Market Overview

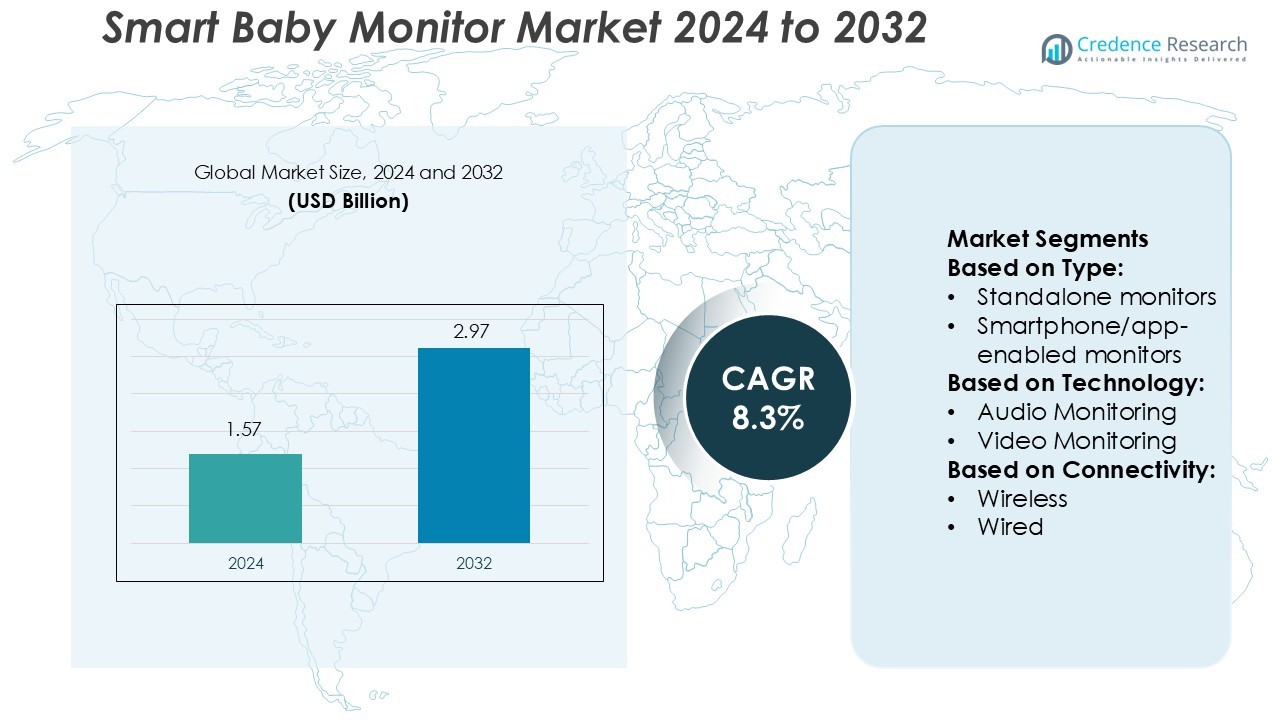

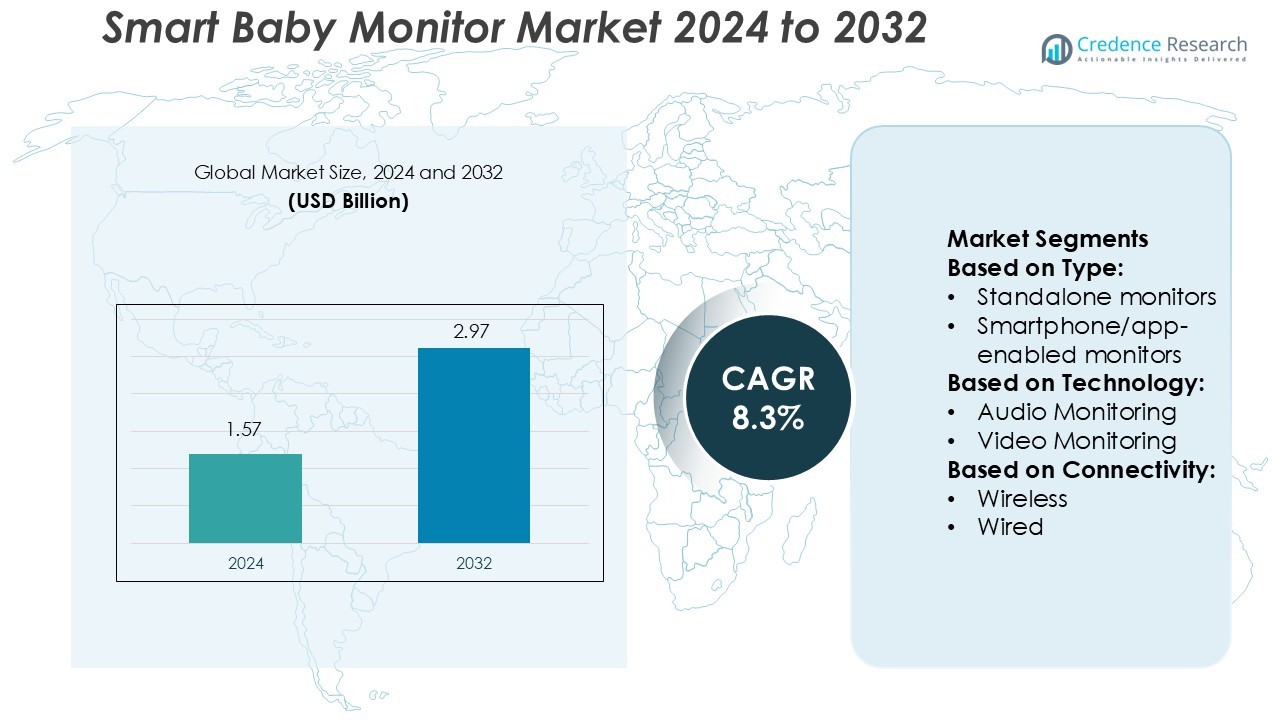

Smart Baby Monitor Market size was valued USD 1.57 billion in 2024 and is anticipated to reach USD 2.97 billion by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Baby Monitor Market Size 2024 |

USD 1.57 Billion |

| Smart Baby Monitor Market, CAGR |

8.3% |

| Smart Baby Monitor Market Size 2032 |

USD 2.97 Billion |

The Smart Baby Monitor Market is dominated by major players such as Masimo’s, Haier Group, Lorex Technology Inc., Angel Care Monitor Incorporation, Maxi-Cosi Inc., Infant Optics, I Baby Labs, Dorel Industries, Inc., Baby Brezza, and Arlo Technologies, Inc. These companies focus on AI-enabled monitoring, enhanced connectivity, and real-time data tracking to strengthen their global presence. North America leads the market with a 35% share, driven by strong consumer awareness, widespread adoption of IoT devices, and the availability of premium smart monitoring solutions. Continuous product innovation, coupled with expanding online retail channels, enables regional manufacturers and global brands to maintain competitive advantages and meet rising demand for advanced infant safety technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Baby Monitor Market was valued at USD 1.57 billion in 2024 and is projected to reach USD 2.97 billion by 2032, growing at a CAGR of 8.3%.

- Rising demand for AI-integrated and IoT-based baby monitors drives market growth, offering real-time health and safety tracking.

- Smart wearable and app-connected monitors are gaining popularity, supported by growing awareness of infant wellness and digital parenting trends.

- North America leads the market with a 35% share, followed by Europe at 28% and Asia Pacific at 25%, driven by urbanization and expanding e-commerce.

- Video monitoring holds the dominant segment share due to higher parental preference for HD visual tracking, while wireless connectivity continues to outperform wired options owing to its flexibility and easy integration with smart home systems.

Market Segmentation Analysis:

By Type

The smartphone/app-enabled monitors segment dominates the Smart Baby Monitor Market, accounting for the largest market share. This dominance is driven by rising smartphone penetration and the convenience of remote access through dedicated apps. Parents prefer app-connected devices for their real-time alerts, video streaming, and two-way communication features. Standalone monitors maintain demand among budget-conscious users, while wearable monitors gain traction due to their health-tracking capabilities, such as heart rate and oxygen monitoring. The trend toward integrated smart home ecosystems further supports growth in smartphone/app-enabled baby monitors.

- For instance, Robert Bosch GmbH manufactures the TDL110 transport data logger, a device that uses Bluetooth Low Energy (BLE) connectivity for configuration and data retrieval.

By Technology

Video monitoring holds the dominant position in the Smart Baby Monitor Market, contributing the highest share among all technologies. Parents increasingly favor video-enabled monitors for real-time visual tracking, night vision, and motion detection capabilities. Audio monitoring remains relevant in low-cost models or secondary devices. However, advanced video systems with HD resolution, AI-driven motion recognition, and cloud storage integration are driving adoption across urban households. The ability to record and review video footage provides reassurance to parents, fueling the continued preference for video monitoring technology.

- For instance, Lorex Technology Inc. offers the 2K Indoor Wi-Fi Security Camera (model W461ASC-E), which is suitable for baby monitoring. This camera delivers 2K (2560×1440) resolution video, has up to 32 feet (10m) of infrared night vision, and provides 2.4 GHz Wi-Fi connectivity.

By Connectivity

Wireless connectivity leads the Smart Baby Monitor Market, securing the largest share due to flexibility and ease of installation. Wi-Fi and Bluetooth-enabled monitors allow seamless integration with smartphones and smart home platforms. The growing reliance on mobile apps and cloud-based monitoring services enhances user convenience and accessibility. Wired systems retain niche applications in settings requiring stable connections or security-conscious users. The demand for wireless smart monitors continues to rise, supported by advancements in network stability, faster data transfer, and enhanced encryption for user data protection.

Key Growth Drivers

Rising Parental Focus on Infant Safety and Health

Parents are increasingly adopting smart baby monitors to ensure real-time tracking of their infants’ safety and health. Features like temperature sensing, sleep pattern analysis, and motion detection enhance confidence among working parents. Continuous innovation in sensor technology and mobile app integration supports early detection of irregularities. For instance, Nanit’s smart monitor includes computer vision algorithms to analyze sleep posture and breathing patterns, providing real-time alerts through its mobile app to improve child safety and reduce parental stress.

- For instance, Angelcare Monitor Incorporation’s AC327 Baby Movement Monitor integrates a non-contact 2.4 GHz wireless sensor pad with four adjustable sensitivity levels, designed to detect a baby’s slightest movements beneath the mattress and alarm after 20 seconds of inactivity.

Integration of AI and IoT in Monitoring Systems

AI and IoT technologies are transforming smart baby monitors into intelligent health assistants. Predictive alerts, automatic sound filtering, and real-time data transmission enhance responsiveness and user experience. IoT-based connectivity allows seamless synchronization with smart home ecosystems. For instance, Cubo Ai’s smart baby monitor integrates AI to recognize face coverage and crying detection, while cloud storage enables secure data sharing across multiple devices, improving the monitor’s utility and convenience for tech-savvy parents.

- For instance, Maxi-Cosi Inc.’s See Pro 360° Baby Monitor employs AI Motion & Sound Detection powered by Zoundream’s CryAssist technology. The monitor offers 2K Ultra HD (2560×1440) HDR video with a 360° pan and 90° tilt field of view.

Growing Penetration of Smartphone-Enabled Ecosystems

The widespread use of smartphones and mobile apps has made baby monitoring accessible and efficient. App-enabled systems allow remote observation and instant notifications, even when parents are away. Cloud-based video storage and two-way communication features further enhance engagement. For instance, Motorola’s Hubble Connected app offers 1080p live video streaming, temperature tracking, and customizable alerts, allowing parents to monitor infants remotely with secure cloud backup and multiple user access through mobile devices.

Key Trends & Opportunities

Expansion of Wearable Baby Monitors

Wearable monitors are gaining traction for their ability to track vital health metrics. They provide real-time data on heart rate, sleep quality, and oxygen saturation. Compact, lightweight designs enhance comfort and accuracy. For instance, Owlet Smart Sock uses pulse oximetry sensors to track heart rate and oxygen levels, transmitting the data through Bluetooth to a smartphone app, opening new opportunities for medical-grade monitoring at home.

- For instance, The Infant Optics DXR-8 PRO system includes a camera unit and a portable parent monitor that pairs via 2.4 GHz FHSS (Frequency-Hopping Spread Spectrum) technology to ensure a secure, hack-proof connection.

Increasing Adoption of Cloud-Integrated Solutions

Manufacturers are adopting cloud integration to store and analyze long-term health data securely. Parents can access historical patterns, receive insights, and share data with pediatricians. For instance, Arlo Baby integrates cloud-based storage for high-definition video and analytics, providing multi-device synchronization and remote access for extended monitoring and early detection of sleep irregularities, enhancing user convenience and scalability.

- For instance, Arlo Baby (model ABC1000) supports 1080p HD video at 30fps, with an 8× digital zoom and CMOS imaging sensor.The unit offers a 110° field of view (adjustable) and night-vision via 940 nm infrared LEDs effective up to 15 feet.

Opportunities in Emerging Markets

Rapid urbanization and increased disposable income in developing regions create growth potential. Awareness campaigns and e-commerce expansion improve product accessibility. For instance, Xiaomi’s affordable smart baby monitors with AI-based night vision and motion detection have gained popularity in Asian markets, providing low-cost solutions that meet growing middle-class demands for advanced baby care technologies.

Key Challenges

Data Privacy and Cybersecurity Concerns

Smart baby monitors connected through Wi-Fi or cloud services pose risks of unauthorized access. Breaches can expose sensitive video and biometric data, undermining consumer trust. For instance, reports of vulnerabilities in certain Wi-Fi-enabled monitors from major brands prompted recalls and firmware updates, highlighting the need for enhanced encryption protocols and secure authentication systems to maintain market credibility.

High Product Costs and Limited Awareness in Developing Regions

Advanced smart monitors with AI and IoT capabilities remain expensive, limiting adoption in price-sensitive markets. Limited digital literacy and awareness about smart monitoring benefits further hinder growth. For instance, premium models like Nanit Pro and Owlet Smart Sock retail above USD 250, restricting penetration among middle-income households and creating opportunities for mid-range alternatives and localized production strategies.

Regional Analysis

North America

North America leads the Smart Baby Monitor Market with a market share of 35%. The region’s growth is driven by high adoption of IoT-based devices, strong internet penetration, and rising awareness of infant health and safety. The U.S. dominates due to the presence of key brands like Motorola and Nanit offering AI-integrated and Wi-Fi-enabled monitors. Increasing working parents and growing preference for real-time monitoring boost product demand. For instance, Nanit’s Smart Baby Monitor with computer vision technology offers sleep analytics and breathing tracking, gaining strong traction among tech-savvy parents in the U.S. and Canada.

Europe

Europe holds a 28% share in the global Smart Baby Monitor Market. The region’s demand is driven by growing disposable incomes, enhanced safety standards, and government emphasis on child well-being. Countries such as Germany, France, and the UK show strong uptake of smart monitors with encrypted connectivity and HD video capabilities. Rising use of app-enabled devices supports market penetration. For instance, Philips Avent launched its Connected Baby Monitor SCF950/00, offering remote access and noise detection through a secure app, enhancing adoption across European households seeking advanced monitoring solutions.

Asia Pacific

Asia Pacific accounts for 25% of the Smart Baby Monitor Market, showing the fastest growth rate globally. The region benefits from a large infant population, urbanization, and rising awareness of smart parenting solutions. China, Japan, and India are major contributors due to expanding e-commerce channels and increasing smartphone users. Affordable and feature-rich models appeal to middle-income consumers. For instance, Xiaomi’s Mijia Smart Baby Monitor integrates AI motion detection and two-way audio, making it popular among digitally connected parents in China and Southeast Asia.

Latin America

Latin America captures a 7% share of the Smart Baby Monitor Market. Growth is supported by expanding internet access, improving economic stability, and increasing awareness of child safety technologies. Brazil and Mexico lead adoption, driven by higher penetration of mobile devices and online retail. Local distributors promote affordable Wi-Fi and app-based models. For instance, D-Link introduced its DCS-850L Wi-Fi Baby Camera, enabling remote HD video streaming and temperature alerts, which gained traction among urban families seeking convenient home monitoring solutions across major Latin American cities.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 5% share of the Smart Baby Monitor Market. Demand is growing in Gulf Cooperation Council (GCC) countries due to high-income levels and rising interest in connected home devices. Smart city initiatives and modern lifestyle adoption are also boosting uptake. In South Africa and the UAE, urban families are increasingly purchasing smart monitors with motion and sound detection. For instance, Motorola’s MBP88 Connect Wi-Fi Video Baby Monitor, featuring two-way communication, has seen rising sales in premium retail and online stores across MEA.

Market Segmentations:

By Type:

- Standalone monitors

- Smartphone/app-enabled monitors

By Technology:

- Audio Monitoring

- Video Monitoring

By Connectivity:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Smart Baby Monitor Market features leading companies such as Masimo’s, Haier Group, Lorex Technology Inc., Angel Care Monitor Incorporation, Maxi-Cosi Inc., Infant Optics, I Baby Labs, Dorel Industries, Inc., Baby Brezza, and Arlo Technologies, Inc. The Smart Baby Monitor Market is highly competitive, driven by continuous innovation and evolving consumer needs. Manufacturers focus on integrating advanced features such as AI-enabled video analytics, biometric tracking, and voice recognition to enhance real-time infant monitoring. Companies are also prioritizing secure data transmission through encrypted cloud storage and mobile app integration for remote access. The growing preference for multifunctional devices that combine sleep tracking, temperature monitoring, and two-way communication supports product differentiation. Strategic partnerships with healthcare providers, retail chains, and e-commerce platforms help expand global reach. Continuous R&D investment and user-centric design innovations remain key factors shaping competitive advantage in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Masimo’s

- Haier Group

- Lorex Technology Inc.

- Angel Care Monitor Incorporation

- Maxi-Cosi Inc.

- Infant Optics

- I Baby Labs

- Dorel Industries, Inc.

- Baby Brezza

- Arlo Technologies, Inc.

Recent Developments

- In June 2024, ASUS announced the launch of new computers, including the stunning ProArt Display 5K and 8K professional range, wellness-focused ASUS VU displays, and flexible ZenScreen displays to encourage professional content creation, entertainment, hybrid work, and well-being.

- In February 2024, Lenovo announced the launch of software, purpose-built AI devices, infrastructure solutions, and introduced two proof-of-concept devices, which stand out as challenging to the traditional PC and smartphone form factors.

- In January 2024, Maxi-Cosi launched the See Pro 360-degree baby monitor, which utilises AI technology called cry assist interpret baby cries helping parents understand their babies needs.

- In August 2023, Masimo, a global leader in non-invasive monitoring technologies, announced the release of the Stork smart home baby monitoring system for the U.S. market.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Connectivity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of AI and IoT will enhance real-time monitoring accuracy and parental convenience.

- Integration of biometric sensors will enable continuous health tracking and predictive alerts for infants.

- Cloud-based and app-connected systems will expand remote accessibility for parents and caregivers.

- Voice-enabled controls and compatibility with smart home ecosystems will improve device functionality.

- Demand for wearable baby monitors will rise due to compact design and mobility benefits.

- Data security and privacy-focused solutions will gain traction among tech-conscious consumers.

- Eco-friendly materials and energy-efficient devices will attract sustainability-focused buyers.

- Expansion of e-commerce and online retail will accelerate global product availability.

- Collaboration between healthcare providers and baby monitor brands will drive medical-grade innovation.

- Regional players will invest in affordable smart monitors to cater to middle-income households worldwide.