Market Overview

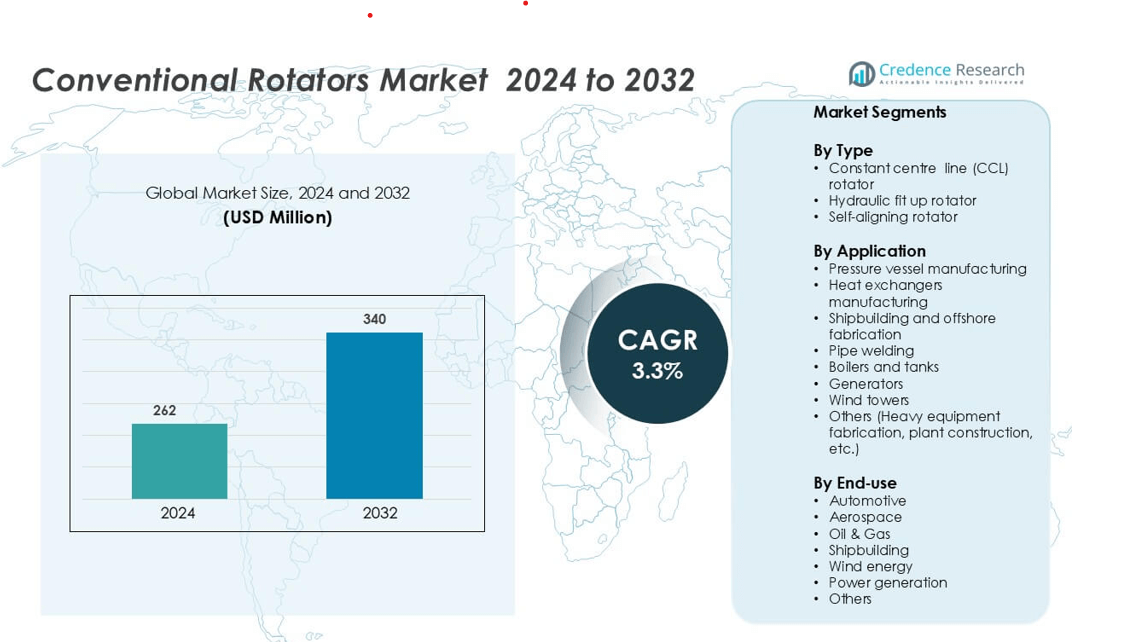

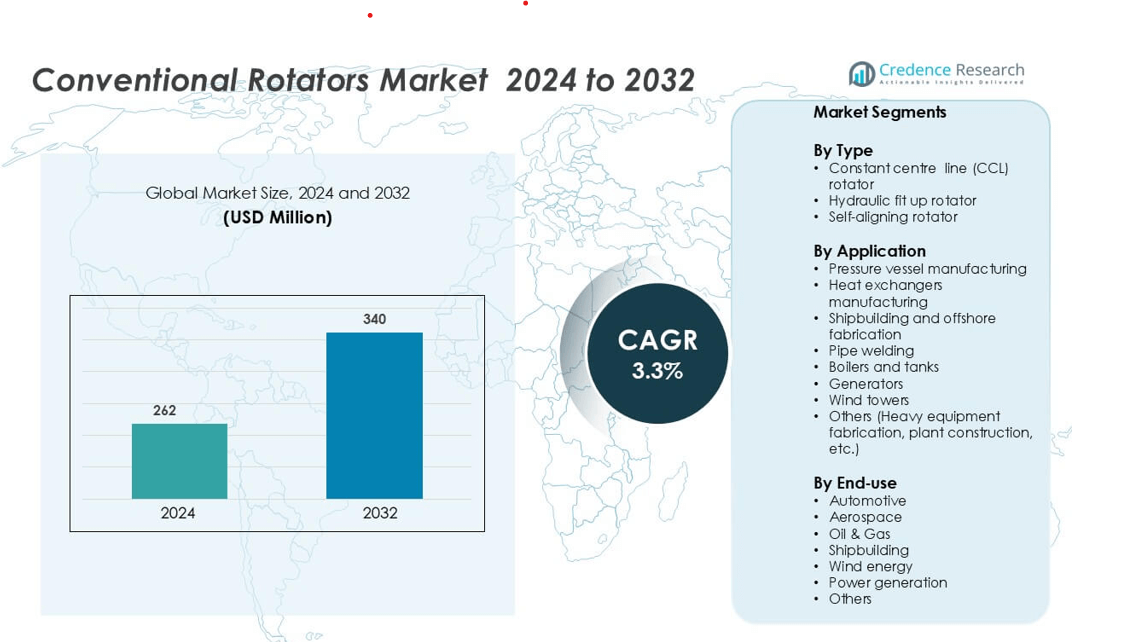

Conventional Palletizers Market was valued at USD 262 million in 2024 and is anticipated to reach USD 340 million by 2032, growing at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conventional Rotators Market Size 2024 |

USD 262 million |

| Conventional Rotators Market, CAGR |

3.3% |

| Conventional Rotators Market Size 2032 |

USD 340 million |

The conventional rotators market features prominent players such as Huaheng Automation, KUKA Robotics, Key Plant Automation, Cascade Corporation, Anvin Engineers, Amin Machinery, Cubuilt Engineers, Innovic Technology, Intermercato, and Indexator. These companies compete through technological innovation, automation integration, and global service networks, catering to industries like oil and gas, power generation, and shipbuilding. Asia-Pacific leads the market with a 35% share in 2024, driven by large-scale industrialization, expansion of renewable energy projects, and the presence of major fabrication hubs in China, Japan, and India. Continuous investment in automated welding solutions reinforces the region’s dominant position globally

Market Insights

- The global conventional rotators market was valued at USD 262 million in 2024 and is projected to grow at a CAGR of 3.3% during 2025–2032.

- Increasing demand for automation in heavy fabrication and welding processes drives market growth across power generation, oil and gas, and shipbuilding industries.

- Key trends include the integration of smart controls, IoT-enabled monitoring, and robotic-assisted welding systems to enhance precision and productivity.

- The market is moderately competitive, with leading players such as Huaheng Automation, KUKA Robotics, and Key Plant Automation focusing on advanced drive technologies and customized solutions.

- Asia-Pacific dominates the market with a 35% share, while the self-aligning rotator segment leads with over 45% share, supported by rapid industrialization and expansion of renewable energy fabrication in China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The self-aligning rotator segment held the dominant share in the conventional rotators market, accounting for over 45% in 2024. Its popularity stems from the ability to automatically adjust to varying diameters without manual intervention, ensuring uniform rotation and higher operational safety. These rotators are extensively used in large cylindrical fabrications such as pressure vessels and wind towers. Their efficiency in handling heavy-duty welding tasks drives demand across fabrication plants, as industries increasingly adopt automated alignment systems to minimize setup time and improve production accuracy.

- For instance, Huaheng Automation’s HGZ series self-aligning rotators can handle loads up to 600 tonnes with independent drive control and automatic diameter adjustment ranging from 1,000 mm to 8,500 mm, ensuring precision rotation and reduced setup time for heavy fabrication projects.

By Application

Pressure vessel manufacturing represented the leading application segment with a share exceeding 30% in 2024. The segment’s growth is driven by increased demand from energy, chemical, and petrochemical sectors for precision-engineered vessels. Conventional rotators provide stable rotation and enhanced weld quality for large cylindrical tanks and vessels. Their integration helps reduce manual handling and welding defects, making them vital in high-pressure and high-temperature manufacturing processes. The expansion of oil and gas refinery projects and power generation infrastructure continues to strengthen this segment’s market dominance.

- For instance, Key Plant Automation supplied heavy-duty rotators capable of rotating vessels weighing up to 1,200 tonnes for use in refinery pressure vessel fabrication, achieving precise welding accuracy through variable frequency drive (VFD) synchronization and digital load monitoring systems.

By End-use Industry

The oil and gas industry emerged as the dominant end-use sector, capturing nearly 38% of the market share in 2024. The sector relies on conventional rotators for assembling storage tanks, pressure vessels, and long pipelines, where consistent weld quality and high productivity are essential. Rising global refinery capacity expansions and offshore project developments are fueling product adoption. The growing preference for automated welding solutions that improve operational efficiency and safety standards further supports the segment’s growth, especially in large-scale fabrication and maintenance activities.

Key Growth Drivers

Expanding Adoption in Heavy Fabrication Industries

The growing demand for automation and precision in heavy fabrication industries is a key driver for the conventional rotators market. Manufacturers across oil and gas, power generation, and shipbuilding sectors are increasingly using rotators to improve welding quality, reduce manual intervention, and enhance production consistency. These systems ensure stable rotation of large cylindrical components such as boilers, tanks, and wind towers, minimizing material distortion and welding errors. Additionally, the rise in infrastructure and industrial projects in emerging economies is creating new installation opportunities. The ability of conventional rotators to handle heavy-duty workloads efficiently while reducing labor dependency continues to strengthen their adoption across global fabrication facilities.

- For instance, KUKA robots are used in general metal industry applications, including for large items like textile machine rotary drums diameter 1.2m, 22mm thickness.

Rising Investments in Renewable Energy Infrastructure

The global shift toward renewable energy, particularly wind power generation, is driving demand for rotators used in tower and nacelle fabrication. Conventional rotators support the production of wind towers by providing accurate alignment and steady rotation during welding and assembly. As nations aim to meet carbon neutrality goals, wind energy capacity additions are increasing rapidly, boosting demand for precision fabrication tools. Rotators play a critical role in ensuring structural integrity and reducing fabrication time for large steel sections. The integration of automated control systems and improved load-handling capacity further enhances productivity. This trend positions conventional rotators as essential equipment in renewable energy manufacturing hubs across Europe, China, and the United States.

- For instance, Huaheng Automation supplied its self-aligning rotators to a wind tower fabrication plant in Jiangsu Province, China, enabling the rotation of tower sections weighing up to 500 tonnes with synchronized servo-controlled precision during automated welding operations.

Technological Advancements and Process Automation

Technological improvements in drive systems, control panels, and load-balancing mechanisms are significantly enhancing rotator performance. The integration of variable frequency drives (VFDs), digital controllers, and advanced sensors allows smoother rotation, improved torque control, and higher operational safety. Automated and programmable rotators enable manufacturers to handle diverse workpiece geometries with minimal manual adjustment, cutting setup times substantially. Companies are also investing in Industry 4.0-ready systems that support remote monitoring and predictive maintenance, further improving production efficiency. These innovations reduce human errors, enhance consistency in weld quality, and lower long-term operational costs. The adoption of such smart manufacturing equipment is reinforcing the growth trajectory of the conventional rotators market globally.

Key Trends & Opportunities

Growing Integration of Automation and Robotics

Automation and robotics are reshaping welding and fabrication processes, presenting new opportunities for the conventional rotators market. Modern rotators are being integrated with robotic welding systems to improve precision, reduce downtime, and ensure uniform weld seams. Manufacturers are developing hybrid systems combining self-aligning rotators with automated welding arms, particularly for large-diameter vessels and wind tower sections. The use of robotics also enhances operator safety and allows for continuous operation in high-temperature or hazardous environments. As industries focus on digital transformation, the adoption of robot-integrated rotator solutions is expected to expand, offering significant efficiency and quality improvements.

- For instance, KUKA Robotics introduced its KR CYBERTECH ARC series integrated with synchronized rotator systems capable of achieving weld path accuracy within ±0.04 mm, significantly enhancing consistency in high-volume automated fabrication lines for pressure vessels and structural components.

Expansion in Offshore and Shipbuilding Applications

The shipbuilding and offshore fabrication sectors present major growth opportunities due to rising investments in maritime trade and offshore oil exploration. Conventional rotators facilitate efficient welding of heavy cylindrical sections such as ship hulls, pontoons, and pressure modules used in offshore platforms. Their high load-bearing capacity and adjustable rotation speed enable precise assembly of large marine structures. Countries in Asia-Pacific, including South Korea, China, and Japan, are leading in shipbuilding automation, creating consistent demand for advanced rotator systems. The continued expansion of global offshore energy projects ensures strong, long-term prospects for this application segment.

- For instance, Huaheng’s products are explicitly stated to be used in the offshore and shipbuilding industries, which includes the fabrication of LNG carriers and offshore rigs.

Key Challenges

High Initial Investment and Maintenance Costs

The high capital requirement for installing conventional rotators limits adoption among small and medium-sized manufacturers. These systems often involve complex drive assemblies, heavy-duty rollers, and automated control units, raising upfront costs. Additionally, maintenance and calibration require skilled technicians, adding to operational expenses. In industries with limited budgets, the return on investment can be slow, especially in low-volume fabrication operations. Manufacturers are addressing this challenge by offering modular, cost-optimized designs and leasing options, but cost barriers remain a key restraint for broader market penetration.

Shortage of Skilled Labor for Operation and Maintenance

Despite automation, conventional rotators still require skilled personnel for setup, alignment, and maintenance tasks. The shortage of qualified operators and technicians in welding automation poses a challenge to efficient system utilization. Improper handling or calibration can lead to misalignment, reduced weld quality, or equipment wear. Many developing regions face a widening skill gap due to limited vocational training in advanced fabrication technologies. This challenge underscores the need for workforce development initiatives and operator training programs, as the efficiency and longevity of rotator systems depend heavily on proper human oversight.

Regional Analysis

North America

North America held a 27% share of the conventional rotators market in 2024, driven by strong demand from the oil and gas, power generation, and shipbuilding industries. The United States remains the leading market, supported by continuous infrastructure modernization and industrial automation initiatives. Manufacturers in the region are integrating advanced control systems and digital monitoring features into rotators to improve precision and efficiency. The growing focus on renewable energy projects, including wind tower fabrication, further fuels equipment demand. Additionally, the presence of established fabrication equipment suppliers ensures steady market expansion across the U.S. and Canada.

Europe

Europe accounted for 24% of the global conventional rotators market share in 2024, supported by high adoption in shipbuilding, offshore, and wind energy fabrication. Germany, Italy, and the Netherlands lead in deploying automated welding solutions for heavy components. Stringent environmental standards and strong industrial automation policies drive the use of energy-efficient rotator systems. European manufacturers are focusing on integrating smart sensors and digital alignment controls to reduce operational downtime. Expanding offshore wind projects in the North Sea and rising demand for heavy-duty equipment in industrial plants continue to strengthen regional growth prospects.

Asia-Pacific

Asia-Pacific dominated the conventional rotators market with a 35% share in 2024, fueled by rapid industrialization and large-scale infrastructure projects. China, Japan, and India are major contributors, driven by growing investments in shipbuilding, oil refining, and wind energy fabrication. The region benefits from strong manufacturing bases and government support for industrial automation. Increasing demand for automated welding solutions in power generation and heavy machinery sectors further accelerates adoption. Expanding offshore and onshore fabrication activities in China and South Korea ensure Asia-Pacific’s continued leadership in production and consumption of conventional rotators globally.

Latin America

Latin America captured 8% of the global conventional rotators market share in 2024, supported by expansion in oil and gas and energy infrastructure. Brazil and Mexico are key contributors, with rising adoption of automated fabrication systems in refineries, pressure vessel manufacturing, and heavy equipment sectors. The modernization of industrial facilities and foreign investments in renewable energy projects further promote market growth. Manufacturers are targeting cost-effective and durable rotator solutions to cater to regional industrial needs. Steady recovery in the construction and energy industries is expected to enhance Latin America’s market share over the forecast period.

Middle East & Africa

The Middle East & Africa region held a 6% share of the conventional rotators market in 2024, primarily driven by the oil and gas and power generation sectors. The Gulf countries, led by Saudi Arabia and the UAE, are investing heavily in new refinery, pipeline, and storage tank projects. These initiatives boost demand for heavy-duty rotators capable of handling large cylindrical components. African nations are gradually adopting industrial automation to support power and construction industries. Strategic partnerships between international suppliers and regional fabricators are helping improve equipment accessibility and operational standards across the region.

Market Segmentations:

By Type

- Constant center line (CCL) rotator

- Hydraulic fit up rotator

- Self-aligning rotator

By Application

- Pressure vessel manufacturing

- Heat exchangers manufacturing

- Shipbuilding and offshore fabrication

- Pipe welding

- Boilers and tanks

- Generators

- Wind towers

- Others (Heavy equipment fabrication, plant construction, etc.)

By End-use

- Automotive

- Aerospace

- Oil & Gas

- Shipbuilding

- Wind energy

- Power generation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the conventional rotators market is characterized by a mix of global automation leaders and specialized fabrication equipment manufacturers focusing on innovation, precision, and customization. Key players such as Huaheng Automation, KUKA Robotics, Key Plant Automation, and Cascade Corporation emphasize advanced drive systems, digital control panels, and automated alignment technologies to improve welding efficiency and safety. Companies like Anvin Engineers, Amin Machinery, and Cubuilt Engineers are expanding their regional presence by offering cost-effective solutions tailored for heavy fabrication industries. Strategic collaborations, product upgrades, and after-sales service enhancements remain central to maintaining competitiveness. Leading manufacturers are also integrating Industry 4.0 technologies, including IoT-based monitoring and predictive maintenance, to differentiate their product portfolios. Meanwhile, partnerships with end-use sectors such as shipbuilding, oil and gas, and renewable energy continue to create opportunities for sustained revenue growth and broader market penetration worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huaheng Automation

- Anvin Engineers

- KUKA Robotics

- Innovic Technology

- Cascade Corporation

- Key Plant Automation

- Cubuilt Engineers

- Intermercato

- Amin Machinery

- Indexator

Recent Developments

- In October 2024, BZI, announced that its research and development division, Innovatech, had unveiled the highly anticipated Beam Champ 30 beam rotator at the FABTECH Expo. The cutting-edge equipment was showcased at booth #S31178, where industry professionals and attendees had the opportunity to explore its advanced features and capabilities.

- In June 2024, Key Plant Automation is pleased to announce a strengthened working relationship and partnership with WB Alloys, enhancing the conventional rotators offering, particularly in Scotland and Northern England. As part of the ongoing restructuring of the recently acquired RED-D-ARC UK Welderental business, WB Alloys will serve as the official partner for rentals in Scotland and Northern England.

- In February 2024, Key Plant Automation acquired the Europe entities of Red-D-Arc as part of the company’s ongoing expansion. This acquisition is another testament to Key Plant Automation’s commitment to many of the industry’s best solutions in weld automation and positioning equipment to customers across the globe. Now with Red-D-Arc’s European division under Kyle’s team, it has extended its footprint into the industry and Key Plant Automation’s presence in the industry is now much broader state of the art innovations to customers globally.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation and digital integration will continue to enhance precision and productivity in fabrication operations.

- Manufacturers will increasingly adopt IoT-enabled rotators for remote monitoring and predictive maintenance.

- Rising renewable energy projects, especially wind tower fabrication, will create strong equipment demand.

- Advancements in drive systems and control technology will improve load capacity and efficiency.

- Partnerships between fabrication equipment suppliers and energy companies will expand global market presence.

- Growing adoption of Industry 4.0 standards will drive innovation in rotator design and operation.

- Emerging economies will witness increased installations due to expanding industrial infrastructure.

- Demand for self-aligning rotators will rise as manufacturers seek flexibility and reduced setup time.

- Focus on operator safety and automated alignment features will influence new product developments.

- Sustainable and energy-efficient equipment designs will gain traction amid tightening environmental standards.