Market Overview

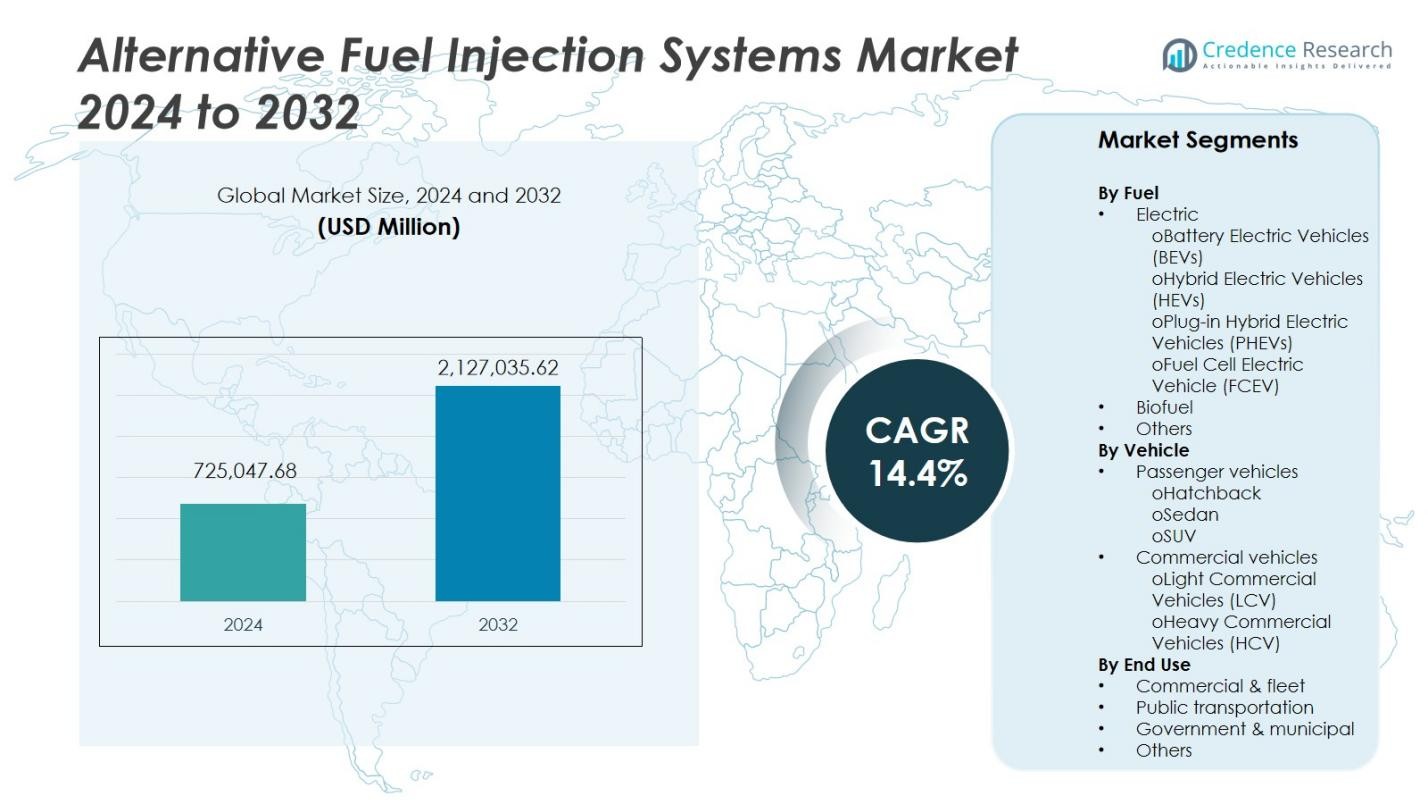

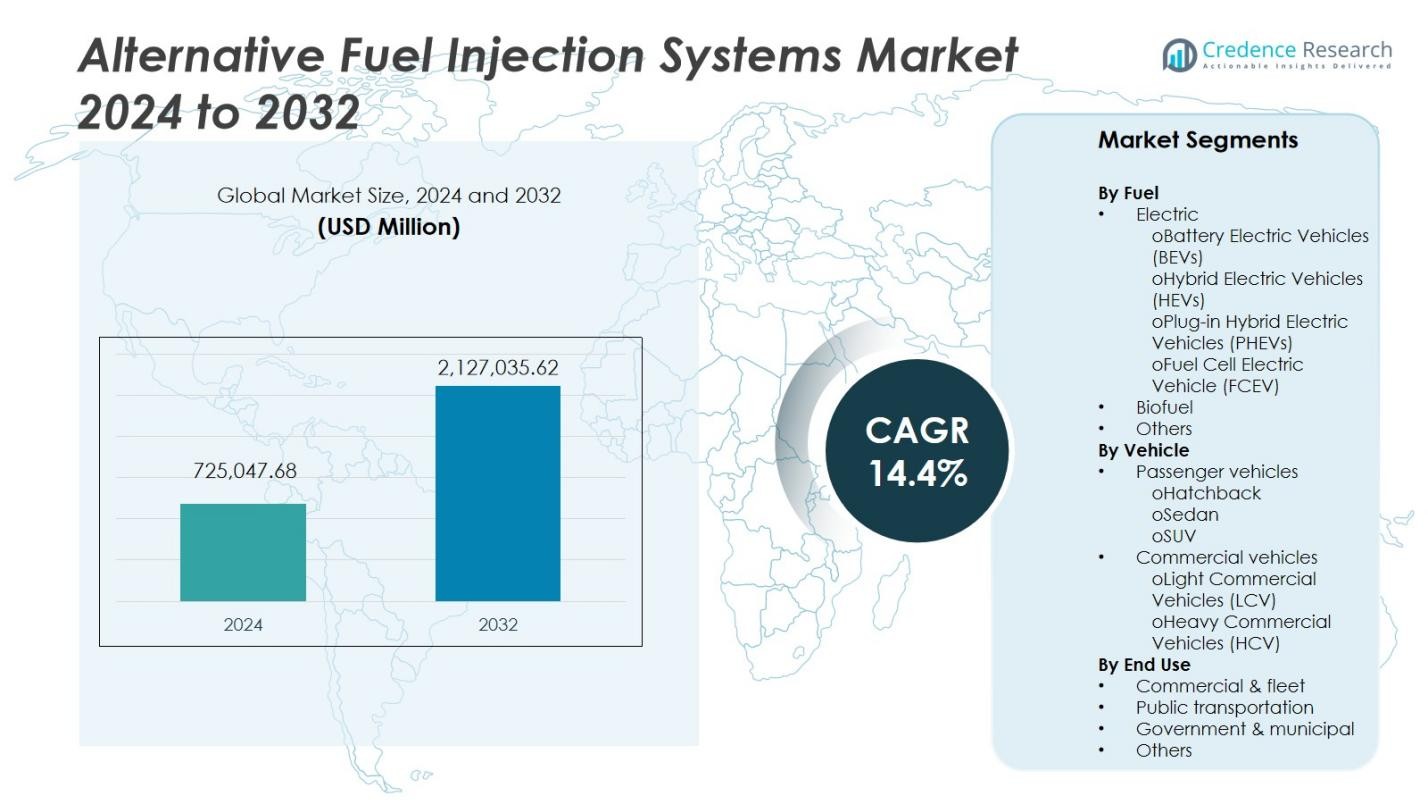

The Global Alternative Fuel Vehicles Market size was valued at USD 725,047.68 million in 2024 and is anticipated to reach USD 2,127,035.62 million by 2032, expanding at a CAGR of 14.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alternative Fuel Vehicles Market Size 2024 |

USD 725,047.68 Million |

| Alternative Fuel Vehicles Market, CAGR |

14.4% |

| Alternative Fuel Vehicles Market Size 2032 |

USD 2,127,035.62 Million |

The Alternative Fuel Vehicles Market is led by major players including Toyota Motor Corporation, Tesla Inc., BYD Company Ltd., Hyundai Motor Company, Ford Motor Company, General Motors, BMW AG, Honda Motor Co., Ltd., Mercedes-Benz Group AG, and Audi AG. These companies focus on expanding their electric and hybrid vehicle portfolios through advanced battery systems, hydrogen fuel cell technology, and strategic infrastructure partnerships. Asia-Pacific dominates the global market with a 34% share, driven by strong government incentives and large-scale production in China and Japan. Europe follows with a 32% share, supported by stringent emission norms and the European Union’s Green Deal initiatives, while North America holds 28%, propelled by technological innovation and widespread electric vehicle adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Alternative Fuel Vehicles Market was valued at USD 725,047.68 million in 2024 and is projected to reach USD 2,127,035.62 million by 2032, growing at a CAGR of 14.4%.

- Rising environmental concerns, strict emission norms, and government incentives for cleaner mobility continue to drive adoption of electric, hybrid, and hydrogen-powered vehicles worldwide.

- The market is witnessing strong trends in battery innovation, charging infrastructure expansion, and integration of smart grid and vehicle-to-grid technologies enhancing efficiency and energy use.

- Competition remains high with key players like Toyota, Tesla, BYD, Hyundai, and BMW focusing on R&D, product diversification, and sustainability-driven strategies to strengthen their global footprint.

- Asia-Pacific leads the market with a 34% share, followed by Europe at 32% and North America at 28%, while the electric segment dominates overall with 68% share driven by BEV demand and technological advancements.

Market Segmentation Analysis:

By Fuel:

The electric segment dominates the Alternative Fuel Vehicles Market, accounting for nearly 68% of the total market share in 2024. Within this category, Battery Electric Vehicles (BEVs) hold the largest share due to improving battery efficiency, expanding charging networks, and government incentives for zero-emission mobility. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) follow, driven by consumer demand for flexible fuel options. The Fuel Cell Electric Vehicle (FCEV) segment is gaining traction in regions emphasizing hydrogen infrastructure. Meanwhile, biofuel and other alternative fuels remain niche but continue to grow in rural and fleet-based applications.

For instance, Factorial Energy introduced the Solstice solid-state battery in 2024, designed to significantly improve Battery Electric Vehicle (BEV) battery safety and energy density, boosting overall efficiency.

By Vehicle:

Passenger vehicles lead the Alternative Fuel Vehicles Market, capturing about 72% of the market share in 2024. The SUV sub-segment shows the strongest performance, supported by rising consumer preference for larger, energy-efficient models with extended range. Hatchbacks and sedans contribute steadily, appealing to urban buyers prioritizing cost and convenience. Commercial vehicles, including Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs), hold the remaining share, with growing adoption across logistics and delivery sectors as governments enforce stricter emission standards and businesses aim to reduce operating costs.

For instance, Hyundai Motor Company has significantly contributed to the SUV segment with the popular Hyundai Creta, which sold approximately 1.87 lakh units in 2024, reaffirming its dominance in urban markets owing to its safety features, modern design, and fuel efficiency improvements.

By End Use:

The commercial and fleet segment dominates the market with approximately 46% of the total share in 2024, driven by high utilization rates and a focus on lowering fuel expenses. Companies in logistics, ride-hailing, and e-commerce are increasingly shifting to electric and hybrid fleets to meet sustainability goals. Public transportation follows closely, supported by government-backed initiatives for electrified buses and shared mobility. Government and municipal applications contribute a smaller but growing share as cities transition service fleets to low-emission models. The others segment includes private and institutional users emphasizing energy independence and long-term cost savings.

Key Growth Drivers

Rising Environmental Awareness and Emission Regulations

Increasing global concern over climate change and carbon emissions drives the shift toward alternative fuel vehicles. Governments worldwide are enforcing strict emission standards and offering incentives such as tax benefits, rebates, and subsidies to promote cleaner mobility. Consumers and corporations are also aligning with sustainability goals, fueling demand for electric, hybrid, and biofuel-powered vehicles. This collective push from regulatory frameworks and environmental consciousness continues to accelerate adoption, positioning alternative fuel vehicles as a key solution for achieving carbon neutrality targets.

For instance, Toyota Motor Corporation reported cumulative global hybrid vehicle sales of 10 .05 million units by January 31 2017, demonstrating strong uptake of cleaner mobility solutions

Technological Advancements in Powertrains and Battery Systems

Continuous innovation in battery chemistry, electric drivetrains, and energy storage systems enhances vehicle efficiency and range. Advancements in solid-state batteries, fast-charging technologies, and lightweight materials reduce costs and improve performance reliability. Manufacturers are integrating smart energy management systems to optimize vehicle operation and charging cycles. These developments make alternative fuel vehicles more practical and competitive compared to conventional internal combustion engines, further stimulating consumer confidence and expanding adoption across both passenger and commercial segments.

For instance, Contemporary Amperex Technology Co., Ltd. (CATL) launched its “CTP 3.0” battery system achieving energy densities of 255 Wh/kg for ternary (NCM) and 160 Wh/kg for LFP in 2022, illustrating the major leaps in battery performance metrics.

Expanding Infrastructure and Public-Private Investments

Rapid expansion of charging and refueling infrastructure supports widespread alternative fuel vehicle adoption. Public-private collaborations are accelerating the rollout of electric charging stations, hydrogen refueling hubs, and biofuel supply networks. Governments in regions like North America, Europe, and Asia-Pacific are offering grants and partnerships to encourage network development. Fleet operators and automakers are investing heavily in infrastructure integration, ensuring vehicle availability aligns with operational convenience. This infrastructure growth directly addresses range anxiety and accessibility barriers, fostering long-term market expansion.

Key Trends and Opportunities

Emergence of Vehicle-to-Grid (V2G) and Smart Charging Solutions

The integration of smart grid technology and V2G systems creates new opportunities for energy optimization. Electric vehicles can now interact with power grids, storing and redistributing electricity during peak and off-peak periods. This trend enhances grid stability, lowers energy costs, and encourages renewable energy utilization. Automakers and energy companies are partnering to develop intelligent charging solutions, turning vehicles into dynamic energy assets. Such innovation not only supports environmental goals but also opens new revenue streams for consumers and service providers.

For instance, Nissan, in collaboration with E.ON and platform provider Virta, implemented 20 V2G chargers as part of a UK project to automate EV charging and energy export based on grid demand and energy mix signals, demonstrating viable business applications of V2G technology.

Adoption of Hydrogen Fuel Cell Technology in Heavy Transport

Hydrogen-powered vehicles are emerging as a promising solution for heavy commercial applications where long range and rapid refueling are essential. Investments in hydrogen production, storage, and refueling infrastructure are expanding globally. Leading automotive and energy companies are developing scalable hydrogen ecosystems for trucks, buses, and industrial fleets. As fuel cell efficiency improves and production costs decline, hydrogen vehicles are positioned to complement electric mobility, particularly in sectors demanding continuous operation and minimal downtime.

For instance, Nikola Corporation wholesaled 88 Class 8 hydrogen fuel cell trucks in Q3 2024 across North America, with a total of 200 trucks wholesaled in the first three quarters of 2024. All trucks are assembled at Nikola’s Coolidge, Arizona facility.

Key Challenges

High Production and Ownership Costs

Despite technological progress, the cost of manufacturing and owning alternative fuel vehicles remains high compared to conventional vehicles. Batteries, power electronics, and rare earth materials significantly add to production expenses. Additionally, infrastructure deployment and maintenance costs are substantial, limiting affordability for consumers in emerging economies. While subsidies and incentives help offset expenses, long-term cost reduction will depend on large-scale production efficiency, improved battery supply chains, and innovation in material sourcing and recycling processes.

Limited Charging and Refueling Infrastructure in Developing Regions

In many developing economies, inadequate infrastructure continues to restrict the adoption of alternative fuel vehicles. The lack of widespread charging stations, hydrogen refueling hubs, and biofuel distribution points discourages both consumers and fleet operators. Rural and remote areas face greater challenges due to unreliable power supply and limited investment. Addressing this gap requires coordinated efforts between governments, automakers, and private investors to ensure equitable access, standardized protocols, and seamless integration across diverse vehicle platforms.

Regional Analysis

North America

North America holds a 28% market share in the Alternative Fuel Vehicles Market, driven by strong adoption of electric and hybrid models across the United States and Canada. Federal and state-level incentives, such as tax rebates and emission credits, continue to accelerate the transition toward clean mobility. Major automakers, including Tesla, Ford, and General Motors, are investing heavily in EV manufacturing and battery plants. Expanding charging infrastructure and supportive policies for fleet electrification further enhance growth. The region’s emphasis on sustainability and renewable energy integration positions it as a leading innovator in the global market.

Europe

Europe accounts for 32% of the market share, making it the leading region in the global Alternative Fuel Vehicles Market. The European Union’s Green Deal and strict emission regulations push automakers toward rapid electrification. Countries such as Germany, Norway, and the Netherlands show strong demand for Battery Electric Vehicles (BEVs) supported by extensive public charging networks. Leading brands, including BMW, Mercedes-Benz, and Volkswagen, are introducing diverse electric and hybrid models. Government subsidies and urban low-emission zones further encourage consumers to shift toward eco-friendly vehicles, solidifying Europe’s dominance in sustainable automotive transformation.

Asia-Pacific

Asia-Pacific captures a 34% market share, emerging as the fastest-growing region in the Alternative Fuel Vehicles Market. Strong government support in China, Japan, South Korea, and India fuels mass adoption of electric and hybrid vehicles. China dominates production and exports through major players like BYD and Toyota, supported by robust supply chains and low-cost battery manufacturing. Expanding EV infrastructure, rising fuel prices, and rapid urbanization strengthen demand. Governments are also focusing on hydrogen fuel and biofuel alternatives, promoting energy security and reducing dependence on imported petroleum, ensuring the region’s continued leadership in clean mobility.

Latin America

Latin America holds a 4% market share in the global Alternative Fuel Vehicles Market, showing steady growth driven by rising urbanization and government-led sustainability initiatives. Brazil and Mexico are leading markets, supported by biofuel infrastructure and emerging EV adoption. Regional governments are implementing incentives for low-emission vehicles and investing in charging networks. Automotive manufacturers are expanding operations to introduce hybrid and flexible-fuel models suited to regional fuel availability. Growing environmental awareness and collaborations with international automakers are expected to accelerate adoption over the coming years, despite infrastructure limitations in some areas.

Middle East & Africa

The Middle East and Africa account for a 2% market share, reflecting early-stage development in the Alternative Fuel Vehicles Market. Gulf nations such as the UAE and Saudi Arabia are increasingly investing in electric and hydrogen mobility as part of national sustainability goals. Government initiatives like Vision 2030 promote diversification from oil dependence toward green energy solutions. South Africa leads the African market, focusing on hybrid imports and localized EV infrastructure. Limited charging infrastructure and high vehicle costs remain barriers, but long-term policy commitments are expected to stimulate gradual market expansion.

Market Segmentations:

By Fuel

- Electric

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicle (FCEV)

- Biofuel

- Others

By Vehicle

- Passenger vehicles

- Commercial vehicles

-

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

By End Use

- Commercial & fleet

- Public transportation

- Government & municipal

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Alternative Fuel Vehicles Market features key players such as Toyota Motor Corporation, Tesla Inc., BYD Company Ltd., Hyundai Motor Company, Honda Motor Co., Ltd., BMW AG, Ford Motor Company, General Motors, Nissan Motor Co., Ltd., and Mercedes-Benz Group AG. These companies compete through innovations in electric powertrains, battery efficiency, and vehicle range. Strategic partnerships with energy providers and charging network developers enhance accessibility and brand presence. Automakers are investing in R&D for solid-state batteries, hydrogen fuel cells, and lightweight materials to strengthen product portfolios. Mergers and collaborations with technology firms enable software integration, autonomous features, and improved connectivity. Additionally, regional manufacturers in Asia-Pacific and Europe are expanding production capacity to meet rising demand. Sustainability goals, government incentives, and consumer awareness continue to shape competition, driving companies to innovate and diversify offerings across passenger and commercial vehicle categories.

Key Player Analysis

- Hyundai Motor

- Ford Motor

- Audi

- General Motors

- Fiat Chrysler Automobiles

- Toyota

- BMW

- Honda Motors

- Mercedes-Benz

- BYD Company

Recent Developments

- In 2025, Tata Motors formed a strategic partnership with Think Gas to advance LNG and alternative-fuel-powered commercial vehicles across India, promoting sustainable mobility and reducing carbon emissions.

- In December 2024, ChargePoint and General Motors (GM) announced a partnership to expedite the development of Electric Vehicle (EV) charging infrastructure across the U.S. This collaboration aims to install hundreds of ultra-fast charging stations by 2025, providing faster and more convenient charging options for EV drivers nationwide.

- In November 2024, Lumax Auto Technologies made a strategic move into the green fuels sector by acquiring Greenfuel. This acquisition positions Lumax for growth in the expanding alternative fuels market and enhances its presence in the global marketplace.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Fuel, Vehicle, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by global emission reduction targets.

- Electric vehicles will continue to dominate due to battery cost reduction and efficiency improvements.

- Hydrogen fuel cell vehicles will gain adoption in heavy commercial and long-haul transport.

- Governments will expand incentives and infrastructure to accelerate clean mobility transition.

- Advanced battery recycling and second-life applications will improve sustainability and supply security.

- Software integration and connected mobility solutions will enhance energy management and performance.

- Automakers will diversify portfolios with hybrid, plug-in, and fuel cell options for multiple uses.

- Emerging markets will witness rapid adoption supported by policy reforms and local manufacturing.

- Partnerships between energy companies and automakers will boost renewable-powered charging networks.

- Continuous innovation in lightweight materials and smart powertrains will enhance vehicle range and durability.