Market Overview:

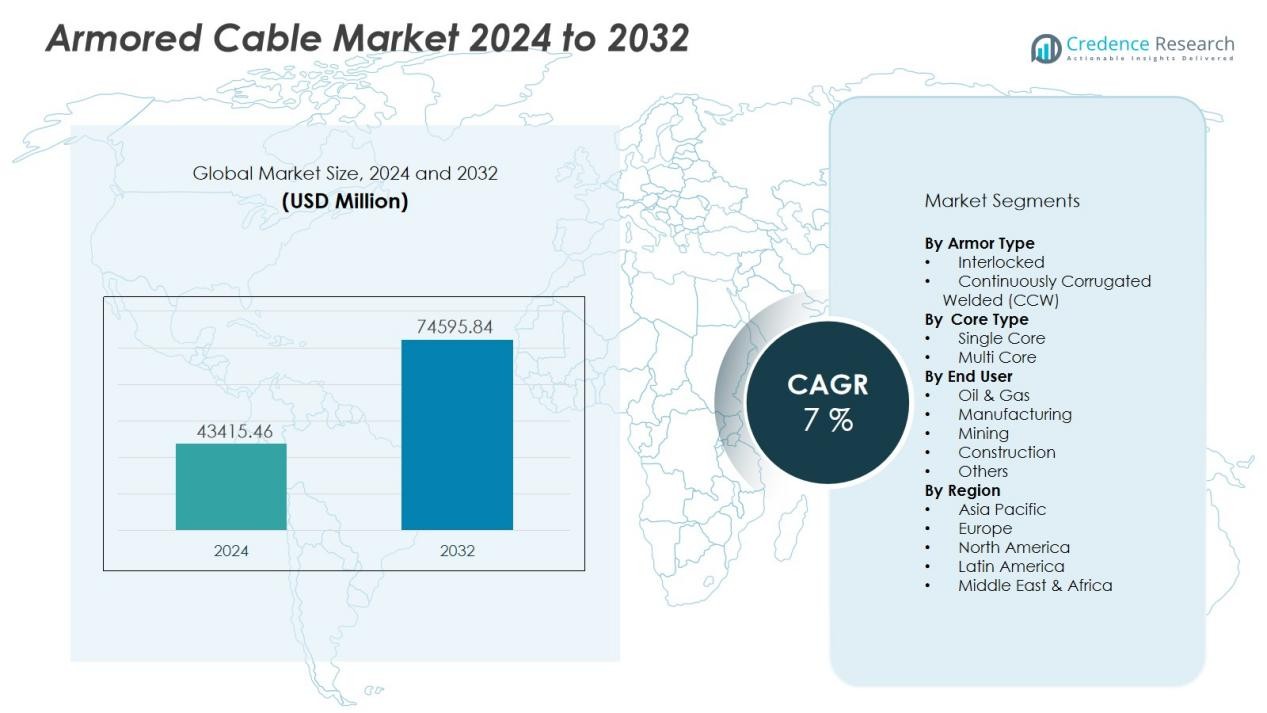

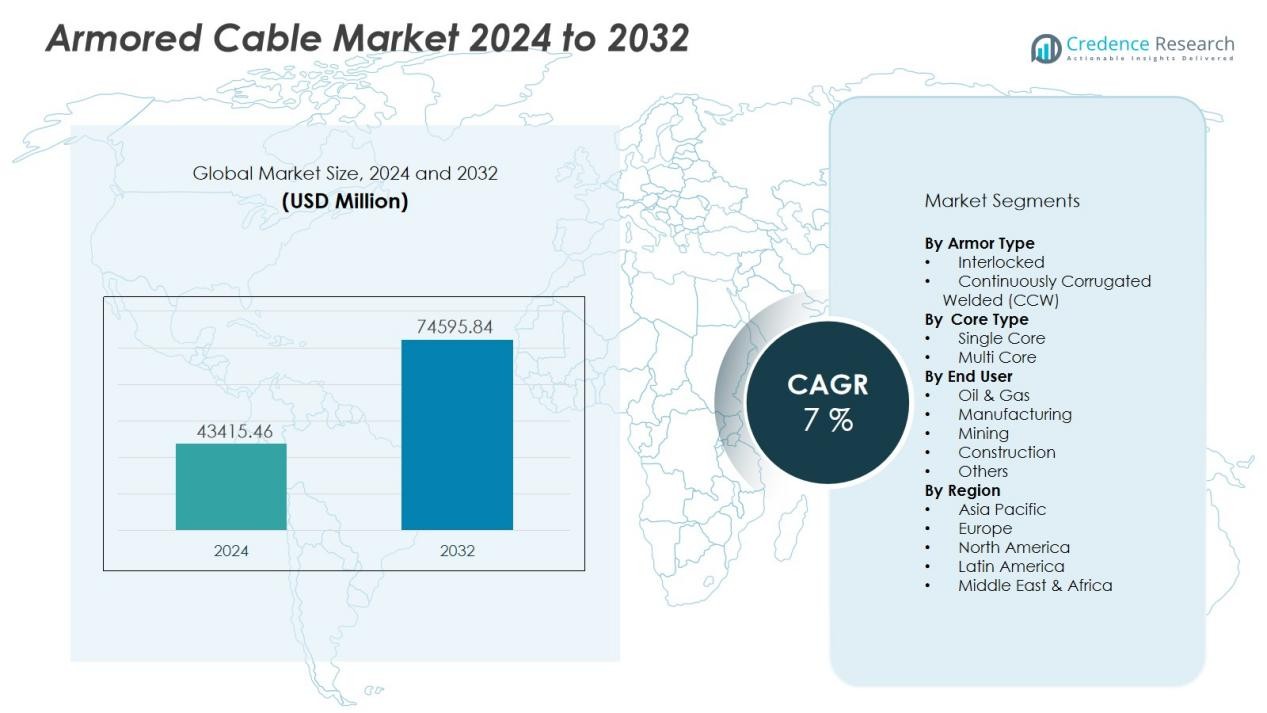

The Armored Cable Market size was valued at USD 43415.46 million in 2024 and is anticipated to reach USD 74595.84 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Armored Cable Market Size 2024 |

USD 43415.46 Million |

| Armored Cable Market, CAGR |

7% |

| Armored Cable Market Size 2032 |

USD 74595.84 Million |

Key growth drivers include increasing investment in electricity distribution and renewable energy projects, where armored cables offer mechanical protection and weather resistance. Additionally, stricter safety regulations and rising urbanization in emerging markets stimulate demand for robust cabling solutions.

Regionally, the Asia-Pacific region stands out as the fastest-growing market, driven by large infrastructure and electrification programs in countries such as China and India. Meanwhile, North America and Europe show steady but more mature growth, focusing on grid modernization and industrial replacement of aging cable systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Armored Cable Market was valued at USD 43,415.46 million in 2024 and is anticipated to reach USD 74,595.84 million by 2032, growing at a CAGR of 7%.

- North America holds 35% of the market share, driven by large infrastructure upgrades, grid modernization, and high demand in commercial construction and data centers.

- Asia-Pacific commands nearly 30% of the market share, supported by rapid urbanization, industrial expansion, and major electrification programs in China and India.

- Europe holds 25% of the market share, with growth driven by grid modernization, offshore wind farm expansions, and industrial automation.

- The key segments include Continuously Corrugated Welded (CCW) armor types, leading the market, and Multi-Core cables, which hold the majority share in core types.

Market Drivers:

Increasing Demand for Power Transmission and Distribution Infrastructure

The growing need for reliable and secure power transmission is a primary driver for the armored cable market. Increasing electricity consumption globally has prompted governments and private enterprises to focus on expanding and upgrading power grids. Armored cables provide the necessary protection against mechanical stress, making them suitable for underground, underwater, and high-risk installations. This is crucial in urban areas where the risk of physical damage is higher.

- For Instance, Prysmian Group acted as a primary contractor for the Viking Link interconnector between the UK and Denmark, which began commercial operations on December 29, 2023. Prysmian was responsible for the design, manufacture, and installation of approximately 1,250 km of submarine cable and 135 km of land cables on the UK side.

Expansion of Renewable Energy Projects

The shift toward renewable energy sources is accelerating the demand for armored cables. Wind, solar, and hydroelectric power plants require efficient and safe power transmission infrastructure. Armored cables are essential in these projects, offering protection against harsh environmental conditions. As renewable energy capacity grows worldwide, armored cables will continue to play a key role in ensuring long-term operational reliability.

- For Instance, Equinor’s Empire Wind 1 project is set to deliver 810 megawatts of offshore wind energy to New York using approximately 46 miles (74 km) of high-voltage export cables.

Growing Industrial Sector and Infrastructure Development

The expansion of industrial sectors such as manufacturing, mining, and oil & gas significantly drives the armored cable market. These industries require durable, high-performance cables to support complex machinery and equipment. Armored cables offer superior durability, fire resistance, and protection against environmental factors, making them ideal for use in challenging industrial environments. Infrastructure development, particularly in emerging economies, further contributes to the rising demand.

Stringent Safety Standards and Regulations

Stricter safety regulations and standards for electrical installations have bolstered the demand for armored cables. Countries across the globe are implementing tougher regulations to prevent electrical accidents, fires, and other hazards. These regulatory frameworks require the use of cables that can withstand extreme conditions, and armored cables are seen as the optimal solution. The increasing focus on safety in both residential and industrial sectors is expected to keep driving market growth.

Market Trends:

Shift toward advanced materials and lightweight designs

Manufacturers in the Armored Cable Market increasingly adopt innovative materials that enhance durability while reducing weight and installation complexity. They build armor with lighter metallic alloys and optimize insulation to deliver high performance under demanding conditions. This approach supports sectors such as utilities and industrial infrastructure that value both protection and ease of deployment. It also enables cable providers to meet stricter fire‑resistance and mechanical‑stress standards across applications. The move improves lifecycle cost efficiency and appeals to customers focused on long‑term reliability.

- For Instance, TE Connectivity has developed carbon nanotube (CNT)-based cables for aerospace applications, including a two-layer CNT tape shield for MIL-STD-1553B data bus systems that provides comparable shielding effectiveness to copper braid at high frequencies (approximately 50 dB at 4 GHz).

Growing role of smart grids, renewable integration and IoT‑centric infrastructure

The armored cable market is responding to broader infrastructure shifts by supporting smart‑grid deployments, renewable‑energy projects and IoT‑enabled installations. Cable systems now supply power to wind farms, solar parks and sensor‑heavy applications where exposure and risk are elevated. It is increasingly common for cables to incorporate features that support fault detection, connectivity and resilience in harsh environments. This trend positions armored cables not just as passive components but as integral parts of modern power and communications ecosystems. Firms operating in the market invest in these capabilities to expand their role in digital‑infrastructure roll‑outs.

- For instance, Nexans has supplied armored 66 kV submarine cables with 127 mm diameter specifications to pioneering offshore wind pilot projects including the Blyth Offshore Demonstrator (UK), which generates 41.5 MW of clean energy capacity from five turbines, serving approximately 34,000 homes since its commissioning in early 2018.

Market Challenges Analysis:

High Upfront Costs and Complex Installation Requirements

The Armored Cable Market faces hurdles from high initial cost of materials and installation. Manufacturers must invest in premium steel or aluminum armoring and robust insulation systems, which push up production cost. Projects in remote or harsh environments demand skilled labour, special equipment, and extended timelines, which raise installation expenses and complicate logistics. Some clients with tight budgets may prefer lower‑cost alternatives. This cost barrier slows adoption especially in emerging and price‑sensitive markets.

Raw Material Volatility, Regulatory Burden and Competitive Pressures

Producers in the armored cable sphere contend with fluctuating raw material prices—steel, aluminium and insulating polymers—which erode margin stability. Manufacturers also must comply with increasingly strict safety and environmental standards, which adds process cost and design complexity. Alternative cable solutions with lower cost or less robust armoring pose competitive threats and may deter buyers from choosing armored variants. Supply chain disruptions amplify these pressures by delaying deliveries or increasing procurement cost. These factors collectively reduce flexibility and challenge growth for the market.

Market Opportunities:

Expansion into Renewable Energy and Smart Infrastructure

The Armored Cable Market presents significant opportunity as utility companies expand renewable‑energy networks. Wind farms, solar parks and other clean‑power installations demand cables that withstand harsh environments, and armored variants meet this need. It allows cable manufacturers to secure contracts in energy‑transmission upgrades and offshore installations. Industrial and commercial projects now prioritise protective cabling, creating new demand streams. Suppliers who adapt product lines to meet these requirements can capture early‑mover advantage.

Penetration in Emerging Regions and Specialized Applications

Emerging economies in Asia‑Pacific, Latin America and Middle East offer high‑growth markets for armored cables. Infrastructure build‑out, urbanisation and grid‑modernisation programmes drive the need for durable cabling solutions. It opens doors for firms to deliver customised products for challenging environments like mining, oil‑&‑gas, marine and underground utilities. Manufacturers that tailor offerings for local conditions and regulatory needs can build long‑term partnerships. Strategic localisation of production and distribution enhances competitiveness in these fast‑growing markets.

Market Segmentation Analysis:

By Armor Type

The market splits by armor type into two main categories: Continuously Corrugated Welded (CCW) and Interlocked. The CCW segment leads thanks to its superior crush resistance and suitability for underground and subsea installations. It supports high‑voltage transmission and corrosion‑prone environments better than interlocked designs. The interlocked type retains appeal for industrial and commercial wiring where flexibility and cost‑effectiveness matter. Manufacturers favour CCW when project demands prioritise extreme durability.

- For instance, Prysmian Group is the cable supplier for the NeuConnect energy project, a 725 km interconnector link between the UK and Germany. Prysmian will supply more than 720 km of high-voltage cable for this project

By Core Type

The core type classification includes Multi Core and Single Core cables. The Multi Core segment commands the majority share because it houses multiple conductors in one protective shield, reducing installation complexity and space needs. It fits large infrastructure, utility and complex industrial applications. The Single Core segment retains relevance in niche zones where high current or dedicated circuits are needed. It remains critical where segmentation of circuits enhances safety or servicing.

- For instance, Southwire’s SIMpull XHHW-2® single-conductor cables rated at 600/1000V achieved maximum ampacity ratings of 430 amps for 500 kcmil configurations under 90°C operating conditions, with minimum bending radius of 12 times cable diameter during installation to ensure circuit integrity in demanding industrial and utility applications.

By End User

End‑user segmentation covers industries such as Oil & Gas, Manufacturing, Mining, Construction, and Others. The Oil & Gas sector holds a dominant position in the market owing to the extreme conditions in drilling, offshore platforms and pipelines that demand robust armored solutions. Manufacturing and mining end‑users follow, given their heavy reliance on durable cables in harsh environments. Construction end‑users drive growth through urban development and infrastructure build‑out. Niche applications under “Others” open incremental opportunities in utilities, transportation and data‑centres.

Segmentations:

By Armor Type

- Interlocked

- Continuously Corrugated Welded (CCW)

By Core Type

By End User

- Oil & Gas

- Manufacturing

- Mining

- Construction

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Region—Leading Share

North America holds approximately 35% of the Armored Cable Market revenue share, driven by large‑scale infrastructure upgrades and rigorous safety standards. The United States contributes a major portion of this regional share, where utilities modernise distribution systems and data‑centre expansion demands advanced cabling. Contractors favour armored cables for underground retrofit work and high‑rise commercial construction where physical protection and code compliance matter. It benefits from long‑standing supply chains and established manufacturer networks, which reduce lead‑time and installation challenges. Growth prospects remain steady thanks to federal funding in grid resilience and renewable‑energy link‑ups.

Asia‑Pacific Region—Fastest Growing and Significant Share

Asia‑Pacific commands near 30% of the Armored Cable Market share, propelled by rapid urbanisation, industrial expansion, and major electrification programs across China and India. Large infrastructure projects in metro rail, offshore wind, and manufacturing clusters demand cables that resist mechanical stress and harsh terrain. It draws strong investment from local government programmes aimed at expanding transmission and distribution networks. Manufacturers in the region scale local production and tailor products to meet regional environmental conditions. Rising project pipelines promise sustained growth and new demand forms.

Europe & Middle East & Africa Regions—Stable Growth Profile

Europe accounts for roughly 25% of the armored‑cable market share, with Middle East & Africa contributing smaller but growing percentages. European growth stems from grid modernisation, offshore wind farm expansions, and industrial automation, which favour armored solutions. It leverages high technical standards and mature installation practices to maintain market share. In the Middle East & Africa, infrastructure build‑out in oil‑and‑gas, mining and utilities offers emerging opportunities despite budget or logistics constraints. It presents a regional mix where specialised environments increase demand for durable, protected cable systems.

Key Player Analysis:

- Belden

- CommScope

- Elsewedy Electric

- Fujikura

- Furukawa Electric

- Helukabel

- Hellenic Group

- Kabelwerk Eupen

- Lapp Group

- Leoni

- LS Cable & Systems

Competitive Analysis:

The competitive landscape of the Armored Cable Market centres on key global players such as Belden Inc., CommScope Inc., Elsewedy Electric Co. S.A.E., Fujikura Ltd., Furukawa Electric Co., Ltd. and HELUKABEL GmbH. These firms deploy strong footprints in engineering, production and global supply, boosting innovation and delivering robust armored‑cable solutions. It drives product competitiveness through differentiated features such as advanced armor constructions, improved mechanical protection and compliance with stringent safety standards. Belden offers crush‑ and impact‑resistant armored cables suited for indoor and direct‑burial applications. CommScope and Elsewedy Electric leverage large‑scale manufacturing and regional availability to meet infrastructure demands. Fujikura and Furukawa Electric emphasise high‑performance materials and custom designs for specialized environments. HELUKABEL supports infrastructure and renewable‑energy sectors with versatile cable variants and global distribution. Firms deepen their competitive edge by optimising supply chains, obtaining certifications and expanding into emerging markets. They pursue strategic partnerships, mergers or capacity expansions to address growing demand and regulatory pressures. This dynamic places pressure on smaller players, raises entry barriers and guides procurement in favour of established brands.

Recent Developments:

- In August 2025, Belden launched next-generation connectivity and cybersecurity products, such as industrial firewalls and extended Ethernet solutions aimed at supporting advanced OT network security requirements.

- In August 2025, CommScope agreed to sell its Connectivity and Cable Solutions business to Amphenol Corporation for $10.5 billion in cash as part of debt-reduction and strategic portfolio reshaping efforts.

Report Coverage:

The research report offers an in-depth analysis based on Armor Type, Core Type, End User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Future Outlook:

- The market will expand into smart‑infrastructure projects where cables carry power and data circuits.

- It will benefit from growth in renewables — wind, solar and hydro installations require rugged cable solutions.

- Manufacturers will develop lighter yet stronger armor materials to ease installation and reduce labour cost.

- It will see rising demand in emerging economies driven by urbanisation and large‑scale grid upgrades.

- Multi‑core armored cables will gain preference due to simplified wiring, space saving and fewer joints.

- It will face opportunities in harsh‑environment sectors such as mining, oil & gas, offshore platforms, and marine.

- Standardisation and stricter safety regulations will force buyers to choose higher‑quality armored cables.

- It will attract aftermarket services like monitoring and diagnostics embedded in cable systems for predictive maintenance.

- Regional production and localisation will increase to reduce supply‑chain risk and meet local content requirements.

- It will present new business models such as cable‑as‑a‑service for infrastructure operators seeking lower upfront cost.