Market Overview

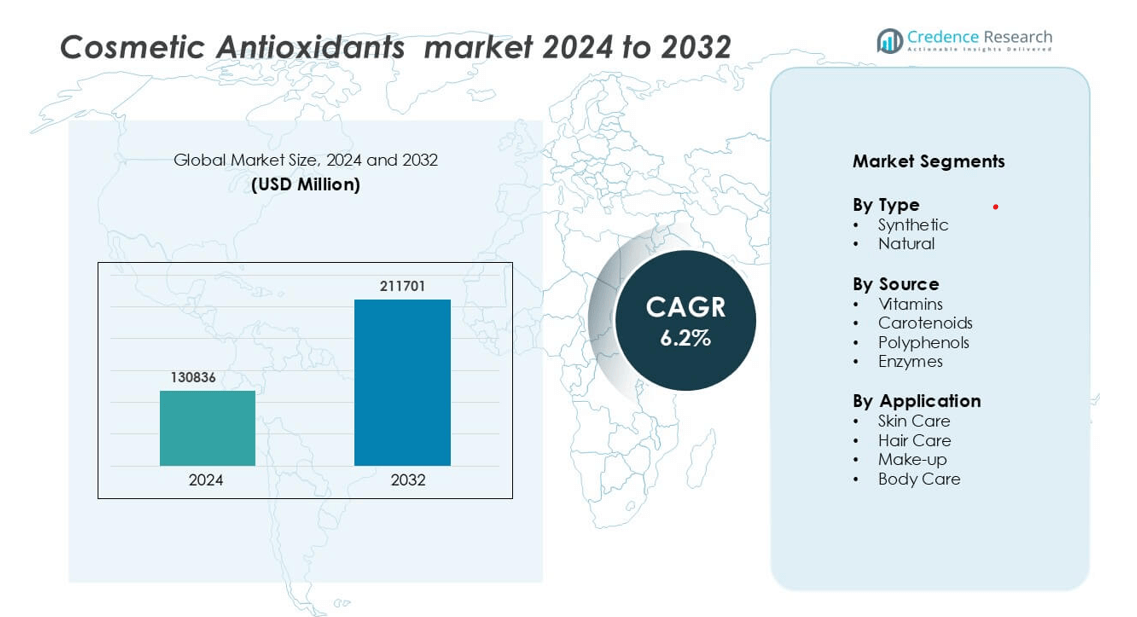

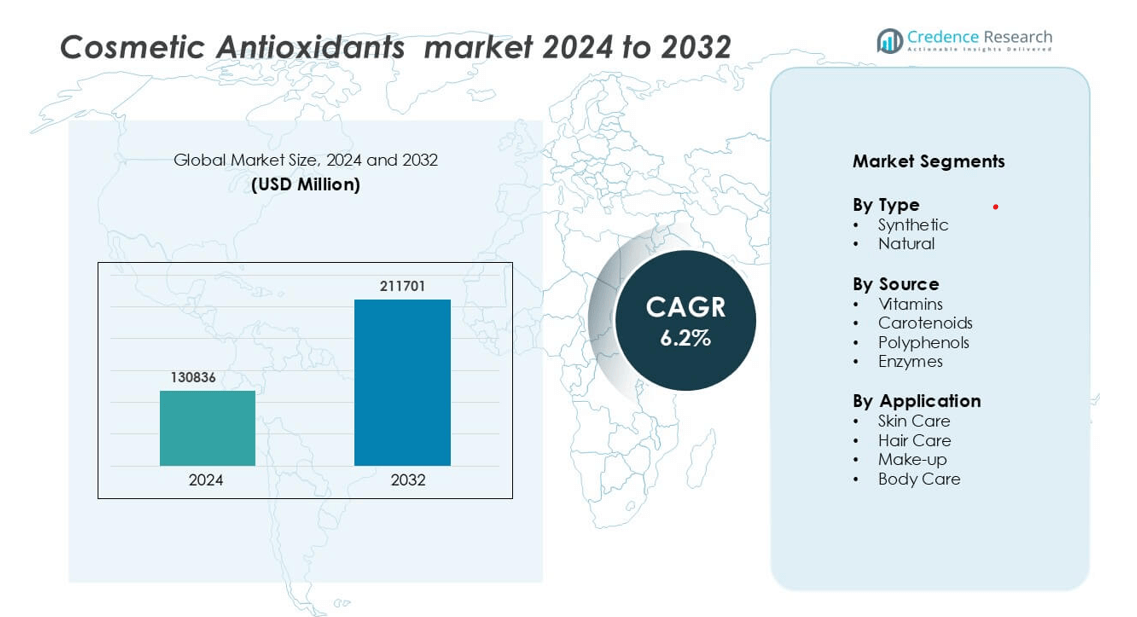

Cosmetic Antioxidants Market was valued at USD 130836 million in 2024 and is anticipated to reach USD 211701 million by 2032, growing at a CAGR of 6.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Antioxidants Market Size 2024 |

USD 130836 million |

| Cosmetic Antioxidants Market , CAGR |

6.2% |

| Cosmetic Antioxidants Market Size 2032 |

USD 211701 million |

The cosmetic antioxidants market is shaped by the presence of major global players such as Evonik Industries AG, BASF SE, Croda International PLC, Eastman Chemical Company, Archer Daniels Midland Company, Amorepacific Corporation, and Giuliani S.p.A. These companies focus on developing innovative natural and synthetic antioxidant ingredients to meet rising demand for anti-aging and clean beauty products. Firms like BTSA Biotecnologías Aplicadas S.L. and Barentz International B.V. emphasize bio-based antioxidant formulations and sustainable sourcing practices. Strategic mergers, R&D investments, and product diversification remain central to maintaining competitiveness. North America leads the global cosmetic antioxidants market with a 36% share, driven by strong consumer spending on premium skincare, rapid innovation in antioxidant formulation technologies, and expanding e-commerce distribution networks across the United States and Canada.

Market Insights

- The global cosmetic antioxidants market was valued at USD 130836 million in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2032.

- Rising demand for anti-aging, pollution-protection, and skin-repair formulations is driving the adoption of natural and synthetic antioxidants in cosmetics.

- Market trends highlight increased use of plant-based antioxidants and multifunctional products combining vitamins, polyphenols, and botanical extracts for enhanced skin protection.

- Key players such as BASF SE, Croda International PLC, Evonik Industries AG, and Eastman Chemical Company are investing in bio-based formulations and sustainable ingredient sourcing to strengthen market positioning.

- North America leads the market with a 36% share, while the skincare segment dominates with 59% share; Asia-Pacific remains the fastest-growing region, supported by rising beauty awareness, expanding e-commerce, and high demand for antioxidant-enriched products in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Synthetic antioxidants dominate the cosmetic antioxidants market with a 64% share in 2024. Their high stability, cost-effectiveness, and strong free radical neutralization make them widely used in skincare and haircare formulations. Ingredients such as butylated hydroxytoluene (BHT) and propyl gallate offer longer shelf life and reliable performance in preventing product oxidation. The rising demand for anti-aging and skin protection products also supports their growth. However, growing regulatory scrutiny and consumer inclination toward safer ingredients are prompting manufacturers to innovate sustainable synthetic variants with improved safety profiles.

- For instance, BASF SE offers antioxidant solutions as part of its portfolio to address oxidation in personal care formulations containing oil and fat-based ingredients, helping to extend their product shelf life.

By Function

Anti-aging agents hold the largest market share at 48%, driven by rising consumer focus on skin rejuvenation and protection against oxidative stress. These antioxidants counteract environmental damage, minimize wrinkles, and enhance skin elasticity. Products formulated with vitamin E, coenzyme Q10, and resveratrol are gaining significant traction for their proven efficacy in reducing visible aging signs. Growing adoption of multifunctional skincare solutions in both premium and mass-market products continues to strengthen this segment’s dominance across global cosmetic portfolios.

- For instance, Indena SpA developed a Coenzyme Q10 phytosome formulation that achieved a three-fold increase in bioavailability compared with standard CoQ10 in an 8-week clinical trial.

By Application

Skincare applications account for the largest market share of 59%, supported by growing awareness of UV protection and pollution defense. Antioxidants are key components in moisturizers, serums, and sunscreens, where they protect skin cells from oxidative damage. The popularity of clean beauty and preventive skincare further fuels demand for antioxidant-infused formulations. Haircare products are also witnessing rising adoption due to the use of vitamins and plant-based extracts for scalp health and color retention. Expanding consumer preference for daily-use skincare products continues to reinforce the segment’s leadership.

Key Growth Drivers

Rising Demand for Anti-Aging and Skin Protection Products

The growing consumer preference for anti-aging and protective skincare formulations is a major driver of the cosmetic antioxidants market. These compounds help neutralize free radicals, preventing premature skin aging caused by UV radiation and pollution. The increasing focus on youthful appearance and healthier skin among millennials and older populations is fueling demand. Manufacturers are incorporating vitamins C and E, coenzyme Q10, and polyphenols into creams, serums, and lotions to enhance product effectiveness. Expanding sales of premium cosmetics with antioxidant-rich ingredients continue to strengthen the market’s growth across global skincare segments.

- For instance, Amorepacific Corporation introduced its Time Response Skin Reserve Serum with “AbsoluTea™” green tea extract; the product lists Tocophersolan (a stabilized form of vitamin E) plus its Camellia Sinensis leaf extract as core antioxidant actives—unciated to improve skin firmness over an eight-week period.

Expansion of Natural and Plant-Based Ingredient Portfolio

The shift toward clean beauty and sustainable cosmetics is driving innovation in natural antioxidants derived from botanical sources. Consumers are actively seeking products free from synthetic additives, creating opportunities for plant-based formulations using green tea extracts, resveratrol, and rosemary. Cosmetic companies are investing in advanced extraction and stabilization techniques to maintain bioactivity. Brands are also promoting transparency and eco-friendly sourcing to align with ethical beauty trends. This rising inclination toward organic and vegan cosmetic products continues to accelerate market growth for natural antioxidant ingredients.

- For instance, Evonik Industries AG launched two new natural active ingredients — CapilAcid™ from Maqui fruit and Oleobiota™ from the Misiones rainforest — to strengthen its botanical portfolio.

Technological Advancements in Formulation and Delivery Systems

Continuous improvements in formulation technology are enhancing antioxidant stability and bioavailability in cosmetics. Nanoencapsulation, liposomal systems, and microemulsions are increasingly used to ensure deep skin penetration and prolonged antioxidant activity. These technologies improve formulation texture, absorption rate, and product shelf life. Cosmetic manufacturers are integrating these systems into multifunctional skincare products that combine moisturizing, anti-aging, and UV protection benefits. The growing adoption of technologically advanced delivery mechanisms is helping brands deliver high-performance cosmetics, meeting consumer demand for both efficacy and sensory appeal.

Key Trends & Opportunities

Integration of Antioxidants in Multifunctional Cosmetics

The market is witnessing a surge in multifunctional cosmetic formulations that combine antioxidants with SPF, moisturizing, and anti-inflammatory ingredients. Consumers increasingly prefer hybrid products that deliver protection and treatment benefits simultaneously. Manufacturers are leveraging ingredients like niacinamide, tocopherol, and ferulic acid for all-in-one solutions. This trend aligns with the fast-paced lifestyle of urban consumers who seek simplified beauty routines without compromising results. The growing popularity of multitasking products in both skincare and makeup segments presents strong opportunities for antioxidant integration across premium and mass-market brands.

- For instance, BASF SE launched Epispot™, a bioactive ingredient (used at 0.2 % concentration) that reduced skin greasiness by 37 % after 56 days in a clinical split-face study of 34 female volunteers.

Rising Adoption of Personalized Skincare Solutions

Personalized skincare is emerging as a significant opportunity in the cosmetic antioxidants market. Companies are using AI, DNA-based analysis, and skin diagnostics to develop customized antioxidant formulations tailored to individual skin conditions and environmental factors. This trend enhances consumer engagement and loyalty through data-driven product recommendations. Increasing investments in skin-tech startups and digital dermatology platforms are supporting this shift. As consumers become more aware of their specific skin needs, personalized antioxidant-based products are expected to become a core growth avenue for cosmetic manufacture.

- For instance, Revieve’s AI engine evaluates over 100 diagnostic markers from more than 15 million uploaded selfies and collaborates with brands to deliver tailored skincare routines.

Key Challenges

Instability of Natural Antioxidants During Formulation

One of the major challenges in the cosmetic antioxidants market is the instability of natural compounds during formulation and storage. Exposure to light, oxygen, and temperature fluctuations can degrade active ingredients like vitamin C and polyphenols, reducing their efficacy. Manufacturers must invest in encapsulation and stabilization technologies to maintain potency. This increases production costs and limits smaller brands from adopting advanced preservation methods. Addressing stability challenges is crucial to ensuring product consistency and consumer satisfaction across antioxidant-infused cosmetic products.

Stringent Regulatory Framework and Compliance Requirements

The market faces complex regulatory standards regarding ingredient safety, labeling, and environmental impact. Authorities in regions such as the EU and North America have implemented strict testing and approval processes for cosmetic ingredients. Compliance with these regulations demands extensive documentation and clinical validation, increasing time-to-market and cost burdens. Additionally, differences in regulatory policies across countries hinder global product standardization. Companies must maintain transparency and adhere to evolving compliance norms to sustain consumer trust and ensure successful market expansion.

Regional Analysis

North America

North America holds a 36% share of the cosmetic antioxidants market, driven by strong consumer demand for premium skincare and anti-aging products. The United States leads the region due to advanced R&D in cosmetic formulations and a well-established beauty industry. Growing awareness of pollution-related skin damage and UV protection supports antioxidant product adoption. Major cosmetic brands focus on innovation and natural ingredient integration to meet consumer expectations. High purchasing power and the expansion of e-commerce channels continue to strengthen regional market growth across both skincare and haircare segments.

Europe

Europe accounts for a 30% share of the cosmetic antioxidants market, supported by rising demand for natural and sustainable cosmetics. Countries such as Germany, France, and the United Kingdom lead due to strong consumer preference for clean beauty and anti-aging solutions. Regulatory standards promoting safe and transparent ingredient labeling further enhance market credibility. European brands invest heavily in botanical antioxidant extracts like resveratrol and green tea. The growing popularity of vegan and organic formulations continues to fuel regional expansion, with major cosmetic manufacturers focusing on eco-friendly innovation and ethical sourcing.

Asia-Pacific

Asia-Pacific represents a 25% share of the cosmetic antioxidants market and is the fastest-growing region globally. Rising disposable incomes, urbanization, and increasing beauty awareness are driving antioxidant-based skincare product adoption. Countries like China, Japan, and South Korea dominate with high consumption of anti-aging and whitening cosmetics. Regional brands emphasize innovation in antioxidant-rich formulations tailored to local skin needs. Expanding e-commerce platforms and K-beauty trends further accelerate growth. Government support for domestic cosmetic manufacturing and growing demand for natural ingredients strengthen Asia-Pacific’s position as a key market hub for antioxidant-infused beauty products.

Latin America

Latin America holds a 6% share of the cosmetic antioxidants market, led by Brazil and Mexico. The region’s growth is supported by increasing demand for skincare products addressing UV exposure and pollution effects. Local brands are introducing antioxidant-rich creams and serums to meet the rising preference for preventive skincare. Expanding middle-class populations and the influence of global beauty trends promote market penetration. However, economic fluctuations and import dependency slightly restrain large-scale development. Despite challenges, growing awareness of skin health and rising retail presence of international cosmetic brands sustain market momentum.

Middle East & Africa

The Middle East & Africa region captures a 3% share of the cosmetic antioxidants market, driven by increasing awareness of skincare and personal grooming. Gulf countries such as the UAE and Saudi Arabia lead demand, supported by higher disposable income and preference for premium beauty products. Expanding retail infrastructure and the influence of Western beauty standards promote adoption of antioxidant-based formulations. However, limited local manufacturing and climatic challenges affect broader market penetration. Growing youth demographics and rising investment by international cosmetic firms continue to enhance market growth prospects across the region.

Market Segmentations:

By Type

By Source

- Vitamins

- Carotenoids

- Polyphenols

- Enzymes

By Application

- Skin Care

- Hair Care

- Make-up

- Body Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cosmetic antioxidants market is highly competitive, featuring global and regional players focusing on innovation, sustainability, and ingredient diversification. Key companies such as Evonik Industries AG, BASF SE, Croda International PLC, Eastman Chemical Company, and Archer Daniels Midland Company lead through advanced R&D and a strong product portfolio of natural and synthetic antioxidants. Firms like Amorepacific Corporation and Giuliani S.p.A. emphasize plant-based formulations and biotechnological innovations to cater to the growing demand for clean beauty products. Meanwhile, BTSA Biotecnologías Aplicadas S.L. and Barentz International B.V. focus on supplying stabilized natural antioxidants to cosmetic manufacturers worldwide. Strategic collaborations, sustainable sourcing initiatives, and expansion into emerging markets remain central to competitive strategies. Companies continue investing in eco-friendly extraction and encapsulation technologies to enhance ingredient stability, efficacy, and consumer appeal, strengthening their positions in a market increasingly driven by transparency, performance, and environmental responsibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Evonik Industries AG

- Ashland Global Holdings Inc.

- Giuliani S.p.A.

- Croda International PLC

- Amorepacific Corporation

- BASF SE

- Barentz International B.V.

- BTSA Biotecnologias Aplicadas S.L.

- Eastman Chemical Company

- Archer Daniels Midland Company

Recent Developments

- In February 2024, Ashland globally launched Perfectyl biofunctional, a chamomile-derived antioxidant for skincare formulations built on Zeta-Fraction™ technology.

- In September 2023, BASF Personal Care introduced Epispot, a blemish-control antioxidant targeting lipid imbalance, microbiota modulation, and the skin’s defense system.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cosmetic antioxidants market will continue growing with rising awareness of skin protection and aging prevention.

- Demand for natural and plant-derived antioxidants will expand as consumers shift toward clean beauty products.

- Companies will invest more in sustainable sourcing and eco-friendly manufacturing processes.

- Technological innovations such as nanoencapsulation will enhance antioxidant stability and absorption in formulations.

- Multifunctional cosmetic products combining antioxidants with UV filters and moisturizers will gain higher traction.

- E-commerce and digital marketing will strengthen brand visibility and product accessibility across emerging markets.

- Asia-Pacific will experience rapid growth due to increasing disposable income and skincare awareness.

- Partnerships between chemical manufacturers and cosmetic brands will drive ingredient innovation.

- Regulatory compliance and transparency in ingredient labeling will become key for market differentiation.

Personalized skincare using AI and diagnostic tools will boost demand for customized antioxidant-based formulations