Market Overview

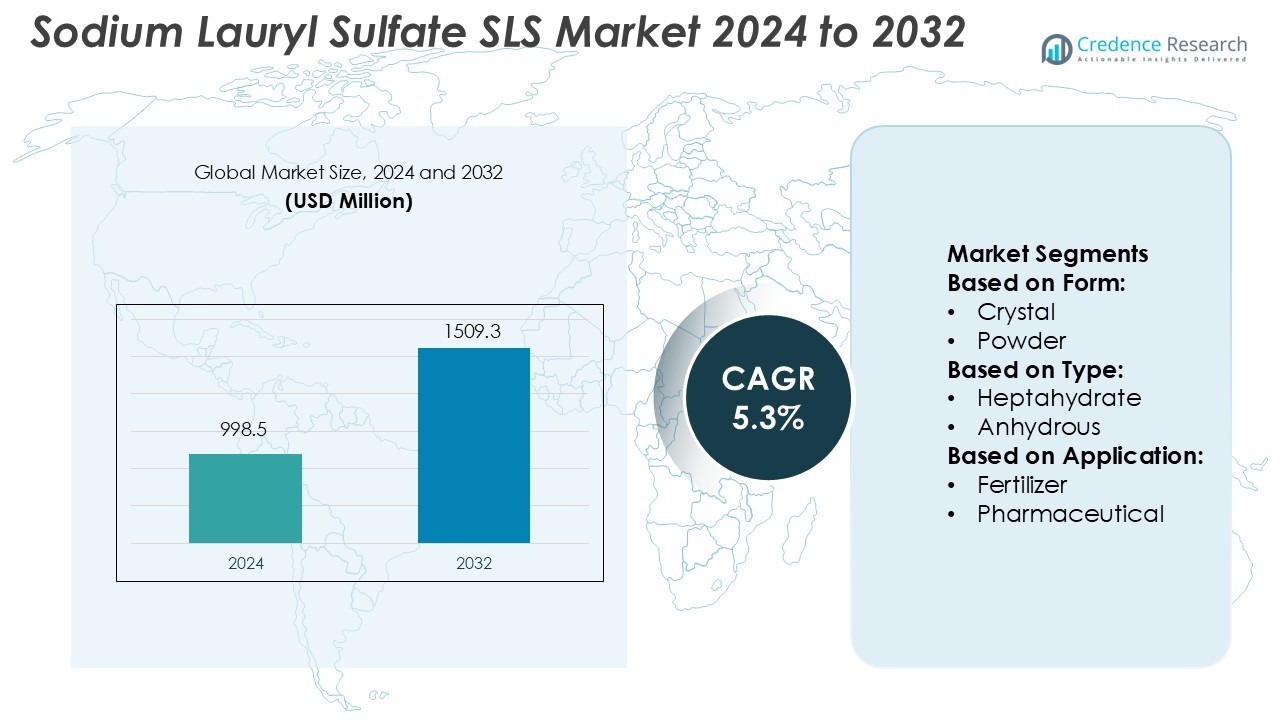

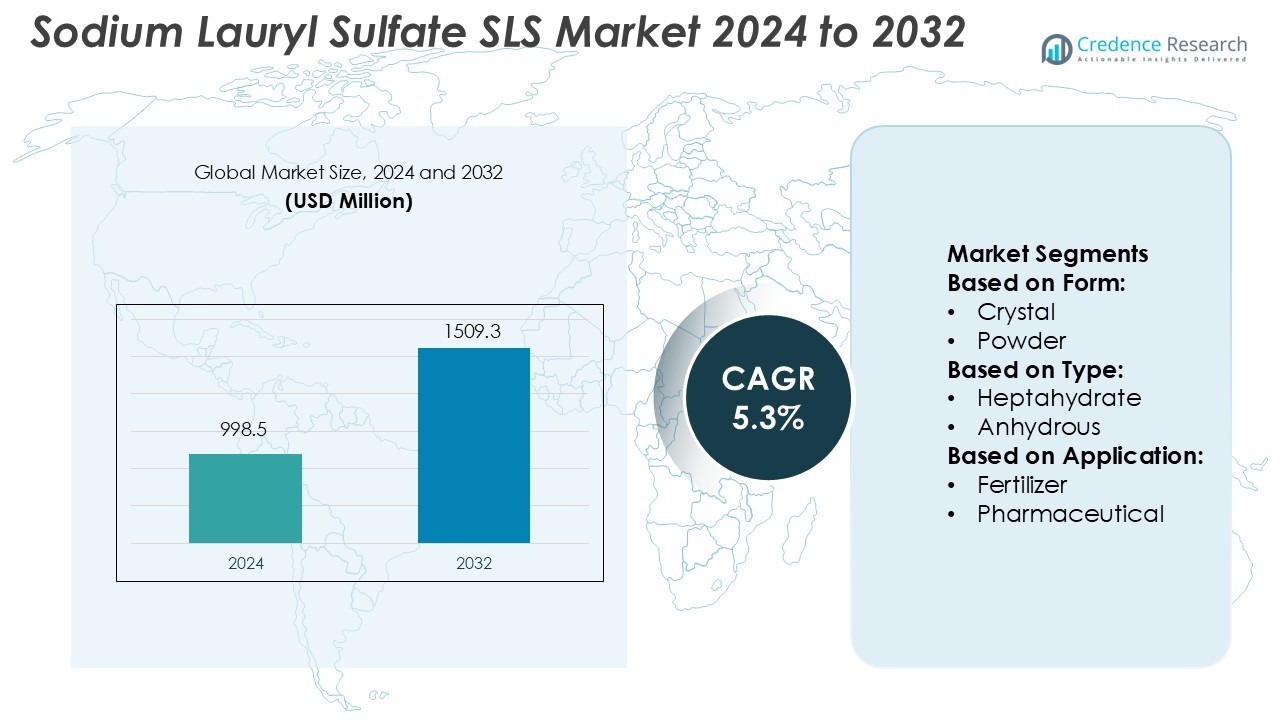

Sodium Lauryl Sulfate (SLS) Market size was valued USD 998.5 million in 2024 and is anticipated to reach USD 1509.3 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Lauryl Sulfate (SLS) Market Size 2024 |

USD 998.5 Million |

| Sodium Lauryl Sulfate (SLS) Market, CAGR |

5.3% |

| Sodium Lauryl Sulfate (SLS) Market Size 2032 |

USD 1509.3 Million |

The Sodium Lauryl Sulfate (SLS) market features strong competition among global leaders such as BASF SE, Solvay, Stepan Company, Clariant Corp., Galaxy Surfactants, Croda International, Kao Corporation, Oxiteno, Xiamen Ditai Chemical Co., Ltd., and Melan Chemical Co., Ltd. These companies emphasize innovation, sustainability, and production efficiency to strengthen market presence. Advanced formulations and eco-friendly surfactants drive product differentiation across personal care, household, and industrial cleaning applications. Asia-Pacific leads the global market with a 34.6% share, supported by large-scale manufacturing capacity, cost-effective raw materials, and expanding consumer markets in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sodium Lauryl Sulfate (SLS) Market was valued at USD 998.5 million in 2024 and is projected to reach USD 1509.3 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- Growing demand for SLS in personal care, detergents, and industrial cleaning products drives market expansion, supported by its strong foaming and emulsifying properties.

- Sustainable and bio-based SLS formulations are emerging as key trends, aligning with environmental regulations and consumer preference for eco-friendly products.

- The market is highly competitive, with leading players investing in innovation and efficiency to strengthen their global presence across multiple applications.

- Asia-Pacific dominates with a 34.6% share, driven by large-scale manufacturing and rising hygiene awareness, while the crystal form segment leads overall usage due to superior solubility and high performance in household and cosmetic formulations.

Market Segmentation Analysis:

By Form

The crystal form dominates the Sodium Lauryl Sulfate (SLS) market, holding a 44.3% share in 2024. Its superior solubility, consistent texture, and stability make it ideal for liquid detergents, shampoos, and personal care formulations. The crystalline structure ensures high foaming ability and uniform performance across product lines. The powder and granule forms follow closely, serving industrial and household cleaning applications. Increasing consumer demand for high-performance cleansing agents in the cosmetics and hygiene sectors continues to drive the adoption of the crystal form.

- For instance, BASF’s “Kolliphor® SLS” grade offers a bulk density of 0.61 g/mL for the granular variant and 0.28 g/mL for the fine powder, enabling enhanced dispersion in shampoo formulations.

By Type

The anhydrous type leads the market with a 47.6% share in 2024 due to its excellent moisture control and long shelf life. This type is preferred in applications requiring stable surfactant properties, such as toothpaste, pharmaceutical formulations, and detergents. Anhydrous SLS also exhibits enhanced compatibility with additives and fragrances, making it ideal for concentrated formulations. Growing demand for efficient and durable surfactants in industrial cleaning and healthcare applications supports its dominance across global production facilities.

- For instance, Stepan’s product STEPANOL® ME‑DRY (an anhydrous sodium lauryl sulfate powder) offers an actives content of 90% minimum. It also specifies sodium sulfate impurity at maximum 3.5%.

By Application

The detergent and cleaning products segment dominates the SLS market with a 41.2% share in 2024. Sodium Lauryl Sulfate’s strong emulsifying and foaming properties make it essential in shampoos, dishwashing liquids, and surface cleaners. The pharmaceutical and food & beverage sectors are emerging users, leveraging SLS for emulsification and controlled-release functions. Rising hygiene awareness, rapid urbanization, and growth in personal care product consumption globally continue to propel the detergent and cleaning application segment as the largest revenue contributor.

Key Growth Drivers

- Expanding Personal Care and Cosmetic Applications

The growing use of Sodium Lauryl Sulfate (SLS) in shampoos, body washes, and facial cleansers is a major driver. Its strong foaming, cleansing, and emulsifying properties make it a preferred ingredient for effective formulations. Rising global demand for affordable personal care products, especially in emerging economies, supports market expansion. Manufacturers are focusing on mild formulations with controlled concentrations of SLS to meet skin safety and regulatory standards, further strengthening its adoption across cosmetic and hygiene product lines.

- For instance, Solvay’s “Miracare® SLB” liquid-surfactant system demonstrated that 74% of panelists perceived stronger fragrance intensity at 0.08 hours compared to a conventional benchmark.

- Rising Industrial and Household Cleaning Demand

The increase in cleaning and hygiene awareness worldwide significantly drives SLS demand. It serves as a vital surfactant in detergents, dishwashing liquids, and surface cleaners, offering efficient grease removal and consistent foaming action. The rapid growth of the e-commerce and hospitality sectors has boosted consumption of cleaning products, supporting market stability. Manufacturers continue investing in cost-effective, high-purity SLS production to cater to both household and industrial applications, driving the market’s long-term growth.

- For instance, Galaxy’s “SLS Needles (Blue)” grade of Sodium Lauryl Sulfate is specified with a minimum active matter content of 92 % by mass, a maximum moisture content of 2.5 % by mass, and a bulk density range of 0.50-0.70 g/mL.

- Expanding Use in Pharmaceutical and Food Sectors

Sodium Lauryl Sulfate is increasingly used in pharmaceutical formulations as an emulsifier and solubilizer, improving drug absorption and stability. In the food sector, it acts as a processing aid in instant powders and beverages. Growing pharmaceutical manufacturing and strict product quality standards encourage the inclusion of SLS for consistency and performance. The versatility of SLS across non-toxic concentration ranges and its regulatory acceptance by bodies such as the FDA continue to expand its application base globally.

Key Trends & Opportunities

- Shift Toward Sustainable and Bio-Based Surfactants

A growing trend in the SLS market is the development of bio-based and biodegradable formulations. Manufacturers are investing in plant-derived SLS produced from natural fatty alcohols to meet environmental and consumer safety demands. This transition aligns with global sustainability goals and stricter chemical regulations. Companies adopting eco-friendly surfactants can capitalize on expanding opportunities in green personal care, household cleaning, and pharmaceutical formulations, reinforcing their competitive positioning in both developed and emerging markets.

- For instance, Ditai’s technical grade Sodium Lauryl Sulfate (SLS, K12) offers a minimum active-matter value of 95.0 %, a maximum allowable sodium sulfate content of 3.0 %, and maximum moisture content of 3.0 % for its powder grade.

- Increasing R&D Investments for Product Innovation

Producers are prioritizing research and innovation to improve the efficiency and skin compatibility of SLS. Investments in low-irritation formulations and hybrid surfactants combining SLS with mild co-surfactants are gaining traction. Advanced processing technologies, including controlled crystallization and purification systems, help achieve higher purity levels suited for pharmaceutical-grade products. These innovations allow manufacturers to expand into specialized markets while addressing consumer demand for safer, high-performance cleaning and personal care ingredients.

- For instance, Croda’s newly patented “Star Polymer” non-ionic surfactant molecule is built with 100 % bio-renewable ethylene oxide derived from biomass and was recognised with the ICIS Surfactants Product Innovation Award.

Key Challenges

- Health and Environmental Concerns

One of the main challenges in the SLS market is rising concern regarding skin irritation and ecological impact. Prolonged exposure can lead to dryness or sensitivity, particularly in personal care products. Additionally, conventional SLS production from petrochemical sources raises environmental sustainability issues. Manufacturers face regulatory scrutiny and growing consumer preference for sulfate-free alternatives. To overcome this, companies must adopt greener production methods and improve safety testing to maintain compliance and consumer trust.

- Volatility in Raw Material Prices

Fluctuating costs of raw materials such as lauryl alcohol and sulfur trioxide pose a challenge for SLS manufacturers. Price volatility affects production costs and profit margins, particularly for small and medium-sized producers. Supply chain disruptions and geopolitical tensions further impact material availability and logistics. To mitigate these challenges, companies are diversifying sourcing strategies, investing in localized production facilities, and adopting long-term supplier agreements to ensure consistent quality and cost stability

Regional Analysis

North America

North America holds a 28.4% share of the Sodium Lauryl Sulfate (SLS) market in 2024, driven by strong demand across personal care, pharmaceutical, and household cleaning sectors. The United States dominates regional consumption, with established cosmetics and detergent manufacturers emphasizing performance-based surfactants. Increased awareness of hygiene and sustainable ingredients also supports market growth. Ongoing research into bio-based SLS formulations provides new opportunities for product innovation. The region’s advanced regulatory framework and focus on eco-friendly surfactants encourage investments from global producers seeking stable and high-value markets.

Europe

Europe accounts for 26.7% of the global SLS market share, supported by a mature cosmetics and home care industry. Countries such as Germany, France, and the U.K. drive demand through premium skincare and detergent products. The European Union’s stringent chemical safety standards promote the adoption of high-purity and environmentally compliant SLS formulations. Growth is also supported by strong R&D initiatives focusing on biodegradable surfactants. Despite the regulatory push toward sulfate-free alternatives, consistent industrial use and the rise in personal hygiene awareness continue to sustain market demand.

Asia-Pacific

Asia-Pacific leads the global Sodium Lauryl Sulfate market with a 34.6% share in 2024. Rapid industrialization, expanding population, and rising disposable incomes fuel strong demand across personal care and cleaning applications. China, India, Japan, and South Korea remain the largest contributors, supported by large-scale detergent production and export activities. The region benefits from low-cost raw materials and manufacturing capabilities, making it a hub for global supply. Increasing adoption of SLS in pharmaceuticals and processed food industries further accelerates growth, while regional companies invest in capacity expansions to meet surging domestic demand.

Latin America

Latin America holds an 8.1% share of the Sodium Lauryl Sulfate market, driven by growing detergent and personal care product consumption. Brazil and Mexico lead regional demand, supported by expanding consumer markets and increasing urbanization. Rising middle-class incomes and hygiene awareness further enhance SLS-based product penetration. The region is witnessing investments from international surfactant producers establishing local distribution and production facilities. Despite economic fluctuations, consistent demand from household cleaning and food applications ensures steady market performance across key Latin American economies.

Middle East & Africa

The Middle East & Africa region captures a 5.2% share of the global SLS market in 2024. Growth is supported by rising consumption of detergents, cosmetics, and industrial cleaners in countries such as Saudi Arabia, South Africa, and the UAE. Expanding retail and hospitality sectors further increase product utilization. Manufacturers are focusing on cost-effective formulations to meet regional price sensitivity. Additionally, the growth of pharmaceutical manufacturing hubs and investments in chemical processing industries enhance market potential, positioning the region as an emerging growth area for SLS producers.

Market Segmentations:

By Form:

By Type:

By Application:

- Fertilizer

- Pharmaceutical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sodium Lauryl Sulfate (SLS) market is highly competitive, with major players including BASF SE, Melan Chemical Co., Ltd., Stepan Company, Solvay, Galaxy Surfactants, Clariant Corp., Xiamen Ditai Chemical Co., Ltd., Croda International, Oxiteno, and Kao Corporation. The Sodium Lauryl Sulfate (SLS) market is characterized by strong competition, driven by innovation, capacity expansion, and sustainability initiatives. Manufacturers are focusing on developing high-purity, biodegradable surfactants to meet evolving environmental standards and consumer preferences. Growing demand from the personal care, pharmaceutical, and cleaning product sectors encourages continuous investment in research and production efficiency. Companies are integrating advanced purification and crystallization technologies to enhance performance, reduce impurities, and improve product safety. Strategic collaborations, raw material optimization, and regional expansion also play vital roles in maintaining competitiveness and ensuring long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Melan Chemical Co., Ltd.

- Stepan Company

- Solvay

- Galaxy Surfactants

- Clariant Corp.

- Xiamen Ditai Chemical Co., Ltd.

- Croda International

- Oxiteno

- Kao Corporation

Recent Developments

- In January 2025, BASF introduced biodegradable surfactant concepts as alternatives to SLS at Cosmet’Agora 2025, positioning them as climate-adaptive beauty solutions.

- In May 2024, Grasim Industries Ltd launched EcoSodium, an eco-friendly solution sourced from extracted Sodium Sulphate during Viscose Staple Fiber production. By minimizing wastewater discharge, EcoSodium reduces environmental impact. Compliant with REACH and ZDHC MRSL standards, it ensures responsible sourcing and manufacturing.

- In November 2023, the USFDA approved Stride’s generic version of the Suprep Bowel Prep Kit. The kit contains sodium sulfate, potassium sulfate, and magnesium sulfate.

- In September 2023, Cinis Fertilizer announced plans to build a new sodium sulfate creation site in Hopkinsville, Kentucky. They partnered with Ascend Elements to obtain sodium sulfate for the project.

Report Coverage

The research report offers an in-depth analysis based on Form, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see growing adoption of bio-based and biodegradable SLS formulations.

- Rising demand from personal care and household cleaning sectors will sustain steady growth.

- Technological advancements will improve product purity and reduce irritation potential.

- Manufacturers will expand production capacities in Asia-Pacific to meet global demand.

- Regulatory focus on environmental compliance will drive green manufacturing initiatives.

- Pharmaceutical and food applications will offer new opportunities for specialized SLS grades.

- Strategic mergers and collaborations will enhance global supply chain efficiency.

- Research into sulfate-free alternatives will push innovation toward milder surfactant systems.

- Increasing consumer awareness of hygiene and sustainable ingredients will influence product development.

- Continuous R&D investments will strengthen performance efficiency and broaden industrial applications.