuations and Raw Material Shortages

The U.S. Carpets and Rugs Market faces significant challenges related to price fluctuations and raw material shortages. The cost of raw materials, such as wool, nylon, and polyester, can vary greatly, impacting the overall cost structure of manufacturers. These fluctuations can lead to price instability, making it difficult for manufacturers to set consistent pricing. Additionally, global supply chain disruptions have resulted in shortages of essential materials, causing delays in production and delivery. This challenge is compounded by increased demand for sustainable materials, which may not always be readily available in the quantities required.

Intense Competition and Market Saturation

The U.S. Carpets and Rugs Market is highly competitive, with numerous players vying for market share. Many well-established companies dominate the market, which can make it challenging for new entrants to gain traction. Additionally, the market is experiencing saturation in certain segments, particularly within traditional carpet offerings. Companies must continuously innovate to stay ahead of competitors, focusing on product differentiation and providing added value to consumers. Increased competition can also lead to price wars, further affecting profit margins and reducing overall market growth potential.

Market Opportunities:

Growth in Sustainable Flooring Solutions

One of the primary opportunities in the U.S. Carpets and Rugs Market lies in the growing demand for sustainable flooring solutions. As environmental concerns continue to rise, consumers are increasingly seeking eco-friendly options, such as carpets made from recycled materials or natural fibers. This shift towards sustainability presents a significant opportunity for manufacturers to capitalize on the growing preference for green products. Companies can enhance their market position by focusing on developing and promoting environmentally conscious carpets and rugs that cater to eco-conscious consumers.

Emerging Demand for Commercial and Institutional Carpets

The commercial and institutional sectors represent a growing opportunity for the U.S. Carpets and Rugs Market. With the expansion of office spaces, educational institutions, hotels, and healthcare facilities, there is an increasing demand for durable and high-performance carpets. These environments require specialized flooring solutions that can withstand heavy foot traffic, while also maintaining aesthetic appeal. Manufacturers can capitalize on this opportunity by designing carpets and rugs tailored to the specific needs of commercial and institutional applications, opening up new revenue streams and broadening their customer base.

Market Segmentation Analysis:

By Type:

The U.S. Carpets and Rugs Market is segmented into tufted, needle punched, knotted, woven, and other types. Tufted carpets hold the largest share due to their cost-effectiveness and versatility, making them suitable for both residential and commercial applications. Needle-punched carpets are widely used in industrial environments for their durability and low maintenance. Knotted carpets cater to premium market segments, offering high-quality craftsmanship, while woven carpets are preferred for their long-lasting durability and aesthetic appeal. The “Others” category includes custom-designed carpets, meeting niche market demands.

By Material:

The material segment in the U.S. Carpets and Rugs Market consists of polyester, nylon, cotton, polypropylene, and other materials. Nylon dominates the market due to its strength, resilience, and ability to withstand high traffic. Polyester is popular for its affordability and stain resistance, while cotton is favored for eco-friendly options and softness. Polypropylene is known for its moisture resistance, making it ideal for outdoor and commercial uses. Other materials, such as wool and blended fibers, are also gaining traction for their premium appeal and eco-conscious properties.

- For instance, Shaw’s ANSO premium nylon fiber supports carpets known for superior resilience and durability, which demonstrate strong texture retention after extensive performance testing like the Hexapod wear test. Polyester options from Mohawk’s Air.o line are noted for incorporating plant-based renewable content and delivering excellent stain resistance benchmarks, which are evaluated using standard methods like the AATCC Grey Scale for colorfastness.

By End Use:

The market is divided into residential and commercial end uses. The residential segment leads the market, driven by consumer demand for home renovations and comfort. The growing trend of home interior customization further propels this segment. The commercial segment also holds significant potential, particularly in office spaces, hospitality, and retail, where durability and design are essential. The increasing focus on aesthetic and functional flooring solutions fuels demand in commercial properties, further expanding the market.

Segmentation:

By Type:

- Tufted

- Needle Punched

- Knotted

- Woven

- Others

By Material:

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End Use:

Regional Analysis:

Northeast Region Insight

The Northeast region captures roughly 18% of the U.S. Carpets and Rugs Market, supported by high density of older housing stock and frequent renovation cycles. It experiences moderate growth due to established markets and relatively slower new construction activity. Consumers in this region show strong preference for premium, eco‑friendly flooring solutions, driving niche demand. Commercial projects such as refurbished offices and hospitality venues contribute to measurable segment activity. Manufacturers offer tailored designs to match historic homes and modern interiors alike. Despite steady demand, growth remains constrained compared to faster‑expanding regions.

Midwest Region Insight

The Midwest holds nearly 52% of the U.S. Carpets and Rugs Market share, making it the dominant region for industry activity. Cold winters and durable flooring needs boost demand for resilient carpets in both residential and commercial segments. Multi‑family housing developments and suburban expansion support consistent uptake. Manufacturers benefit from proximity to major production centers, enabling cost advantages and faster supply. The region also sees healthy renovation rates as homeowners invest in comfort and durability. Growth remains stable, though incremental rather than explosive, due to mature market conditions.

South and West Region Insight

The South region accounts for around 20% of the U.S. Carpets and Rugs Market share, with the West capturing the remaining approximate 10%. Both regions register faster growth rates than the national average, driven by housing booms, warmer climates, and rising construction activity. The South benefits from strong new housing starts, rental expansion, and remodeling trends. The West market thrives on design trends, eco‑conscious consumer base, and high‑income urban centers. Manufacturers target these regions with innovative products, customization options and sustainable materials. These emerging hotspots offer substantial upside despite their currently smaller share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Carpets and Rugs Market is highly competitive, with several established players leading the market landscape. Companies like Mohawk Industries, Inc., Shaw Industries Group, and Engineered Floors, LLC dominate the sector, leveraging extensive distribution networks and strong brand recognition. These companies consistently innovate by offering sustainable and customizable flooring solutions, capitalizing on consumer demand for eco-friendly and high-quality products. Additionally, new entrants are focusing on digital platforms to offer customized and direct-to-consumer products, creating a competitive challenge for traditional retailers. The market sees a blend of consolidation and innovation, where established players focus on expanding their product portfolios and adopting cutting-edge manufacturing technologies to maintain a competitive edge.

Recent Developments:

- On September 30, 2025, Ruggable announced its most significant product evolution: the All-in-One system, featuring one-piece washable rugs designed to simplify modern living without compromising style, performance, or comfort. The initial All-in-One launch featured 7 new Tufted styles and 9 new Plush styles across 4 sizes (5×7, 6×9, 8×10, and 9×12), with plans for additional options in the future. The new All-in-One products incorporate an ultra-flexible, non-slip silicone backing that fits into standard home washing machines, with Tufted styles accommodating up to 8×10 in typical home washing machines.

- Ruggable launched the latest version of its Founders collection on September 30, 2025, drawing inspiration from founder Jeneva Bell’s personal aesthetic influenced by Spanish, American, and Farmhouse design styles. Earlier, in January 2025, Ruggable and Architectural Digest unveiled a new collaboration featuring a 10-piece collection focused on 2025 design trends, with prices starting at $129 on Ruggable.com.

- In February 2025, The Dixie Group secured a new $75 million senior credit facility with MidCap Financial IV Trust, replacing its previous facility with Fifth Third Bank. This three-year revolving credit facility, effective February 25, 2025, provided the company with secured financing for future needs through 2028.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing consumer demand for sustainable and eco-friendly products.

- Growth in residential and commercial renovation projects driving market expansion.

- Continued innovation in carpet materials and manufacturing technologies.

- Increasing market share of digital platforms and e-commerce sales channels.

- Rise in demand for luxury and high-quality carpets in the residential sector.

- Ongoing urbanization contributing to new housing developments and commercial properties.

- The shift toward smart carpets integrated with IoT and home automation systems.

- Focus on customization and personalization to meet diverse consumer preferences.

- Increasing adoption of sustainable materials like recycled polyester and wool.

- Expansion of the market in emerging regions as demand for premium products rises.