Market Overview

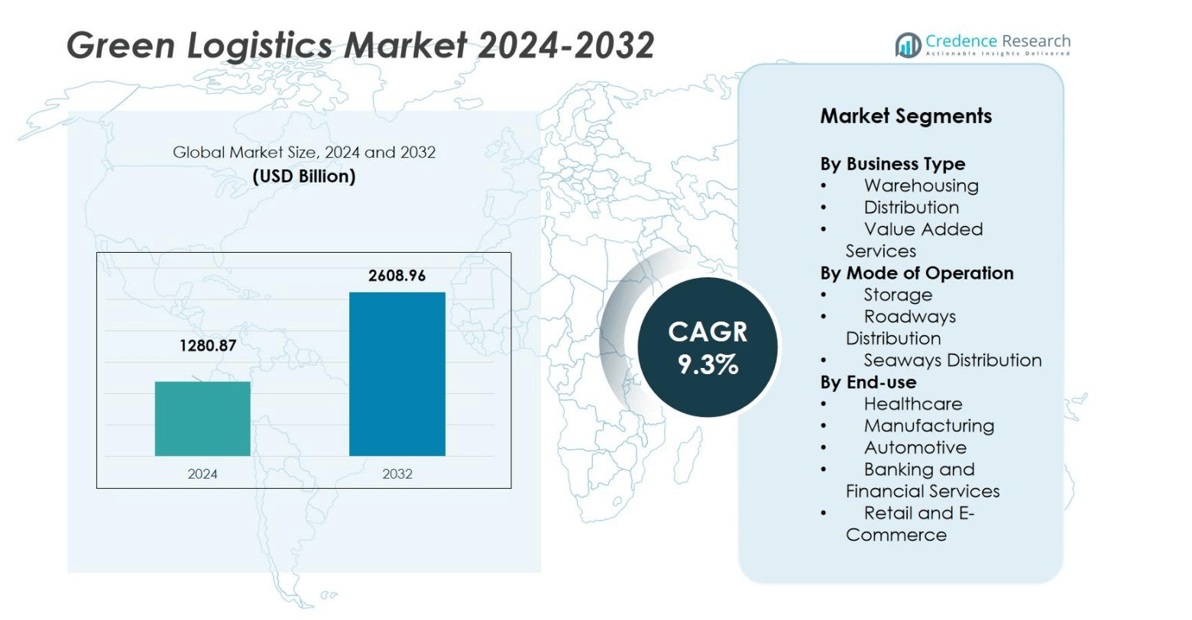

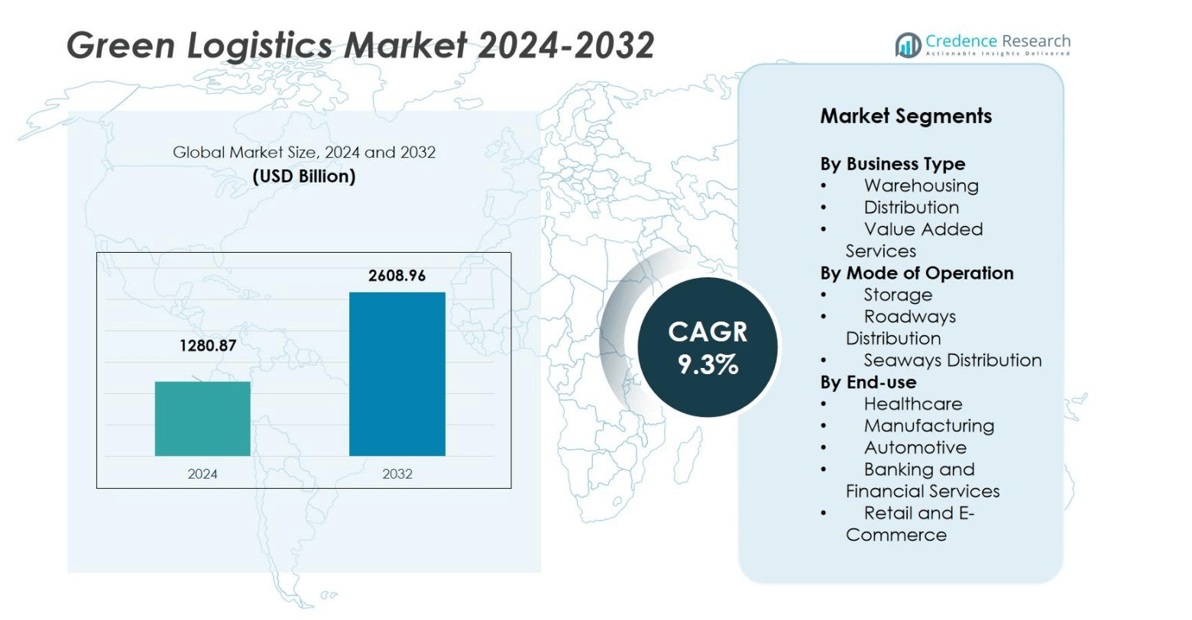

The Green Logistics Market size was valued at USD 1,280.87 billion in 2024 and is anticipated to reach USD 2,608.96 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Logistics Market Size 2024 |

USD 1,280.87 billion |

| Green Logistics Market, CAGR |

9.3% |

| Green Logistics Market Size 2032 |

USD 2,608.96 billion |

The Green Logistics Market is highly competitive, with key players including United Parcel Service (UPS), Bowling Green Logistics, GEODIS, Yusen Logistics Co., Ltd, DHL International GmbH, XPO Logistics, DB Schenker, Kuehne + Nagel, CEVA Logistics, and Agility Public Warehousing Company K.S.C.P.. These companies lead the market by investing in sustainable logistics solutions such as electric vehicles, renewable energy-powered warehouses, and smart supply chain technologies. They also emphasize carbon footprint reduction and operational efficiency through the adoption of advanced analytics and route optimization tools. These top players are focused on expanding their green offerings and increasing service capabilities to meet growing consumer demand for sustainable delivery services. Europe is the dominant region, holding a 36.3% share of the global Green Logistics Market in 2024. The region’s growth is driven by stringent environmental regulations, government incentives for sustainable logistics, and an established infrastructure for green logistics adoption.

Market Insights

- The Green Logistics Market size stood at USD 1,280.87 billion in 2024 with a CAGR of 9.3%.

- Strong regulatory pressure and corporate sustainability goals drive demand for eco‑friendly transport and warehousing systems.

- The shift toward electric vehicles, IoT‑enabled logistics and circular economy practices defines current market trends and opportunity areas.

- Competitive intensity among major global logistics firms is rising, while high initial capital expenditure and uneven standards act as restraints.

- Europe leads regionally with a 36.3 % share in 2024; the warehousing segment held a 40 % share among business‑type segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Business Type:

The Green Logistics Market is segmented into warehousing, distribution, and value-added services. Among these, the warehousing segment dominates, accounting for approximately 40% of the market share. This sub-segment is driven by increasing demand for efficient storage solutions and sustainability initiatives aimed at reducing carbon footprints. The rise in e-commerce and the need for temperature-controlled storage solutions in the healthcare sector further fuel the growth of warehousing services. With the emphasis on green energy and resource-efficient operations, warehousing remains the key growth driver in this sector.

- For instance, IKEA Australia installed over 4,000 solar panels at its Sydney distribution center, generating up to 70% of the warehouse’s energy needs through solar power.

By Mode of Operation:

The storage segment leads the mode of operation sub-segment in the Green Logistics Market, holding a market share of 45%. The primary driver for this sub-segment is the growing emphasis on energy-efficient storage systems, such as warehouses powered by renewable energy. The trend toward reducing operational costs while maintaining a low environmental impact pushes companies to adopt advanced storage technologies, such as automated systems and eco-friendly packaging. Storage’s dominance is also reinforced by the increase in inventory levels in e-commerce and retail sectors, demanding robust green logistics solutions.

- For instance, CJ Logistics has pioneered the use of eco-friendly packaging materials in their warehouses, aligning with zero-waste initiatives to minimize environmental impact while maintaining operational efficiency.

By End-Use:

The retail and e-commerce sector dominates the Green Logistics Market, with a market share of 5%. This sub-segment is driven by the rapid growth of online shopping and the increasing demand for fast, sustainable delivery services. Consumers’ growing preference for eco-friendly products and carbon-neutral shipping options has spurred retailers to adopt green logistics practices. Moreover, logistical advancements such as carbon footprint tracking and route optimization play a significant role in reducing environmental impact, driving the growth of green logistics in this end-use category.

Key Growth Drivers

Rising Demand for Sustainable Practices

The growing awareness of environmental issues is a significant driver of the Green Logistics Market. Companies are increasingly adopting sustainable practices to reduce their carbon footprints and improve operational efficiency. Governments worldwide are also implementing stringent environmental regulations, encouraging businesses to adopt eco-friendly logistics solutions. Consumers’ rising preference for environmentally responsible companies further drives this shift. As sustainability becomes a competitive differentiator, businesses are investing in green logistics, including renewable energy, electric vehicles, and eco-friendly packaging, ensuring long-term growth in the market.

- For instance, Brambles implemented the CHEP Transport Collaboration initiative, cutting 6.6 million km of empty truck journeys and avoiding 6,500 tonnes of CO2 emissions by optimizing transport with customers like Danone Waters.

Technological Advancements in Logistics Operations

Technological innovations in logistics are enhancing operational efficiencies and driving the adoption of green logistics solutions. Advanced technologies, such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT), enable real-time tracking and route optimization, reducing fuel consumption and emissions. Additionally, automation in warehouses and the integration of renewable energy systems contribute to greener operations. These innovations help businesses optimize logistics networks while reducing energy consumption, making them crucial drivers for the growth of green logistics across industries.

- For instance, DHL launched its SmartTruck system in Germany, using AI-driven route optimization to cut delivery-related carbon emissions and improve delivery times.

Expansion of E-Commerce and Online Retail

The explosive growth of e-commerce has significantly boosted the Green Logistics Market. As online shopping increases, there is a corresponding rise in demand for efficient, eco-friendly delivery solutions. To meet consumer expectations for faster and greener deliveries, retailers and logistics providers are investing in electric vehicles, energy-efficient packaging, and optimized last-mile delivery solutions. The continuous expansion of e-commerce and its focus on sustainability will remain a key driver for green logistics adoption as businesses strive to balance customer demand with environmental responsibility.

Key Trends & Opportunities

Adoption of Electric Vehicles in Logistics

The increasing adoption of electric vehicles (EVs) in logistics is one of the most prominent trends in the Green Logistics Market. Logistics companies are transitioning from diesel-powered fleets to electric vehicles to reduce greenhouse gas emissions and operational costs. EVs not only offer lower emissions but also help businesses achieve sustainability goals by reducing noise pollution and dependency on fossil fuels. With governments offering incentives and the global push toward clean energy, the integration of electric vehicles presents a significant opportunity for market growth.

- For instance, FedEx aims to convert all its delivery vehicles to EVs by 2040 and is investing significantly in charging infrastructure to support this shift.

Rise of Circular Economy Models

The shift toward circular economy models in logistics is creating new opportunities for sustainable growth. Companies are increasingly focusing on recycling, reusing, and refurbishing goods, which reduces waste and lowers the need for new resources. This trend is particularly evident in the packaging sector, where reusable and recyclable materials are being used to minimize environmental impact. Embracing circular economy practices offers logistics companies the opportunity to align with sustainability goals, enhance operational efficiency, and cater to eco-conscious consumers.

- For instance, CEVA Logistics processes over 90% of returned items within 24 hours, with 95% of these graded to sellable condition and ready for resale, while unrecoverable goods are recycled or diverted to secondary markets.

Key Challenges

High Initial Investment Costs

One of the primary challenges facing the Green Logistics Market is the high upfront investment required for adopting sustainable logistics solutions. Transitioning to electric vehicles, renewable energy systems, and energy-efficient technologies requires significant capital. Smaller businesses or those with limited resources may find it difficult to justify these initial costs, despite long-term savings and environmental benefits. Overcoming the financial burden of implementing green logistics solutions remains a key challenge that must be addressed to drive widespread adoption across all market segments.

Regulatory and Standardization Challenges

The lack of uniform standards and regulations across different regions presents a challenge for the Green Logistics Market. While some countries have implemented strict environmental policies, others lack clear guidelines, creating confusion for businesses trying to adopt green logistics practices. The absence of standardization in carbon accounting, emissions reporting, and logistics certification can hinder global cooperation and disrupt the efficiency of green logistics operations. To overcome this, there is a need for international collaboration to establish common regulations and standards that facilitate sustainable logistics practices.

Regional Analysis

North America

In 2024, the North American region accounted for about 28% of the global green logistics market. The region’s share is driven by strong government mandates on emissions, rapid uptake of electric delivery fleets, and extensive investments in energy‑efficient warehousing infrastructure. Leading logistics firms deployed alternative‑fuel trucks and built solar‑powered warehouse hubs to meet sustainability commitments. These efforts have positioned North America as a key market, with major corporations embedding green logistics into core operations and driving further adoption across manufacturing and retail supply chains.

Europe

Europe captured a 36.3% share of the green logistics market in 2024. This high share stems from the enforcement of comprehensive climate policies such as the European Green Deal and the Fit for 55 agenda, which incentivise low‑emission transport and green warehousing. Logistics providers across the region invested heavily in electric trucks, hydrogen‑fuel fleets and smart supply‑chain technologies to align with EU targets. Combined with consumer demand for eco‑friendly delivery services and well‑developed infrastructure, Europe remains the most established region for green logistics adoption and innovation.

Asia‑Pacific

The Asia‑Pacific region held 36.2% of the global green logistics market in 2024. Rapid e‑commerce growth in countries such as China, India and Japan is a major driver, alongside national carbon‑neutrality commitments that encouraged investment in solar‑powered logistics hubs and electric vehicle fleets. Corporations are embedding sustainable practices into their Asian supply chains to manage environmental impact and operational costs. With large urban populations and expanding infrastructure, Asia‑Pacific offers significant growth potential and is likely to maintain its leadership position.

Latin America, Middle East & Africa (LAMEA)

The LAMEA region captured 10% of the green logistics market in 2024. Growth in this region is supported by rising awareness of environmental issues, increasing regulatory pressure, and infrastructure development for low‑emission freight. Logistics players focus on upgrading fleets to biodiesel or LNG, improving fuel efficiency and deploying solar‑integrated storage facilities. While the region lags behind more mature markets, it presents opportunities for growth as governments and businesses increasingly adopt green logistics practices to meet sustainability goals.

Market Segmentations:

By Business Type

- Warehousing

- Distribution

- Value Added Services

By Mode of Operation

- Storage

- Roadways Distribution

- Seaways Distribution

By End-use

- Healthcare

- Manufacturing

- Automotive

- Banking and Financial Services

- Retail and E-Commerce

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the green logistics market features major players such as United Parcel Service, Bowling Green Logistics, GEODIS, Yusen Logistics Co., Ltd, DHL International GmbH, XPO Logistics, DB Schenker, Kuehne + Nagel, CEVA Logistics and Agility Public Warehousing Company K.S.C.P.. These firms lead with global infrastructure, technological innovation, and sustainability strategies. They compete by deploying electric and alternative‑fuel vehicle fleets, integrating renewable‑energy powered warehouses and applying advanced analytics for route optimisation. Strategic collaborations and acquisitions strengthen market reach and service portfolios. The companies prioritise scalability, cross‑regional expansion and eco‑friendly credentials to win contracts from large end‑users and gain competitive advantage. Over the forecast period, this group will continue to shape pricing, service standards and green logistics norms across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yusen Logistics Co., Ltd

- CEVA Logistics

- GEODIS

- Kuehne + Nagel

- DB SCHENKER

- Bowling Green Logistics

- United Parcel Service

- Agility Public Warehousing Company K.S.C.P.

- DHL International GmbH

- XPO Logistics

Recent Developments

- In August 2025, GreenLine Mobility Solutions Ltd. deepened its collaboration with Hindustan Zinc Limited to deploy 100 electric vehicles (EVs) and 100 LNG trucks for green logistics.

- In November 2024, CEVA Logistics launched the FORPLANET sub-brand to further its commitment to sustainable logistics and support global decarbonization efforts. The FORPLANET suite includes low-carbon transport solutions and promotes circular economy practices, such as closed-loop supply chains and reverse logistics.

- In July 2024, DHL International GmbH and Envision Group announced a new partnership focused on advancing sustainable logistics and energy solutions, with a primary emphasis on sustainable aviation fuel (SAF)

Report Coverage

The research report offers an in-depth analysis based on Business Type, Mode of Operation, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing as corporations face tighter emissions regulations and upgrade fleets accordingly.

- Investment in renewable‑energy‑powered warehouses will expand, driving broader adoption of green logistics infrastructure.

- Electric and alternative‑fuel vehicles will become the standard for last‑mile delivery, reducing carbon footprints and operational costs.

- Data analytics, AI and IoT will enable smarter route planning, energy usage tracking and emissions monitoring in supply chains.

- Growth of e‑commerce and demand for rapid, sustainable deliveries will push logistics providers to scale green offerings.

- Circular‑economy practices, such as reuse of packaging and reverse logistics, will become mainstream to reduce waste.

- Expansion in emerging regions, especially in Asia‑Pacific and Latin America, will provide new green logistics opportunities.

- Collaboration among governments, logistics firms and clients on sustainability goals will further accelerate market growth.

- High upfront costs and infrastructure gaps will slow adoption in some markets but will trigger innovation and financing solutions.

- Standardisation of emissions metrics and green logistics certifications will emerge, enabling clearer value‑propositions and differentiators.