Market Overview

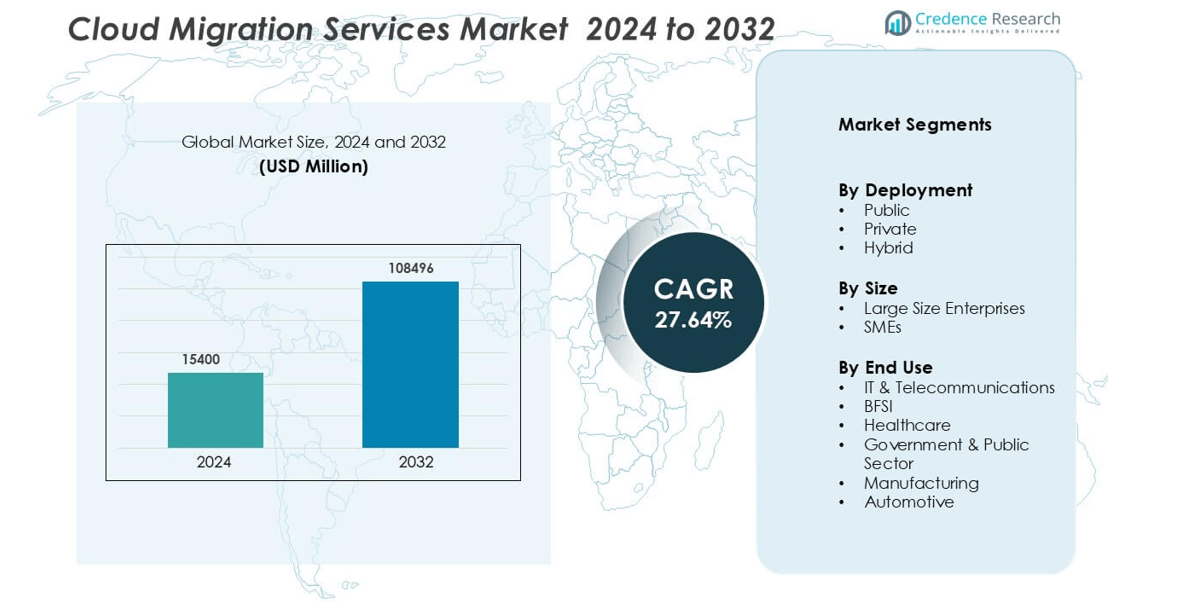

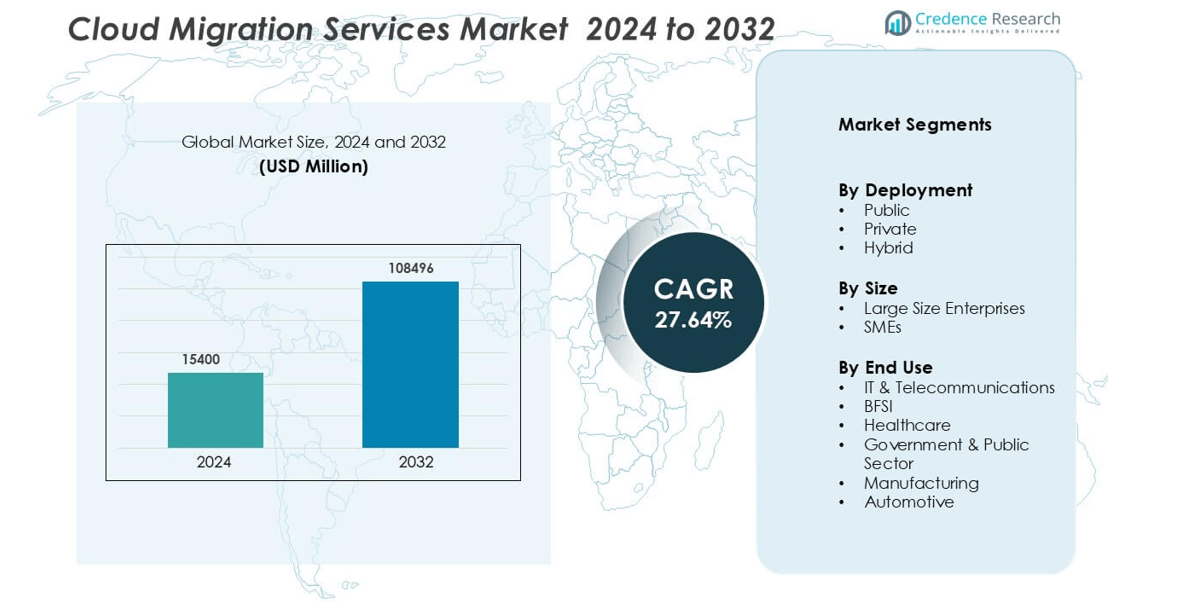

Cloud Migration Services Market was valued at USD 15400 million in 2024 and is anticipated to reach USD 108496 million by 2032, growing at a CAGR of 27.64 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Migration Services Market Size 2024 |

USD 15400 million |

| Cloud Migration Services Market, CAGR |

27.64% |

| Cloud Migration Services Market Size 2032 |

USD 108496 million |

The Cloud Migration Services Market is dominated by leading players including IBM Corporation, Microsoft, Capgemini, Amazon Web Services, Kyndryl Inc., Google LLC, Accenture, SAP SE, Hewlett Packard Enterprise, and NTT DATA Americas, Inc. These companies focus on accelerating digital transformation through AI-enabled automation, hybrid cloud frameworks, and secure data migration solutions. Strategic collaborations and cloud-native innovations strengthen their global market positions. North America leads the market with a 39% share in 2024, driven by advanced IT infrastructure, high enterprise cloud adoption, and strong presence of hyperscale providers supporting large-scale modernization initiatives across industries.

Market Insights

- The Cloud Migration Services Market was valued at USD 15400 million in 2024 and is projected to reach USD 108496 million by 2032, growing at a CAGR of 27.64%.

- The market growth is driven by the increasing adoption of hybrid and multi-cloud strategies that enhance scalability, flexibility, and cost efficiency across industries.

- Emerging trends include the integration of AI, automation, and DevOps tools, which streamline migration processes and minimize downtime for enterprises.

- Key players such as IBM Corporation, Microsoft, AWS, Capgemini, and Accenture dominate the market through advanced service offerings, strategic alliances, and AI-driven migration platforms.

- North America leads with a 39% share, followed by Europe at 27% and Asia-Pacific at 24%, while the hybrid deployment segment accounts for 47% of total market revenue, reflecting the growing preference for hybrid cloud environments among global enterprises.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

The hybrid deployment segment dominated the Cloud Migration Services Market with a 47% share in 2024. Enterprises increasingly adopt hybrid models to balance data security and scalability, integrating on-premises systems with public cloud platforms. This approach allows organizations to migrate critical workloads while maintaining compliance with data regulations. Leading providers such as Amazon Web Services and Microsoft Azure offer hybrid migration tools that enhance operational flexibility and cost optimization. The growing need for seamless workload transfer and real-time data management continues to accelerate hybrid cloud adoption across industries.

- For instance, Microsoft Azure Arc enables unified management across hybrid and multi-cloud environments, managing up to 50,000 virtual machines from a single control plane.

By Size

Large enterprises held a 61% share of the Cloud Migration Services Market in 2024, driven by extensive digital transformation initiatives. These organizations leverage multi-cloud environments to modernize legacy infrastructure and optimize IT costs. The rise in enterprise data volume and global expansion strategies further boost migration demand. Companies invest in advanced analytics and AI-based automation tools for faster cloud integration and improved business agility. Cloud providers’ customized solutions for large-scale migration enhance efficiency, minimize downtime, and strengthen data governance.

- For instance, While IBM Turbonomic is widely reported to automate resource management decisions using AI and machine learning to ensure performance and reduce costs, and there are case studies showing thousands of actions taken over specific periods.

By End Use

The IT and telecommunications segment led the Cloud Migration Services Market with a 28% market share in 2024. Growing network digitization and increased data traffic push telecom firms to migrate core applications to the cloud. IT service providers use scalable cloud architectures to enhance performance and reduce infrastructure costs. BFSI and healthcare sectors also experience rapid adoption due to data security and compliance benefits. Cloud-based migration improves agility, speeds up service delivery, and supports remote collaboration across global operations.

Key Growth Drivers

Rising Adoption of Hybrid and Multi-Cloud Strategies

The growing adoption of hybrid and multi-cloud strategies serves as a major driver for the Cloud Migration Services Market. Enterprises increasingly seek flexible environments that combine private and public cloud infrastructures to achieve greater scalability and control over workloads. This approach helps businesses optimize cost structures, maintain regulatory compliance, and ensure data security while accessing global cloud networks. Service providers like Amazon Web Services, Google Cloud, and Microsoft Azure are enhancing interoperability solutions that support seamless data transfer and workload balancing. The shift toward hybrid models enables enterprises to deploy mission-critical applications across multiple platforms without vendor lock-in. Moreover, growing digital transformation initiatives and the need for efficient resource utilization further accelerate demand for hybrid and multi-cloud migration services worldwide.

- For instance, AWS Outposts delivers consistent hybrid infrastructure, supporting low-latency performance under 10 milliseconds for real-time enterprise workloads.

Increasing Demand for Cost Optimization and Business Agility

Organizations are embracing cloud migration to improve cost efficiency and operational agility. The ability to replace capital expenditures with flexible pay-as-you-go models allows businesses to allocate IT budgets more effectively. Cloud migration also helps companies streamline IT infrastructure, reduce maintenance costs, and scale resources based on workload demands. Enterprises are adopting automation-driven migration tools to minimize downtime and improve system performance during transitions. Moreover, the growing focus on remote work and digital-first operations further drives adoption of cloud-native environments. Industries such as BFSI, healthcare, and manufacturing benefit from faster deployment cycles, enhanced data analytics, and improved decision-making capabilities. This cost and agility advantage has positioned cloud migration as a strategic enabler for competitive differentiation across global enterprises.

- For instance, an IBM case study on automating transactional pricing decisions eliminated 35,000 human hours a year and “reduced average bid cycle time by 75%.

Expanding Digital Transformation and Data Modernization Initiatives

The global shift toward digital transformation continues to propel the Cloud Migration Services Market. Businesses are modernizing legacy applications to improve performance, security, and scalability within cloud-based ecosystems. Migration enables organizations to leverage advanced analytics, artificial intelligence, and machine learning for data-driven operations. Governments and private sectors are accelerating cloud adoption to enhance citizen services, improve IT resilience, and support innovation ecosystems. The surge in IoT adoption and increasing data volumes also contribute to modernization efforts. Service providers are responding with end-to-end migration solutions that include cloud assessment, infrastructure redesign, and managed services. The growing need for real-time insights, automation, and streamlined workflows reinforces the strategic importance of cloud migration in achieving long-term digital transformation goals.

Key Trend & Opportunity

Growing Focus on Security and Compliance-Driven Cloud Solutions

Security and regulatory compliance have become top priorities, creating significant opportunities for cloud migration providers. Enterprises handling sensitive data, especially in BFSI, healthcare, and government sectors, demand migration solutions with robust encryption and governance frameworks. The rise of data protection regulations such as GDPR and HIPAA encourages organizations to adopt secure cloud environments. Service providers are integrating AI-based threat detection, identity management, and zero-trust frameworks to enhance data protection during migration. Companies like IBM and Oracle are offering compliance-driven cloud platforms that support regional data sovereignty. As cyber risks grow, businesses increasingly rely on specialized migration partners to ensure security continuity and maintain compliance standards. This focus on secure cloud operations has positioned compliance-enabled migration as a core market opportunity.

- For instance, IBM Cloud for Financial Services integrates over 250 security controls to meet regulatory requirements for global banks, while Oracle Cloud Infrastructure’s Cloud Guard monitors over 2 billion security events daily to detect and mitigate potential threats during and after migration.or instance,An IBM case study on automating transactional pricing decisions eliminated 35,000 human hours a year and “reduced average bid cycle time by 75%”.

Integration of AI, Automation, and DevOps in Migration Processes

Artificial intelligence and automation are revolutionizing the way enterprises approach cloud migration. Automated tools accelerate application discovery, code refactoring, and workload movement, reducing manual effort and migration errors. AI-driven analytics enhance performance optimization by predicting system behavior and identifying inefficiencies. The integration of DevOps methodologies further improves deployment speed and cross-functional collaboration during migration. Leading providers such as Accenture, Deloitte, and Infosys are investing in AI-empowered platforms to deliver end-to-end automation and monitoring. These intelligent solutions ensure minimal disruption, faster ROI, and enhanced post-migration management. The combination of AI and DevOps practices not only improves operational efficiency but also creates a competitive edge for organizations modernizing through cloud transformation.

- For instance, Infosys’ Cobalt Cloud Suite uses over 35,000 automated scripts to accelerate workload migration and reduces manual effort across large enterprise deployments.

Key Challenge

Data Security and Privacy Concerns During Migration

Despite growing adoption, data security remains a primary challenge in cloud migration. Transferring large datasets across environments exposes organizations to risks such as data breaches, unauthorized access, and compliance violations. Industries handling confidential information must implement strong encryption, authentication, and data-loss prevention strategies. However, misconfigurations, legacy system dependencies, and multi-vendor ecosystems complicate security management. Many enterprises hesitate to move critical workloads due to fear of data exposure and lack of control over shared infrastructure. Cloud providers are addressing these concerns with advanced security frameworks, yet ensuring consistent compliance across jurisdictions remains complex. The challenge of safeguarding sensitive data during and after migration continues to limit adoption in highly regulated industries.

Complexity in Legacy System Integration and Skill Shortages

Integrating legacy applications into modern cloud architectures poses a significant challenge for enterprises. Many organizations still rely on outdated systems that are not cloud-compatible, making migration resource-intensive and technically complex. Re-architecting these systems demands specialized skills in cloud frameworks, APIs, and data orchestration. However, the global shortage of skilled cloud professional delays project timelines and increases costs. Businesses often face performance issues and operational disruptions during transition due to poor integration planning. Service providers are developing migration accelerators and consulting frameworks to address these gaps, but talent limitations persist. This challenge continues to hinder smooth adoption, particularly among large enterprises with extensive legacy infrastructure.

Regional Analysis

North America

North America led the Cloud Migration Services Market with a 39% share in 2024. The region benefits from strong cloud infrastructure, early technology adoption, and the presence of major providers such as Amazon Web Services, Microsoft, and Google Cloud. Enterprises in the U.S. and Canada invest heavily in digital transformation and multi-cloud environments to enhance flexibility and scalability. The region’s regulatory framework supports secure cloud operations across industries like BFSI, healthcare, and government. Continuous investments in AI-driven migration tools and cybersecurity solutions further strengthen North America’s dominance in the global market.

Europe

Europe accounted for a 27% share of the Cloud Migration Services Market in 2024, driven by strong demand across financial services, manufacturing, and public sectors. Strict data protection regulations such as GDPR encourage organizations to adopt compliant cloud environments. Countries like Germany, the U.K., and France lead migration adoption through hybrid and private cloud solutions. European enterprises increasingly rely on managed service providers to ensure compliance and minimize migration complexity. Government-funded cloud transformation projects and digital sovereignty initiatives are further propelling the region’s steady market expansion.

Asia-Pacific

Asia-Pacific captured a 24% share of the Cloud Migration Services Market in 2024, fueled by rapid digitalization and the expansion of data centers. Countries including China, India, Japan, and South Korea are major contributors, supported by strong government incentives and increasing SME cloud adoption. Businesses are shifting workloads to cloud platforms to improve agility and cost efficiency. The growing IT and telecom sectors, combined with rising investments from global providers, strengthen regional competitiveness. Expanding 5G networks and industrial automation trends continue to accelerate cloud migration growth across Asia-Pacific.

Latin America

Latin America held a 6% share of the Cloud Migration Services Market in 2024, supported by growing enterprise digital transformation. Brazil and Mexico lead adoption due to increasing demand from BFSI, retail, and telecom industries. Cloud migration helps local businesses reduce infrastructure costs and enhance remote operations. Service providers are expanding regional data centers and partnerships to improve accessibility and compliance. Although the market faces challenges from limited technical expertise, increasing investments in cloud training and automation are driving sustained growth across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the Cloud Migration Services Market in 2024. The adoption is driven by government-led digital transformation initiatives and smart city projects. Countries like the UAE, Saudi Arabia, and South Africa are rapidly modernizing IT infrastructure through public and hybrid cloud models. Cloud adoption supports economic diversification and enhances public sector efficiency. Global players such as Microsoft and Oracle are establishing local data centers to meet compliance standards. The region’s growing focus on cybersecurity and IT modernization continues to strengthen market potential.

Market Segmentations:

By Deployment

By Size

- Large Size Enterprises

- SMEs

By End Use

- IT & Telecommunications

- BFSI

- Healthcare

- Government & Public Sector

- Manufacturing

- Automotive

- Retail & Consumer Goods

- Media & Entertainment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cloud Migration Services Market is characterized by intense rivalry among global technology leaders offering end-to-end cloud transformation solutions. Key players such as IBM Corporation, Microsoft, Capgemini, Amazon Web Services, Kyndryl Inc., Google LLC, Accenture, SAP SE, Hewlett Packard Enterprise, and NTT DATA Americas focus on expanding hybrid and multi-cloud capabilities to meet evolving enterprise demands. These companies invest heavily in AI-driven automation, data analytics, and cybersecurity integration to enhance migration efficiency and security. Strategic partnerships with hyperscalers, acquisitions of niche service providers, and development of cloud-native frameworks strengthen their market presence. Firms like IBM and Microsoft lead with advanced hybrid solutions, while AWS and Google emphasize scalability and data-driven innovation. Growing competition drives continuous innovation, enabling enterprises to accelerate digital transformation, optimize costs, and modernize legacy infrastructure. This strategic focus on differentiation and service expansion defines the market’s dynamic competitive ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM Corporation

- Microsoft

- Capgemini

- Amazon Web Services, Inc.

- Kyndryl Inc.

- Google LLC

- Accenture

- SAP SE

- Hewlett Packard Enterprise Development LP

- NTT DATA Americas, Inc

Recent Developments

- In December 2024, Capgemini completed acquisition of Syniti, a provider of enterprise data management software and services in the U.S. The acquisition supports Capgemini’s data-driven digital transformation offerings, with a focus on large-scale SAP transformations, including migrations to SAP S/4HANA. Syniti’s expertise in managing complex data quality, migration, and governance initiatives is expected enhance Capgemini’s capacity to support in optimizing their data management and enterprise software strategies, particularly for large companies.

- In March 2024, Accenture collaborated with Microsoft to introduce a Cloud Modernization and Migration Factory on Microsoft Azure Government, designed to fulfill the rigid security demands of national security operations, including the Special Access Program community. This integrated service will support federal agencies and partners securely migrating from any environment

Report Coverage

The research report offers an in-depth analysis based on Deployment, Size, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cloud Migration Services Market will continue to expand with rising enterprise digital transformation initiatives.

- Hybrid and multi-cloud models will dominate as organizations seek flexibility and scalability.

- AI and automation will play a central role in accelerating migration speed and accuracy.

- Demand for secure and compliant migration solutions will grow across regulated sectors.

- Service providers will increase investments in data analytics and intelligent monitoring tools.

- Partnerships between cloud vendors and system integrators will strengthen global market reach.

- SMEs will increasingly adopt cloud migration to reduce infrastructure costs and improve agility.

- Edge computing integration will enhance real-time data processing and cloud efficiency.

- Training and skill development in cloud technologies will gain priority to address talent shortages.

- North America will retain market leadership, while Asia-Pacific will witness the fastest growth due to rapid digitalization and enterprise modernization.