Market Overview:

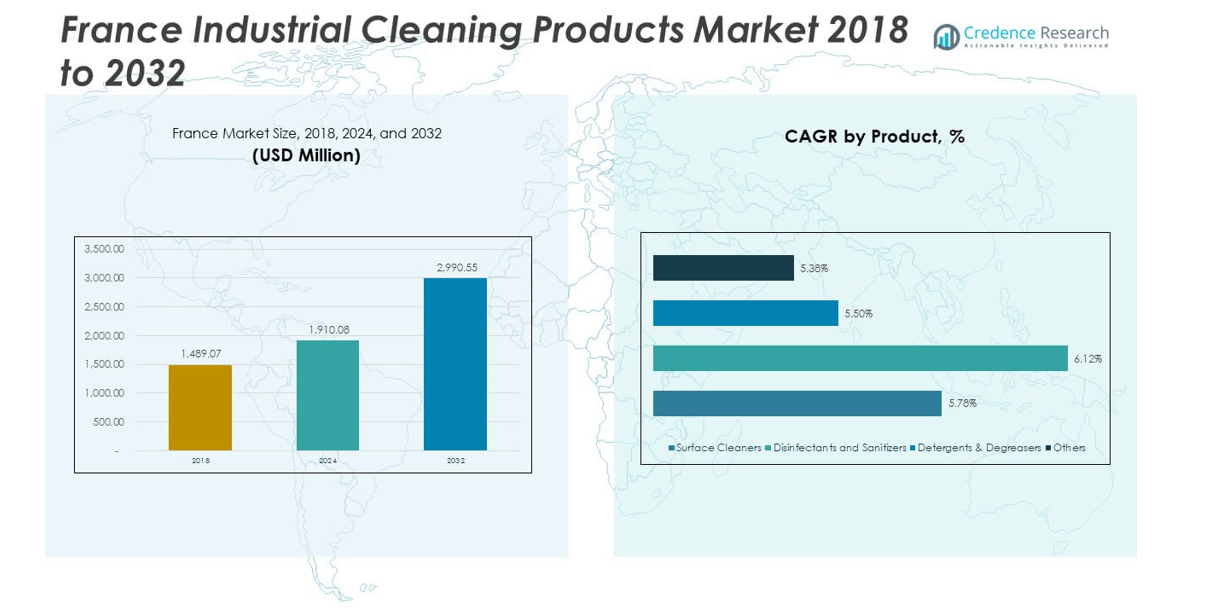

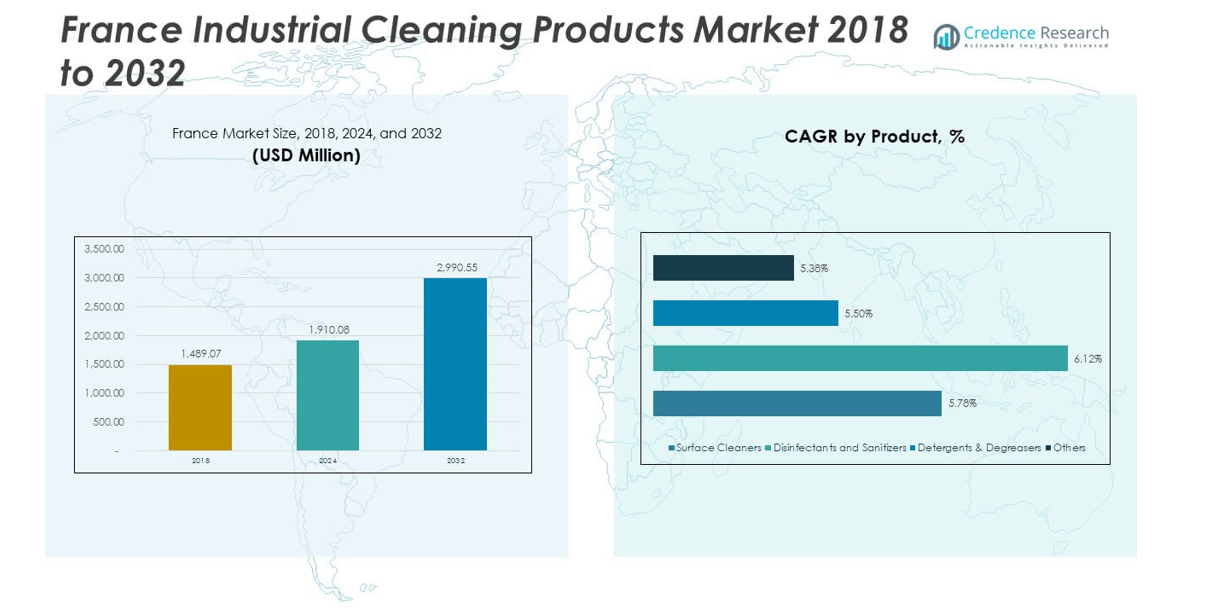

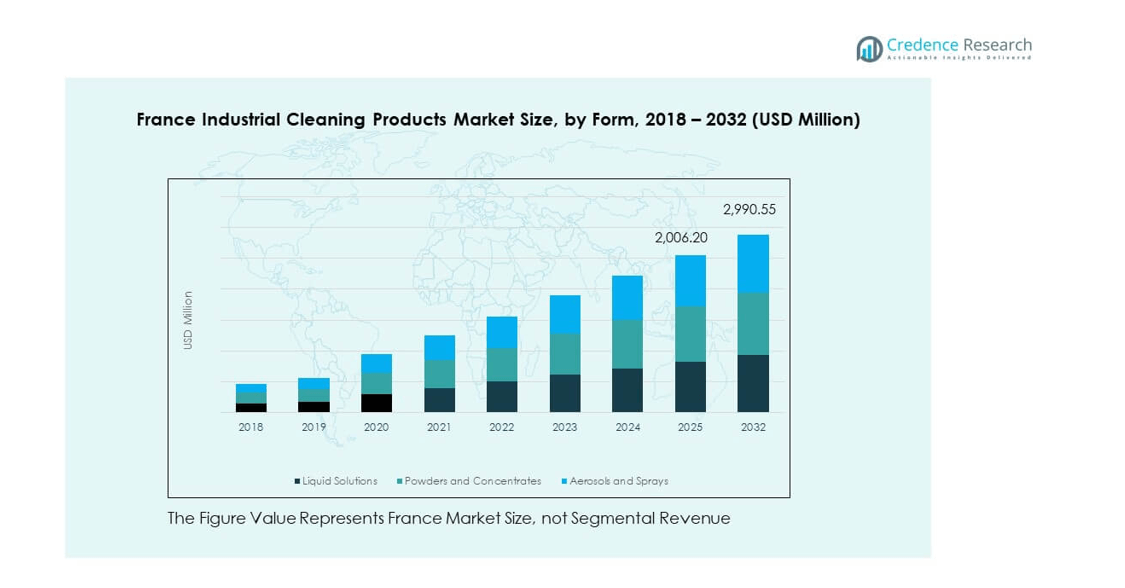

The France Industrial Cleaning Products Market size was valued at USD 1,489.07 million in 2018, rose to USD 1,910.08 million in 2024, and is anticipated to reach USD 2,990.55 million by 2032, at a CAGR of 5.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Industrial Cleaning Products Market Size 2024 |

USD 1,910.08 million |

| France Industrial Cleaning Products Market, CAGR |

5.76% |

| France Industrial Cleaning Products Market Size 2032 |

USD 2,990.55 million |

The France Industrial Cleaning Products Market is driven by increasing industrialization and stricter regulations for hygiene and cleanliness in sectors like food processing, healthcare, and manufacturing. As industries focus on meeting high sanitation standards, demand for effective and compliant cleaning solutions continues to rise. The shift towards eco-friendly and sustainable cleaning products further boosts the market, as businesses prioritize environmental responsibility alongside cleaning efficiency.

Regionally, Western Europe, with France leading the charge, dominates the industrial cleaning products market. France’s mature industrial landscape, including sectors such as manufacturing, food and beverage, and healthcare, drives its market leadership. Emerging growth is evident in Eastern European countries where industrialization is increasing, and demand for industrial cleaning products is expected to rise. The continuous evolution of regulatory standards across Europe further influences the market dynamics, with France maintaining its dominant position in the region.

Market Insights

- The France Industrial Cleaning Products Market was valued at USD 1,489.07 million in 2018, reached USD 1,910.08 million in 2024, and is projected to grow to USD 2,990.55 million by 2032, at a CAGR of 5.76% during the forecast period.

- Western Europe, with France leading, commands the largest market share due to a well-established industrial base, followed by Southern Europe, where growing sectors like food processing boost demand for industrial cleaning products.

- Eastern Europe is the fastest-growing region, contributing to market expansion due to the rise in industrialization and increasing demand for cleaning solutions in manufacturing sectors.

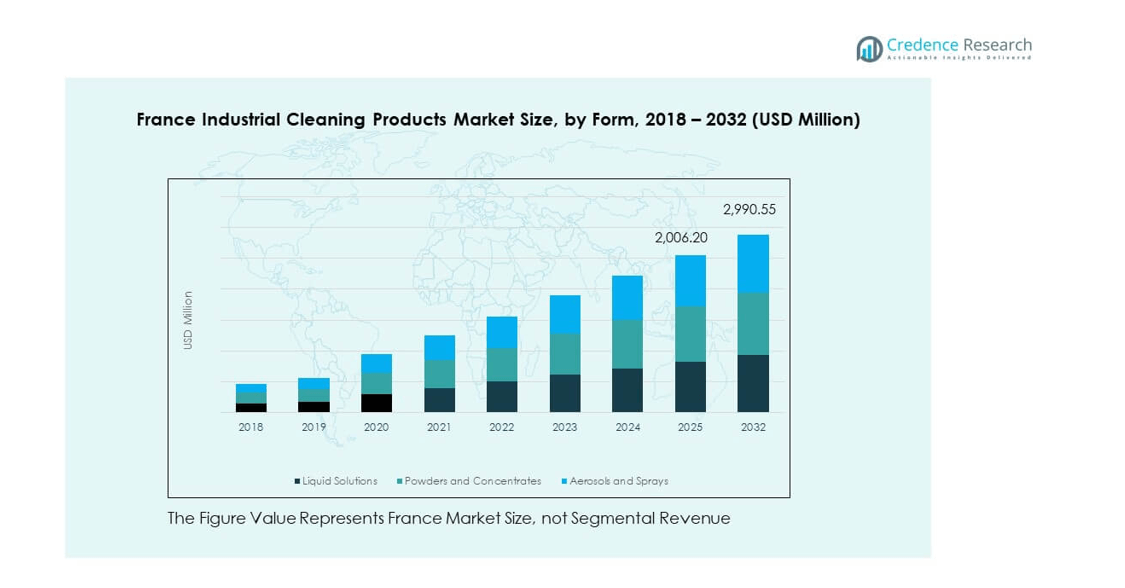

- The market share distribution by form shows that Liquid Solutions hold the largest share at approximately 60%, followed by Powders and Concentrates at around 25%, and Aerosols and Sprays making up the remaining 15%.

- By segment share, Liquid Solutions dominate the market with a 60% share, followed by Powders and Concentrates, which account for 25%, and Aerosols and Sprays, contributing to 15% of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Hygiene Standards

The increasing demand for hygiene across industries significantly drives the France Industrial Cleaning Products Market. Stricter health regulations and awareness of sanitation risks compel businesses to prioritize cleanliness. Industries like healthcare and food processing are particularly focused on maintaining high hygiene standards. As the demand for cleaner and safer environments grows, so does the need for specialized industrial cleaning products. Compliance with hygiene regulations leads to higher adoption of effective cleaning solutions. This trend is expected to continue, benefiting manufacturers offering advanced cleaning products. It fosters consistent market growth as businesses invest in top-quality solutions.

- For example, in 2024, Diversey Holdings partnered with Synexis LLC to introduce Dry Hydrogen Peroxide (DHP®) microbial reduction technology to healthcare clients in France and other countries. DHP® technology, verified by laboratory testing, helps reduce viruses, bacteria, and volatile organic compounds in occupied spaces.

Government Regulations and Industry Standards

Stringent government regulations in France play a crucial role in shaping the market. Regulations regarding workplace safety, sanitation, and health are driving businesses to adopt advanced cleaning products. Companies must meet these legal standards to maintain operational efficiency and avoid penalties. The France Industrial Cleaning Products Market benefits from this regulatory environment, which mandates the use of compliant cleaning solutions. Businesses in sectors such as food processing and pharmaceuticals are especially impacted by these requirements. With evolving regulations, demand for specific products tailored to meet standards continues to rise. Manufacturers are focused on ensuring their products meet stringent safety and quality criteria.

- For example, Version 8 of the International Featured Standards (IFS) Food certification became mandatory for all food-processing sites in France starting January 1, 2024. This regulatory update requires companies to undergo third-party audits by approved certification bodies to maintain compliance.

Expansion of Industrial Sectors and Facilities

France’s expanding industrial sectors contribute to market growth, increasing the demand for cleaning products. Sectors like manufacturing, automotive, and pharmaceuticals require effective solutions to maintain cleanliness and safety standards. The growth of these industries results in a higher need for specialized cleaning solutions that can handle specific industrial challenges. It also drives the demand for efficient, cost-effective cleaning products that improve operational productivity. The need for cleaning in large facilities and complex operations creates a steady market for industrial cleaning products. It is evident that as these industries grow, cleaning product demand will continue to rise.

Technological Advancements in Cleaning Products

Innovations in cleaning product technology are key drivers in the France Industrial Cleaning Products Market. The development of eco-friendly cleaning solutions, which maintain high performance, is gaining momentum. Businesses are seeking products that align with sustainability goals while being highly effective. Advances in cleaning technologies help improve productivity and reduce environmental impact. The shift towards green, biodegradable ingredients and energy-efficient solutions supports this trend. Manufacturers focusing on product innovation are seeing positive market responses. As environmental concerns grow, the demand for sustainable industrial cleaning solutions will likely increase, offering opportunities for innovation.

Market Trends:

Rising Popularity of Eco-Friendly Cleaning Products

Eco-friendly cleaning products are rapidly gaining popularity in the France Industrial Cleaning Products Market. Businesses and consumers are increasingly seeking solutions that minimize environmental impact. The demand for biodegradable ingredients and sustainable packaging has significantly increased. Manufacturers are responding to this shift by developing cleaning products that are both effective and environmentally responsible. It is not just a trend but a growing expectation for businesses to adopt greener solutions. This shift reflects broader societal concerns about sustainability and climate change. The market is likely to see a continued increase in eco-conscious purchasing behavior from both businesses and consumers.

- For instance, SODEL, a French manufacturer, produces products that are certified Ecolabel and Ecocert, with over 99% of its formulations eco-designed. Their manufacturing facility in Lisieux produces over 16,000 tonnes of cleaning products annually using increasingly eco-responsible processes, reflecting a strong commitment to sustainable manufacturing.

Automation in Cleaning Processes

Automation is becoming a key trend in the France Industrial Cleaning Products Market. Robotic cleaning equipment and automated systems are being adopted in various industries for enhanced efficiency. These solutions reduce labor costs while improving cleanliness and consistency. Automated cleaning tools are being used extensively in large facilities such as factories, warehouses, and healthcare centers. They enable businesses to maintain high hygiene standards with minimal human intervention. As technology evolves, automated cleaning solutions are expected to grow in popularity. This shift presents new opportunities for product manufacturers to create automated cleaning solutions that meet industrial demands.

- For instance, Kärcher’s KIRA B 50 autonomous scrubber dryer is capable of cleaning up to 2,300 square meters per hour using a 160 Ah lithium-ion battery. It is deployed widely across healthcare, logistics, and industrial sectors, significantly reducing labor intensity and improving cleaning consistency.

Growth of Online Retail Platforms

The rise of e-commerce platforms is reshaping the way industrial cleaning products are sold in France. Online shopping provides convenience, allowing businesses to order cleaning products quickly and easily. As online platforms gain traction, they become essential sales channels for cleaning product manufacturers. The growing use of digital marketing and online advertising is helping companies reach broader audiences. This trend has expanded the market, enabling smaller businesses to access specialized products. The convenience of e-commerce allows businesses to compare products, read reviews, and make informed purchasing decisions. It is transforming how industrial cleaning products are distributed in the market.

Focus on Customization and Specialized Products

The France Industrial Cleaning Products Market is increasingly focused on customized solutions. Industries are seeking cleaning products tailored to their specific needs and challenges. For example, cleaning solutions designed for the food and beverage industry must meet strict hygiene standards to prevent contamination. Manufacturers are investing in R&D to create specialized products for different sectors. As industries become more diverse, the demand for cleaning products that cater to specific requirements continues to grow. It highlights a shift toward more personalized cleaning solutions, making it a significant trend in the market. Specialized cleaning solutions improve operational efficiency and help businesses meet regulatory standards.

Market Challenges Analysis:

High Competition and Price Sensitivity

The France Industrial Cleaning Products Market faces intense competition, with numerous players vying for market share. Price sensitivity is a significant challenge, particularly in highly competitive sectors like manufacturing and healthcare. Businesses constantly seek cost-effective solutions while maintaining product quality. Smaller manufacturers struggle to compete with larger, well-established companies that can offer lower prices. With tight profit margins, it is critical for companies to balance quality and affordability. The challenge lies in developing competitive pricing strategies that also maintain high product standards. Companies that succeed in offering value-driven solutions will continue to thrive in this competitive market.

Complex Regulatory Compliance

Navigating France’s complex regulatory environment poses a challenge for cleaning product manufacturers. Companies must comply with stringent safety, health, and environmental regulations, which can vary across industries. Adhering to these requirements involves significant investment in research, product testing, and certification. It also requires companies to stay updated with evolving regulations and standards. Non-compliance can lead to fines, product recalls, and damage to brand reputation. The costs associated with maintaining regulatory compliance can be burdensome for small manufacturers. However, businesses that manage this challenge effectively can build trust and a strong market presence.

Market Opportunities:

Increasing Demand from Emerging Sectors

The France Industrial Cleaning Products Market is witnessing growing opportunities in emerging sectors like renewable energy and biotechnology. As these industries expand, their need for specialized cleaning solutions increases. It presents a chance for manufacturers to diversify their offerings and cater to new market demands. The rise of biotechnology, for instance, creates opportunities for cleaning products tailored to highly sensitive environments. Manufacturers that innovate to meet the unique needs of emerging sectors will benefit from early market entry. These sectors offer high-growth potential as businesses look for specialized, efficient cleaning products.

Technological Innovation in Cleaning Solutions

Technological advancements in cleaning solutions offer promising opportunities in the France Industrial Cleaning Products Market. New technologies such as automated cleaning systems and eco-friendly formulations are driving growth. As businesses prioritize efficiency and sustainability, demand for innovative products increases. Companies that invest in R&D to create more effective, energy-efficient cleaning solutions will gain a competitive edge. These innovations can help reduce costs for end-users while improving operational efficiency. As the market evolves, technology-driven solutions will play a central role in shaping industry trends and expanding market potential.

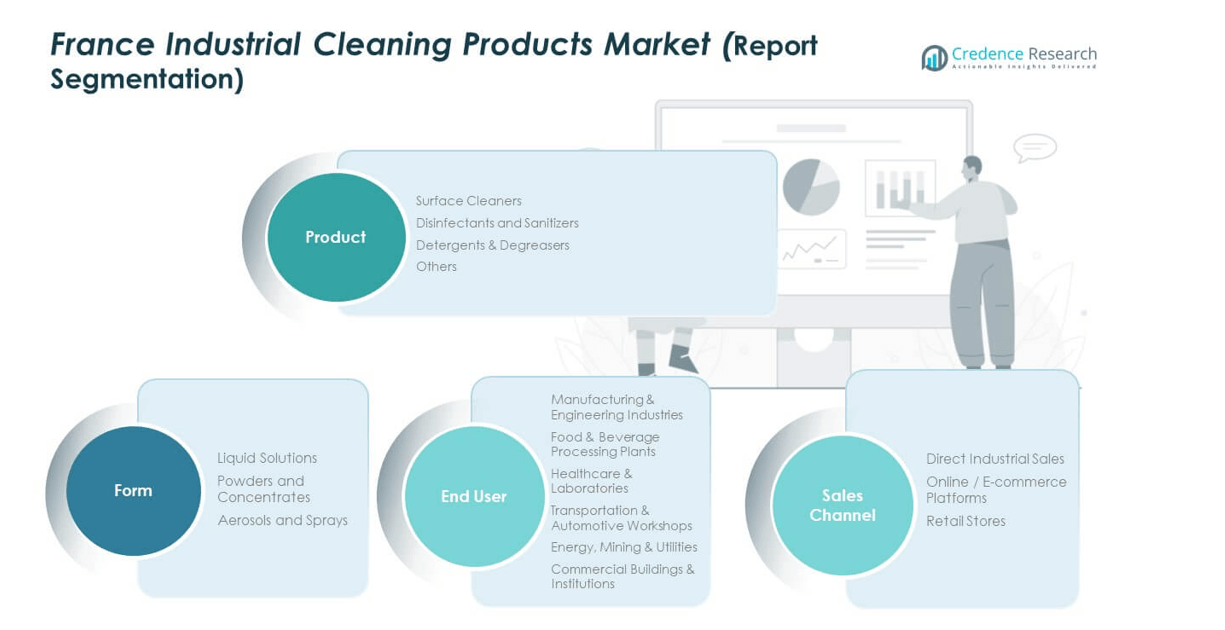

Market Segmentation Analysis

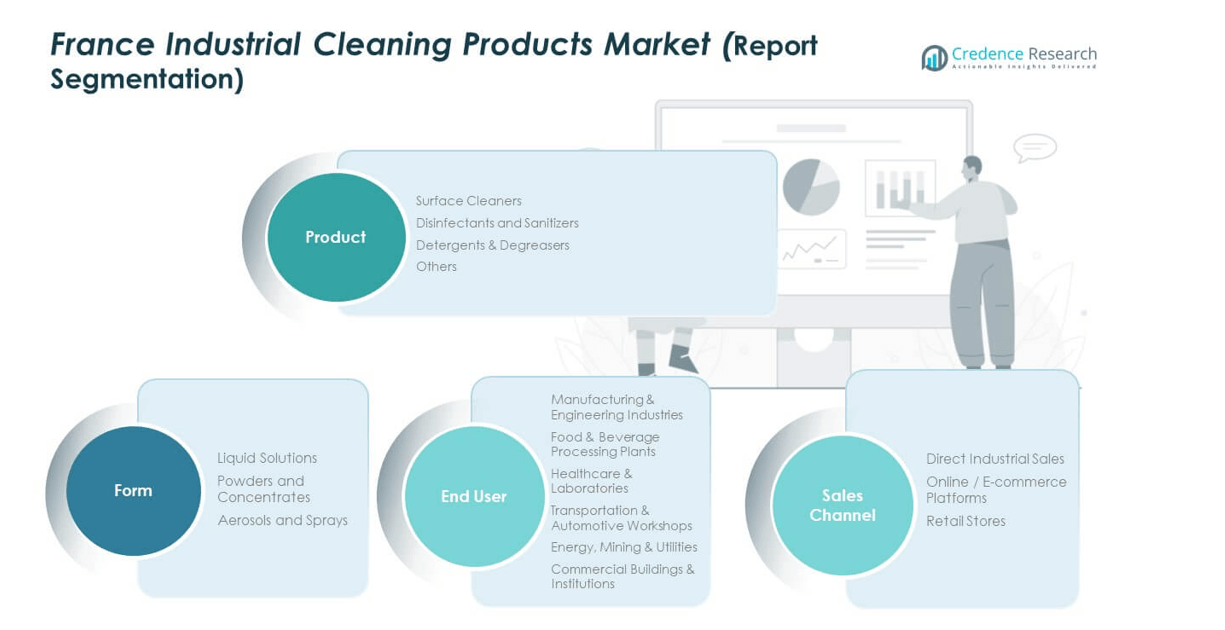

By Product Type

The France Industrial Cleaning Products Market is segmented by product type into surface cleaners, disinfectants and sanitizers, detergents and degreasers, and others. Surface cleaners are widely used across industries for general cleaning tasks, especially in manufacturing and commercial settings. Disinfectants and sanitizers are essential in sectors requiring strict hygiene protocols, such as healthcare and food processing. Detergents and degreasers are particularly important in automotive and manufacturing industries, where they are used to remove grease and heavy dirt.

- For instance, Diversey’s TASKI ride-on scrubber drier machines were documented in a manufacturer case study to deliver 30% faster floor cleaning times compared to traditional methods when adopted by French industrial facilities in 2023. Disinfectants and sanitizers are essential in sectors requiring strict hygiene protocols, such as healthcare and food processing.

By Form

The market is segmented by form, including liquid solutions, powders and concentrates, and aerosols and sprays. Liquid solutions dominate due to their ease of use and versatility in different applications. Powders and concentrates are valued for their cost-effectiveness and long shelf life, making them ideal for bulk purchases. Aerosols and sprays are popular for their convenience, especially in smaller spaces or where precision is required.

- For instance, RINOLCRETE’s polyurethane mortar system, certified for dry and wet production areas in France, withstands mechanical and thermal stress from -40°C to 120°C and offers antibacterial action, validated through independent laboratory tests.

By End User

The France Industrial Cleaning Products Market serves several key sectors, including manufacturing and engineering, food and beverage processing, healthcare, transportation, and commercial buildings. Manufacturing and engineering industries are the largest consumers due to their need for regular cleaning of heavy machinery. Food and beverage processing plants require cleaning products that meet high sanitation standards. Healthcare and laboratory facilities rely heavily on disinfectants and sanitizers to maintain sterile environments.

By Sales Channel

The market is segmented by sales channel, including direct industrial sales, online/e-commerce platforms, and retail stores. Direct sales are common in large industries where bulk purchases are typical. E-commerce platforms are becoming increasingly popular, offering convenience and access to a broader range of products. Retail stores serve small to medium-sized businesses that require smaller quantities or immediate availability of cleaning products.

Segmentation

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

Regional Analysis

The France Industrial Cleaning Products Market is primarily driven by the strong industrial presence in the country, especially in Western Europe, which holds the largest market share. Western Europe commands a substantial 45% of the market share, supported by a high demand from manufacturing, automotive, and healthcare sectors. The region’s stringent hygiene standards and regulatory environment continue to push growth in industrial cleaning solutions, with France at the forefront of adopting advanced cleaning technologies.

In Southern Europe, the market is seeing increasing adoption of industrial cleaning products, contributing to around 25% of the total market share. The growing food processing and healthcare sectors in Spain, Italy, and Greece are key drivers. Southern Europe’s demand for disinfectants, sanitizers, and specialized cleaning solutions is rising due to enhanced hygiene practices in these high-demand sectors. These countries benefit from a combination of increased industrial activity and stricter sanitation standards.

Eastern Europe holds a smaller share of the France Industrial Cleaning Products Market at around 15%. While emerging industries are expanding in countries like Poland and Hungary, the market is still developing. However, as industrialization grows, demand for industrial cleaning products will likely increase. Meanwhile, the rest of the regions, including Nordic countries and the Benelux region, are witnessing steady growth, with smaller market shares. Despite this, these areas are expected to show incremental growth as industrial sectors grow and demand for effective cleaning solutions rises.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PRODEF Group

- Dow Inc.

- Gard Chemicals

- Evonik Industries AG

- Proquimia

- Stepan Company

- Ecolab Inc.

- 3M

- BASF SE

- KEM ONE

- Other Key Players

Competitive Analysis

The France Industrial Cleaning Products Market is highly competitive, with a mix of established players and newer entrants striving for market share. Major multinational companies, such as SC Johnson Professional, Diversey, and Kimberly-Clark, hold a dominant position in the market due to their extensive product ranges and well-established distribution networks. These companies leverage their strong brand recognition and broad customer base across multiple sectors, from manufacturing to healthcare. Local players are also an important part of the competitive landscape, with companies like Proprete France and Anios focusing on providing specialized products tailored to the specific needs of French industries. These companies often capitalize on their understanding of local regulations and customer requirements. They provide high-quality cleaning solutions, particularly in sectors where stringent hygiene standards are vital. The rise of eco-friendly products has spurred innovation, with several companies investing in sustainable solutions. Competitors are also enhancing their product lines to include automated cleaning equipment, which reduces labor costs while maintaining high cleaning standards.

Recent Developments

- In November 2025, BASF Beauty Care Solutions France S.A.S., a key player in France’s industrial cleaning products market, received recognition for its innovation and sustainability efforts across its Care Chemicals division. BASF continues to expand its product offerings with a strong focus on sustainable, eco-friendly ingredients tailored to industrial and institutional cleaning, aligning with strict national and European regulatory standards.

- In October 2025, Nouryon introduced a new suite of sustainable cleaning‑ingredient technologies at the SEPAWA Congress, including surfactants and chelates for industrial cleaning applications. These innovations support more environmentally friendly formulations in the Europe‑based industrial cleaning sector.

- In September 2025, Ecolab Inc. launched its Ecolab® CIP IQ™ platform and announced a strategic partnership with 4T2 Sensors. This solution targets food and beverage industry clean‑in‑place operations with AI‑enabled fluid sensing technology. The move strengthens Ecolab’s digital hygiene offerings in France and beyond.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Industrial Cleaning Products Market will continue to grow due to increasing hygiene and sanitation awareness across industries.

- Eco-friendly cleaning solutions are expected to gain significant traction as sustainability becomes a major priority for businesses.

- Technological advancements, including automation and robotics in cleaning processes, will transform the market landscape.

- The demand for specialized cleaning products tailored to specific sectors, such as food processing and healthcare, will drive innovation.

- Expansion in emerging sectors like biotechnology and renewable energy will create new opportunities for industrial cleaning solutions.

- The rise of e-commerce platforms will reshape the distribution channels, providing easier access to a variety of cleaning products.

- Growing industrialization in Eastern Europe will gradually boost the demand for industrial cleaning products in that region.

- France’s stringent regulatory framework will continue to push companies toward adopting compliant and efficient cleaning technologies.

- A shift towards digitalization will lead to better tracking and monitoring of cleaning processes, enhancing product effectiveness.

- The increasing emphasis on health and safety standards will ensure the continued demand for industrial cleaning products in various sectors.