Market Overview

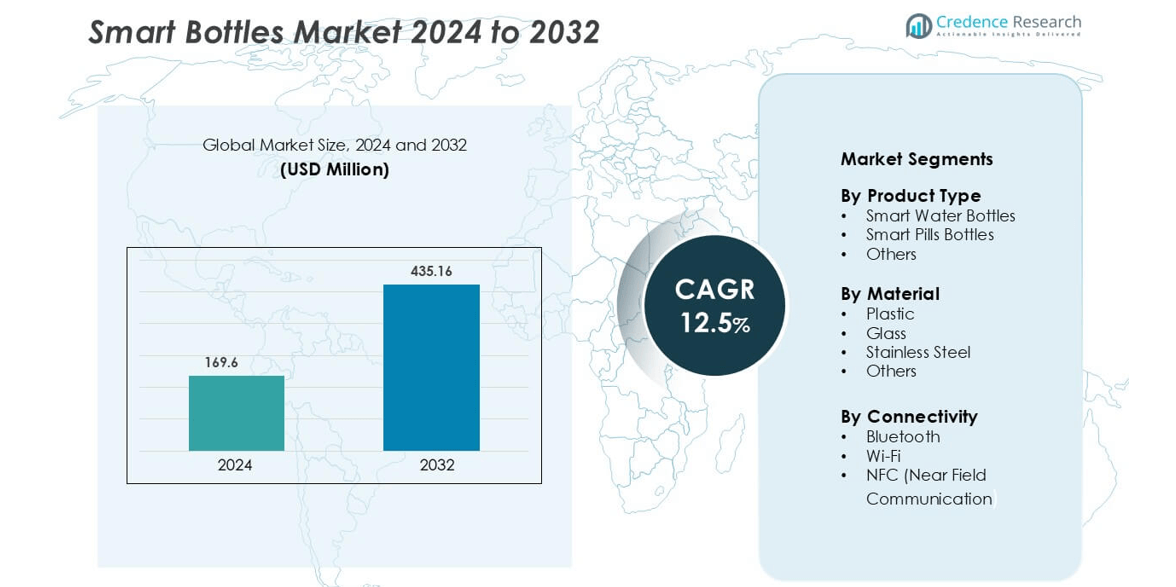

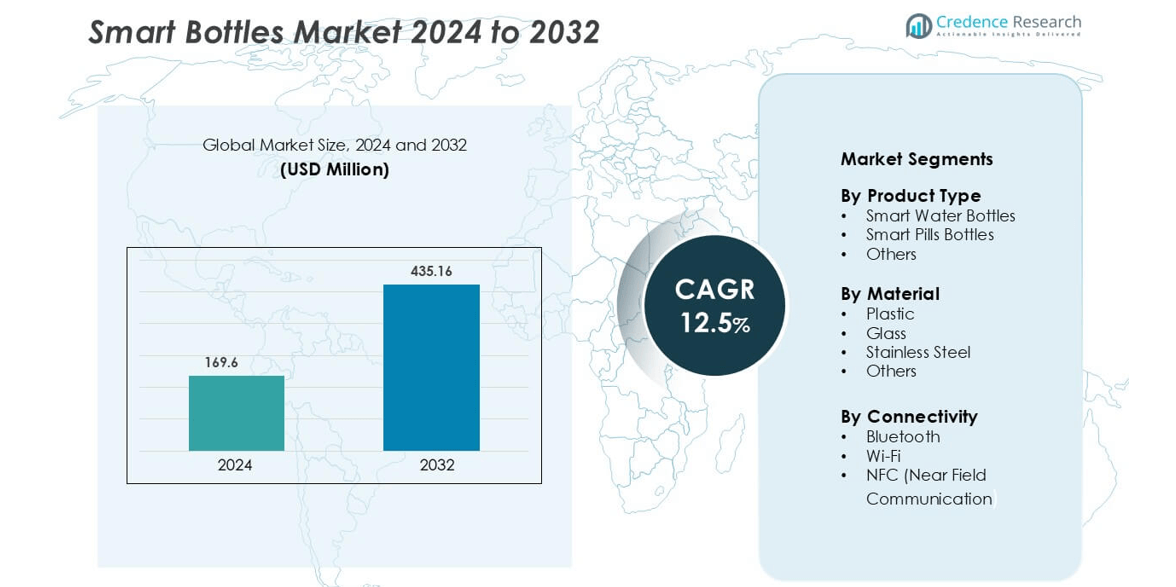

Smart Bottles market was valued at USD 169.6 million in 2024 and is anticipated to reach USD 435.16 million by 2032, growing at a CAGR of 12.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Bottles Market Size 2024 |

USD 169.6 million |

| Smart Bottles Market, CAGR |

12.5% |

| Smart Bottles Market Size 2032 |

USD 435.16 million |

The smart bottles market is led by key players such as Hidrate, Inc., Trago, Inc., LifeFuels, Inc., Thermos LLC, Koninklijke Philips NV, HydraCoach, Inc., Myhydrate, Inc., Moikit, Inc., Gululu, and Sippo (WaterH). These companies compete through innovation in hydration tracking, Bluetooth connectivity, and integration with fitness and health monitoring platforms. Product differentiation focuses on sensor precision, energy efficiency, and user-friendly mobile applications. North America dominates the global market with a 36% share, driven by strong consumer adoption of connected fitness technologies, advanced IoT infrastructure, and growing awareness of hydration tracking in both personal wellness and healthcare applications.

Market Insights

- The Smart Bottles Market was valued at USD 169.6 million in 2024 and is projected to reach USD 435.16 million by 2032, growing at a CAGR of 12.5% during the forecast period.

- Rising health awareness and growing adoption of hydration tracking technologies are driving demand for smart bottles across fitness, healthcare, and personal wellness segments.

- Integration of IoT, Bluetooth, and AI-based analytics is a major trend, enabling real-time hydration insights and smart connectivity with wearable devices.

- Key players such as Hidrate, Inc., LifeFuels, Inc., Trago, Inc., and Thermos LLC are competing through product innovation, app integration, and sustainable material development to strengthen their global presence.

- North America holds a 36% regional share, led by high consumer tech adoption, while the smart water bottles segment leads with a 52% share, driven by growing demand for health-oriented and connected lifestyle products

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The smart water bottles segment dominates the smart bottles market, holding the largest market share due to growing consumer focus on hydration tracking and health monitoring. These bottles integrate sensors that measure water intake, temperature, and consumption patterns, syncing data with mobile apps for real-time feedback. Fitness enthusiasts and tech-savvy consumers are driving demand, supported by increasing awareness of hydration’s role in wellness. Smart pill bottles are gaining traction in healthcare for medication adherence, while other variants cater to specialized applications like sports and travel hydration management.

- For instance, The HidrateSpark PRO is a smart water bottle from Hidrate Inc. that uses sensors to track water intake, syncs via Bluetooth (version 4.0/5.0 depending on the model) to the HidrateSpark app, and integrates with Apple Health and Fitbit platforms.

By Material

Plastic-based smart bottles lead the market, primarily due to their lightweight design, durability, and cost-effectiveness. The material’s flexibility enables the integration of embedded sensors and connectivity modules without affecting portability. Stainless steel bottles follow closely, favored for their insulation properties and long lifespan, particularly in premium product ranges. Glass bottles are positioned as eco-friendly alternatives for consumers seeking non-toxic and recyclable options. The rising adoption of BPA-free and sustainable plastic variants continues to support dominance in this segment.

- For instance, LifeFuels engineered its smart bottle using high-impact Tritan™ copolyester from Eastman Chemical Company, featuring integrated conductivity sensors and NFC-enabled tracking modules within a 499-gram shell.

By Connectivity

Bluetooth-enabled smart bottles hold the dominant market share, as they allow seamless pairing with smartphones and fitness trackers. Bluetooth connectivity supports hydration reminders, data synchronization, and user alerts, making it ideal for personal wellness monitoring. Wi-Fi-enabled models are expanding in commercial and medical environments for remote monitoring and data sharing. NFC-based bottles are emerging as a niche segment, offering touchless connectivity and quick data transfer for healthcare and smart retail use. The demand for Bluetooth-based products remains high due to widespread compatibility and low energy consumption.

Key Growth Drivers

Rising Consumer Focus on Health and Hydration

The growing awareness of hydration’s role in maintaining wellness and preventing fatigue is driving demand for smart bottles. These bottles use sensors and tracking technology to monitor fluid intake and provide reminders through mobile applications. Health-conscious consumers and fitness enthusiasts are increasingly adopting them to meet personalized hydration goals. The rise in smartphone integration and connected fitness ecosystems further supports adoption. With growing preference for self-monitoring tools, smart bottles are becoming an essential part of digital health and lifestyle management across global markets.

- For instance, Out of Galaxy, Inc. launched the H2OPal Smart Bottle Hydration Tracker, which employs a weight sensor and an accelerometer to record fluid intake and syncs data to a smartphone app via Bluetooth.

Expansion of IoT and Smart Device Ecosystems

The proliferation of IoT-enabled devices is a major driver for smart bottle adoption. Integration with Bluetooth, Wi-Fi, and mobile health platforms enhances real-time data collection and user engagement. Manufacturers are leveraging IoT to enable cloud connectivity, predictive analytics, and app-based health insights. Smart bottles integrated with wearables such as fitness bands and smartwatches are gaining traction among tech-driven consumers. The shift toward smart homes and personalized health ecosystems continues to support strong growth, making IoT connectivity a cornerstone of future product innovation.

- For instance, Ecomo developed its IoT-enabled Ecomo Smart Bottle featuring a triple sensor array that detects total dissolved solids, oxidation-reduction potential, and temperature.

Rising Demand in Healthcare and Pharmaceutical Sectors

The healthcare industry is increasingly adopting smart pill bottles to improve patient compliance and medication tracking. These bottles provide digital reminders, dosage monitoring, and real-time alerts for caregivers, reducing risks of missed or incorrect doses. Hospitals and telehealth platforms are integrating smart packaging solutions to enhance patient safety and remote monitoring efficiency. The aging population and rising prevalence of chronic conditions are further fueling adoption. With the global focus on digital healthcare and smart medical devices, the demand for intelligent packaging solutions like smart bottles continues to accelerate.

Key Trends and Opportunities

Integration of Artificial Intelligence and Cloud Analytics

AI and cloud-based platforms are transforming the functionality of smart bottles by enabling predictive insights and personalized hydration recommendations. Manufacturers are incorporating algorithms that analyze lifestyle, activity, and environmental data to optimize hydration goals. Cloud connectivity allows users to track and store long-term data while offering integration with fitness and healthcare platforms. The adoption of AI-powered smart bottles is creating new opportunities in preventive healthcare, corporate wellness programs, and sports performance management, strengthening the technology’s role in personalized health solutions.

- For instance, HidrateSpark’s PRO 2 model uses a Bluetooth sensor puck that tracks every sip in real time, syncs with the app, and has been clinically proven to measure fluid intake with a mean error of about 3% over 24 hours.

Growing Focus on Sustainable and Smart Materials

Sustainability is becoming a key focus area as manufacturers develop smart bottles using recyclable and eco-friendly materials. The use of stainless steel, BPA-free plastics, and glass alternatives aligns with environmental goals and consumer expectations for sustainable products. Companies are also integrating energy-efficient sensors and rechargeable modules to minimize waste. The combination of smart functionality and green design creates new opportunities for innovation in premium lifestyle products, appealing to environmentally conscious consumers seeking both performance and sustainability.

- For instance, HidrateSpark reports that their stainless-steel smart bottle keeps drinks cold for up to 24 hours while using recycled metal for the shell, addressing both tech-performance and eco-material goals.

Key Challenges

High Manufacturing and Technology Integration Costs

The smart bottles market faces challenges related to high production costs due to the integration of advanced sensors, connectivity modules, and power-efficient electronics. Developing compact, durable, and accurate devices requires significant investment in R&D and precision manufacturing. These factors increase retail prices, limiting adoption in cost-sensitive markets. Additionally, maintaining connectivity reliability and sensor accuracy across different environments adds to the technical complexity. Manufacturers are focusing on cost optimization through modular designs and scalable production to overcome these constraints.

Data Privacy and Connectivity Limitations

The integration of smart bottles with mobile apps and cloud platforms raises concerns about data security and privacy. Users share sensitive health and behavioral data, requiring robust encryption and compliance with regulations such as GDPR and HIPAA. Connectivity challenges, including unstable Bluetooth or Wi-Fi links, can also affect device reliability and user experience. Ensuring seamless data transmission, secure storage, and transparent privacy policies remains critical. Addressing these issues is essential for building consumer trust and sustaining long-term market growth.

Regional Analysis

North America

North America dominates the smart bottles market with a 36% share, supported by high consumer awareness of health tracking technologies and early adoption of smart devices. The United States leads regional growth, driven by strong demand for connected hydration products and smart pill bottles in healthcare. The presence of key players and rapid advancements in IoT and wearable integration further boost market expansion. Growing focus on fitness, coupled with increasing use of digital health monitoring, continues to position North America as a leading market for technologically advanced smart hydration solutions.

Europe

Europe accounts for a 28% share of the smart bottles market, driven by rising health consciousness and sustainable product innovation. Countries such as Germany, France, and the UK lead adoption due to strong fitness culture and preference for eco-friendly materials. European consumers favor stainless steel and glass smart bottles equipped with hydration tracking and temperature control features. Stringent environmental regulations encourage the development of recyclable and energy-efficient smart devices. Growing interest in digital health ecosystems and smart consumer goods sustains market demand across both residential and commercial applications.

Asia Pacific

Asia Pacific holds a 24% share and represents the fastest-growing region in the smart bottles market. The expansion is driven by increasing disposable incomes, growing health awareness, and rapid urbanization across countries like China, Japan, and India. The proliferation of smartphones and wearable technologies encourages widespread adoption of connected hydration and medication tracking systems. Local startups and global brands are investing in affordable, app-integrated smart bottles tailored to regional preferences. Government initiatives promoting digital health and IoT adoption further enhance the region’s growth potential in smart consumer technologies.

Latin America

Latin America captures a 7% share of the smart bottles market, with rising interest in fitness technology and personalized wellness products. Brazil and Mexico are the major contributors, supported by increasing smartphone penetration and growing middle-class demand for connected lifestyle products. Manufacturers are introducing cost-effective smart water bottles with Bluetooth functionality and LED reminder features. The healthcare sector is gradually integrating smart pill bottles to improve medication adherence. Although adoption is still emerging, expanding retail distribution and awareness of digital health benefits are expected to drive steady growth in the region.

Middle East & Africa

The Middle East & Africa region accounts for a 5% share, supported by growing demand for premium lifestyle products and digital healthcare solutions. The UAE and Saudi Arabia are key markets due to strong investments in smart technology and wellness initiatives. Increasing adoption of connected hydration systems in gyms, offices, and healthcare facilities fuels market development. Africa’s growth remains moderate but promising, driven by gradual urbanization and improved digital connectivity. Rising consumer focus on health tracking and luxury hydration products continues to create new opportunities for regional market expansion.

Market Segmentations:

By Product Type:

- Smart Water Bottles

- Smart Pills Bottles

- Others

By Material:

- Plastic

- Glass

- Stainless Steel

- Others

By Connectivity:

- Bluetooth

- Wi-Fi

- NFC (Near Field Communication)

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the smart bottles market is characterized by strong innovation and technological integration among global and regional players. Leading companies such as Trago, Inc., Hidrate, Inc., LifeFuels, Inc., Thermos LLC, and Koninklijke Philips NV are investing heavily in IoT-enabled hydration tracking and connected health solutions. These players focus on features like Bluetooth connectivity, app synchronization, and AI-based hydration insights to attract tech-savvy consumers. Emerging brands such as Moikit, Gululu, and Sippo (WaterH) are introducing affordable and child-friendly smart bottles with interactive features to target niche segments. Product differentiation through battery efficiency, sensor precision, and sustainability is intensifying market competition. Strategic partnerships with fitness platforms and healthcare providers are also strengthening brand positioning and expanding market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trago, Inc.

- LifeFuels, Inc.

- Hidrate, Inc.

- Moikit, Inc.

- HydraCoach, Inc.

- Sippo (WaterH)

- Myhydrate, Inc.

- Thermos LLC

- Gululu

- Koninklijke Philips NV

Recent Developments

- In August 2024, Temp X launched a Kickstarter campaign for its innovative smart water bottle, designed with sustainability and convenience in mind. The bottle features advanced hydration tracking and is poised to revolutionize how people stay hydrated on the go.

- In March 2024, Water.IO introduced a smart hydration product comprising a smart bottle and the Water.io app. The bottle features LED lights and vibration reminders, helping users maintain optimal hydration levels throughout the day.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Connectivity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing focus on personal health monitoring will continue to boost demand for smart bottles.

- Integration of AI and IoT technologies will enhance real-time hydration tracking and user insights.

- Expanding applications in healthcare and sports will strengthen market penetration.

- Sustainable and recyclable materials will become a key focus for product development.

- Smart bottles with multi-sensor capabilities will gain popularity among fitness enthusiasts.

- Increased collaboration between tech firms and wellness brands will expand product ecosystems.

- Enhanced app connectivity and data analytics will improve user engagement and accuracy.

- Smart pill bottles will see higher adoption in medical and eldercare management.

- Battery-efficient and self-cleaning designs will drive innovation in premium segments.

- North America will maintain its leadership position, supported by strong consumer tech adoption.