Market Overview

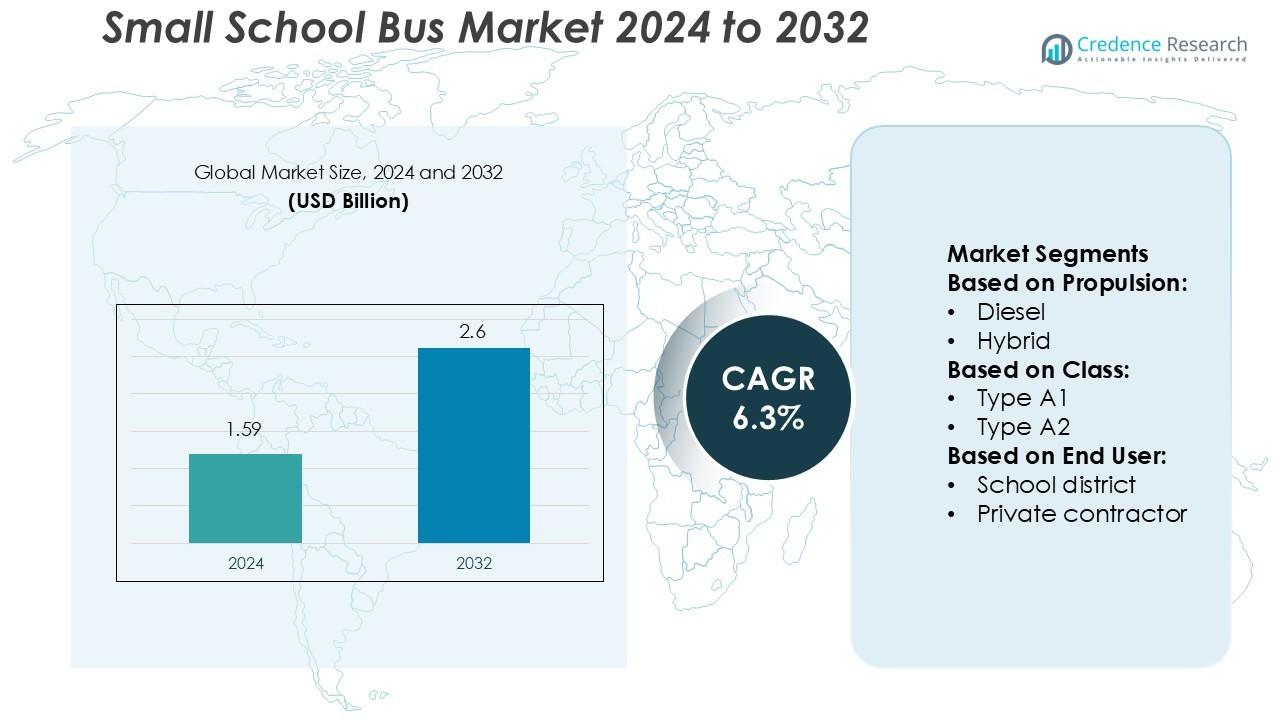

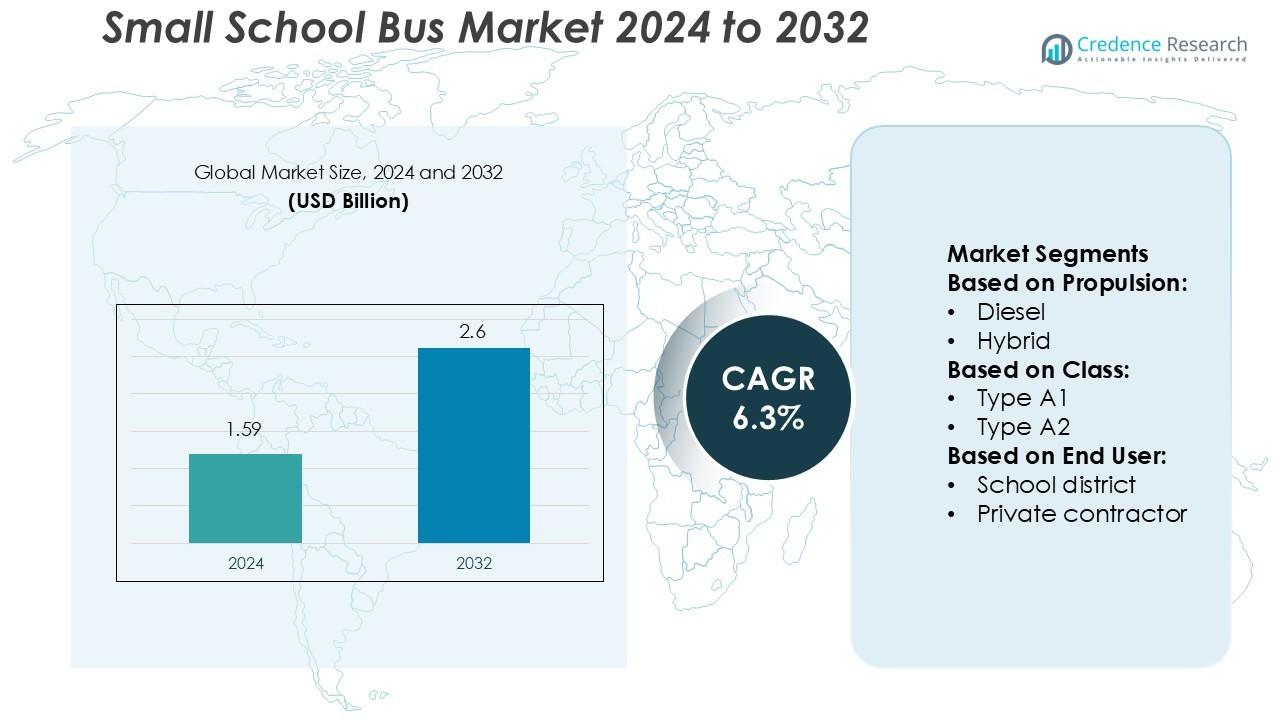

Small School Bus Market size was valued USD 1.59 billion in 2024 and is anticipated to reach USD 2.6 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small School Bus Market Size 2024 |

USD 1.59 Billion |

| Small School Bus Market, CAGR |

6.3% |

| Small School Bus Market Size 2032 |

USD 2.6 Billion |

The small school bus market is driven by leading manufacturers such as IC Bus (Navistar), Lion Electric Co., Forest River, Micro Bird Inc., Corbeil Bus Corporation, Blue Bird Corporation, Phoenix Motor Car, Girardin Minibus, Collins Bus Corporation, and Starcraft Bus. These companies focus on product innovation, electrification, and safety compliance to strengthen market presence. Advanced telematics, zero-emission propulsion, and lightweight construction remain central to their competitive strategies. North America leads the global market with a 41.6% share, supported by strong regulatory frameworks, government-funded fleet modernization programs, and high adoption of electric and connected school buses across the United States and Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Small School Bus Market was valued at USD 1.59 billion in 2024 and is projected to reach USD 2.6 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- Market growth is driven by increasing safety regulations, rising student enrollment, and government-funded fleet modernization initiatives supporting sustainable transportation.

- Electric and hybrid propulsion segments are expanding rapidly as schools shift toward zero-emission and cost-efficient solutions to reduce long-term operational expenses.

- Competitive dynamics are shaped by major players focusing on electrification, telematics integration, and lightweight construction, with North America leading the market with a 41.6% share.

- Market restraints include high upfront costs of electric models and limited charging infrastructure, while Asia-Pacific shows strong growth potential with rising education investments and expanding urban school networks.

Market Segmentation Analysis:

By Propulsion

Diesel-powered small school buses dominate the market with a 58.4% share in 2024. Their widespread use stems from cost efficiency, established fueling infrastructure, and long operational range. Diesel models remain popular among rural and suburban school districts with extended routes. The demand is supported by continuous engine efficiency improvements and reduced emissions. However, the electric segment is gaining momentum as districts aim for sustainable fleets under emission mandates. Growing investment in charging infrastructure and government subsidies accelerates electric bus adoption across urban regions.

- For instance, The Lion Electric Co. developed its LionC electric school bus featuring a top-speed rating of 95 km/h (60 mph) and a peak electric drivetrain output of 365 kW (489 hp).

By Class

Type A2 small school buses hold the largest market share of 62.7% in 2024, driven by higher passenger capacity and robust performance. These buses offer enhanced safety, larger wheelbases, and better fuel efficiency, making them suitable for district-level transportation. Type A2 models comply with advanced safety norms and provide flexibility for diverse route lengths. Manufacturers emphasize lightweight body construction and advanced telematics for route optimization. Type A1 buses serve shorter routes but face slower adoption due to lower seating capacity and limited operational efficiency.

- For instance, Corbeil Bus Corporation overall lengths of 232 inches and 242 inches are specific to certain single-rear-wheel (SRW) models, such as the Collins SL400 and SH400, which were offered under the Corbeil brand.

By End User

School districts lead the market with a 68.5% share in 2024, driven by large-scale fleet operations and state funding support. District-owned fleets enable better maintenance control, safety compliance, and standardized vehicle management. The rise in student enrollment and replacement of aging diesel fleets boost new bus purchases. Private contractors expand in suburban areas through service outsourcing agreements, while charter services focus on customized transport. The push for sustainable and connected fleet management further strengthens district-level investments in new-generation small school buses.

Key Growth Drivers

Rising Student Safety Regulations

Stringent student safety regulations drive the adoption of small school buses equipped with advanced safety technologies. Governments and education boards emphasize compliance with crash standards, seat belts, GPS tracking, and camera monitoring systems. Fleet operators increasingly invest in buses featuring automatic braking, lane assist, and emergency alert systems. This focus on safety enhances trust among parents and institutions. Manufacturers are also integrating AI-driven monitoring tools to ensure safe routing and driver accountability, reinforcing demand for technologically advanced small school buses.

- For instance, Blue Bird introduced a “next-generation” battery pack with a capacity of 196 kWh (not 194 kWh). This battery enables a maximum range of up to 130 miles on a single charge.

Expansion of Electrification Programs

Government-backed electrification initiatives are accelerating the transition toward electric small school buses. Incentives such as subsidies, tax credits, and grants support fleet modernization and sustainability goals. Electric buses help reduce emissions, lower fuel costs, and meet zero-emission mandates. Manufacturers are improving battery efficiency, range, and charging infrastructure to enhance adoption feasibility. School districts across North America and Europe are leading this shift, investing in low-emission fleets that align with environmental regulations. These programs promote long-term operational savings and boost market expansion.

- For instance, Phoenix Motor’s announcement of the Z600 zero-emission Type A school bus and the available battery pack options (90 kWh and 141 kWh). Phoenix Motor’s fourth-generation drive system uses a 650V+ EV architecture.

Growing Fleet Modernization and Replacement Demand

Aging diesel fleets and evolving operational standards are driving replacement demand for small school buses. Districts and private operators are upgrading to newer models with better fuel efficiency, telematics integration, and lower maintenance costs. Modern buses offer improved comfort, reduced emissions, and compliance with updated safety laws. OEMs are introducing connected systems for diagnostics, route optimization, and energy management. This modernization trend strengthens fleet efficiency and reduces lifecycle costs, supporting consistent demand across both developed and emerging markets.

Key Trends & Opportunities

Integration of Smart Fleet Management Systems

Fleet operators are adopting digital tools such as GPS tracking, predictive maintenance, and route optimization software. Smart management systems enable real-time monitoring, fuel management, and driver performance analysis. These technologies reduce operational costs and downtime while improving scheduling efficiency. Cloud-based platforms and telematics allow seamless data sharing between districts and service providers. The trend supports the broader adoption of connected mobility in school transportation, offering new opportunities for software providers and OEMs focusing on data-driven fleet optimization.

- For instance, Polaris’ RANGER XP Kinetic UTV (leveraged in its powersports electrification) uses a 14.9 kWh lithium-ion battery in its Premium trim and delivers an estimated 45 mile range in true AWD/2WD/VersaTrac Turf mode.

Increasing Demand for Sustainable and Lightweight Materials

Manufacturers are focusing on sustainable and lightweight materials to enhance fuel efficiency and reduce emissions. Composite bodies and aluminum-based structures reduce vehicle weight without compromising safety. These advancements improve range for electric models and lower fuel consumption for conventional buses. Additionally, eco-friendly interiors using recycled plastics and non-toxic materials align with green transportation policies. The shift toward sustainable design creates opportunities for innovation in material engineering and helps OEMs meet environmental and performance standards efficiently.

- For instance, Daymak’s Beast ATV Ultimate, featuring a 2,000 W AWD system with twin 1,000 W electric motors, was offered with a standard lithium-ion battery providing a range of approximately 100 km.

Key Challenges

High Initial Cost of Electric Models

The high upfront cost of electric small school buses limits adoption, especially among budget-constrained districts. Battery costs, charging infrastructure, and vehicle price premiums pose financial challenges despite long-term savings. Many operators still rely on diesel fleets due to established refueling systems and lower acquisition expenses. Government incentives mitigate costs partially, but large-scale electrification requires continued funding. Without broader cost reduction and infrastructure expansion, the shift toward electric fleets may progress slower than expected in certain regions.

Infrastructure and Maintenance Constraints

Limited charging infrastructure and specialized maintenance requirements hinder widespread deployment of electric small school buses. Many rural or suburban districts lack access to reliable charging facilities and trained technicians. Additionally, grid capacity constraints and inconsistent power availability create operational inefficiencies. The maintenance of electric drivetrains and advanced digital systems demands skilled personnel and diagnostic tools. Addressing these infrastructure and training gaps is essential for supporting long-term fleet sustainability and ensuring the reliability of new-generation small school buses.

Regional Analysis

North America

North America dominates the small school bus market with a 41.6% share in 2024. The region’s leadership stems from strict school safety laws, advanced infrastructure, and early adoption of electric buses. The United States drives demand through state-funded fleet replacement programs and zero-emission initiatives. Canada contributes with strong rural transportation needs and cold-weather bus adaptations. OEMs such as Blue Bird Corporation and Thomas Built Buses lead through electrification and telematics innovation. Continuous investments in clean energy vehicles and government-backed grant programs strengthen North America’s position as the global hub for small school bus development.

Europe

Europe holds a 26.8% share in the global small school bus market, supported by strong environmental regulations and sustainability mandates. Countries like Germany, France, and the UK lead electrification efforts with EU-backed funding for zero-emission transportation. The region emphasizes safety, energy efficiency, and accessibility in school transport. Manufacturers integrate lightweight body structures and ADAS features to meet regional safety norms. Growing investment in charging networks across cities and rural areas fosters electric bus deployment. Partnerships between local governments and OEMs enhance the transition toward eco-friendly, digitally connected school transportation fleets.

Asia-Pacific

Asia-Pacific accounts for 21.4% of the small school bus market in 2024, driven by rapid urbanization and expanding education infrastructure. China, Japan, and India lead adoption with government-led modernization programs and rising student enrollment. Local manufacturers invest in compact, fuel-efficient, and low-emission designs suited for dense city routes. Electric and hybrid buses gain traction amid growing clean energy policies. Rising disposable income and improved road connectivity further support growth. The region’s focus on affordable yet technologically advanced school transport solutions positions it as a fast-growing market with significant long-term potential.

Latin America

Latin America represents a 6.2% share of the global small school bus market in 2024. Growth is led by Brazil, Mexico, and Argentina, where fleet renewal initiatives improve school transportation standards. Governments prioritize student safety and emission reduction, encouraging investments in newer bus models. Economic recovery and public-private partnerships support gradual electrification efforts. However, high acquisition costs and limited infrastructure remain key barriers. Local assemblers collaborate with international manufacturers to offer cost-efficient diesel and hybrid options. Continued modernization programs and regional trade support strengthen Latin America’s role in the evolving small school bus landscape.

Middle East & Africa

The Middle East & Africa region captures a 4% market share in 2024, driven by increasing education enrollment and infrastructure investment. The UAE, Saudi Arabia, and South Africa lead demand with expanding school networks and public transport projects. Governments emphasize child safety and vehicle reliability, promoting imports of advanced small school buses. Fleet operators adopt air-conditioned, GPS-equipped, and low-emission models suited for regional conditions. Limited local manufacturing and cost challenges slow electric adoption, yet ongoing investments in education and sustainable mobility position the region for steady long-term growth in the market.

Market Segmentations:

By Propulsion:

By Class:

By End User:

- School district

- Private contractor

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The small school bus market features prominent players including IC Bus (Navistar), Lion Electric Co., Forest River, Micro Bird Inc., Corbeil Bus Corporation, Blue Bird Corporation, Phoenix Motor Car, Girardin Minibus, Collins Bus Corporation, and Starcraft Bus. The small school bus market is shaped by continuous innovation, strategic partnerships, and sustainability initiatives. Manufacturers focus on electrification, integrating telematics, and advanced safety technologies to meet regulatory standards and operational efficiency goals. The growing demand for zero-emission and connected buses drives investment in battery technology, lightweight materials, and digital fleet management systems. Companies collaborate with school districts and governments to secure large-scale fleet modernization projects. Competitive advantage increasingly depends on cost optimization, aftersales service quality, and compliance with environmental mandates, making technological leadership a critical differentiator in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IC Bus (Navistar)

- Lion Electric Co.

- Forest River

- Micro Bird Inc.

- Corbeil Bus Corporation

- Blue Bird Corporation

- Phoenix Motor Car

- Girardin Minibus

- Collins Bus Corporation

- Starcraft Bus

Recent Developments

- In May 2024, Blue Bird Corporation extended its exclusive clean school bus collaboration with Ford Component Sales and ROUSH CleanTech to 2030.

- In March 2024, Volvo Buses, a subsidiary of AB Volvo, introduced the Volvo 8900 Electric, a cutting-edge electric low-entry bus designed for intercity, commuter, and city operations. This innovative bus is available in both two- and three-axle configurations, allowing operators to optimize their fleet for efficient, sustainable, and profitable traffic management.

- In December 2023, GreenPower Motor Company announced its first orders for the Type A all-electric, purpose-built, zero-emission Nano BEAST school bus for the New York market through its dealer Leonard Bus Sales.

- In October 2023, Nuvve Holding Corp. and Blue Bird Corporation upgraded the diesel fleet of Martinsville Independent School District. They replaced it with five Blue Bird Vision electric buses, implemented the innovative Nuvve FleetBox 2.0 charge management software, which is AI-powered, and installed five Nuvve Level II chargers.

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Class, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for electric small school buses will rise with stronger government sustainability mandates.

- Fleet modernization programs will accelerate as districts replace aging diesel vehicles.

- Integration of telematics and AI-based fleet management will enhance route optimization and safety.

- Manufacturers will focus on lightweight designs to improve energy efficiency and reduce emissions.

- Public-private partnerships will expand to support large-scale electrification infrastructure.

- Hybrid propulsion systems will gain traction in regions with limited charging networks.

- Autonomous driving technologies will gradually enter pilot projects for school transportation.

- Aftermarket services and predictive maintenance solutions will become key revenue drivers.

- Asia-Pacific will emerge as a major growth region due to rising student populations and urban expansion.

- Competitive intensity will increase as global OEMs and regional players invest in innovation and sustainability.